Lease Purchase Mastery: Structure Win‑Win Deals with Minimal Cash and Maximum Control

Learn about Lease Purchase for real estate investing.

Why Lease Purchase Belongs in Your Toolkit

When I help clients break through negotiation stalemates, lease‑purchase is often the bridge that gets both sides across.

It turns “no” into “now we have a path,” without asking a bank for permission.

A lease‑purchase lets you control today and buy tomorrow, with terms engineered around the seller’s real problem.

It’s not a trick; it’s a structure that trades certainty for flexibility in a way the MLS rarely can.

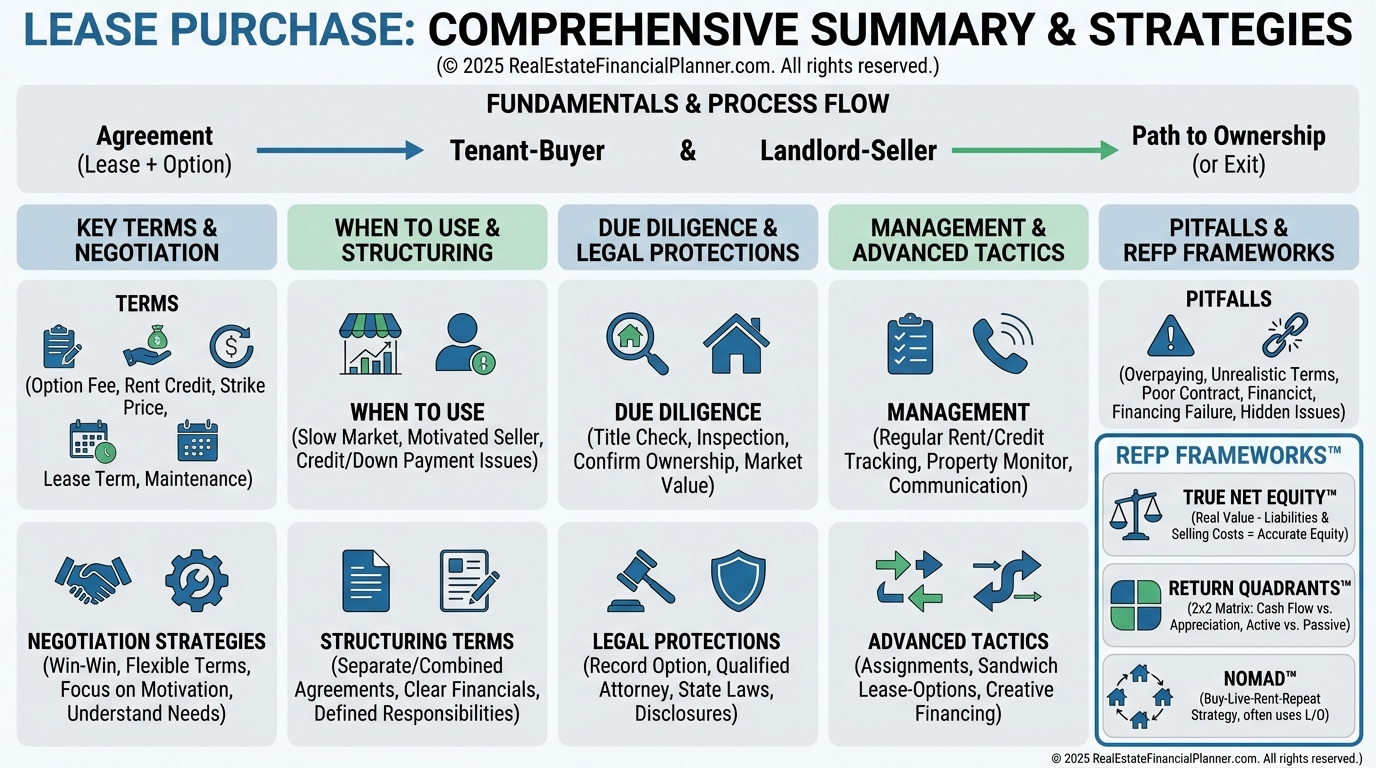

Lease‑Purchase Fundamentals in Plain English

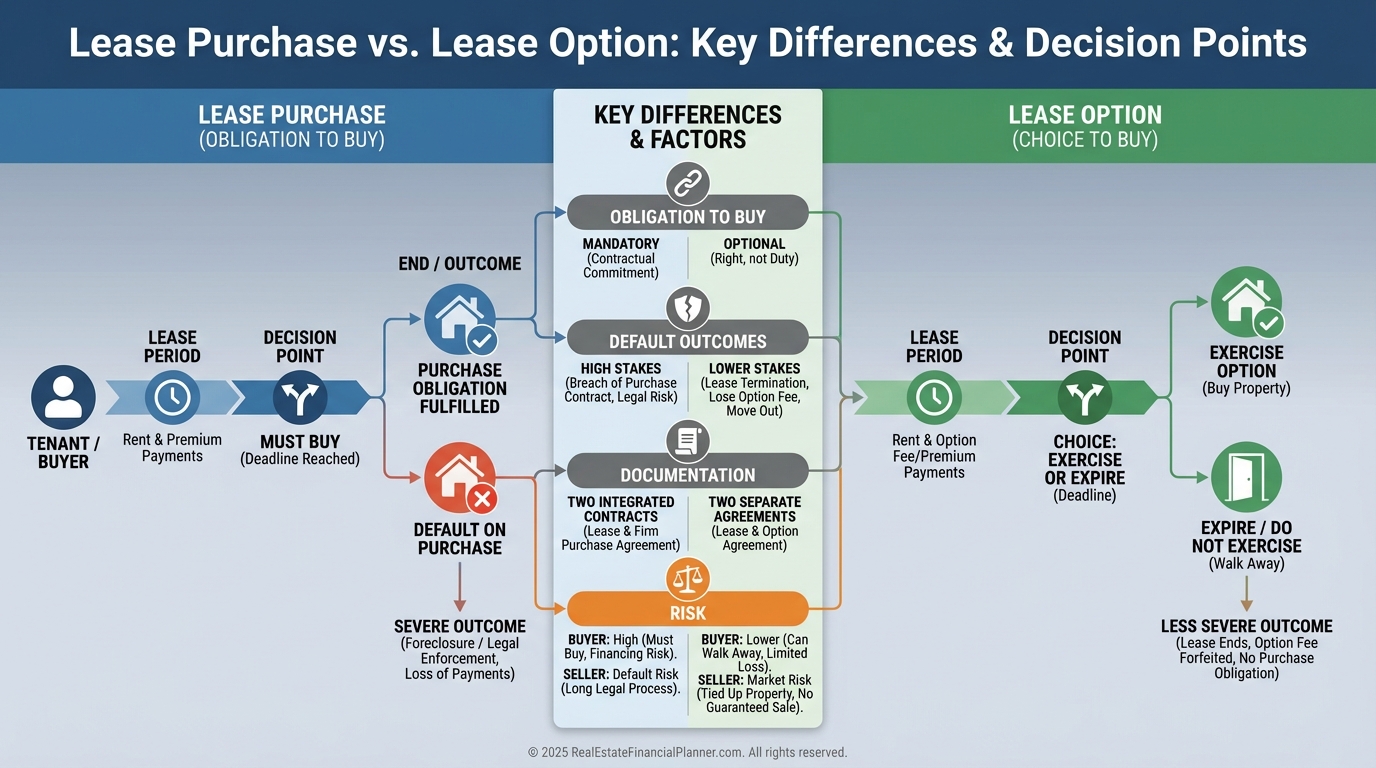

A lease‑purchase is two agreements married together: a lease for a set term and a binding purchase agreement at a pre‑set price.

