Duplexes: The Most Misunderstood Wealth-Building Property in Real Estate

Learn about Duplexes for real estate investing.

Most real estate investors misunderstand duplexes.

They think of them as “two houses stuck together” and move on.

When I help clients analyze properties, that misunderstanding shows up immediately in their numbers, their financing assumptions, and their risk tolerance.

It costs them years.

Duplexes sit in a strange middle ground that most investors never learn how to analyze properly. They are not single-family homes, and they are not commercial apartments. That is exactly why they are so powerful.

When I rebuilt my own portfolio after bankruptcy, duplexes were one of the property types I studied most carefully. They consistently offered leverage, flexibility, and risk control that other properties could not match at the same price point.

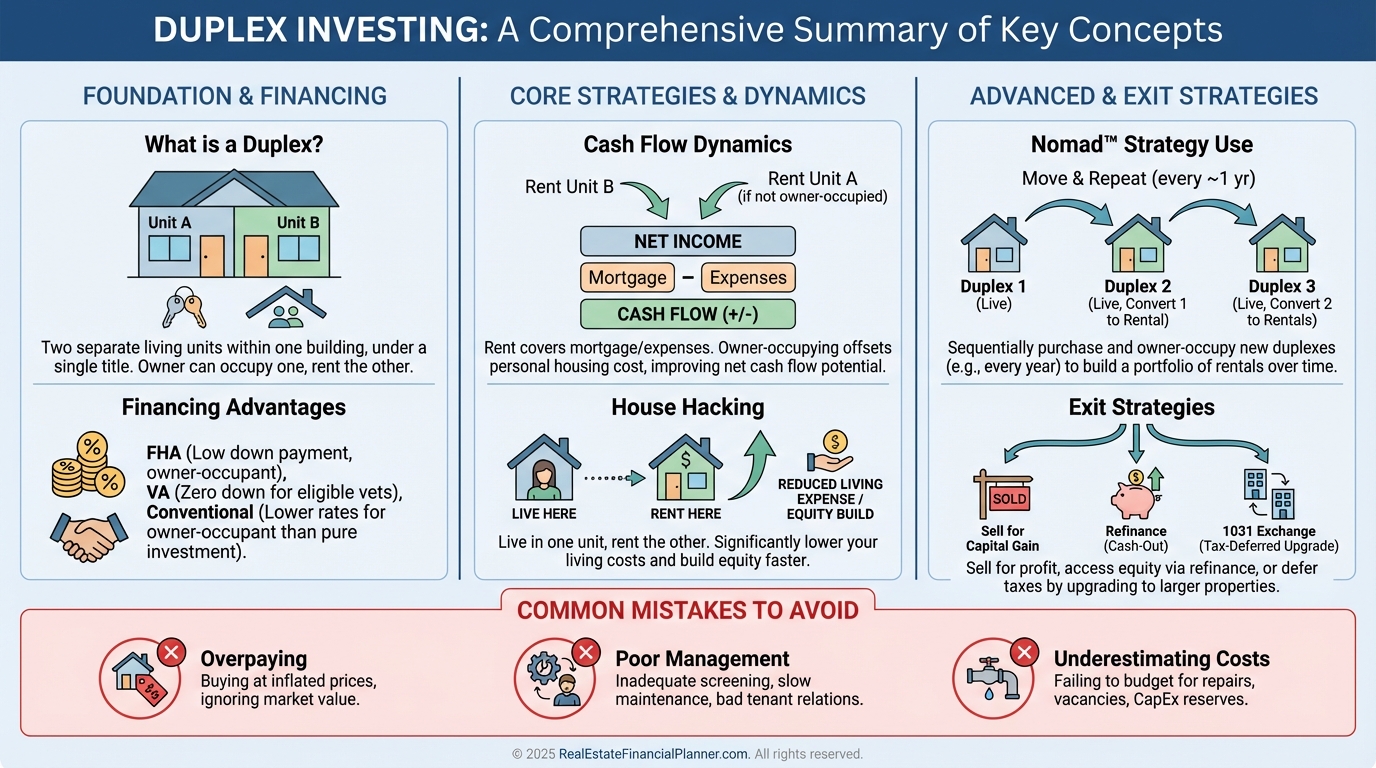

What a Duplex Actually Is

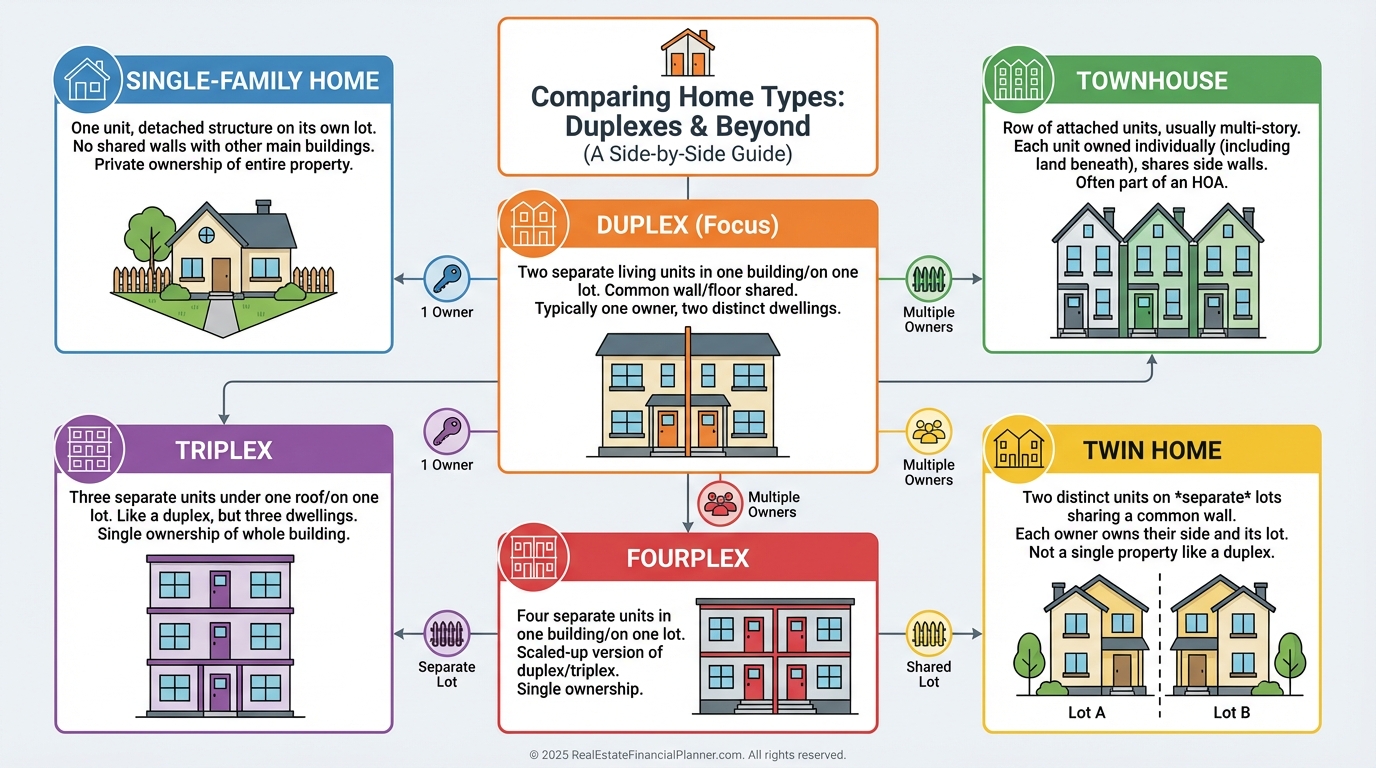

A duplex is one residential building containing two separate, legal dwelling units.

Each unit has its own entrance, kitchen, bathroom, and living space.

That legal classification matters more than most investors realize. Duplexes fall under residential lending rules because they are one-to-four-unit properties. That single detail drives everything else: financing terms, down payments, qualifying rules, and exit options.

I regularly see investors confuse duplexes with twin homes or townhouses. Those mistakes show up later as financing problems or failed exit strategies.

A true duplex is one parcel, one roof, one loan, and two income streams.

