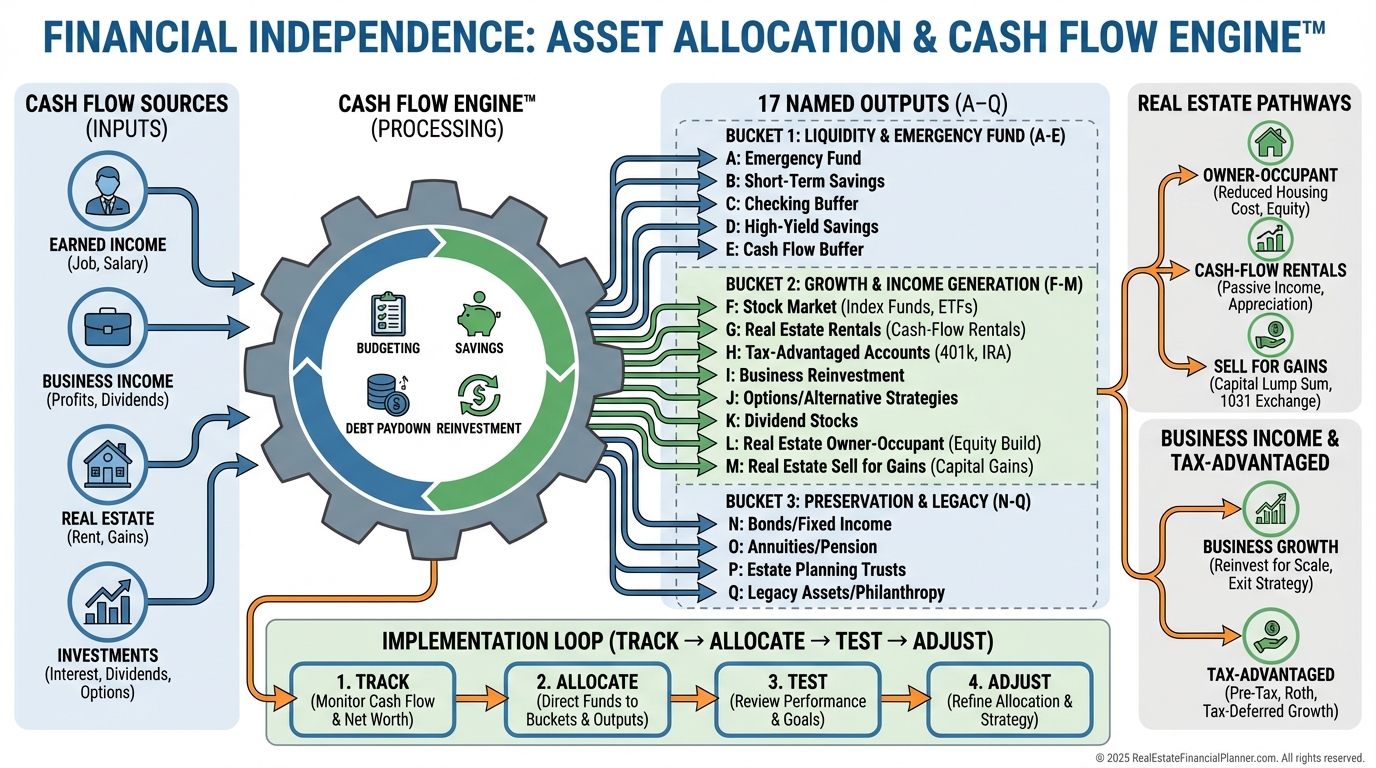

Financial Independence Asset Allocation and Cash Flow Engine™: The Missing System Between “Good Income” and Freedom

Learn about Financial Independence Asset Allocation and Cash Flow Engine™ for real estate investing.

The Problem The Engine Fixes

Most people don’t have a money problem.

They have a coordination problem.

When I help clients map out their plan, they usually have decent income, decent savings habits, and a handful of “smart” accounts.

They also have a blind spot.

Their money decisions are disconnected.

A retirement account decision here, a rental property decision there, a “should I pay down the mortgage?” debate that never ends, and a vague hope that it all adds up to financial independence.

It usually doesn’t.

Not because they’re lazy.

Because they’re running their financial life like a pile of separate apps that never talk to each other.

The Financial Independence Asset Allocation and Cash Flow Engine™ exists to solve that.

