Finding Off-Market Deals That Actually Close

Learn about Finding Off-Market Deals for real estate investing.

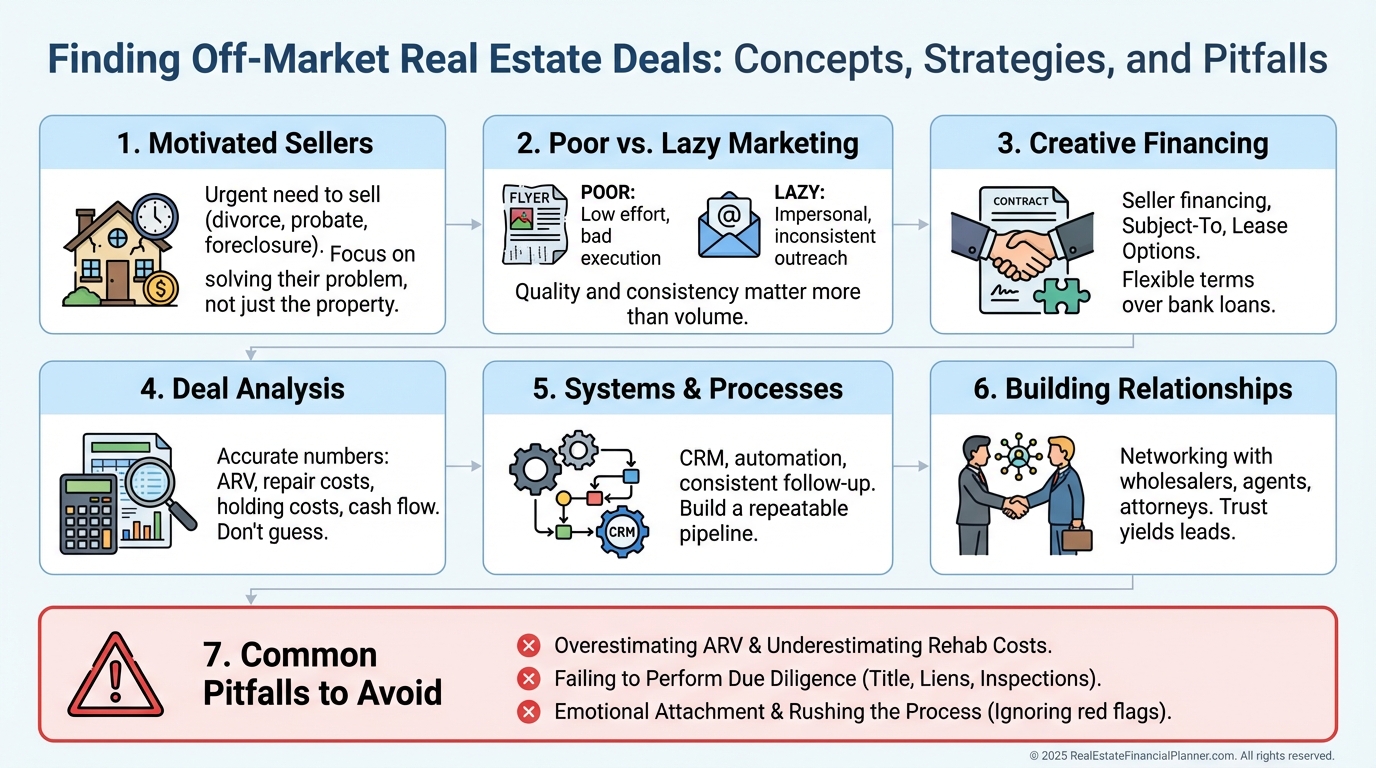

Infographic Prompt:

"Create a 16:9 infographic summarizing all major concepts taught in this article about finding off-market deals, including motivated sellers, poor vs lazy marketing, creative financing, deal analysis, systems, and common pitfalls. Use a clean, structured layout that helps readers understand the entire topic at a glance. Add the text '© 2025 RealEstateFinancialPlanner.com. All rights reserved.' in a subtle position."

If you want to build a real estate business—not just buy the occasional rental—you must learn how to find off-market deals.

