Cap Rate vs Cash on Cash ROI: What Actually Matters for Real Estate Investors

Learn about Cap Rate vs Cash on Cash ROI for real estate investing.

Cap Rate vs Cash on Cash ROI Overview

When I help clients analyze rental properties, I see the same confusion over and over again.

They’ll ask, “Is this a good Cap Rate?”

Then immediately follow it with, “But the Cash on Cash ROI looks amazing.”

Both metrics matter.

But they answer very different questions.

Understanding Cap Rate vs Cash on Cash ROI is one of the fastest ways to stop buying mediocre deals and start buying properties that actually support your long-term plan.

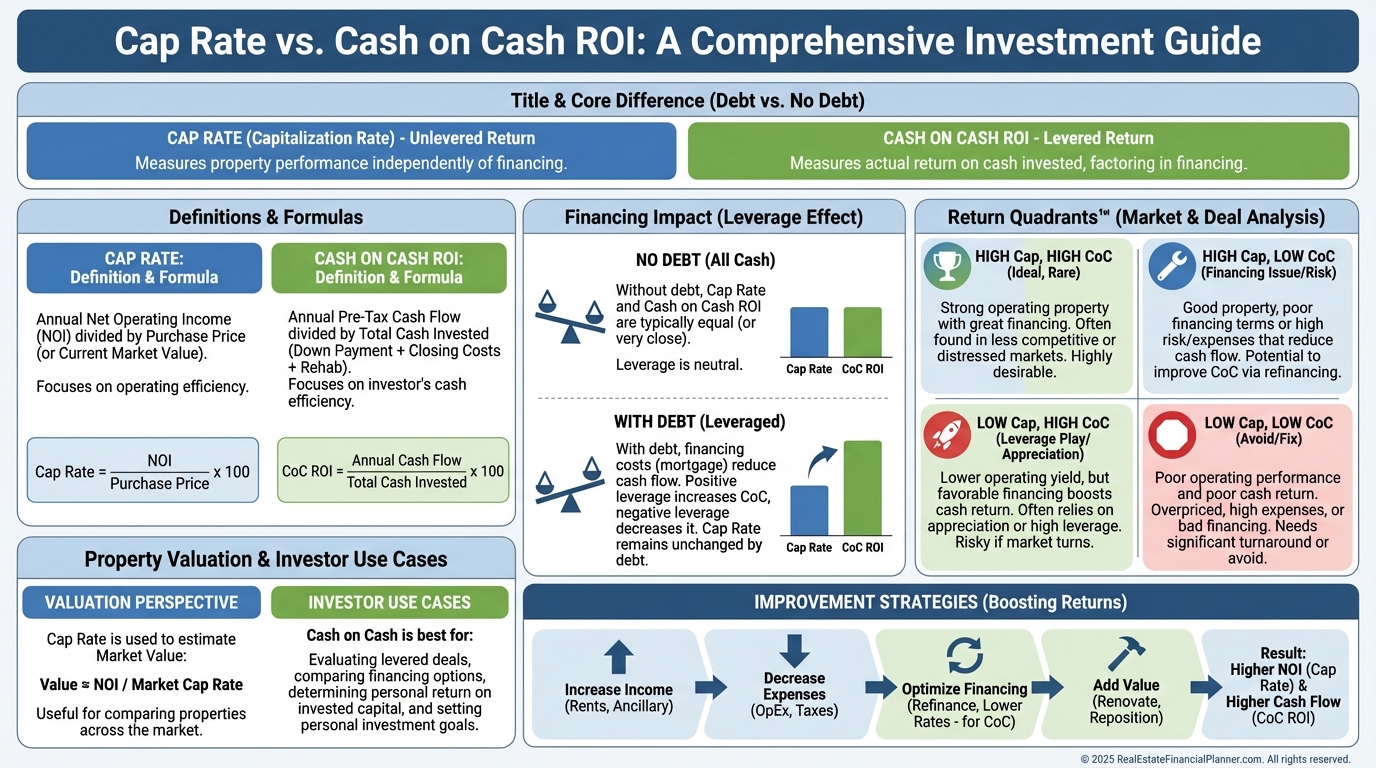

Cap Rate vs Cash on Cash ROI

Cap Rate and Cash on Cash Return on Investment are often discussed as if they compete with each other.

