Property Seasoning: The Clocks, Traps, and Timelines That Decide Your Profits

Learn about Property Seasoning for real estate investing.

Why Property Seasoning Quietly Dictates Your Results

Sarah felt it after a flawless eight-week renovation on a duplex we modeled together.

The value was there, the tenants were ready, but the refinance door stayed locked because the clocks hadn’t run long enough.

On paper, her deal was a home run.

On the calendar, it needed more time.

My goal today is to make those clocks visible so you can plan actions that align with lender reality instead of fighting it.

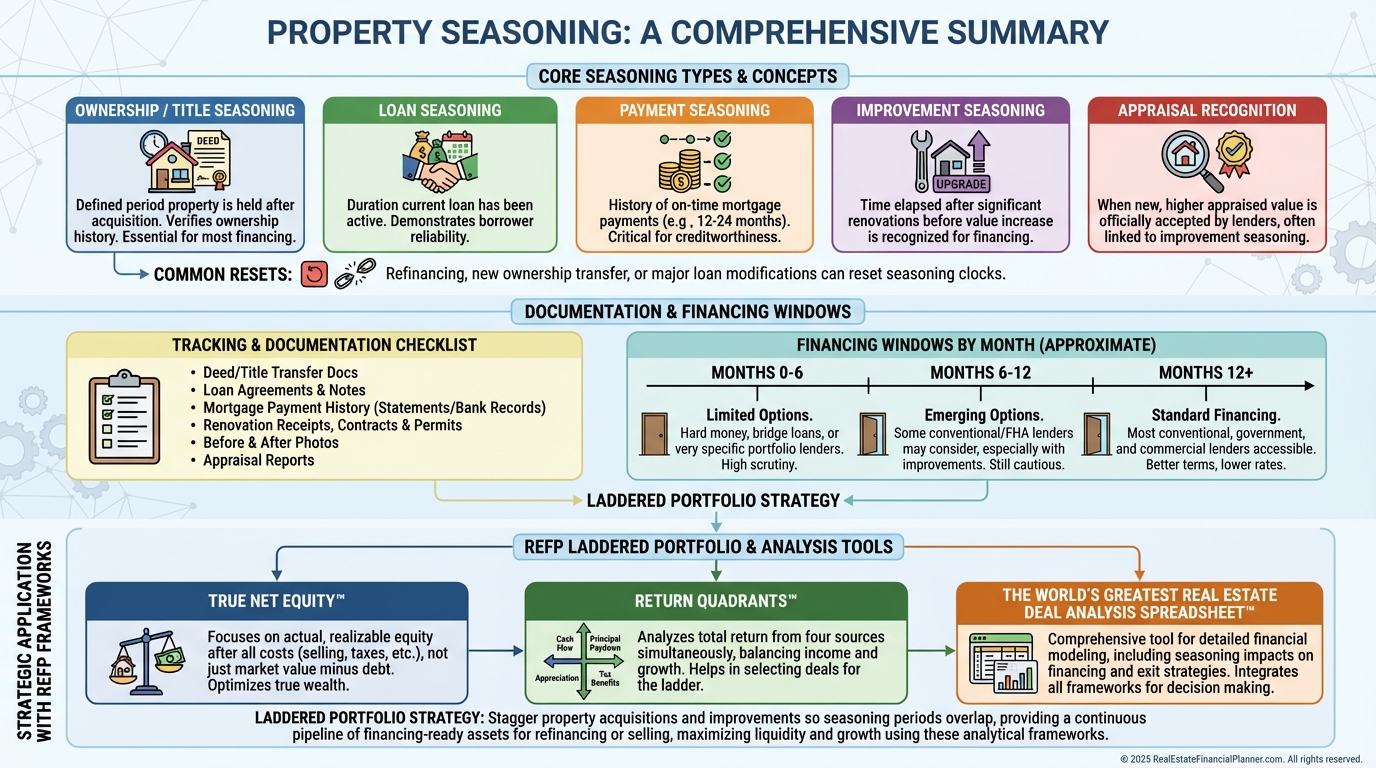

What Is Property Seasoning?