Unlike a lease‑option, you must buy by the deadline, and the seller must sell.

You pay monthly rent, sometimes with a portion credited toward the purchase price, and you clarify who maintains what during the lease.

I model these with The World’s Greatest Real Estate Deal Analysis Spreadsheet™ so we see cash flow, credits, and equity building across the entire term.

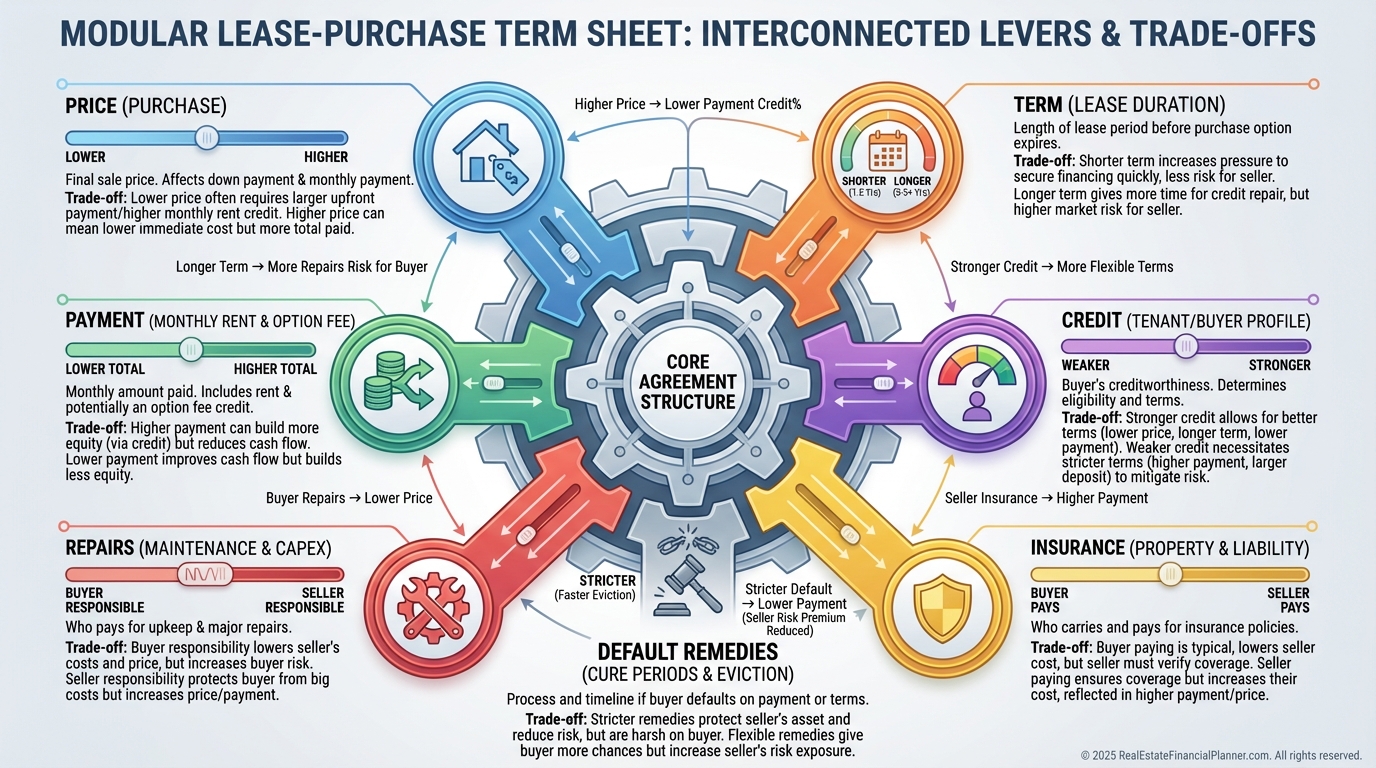

The Deal Anatomy: Terms You Actually Negotiate

Here are the levers I adjust to engineer win‑win results.