They don’t.

They look at the same property from completely different angles.

One measures the property.

The other measures you.

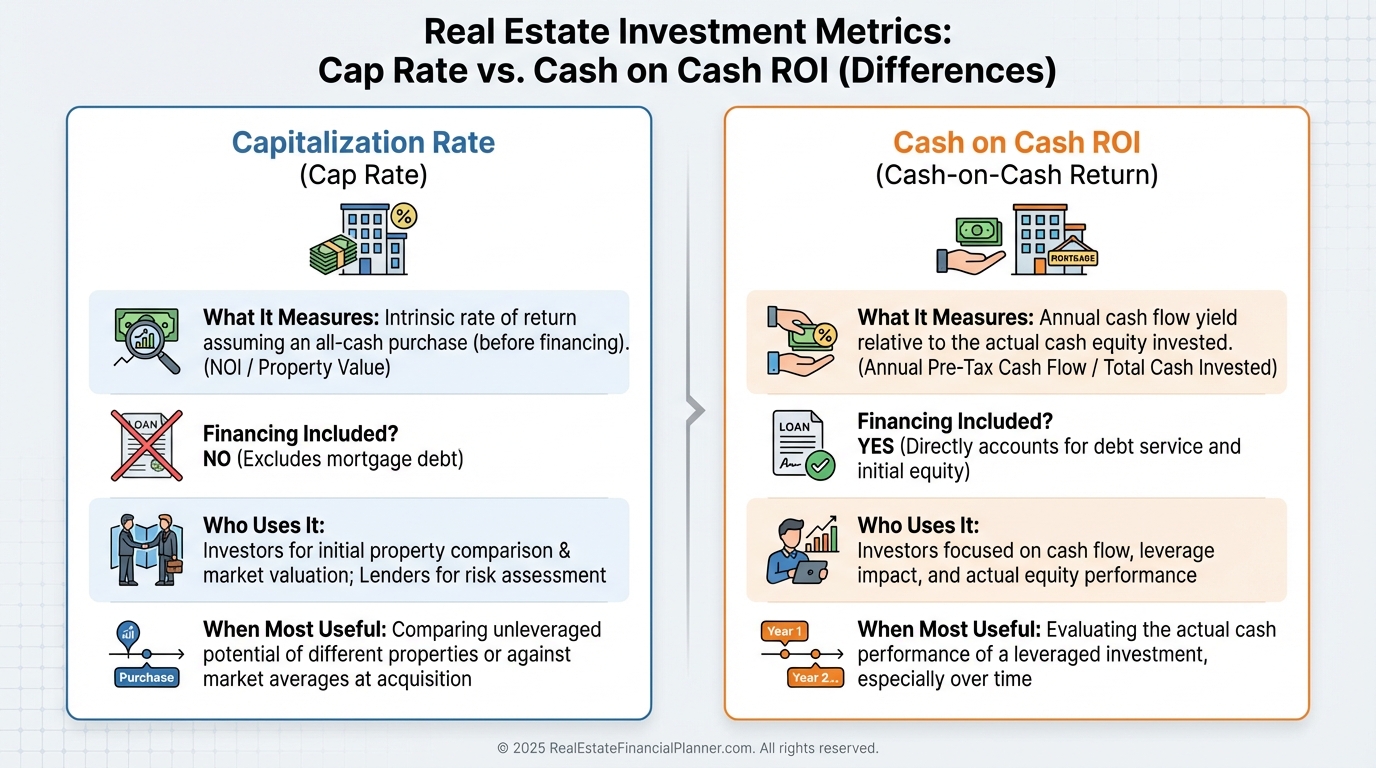

What Is Cap Rate?

Cap Rate, short for Capitalization Rate, measures how much income a property produces relative to its price or value.

The basic formula is simple:

Cap Rate ignores financing entirely.

When I’m reviewing deals with investors, I describe Cap Rate as asking one question:

“If I bought this property with cash, how hard would my money be working?”

That makes Cap Rate especially useful for comparing properties across markets, prices, and unit counts.

