Forced Appreciation: How You Create Equity on Demand

Learn about Forced Appreciation for real estate investing.

Most real estate investors wait.

They wait for the market to go up.

They wait for appreciation to “just happen.”

They wait years for equity to slowly appear on a net worth statement.

When I rebuilt my own portfolio after bankruptcy, waiting was not an option.

That’s when forced appreciation stopped being a concept and became a survival skill.

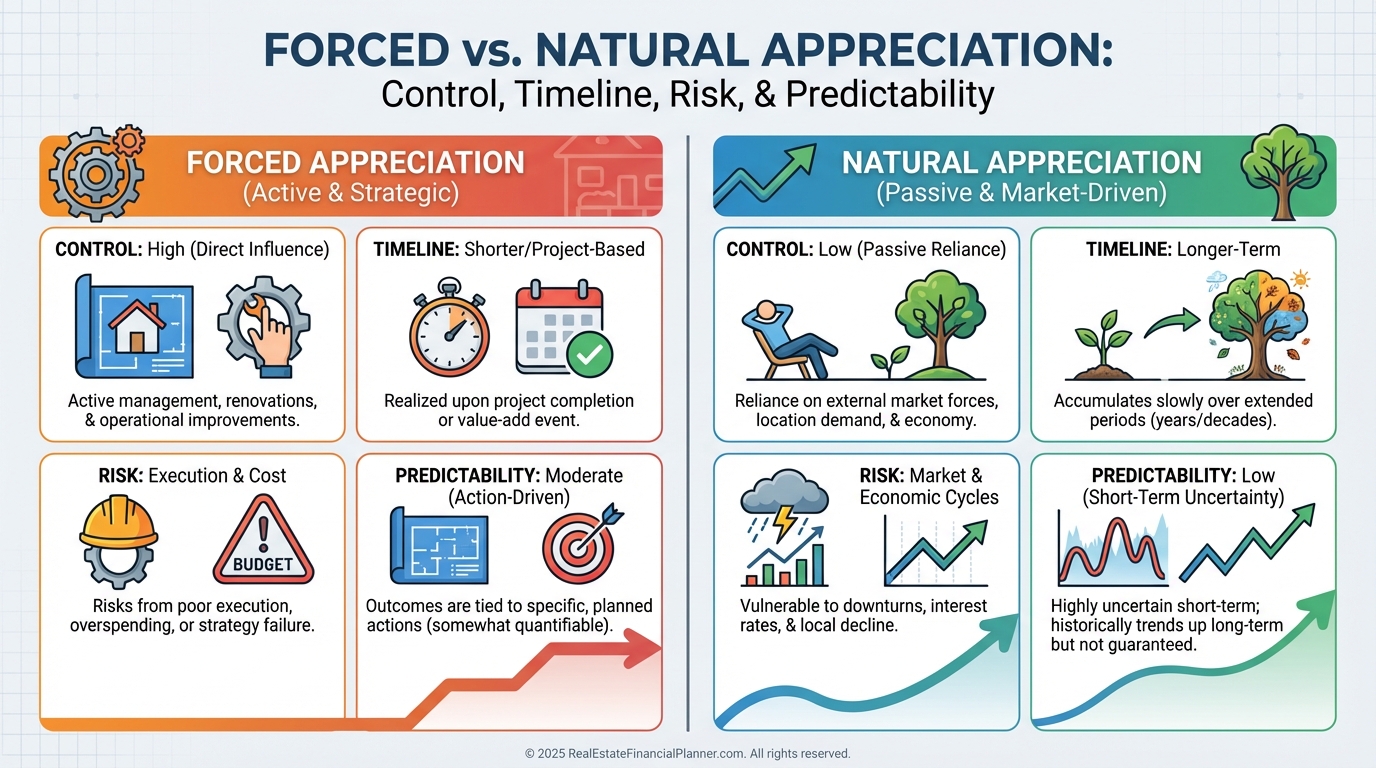

Forced appreciation is how you manufacture equity through deliberate action instead of hoping the market cooperates.

It’s the difference between passive optimism and controlled execution.

