Cash-Out Refinances: How Smart Investors Turn Trapped Equity Into Accelerated Growth

Learn about Cash-Out Refinances for real estate investing.

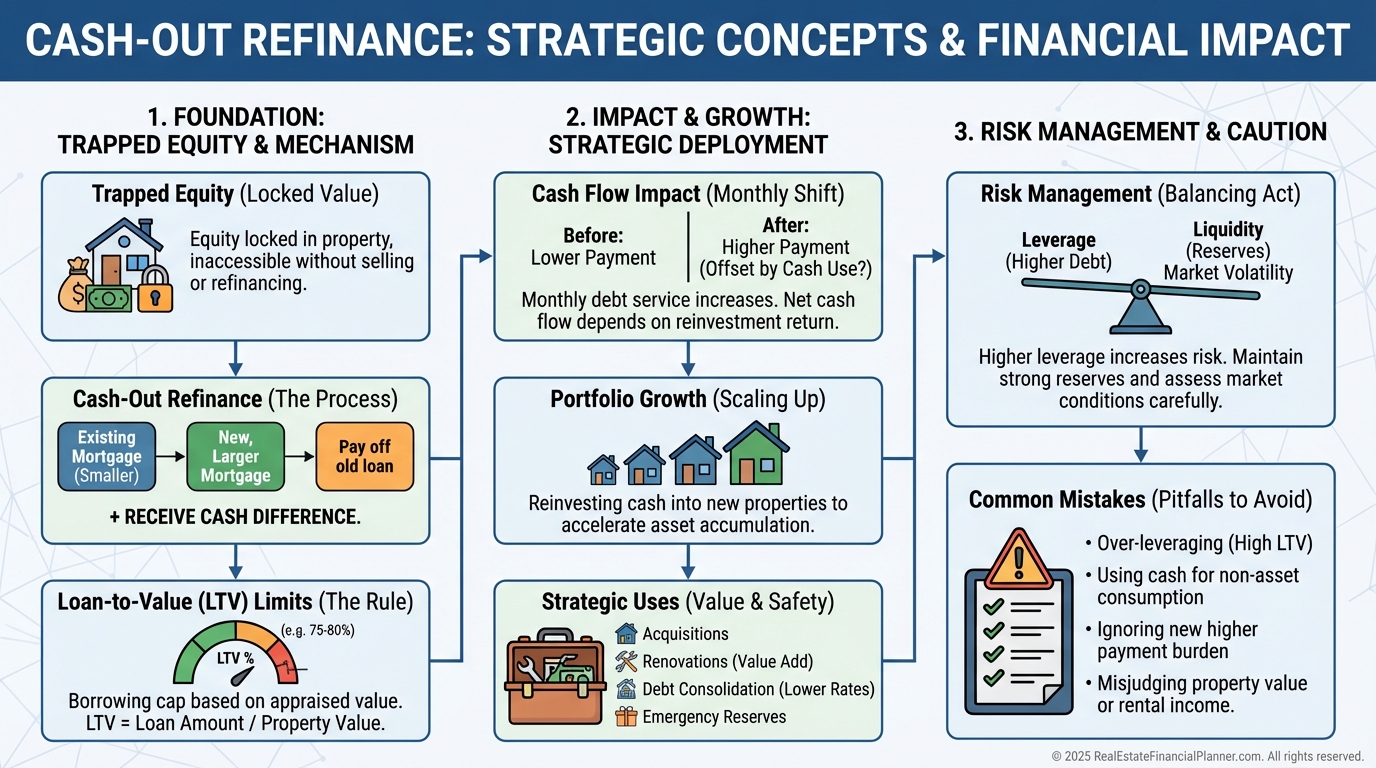

Cash-Out Refinance Overview

Most real estate investors are far richer on paper than they feel in real life.

When I help clients review their portfolios, one pattern shows up again and again: tens or hundreds of thousands of dollars locked inside properties, doing nothing.

This is trapped equity.

It feels safe. It feels conservative. But it often slows progress far more than investors realize.

I learned this lesson the hard way while rebuilding after bankruptcy. Equity that just sits there doesn’t compound. Equity that’s deployed intentionally can change the trajectory of your entire plan.

That’s where cash-out refinances come in.

