Closing Costs: The Silent Deal Killer Investors Ignore

Learn about Closing Costs for real estate investing.

Closing Costs for Real Estate Investors

When I help clients analyze deals, closing costs are almost always underestimated.

Not because they are hard to understand, but because investors mentally treat them as “future paperwork,” not real money.

That mistake quietly wrecks returns.

I have seen solid-looking deals collapse at the closing table because an investor was short ten or fifteen thousand dollars they never modeled. I have also seen deals that looked mediocre suddenly make sense once we tightened assumptions and negotiated costs correctly.

Closing costs are not a nuisance. They are part of the investment.

What Closing Costs Really Are

Closing costs are all the one-time expenses required to legally complete a real estate transaction, beyond the purchase price.

They are not monthly expenses.

They do not show up in your rent roll.

But they absolutely show up in your returns.

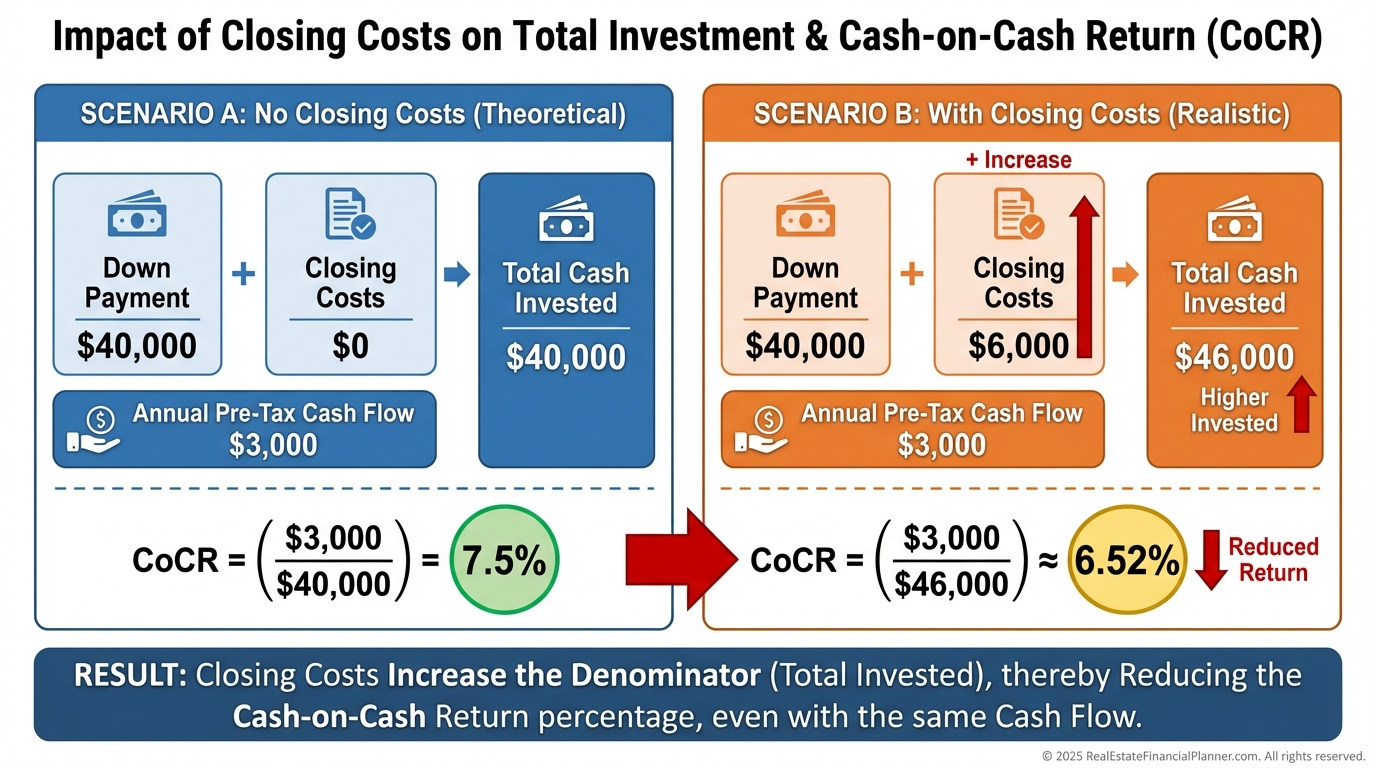

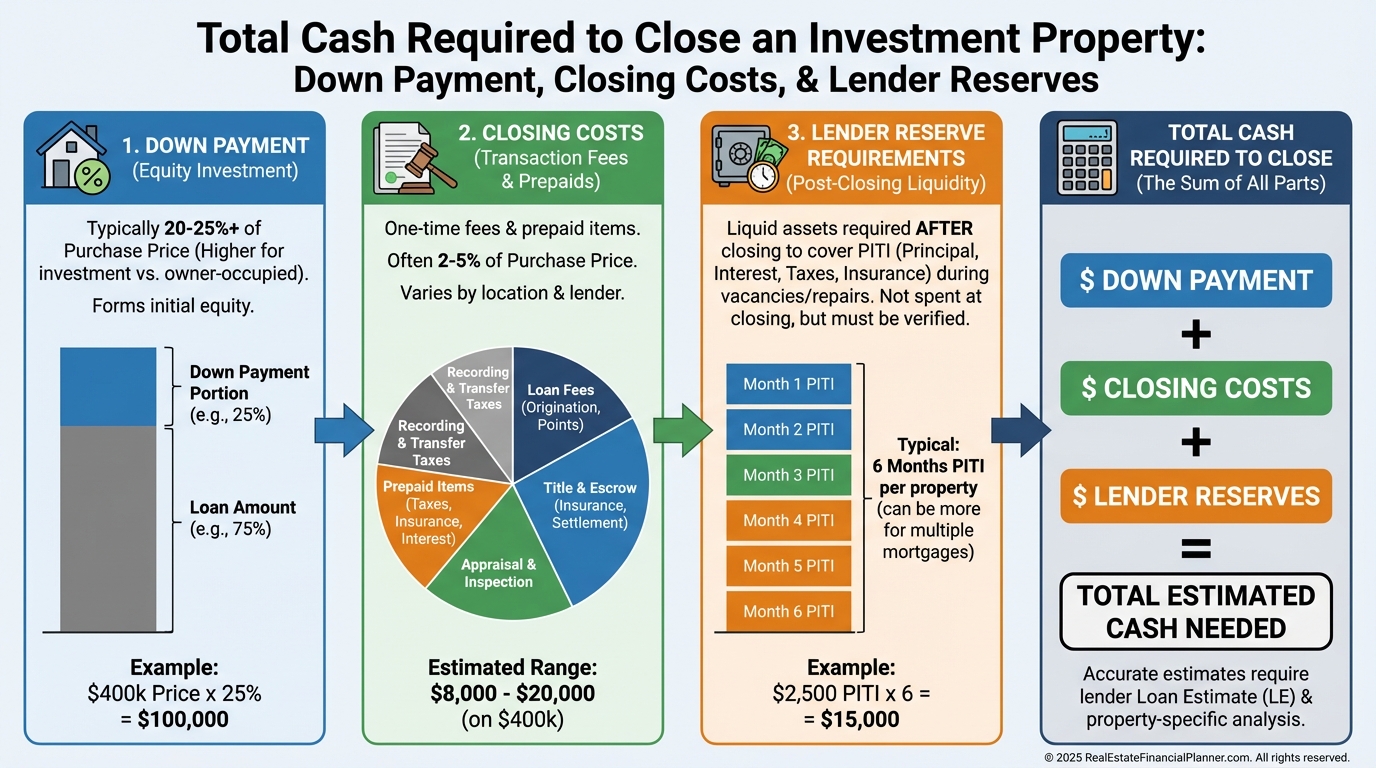

Every dollar of closing costs increases your initial cash investment. That directly lowers your cash-on-cash return and stretches your payback period.

When I rebuilt after bankruptcy, one of my non-negotiables was simple: no deal got analyzed without explicit acquisition costs. That discipline saved me from repeating the same mistakes that wiped me out the first time.