What Forced Appreciation Really Is

Forced appreciation is the intentional increase of property value through improvements, repositioning, or operational changes.

Natural appreciation happens to you.

Forced appreciation happens because of you.

When I help clients analyze deals, I always separate these two in their minds.

If you don’t, you’ll overpay, over-renovate, or overestimate future returns.

Forced appreciation compresses time.

What might take seven to ten years through market growth alone can often be created in six to twelve months with the right execution.

That time compression is the real power.

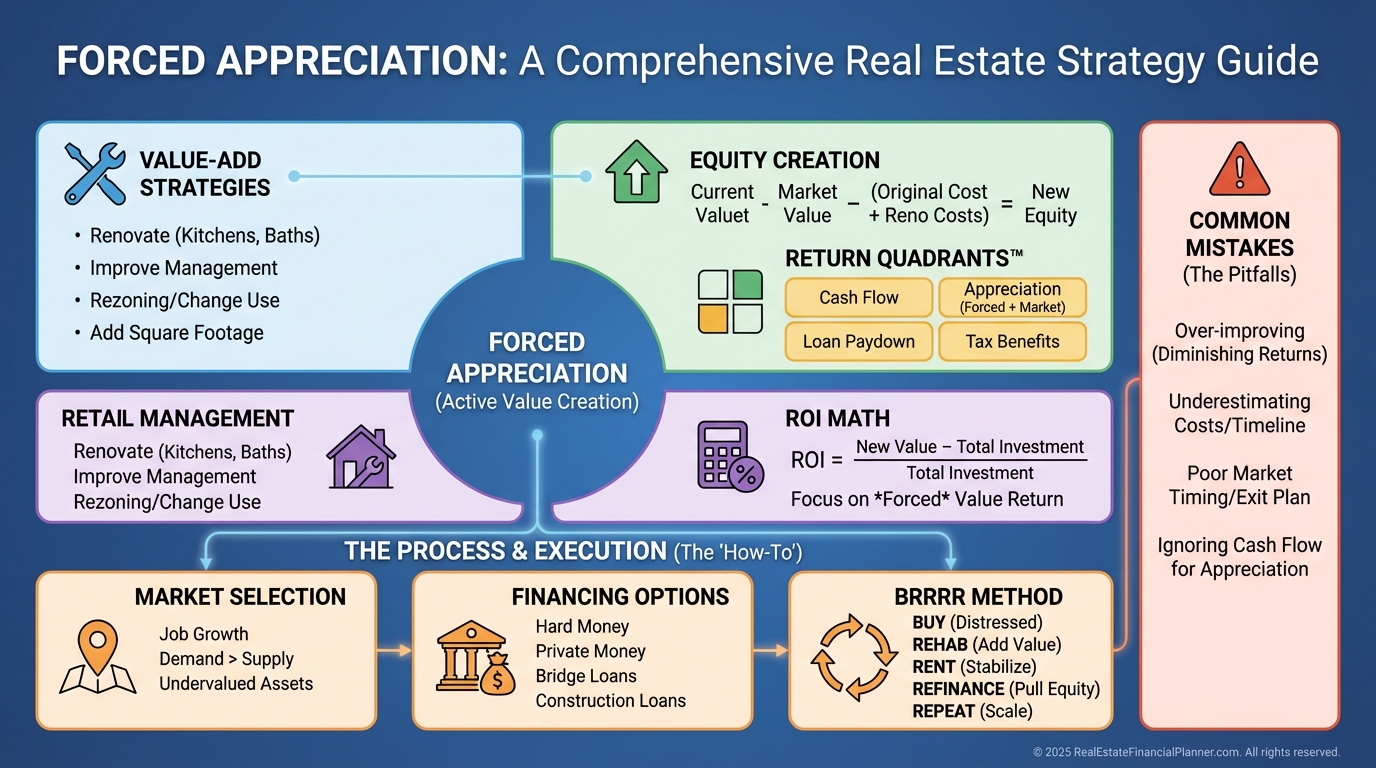

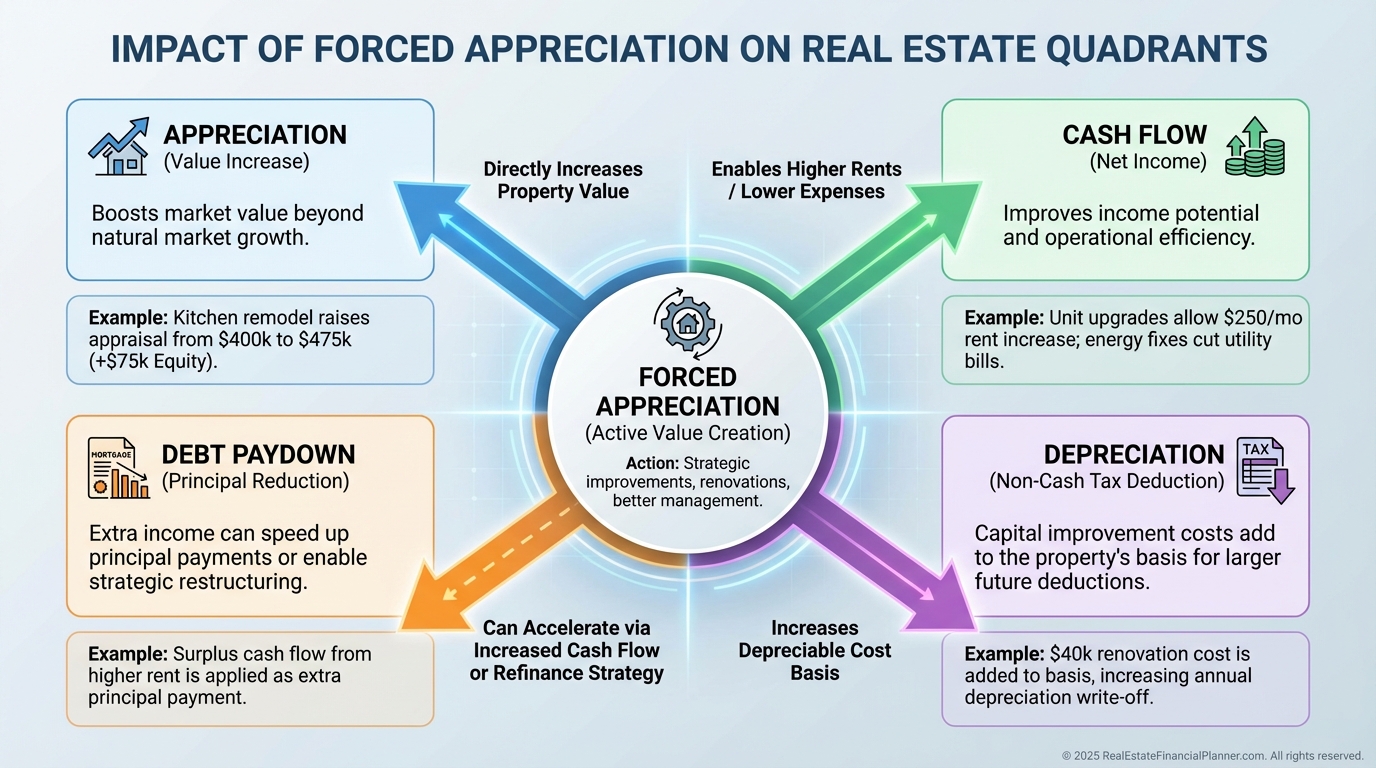

How Forced Appreciation Fits the Return Quadrants™

Inside the Return Quadrants™ framework, forced appreciation lives in the Appreciation quadrant.

But it never stays isolated there.

When I model deals in The World’s Greatest Real Estate Deal Analysis Spreadsheet™, I see forced appreciation ripple through every quadrant.

Higher value often leads to higher rent.

Higher rent improves cash flow.

Capital improvements increase depreciation.

The debt paydown stays the same, but becomes less important by comparison.

That’s a good thing.

