Land Trusts: Step-by-Step Guide for Real Estate Investors

Learn about Land Trusts for real estate investing.

Why Savvy Investors Use Land Trusts

When I help clients clean up their public footprint, the first win is removing their names from the county website.

Privacy lowers noise, reduces solicitation, and preserves negotiating leverage.

I once consulted for an investor who listed ten rentals in his personal name.

Within months, he was fielding 50+ letters a week and tipped his hand in every negotiation.

A simple title change to a land trust flipped the script without changing who controlled the property or how it performed.

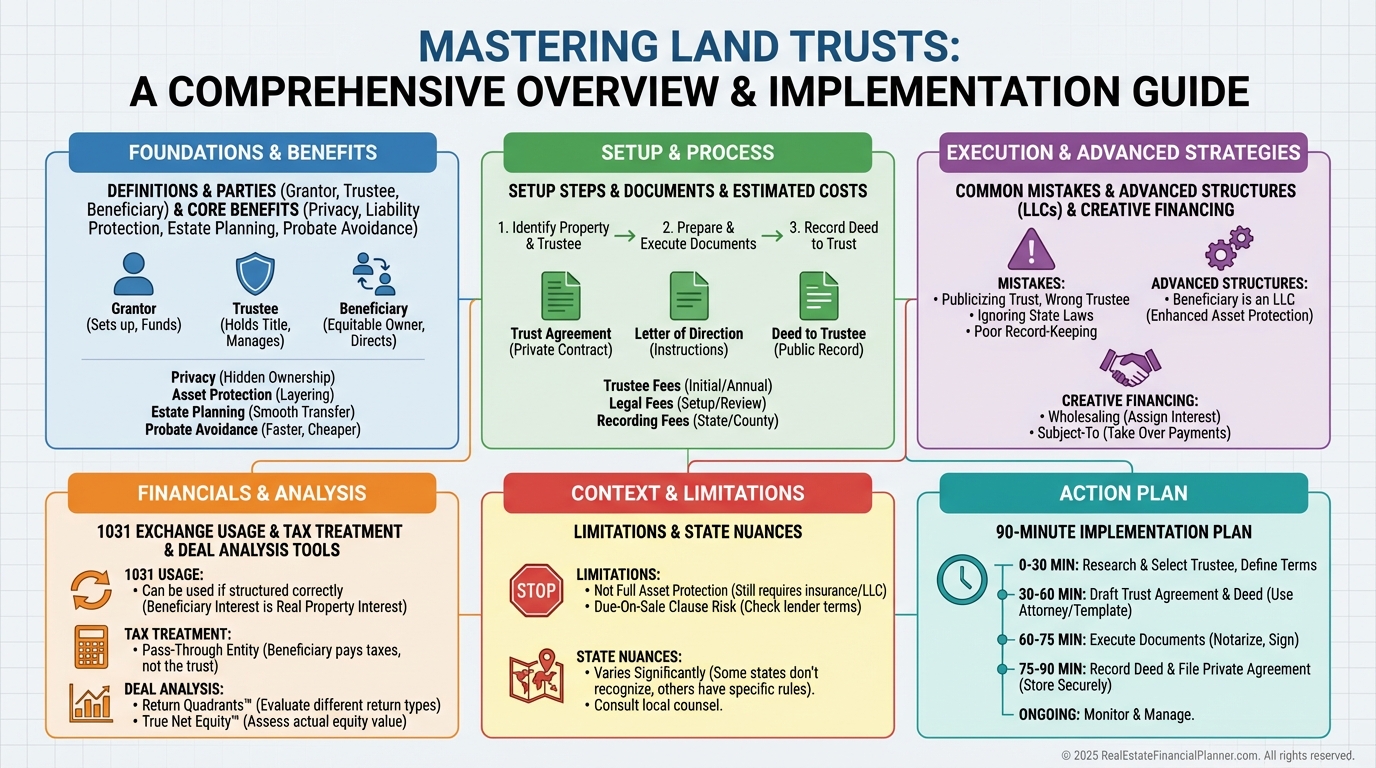

What a Land Trust Is (Plain English)