What The Engine Actually Is

The Engine is not “a spreadsheet that tracks expenses.”

It’s a system that forces every dollar to answer three questions.

Where did it come from?

Where did it go?

What did it do for you after it got there?

That last question is where most planning fails.

Net worth feels productive, but cash flow is what buys your freedom.

And cash flow that can’t be repeated, defended, or reinvested is just a temporary win.

The Engine is built to make repeatable wins obvious.

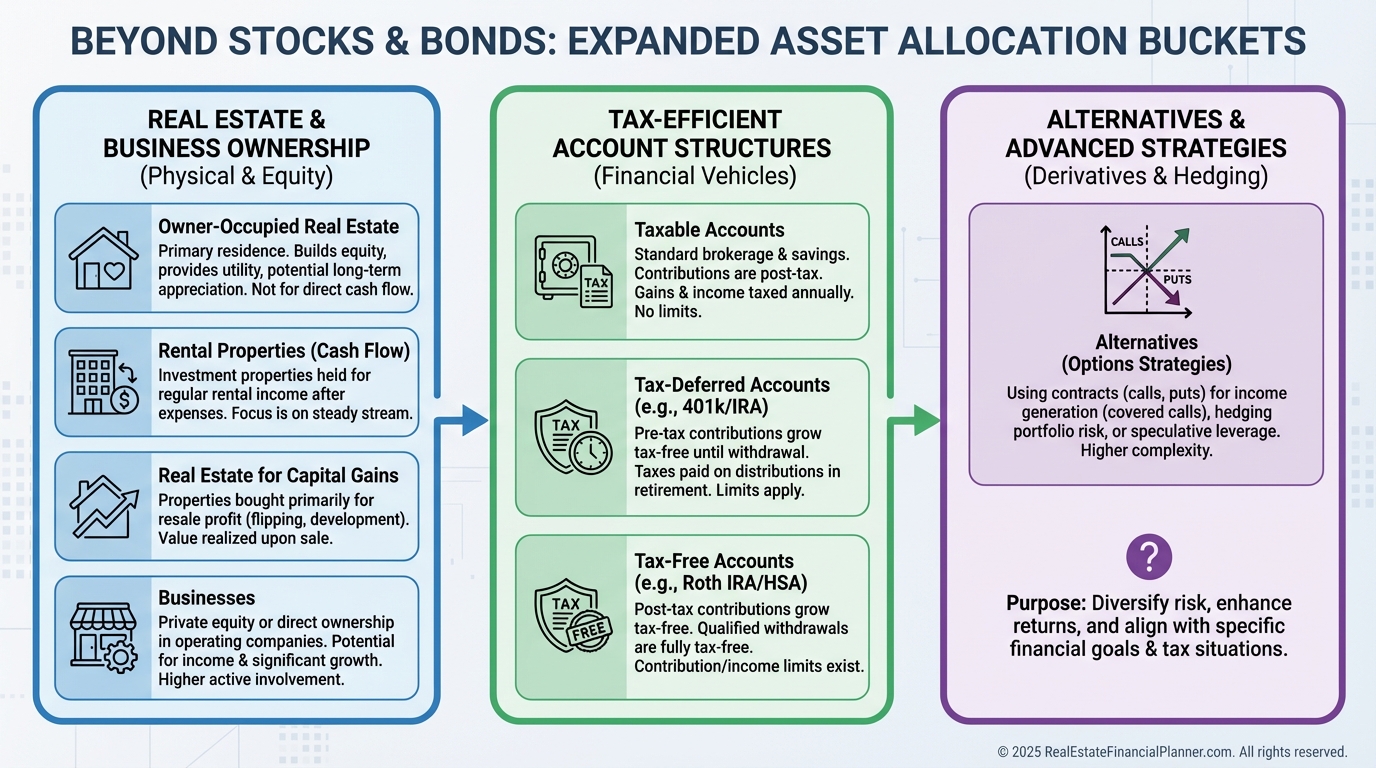

Why “Asset Allocation” Is Bigger Than Stocks And Bonds

Traditional asset allocation is usually code for “pick a mix of stocks and bonds.”

That’s fine, but it’s incomplete.

Real financial independence investors hold a mix of asset classes that behave differently, produce different types of returns, and fail in different ways.

