Series LLCs for Real Estate Investors: The Complete, Practical Guide

Learn about Series LLCs for real estate investing.

The Wake-Up Call: One Fall, Five Properties at Risk

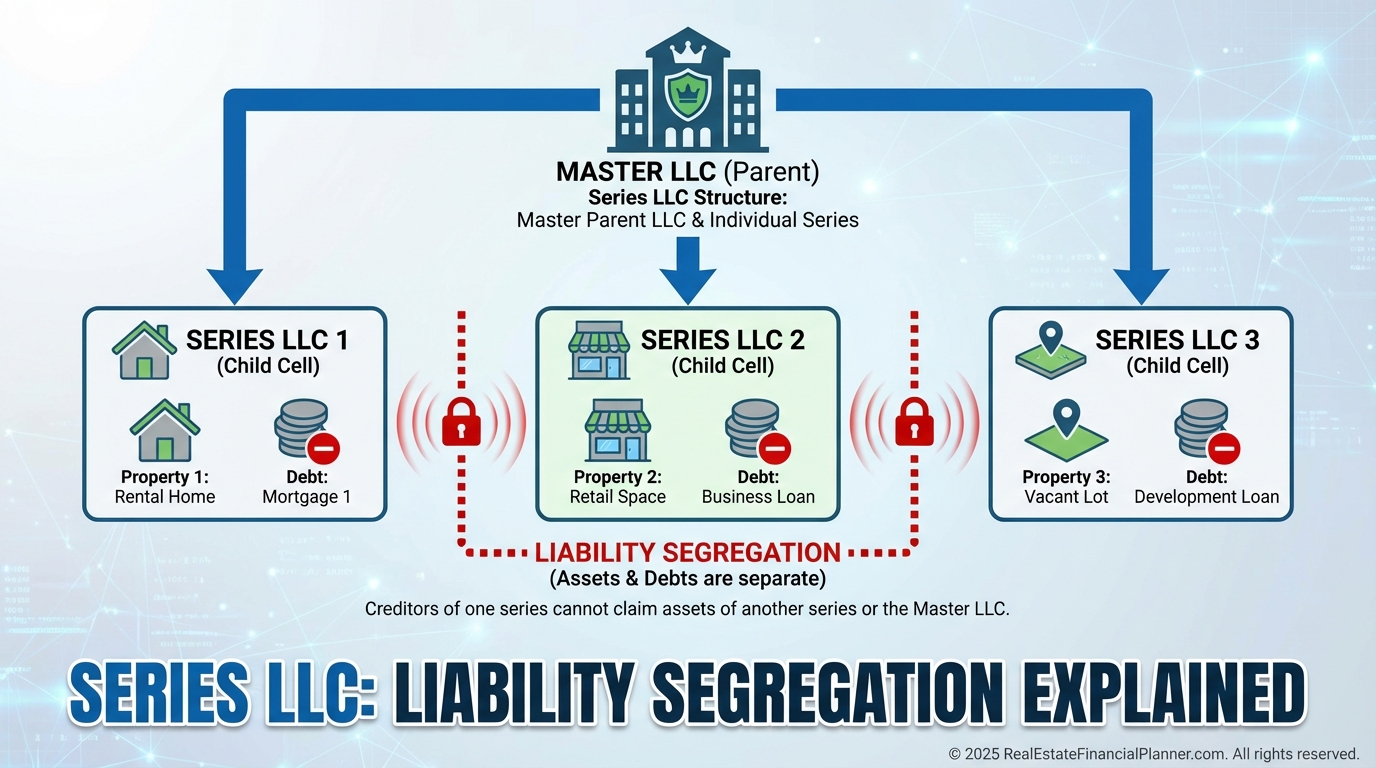

When I review portfolios, the scariest pattern I see is five rentals in one LLC or, worse, in your personal name.

One slip-and-fall at Property A, and suddenly Properties B through E are on the table.

That’s why sophisticated investors use Series LLCs to place each property behind its own legal firewall while keeping admin lean.

