Commercial Real Estate: How Investors Scale Beyond Residential

Learn about Commercial Real Estate for real estate investing.

Commercial Real Estate Overview

Commercial real estate is where many investors finally realize that real estate is a business, not a hobby.

When I help clients transition from residential to commercial properties, the biggest shift isn’t the numbers.

It’s the mindset.

Residential investing often rewards emotion, timing, and patience.

Commercial real estate rewards clarity, income analysis, and discipline.

After rebuilding my own portfolio post-bankruptcy, commercial real estate forced me to stop guessing and start proving every assumption with math.

That shift changed how I analyze risk, returns, and long-term scalability.

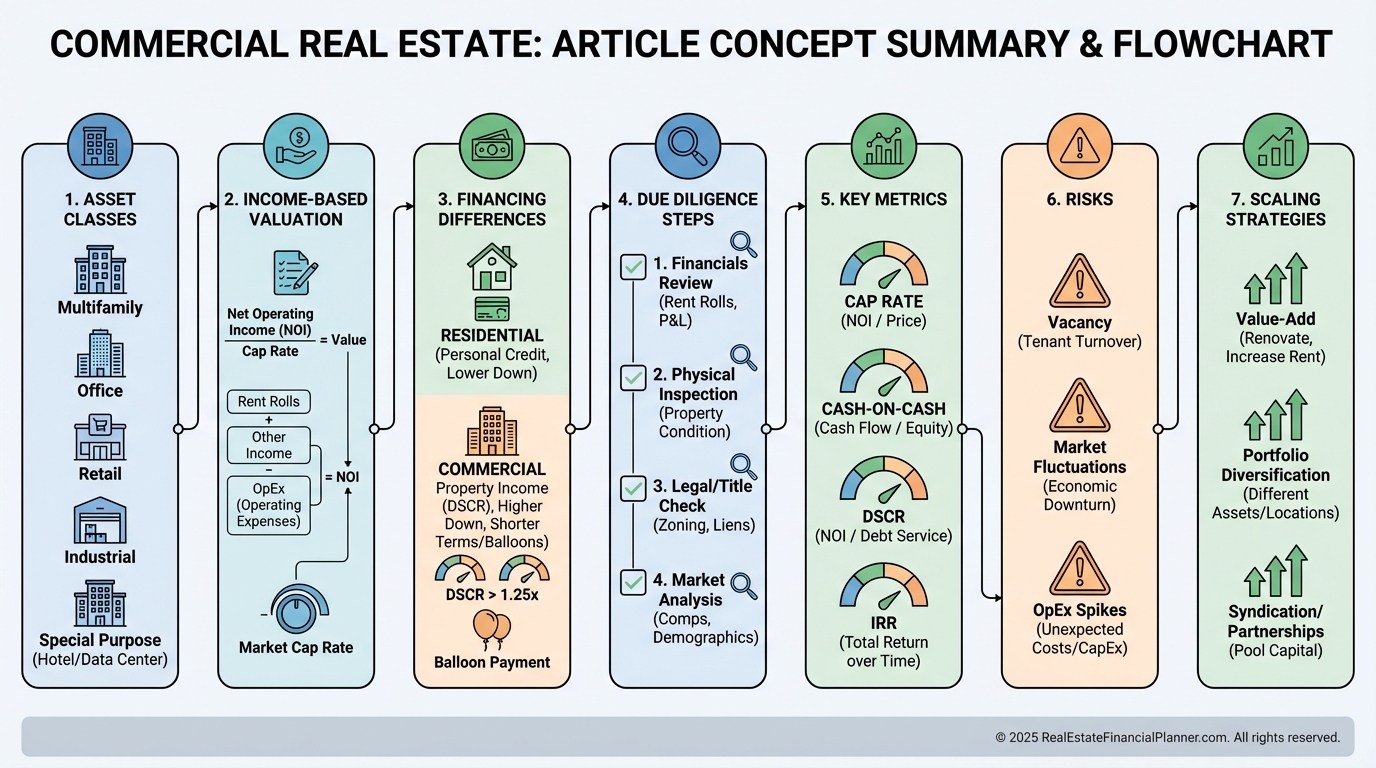

What Counts as Commercial Real Estate

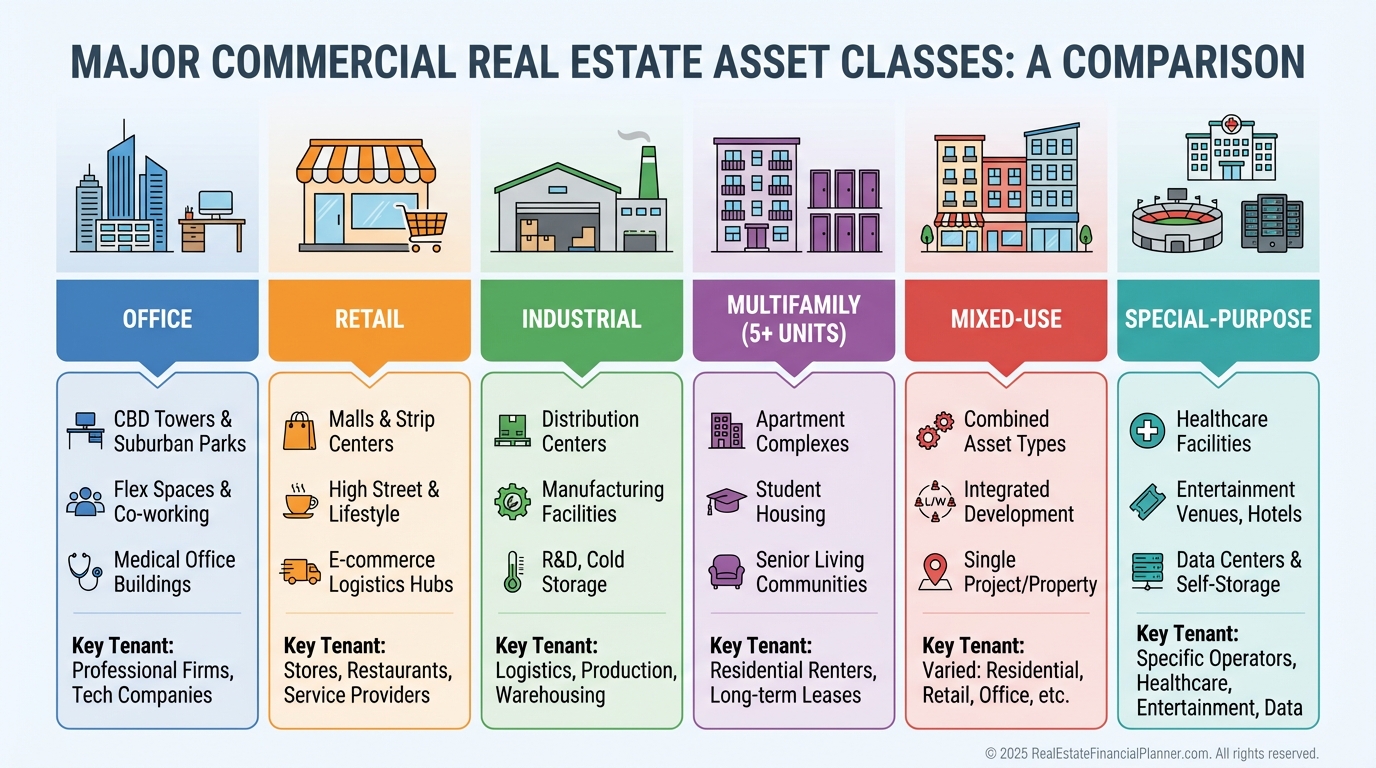

Commercial real estate includes any property purchased primarily for income, not personal use.

That means properties like office buildings, retail centers, industrial warehouses, and apartment buildings with five or more units.

Even familiar residential-style assets behave very differently once they cross into commercial financing and valuation.

Commercial Real Estate Asset Classes

Each asset class responds differently to economic cycles.

Multifamily and self-storage tend to hold up during recessions.

