Private Money for Real Estate Investors: Flexible Terms, Real Risks, and How to Structure Deals That Close

Learn about Private Money for real estate investing.

What Is Private Money and When to Use It

Private money is capital you borrow from individuals instead of banks.

It’s relationship-driven, flexible, and fast—perfect when speed or creativity wins deals.

When I help clients compete against cash buyers, private money is often the edge that gets us under contract.

It’s also how I rebuilt after bankruptcy years ago—by structuring transparent, win-win loans for lenders who believed in the deal and in my plan.

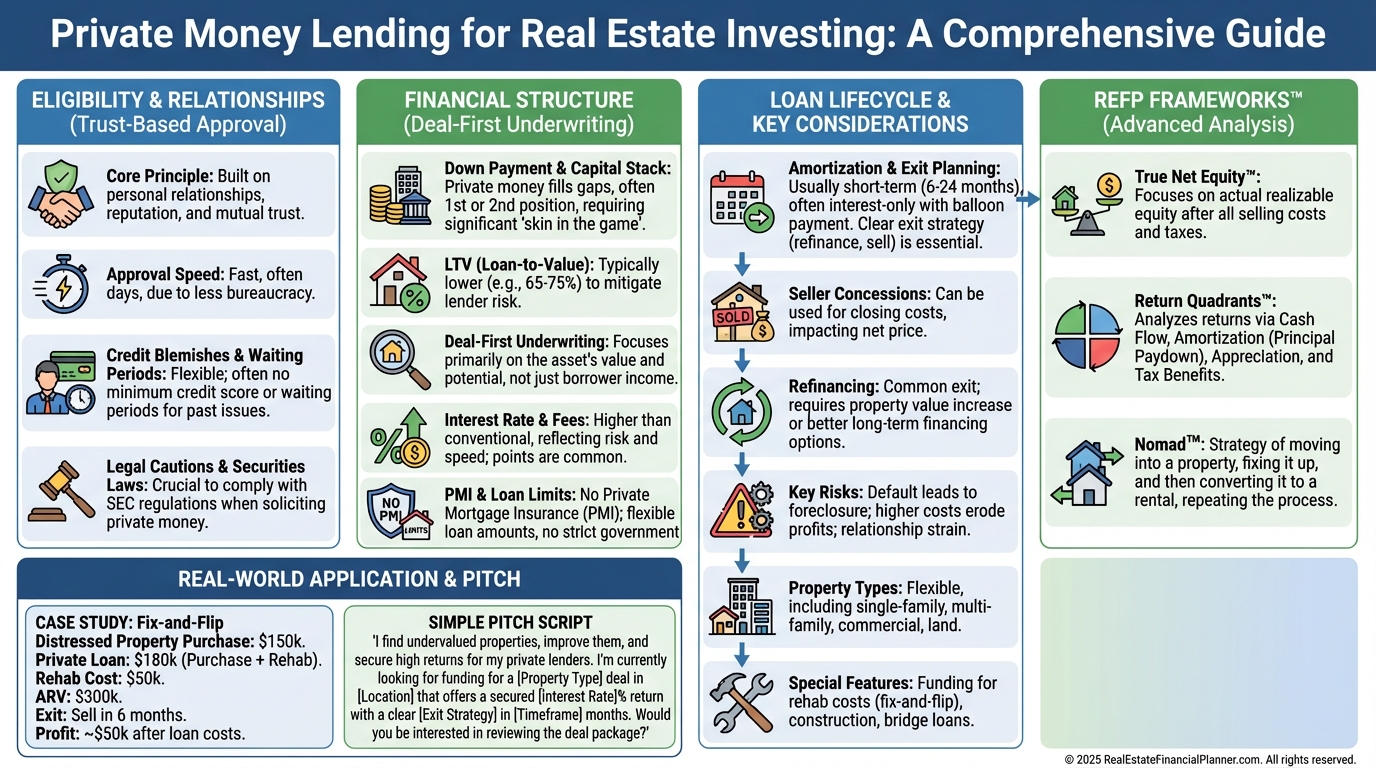

Eligibility and What Lenders Actually Want

Most private lenders underwrite you and your deal in two buckets: trust and execution.