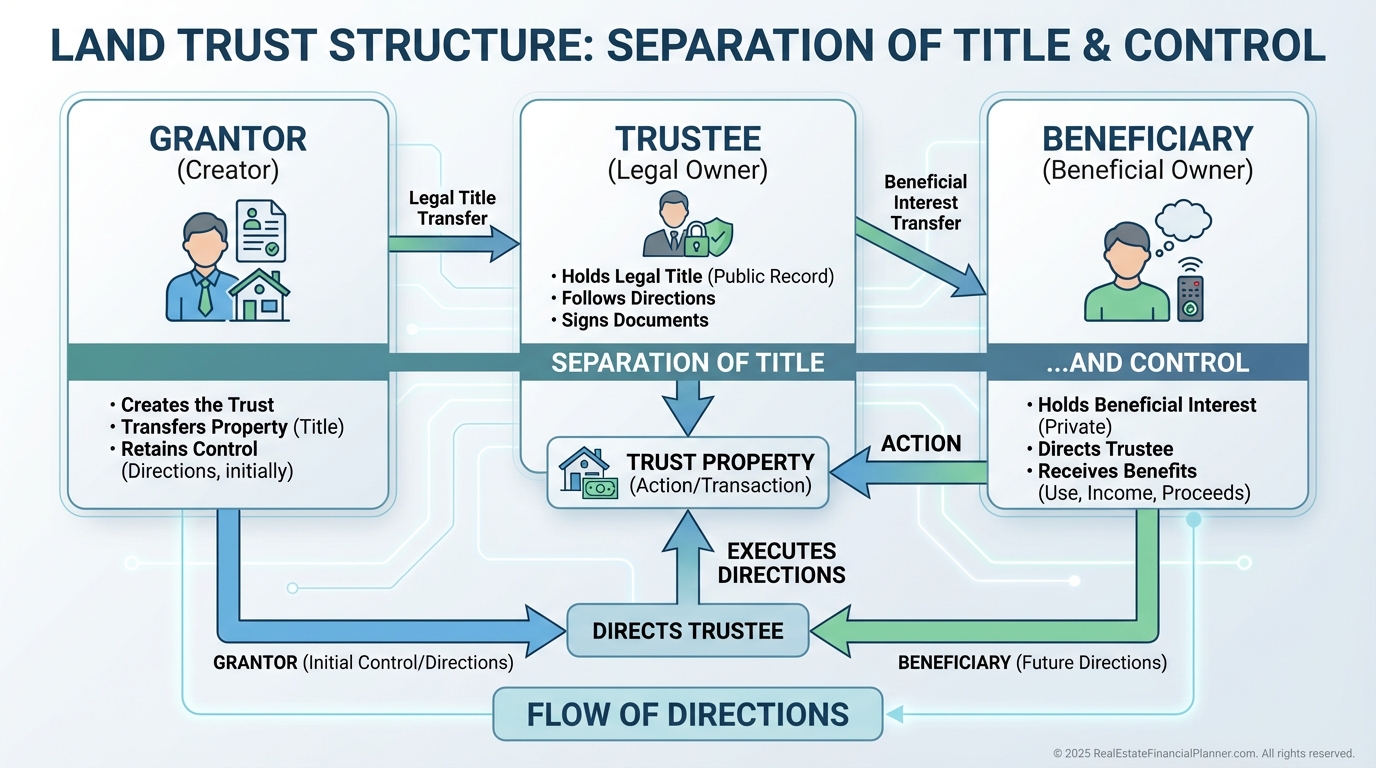

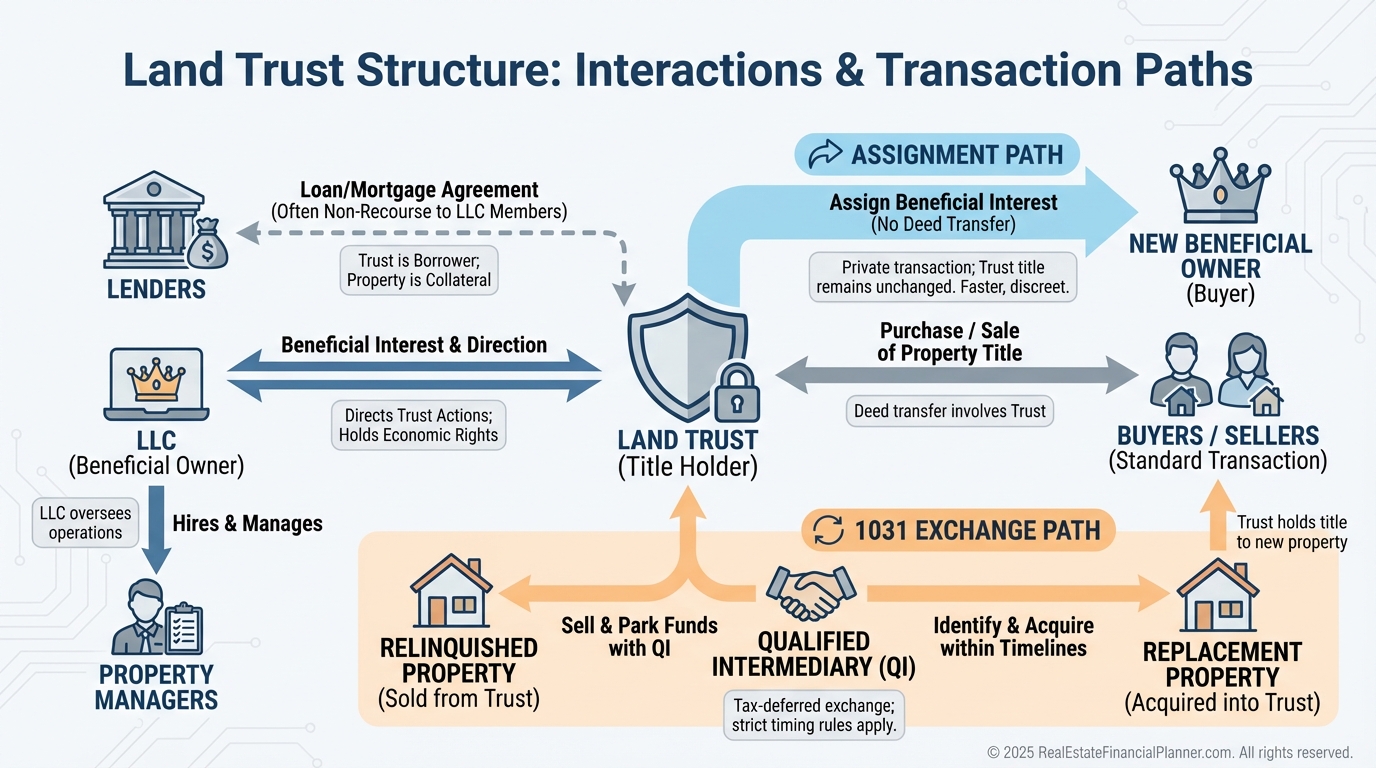

A land trust is a private agreement where a trustee holds legal title to real estate for the benefit of a beneficiary.

You still control the deal through written directions, but your name no longer sits on public title.

Three roles matter.

•

Grantor: you, transferring the property into the trust.

•

Trustee: the person or company on title who follows your written directions.

•

Beneficiary: the true owner with all economic rights.

A land trust is not a separate legal entity like an LLC.

It is a titling tool that pairs neatly with your asset protection plan.

You can create them in most states and even use an out-of-state trustee where laws are friendlier.