Office and retail depend heavily on employment trends and consumer behavior.

Industrial properties often benefit from logistics, manufacturing, and e-commerce demand.

Understanding these cycles matters more than chasing whatever is “hot” right now.

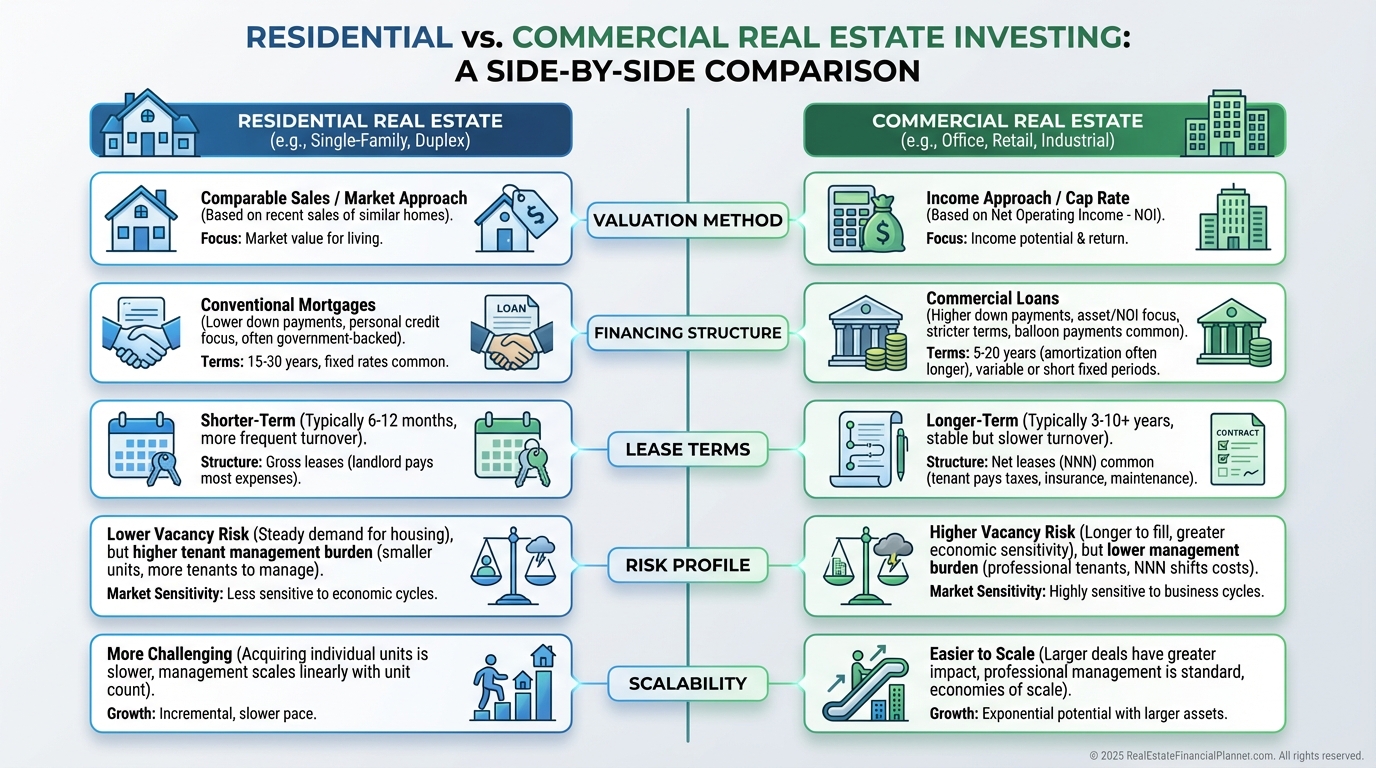

The Biggest Difference From Residential Investing

Commercial real estate is valued based on income, not emotion.

A residential buyer might pay more because a home “feels right.”

A commercial buyer pays based on what the property produces and what it can produce with better management.

That one difference changes everything.

Residential vs Commercial Investing

This is where many investors either level up or tap out.