Property seasoning is the minimum time a lender or the market wants to see before recognizing your improved value or allowing certain loans.

Think of it as “time-on-title plus performance proof.”

It’s not just bureaucracy.

It’s how lenders filter out inflated values and unstable owners.

Most investors mix up property seasoning with title seasoning and loan seasoning.

They’re related, but different.

Property seasoning is the umbrella.

Title seasoning is strictly time since you took title.

Loan seasoning is time since your current mortgage funded.

Payment seasoning is your on-time payment streak on that property.

Improvement seasoning is how long it’s been since renovations were completed and stabilized.

The Clocks I Model Before Anyone Swings a Hammer

Here’s how I define and track each clock when we plan a deal in The World’s Greatest Real Estate Deal Analysis Spreadsheet™.

•

Ownership/Title Seasoning: Starts the day your name hits the deed. Many conventional lenders require 6–12 months before cash-out.

•

Loan Seasoning: Resets every time you refinance. This is how serial refi investors accidentally create endless waiting cycles.

•

Payment Seasoning: Documented on-time payments on this property. One late can knock you out of programs for a while.

•

Improvement Seasoning: Time since permitted work closed and the property stabilized. Some lenders want 6–12 months before recognizing all the added value.

When these clocks align with your cash-out timeline, you recycle capital.

When they don’t, holding costs eat your returns.