That combination is rare.

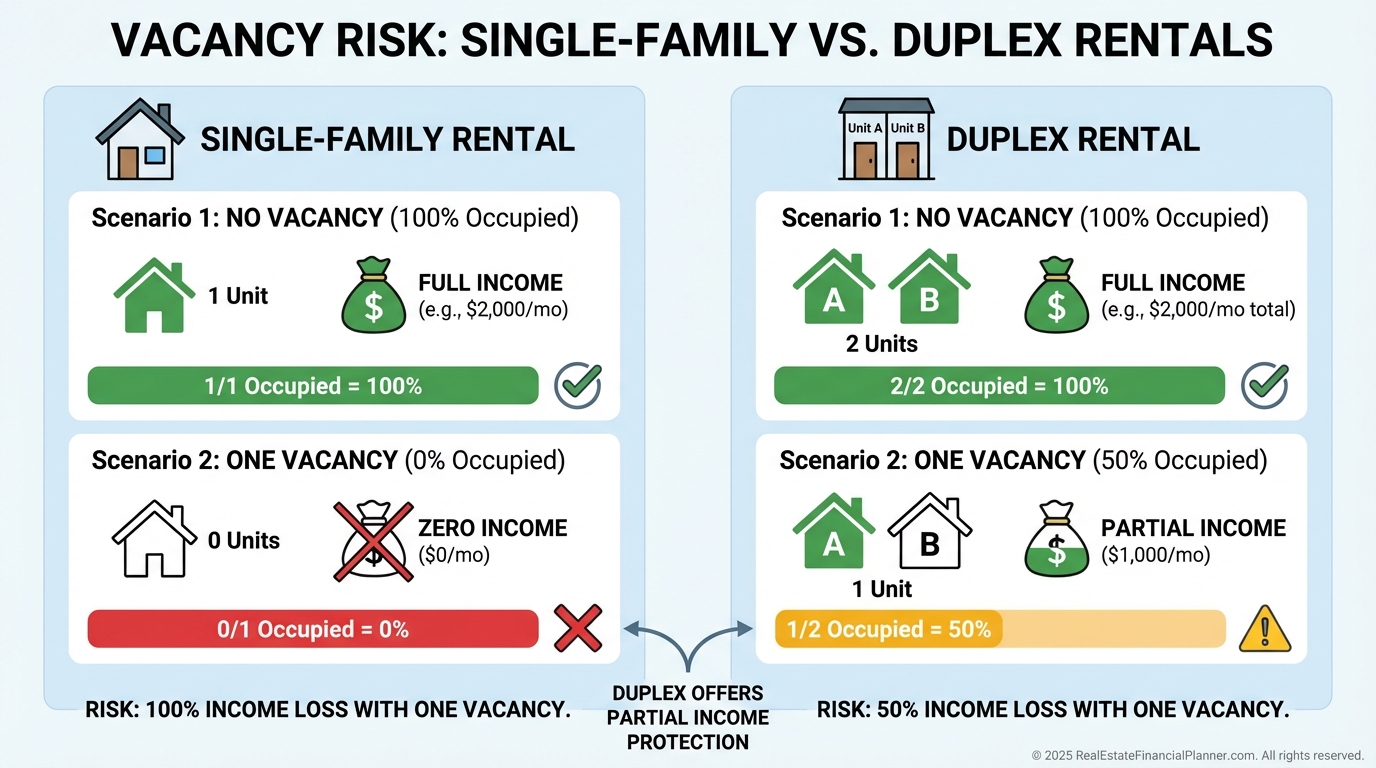

Why Duplexes Change the Risk Equation

Single-family rentals have a single point of failure.

When the tenant leaves, income drops to zero.

Duplexes reduce that risk automatically.

If one unit is vacant, you still collect roughly half of the property’s income. That built-in redundancy dramatically improves cash flow stability, especially in slower rental markets.

When I model duplexes in Real Estate Financial Planner™ software, the volatility profile looks very different than single-family rentals. Cash flow dips are smaller, recovery is faster, and long-term outcomes cluster more tightly.