What a Cash-Out Refinance Really Is

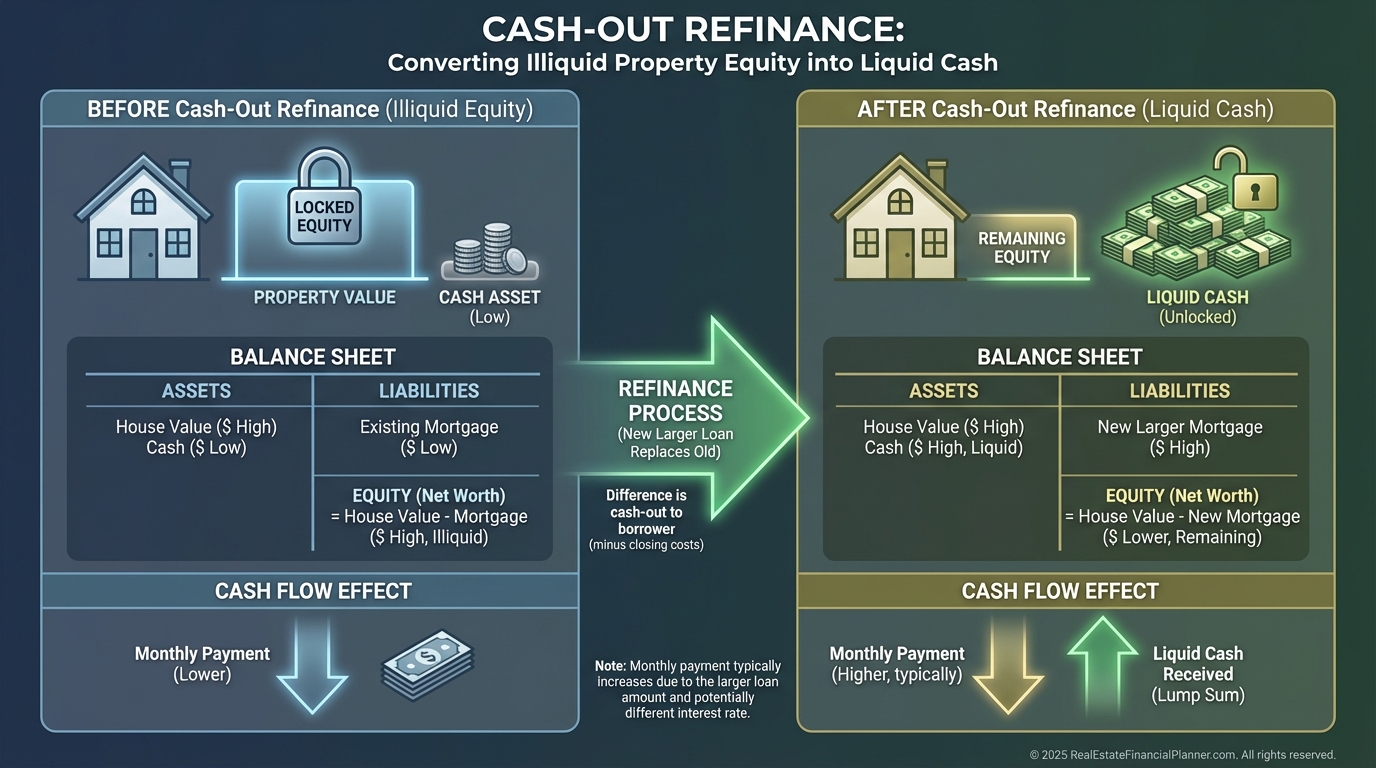

A cash-out refinance replaces your existing loan with a larger one and deposits the difference into your bank account.

You’re not selling. You’re not triggering capital gains taxes. You’re borrowing against equity you already own.

The key distinction I emphasize with clients is this:

You’re converting illiquid equity into liquid capital.

That single shift changes what’s possible.

Equity to Cash Conversion

You still own the property.

You still collect rent.

You still benefit from depreciation and long-term appreciation.

But now, the equity is working.

How Cash-Out Refinances Differ From Other Options

When clients say “refinance,” they often mean very different things.

A rate-and-term refinance only changes interest rate or loan length. No cash comes out.

A HELOC adds a second loan with variable rates and another payment.

A home equity loan does the same, just with fixed terms.

