Cash Now: The Real Returns That Pay You Every Month

Learn about Cash Now for real estate investing.

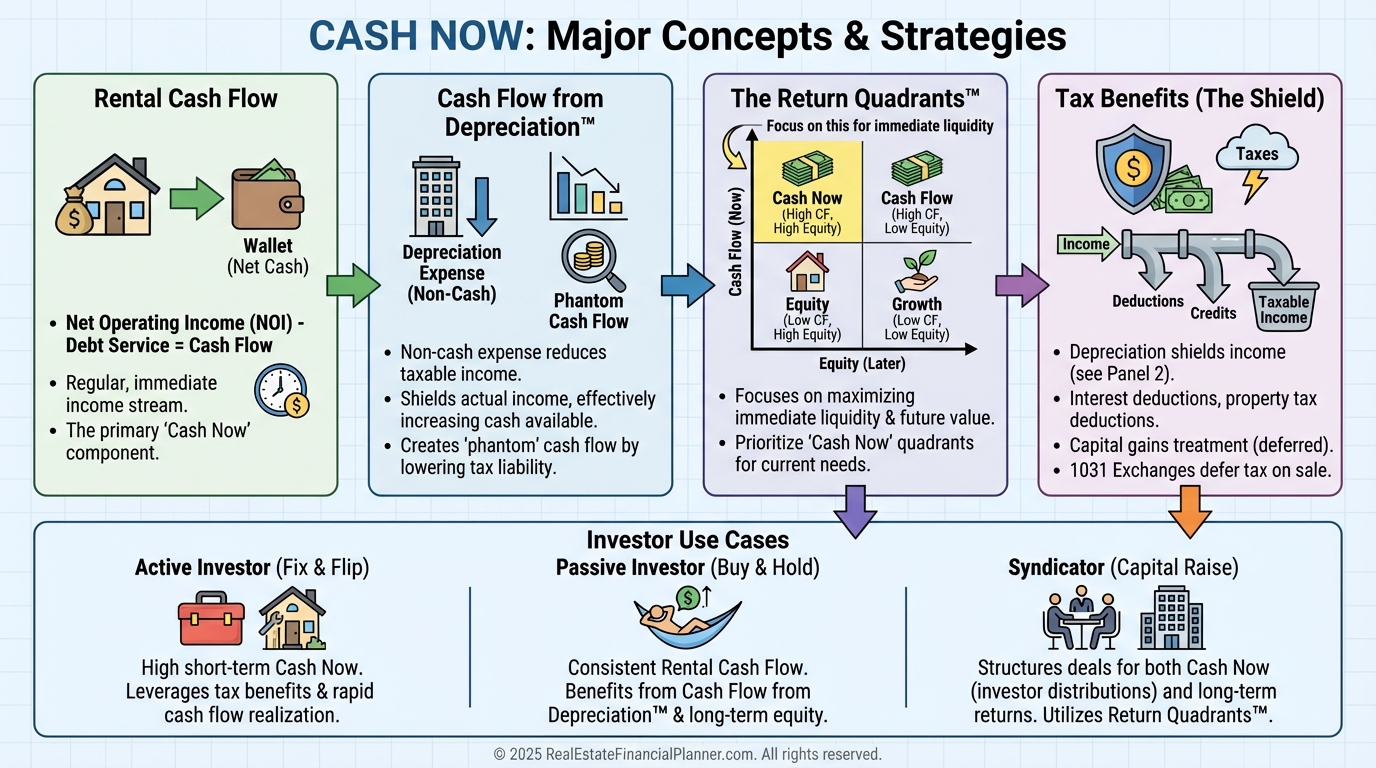

Cash Now Overview

When I help investors analyze deals, the biggest misunderstanding I see is this: they think returns are something you wait for.

They talk about appreciation.

They talk about future equity.

They talk about what the property might be worth someday.

But they ignore what actually shows up in their bank account right now.

That’s what Cash Now is about.