Benefits That Actually Move the Needle

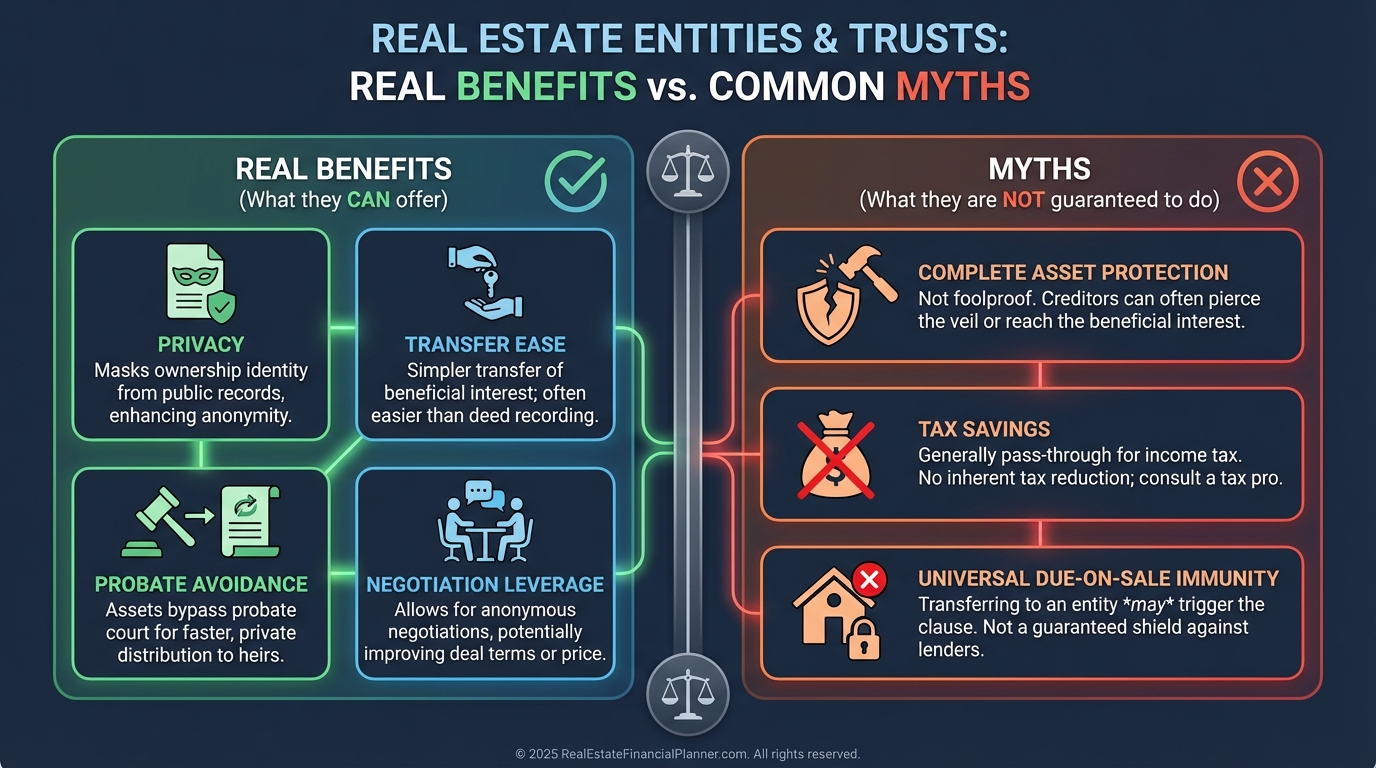

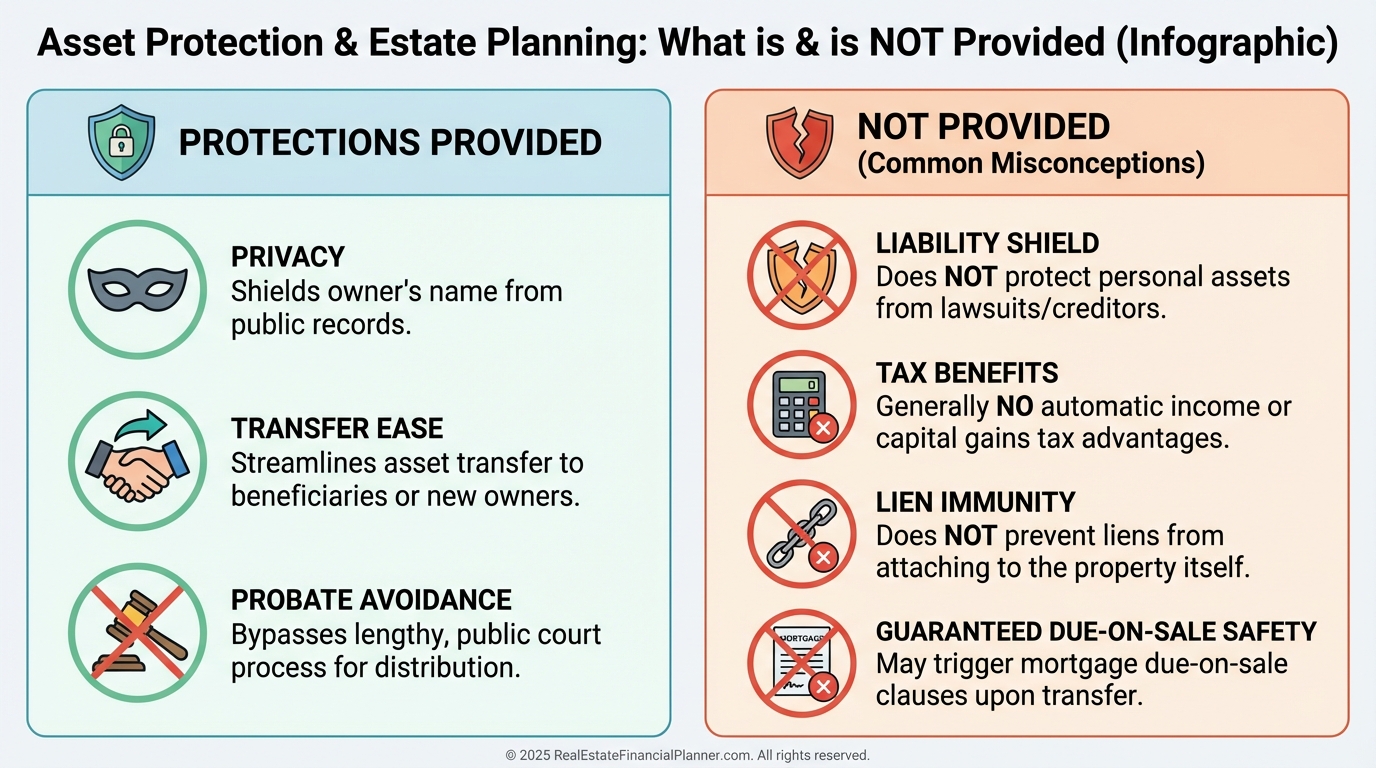

Privacy on public records preserves negotiating power and reduces nuisance claims.

Estate planning is cleaner since beneficial interests can transfer without probate.

Trust title can deter casual litigants because your holdings are harder to map.

Transfers to certain trusts typically do not trigger due-on-sale when the borrower stays a beneficiary and occupies the home under federal rules.

For rentals, there is no absolute safe harbor, but lenders rarely accelerate for a trust transfer alone.

Using one trust per property keeps records tidy and makes dispositions surgical.

Where Land Trusts Fit in Your Strategy

I treat land trusts as privacy and administrative tools.

True liability protection still lives with insurance and entities like LLCs.

When I model a portfolio, I start with risk stacking.

•

Primary: quality insurance with proper limits and umbrellas.

•

Secondary: entity structure, often LLCs.

•

Tertiary: privacy via land trusts to reduce being targeted.

That sequence keeps protection, compliance, and costs aligned.