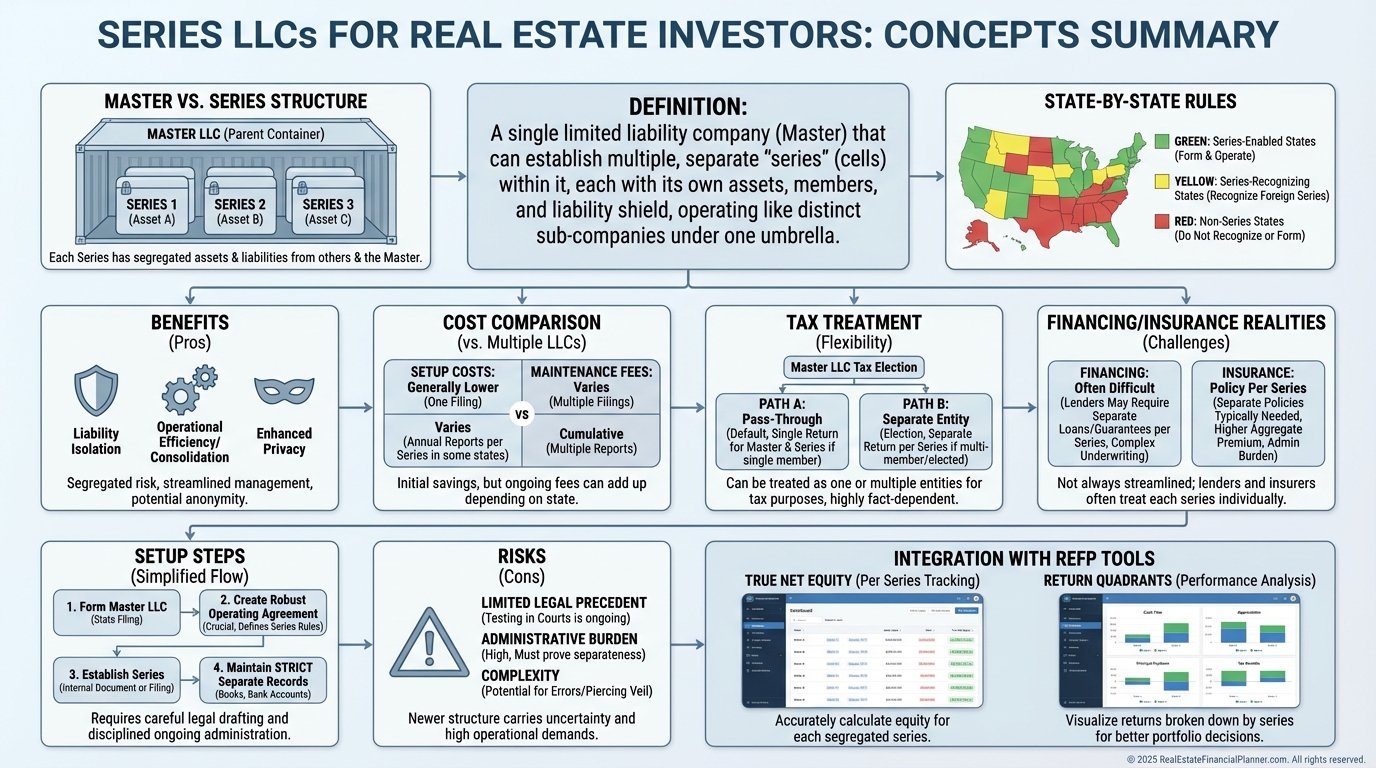

What a Series LLC Is (In Plain English)

A Series LLC is a parent LLC that can spin up child “series,” each with its own assets, liabilities, members, bank accounts, and books.

Think “one umbrella, many compartments,” where a claim in one compartment doesn’t spill into the others—if you keep the formalities tight.