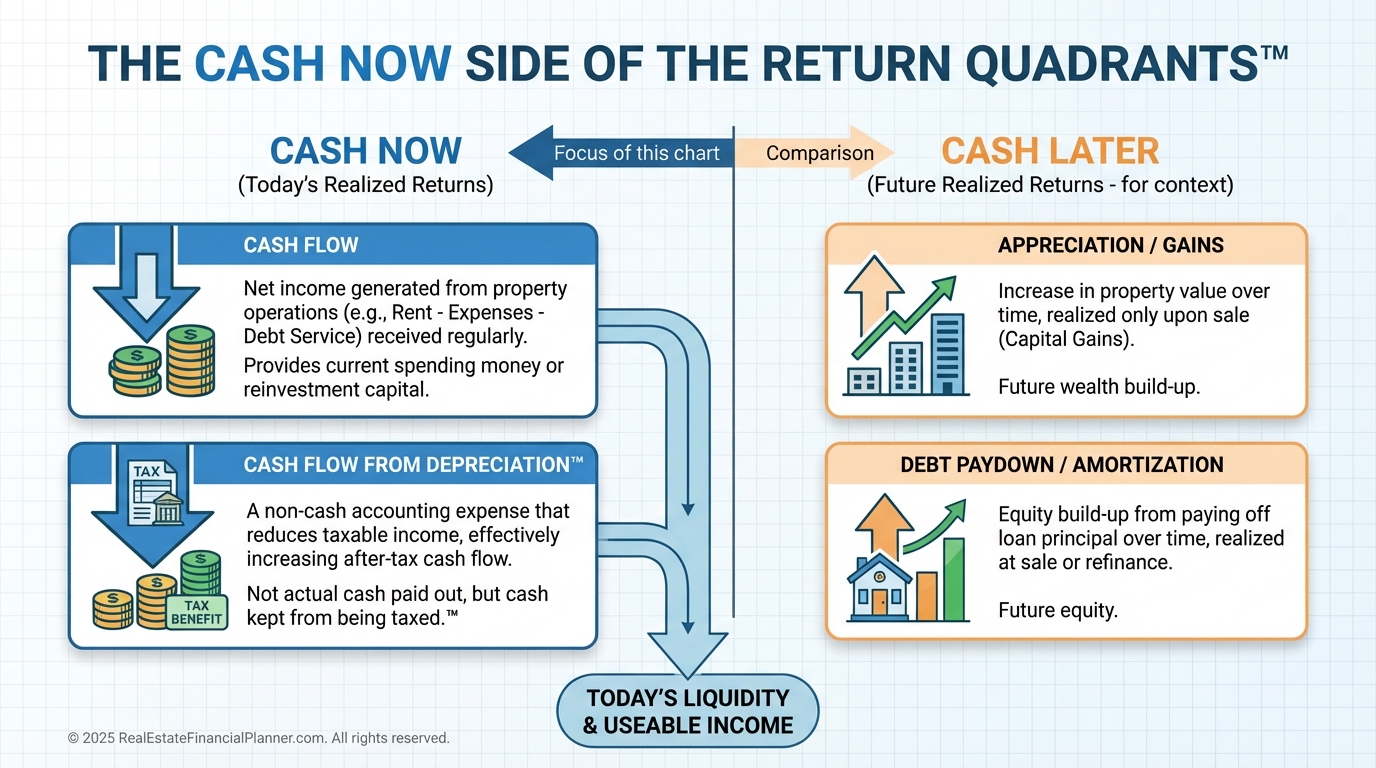

Cash Now represents the immediate, spendable returns from real estate.

It is the money you can use this month, not years from now.

In the Return Quadrants™, Cash Now lives on the right side.

It includes Cash Flow and Cash Flow from Depreciation™.

These are the returns that pay your bills, build reserves, and keep you investing long enough to benefit from Cash Later.

Why Cash Now Matters More Than Most Investors Admit

When I rebuilt my portfolio after bankruptcy, Cash Now was non-negotiable.

I didn’t have the luxury of waiting for appreciation to save me.

I needed properties that worked immediately.

Cash Now creates survival margin.

It buys time.

It reduces stress.

Appreciation feels exciting.

Cash Now feels boring.

Until a vacancy hits.

Until a repair shows up.

Until life happens.

That’s when Cash Now stops being boring and starts being everything.