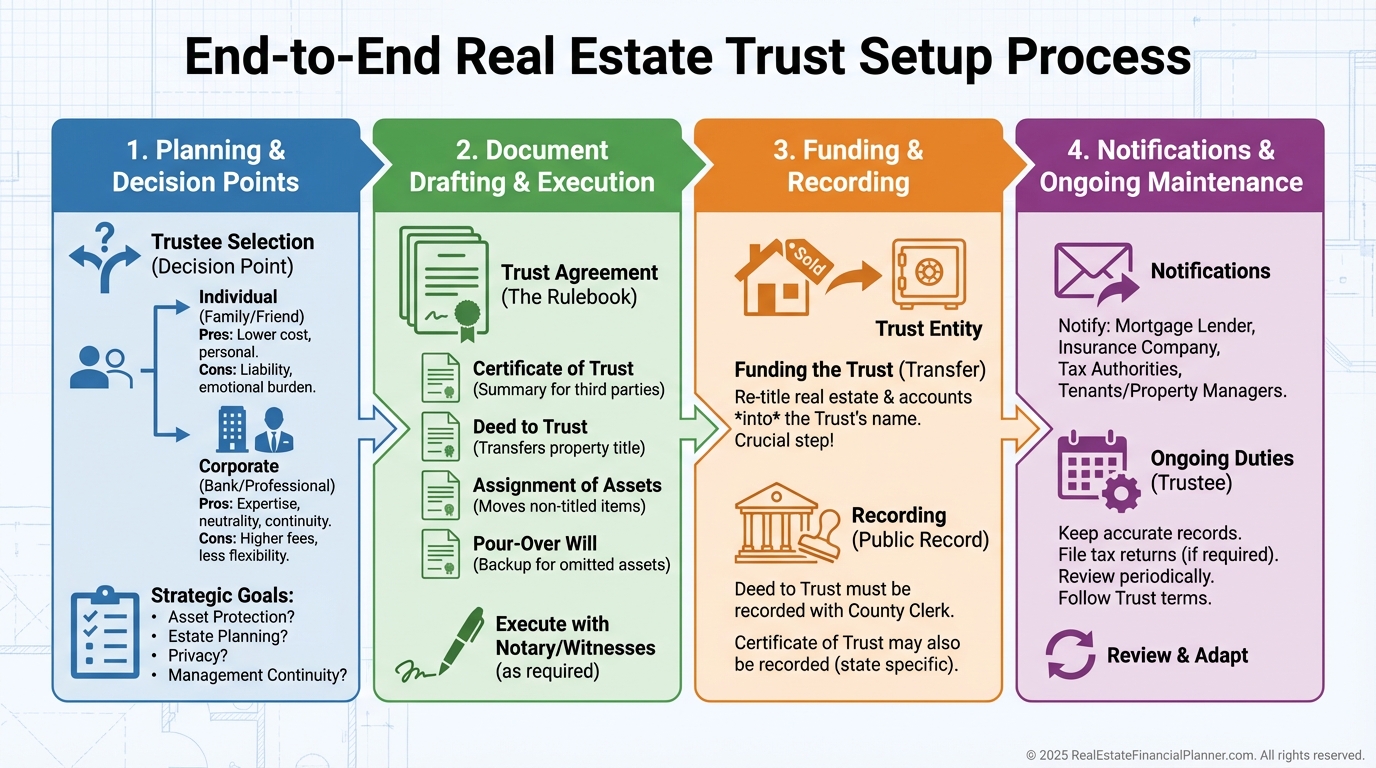

Setting One Up the Right Way

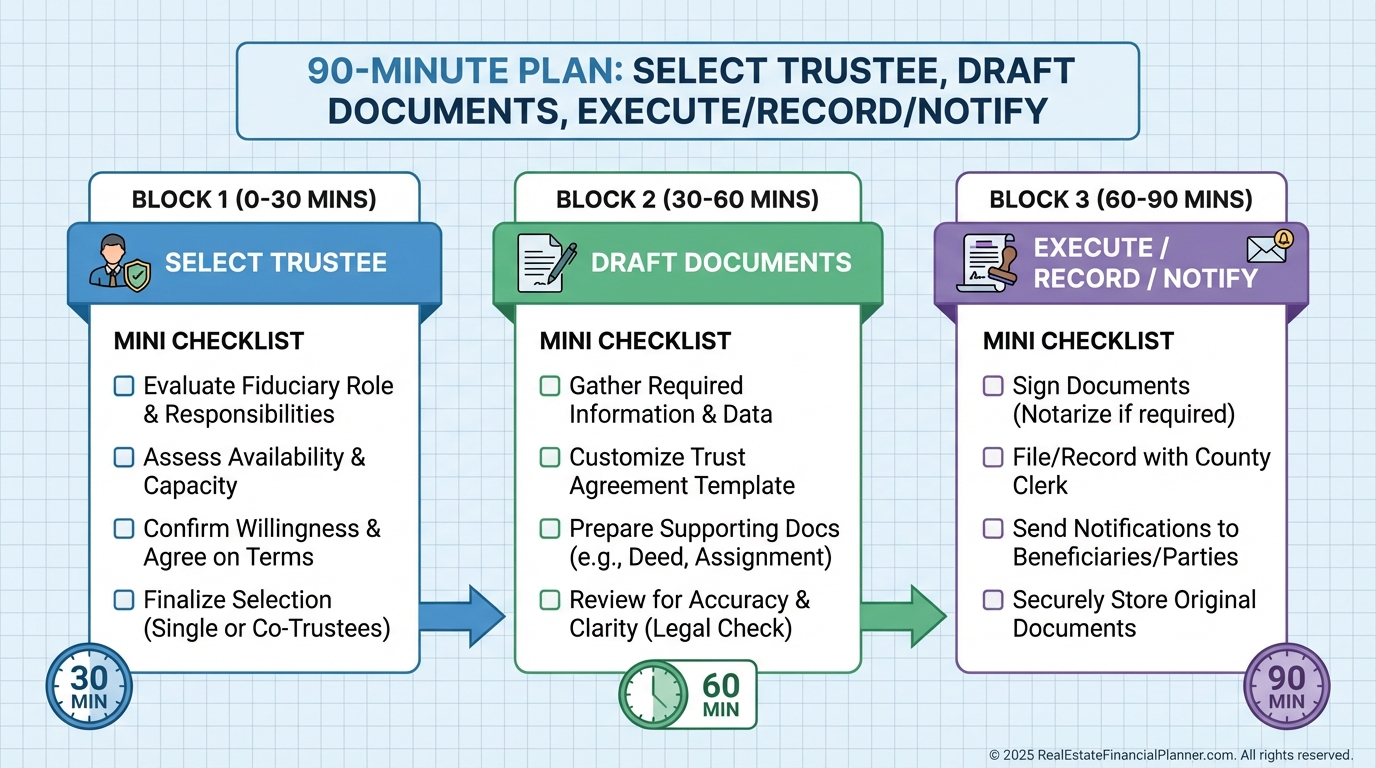

The trustee choice matters.