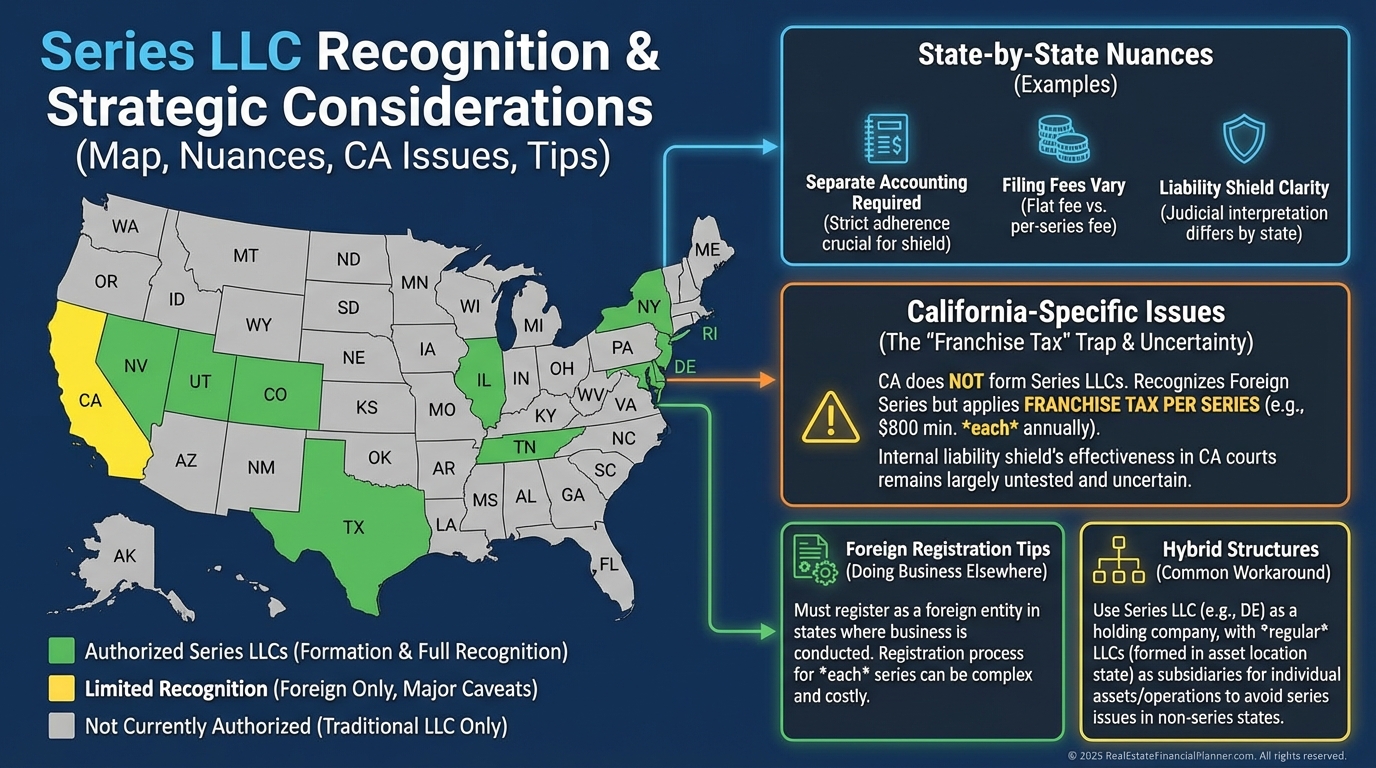

Where Series LLCs Work (And The California Problem)

Series LLC statutes exist in states like Delaware, Illinois, Iowa, Nevada, Oklahoma, Tennessee, Texas, Utah, Wyoming, Alabama, Arkansas, District of Columbia, Kansas, Missouri, Montana, and North Dakota.

Rules vary widely, and some non-series states may treat the whole thing as one entity, so we plan by property location, not just where you file.

California doesn’t let you form Series LLCs and may assess the $800 franchise tax per series doing business there, so we often use hybrids or standard LLCs for CA assets.

Why Portfolio Builders Care

Asset segregation is the headline benefit—each property gets its own silo.

Costs drop because you form one master LLC and add series instead of new LLCs every time.

Admin is easier with one overarching governance structure while each series runs separate bank accounts and books.

Tax flexibility matters too—each series can make its own tax election, which lets you optimize cash flow, depreciation, and partner allocations.

When I help clients grow from three doors to twenty, Series LLCs scale without creating an entity maze.

How I Set These Up With Clients

We form the master LLC in a Series-competent state with the right statutory language in the articles and operating agreement.

We then create a new series for each property and title the property to that series with clear naming.