A cash-out refinance replaces the original loan entirely and simplifies everything into one payment.

For investors, simplicity matters more than most realize.

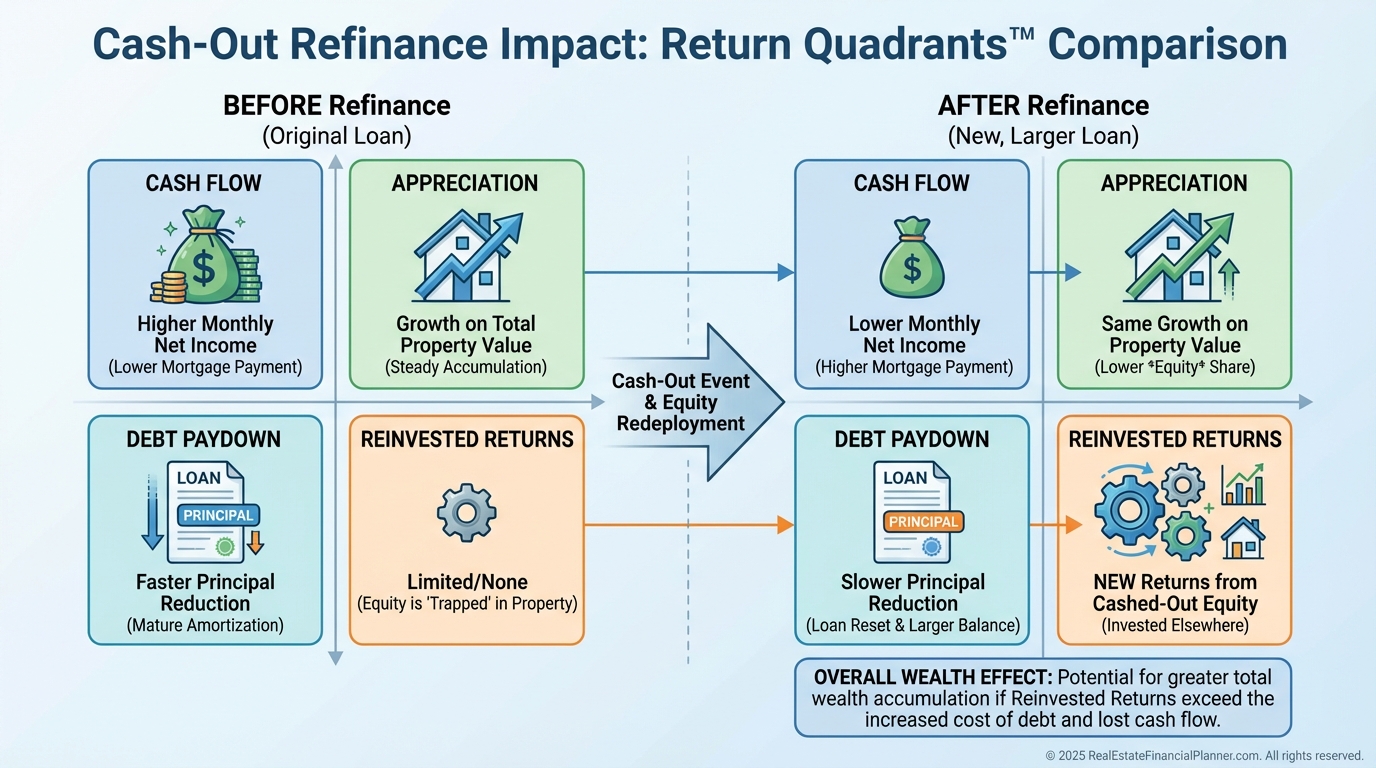

The Metrics That Actually Change

Any time you pull equity out, the numbers move. Pretending otherwise is how investors get into trouble.

Your loan-to-value ratio increases.

Most investment properties cap out around seventy-five to eighty percent LTV.

Your cash flow usually drops in the short term because the payment increases.

Your cash-on-cash return may decline on that property, but portfolio-level returns often improve if the capital is redeployed well.

This is where I rely heavily on the Return Quadrants™.

Cash flow might dip, but appreciation, debt paydown, and reinvested returns often accelerate.