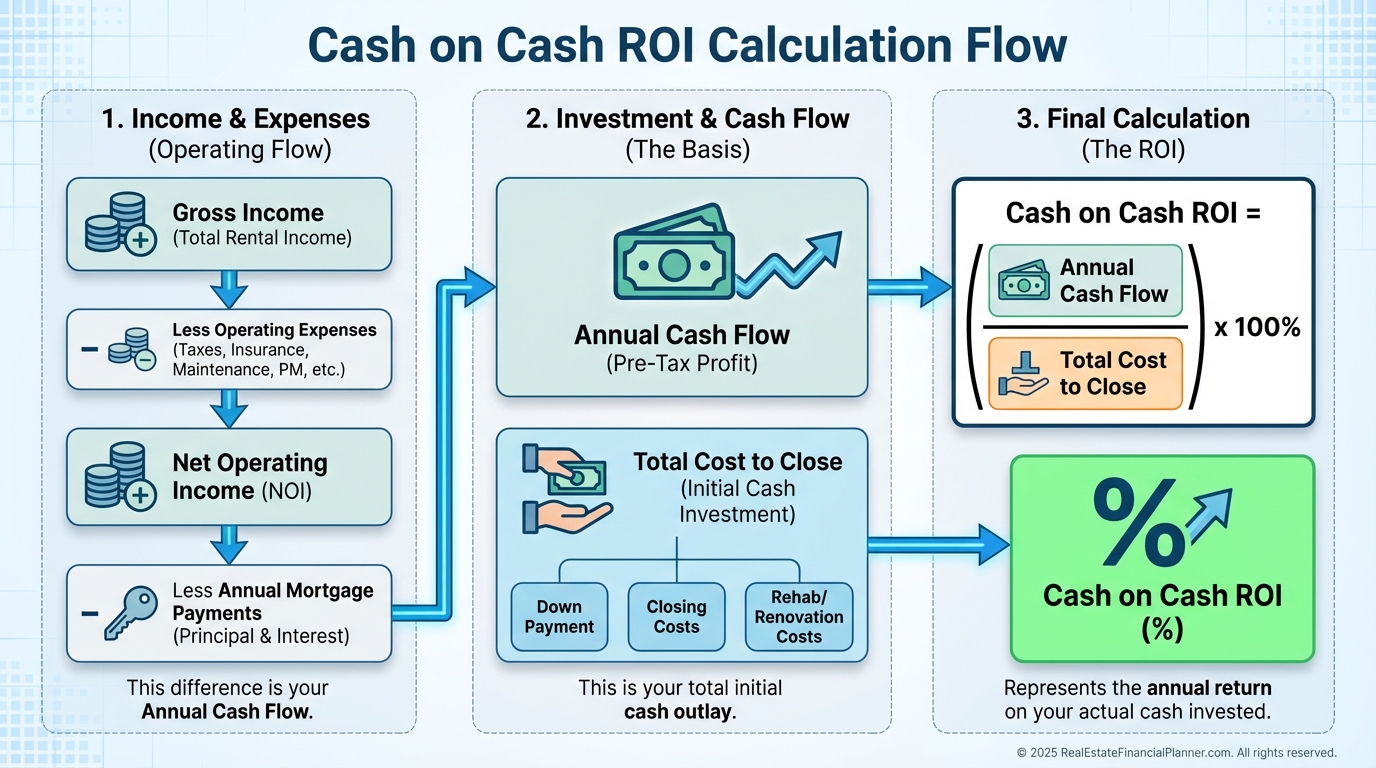

What Is Cash on Cash ROI?

Cash on Cash Return on Investment measures how much cash flow you receive relative to the cash you invested.

The formula looks like this:

Cash on Cash ROI = Cash Flow ÷ Total Cost to Close

This metric cares deeply about financing.

When I rebuilt my portfolio after bankruptcy, Cash on Cash ROI was non-negotiable.

If the property didn’t support itself with real cash flow, it didn’t belong in my plan.

Cash on Cash ROI answers a different question:

“How hard is my actual cash working for me?”

Cap Rate vs Cash on Cash ROI Compared

Here’s the mistake I warn clients about constantly.

Net Operating Income is not Cash Flow.

NOI ignores mortgages.

Cash Flow includes them.

Those two numbers only match if the property has no loan.