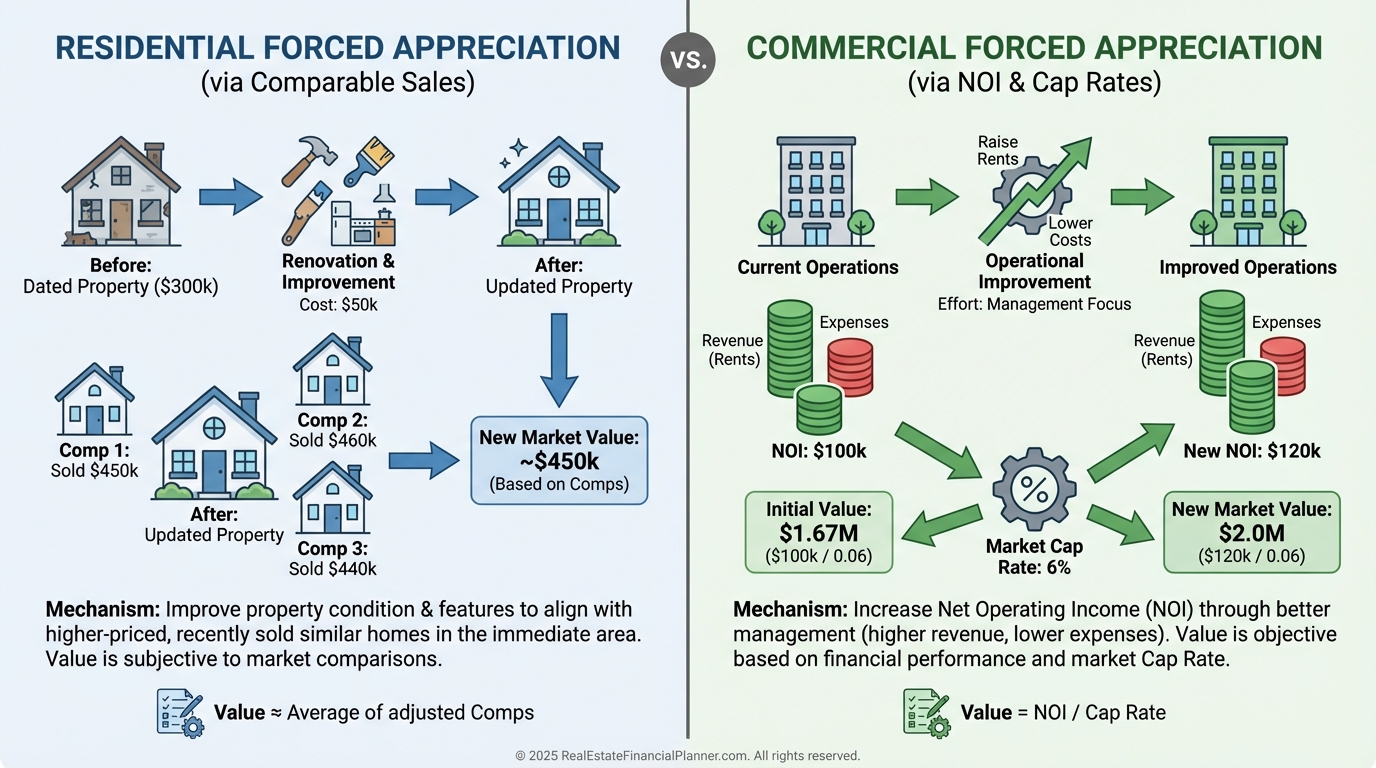

Residential vs Commercial Forced Appreciation

Residential forced appreciation is driven by comparable sales.

Commercial forced appreciation is driven by Net Operating Income.

That distinction matters more than most investors realize.

In residential investing, making a property more desirable than nearby comps creates value.

In commercial investing, every dollar of increased NOI multiplies value through the cap rate.

Miss this distinction, and your renovation strategy will be wrong from day one.