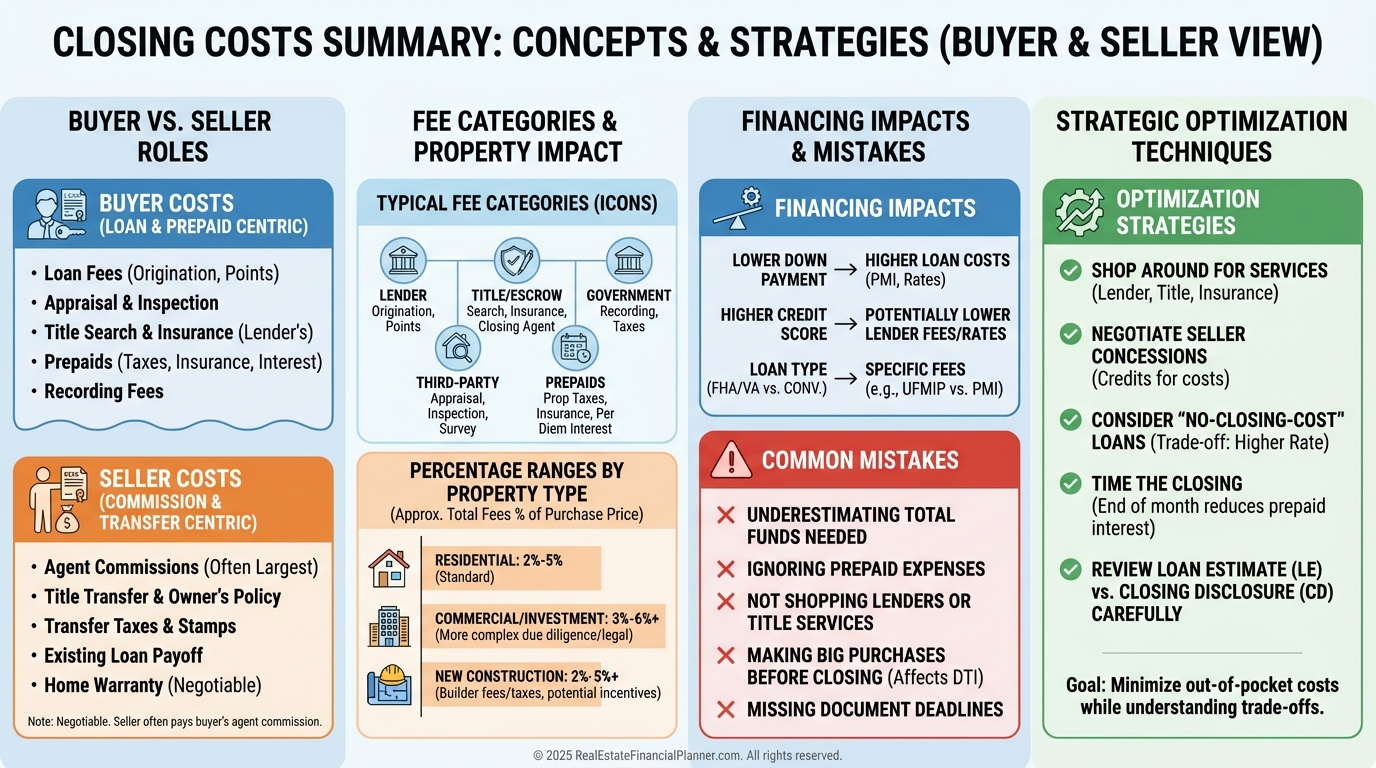

There are two broad buckets investors must track separately.