This single misunderstanding causes investors to overestimate returns, underestimate risk, and take on properties that quietly bleed them over time.

Cap Rate tells you how the property performs.

Cash on Cash ROI tells you how your decision performs.

When Cap Rate Is the Better Tool

Cap Rate shines when you want to strip financing out of the equation.

That’s why institutional investors love it.

Cap Rate helps you:

•

Compare properties across markets

•

Evaluate income relative to price

•

Assess risk based on income stability

•

Estimate property value from income

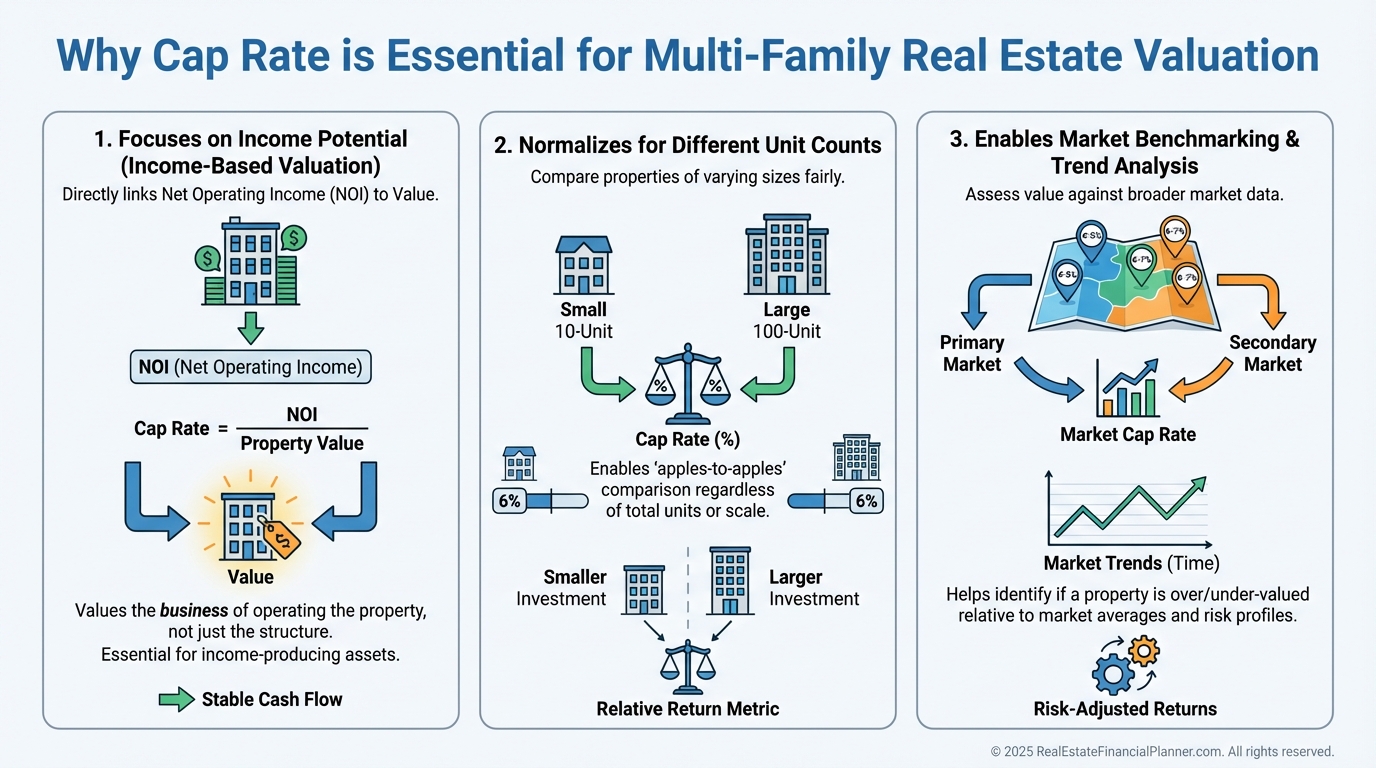

It’s especially powerful for multi-family properties.

Why Cap Rate Rules Multi-Family Properties

A fourteen-unit property and a twenty-seven-unit property don’t compare well using price per unit alone.