•

Purchase price: Locked at signing or with a defined escalator.

•

Lease term: Usually 12–60 months, matching lending windows and rehab plans.

•

Monthly payment: Market‑based with clear allocation of any rent credits.

•

Upfront consideration: Non‑refundable consideration credited at closing.

I verify that the seller’s mortgage, if any, allows the structure we’re proposing and plan around any due‑on‑sale risk with counsel.

When Lease‑Purchase Works Best

I look for sellers who value certainty and monthly relief more than a fast closing.

Four patterns show up repeatedly.

•

Low or no equity: Sellers who can’t absorb commissions or concessions.

•

Relocations: They need reliability and a set exit date, not a fire sale.

•

Deferred maintenance: You can improve during the term and finance later.

•

Expired listings and burned‑out landlords: They want one committed counterparty, not endless showings.

Run a side‑by‑side in the Spreadsheet™ comparing traditional sale, owner‑financing, subject‑to, and lease‑purchase to confirm the winner for both sides.

Structuring Terms That Sellers Say Yes To

When I sit with a seller, I ask, “Which is more important to you—price, payment, or timing?”

Then I build terms that honor that priority and still meet my minimum returns.

•

Price: Support with comps and, if needed, share upside via a capped escalator.

•

Payment: Offer on‑time, auto‑drafted payments that cover their obligations.

•

Credits: 10–50% of monthly payments credited only if you close, aligning incentives.

•

Maintenance: You handle day‑to‑day; seller keeps roof, foundation, and major systems unless compensated by lower price.

•

Defaults: Clear cure periods, notice methods, and fair remedies both ways.

Present two or three offer versions side‑by‑side in the Spreadsheet™ so the seller can choose their favorite win.