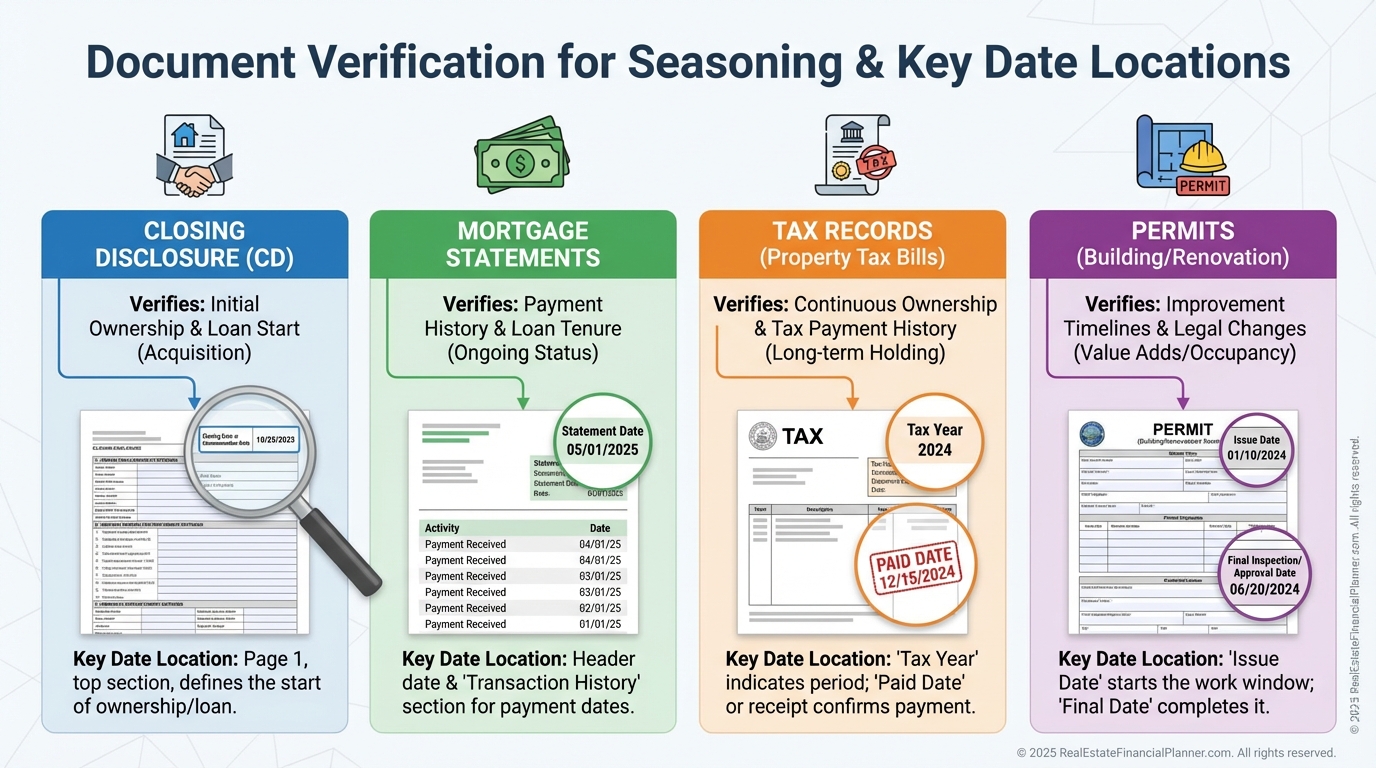

The Documents That Prove Your Seasoning

When I underwrite a client’s plan, I verify the seasoning dates before making any promises.

It takes five minutes, and it prevents five-figure mistakes.

Keep these in every property file.

•

Closing Disclosure or HUD-1: This is Day Zero for title/ownership seasoning.

•

Mortgage Statements: Your clean, on-time payment history lives here.

•

Property Tax Records: Third-party ownership verification.

•

Permits and Final Inspections: “Complete” for lenders usually means permit closed, not when the last contractor left.

Build Your Simple Seasoning Tracker

I start with a one-page spreadsheet per property.

Short columns.

Fast decisions.

•

Purchase/Closing Date

•

First Mortgage Payment Date

•

Renovation Start and Permit Close Dates

•

6-, 12-, and 24-month milestones

Then I drop those dates into The World’s Greatest Real Estate Deal Analysis Spreadsheet™ timeline so the cash flow and refinance assumptions match reality.

Missing a milestone by a week can delay a cash-out by months.

Ask me how many times I’ve seen that.