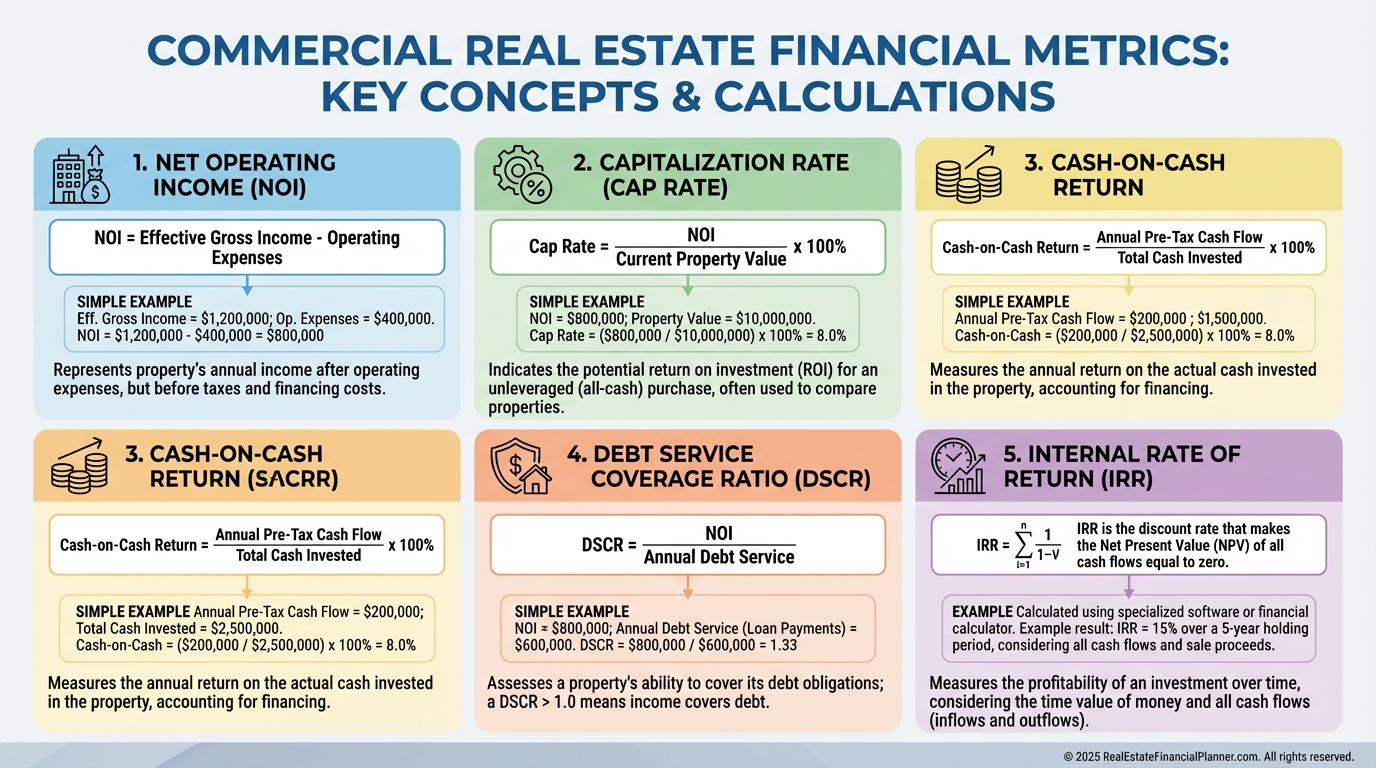

The Metrics That Actually Matter

Commercial deals live or die by a small set of numbers.

If you don’t understand them, you’re guessing.

If you do understand them, you can spot problems long before closing.

Core Commercial Deal Metrics

When I review deals with clients, I always start with NOI.

Everything flows from it.

Cap rates help compare risk across markets.

DSCR determines whether the lender even says yes.

Cash-on-cash tells you how efficiently your capital works today.

IRR shows whether the long-term story makes sense.