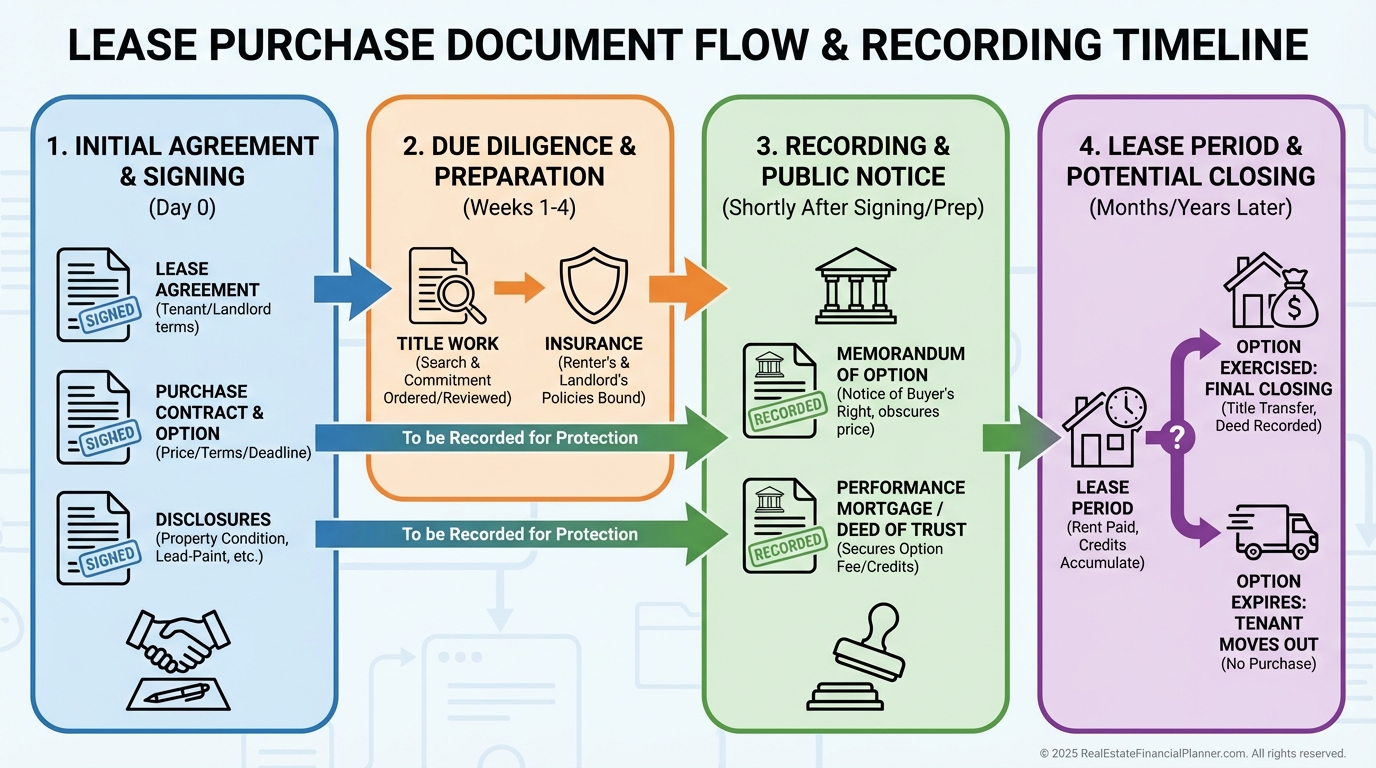

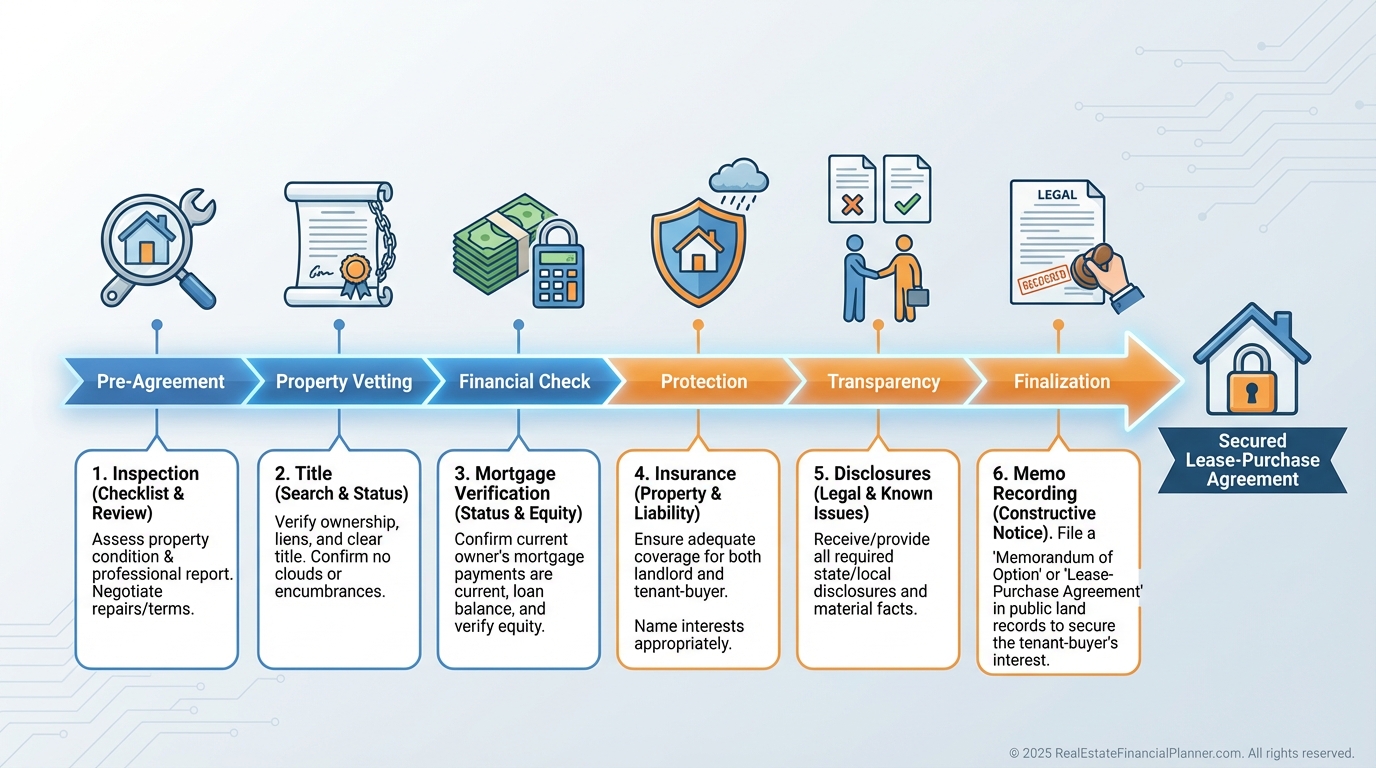

Due Diligence, Protections, and Compliance

I treat every lease‑purchase like a purchase with a delayed closing.

That means full inspections, title, insurance coordination, and legal review before I sign.

•

Property condition: Third‑party inspection and a detailed condition report with photos.

•

Financials: Verify mortgage balance, payment status, taxes, HOA, and any liens.

•

Title: Preliminary title commitment and explicit plan for curing issues.

•

Insurance: Seller keeps owner policy; I carry renter’s or DP policy plus liability as advised by the carrier.

•

Recording: Record a memorandum of option or performance mortgage to protect priority.

•

Compliance: Align structure with state law and any federal rules; get local counsel involved early.

Full disclosure earns trust, especially if you plan to sublease or assign with permission.