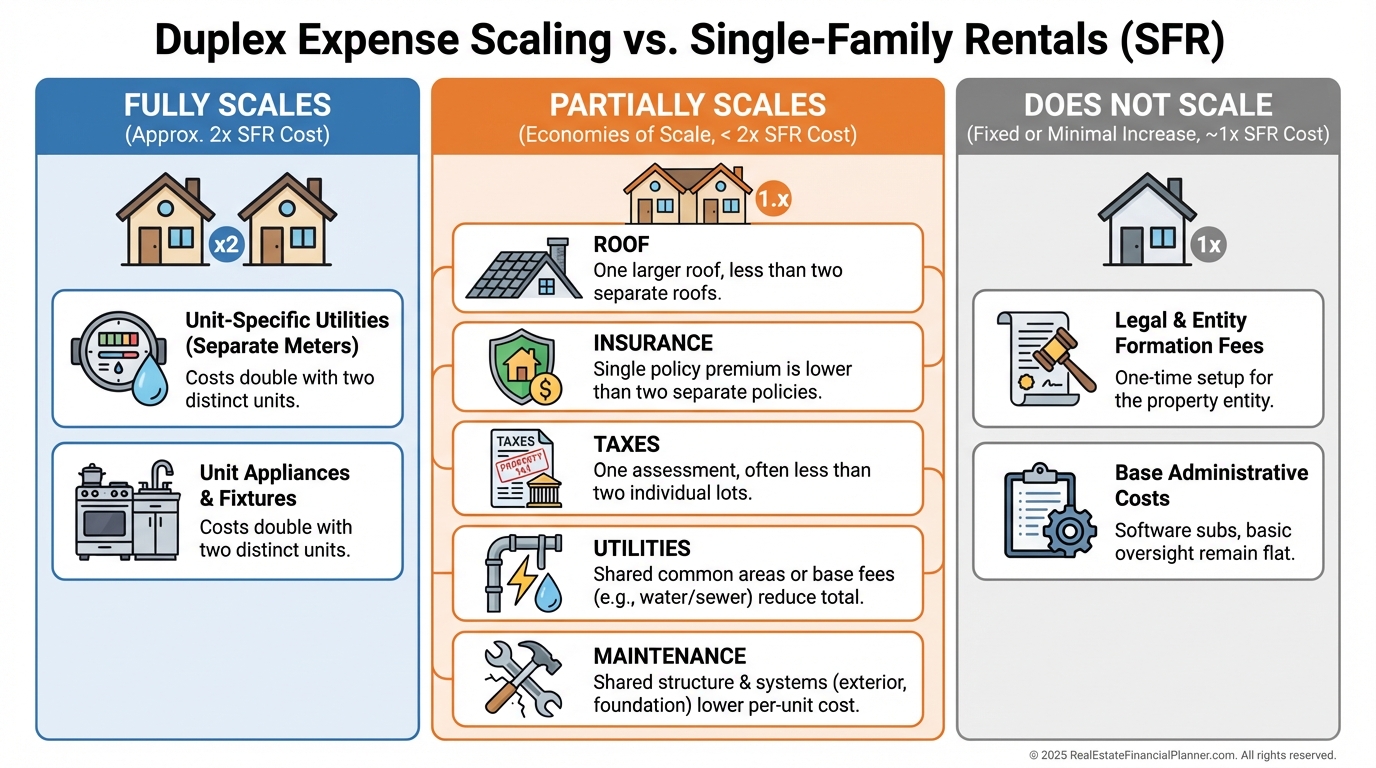

Duplex Expenses Do Not Scale Linearly

This is where many investors miscalculate.

Two units do not mean double the expenses.

You still have one roof, one foundation, one exterior, and one tax bill. Insurance and maintenance usually increase modestly, not proportionally.

When I review client spreadsheets, I often see duplex expenses inflated as if they were two separate houses. That error alone can turn a good deal into a rejected one.