Tools like The World’s Greatest Real Estate Deal Analysis Spreadsheet™ make the math faster, but understanding the relationships prevents expensive mistakes.

Due Diligence Is Where Deals Are Won or Lost

Commercial due diligence isn’t a checkbox exercise.

It’s where reality replaces the marketing package.

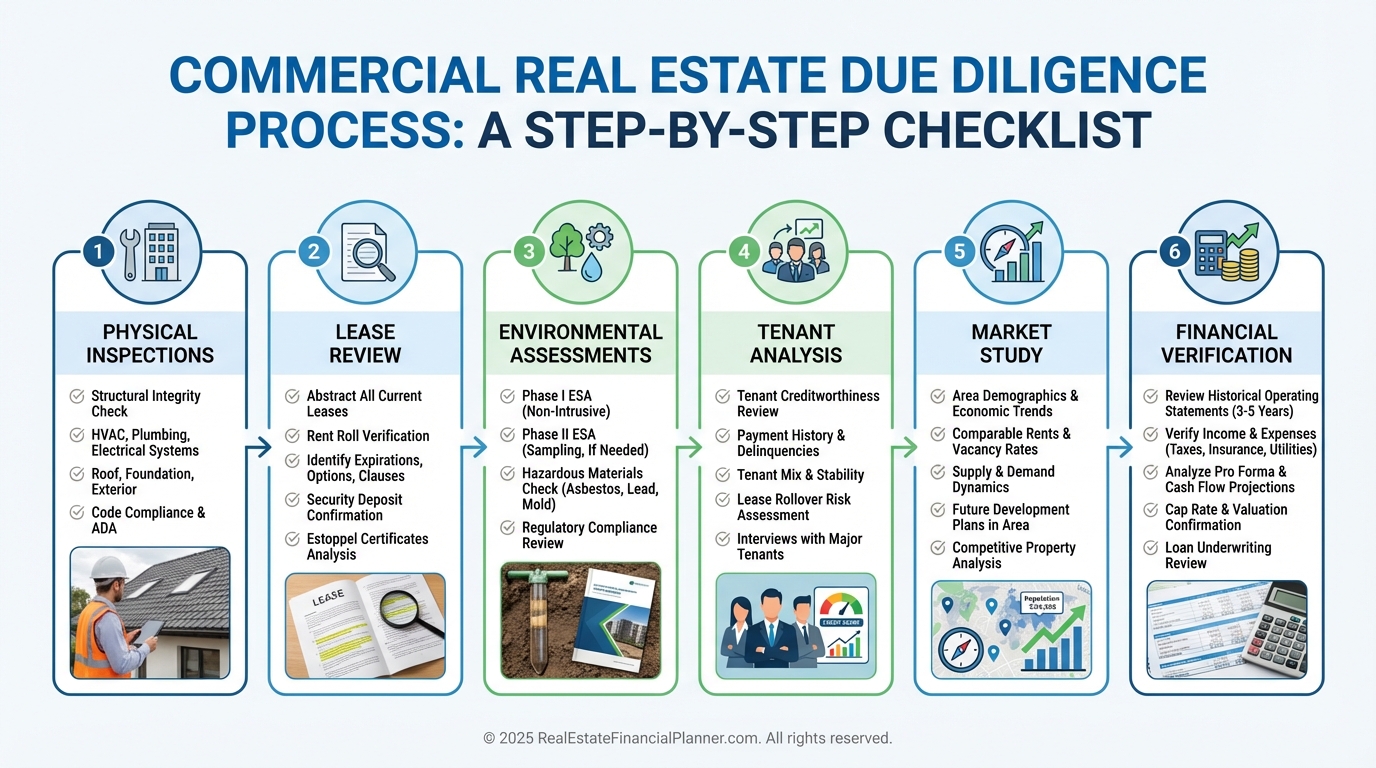

Commercial Due Diligence Checklist

I’ve seen deals collapse because investors skipped lease reviews.

I’ve seen returns evaporate because tenant improvement costs weren’t modeled.

I’ve seen environmental issues kill financing weeks before closing.

Commercial properties don’t forgive assumptions.