They want to know who you are, what you’ve done, and how you’ll protect their principal.

Expect simple documentation: a deal summary, scope of work, ARV comps, budget, timeline, and exit plan.

Closer relationships often mean lighter documentation, but I still prepare a concise, professional package because it earns confidence.

Owner-Occupancy and Strategy Fit

Private money rarely requires owner-occupancy.

That makes it flexible for flips, BRRRR, mid-term rentals, short-term rentals, and traditional buy-and-hold.

If you’re pursuing Nomad™ or house hacking, private money can bridge acquisition or rehab, then you can refinance into long-term, low-cost financing after you move in.

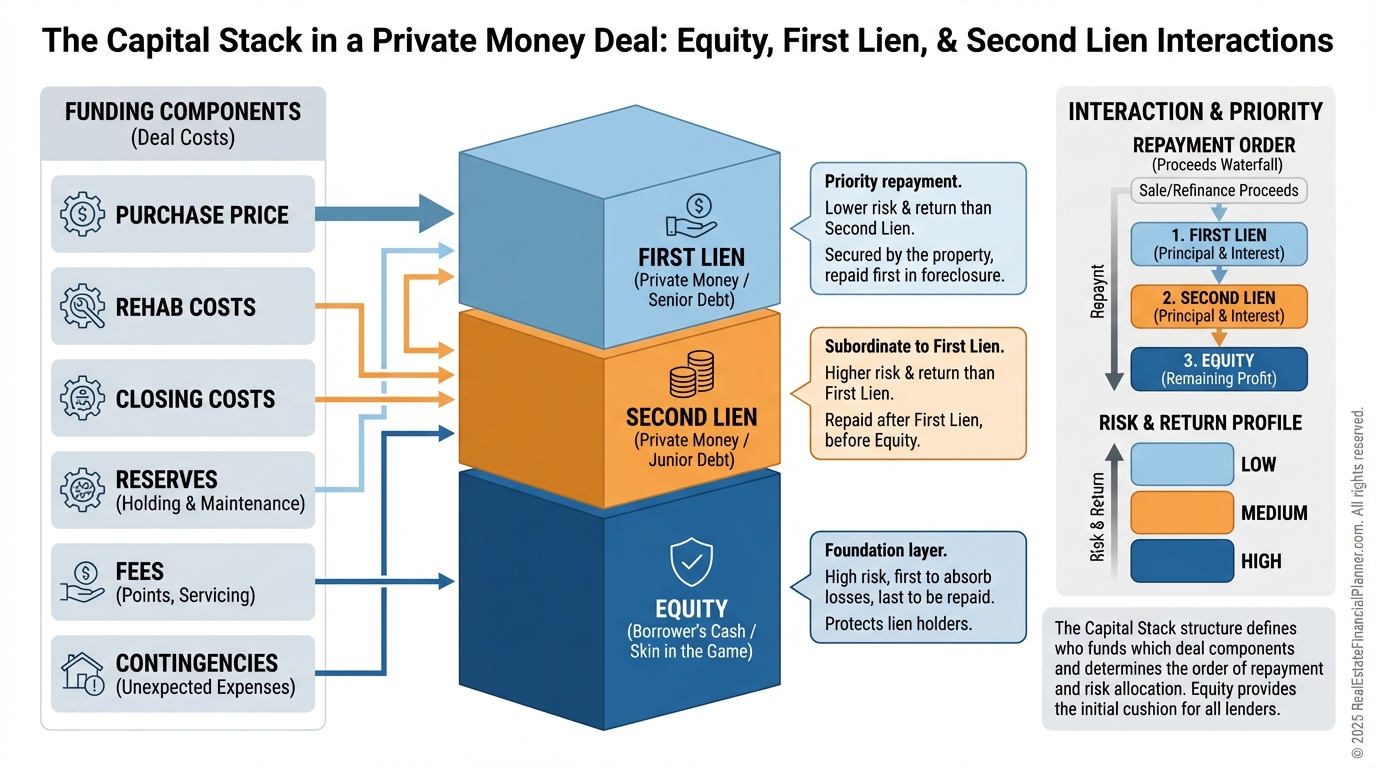

Down Payment and Capital Stack

Down payments are negotiable and tied to risk, track record, and deal strength.

I’ve seen lenders fund purchase, closing costs, and rehab when the margin of safety is strong and the borrower is proven.

When the deal is thinner or the borrower is newer, expect 10–30% down or to raise a second private note for the gap.

Loan-to-Value and Deal-First Underwriting

There’s no formal LTV box to fit.

Some lenders go to 100% of purchase plus rehab when the ARV provides ample coverage and the budget is credible.

I model LTV multiple ways: to purchase, to ARV, and to True Net Equity™ after selling costs, holding costs, and payoff, so we see the real margin of safety.