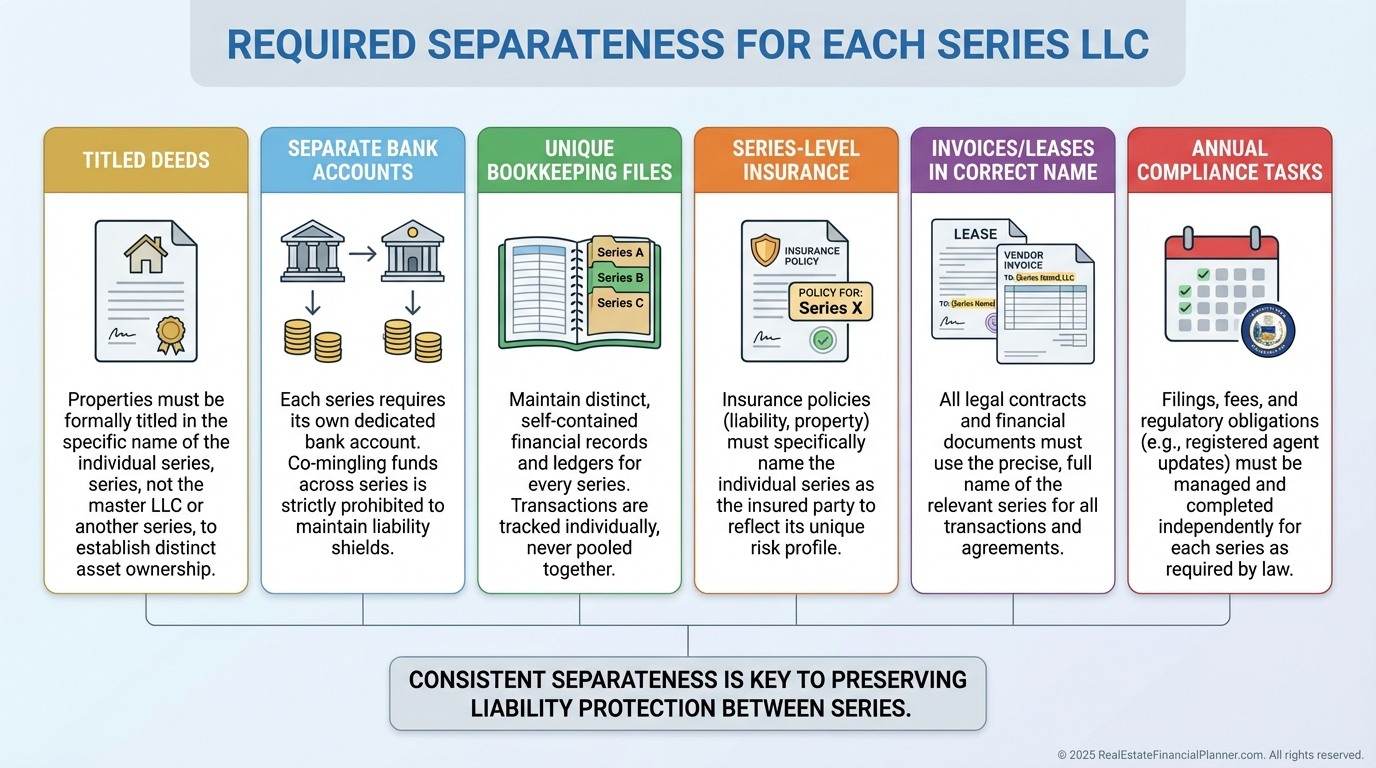

Each series gets a separate bank account, its own bookkeeping file, and its own insurance naming the correct series as insured.

If the state requires it, we file a certificate for each series and designate the master as manager to standardize control.

Banking and Bookkeeping: Non-Negotiables

Liability protection lives or dies with separateness.

I insist on separate bank accounts, distinct books, separate property management sub-ledgers, and clean documentation showing which series owns what.

Commingling or sloppy records are how plaintiffs try to collapse your series into one pot.