This is why I always reconcile rent rolls, leases, and bank statements line by line before trusting any projections.

How Commercial Financing Really Works

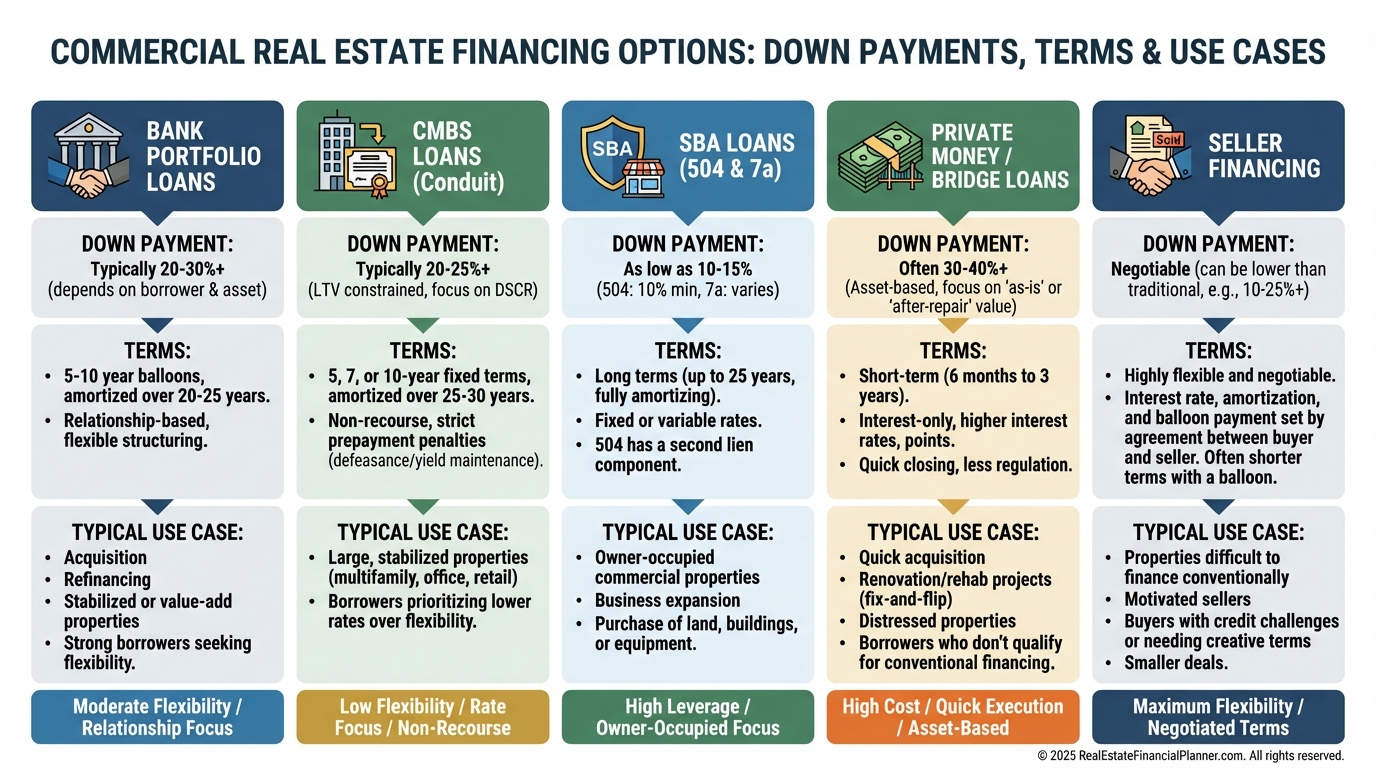

Commercial loans are not thirty-year fixed mortgages.

They usually involve shorter terms, balloon payments, variable rates, and stricter underwriting.

Lenders care deeply about DSCR, liquidity, and experience.

Commercial Financing Options

Personal guarantees are common.

Non-recourse loans exist, but they are earned, not given.

This is where understanding True Net Equity™ matters.

Cheap leverage that traps you in bad terms is not real wealth.

