Loan Applications Demystified: The Investor’s Guide to Faster Approvals, Better Rates, and Bigger Portfolios

Learn about Loan Applications for real estate investing.

Why Loan Applications Are Not “Just Paperwork”

When I help clients clean up rejected files, I rarely find a bad deal—I find a bad presentation.

Investment property loan denials run far higher than owner-occupant mortgages, with many first-time investor applications denied on the first attempt.

I watched Sarah lose a cash-flowing fourplex because her package missed key investment docs. Another investor closed while she “collected one more statement.”

Your loan application is not a form. It’s a financial presentation that persuades a risk manager to fund your business plan.

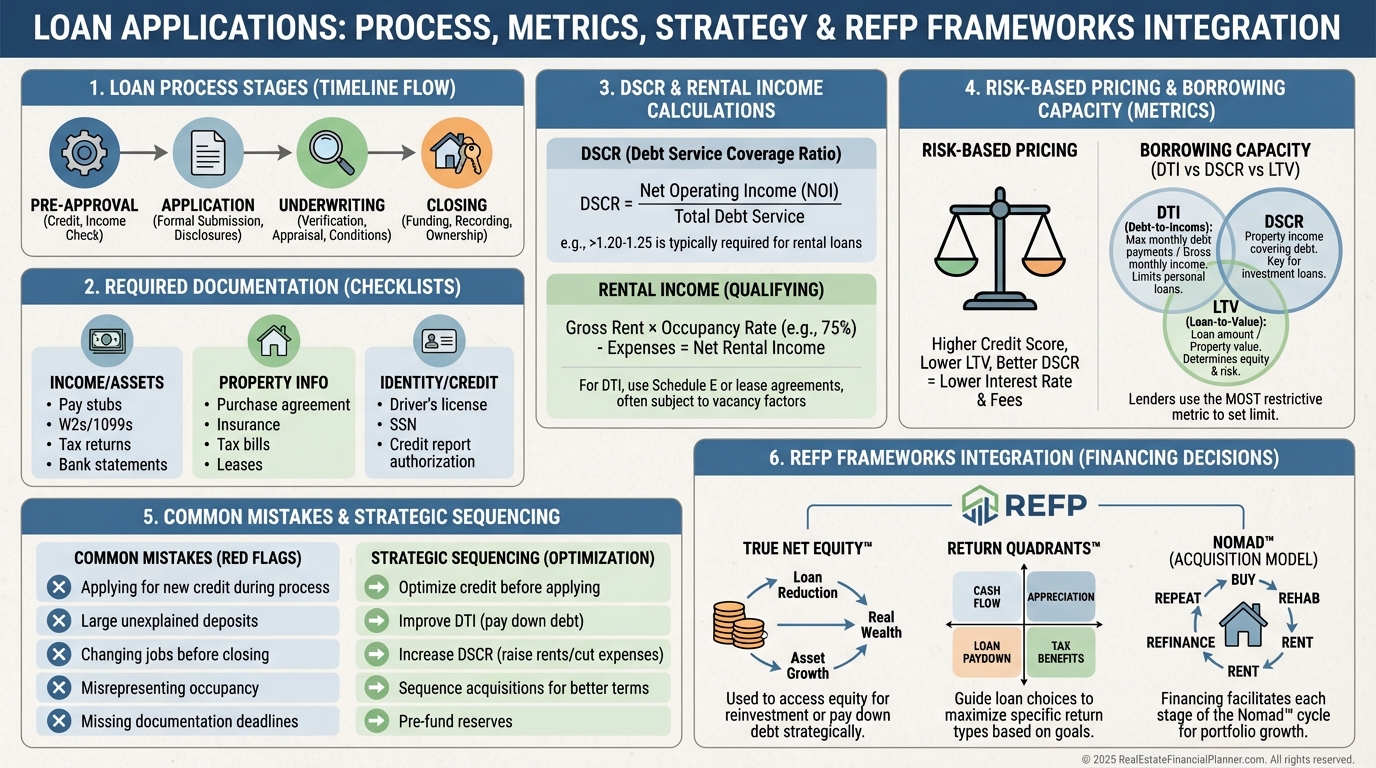

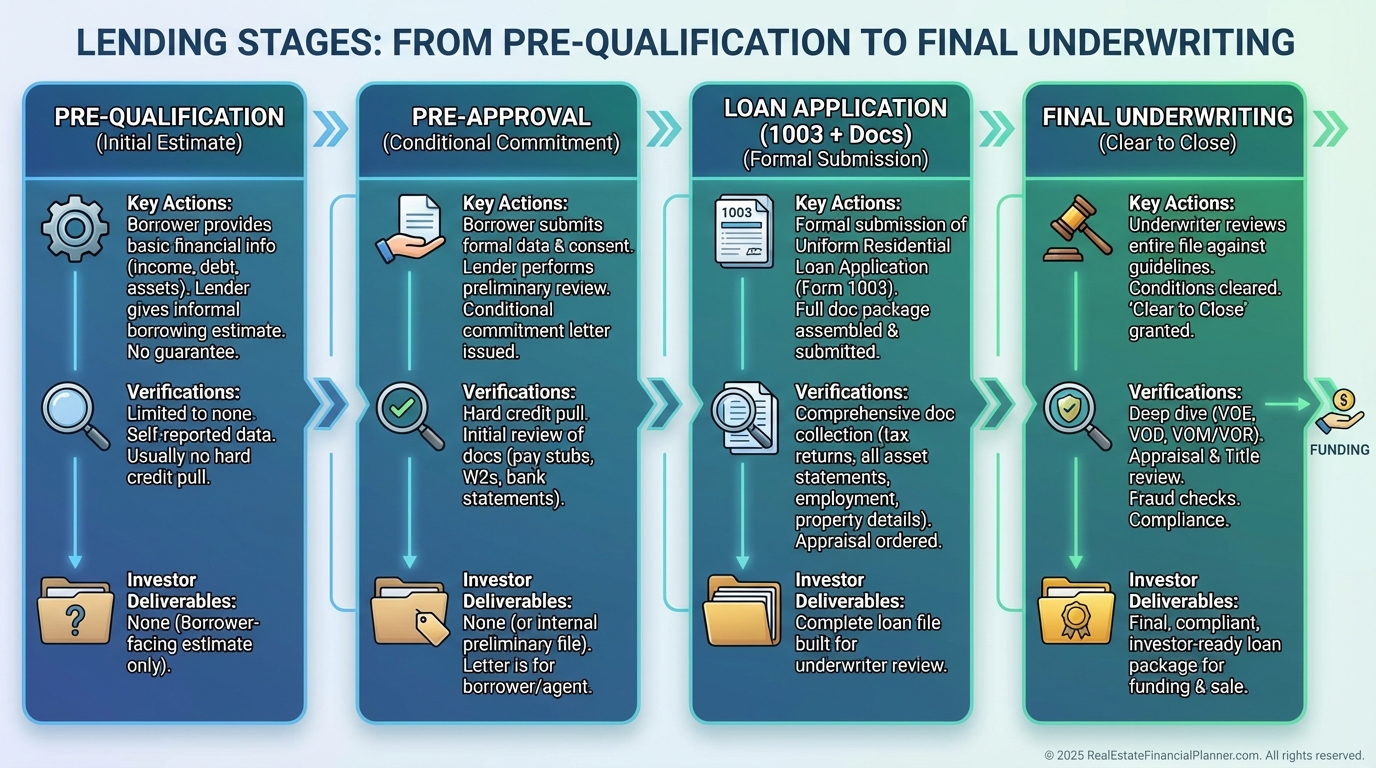

The Lending Process—And Where Deals Die

A sloppy pre-approval signals risk and sets your pricing ceiling. A meticulous application earns faster underwriting and better rates.

Here’s how I explain it to clients: each stage filters risk, and the weakest link determines your terms.

Pre-qualification is a quick look and a soft credit pull. It’s not a commitment.

Pre-approval is conditional and document-driven. It’s your first credibility test.

The formal loan application ties you to a property and triggers appraisal and full documentation.

Final underwriting is a deep audit of you and the asset. Don’t let surprises show up here.