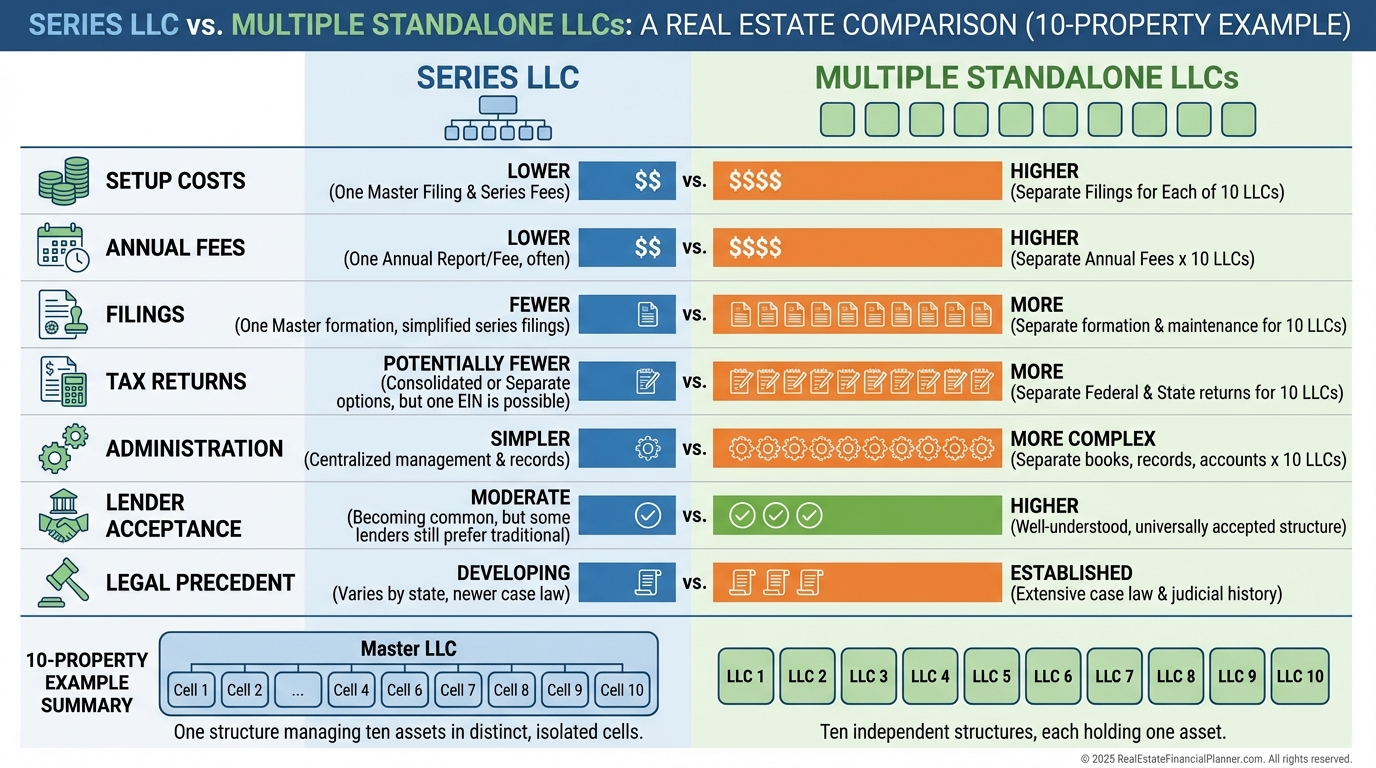

The Math: When Series LLCs Beat Multiple LLCs

For one or two rentals in one state, a standard LLC per property is simple and widely accepted.

Once you’re at three or more properties—especially in Series-friendly states—the Series LLC usually wins on cost and administration.

On a 10-property plan, I often see first-year savings of thousands and ongoing annual savings that improve portfolio cash flow and Return on Equity.

I run this analysis alongside Return Quadrants to see how lower fixed costs improve true cash flow and overall return.