That includes things like:

A primary residence strategy (done intentionally, not accidentally).

Cash-flowing rentals.

Properties you plan to sell for capital gains.

A business that throws off income.

Taxable, tax-deferred, and tax-free accounts.

Sometimes options strategies, if you treat them like a tool, not a lottery ticket.

The Engine makes these comparable, so you stop arguing with yourself using mismatched math.

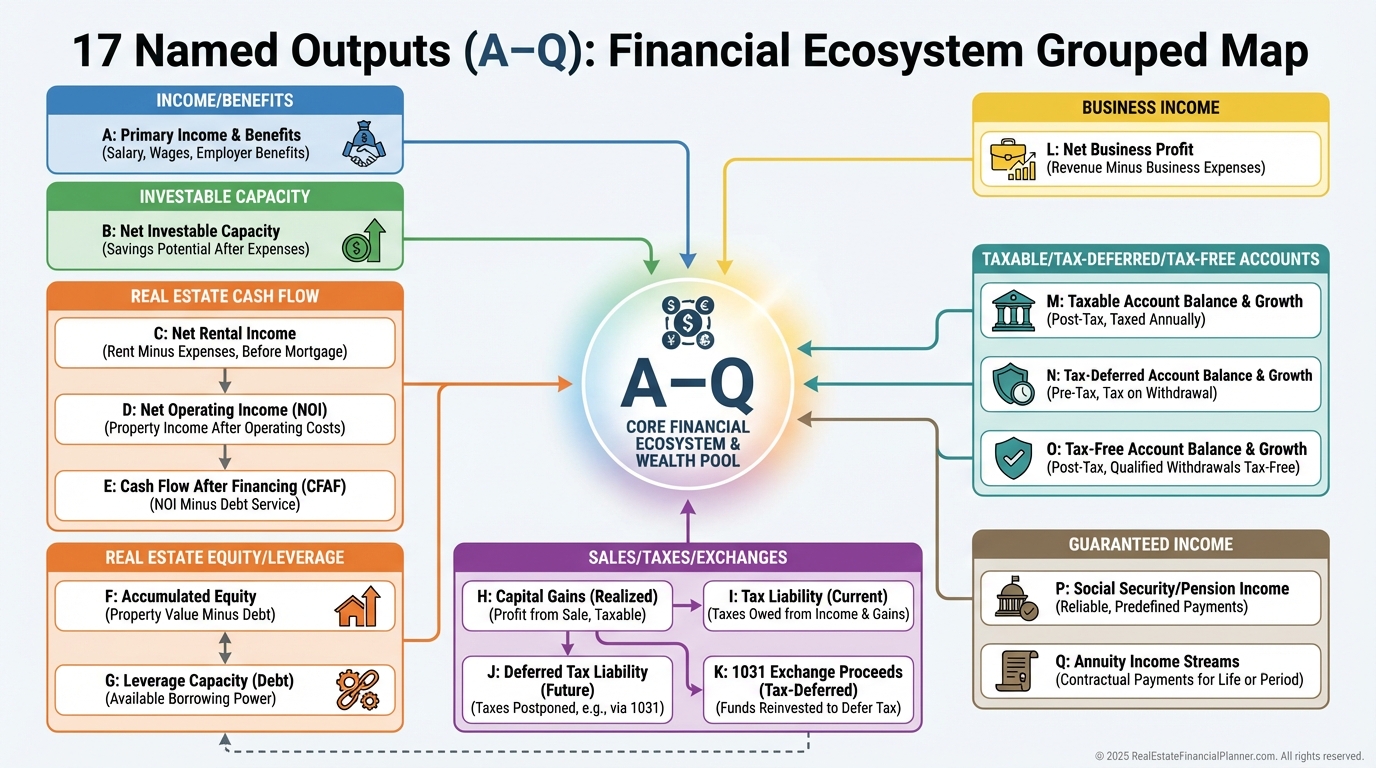

The 17 Named Outputs: Why The Engine Doesn’t Guess

The Engine tracks 17 Named Outputs (A through Q).

I like named outputs because they prevent the kind of spreadsheet “creep” that ruins good intentions.

If a number doesn’t change a decision, it’s usually noise.

When I rebuilt after bankruptcy, I didn’t have the luxury of vague.

I needed decision-making metrics.

Not motivational quotes.