When I help clients who say they “can’t find deals,” it’s almost always because they’re waiting for the MLS to save them.

It never does.

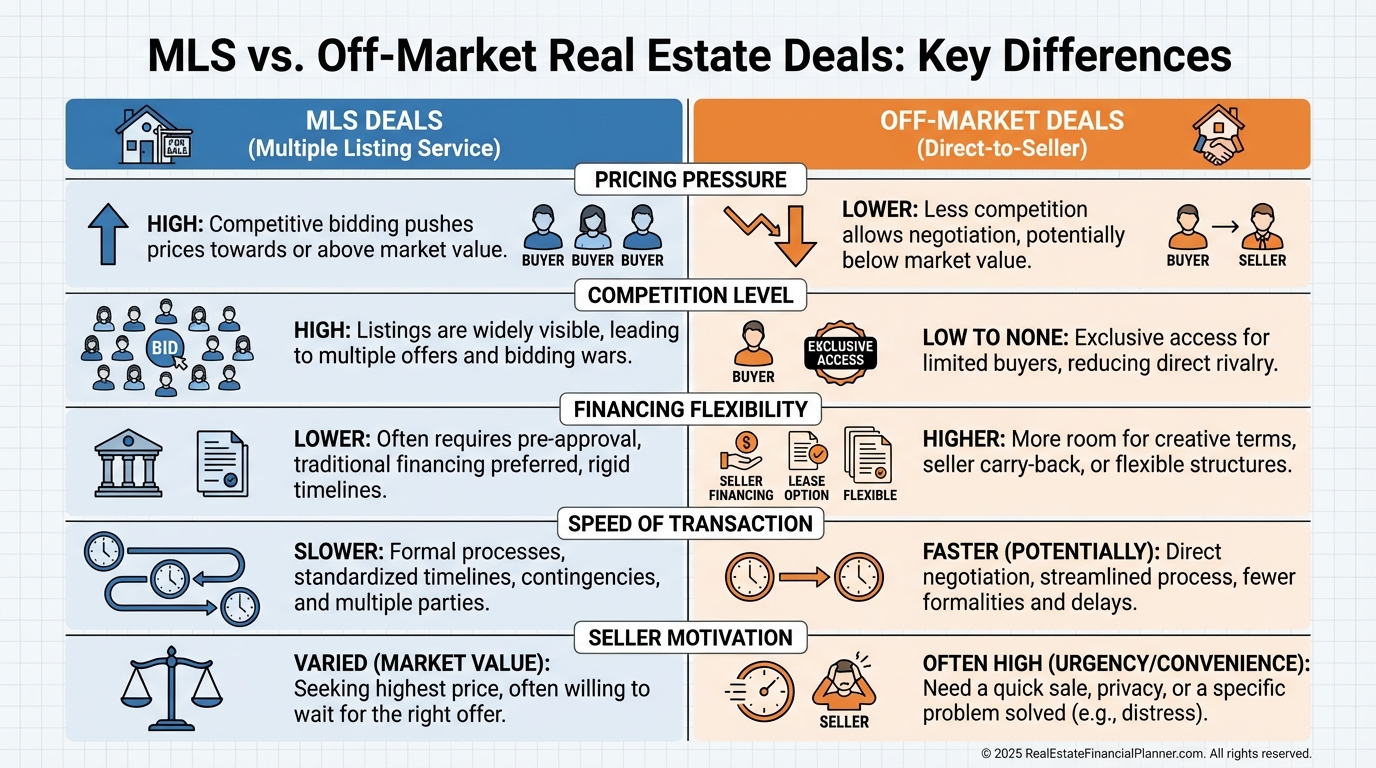

Off-market deals are not hidden listings.

They are conversations you create with sellers before the market ever sees the property.

That difference changes everything.

Off-market properties are sold directly from owner to buyer.

No listing agent.

No bidding war.

No retail pricing pressure.

That’s why nearly all creative financing, wholesaling, and high-margin fix-and-flip deals start off-market.

When I rebuilt my own portfolio after bankruptcy, I could not afford to compete with retail buyers.