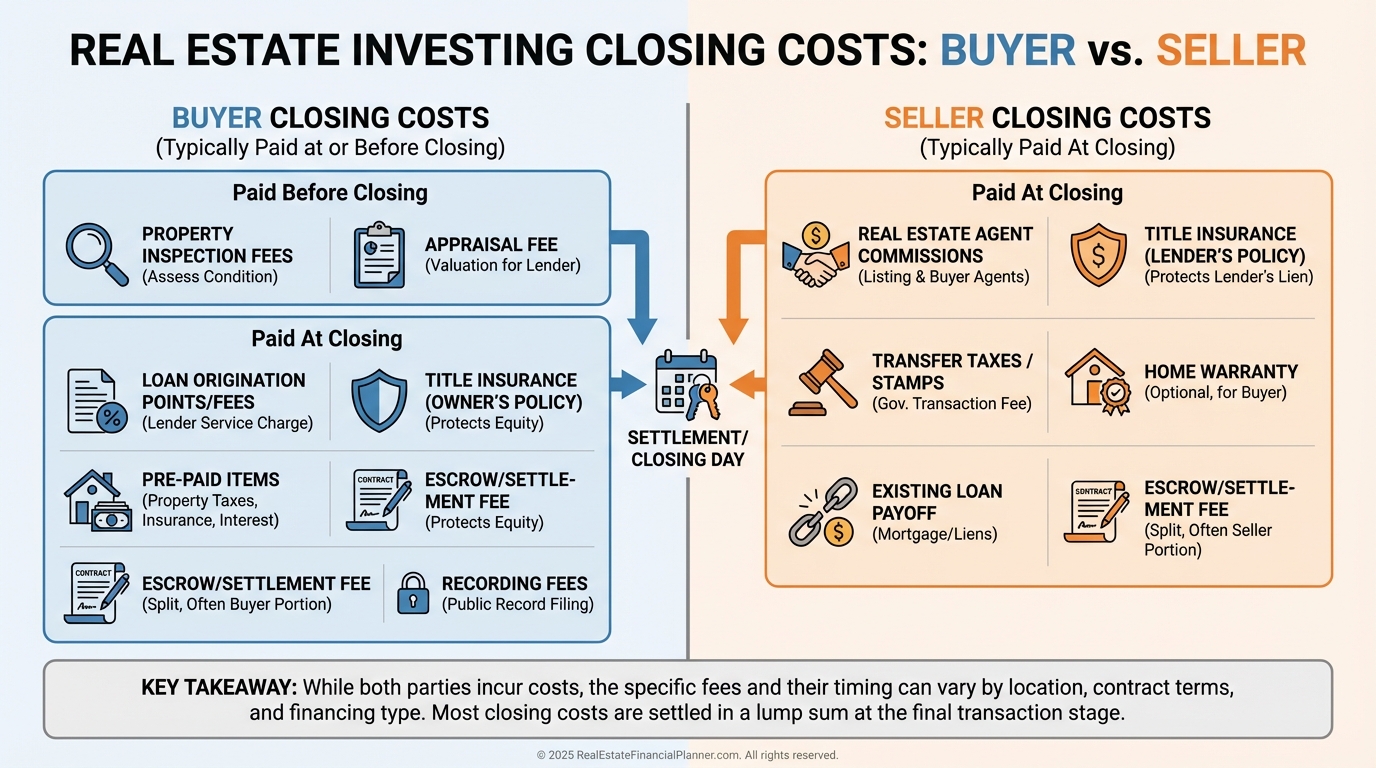

Buyer Closing Costs

These include lender fees, title insurance, escrow, inspections, appraisals, prepaid taxes, and insurance. For financed investment properties, they typically range from two to five percent of purchase price.

Seller Closing Costs

These include agent commissions, transfer taxes, title fees for the buyer, and prorated taxes. You may not pay them today, but they matter when you calculate True Net Equity™ and eventual exit returns.

Buyer vs Seller Closing Costs

Why Closing Costs Change Your Returns More Than You Think

Most investors obsess over purchase price.

Professionals obsess over total cash invested.

Closing costs increase the denominator in every return calculation. That matters more than most people realize.

On a two-hundred-thousand-dollar rental with twenty-five percent down, an extra ten thousand dollars in closing costs increases your cash investment by twenty percent. The property did not change. The rent did not change. Only your returns did.

When we analyze deals inside Real Estate Financial Planner™, closing costs live in acquisition costs, not buried in the purchase price. That separation makes their impact obvious instead of invisible.

How Closing Costs Reduce Cash-on-Cash Return

The Five Major Categories of Closing Costs

When I review Loan Estimates with clients, I break closing costs into five categories. This prevents surprise math and emotional decision-making late in the deal.

Lender Fees

Origination points, underwriting, processing, application fees, and rate lock charges. Investment property loans almost always cost more than owner-occupied loans.

Title and Escrow

Owner’s and lender’s title insurance, escrow handling, recording fees, and settlement charges. These vary wildly by state.

Inspections and Appraisals

General inspections, pest inspections, specialty inspections, and lender-required appraisals. Multifamily and commercial properties increase these costs fast.

Prepaid Items

Insurance premiums, property taxes, HOA dues, and interest from closing to first payment. This is the most common investor surprise.

Professional Services

Attorneys, surveys, environmental reports, and specialty reviews required by lenders or municipalities.