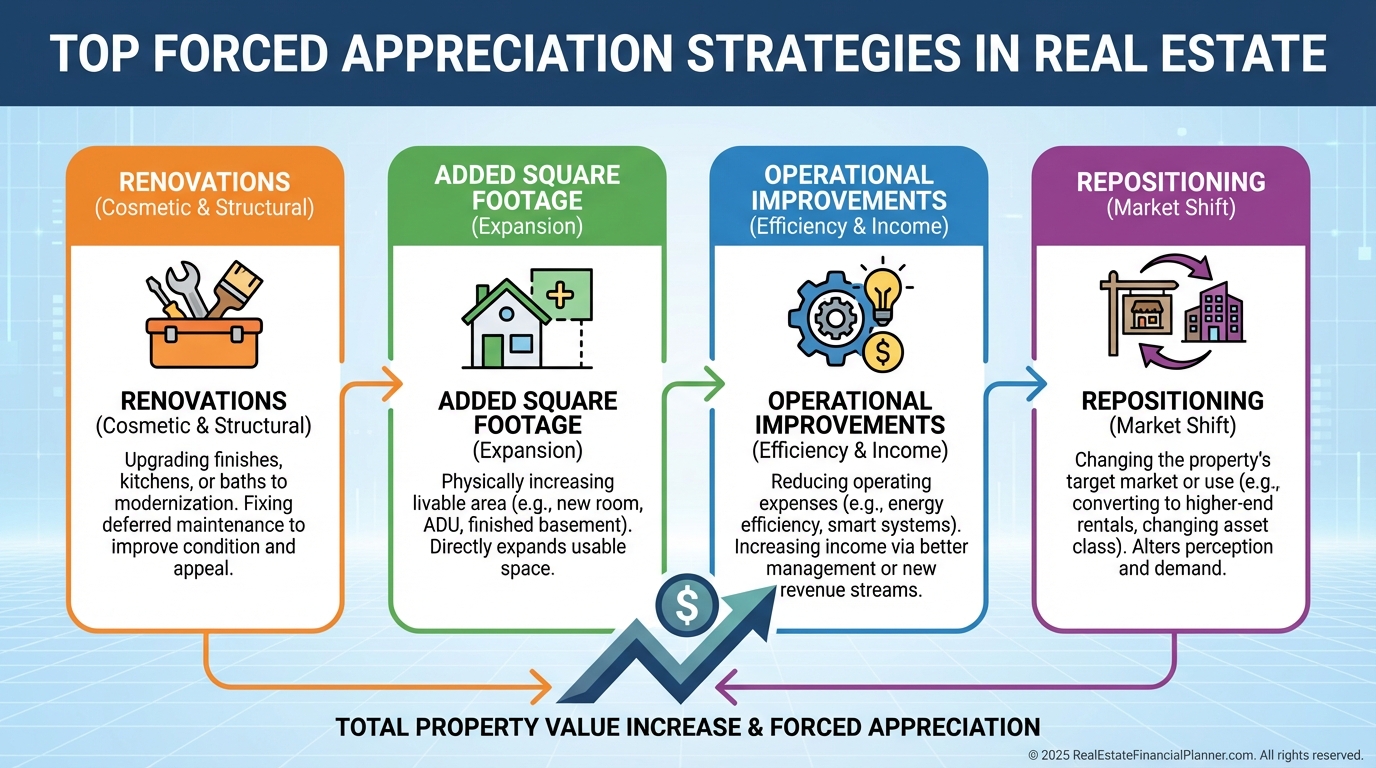

Forced Appreciation Strategies That Actually Work

When I review renovation plans, I’m not looking for creativity.

I’m looking for restraint.

These are the strategies that consistently create equity without destroying returns:

Strategic Renovations

Kitchens and bathrooms matter, but only to neighborhood standards. Luxury finishes in average areas don’t appraise.

Adding Bedrooms or Units

Extra rentable space often creates the largest valuation jumps with the least aesthetic risk.

Operational Improvements

Expense reduction, rent optimization, and better tenant quality increase NOI quietly and reliably.

Curing Deferred Maintenance

Fixing what scares retail buyers often restores full market value immediately.

Repositioning the Asset

Changing how a property is used can change what it’s worth entirely.