I needed flexibility, speed, and sellers who valued solutions over price.

That only happened off-market.

Why Off-Market Deals Matter If You’re Running a Business

Buying a rental every few years is investing.

Needing deals every month is a business.

The MLS works well for owner-occupants and patient buy-and-hold investors.

It works terribly for entrepreneurs who need margin and volume.

By the time a property hits the MLS, it has been priced, polished, and marketed to maximize seller leverage.

Off-market deals reverse that leverage.

You control the conversation.

You control the timeline.

You control the structure.

That’s why off-market deals allow things the MLS rarely does:

•

Seller financing

•

Subject-to existing loans

•

Flexible possession timelines

•

As-is purchases

•

Speed-based discounts

When I sit at a kitchen table with a motivated seller, I’m not asking for permission to submit an offer.

I’m diagnosing a problem and proposing a solution.

Infographic Prompt:

"Create a 16:9 infographic explaining the differences between MLS deals and off-market deals, including pricing pressure, competition, financing flexibility, speed, and seller motivation. Use clear labels, structured layout, and concise text. Add the text '© 2025 RealEstateFinancialPlanner.com. All rights reserved.' in a subtle position."

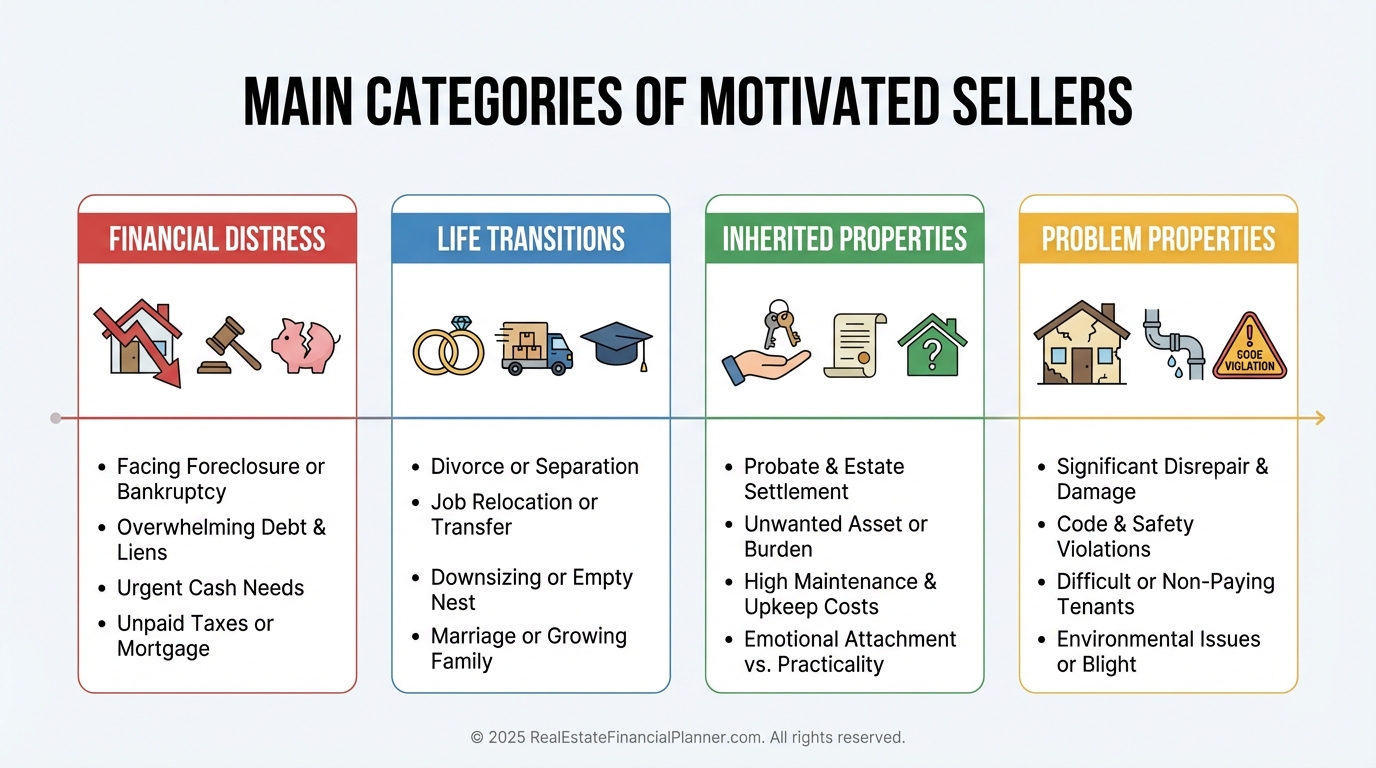

Understanding Motivated Sellers (Without Being Predatory)

Motivated sellers are not irrational sellers.

They are people whose priorities are not price.

Most motivation comes from pressure, not ignorance.

I see the same patterns repeatedly:

•

Pre-foreclosure or behind on payments

•

Divorce or death

•

Inherited properties

•

Long-distance ownership

•

Tired landlords

•

Code violations

The key is not creating motivation.

It is recognizing it.

When I talk to sellers, I listen for timing stress, financial stress, or complexity stress.

Those pressures dictate structure.

Price is often secondary.

That’s where ethical off-market investing lives.

You are not convincing someone to sell.

You are offering a way out that fits their situation.