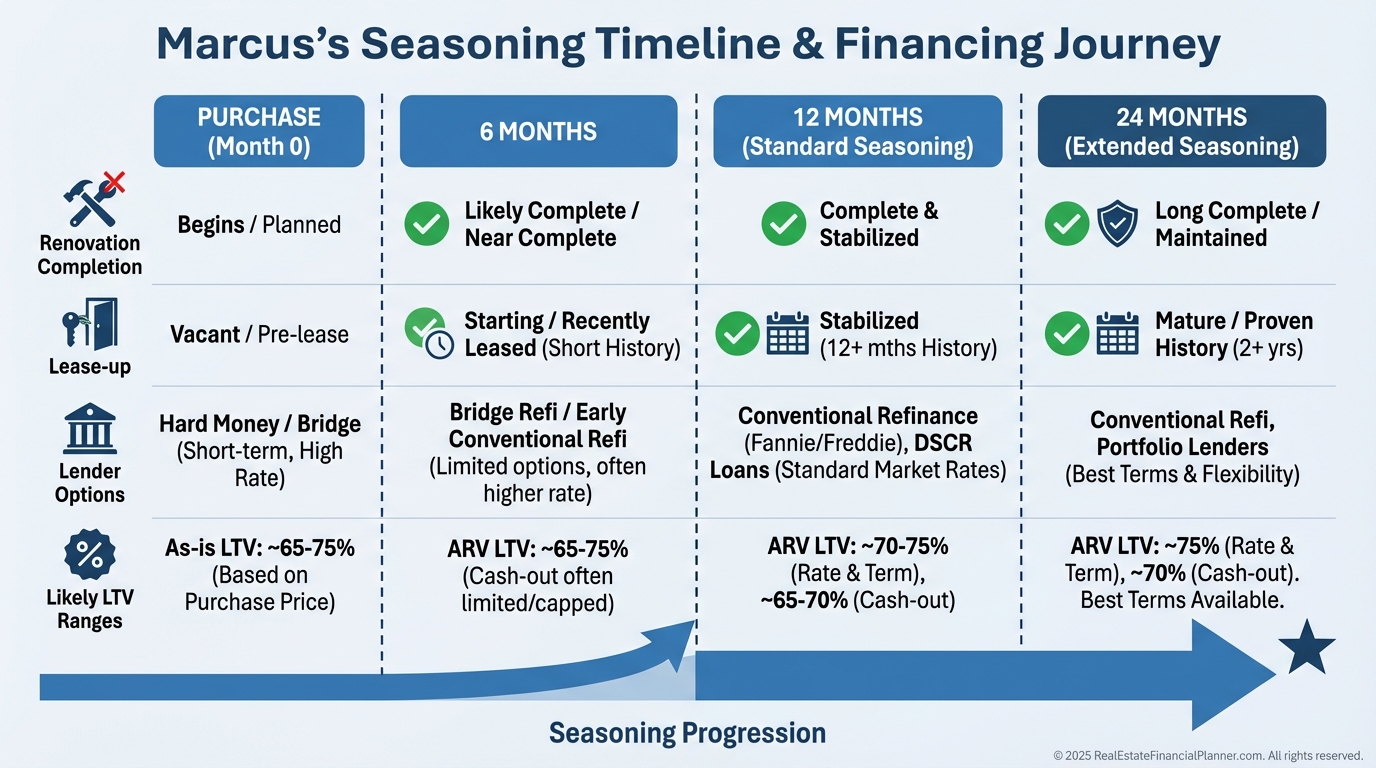

A Real Timeline Walkthrough

Marcus closed a duplex on March 15 with hard money.

He finished renovations by May 15 and leased by July 1.

Here’s how we planned his clocks.

•

September 15 (6 months on title): Strong candidates are portfolio lenders and credit unions if payments are clean.

•

March 15 next year (12 months): Conventional cash-out options typically open, subject to appraisal and guidelines.

•

March 15 a year later (24 months): Best terms and widest menu of programs, especially with documented rent history.

Because we had this mapped at closing, we set expectations for cash-out dates, not wish dates.