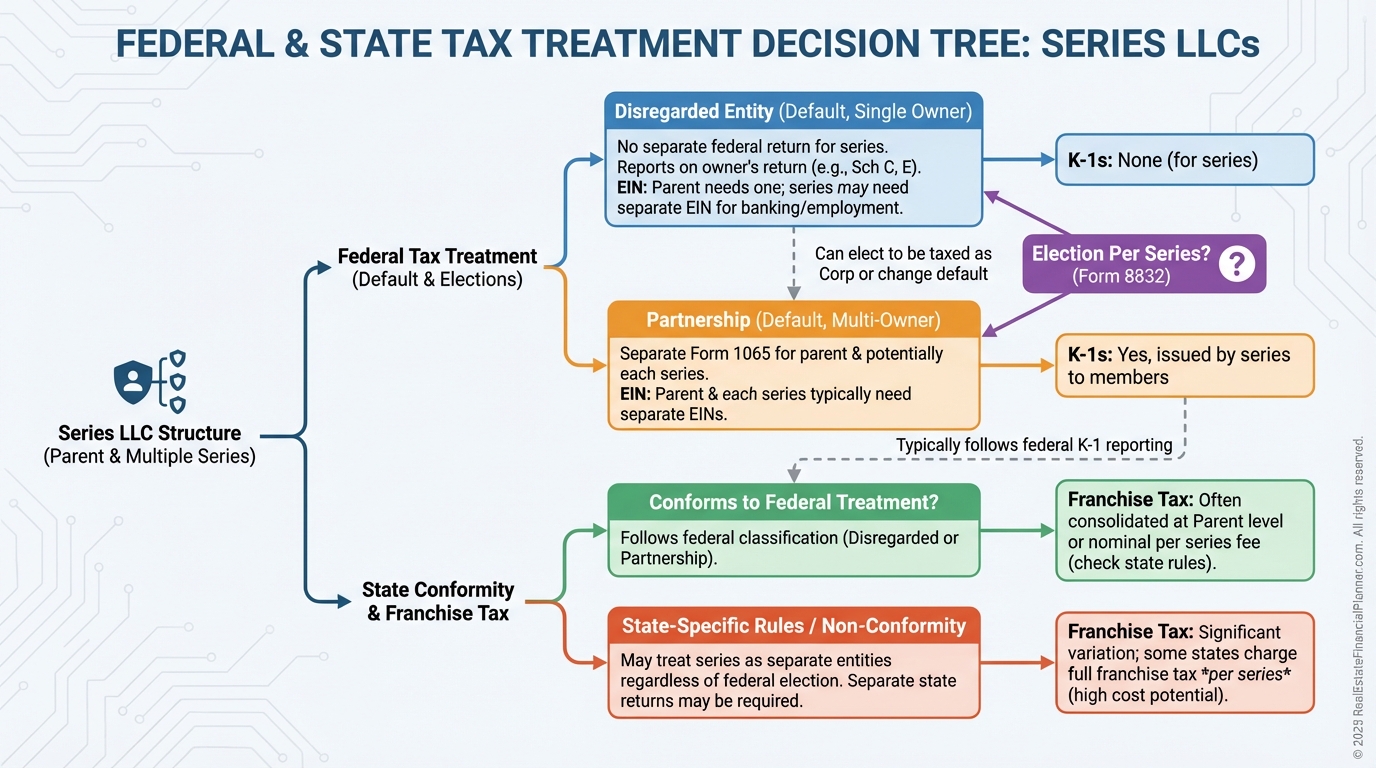

Tax Treatment in Plain English

For federal purposes, each series is generally treated as its own entity, so tax elections can vary by series.

Single-member series are often disregarded, and multi-member series are usually taxed as partnerships, issuing their own K-1s.

States differ—some follow federal treatment, others tax the Series LLC as one, and a few impose franchise taxes per series.

Your CPA should document allocations for shared master-level costs and maintain series-by-series books to support returns.