Infographic Prompt:

"Create a 16:9 infographic explaining the main categories of motivated sellers, including financial distress, life transitions, inherited properties, and problem properties. Use clear labels, structured layout, and concise text. Add the text '© 2025 RealEstateFinancialPlanner.com. All rights reserved.' in a subtle position."

Poor Marketing vs Lazy Marketing

Every off-market strategy fits into one of two buckets.

Time-heavy or money-heavy.

I call them Poor Marketing and Lazy Marketing.

Poor Marketing uses effort instead of cash.

Lazy Marketing uses cash instead of effort.

Neither is better.

They just match different stages of your business.

Infographic Prompt:

"Create a 16:9 infographic comparing poor marketing and lazy marketing for off-market deals, including time required, money required, scalability, and lead quality. Use clear labels, structured layout, and concise text. Add the text '© 2025 RealEstateFinancialPlanner.com. All rights reserved.' in a subtle position."

Poor Marketing Methods (Time-Intensive)

When clients are starting with more time than money, this is where I send them.

Door knocking works because it creates real conversations.

It also forces you to learn rejection tolerance fast.

Driving for dollars teaches you how to spot distress before anyone else does.

Calling FSBOs and expired listings reaches sellers who already tried the traditional route and failed.

Networking works slower, but referrals close faster.

These methods build skill before scale.

They are uncomfortable.

They are effective.

They are not optional if you want to understand sellers.

Lazy Marketing Methods (Money-Intensive)

Lazy Marketing creates leverage.

Direct mail works because consistency beats cleverness.

Most sellers call on the fifth or sixth touch, not the first.

Digital ads work because motivation is searchable.

“Sell my house fast” is not curiosity.

It is intent.

Signs, radio, TV, and paid lead sources all trade money for reach.

The danger is starting Lazy Marketing before you know how to convert leads.

Traffic without skill burns cash.