Finding Deals That Actually Close

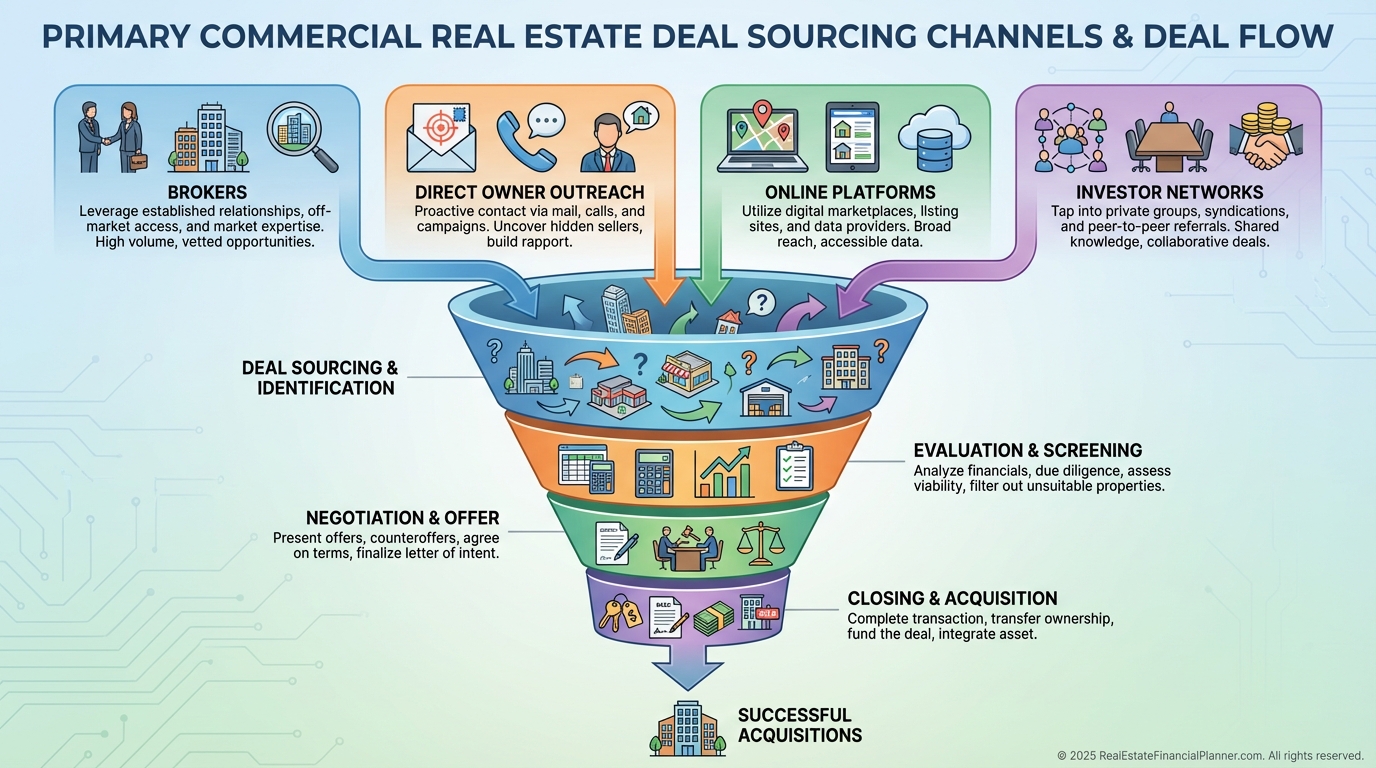

Most good commercial deals never hit public listings.

They move through broker relationships, private networks, and direct owner conversations.

Credibility matters more than speed.

Commercial Deal Sourcing Channels

When brokers know you analyze quickly, make clean offers, and close, they bring you better opportunities.

That reputation compounds faster than any marketing campaign.