The goal is not perfection.

The goal is spread between cost and value.

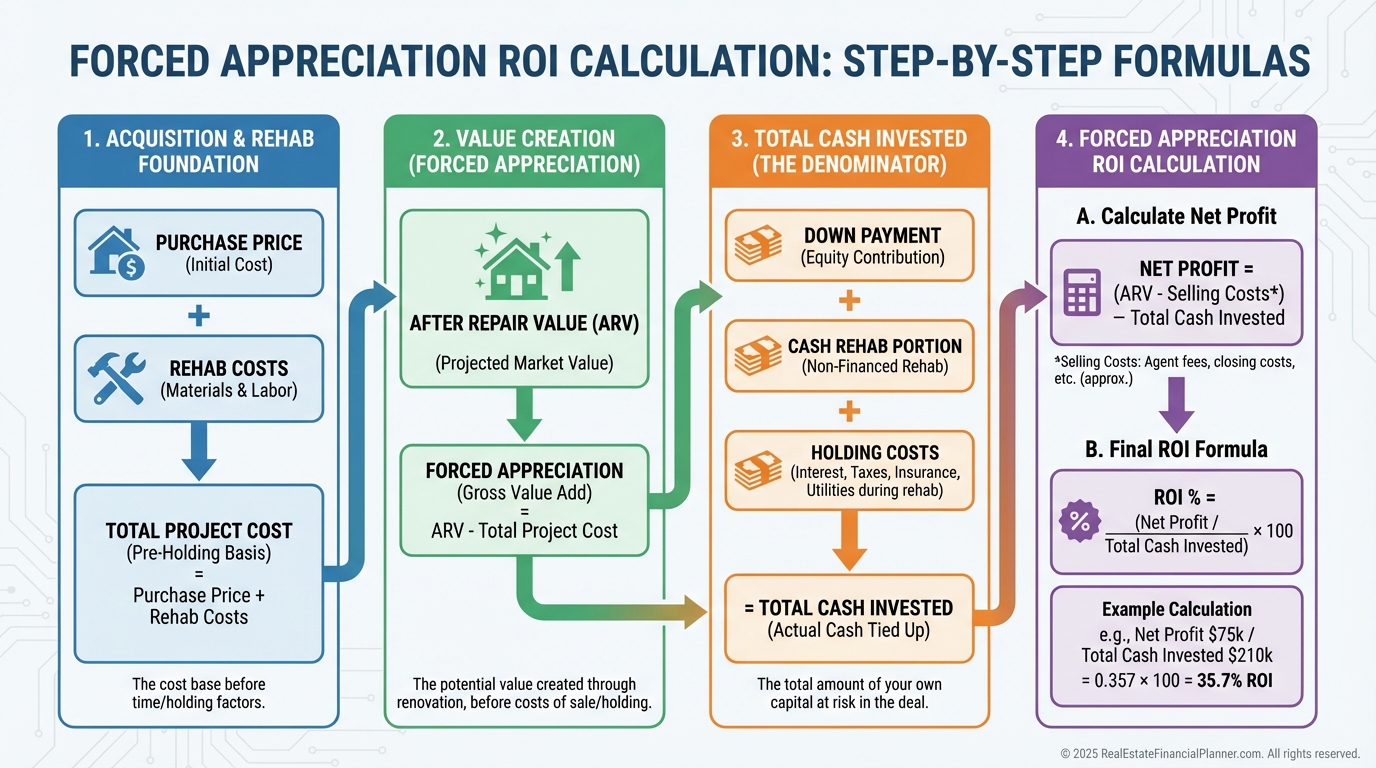

Calculating Forced Appreciation Correctly

This is where most investors fool themselves.

They calculate upside and ignore friction.

When I run forced appreciation scenarios, I look at:

Improvement costs

Holding and financing costs

Cash invested

Time to completion

A project that looks great on paper can collapse once time and capital are properly priced.

That’s why I always compare forced appreciation returns to alternative uses of the same cash using True Net Equity™ logic.