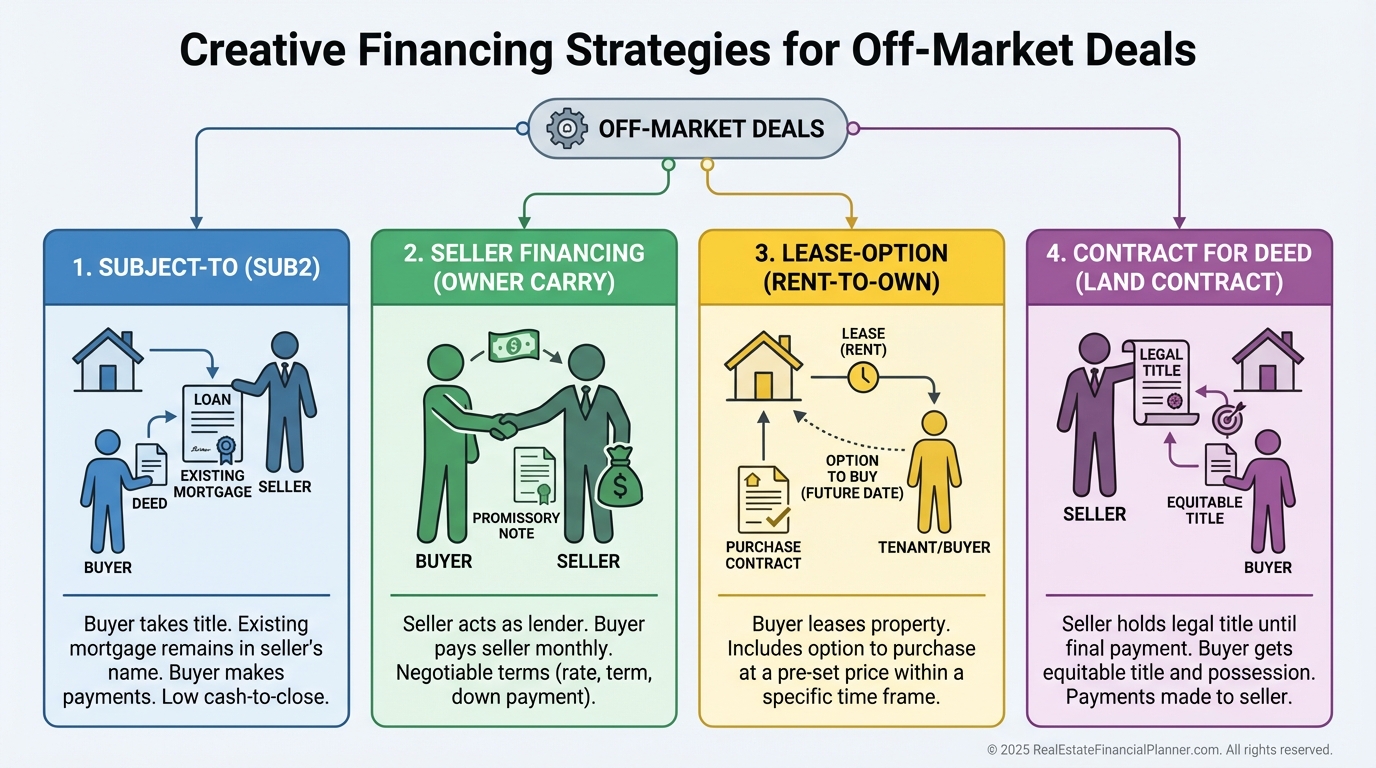

Why Creative Financing Almost Always Happens Off-Market

Creative financing fails on the MLS because agents are trained to avoid it.

That is not a criticism.

It is an incentive mismatch.

Off-market, the seller is deciding—not a listing agent, broker, or lender.

That’s where subject-to, seller financing, lease-options, and land contracts live.

Infographic Prompt:

"Create a 16:9 infographic explaining creative financing strategies used in off-market deals, including subject-to, seller financing, lease-options, and contract for deed. Use clear labels, structured layout, and concise text. Add the text '© 2025 RealEstateFinancialPlanner.com. All rights reserved.' in a subtle position."

When I analyze these deals, I never rely on emotion.

I model cash flow, equity, and exit paths using True Net Equity™ and Return Quadrants™ thinking.

Some deals look terrible as rentals and brilliant as short-term solutions.

Others only work if structured correctly.

The spreadsheet does not lie.

It tells you what structure survives reality.

Building a Repeatable Off-Market Deal System

Deals do not scale.

Systems do.

Every lead must be tracked.

Every follow-up must be scheduled.

Every offer must be calculated before it is made.

If you do not have follow-up, you do not have a business.

Most deals close months after first contact.

That’s why CRMs matter more than marketing hacks.