Return Quadrants Before vs After Cash-Out

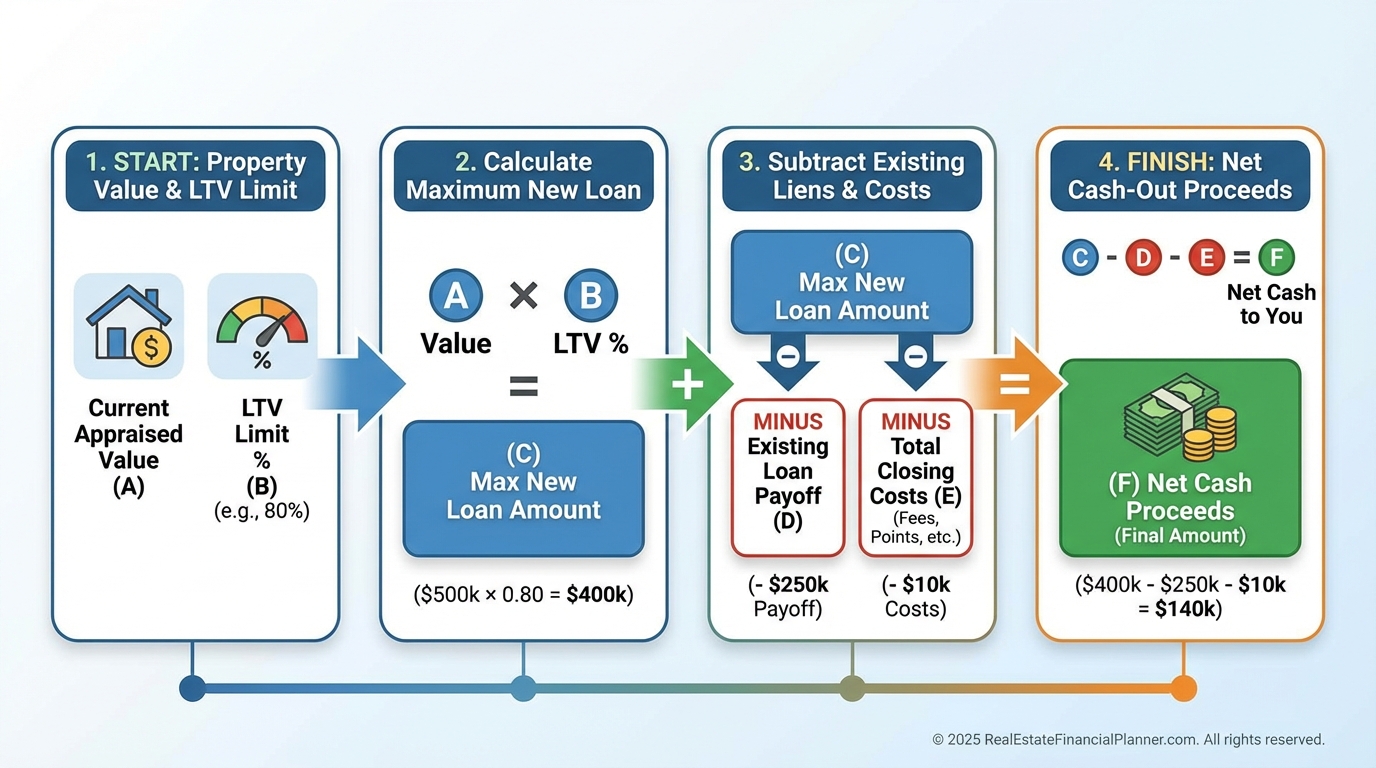

How I Calculate Cash-Out Proceeds

I don’t allow clients to guess. We calculate everything conservatively.

Start with a realistic property value based on comps, not optimism.

Multiply that value by the maximum LTV the lender allows.

Subtract the current loan payoff.

Subtract closing costs, which are almost always two to five percent of the new loan.

What remains is usable cash.

Cash-Out Refinance Math Breakdown

That final number is the only one that matters.

Why Lenders Care More Than You Think

Investment property refinances are not homeowner loans.

Credit scores matter.

Debt service coverage ratios matter.

Reserves matter.

Most lenders want a DSCR of at least one point two five. That means the property must earn twenty-five percent more than its total mortgage payment.

When I see investors skip this step, they’re often shocked when underwriting kills the deal late in the process.