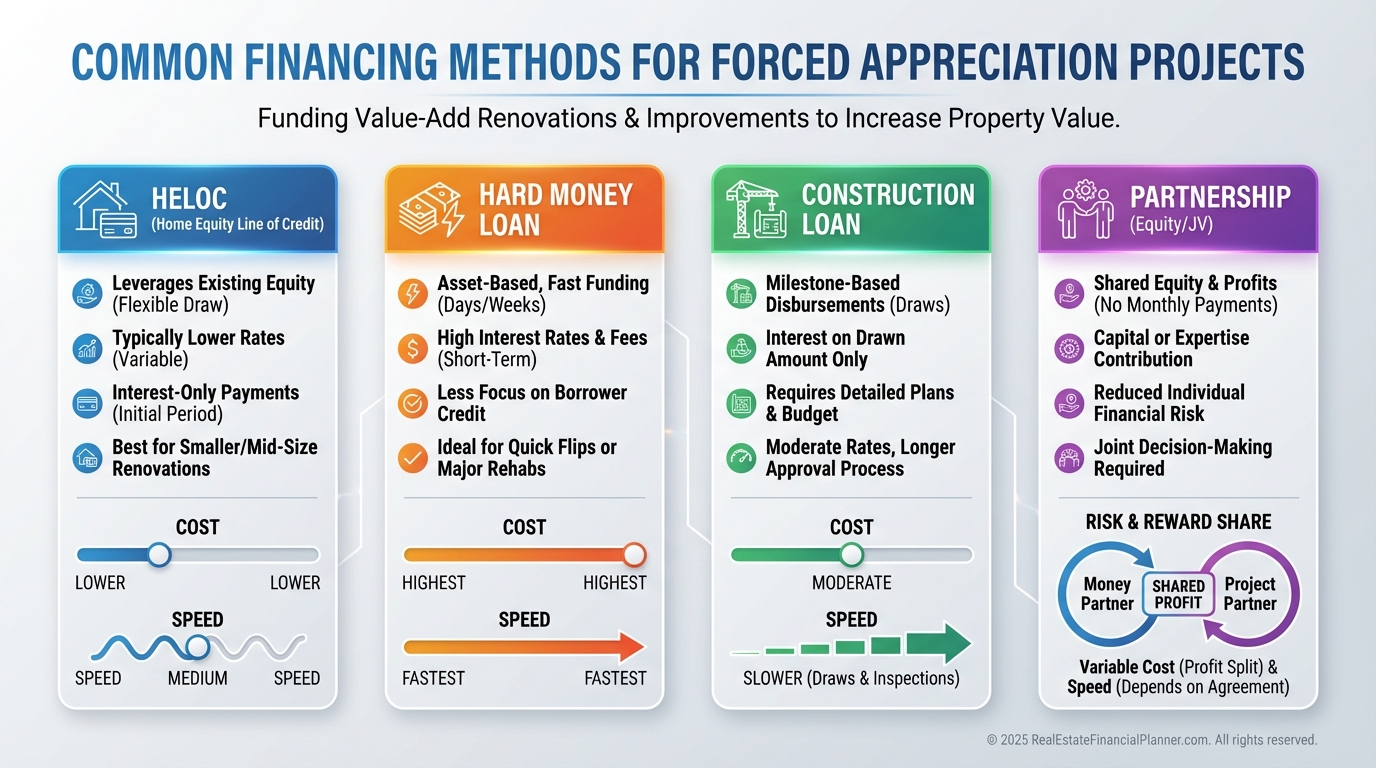

Financing Forced Appreciation Projects

Financing determines scale.

Cash determines survival.

The most common tools I see investors use effectively include:

HELOCs on stabilized properties

Short-term private or hard money loans

Construction loans that convert to permanent financing

Partnerships that split capital and execution

This is where BRRRR often enters the picture.

Forced appreciation is the engine that makes BRRRR possible.

Without real equity creation, refinancing becomes wishful thinking.