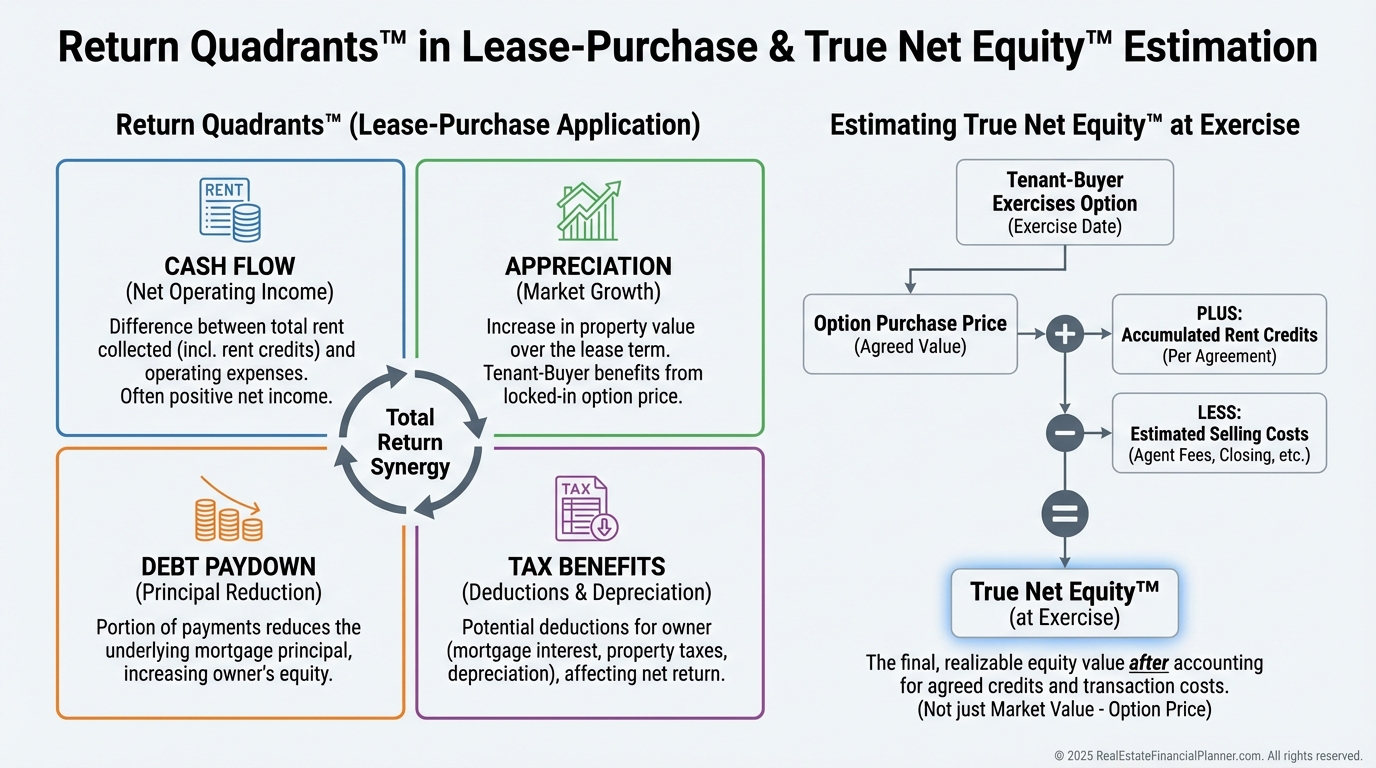

Modeling Returns the REFP Way

I evaluate lease‑purchases with Return Quadrants™ so I see the whole picture.

Cash flow, appreciation, debt paydown, and tax benefits all matter, even before I close.

Then I sanity‑check with True Net Equity™ to estimate what I would really keep after selling costs, capital gains, and payoff.

Here’s a simple sketch I often model for clients.

•

Price locked today: $300,000 with a 36‑month term.

•

Monthly rent: $2,200 with $400 credit if we close.

•

Market appreciation assumption: 3% annually.

•

Estimated value at month 36: ~$327,000.

•

Credits accrued: $14,400, applied at closing.

•

True Net Equity™ on day one: Negative by closing costs; on day 36, we estimate net by subtracting transaction costs and adding credits and paydown if any seller financing is involved at closing.

I also model Nomad™ variants where the investor lives in the property for a year to access better end‑loan terms, then converts to a rental.