Cash Now in the Return Quadrants™

The Return Quadrants™ divide returns into four categories.

Two are Cash Later.

Two are Cash Now.

Cash Now returns are unique because you do not need to sell or refinance to access them.

They show up while you still own the property.

They also share another important trait.

They are taxed in the current year.

That makes accurate modeling critical.

Cash Flow: The Obvious Part Everyone Still Gets Wrong

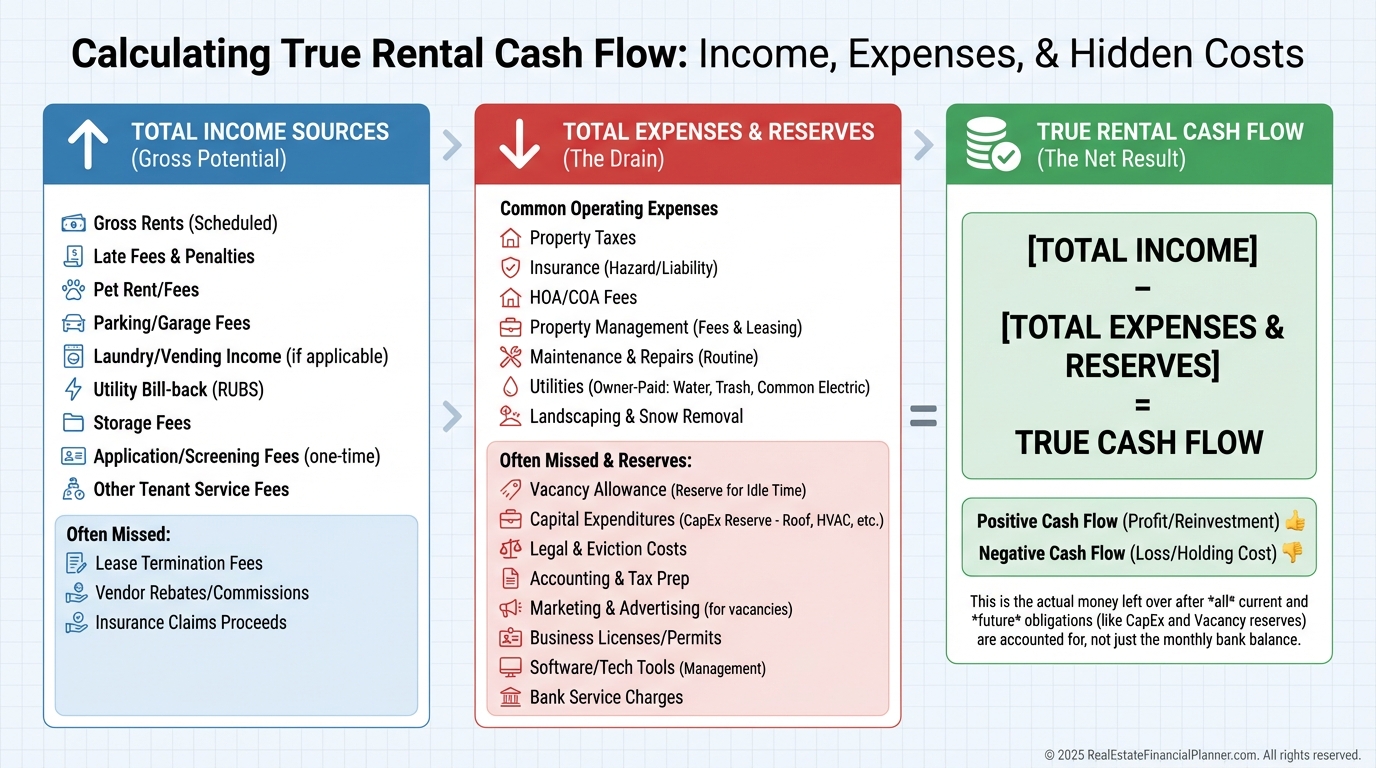

Cash flow is the net result of all income minus all expenses.

That sounds simple.

It almost never is.

When I review deals for clients, missing expenses are the rule, not the exception.

Vacancy is underestimated.

Maintenance is minimized.

Capital expenditures are ignored.