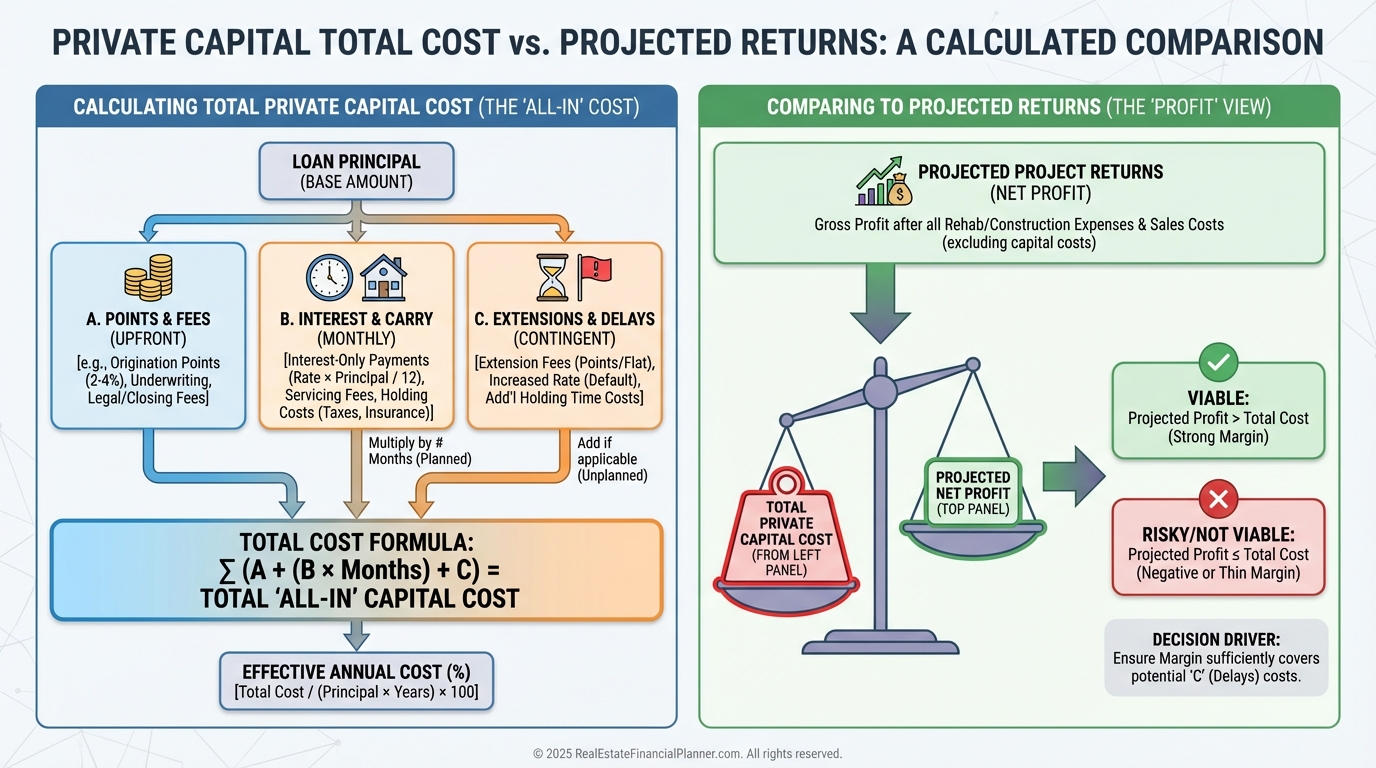

Interest Rate, Fees, and Total Cost of Capital

Rates and fees are entirely negotiable.

I price total cost of capital, not just rate: origination, points, junk fees, interest carry, extension fees, and cost of delays.