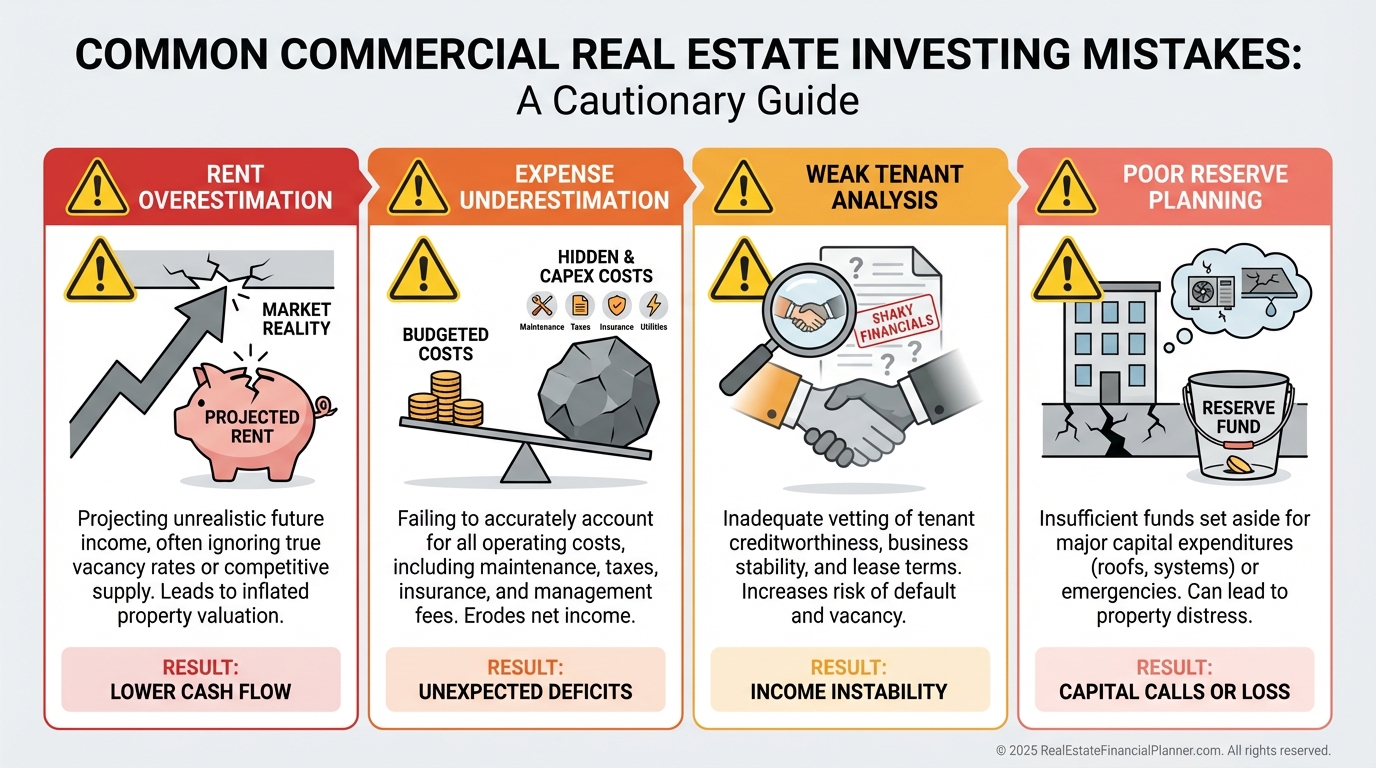

Mistakes I Warn Investors About Early

Commercial real estate magnifies both discipline and error.

Overestimating rents.

Ignoring capital reserves.

Underestimating tenant turnover costs.

Chasing cap rates without understanding market risk.

Common Commercial Investing Mistakes

Commercial real estate rewards patience and preparation.

It punishes shortcuts.

Why Commercial Real Estate Changes Investor Trajectories

Commercial real estate isn’t better than residential.

It’s different.

It forces you to think in systems, cash flows, and probabilities.

It exposes weak assumptions quickly.

It scales faster when done correctly.

For investors willing to learn income-based valuation, disciplined underwriting, and long-term planning, commercial real estate becomes a powerful tool for building durable wealth.