Meanwhile, income opportunities are overlooked.

Rent is not the only source of Cash Now.

Parking income.

Pet rent.

Laundry machines.

Storage.

Utility reimbursements.

Small numbers add up fast.

True Cash Flow Calculation

Cash flow improves three ways.

Increase income.

Reduce expenses.

Optimize financing.

None of these are glamorous.

All of them work.

What I warn clients about most is false positive cash flow.

That is cash flow created by bad assumptions.

If your deal only works when nothing goes wrong, it does not work.

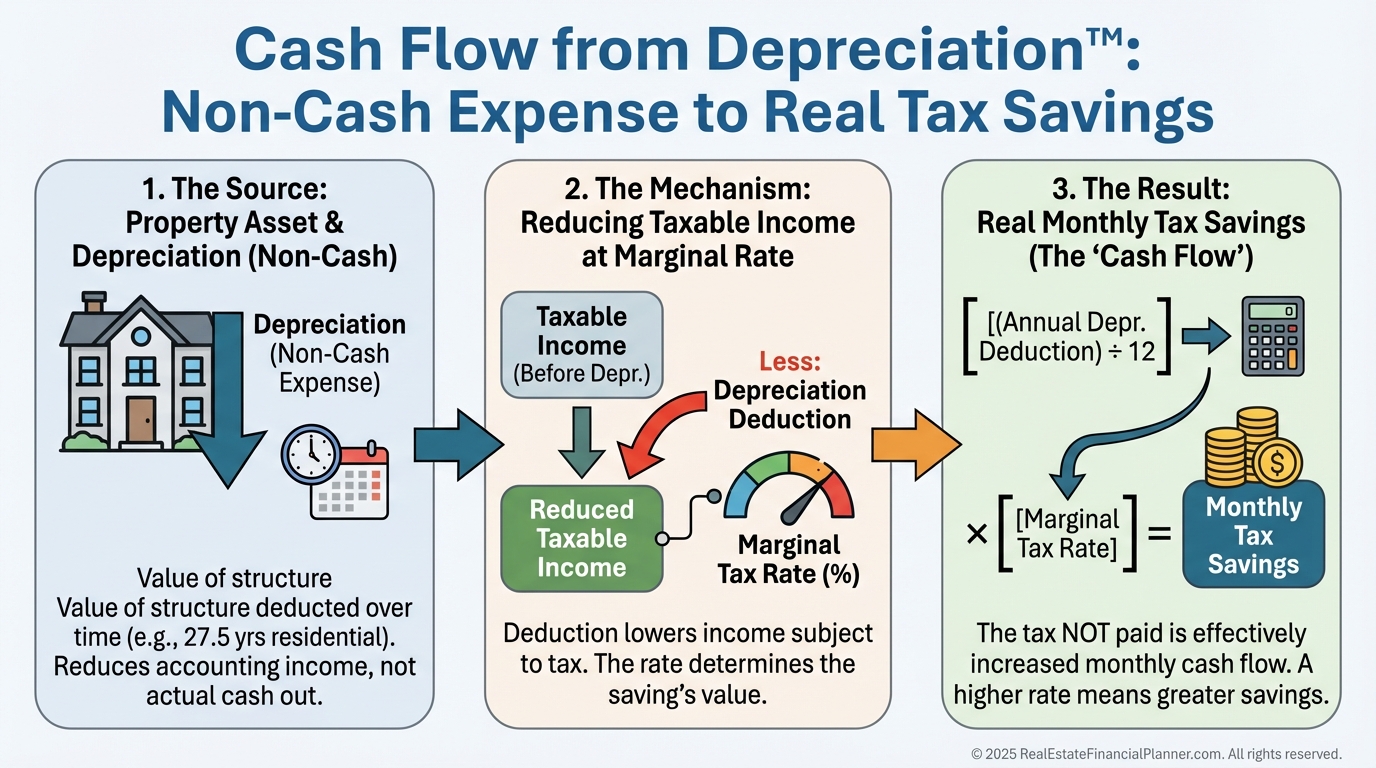