Cap Rate lets income do the talking.

In multi-family, increasing NOI directly increases value.

That’s why experienced operators obsess over Cap Rate improvements.

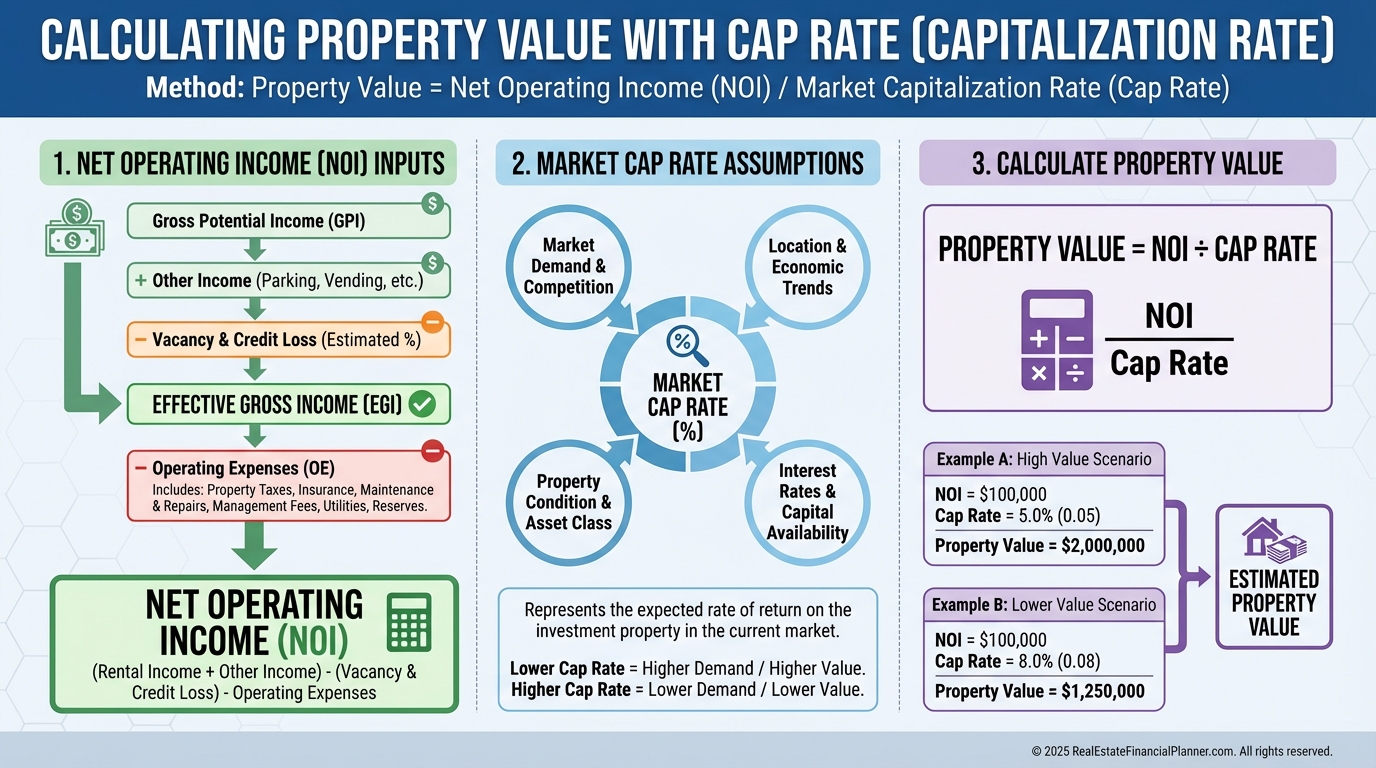

Calculating Property Value from Cap Rate

If you know the NOI and the market Cap Rate, you can estimate value.

Property Value = Net Operating Income ÷ Cap Rate

This is how investors create value without relying on appreciation.

Raise NOI.

Lower perceived risk.

Increase value.

When Cash on Cash ROI Is the Better Tool

Cash on Cash ROI matters most when leverage matters.

That’s most individual investors.