The point of Outputs A–Q is to answer questions like:

What is the easiest, highest-return move available right now?

How much investable cash do you actually have after life happens?

Which assets produce cash now, and which only pay later?

Where are you overexposed?

Where are you underfunded?

What taxes are about to surprise you?

If you’re serious about financial independence, your plan has to survive contact with reality.

Outputs are how you test reality.

Start Where The Money Starts: Your Job As An Asset

Most people treat their job like weather.

They complain about it, plan around it, and assume it’s permanent until it’s not.

The Engine treats your job like an asset with a shelf life.

That’s human capital.

It produces a stream of cash flow, and that stream can be optimized.

When I’m reviewing someone’s plan, this is where I find the easiest wins:

They’re not capturing the full company match.

They’re ignoring benefit value that changes real cash flow.

They’re underestimating the after-tax cost of decisions.

They’re treating bonuses like “fun money” instead of a strategic tool.

If you want to build FI faster, don’t start by trying to be clever.

Start by not being sloppy.

Output A: Company Match Is The Highest Guaranteed Return

If you’re skipping match dollars, you’re saying “no” to instant returns.

That’s not conservative.

That’s just expensive.

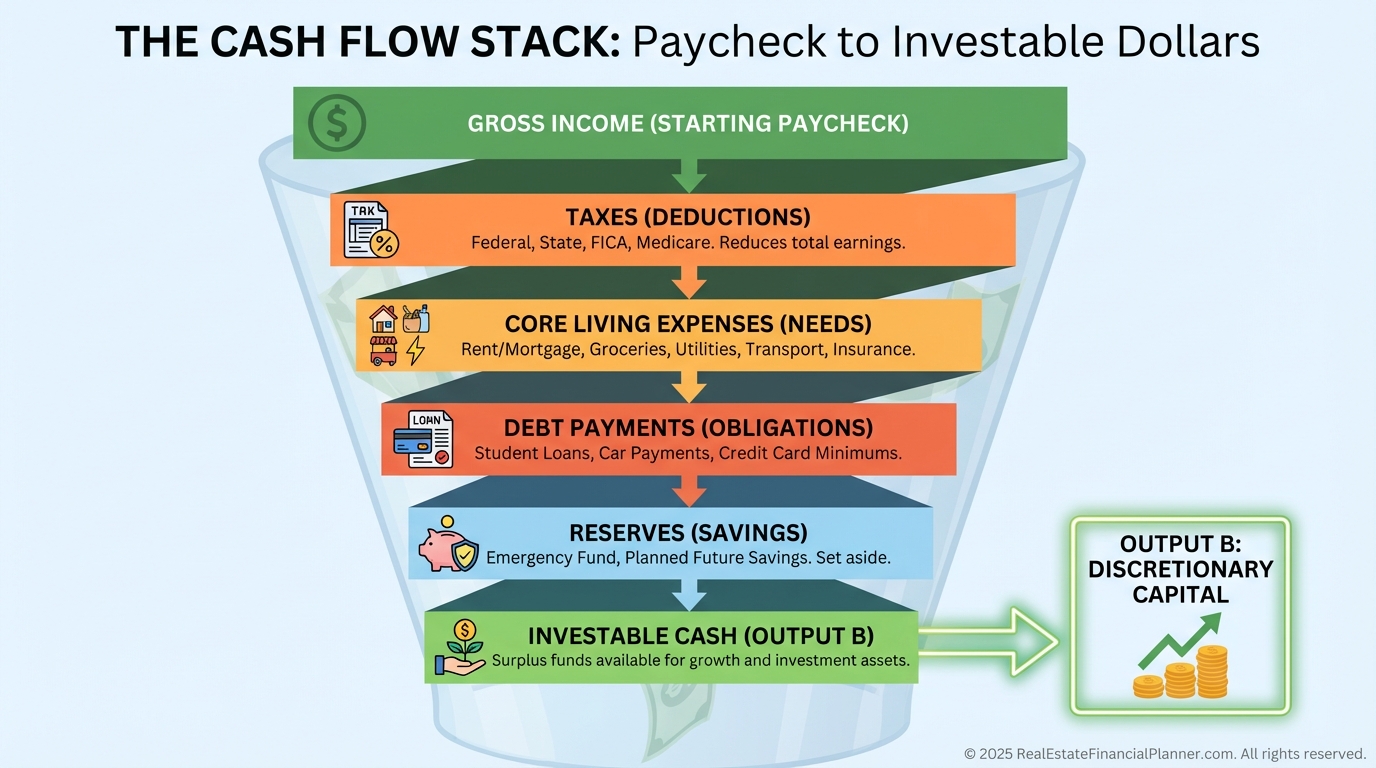

Output B: After-Tax Investable Cash Is The Real Constraint

Income isn’t the constraint.