An individual works, but continuity and responsiveness can fail at the worst time.

Corporate trustees charge a modest annual fee and deliver consistency.

You need four documents.

•

Trust Agreement.

•

Deed in Trust.

•

Assignment of Beneficial Interest.

•

Letter of Direction.

Follow a clean sequence.

•

Get the trustee’s consent and info.

•

Draft the trust with clear powers and successor provisions.

•

Execute and record the deed in trust.

•

Assign beneficial interest and store the original securely.

•

Notify insurance, lender if required, property manager, and title company.

Expect attorney-prepared setups to run $500–$2,000 plus recording fees.

Templates exist, but errors here are expensive and public.

Common mistakes include forgetting to assign beneficial interest, using the wrong deed, failing to notify insurance, and selecting an unresponsive trustee.

Advanced Plays I Use With Clients

Pair the land trust with an LLC that owns the beneficial interest.

The trust provides privacy on title, while the LLC supplies liability protection.

In creative finance, trusts make assignments and exits smooth.

•

Subject-to: transfer to trust to lower visibility; know the due-on-sale nuance and keep payments current.

•

Seller financing or wraps: title in trust with precise directions to the servicer.

•

Wholesaling: contract in trust, assign the beneficial interest instead of double closing.

For partnerships, percentage beneficial interests keep partners off title while documenting economics cleanly.

For 1031 exchanges, have the trustee execute exchange documents as the legal titleholder.

You maintain privacy, and your accommodator preserves the chain of ownership for tax deferral.