Cash on Cash ROI helps you:

•

Measure real cash performance

•

Evaluate financing decisions

•

Manage risk and reserves

•

Build income toward financial independence

When I model deals inside the Return Quadrants™, Cash on Cash ROI maps directly to the Cash Flow quadrant of the Return on Investment Quadrant™.

That’s intentional.

Cash on Cash ROI Calculation Breakdown

Cash on Cash ROI improves when you:

Increase income

Lower expenses

Improve financing

Reduce total cash invested

It punishes bad loans and rewards disciplined structure.

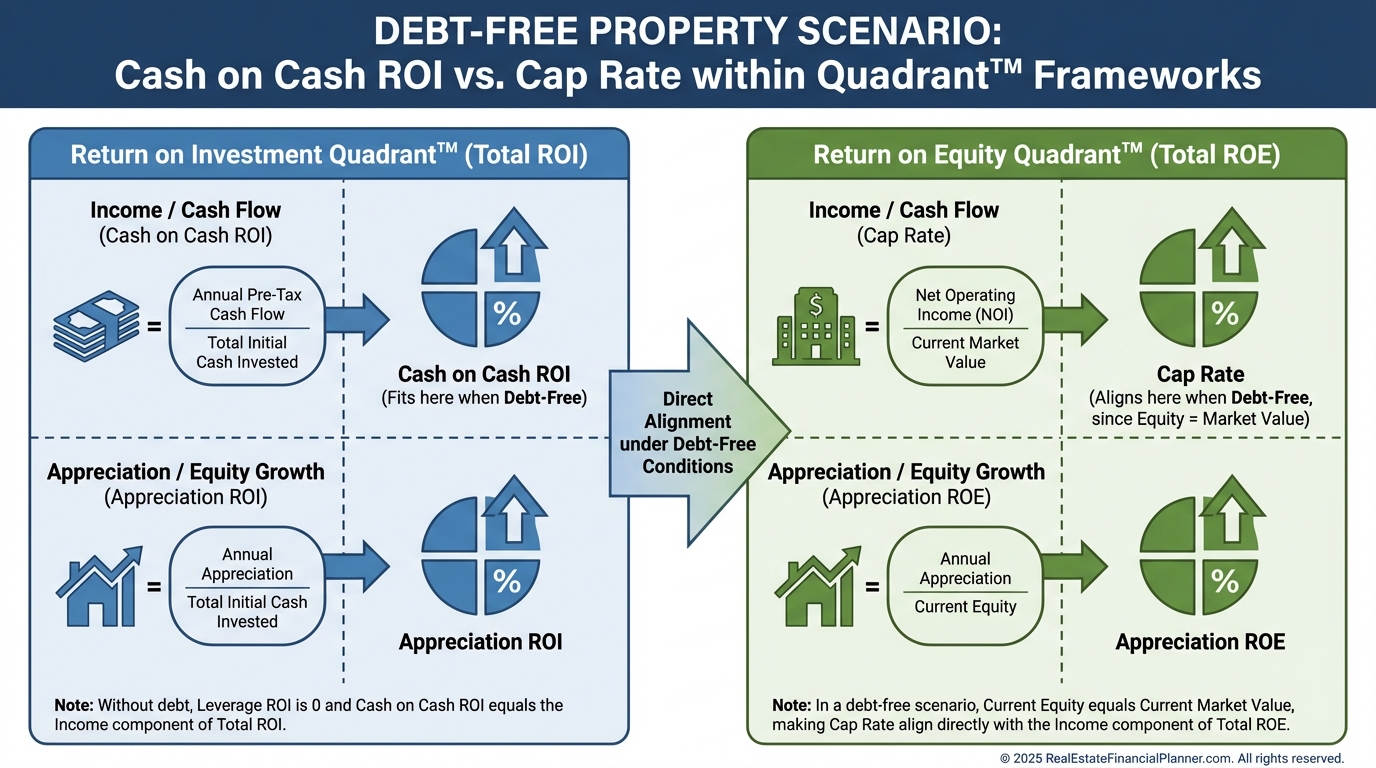

Cap Rate and Cash on Cash ROI in the Return Quadrants™

Here’s the insight most investors never notice.

As debt approaches zero, Cash Flow approaches NOI.

Equity approaches property value.

At that point, Cash on Cash ROI starts to resemble Cap Rate.

That’s why paid-off properties feel so different.