Breakdown of Investor Closing Costs

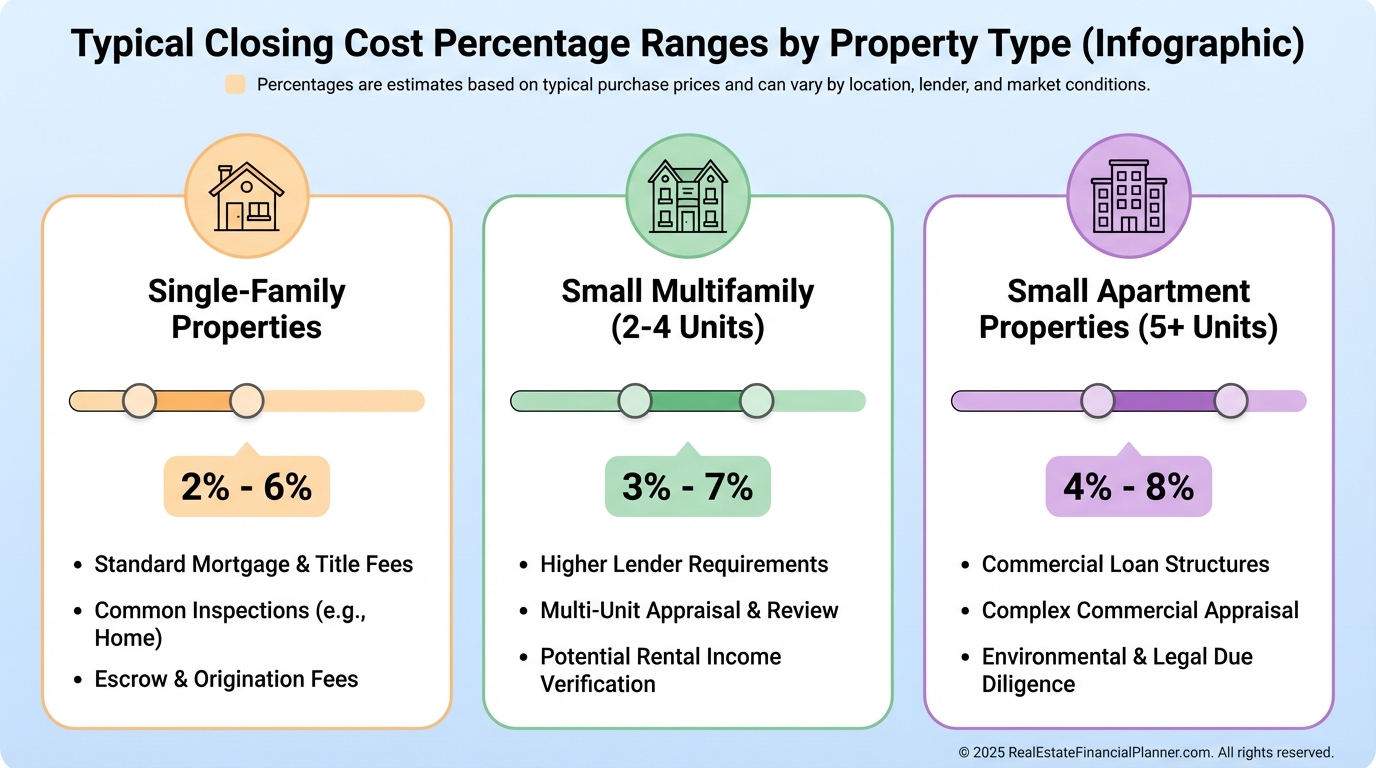

Estimating Closing Costs Like a Professional

Amateur investors use rules of thumb.

Professionals use ranges by property type and market.

Here is how I model them.

Single-Family Rentals

Two to four percent of purchase price.

Small Multifamily (Two to Four Units)

Two and a half to five percent.

Small Apartments and Commercial

Three to six percent, sometimes more.

These are planning ranges, not guesses.

Before submitting offers, I request a preliminary net sheet from a title company and a Loan Estimate from a lender. Those two documents eliminate ninety percent of closing-day surprises.

Typical Closing Cost Ranges by Property Type

Financing, Reserves, and the Cash Trap

Closing costs do not exist in isolation.

Lenders care about total liquidity.

Most investment loans require not just down payment and closing costs, but three to six months of reserves. That reserve requirement kills more deals than interest rates ever will.

I regularly see investors qualify on paper, then fail in practice because they ignored reserves tied to taxes and insurance escrowed into the payment.