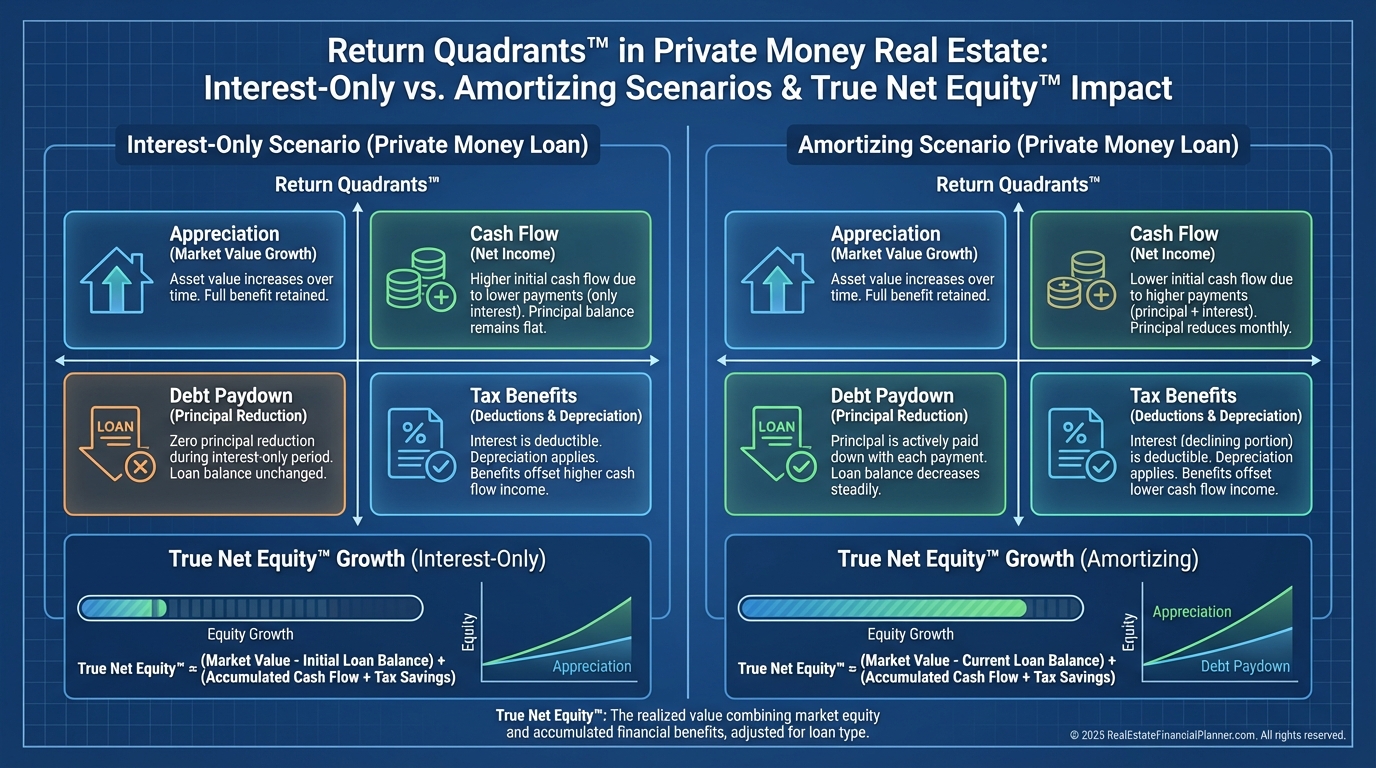

Then I compare that to the deal’s Return Quadrants™ to confirm the profits justify the cost.