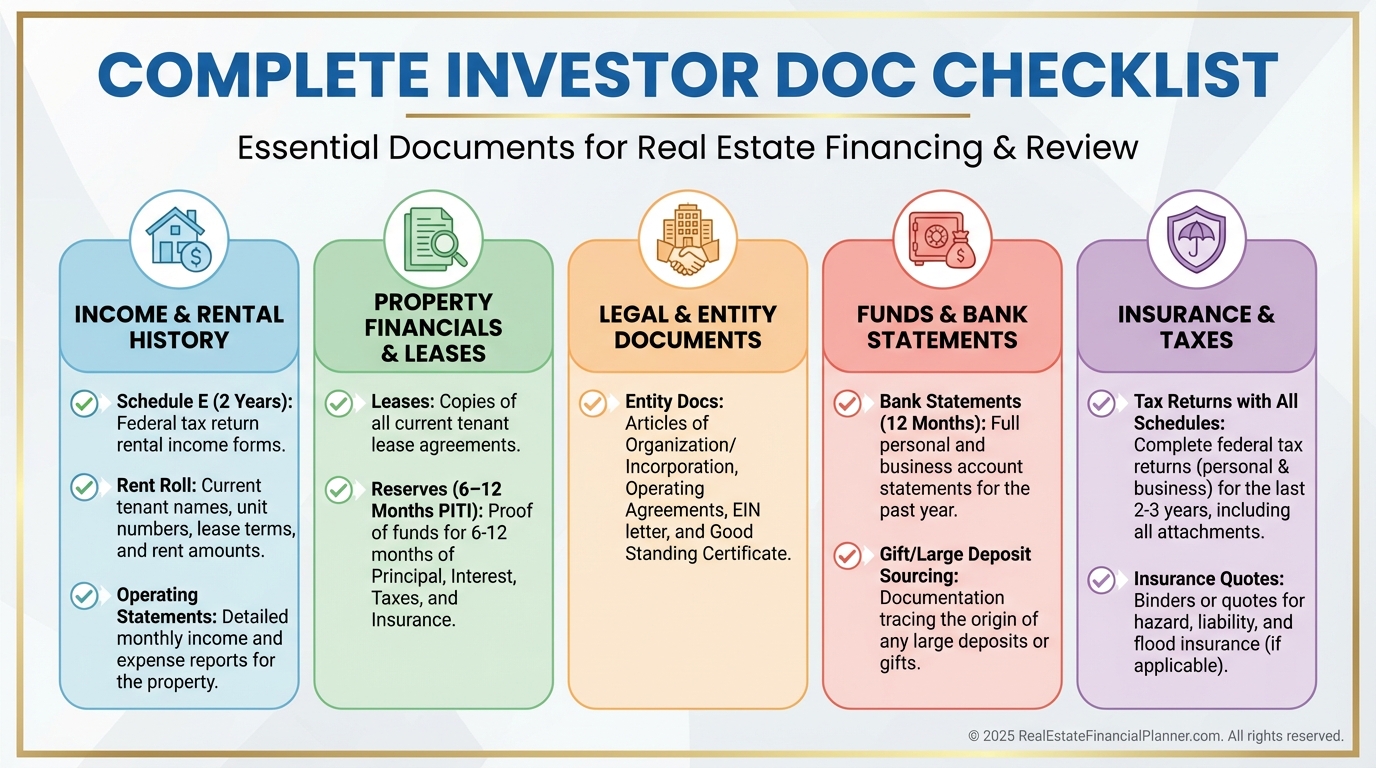

What Investors Must Provide That Homebuyers Don’t

Underwriters need to see you can run a rental like a business and still service debt if things go sideways.

Two years of full tax returns with Schedule E if you have rentals. Don’t omit a loss year—explain it.

A current rent roll and trailing 12–24 month operating statements if the property is stabilized.

Proof of liquid reserves beyond your down payment. Six to twelve months of PITI per property is typical.

If you buy in an LLC, bring entity docs, but expect to personally guarantee most residential loans.

Pre-Application Prep: Where Rates Are Won or Lost

I ask clients to start 90 days before they need a loan. That window is where we fix pricing levers.

Pull all three credit reports. Dispute errors and get revolving utilization under 30%—ideally under 10%.

Document income thoroughly. W-2s, 1099s, two years of returns, and year-to-date P&L if self-employed.

Source every large deposit. If it’s over 50% of monthly income, assume you’ll need a paper trail.

When I rebuilt after bankruptcy, this 90-day discipline is what got me back into bankable shape.

The 1003—And The Parts That Trigger Conditions

The Uniform Residential Loan Application is the skeleton. Your supporting docs are the muscle.

Be precise with employment history, liabilities not on credit, and all properties you own.

Complete the declarations honestly. If you had a BK or foreclosure, write a tight, factual letter of explanation.

Lenders don’t penalize well-documented history. They penalize surprises.