Total Cash Required to Close an Investment Property

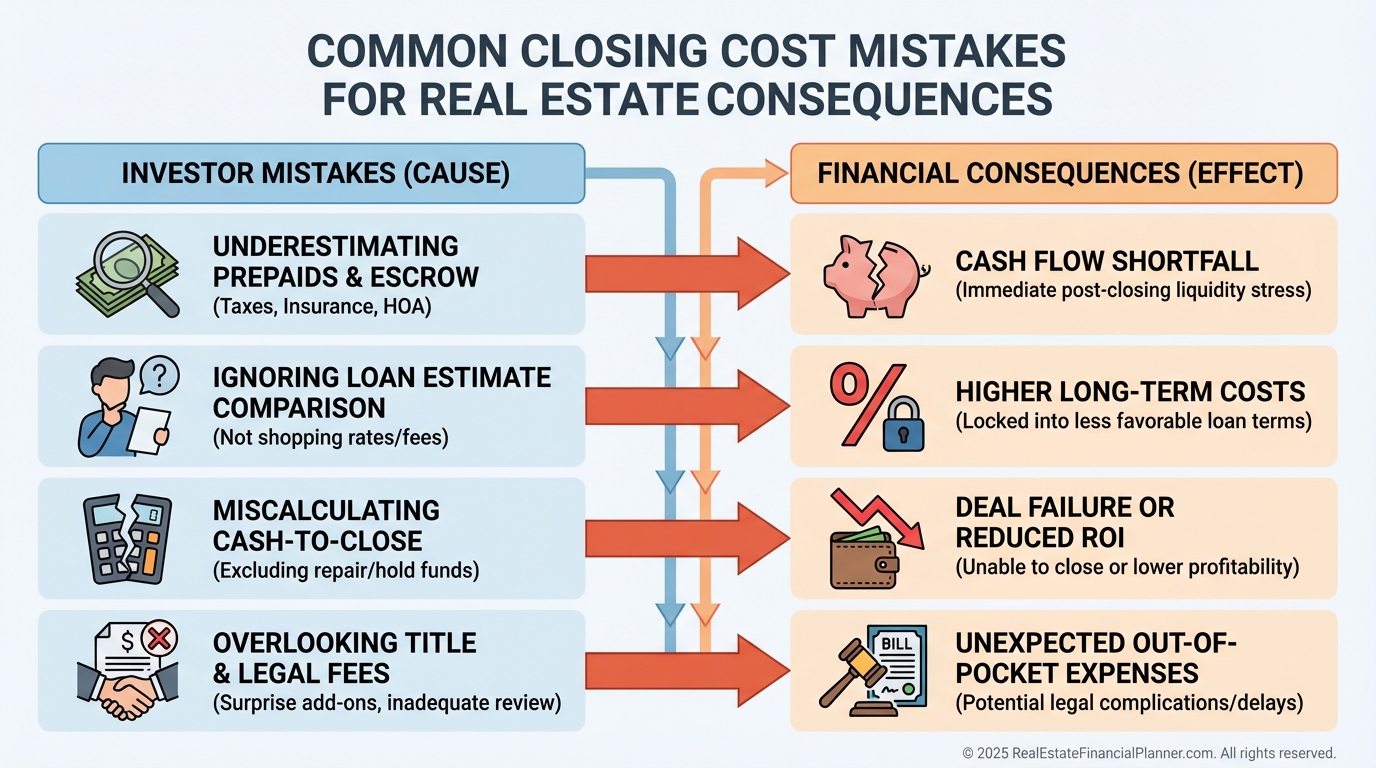

Common Closing Cost Mistakes I See Constantly

After reviewing thousands of deals, the mistakes repeat.

Forgetting Prepaids

Insurance and taxes routinely add several thousand dollars investors never planned for.

Ignoring Regional Taxes

Transfer taxes alone exceed two percent in some states.

Assuming Seller Concessions

Investment properties have tighter limits, and hot markets offer none.

Skipping Title Insurance

Saving a couple thousand dollars while risking the entire property is not investing. It is gambling.

Treating Cash Deals as “Free”

Cash purchases still have title, recording, inspection, and tax costs.

These mistakes rarely feel fatal in isolation. Together, they quietly crush returns.

Costly Closing Cost Mistakes Investors Make

Strategic Uses of Closing Costs

Professional investors do not just accept closing costs. They use them.

Seller concessions can improve cash flow when markets allow. Lender credits can preserve liquidity when cash is constrained. Timing closings can reduce prepaid taxes. Vendor relationships can shave thousands over a portfolio.

Closing costs also matter on exit.

When I calculate True Net Equity™, selling costs are always included. A property that looks profitable on paper may be underwater after commissions, taxes, and transaction friction.

That awareness changes which deals I buy and which I pass on.

Control the Part of the Deal Most Investors Ignore

Closing costs are not optional, but surprises are.

Model them early. Verify them often. Track them against actuals. Treat them as part of your investment, not an inconvenience at the end.

Every dollar you control here permanently improves your returns.

And in a business where one or two percent differences compound for decades, that control is not optional.