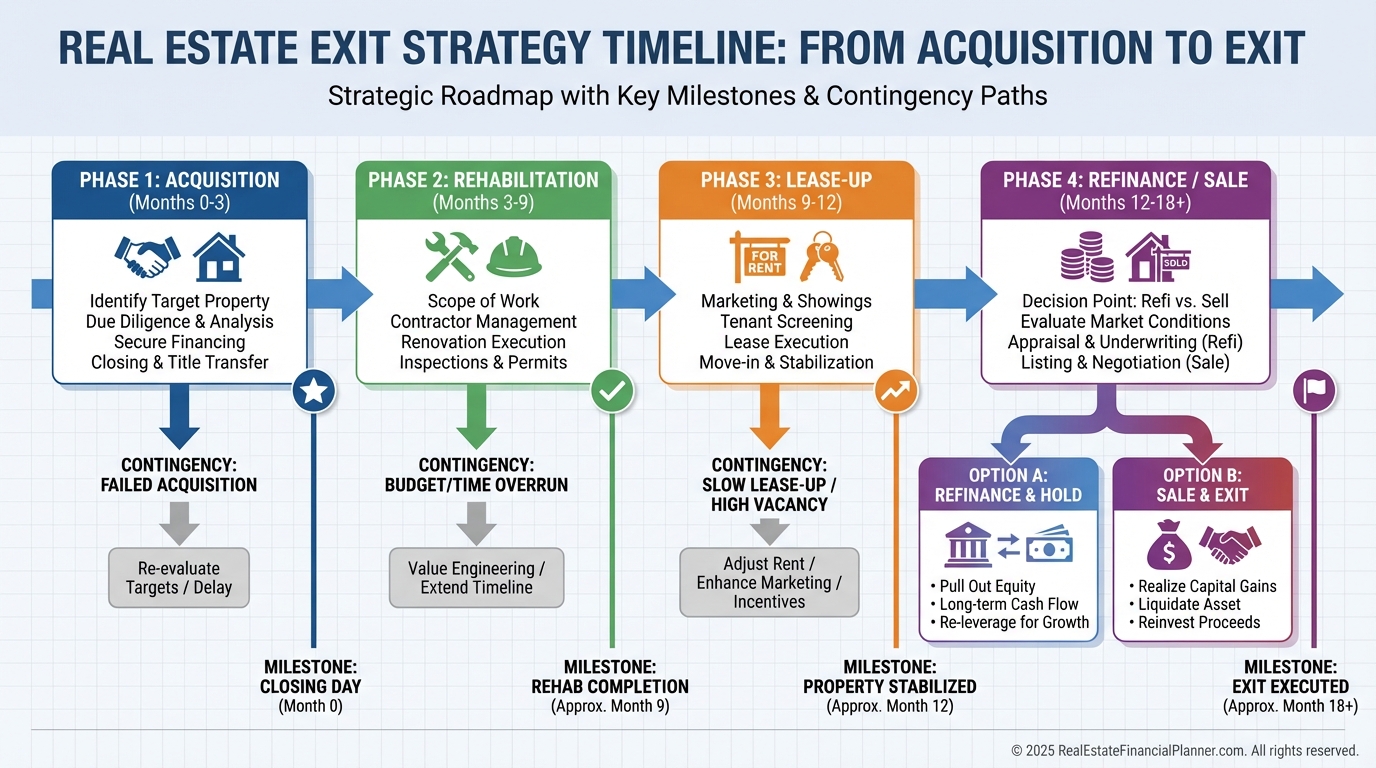

Amortization, Payments, and Exit Planning

Private loans can be interest-only, fully amortizing, or even accrue with no payments.