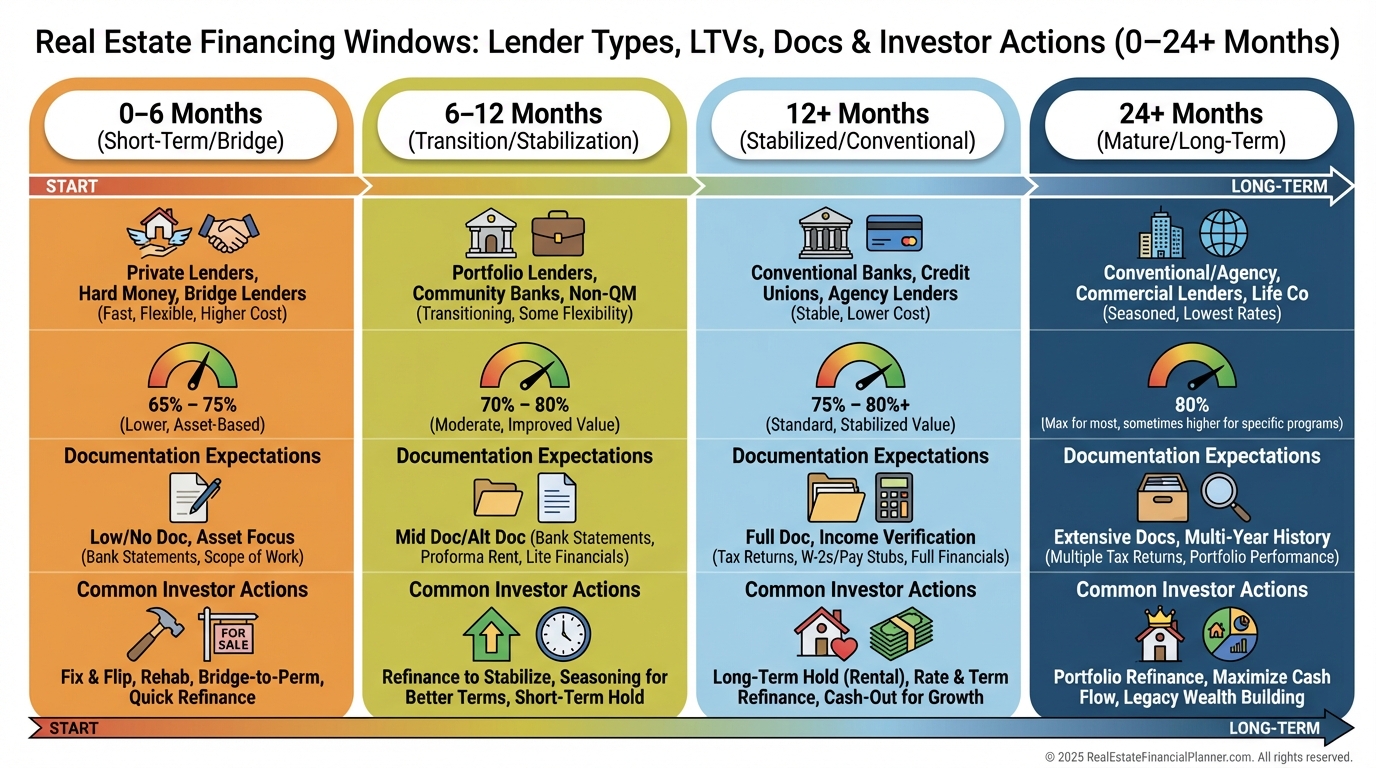

Financing Windows And Appraisal Reality

Here’s the pattern I see across markets and cycles.

Adjust rates to what’s current when you read this, but the windows stay consistent.

•

0–6 Months: Hard money, private money, some portfolio lenders. Conservative LTVs and higher pricing.

•

6–12 Months: More portfolio options, the occasional conventional route depending on guidelines. Better pricing and more leverage.

•

12+ Months: Conventional opens broadly. Cash-out becomes far more feasible.

•

24+ Months: Best terms. Performance history can push appraised value and confidence.