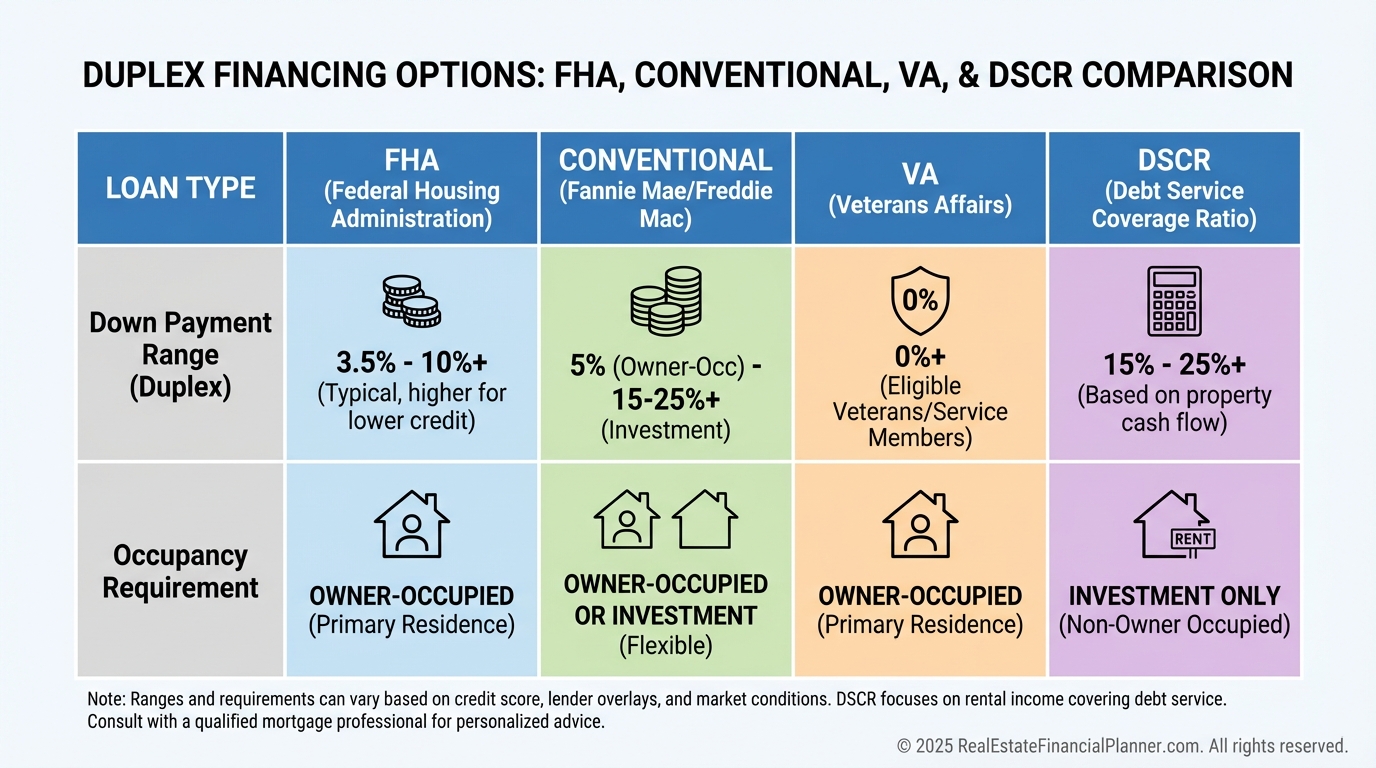

Duplex Financing Is the Hidden Advantage

This is where duplexes quietly outperform almost every other property type.

Owner-occupied duplexes qualify for the same financing as single-family homes. That means low down payments and lower interest rates.

When I walk clients through house hacking scenarios, duplexes almost always produce the lowest effective housing cost with the least risk.

Living in one unit while renting the other often drops your housing cost below anything available in the single-family market.

That is not theory.

I have watched clients cut their housing expense by more than half simply by choosing a duplex instead of a house.