Shorter terms are common, so I insist on a written exit plan with dates, milestones, and backup options.

When I coach clients, we pre-schedule refinance docs, appraisal, and rate lock windows before we close on the purchase.

PMI, Loan Limits, and Number of Loans

PMI doesn’t apply because lenders price risk with rate, fees, and terms.

There are no agency loan limits, only what your lender is comfortable with.

You can stack multiple private loans as long as your relationships and execution support it.

Seller Concessions and Closing Costs

Most private lenders don’t cap seller concessions.

We often finance repairs and closing costs into the loan or negotiate them from the seller to preserve cash.

I still underwrite net to seller to anticipate pushback during negotiation.

Credit Blemishes and Waiting Periods

Private lenders rarely have fixed waiting periods after bankruptcy, foreclosure, or short sale.

They care more about the deal, the collateral, and your plan.

After my bankruptcy, I won trust by offering conservative LTV, transparent reporting, and third-party control of draws.

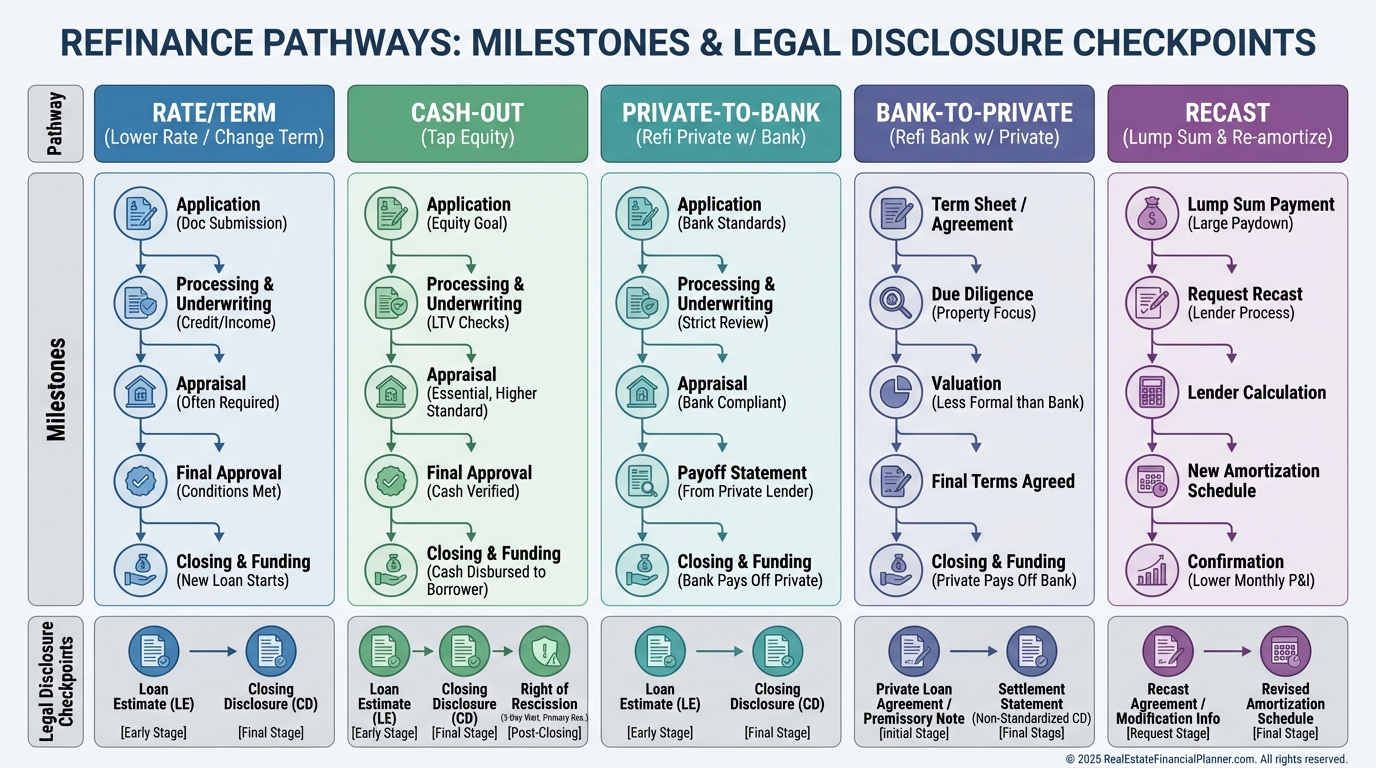

Refinancing and Recasting Without Tripping Legal Wires

You can refi with another private lender or a bank, do a rate/term or cash-out, or negotiate a recast.

Be careful with “rolling” private lenders in and out—disclose fully, paper everything, and avoid any structure that looks like new money repaying old investors’ returns.

Have a real attorney review your documents and marketing before you raise or replace capital.

Property Types and Use Cases

Private money routinely funds single-family, small multifamily, condos/townhomes, light commercial, and even land or entitlement plays.

If the collateral is strong and the story is tight, there’s likely a lender for it.

Special Features Investors Negotiate

Speed is the headline benefit—days instead of weeks.

You can close in an entity, customize draw schedules, waive prepayment penalties, or structure profit participation if that lowers cash cost and aligns incentives.

I avoid “no-doc forever” thinking; clean paperwork keeps relationships healthy.

Approval and Underwriting: What Moves the Needle

What moves a private lender: credible comps, detailed scope, realistic timeline, and proof you can execute.

A short video walk-through, before-photos, and line-item budget do more than a glossy pitch deck.