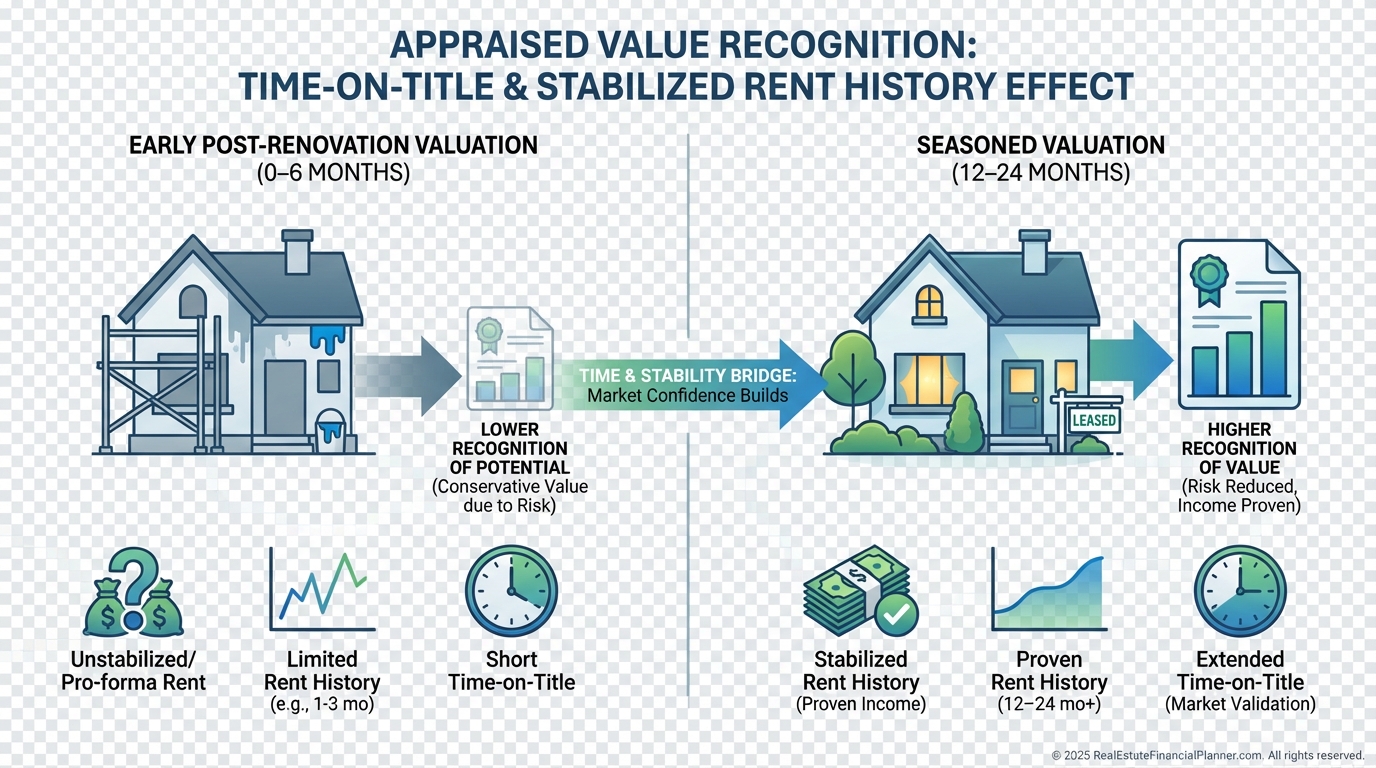

Appraisers also look at seasoning and rent history when selecting comps and making adjustments.

Documentation beats speculation.

Your net proceeds hinge on it.

True Net Equity™ And Return Quadrants™ Under Seasoning

I calculate True Net Equity™ as the money you’d actually walk away with after selling or refinancing, net of costs and lender limits.

Seasoning directly changes that number because LTV caps and appraised value recognition change with time.

Your Return Quadrants™ also shift.

•

Appreciation: Forced appreciation shows up faster than lenders recognize it.

•

Cash Flow: Improves as you stabilize and lock lower-cost debt later.

•

Debt Paydown: Continues quietly while you wait.

•

Tax Benefits: Depreciation runs regardless, but cost segregation benefits usually pair better with longer holds.

When clients see this laid out, they stop rushing and start sequencing.