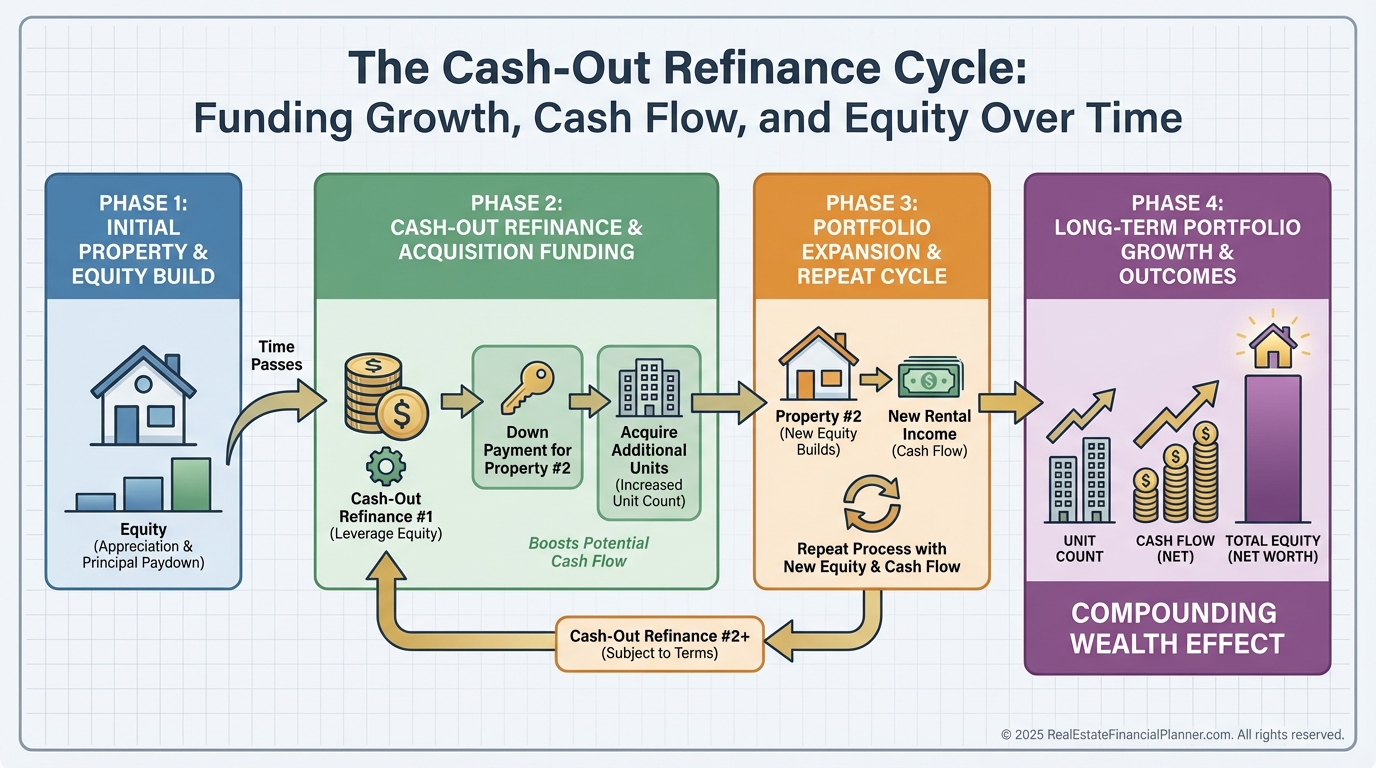

Portfolio Growth Is Where the Magic Happens

One property rarely changes your life.

A system does.

When investors use cash-out refinances across multiple properties, the effect compounds.

Portfolio Expansion Using Cash-Out Refinances

This is how three properties become five.

This is how five become eight.

The properties themselves become capital engines.

The Mistakes I Warn Clients About First

Every leverage strategy has a dark side if misused.

Pulling equity at peak prices leaves no margin for error.

Ignoring closing costs creates false confidence.

Shopping only one lender quietly costs thousands.

Confusing tax-free proceeds with deductible expenses leads to bad planning.

I lived through the consequences of over-leverage during my own downturn. That experience permanently changed how conservative I am with LTV targets.