After-tax, after-life, after-reality investable cash is the constraint.

The Engine makes that number obvious, so you stop making plans that rely on imaginary money.

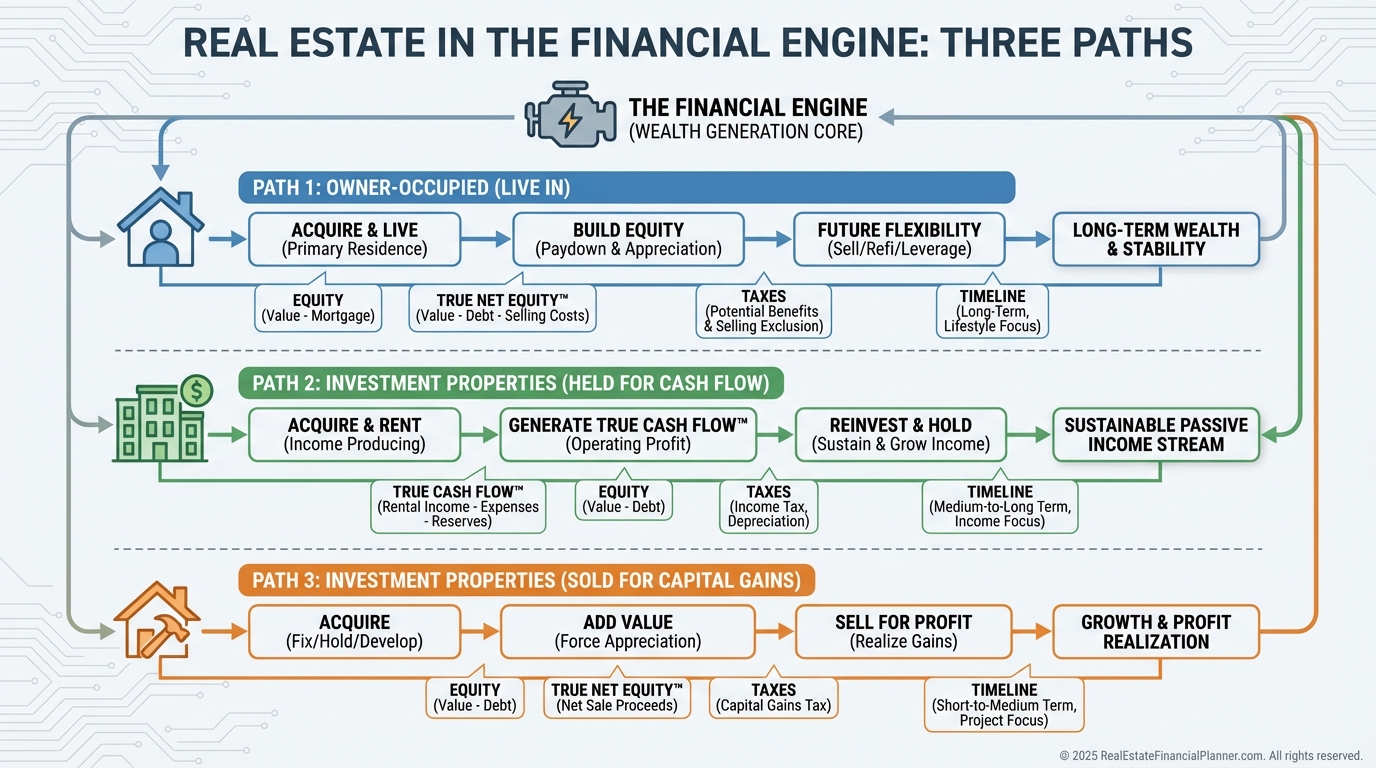

The Real Estate Side: Three Paths, Three Jobs

Real estate shows up in the Engine as three distinct modules because investors confuse them constantly.

An owner-occupied property has different rules, returns, and tax treatment than a rental.