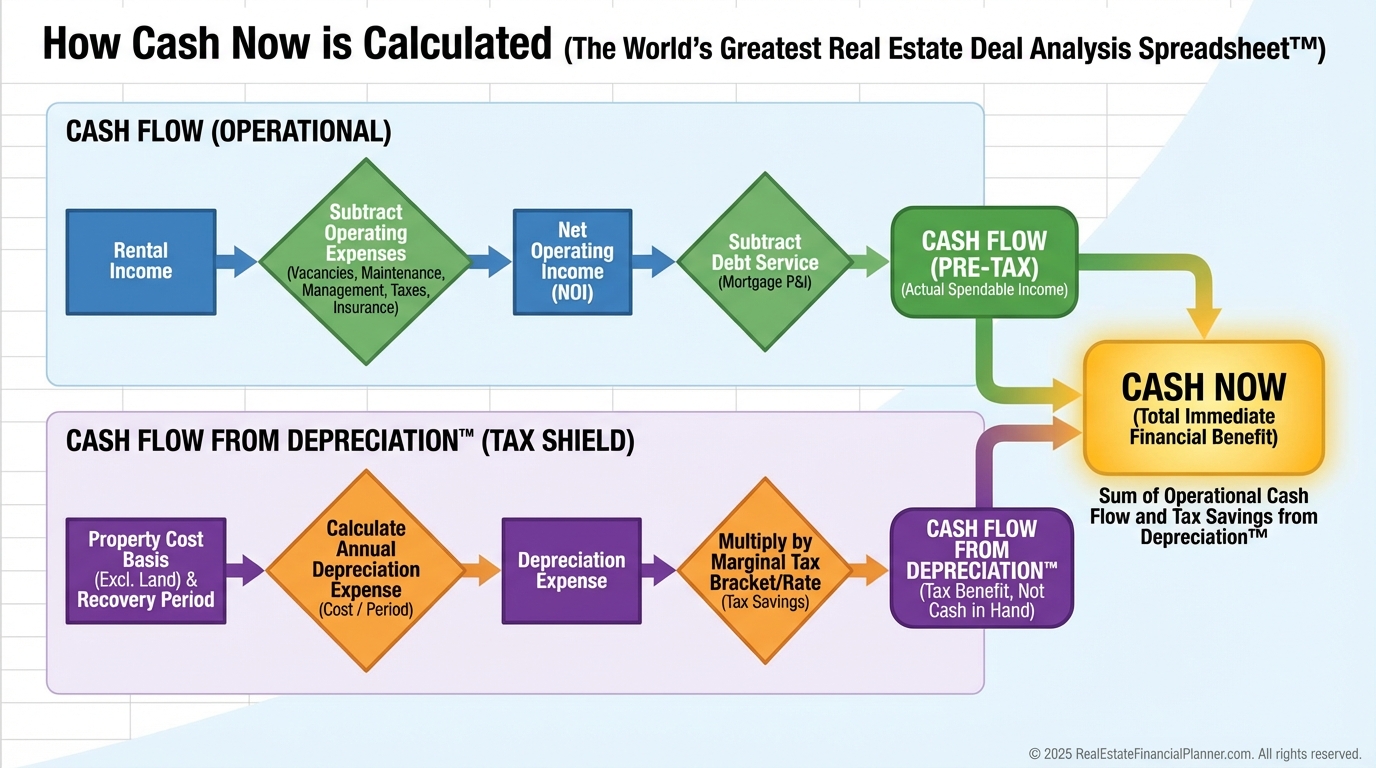

Cash Flow from Depreciation™ Explained

Depreciation is where most investors lose thousands without realizing it.

They know depreciation exists.

They do not model the cash impact.

Depreciation is a paper expense.

The tax savings are real cash.

A $10,000 annual depreciation deduction does nothing by itself.

The tax rate is what matters.

Cash Flow from Depreciation™ converts deductions into spendable dollars.

Higher income often means higher benefit.

That surprises people.

It should not.