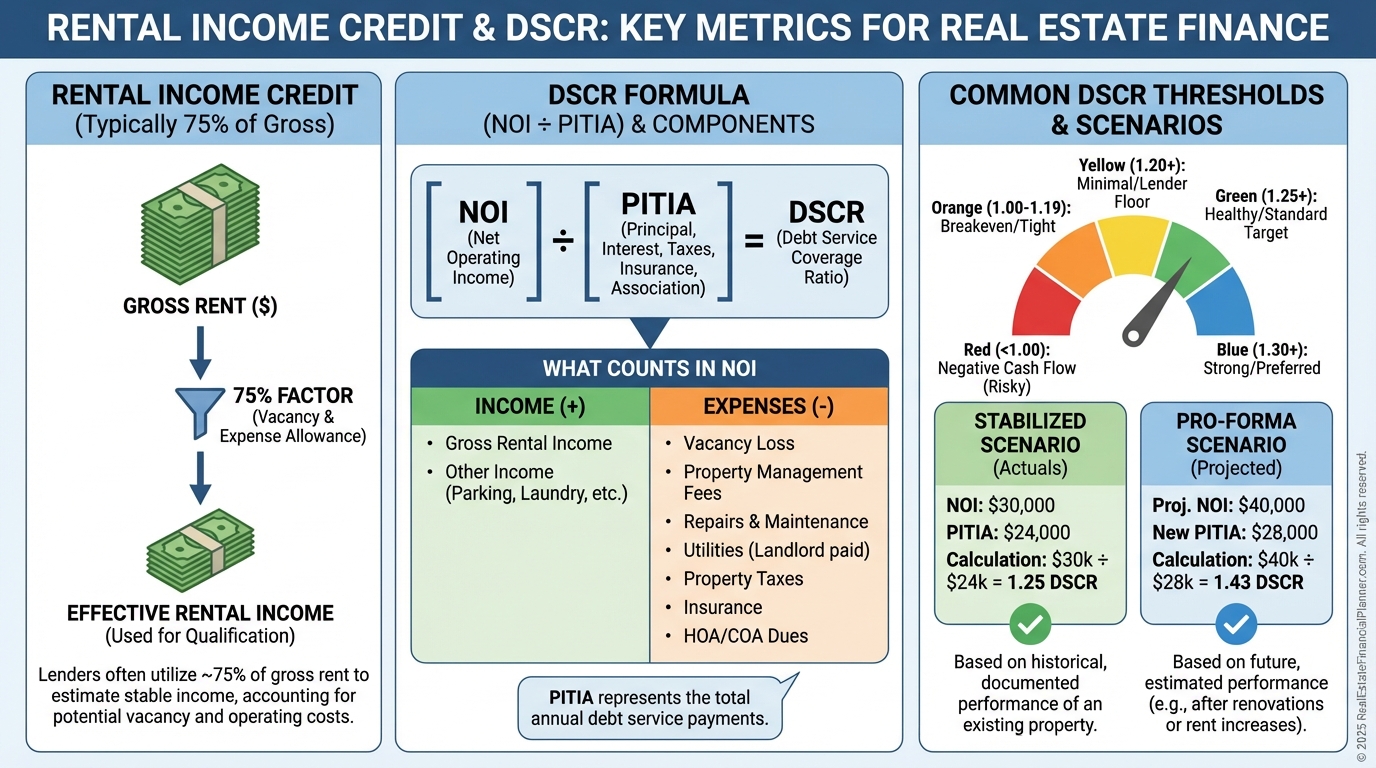

Investment-Specific Math You Must Win

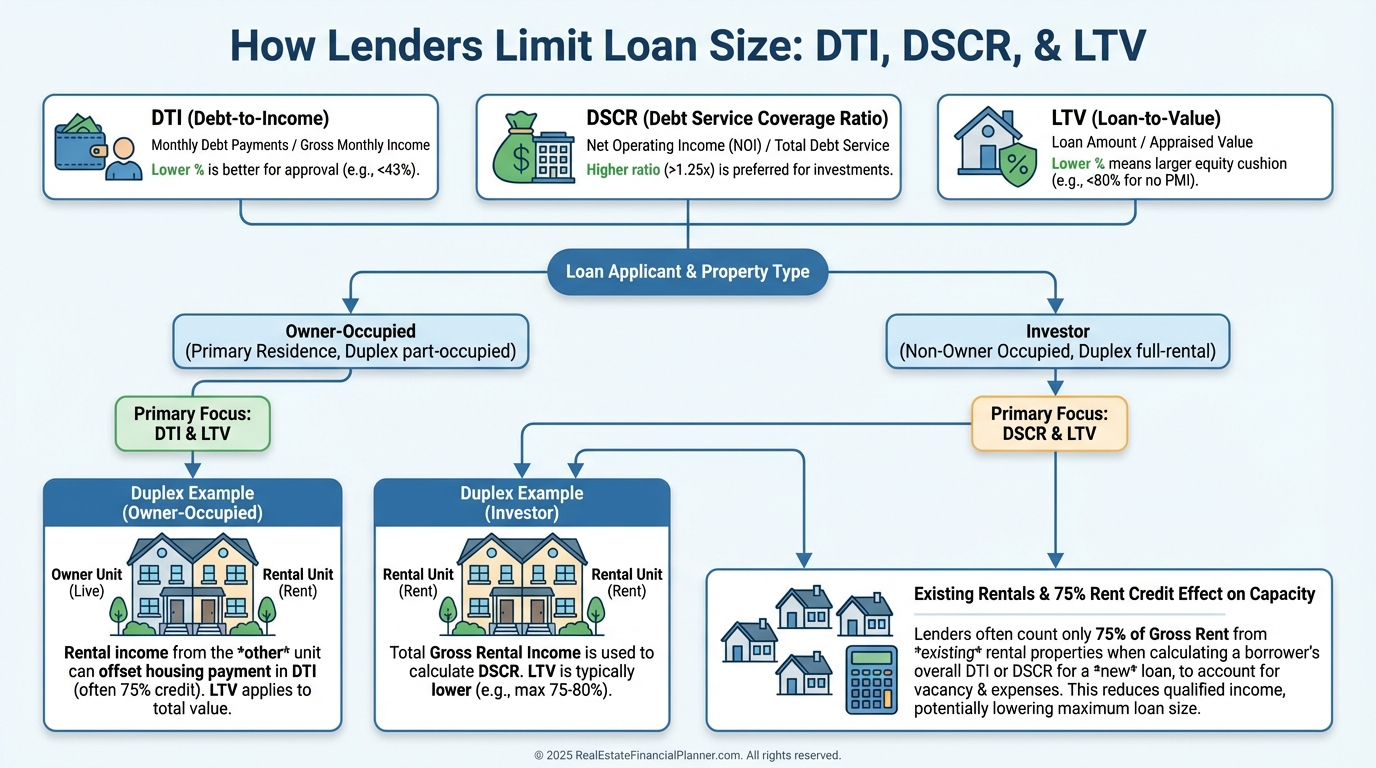

Investment loans pivot on two calculations: how much income the lender will give you credit for, and whether the property services its debt.

Most lenders haircut rent to 75% for vacancy and management. Underwrite to that number before they do.

Debt Service Coverage Ratio (DSCR) is NOI divided by total monthly debt payments. Aim for 1.20 or higher.

First-time landlords may face tighter DSCR or higher rates. Education and management plans help.

For new purchases, lenders use the lower of your projection or the appraiser’s rent survey. Plan for that.