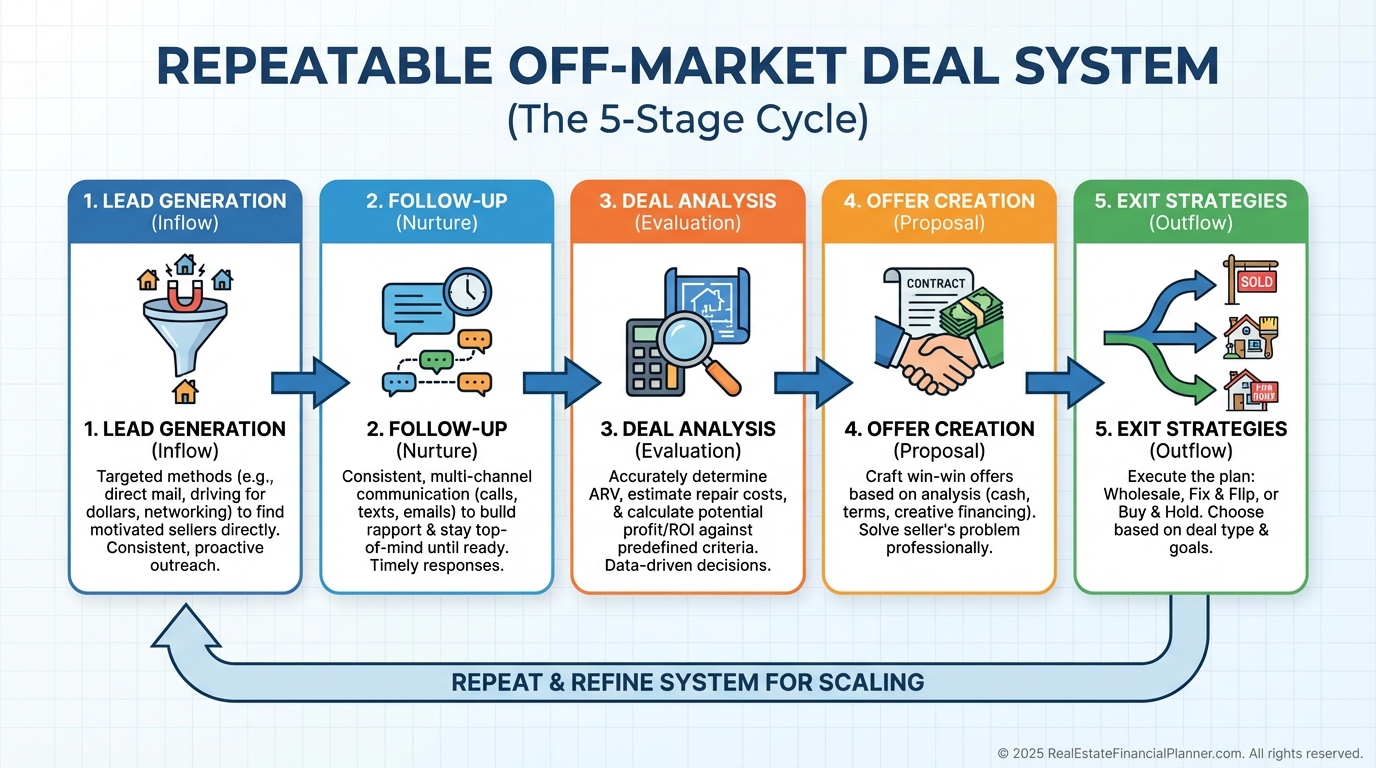

Infographic Prompt:

"Create a 16:9 infographic explaining a repeatable off-market deal system, including lead generation, follow-up, deal analysis, offer creation, and exit strategies. Use clear labels, structured layout, and concise text. Add the text '© 2025 RealEstateFinancialPlanner.com. All rights reserved.' in a subtle position."

Common Mistakes I See Over and Over

People quit too early.

They market inconsistently.

They fail to follow up.

They guess instead of calculate.

They chase too many strategies at once.

Off-market success is boring when done correctly.

It is repetition.

It is tracking.

It is patience.

Ethics matter more than tactics.

Your reputation compounds faster than your profits.

What To Do Next

Pick one Poor Marketing method and one Lazy Marketing method.

Commit to both for six months.

Track conversations, not just deals.

Analyze every offer before you make it.

When you treat off-market investing like a system instead of a hunt, deals stop feeling rare.

They become inevitable.