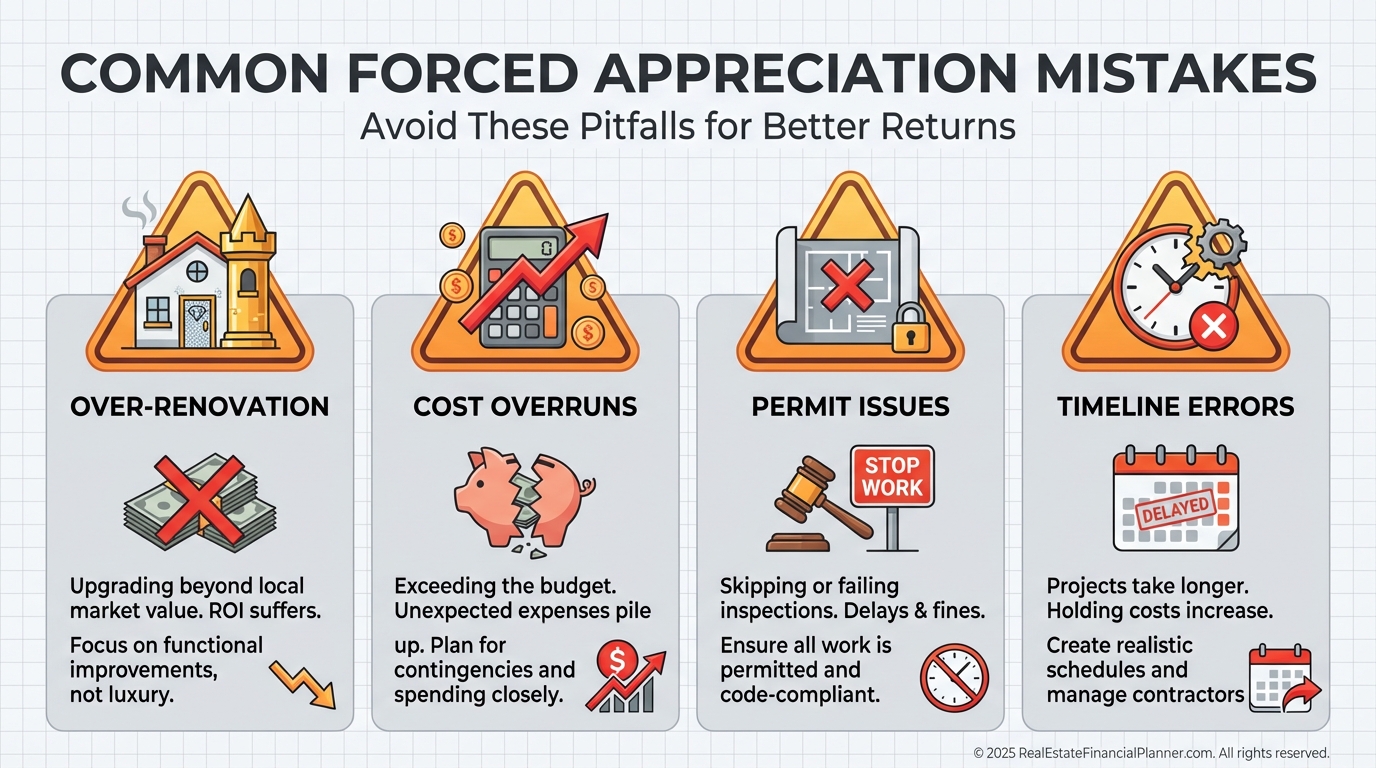

The Most Common Forced Appreciation Mistakes

These mistakes show up again and again.

I warn clients about them constantly.

Over-improving for the neighborhood

Underestimating renovation timelines

Skipping permits to “save time”

Trusting a single contractor

Ignoring exit liquidity

Forced appreciation rewards discipline.

It punishes optimism.

Why Forced Appreciation Changes Everything

Forced appreciation gives you leverage over time itself.

It lets you move faster, recycle capital, and compound results.

One well-executed project can change your entire trajectory.

I’ve seen it happen hundreds of times.

You don’t need dozens of properties.

You need one deal done correctly.

That’s how real estate stops being passive hope and becomes an intentional financial plan.