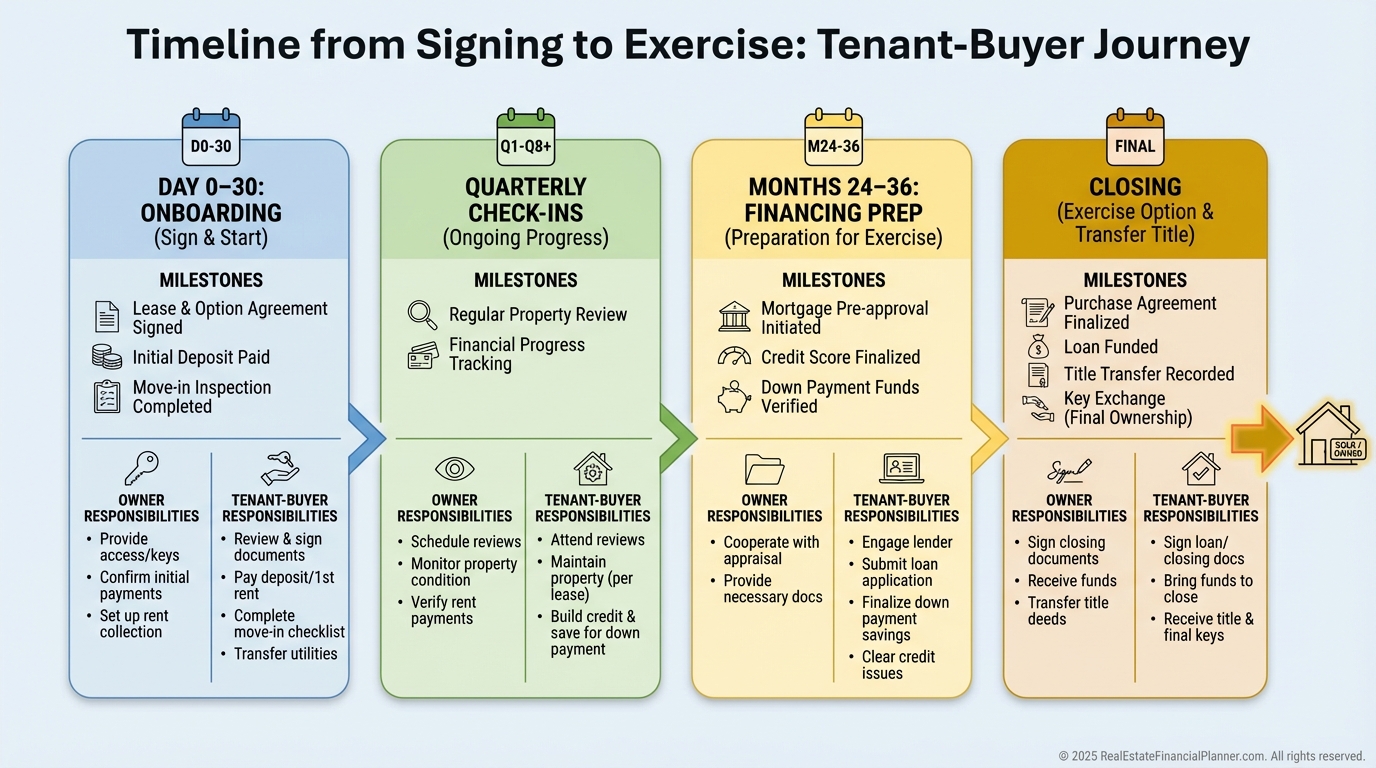

Implementation and Relationship Management

Signing is the start, not the finish.

I map the first 30 days so nothing falls through the cracks.

•

Possession day: Document condition, meter readings, and keys.

•

Utilities: Pre‑scheduled transfers and confirmations.

•

Maintenance: One channel for requests, with timestamped photos.

•

Improvements: Notify the seller of non‑structural upgrades and keep permits clean.

•

Financing runway: Begin end‑loan prep 6–12 months before the deadline and send quarterly status updates to the seller.

Sellers who feel informed rarely become obstacles when speed matters later.

Advanced Plays Without the Headaches

As your reps increase, you can add nuance without adding chaos.

I like hybrid structures that start as a lease‑option and convert to lease‑purchase after financing milestones, which lowers early obligation risk.

Graduated pricing can share appreciation while still rewarding you for early action.

Performance adjustments can exchange capital improvements for added credits or minor price reductions.

Assignment rights create exit optionality, but I disclose them and cap assignment fees to keep trust with sellers.

Common Pitfalls and How I Avoid Them

Overpaying because you’re excited to control the property is the fastest way to regret.

I anchor to the Spreadsheet™, not my emotions, and walk if Return Quadrants™ don’t clear my minimums.

Vague contracts cause the biggest fights, especially around maintenance and default remedies.

I record my interest to prevent title surprises and watch rate markets to avoid end‑loan shocks.

When the market shifts mid‑term, I renegotiate early rather than wish it away.

Your Next Three Moves

Identify two current leads where traditional listings failed and a seller still needs monthly relief.

Model three versions in The World’s Greatest Real Estate Deal Analysis Spreadsheet™ and highlight the seller’s best‑fit option on page one.

Call your investor‑friendly attorney and line up the exact memo and performance security you’ll use in your market.