They behave like income-producing assets, not leveraged bets.

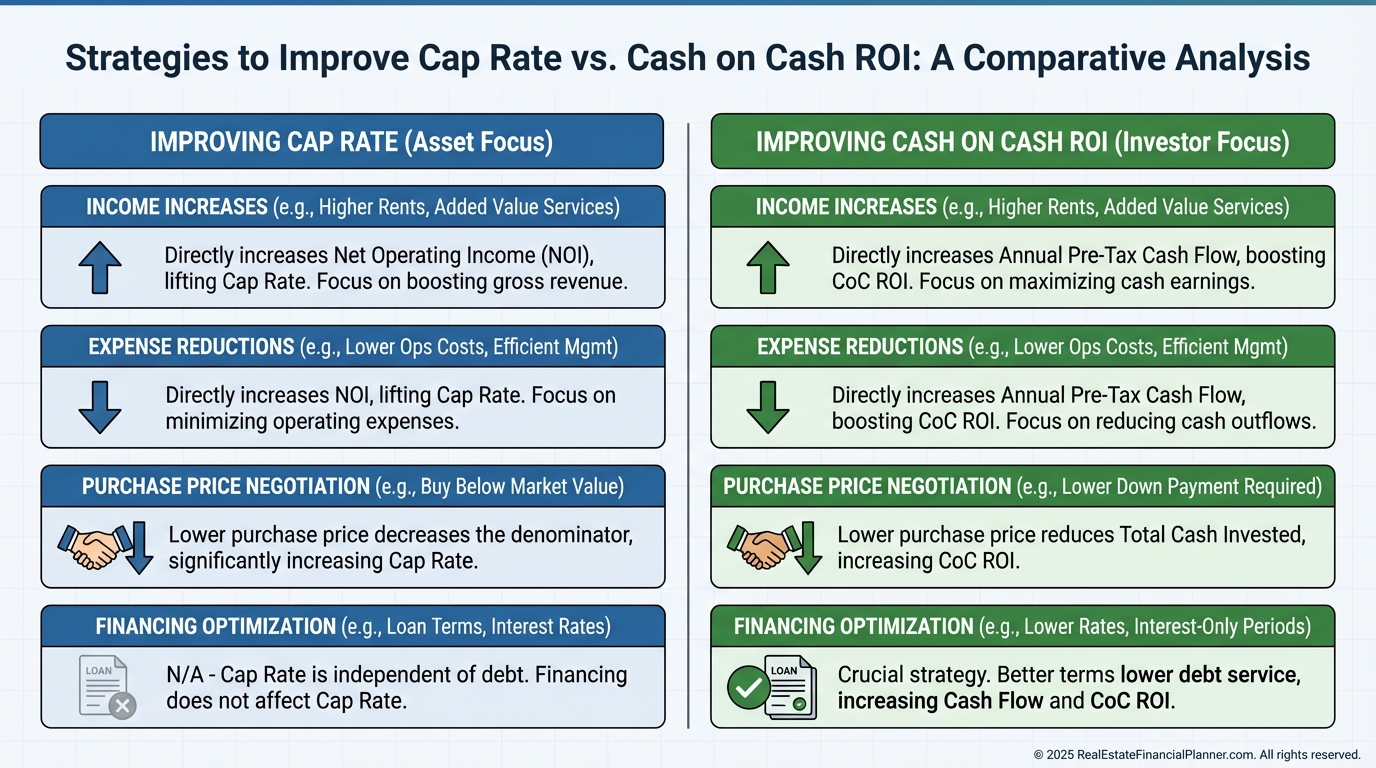

Improving Cap Rate vs Improving Cash on Cash ROI

Improving Cap Rate focuses on the property.

Improving Cash on Cash ROI focuses on structure.

The best investors do both, but they never confuse the two.

The Mistake I Warn Every Investor About

If you chase Cap Rate alone, you can end up asset-rich and cash-poor.

If you chase Cash on Cash ROI alone, you can ignore long-term wealth creation.

The solution isn’t choosing sides.

It’s understanding Cap Rate vs Cash on Cash ROI well enough to know which question you’re answering at each stage of your investing journey.

That’s how real portfolios survive, scale, and compound.