Deal Analysis With REFP Tools

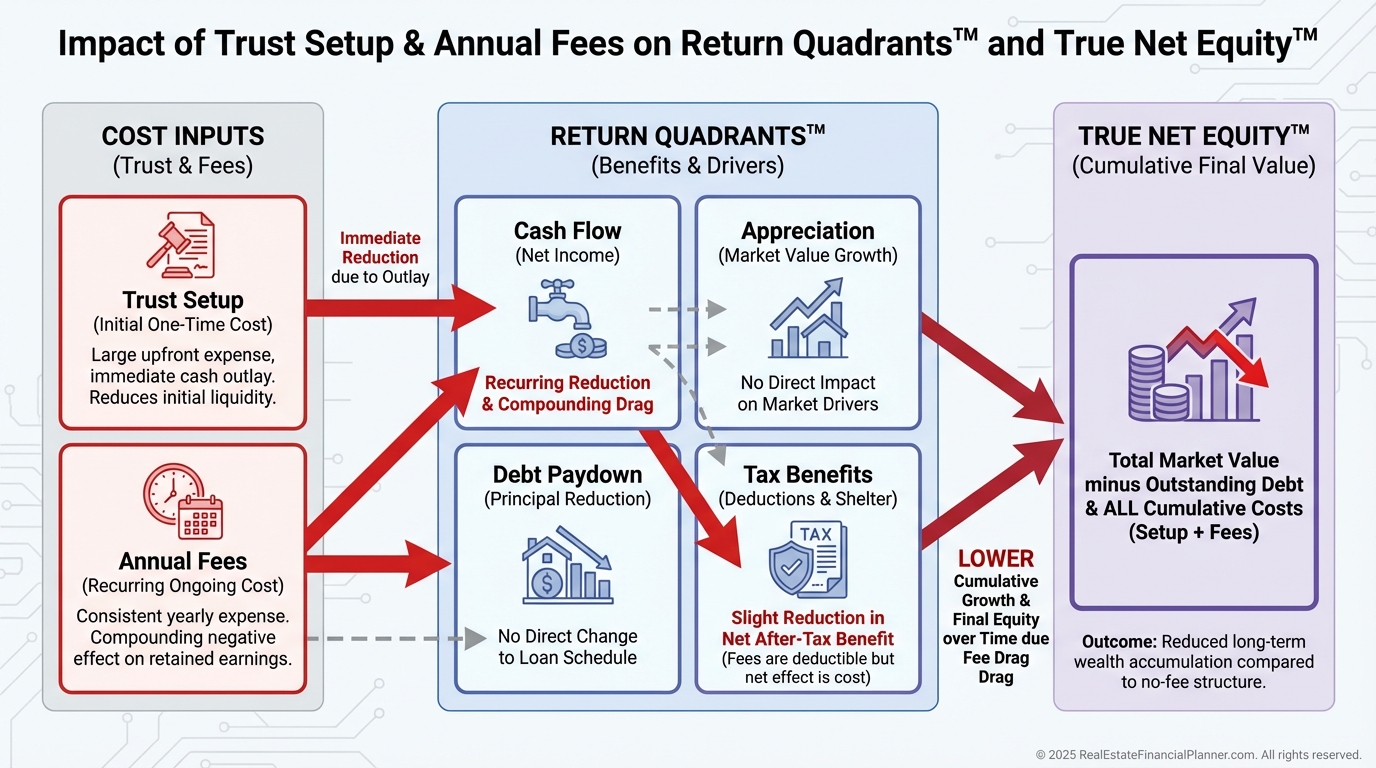

When I analyze deals, I add trust setup to acquisition costs and the trustee fee to operating expenses.

That keeps cash-on-cash honest.

In Return Quadrants™, trust costs slightly reduce Cash Flow but leave Appreciation, Principal Paydown, and Tax Benefits unchanged.

Depreciation remains identical because tax treatment looks through the trust to you.

Use True Net Equity™ to compute equity after transaction costs if you plan to assign beneficial interests rather than record a new deed.

Your exit friction can drop, improving your net.

If you Nomad™, you can buy as an owner-occupant, later move out, and retitle or assign interests as your plan evolves.

Just respect the due-on-sale rules, occupancy certifications, and loan covenants during the initial period.

The World’s Greatest Real Estate Deal Analysis Spreadsheet™ models these with a few line items.

Add the one-time trust setup to closing costs and the annual trustee fee to operating expenses.

Taxes: What Actually Happens

For tax purposes, most land trusts are disregarded.

You report income and expenses as if you held title directly.

Your depreciation schedule stays the same.

Schedule E reporting continues for rentals, and there is no separate trust return unless you structure a complex trust with multiple beneficiaries.

Check state transfer tax rules on moving property into or out of trusts.

Some states are friendly, and others assess tax on transfers you assumed were neutral.

Limits, Risks, and Lender Nuance

A land trust is not a force field.

It does not block tax liens, divorce orders, criminal matters, or determined judgment creditors.

Some lenders dislike trusts and ask for extra documentation or seasoning.

Local banks and credit unions tend to be easier than national lenders.

Always notify your insurer and list the trust and trustee as appropriate insureds.

Skipping this step creates coverage gaps at the worst time.

If you need maximum liability protection, use an LLC regardless of whether a trust holds title.

If your state charges heavy transfer tax or you plan to owner-occupy indefinitely, the benefit may be marginal.

What I Check, Avoid, and Document

When I review trust setups, I confirm the deed was recorded correctly, beneficial interest is assigned and dated, and successor trustee language exists.

I also verify lender and insurer notifications, and I store original wet signatures in a safe, not in the property files.

I avoid naming the beneficiary on any recorded document.

I avoid trustees who are slow to respond, because unresponsive trustees kill deals and lock up closings.

I document a standing Letter of Direction with precise limits and require trustee indemnification language.

A 90-Minute Implementation Plan

Block 30 minutes to choose the trustee and confirm their data.

Block 30 minutes to draft the trust agreement, assignment, and letter of direction.

Block 30 minutes to execute, record the deed in trust, and notify insurance and any servicer.

Then update your spreadsheet with setup and annual fees so your projections stay true.

Action Steps

•

Identify which properties benefit most from privacy and clean transfer options.

•

Consult a real estate attorney in your state for document prep and local tax rules.

•

Start with one property and refine your process before rolling out.

•

Consider a corporate trustee for reliability.

•

Update your models using Return Quadrants™ and True Net Equity™ to reflect the small cost and the large operational benefit.

Remember, privacy is best installed before you need it.

Get this done while the water is calm, not during a storm.