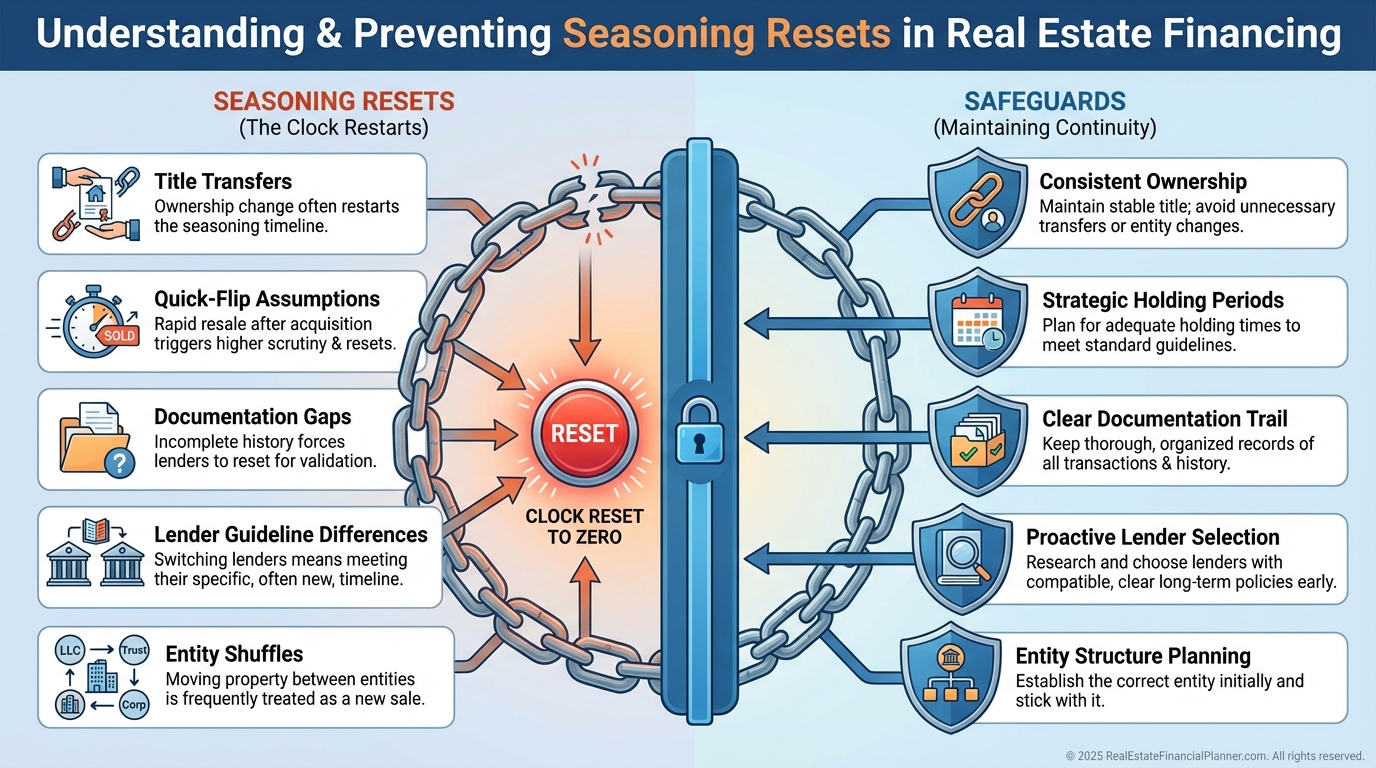

The Mistakes That Reset The Clock

Here are the avoidable resets I warn clients about every week.

They look small on paper and expensive on your statement.

•

Quick-Flip Refinance Assumption: Finishing in 60 days doesn’t guarantee cash-out any sooner.

•

Title Transfers Mid-Seasoning: Moving title from personal name to a new LLC can reset the clock with many lenders.

•

Documentation Gaps: If you can’t prove on-time payments and permit close dates, underwriting stalls.

•

Ignoring Lender-Specific Guidelines: Two lenders, same product name, different seasoning rules.

•

Entity Shuffles: Inter-LLC transfers can create seasoning and tax headaches unless structured carefully.

Robert learned this the hard way.

He moved a triplex into a fresh LLC at six months.

The lender viewed it as a new acquisition.

A full year of higher interest expense followed.