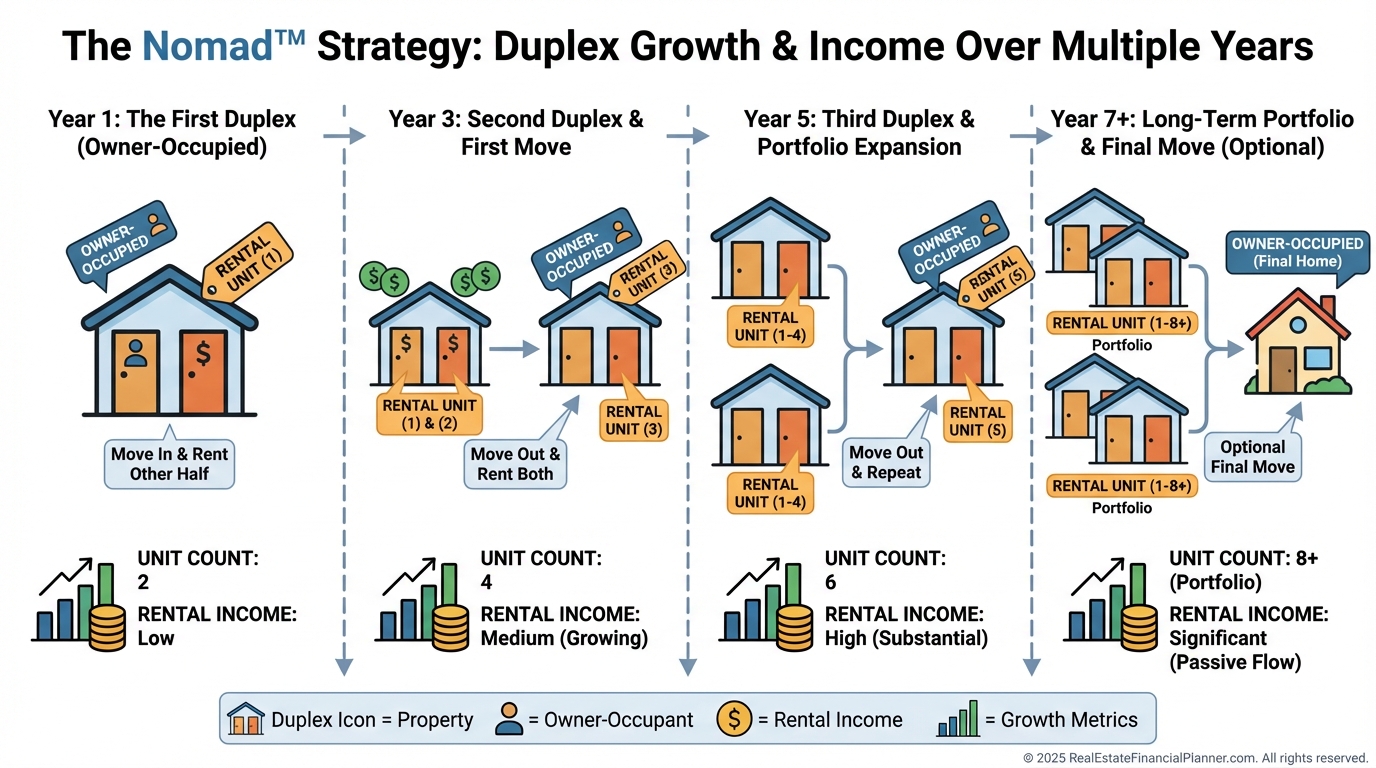

Instead of moving between single-family homes, you move between small income-producing assets. Each move adds two rent checks to your portfolio instead of one.

When I model long-term outcomes, Nomad™ duplex investors often reach the same unit count in half the time with less total cash invested.

Valuation Works in Your Favor

Duplexes live between two valuation worlds.

In owner-occupied neighborhoods, appraisers lean on comparable sales. In investor-heavy areas, income approaches matter more.

That creates opportunities for investors who understand both sides.

I have seen duplexes purchased based on conservative income valuations and later sold to owner-occupants at prices driven by comparable sales. That spread shows up as equity growth without relying on market appreciation.

Common Duplex Mistakes I See Repeated

Most duplex mistakes come from applying the wrong mental model.

Investors treat them like single-family homes or like apartment buildings. Both approaches miss the point.

The most common errors I see include mis-metered utilities, incorrect rent comps, ignoring owner-occupancy rules, and failing to plan the transition from house hack to full rental.

Each one is avoidable.

Each one is expensive.

Duplexes as Portfolio Building Blocks

Duplexes are not just starter properties.