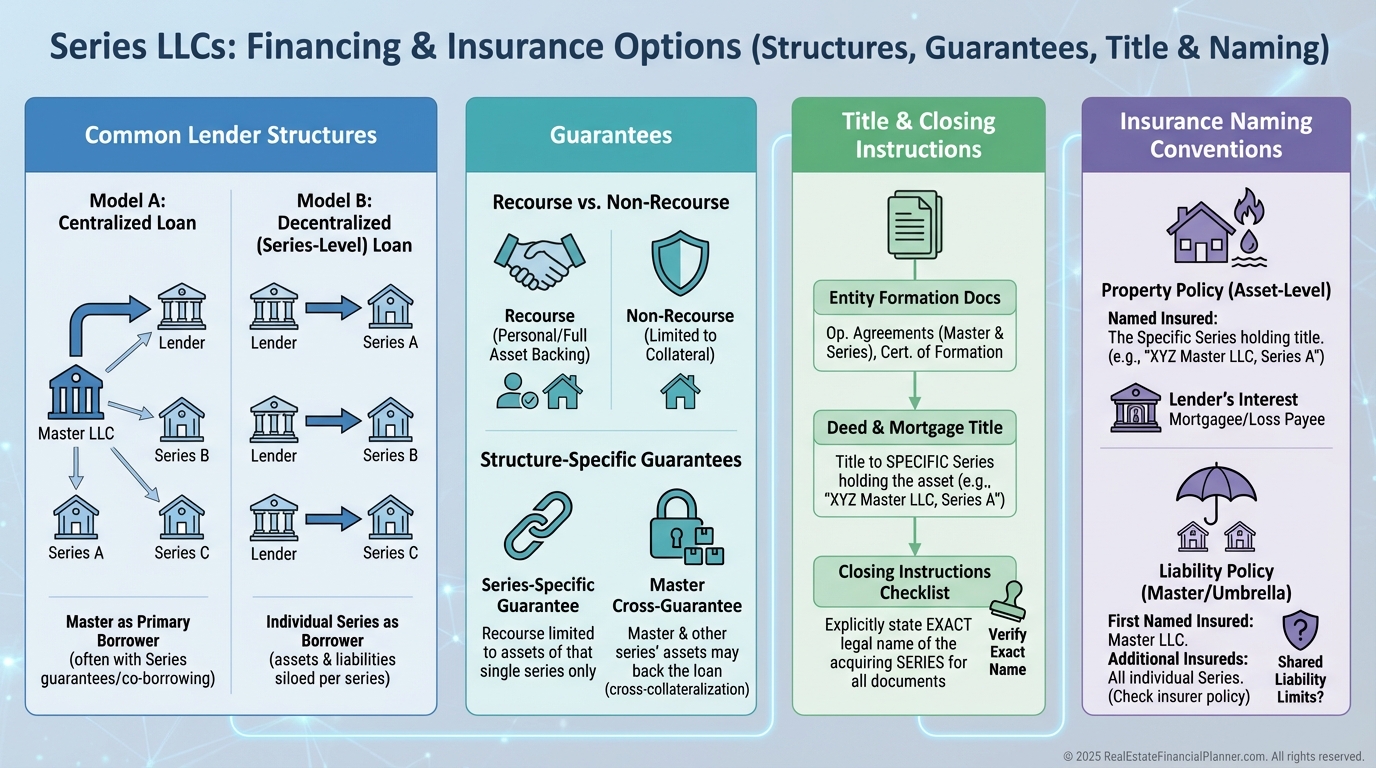

Financing and Insurance Realities

Some lenders prefer clean, single-asset, single-entity loans and may ask you to borrow in your name or in the master with a series-specific pledge.

Portfolio lenders and community banks often understand Series LLCs, especially in Texas, Delaware, and Illinois.

Insurers can cover the master and list each series and property correctly, but you must verify the named insured and endorsements match your structure.