A rental you plan to hold for cash flow is not the same as a property you plan to sell for gains.

When you blur those together, you miscalculate risk, misjudge cash flow, and pick the wrong financing.

Module 1: Owner-Occupied Strategy

Owner-occupant financing is a cheat code if you actually use it as a strategy.

Lower down payments.

Better rates.

Different tax rules.

And the ability to convert later.

This is where Nomad™ investing shines, because it repeatedly harvests owner-occupant advantages and turns them into rentals over time.

When clients ask me how to get “more deals” with limited capital, this is usually where the math starts working.

Not because it’s magical.

Because it’s structured.

Module 2: Hold For Cash Flow

This is where you care about what I call True Cash Flow™.

Not “rent minus mortgage.”

This is also where the Engine ties in what I call Cash Flow from Depreciation™.

Because your tax situation can turn a mediocre cash flow deal into a solid one, or a “good” deal into a disappointment.

And if you ignore that, you’re flying blind.

Module 3: Sell For Capital Gains

Selling is not failure.

Selling is a strategy.

But it only works if you account for the real friction.

Depreciation recapture.

Capital gains taxes.

Time.

Stress.

When I’m evaluating whether to hold or sell, I always compare returns on equity, not just returns on the original down payment.

That’s where True Net Equity™ thinking becomes useful.

Equity isn’t the same as spendable equity.

If you can’t access it without paying a pile of costs, it’s not the number you should optimize.

The Allocation Matrix: Where Every Dollar Gets A Job

Most people don’t have a plan.

They have a default.

Default spending.

Default saving.

Default investing.

Default fear when the market drops.

The Engine’s allocation matrix forces a decision for every dollar.

Not perfect decisions.

Clear decisions.

When I sit down with someone and we build the matrix, the biggest change is psychological.

They stop asking, “What should I do?”

They start asking, “What job do I want this dollar to do?”

That shift is everything.

Because financial independence is not a single investment.

It’s a repeatable allocation process.