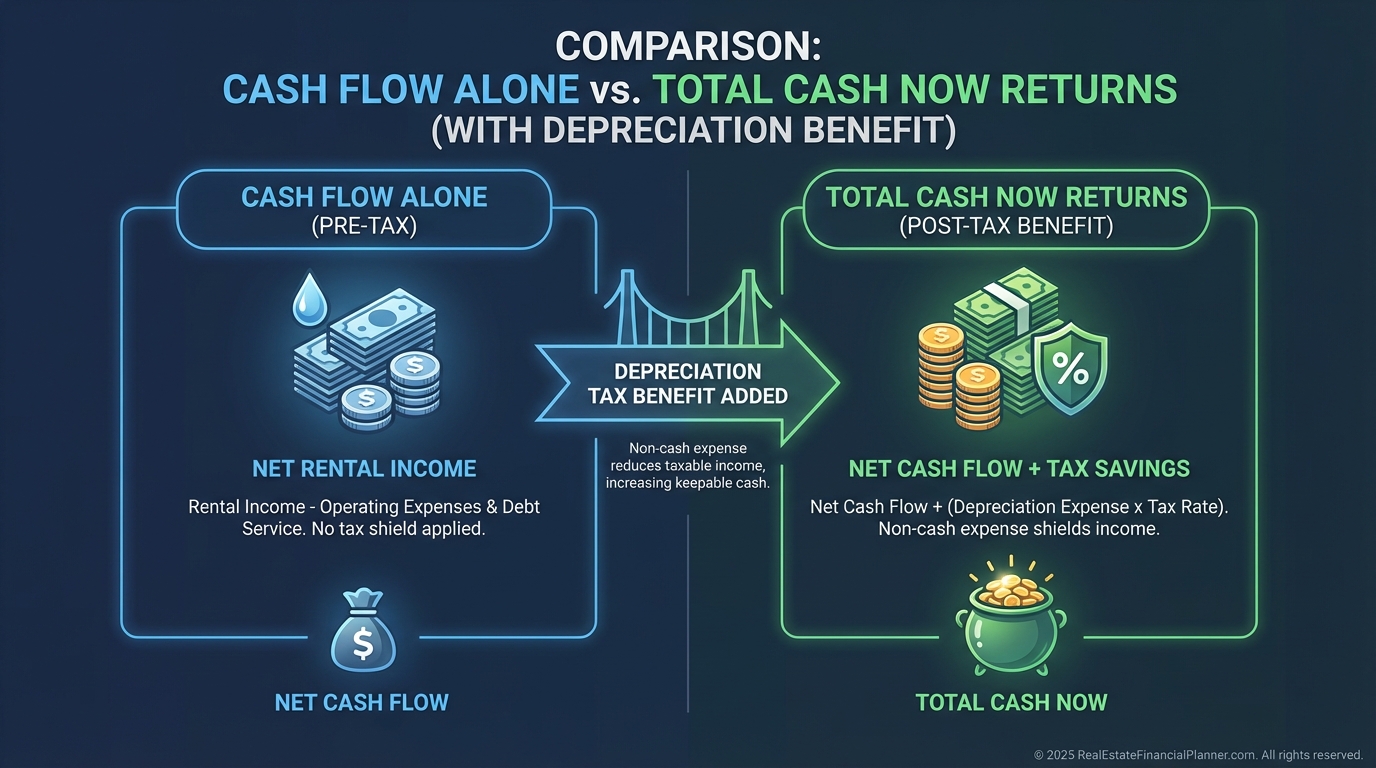

Cash Flow vs Total Cash Now

I regularly see investors reject good deals because “the cash flow is too low.”

Then we include depreciation.

Suddenly the math changes.

A property showing $400 per month in cash flow might actually deliver $550 or $600 in total Cash Now.

Ignoring depreciation is not conservative.

It is incomplete analysis.

Cash Now as Downside Protection

Cash Now does more than pay you.

It protects you.

Vacancies come and go.

Repairs spike unpredictably.

Depreciation does not care.

Even in rough years, Cash Flow from Depreciation™ continues.

That stability matters when you hold properties long term.