Implementation Playbook

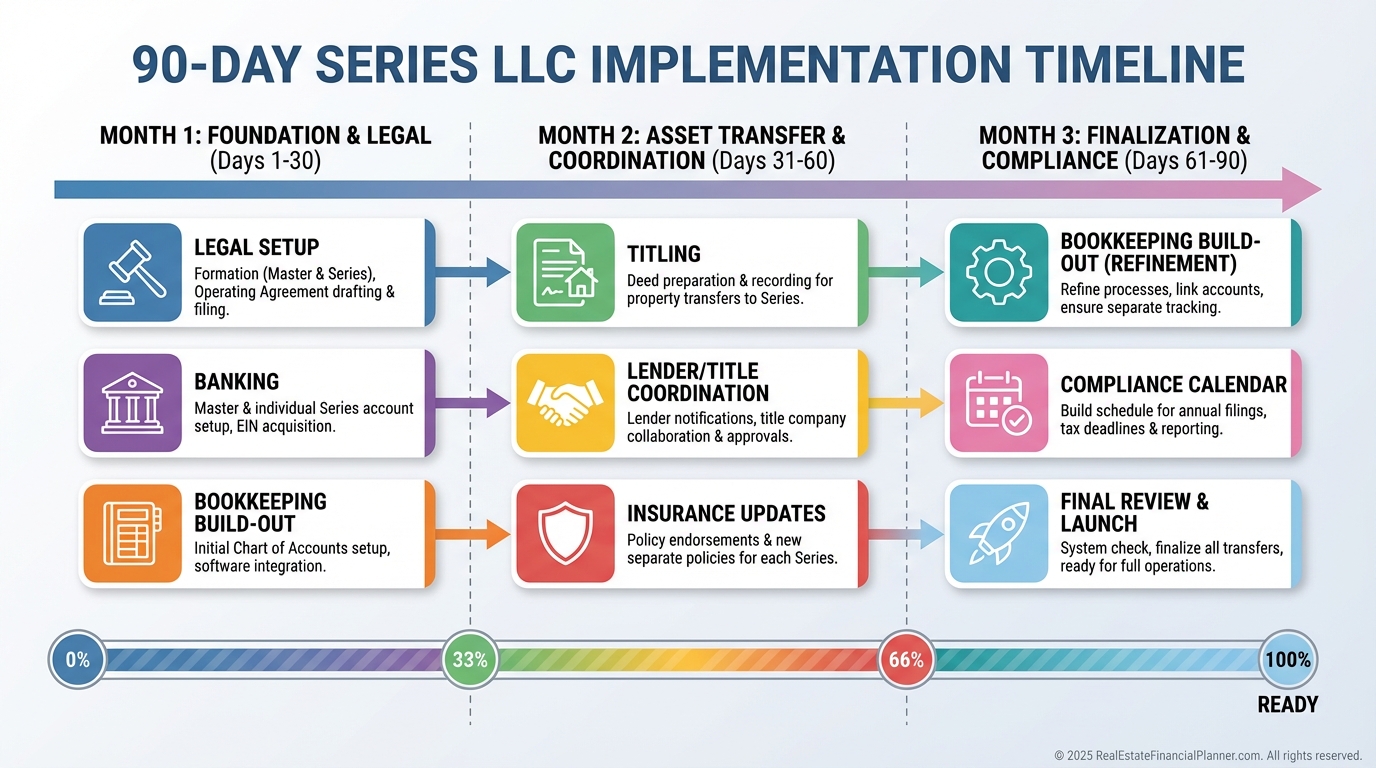

I start with a legal and tax consult in every relevant state, then draft the master operating agreement with series provisions.

We sequence property transfers to minimize due-on-sale risk and coordinate with lenders and title.

We open accounts, update leases, and retitle utilities to the correct series name.

We update insurance and property management agreements to reference the right series.

What I Watch, Check, and Avoid

I check deeds and assignments to ensure the exact legal name of the series appears on title and insurance.

I avoid master-level expenses getting paid by a random series; we allocate proportionally and document the math.

I warn clients that sloppy operational overlap is how plaintiffs argue all series are really one.

I also watch state nexus—owning or operating in a state can trigger foreign registration and taxes even if the master is elsewhere.

Using REFP Tools to Run Smarter

I model each series as its own “deal” in The World’s Greatest Real Estate Deal Analysis Spreadsheet to keep performance clean.

Return Quadrants help you see which properties produce most of your return via cash flow, appreciation, debt paydown, or tax benefits.

True Net Equity shows what you’d really net after costs and taxes if you sold a series-held property, which informs refinance vs. sell vs. hold.

For Nomad investors living in a property before converting it to a rental, we keep the primary residence outside the Series LLC and move it in after it becomes a true investment, subject to lender and legal guidance.

Common Mistakes That Kill Protection

Using one bank account for all series.

Titling assets to the master while claiming series-level ownership.

Letting leases, insurance, or vendor contracts use the wrong entity name.

Skipping state filings for series where required.

Assuming California will treat your series as separate without paying its franchise taxes.

When Not To Use a Series LLC

You have one property and don’t plan to scale soon.

Your portfolio spans mostly non-Series states with unfriendly rules.

Your lender will only fund if you hold title in a simple, single LLC.

You don’t have the discipline for per-series banking and books.

Action Steps

Inventory your properties by state and lender and map where series are advantageous.

Meet with an attorney and CPA who have Series LLC experience in your target states.

Decide whether to pilot with the next acquisition or convert existing holdings.

Stand up banking, bookkeeping, and compliance before you move titles.

Review annually for state changes and lender policy updates.

Quick Legal and Tax Note

This article is educational, not legal or tax advice.

Get guidance from qualified professionals to design the right structure for your goals and jurisdictions.