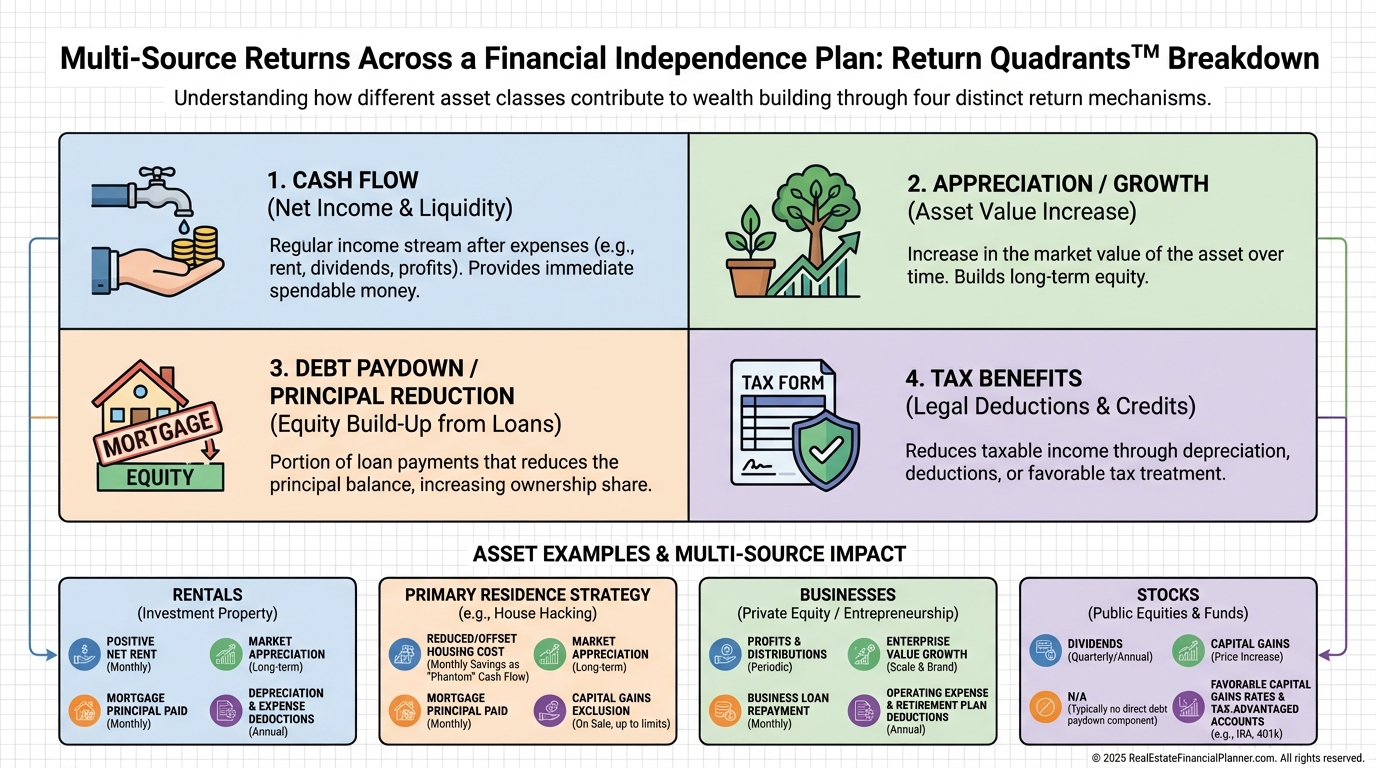

How I Think About Returns Inside The Engine

I don’t like single-metric thinking.

Cash-on-cash alone can trick you.

Appreciation alone can trap you.

“Net worth” alone can lie to you for a decade.

This is where the Return Quadrants™ mindset is useful.

A property doesn’t just do one thing.

It can produce:

Cash flow.

Appreciation.

Tax benefits.

And you can make the same kind of multi-return thinking apply to businesses and paper assets too.

The Engine doesn’t let you “win” on one return while losing quietly on the others.

Businesses, Traditional Accounts, And “Optional” Complexity

Business income can be one of the fastest accelerators to FI.

It can also be a chaotic mess if you don’t track it like an asset.

The Engine treats business cash flow as Output K.

It’s not “side hustle money.”

It’s an asset stream you can reinvest, stabilize, and eventually sell.

Then you’ve got traditional investments.

Taxable accounts.

Tax-deferred accounts.

Tax-free accounts.

Each of these has different withdrawal rules, tax impacts, and timing constraints.

If you don’t model those constraints, you’ll accidentally build a plan where your money exists, but you can’t access it when you need it.

That’s not financial independence.

That’s financial frustration with extra steps.

And yes, you can track options strategies if you use them.

But the Engine assumes you’re doing it with position sizing rules, clear risk limits, and a goal that fits your overall allocation.

Not because it’s “advanced.”

Because untracked risk is how people blow up good plans.

The Two Mistakes I See Over And Over

Over-Optimization Paralysis

People want to optimize a plan they haven’t implemented.

They spend six months tuning account choices while ignoring the big moves that matter.

The Engine fixes that by showing the highest-impact decisions first.

Neglecting Risk Management

Aggressive plans need aggressive risk management.

Reserves.

Insurance.

Liquidity.

Diversification.

Stress tests.

When I’m reviewing plans, I’m not impressed by the best-case scenario.

I’m interested in whether your plan survives job loss, vacancy, a roof replacement, a market drop, or a medical surprise.

The Engine makes those scenarios part of the model, not an afterthought.

A Practical Loop: Track, Allocate, Test, Adjust

You don’t “finish” the Engine.

You run it.

You update it.

You use it to make your next decision.

Then you repeat.

When I rebuilt my own portfolio, consistency mattered more than brilliance.

One good decision per month compounded faster than a perfect plan that never got executed.

If you want a simple way to start, use this loop:

Track your current reality.

Allocate your next dollars with intention.

Test decisions using real costs and realistic assumptions.

Adjust as results come in.

That’s the Engine in practice.

What Financial Independence Looks Like When This Works

Financial independence is not a number you hit.

It’s a condition you maintain.

It’s when your asset-produced cash flow reliably covers your lifestyle, with enough margin that a bad month doesn’t threaten your freedom.

The Engine helps you build that condition by making the whole system visible.

Not just your savings rate.

Not just your rental cash flow.

Not just your retirement accounts.

All of it.

Coordinated.

Measured.

And pointed at the same outcome.

Your job can feel like a cage when the plan is fuzzy.

When the system is clear, it becomes a funding source with an expiration date.

And that’s a very different feeling.