They are structural assets that work at every stage of portfolio growth.

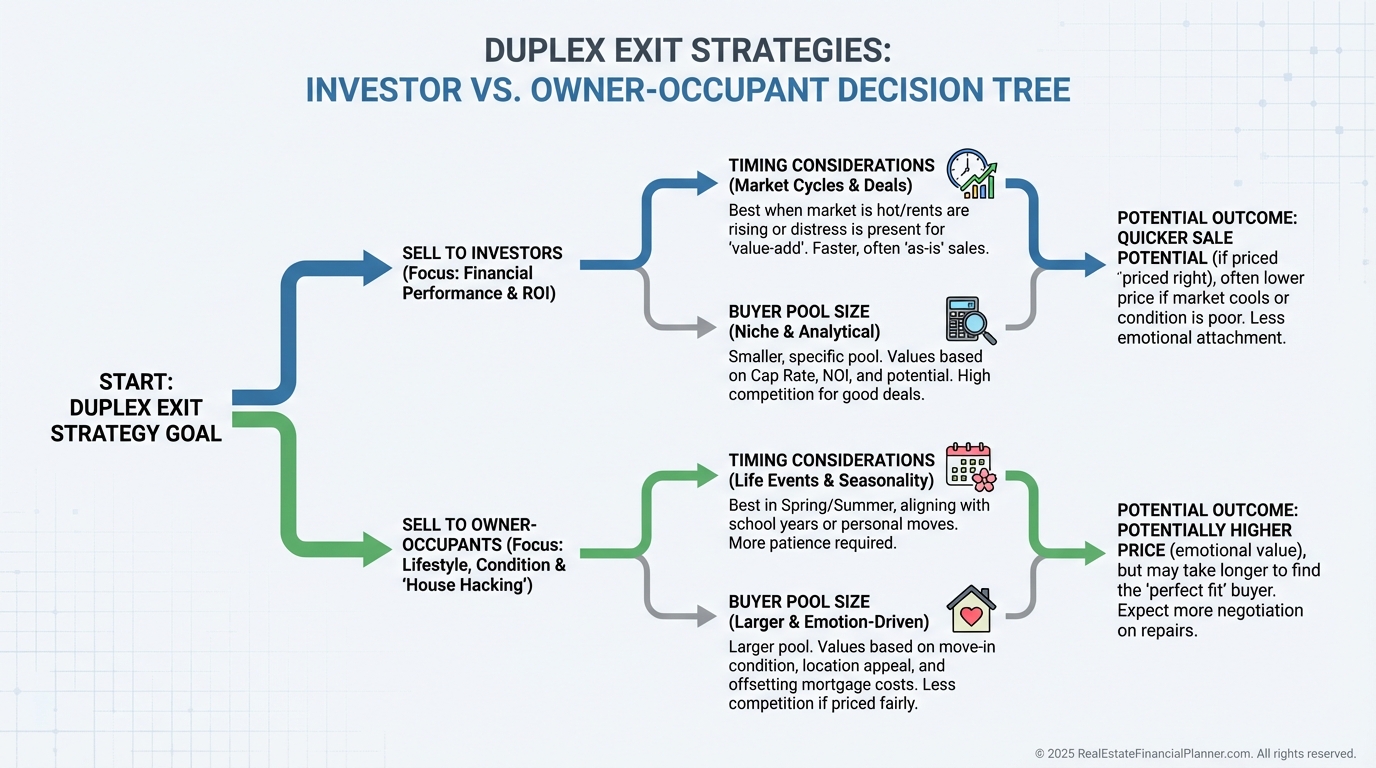

They allow phased renovations, mixed tenant strategies, geographic diversification, and flexible exit options that larger properties cannot match.

When clients tell me they want “something simple,” duplexes are often the simplest property that still behaves like a real investment business.

How I’d Approach Duplexes Today

If I were starting over again, I would not skip duplexes.

I would analyze them conservatively, assume higher maintenance, plan for management even if self-managing, and model returns using True Net Equity™ instead of simple appreciation assumptions.

Duplexes reward disciplined investors who think in systems, not shortcuts.

They are not flashy.

They are effective.

And they remain overlooked by the people you are competing against.