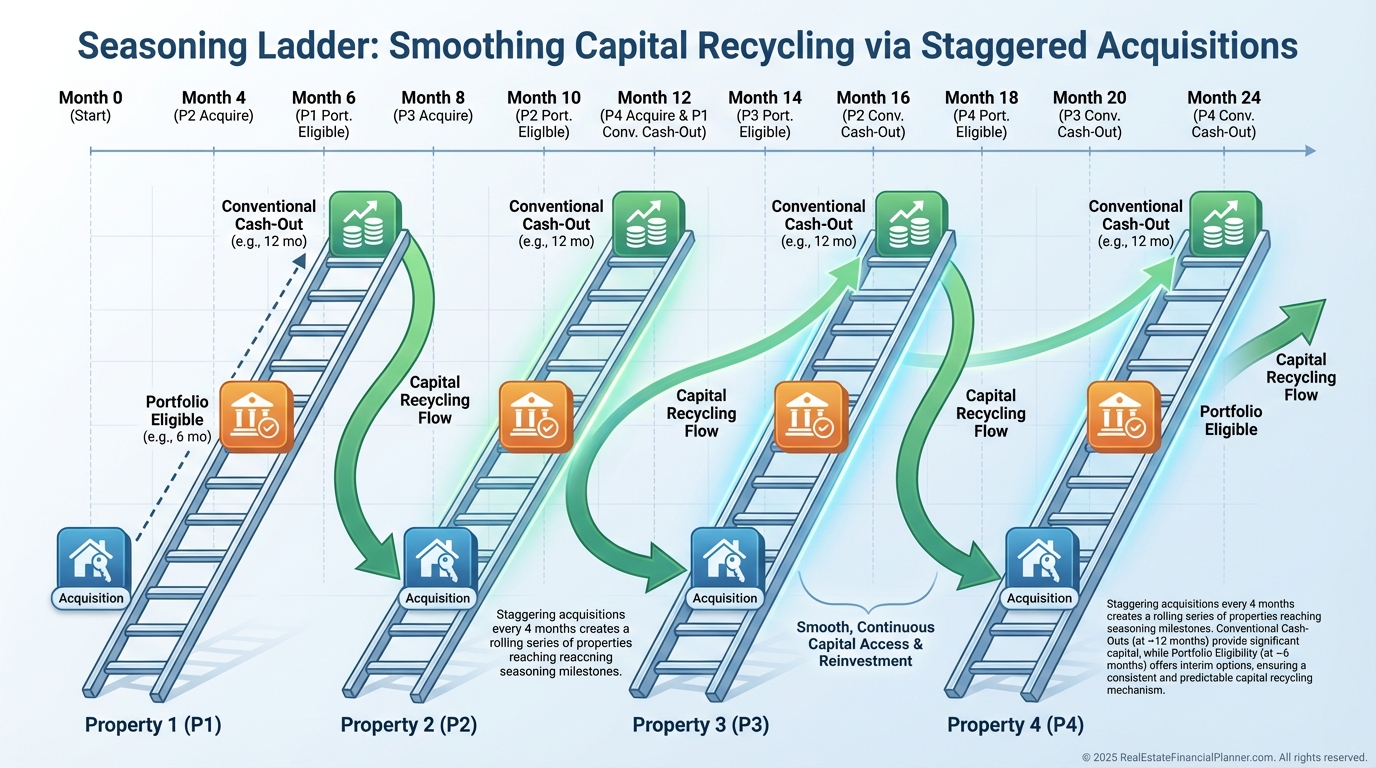

Advanced Strategy: Build A Seasoning Ladder

Professionals ladder seasoning across their portfolio so capital unlocks every quarter.

Instead of buying three this month, they buy one now, one in four months, one four months later.

That creates a steady refinance pipeline and smoother cash flow.

It also reduces feast-or-famine risk.

In BRRRR sequences, I align renovations to run concurrently with the seasoning clock, not after it.

I also negotiate better buys when sellers can’t sell conventionally because they’re not seasoned yet.

That timing is worth real dollars.

The Nomad™ Angle And Owner-Occupied Paths

For clients using Nomad™, that first year of owner-occupancy often satisfies both title and payment seasoning while unlocking superior loan terms.

You move in, season naturally, then convert to a rental and roll capital into the next property.

It’s the simplest seasoning plan on the planet if your life allows it.

Your 30-Minute Action Plan

Open your calendar and pull one file.

Set the 6-, 12-, and 24-month dates from your Closing Disclosure.

Add permit close dates and your first on-time mortgage payment date.

Drop those into The World’s Greatest Real Estate Deal Analysis Spreadsheet™ to sync your cash-out and capex timelines.

Call two portfolio lenders and two conventional lenders.

Ask for current seasoning rules, cash-out LTV, and documentation requirements.

Save those guidelines in your property file.

You’ll sleep better, and you’ll stop missing windows.

Bottom Line

Seasoning is predictable.

When you model it, you recycle capital with precision.

When you ignore it, you fund lender risk with your profit.

Start tracking the clocks today.

Your future self will thank you when the refinance approval arrives exactly when you planned it.