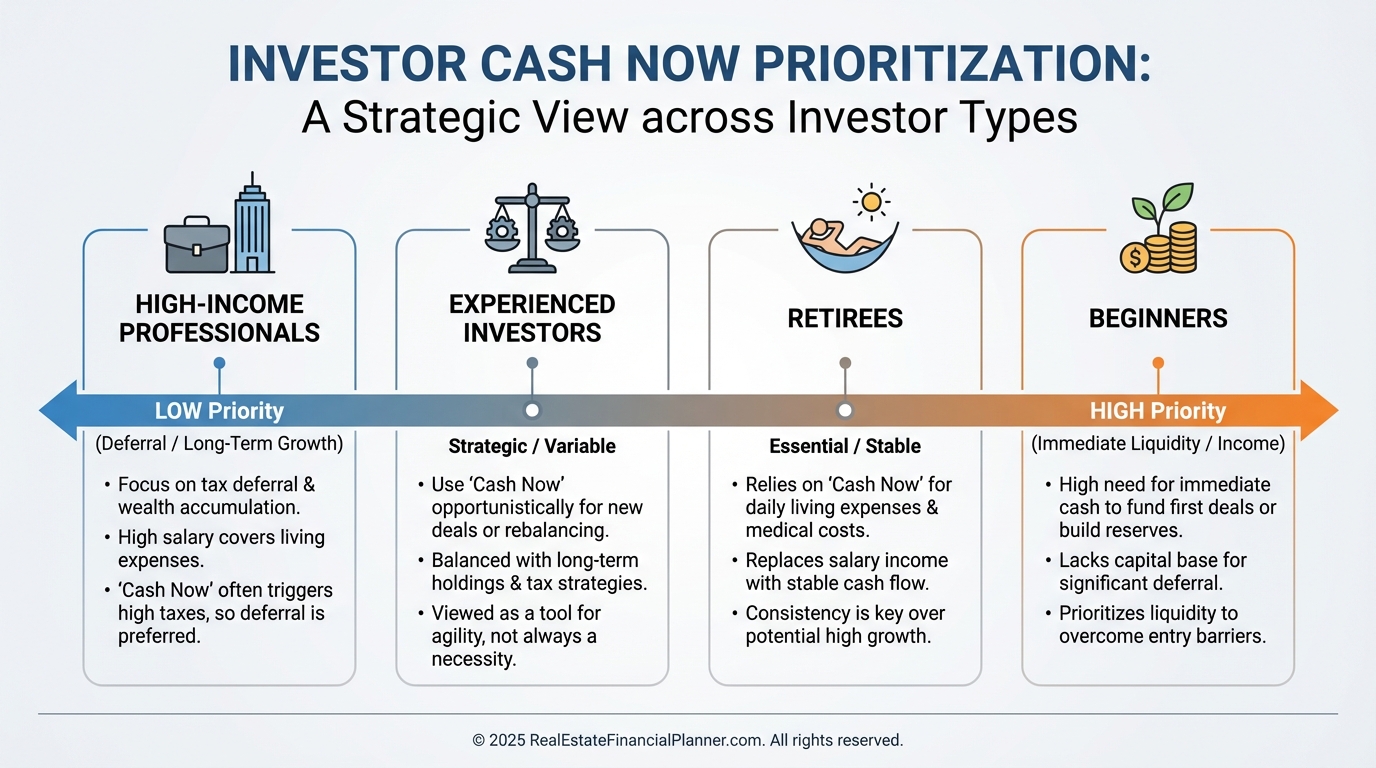

Cash Now by Investor Profile

New investors need Cash Now to survive.

House hacking and small multi-family often shine here.

High-income professionals need depreciation strategies.

Cost segregation can change everything.

Retirees prioritize predictability.

They trade upside for stability.

There is no universal answer.

There is only alignment with your situation.

Cash Now Inside the Deal Analysis Spreadsheet™

This is why I rely on The World’s Greatest Real Estate Deal Analysis Spreadsheet™.

It forces completeness.

It calculates Cash Now automatically.

It exposes bad assumptions early.

It shows when a deal supports your life today, not just your ego.

Final Thoughts on Cash Now

Cash Now is not exciting.

It is essential.

It keeps you in the game long enough for Cash Later to matter.

Appreciation builds wealth quietly.

Cash Now keeps you solvent loudly.

If you only optimize for the future, you risk never reaching it.

Cash Now is how real estate pays you while you wait.