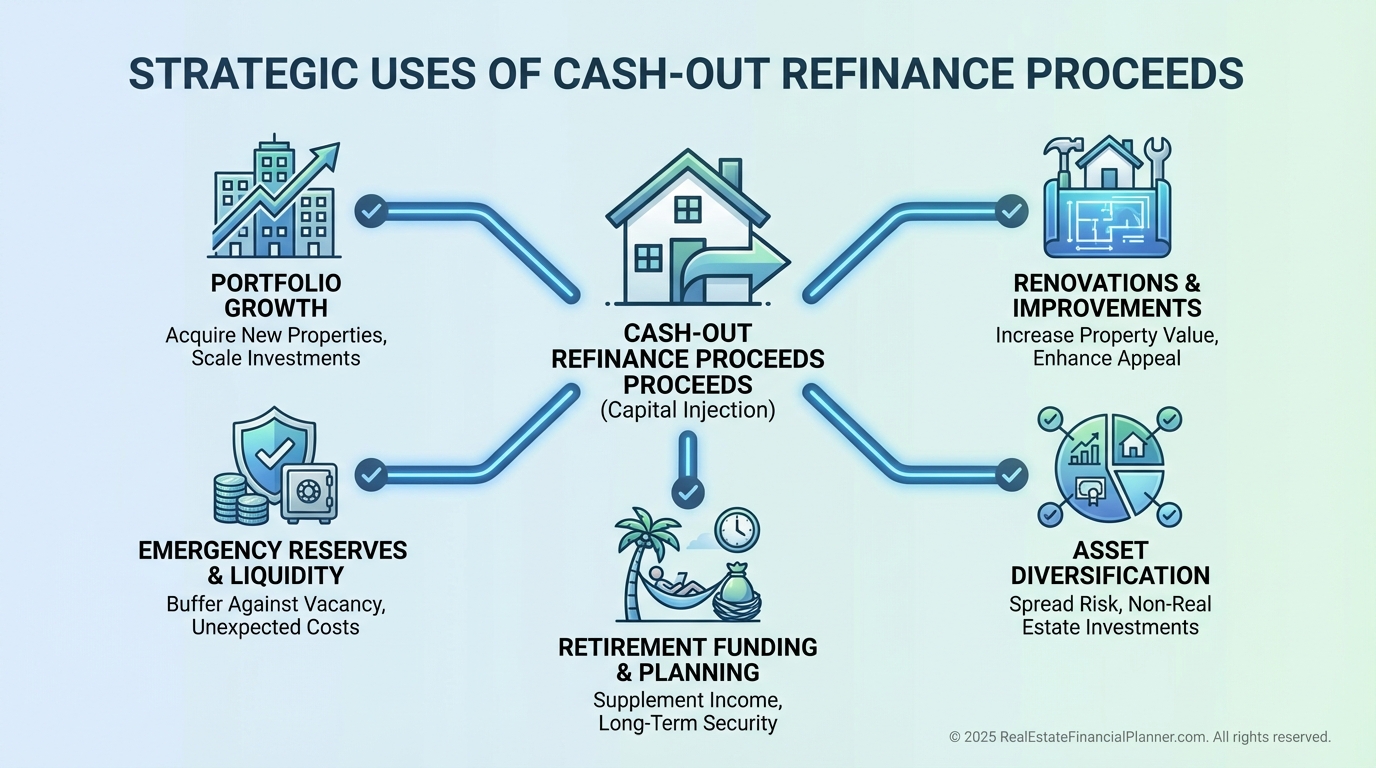

Strategic Uses That Actually Make Sense

Cash-out refinances work best when tied to a clear purpose.

Funding down payments without selling.

Renovating units to force appreciation.

Building serious reserves for downturns.

Creating flexibility before retirement or estate transitions.

Strategic Uses of Cash-Out Refinance Capital

What I discourage is lifestyle inflation disguised as investing.

Your Equity Should Have a Job

Equity that sits idle feels safe, but it often delays financial independence.

Equity that’s deployed thoughtfully accelerates it.

Cash-out refinances are not about being aggressive.

They’re about being intentional.

When modeled properly using True Net Equity™ and long-term scenarios, they become one of the most powerful tools investors have.

Your properties are more than rentals.

They are balance sheets waiting to be activated.