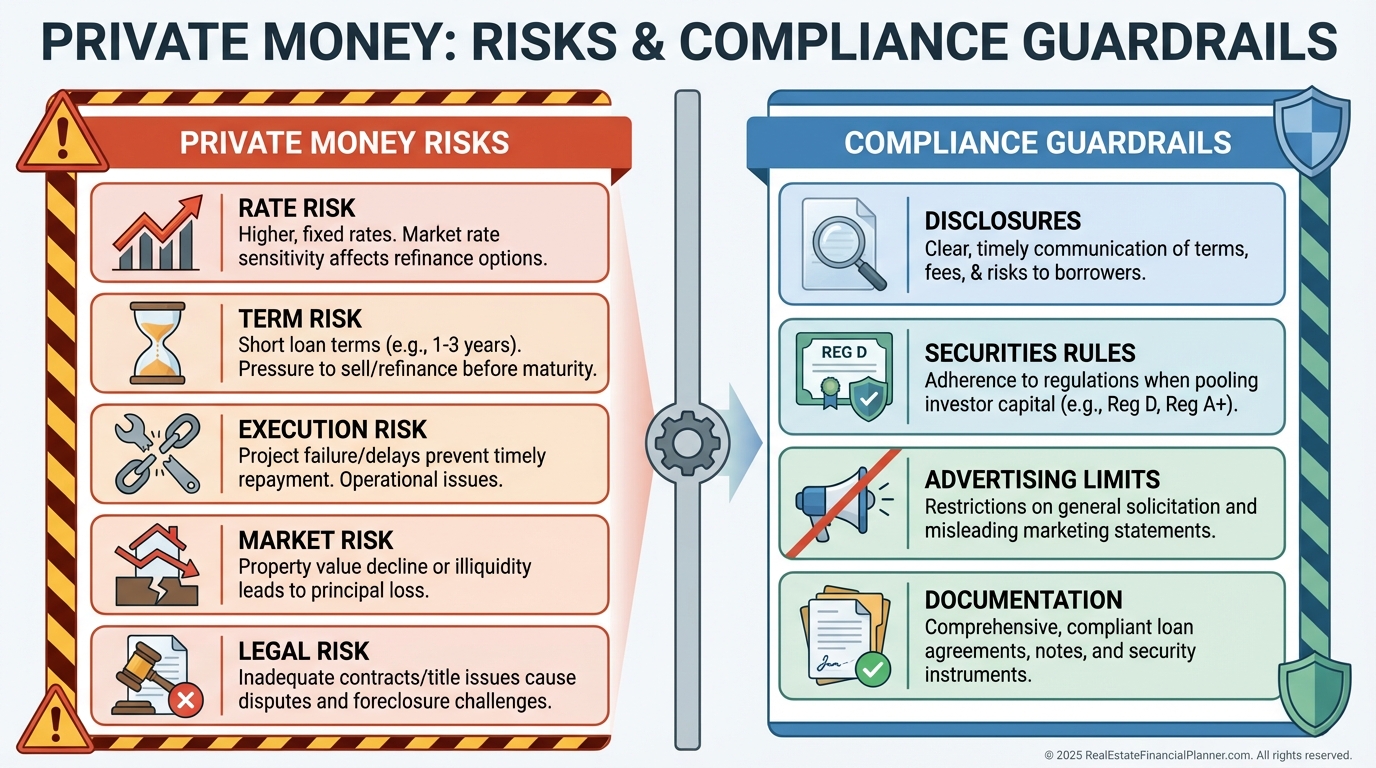

Risks, Guardrails, and Compliance

Private money is often pricier and shorter-term.

You must have reserves, contingency time, and backup exits if values or rates move.

Mind your state and federal securities rules before advertising for lenders; most investors are safer raising capital from existing relationships with proper disclosures.

Model the Deal: REFP Frameworks

I run Return Quadrants™ to break returns into appreciation, cash flow, debt paydown, and tax benefits.

With interest-only private loans, cash flow may be thinner, but speed can unlock equity and tax benefits faster.

I compute True Net Equity™ at acquisition and post-rehab: ARV minus selling costs, financing carry, rehab, and payoff, so we know exactly what’s real and what’s noise.

For Nomad™, I model move-in timing, rehab sequencing, and refinance windows to lock long-term, low-rate financing once seasoning requirements are met.

A Simple Private Money Script and Checklist

When I introduce a deal to a new lender, I keep it straightforward.

I open with the problem I’m solving, the collateral, the margin of safety, the timeline, and how their principal is protected.

Checklist I send:

•

One-page deal summary with photos and ARV comps

•

Budget and timeline with contingencies

•

Capital stack and uses of funds

•

Exit plan with primary and backup strategies

•

Insurance, title, and lender protections

•

Reporting schedule and draw controls

Sample Case Study: Fix-and-Flip to BRRRR

A client bought a dated SFR for $285,000 with a private first at 10% interest-only, two points, and a six-month term.

The lender funded purchase plus $40,000 rehab; client brought $10,000 for closing and reserves.

ARV appraised at $395,000 after a nine-week rehab.

We refinanced at 70% LTV into a 30-year fixed, paid off the private lender, and left about $6,000 in the deal.

Return Quadrants™ showed most of the value in forced appreciation and debt paydown post-refi, while True Net Equity™ at refi was $66,000 after all costs.

Next Steps

Build a short list of potential lenders you already know and trust.

Package one high-confidence deal with professional materials, then execute flawlessly and report proactively.

One well-run project begets the next three—private money follows performance.