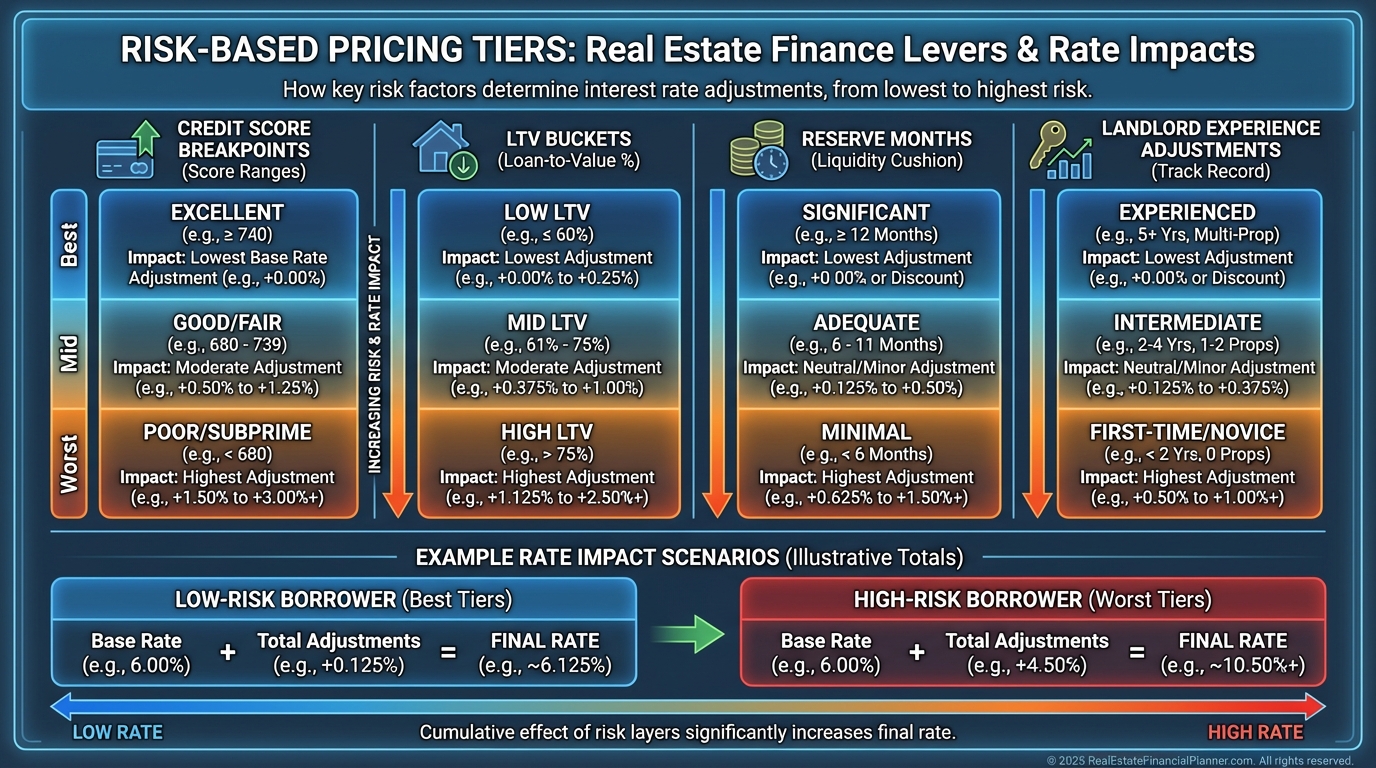

How Application Quality Changes Your Rate

I watched Marcus submit a rushed file and get a 7.75% quote. We rebuilt his package and got 7.00% on the same duplex.

That 0.75% cut saved him $167 a month and about $60,000 over 30 years. Organization pays like a business decision.

Credit score tiers matter, with meaningful breaks around 700, 720, and 740+.

Lower LTV improves pricing. Extra reserves can shave an additional 0.125%–0.25%.

Documented landlord experience often earns small price improvements and smoother underwriting.

Picking The Right Program For Your Strategy

Conventional loans are cheapest, but they want clean files, solid scores, and 15%–25% down.

Portfolio lenders are more flexible, price a bit higher, and value relationships.

DSCR loans lean on property cash flow, not personal income. Expect 20%–30% down and higher rates.

Hard money focuses on collateral and exit plan. Use it for flips and bridges, not long-term holds.

When I map loan program to strategy, I tie it to the Return Quadrants™. Your financing choice shifts cash flow, appreciation, debt paydown, and tax benefits.

How Much Can You Borrow—Two Gates You Must Clear

Conventional lenders look at your Debt-to-Income ratio and the property’s cash flow. You need to pass both.

They count 100% of your housing payment as debt but only 75% of the rents as income. That math catches many investors by surprise.

Existing rentals help, but each one takes the 75% income haircut while the full payment hits your DTI.

This is why many investors hit a wall around property four to seven with conventional loans.

I model capacity with The World’s Greatest Real Estate Deal Analysis Spreadsheet™ and our Planner’s constraints. It prevents buying yourself into a financing corner.

Avoidable Mistakes That Kill Deals

Insufficient reserves are the fastest denial. Bring more than the down payment and closing costs.

Commingling business and personal funds delays underwriting. Keep clean, separate accounts.

Poorly timed large deposits trigger sourcing requests. Season funds 60+ days when possible.

Overstating income or claiming 100% occupancy screams novice. Underwrite to real-world vacancy.

Moving money mid-underwriting forces re-verifications. Freeze transfers after you apply.

If you have partial Schedule E history, disclose it and explain repairs or vacancies. Credibility compounds.

Strategic Sequencing To Expand Faster

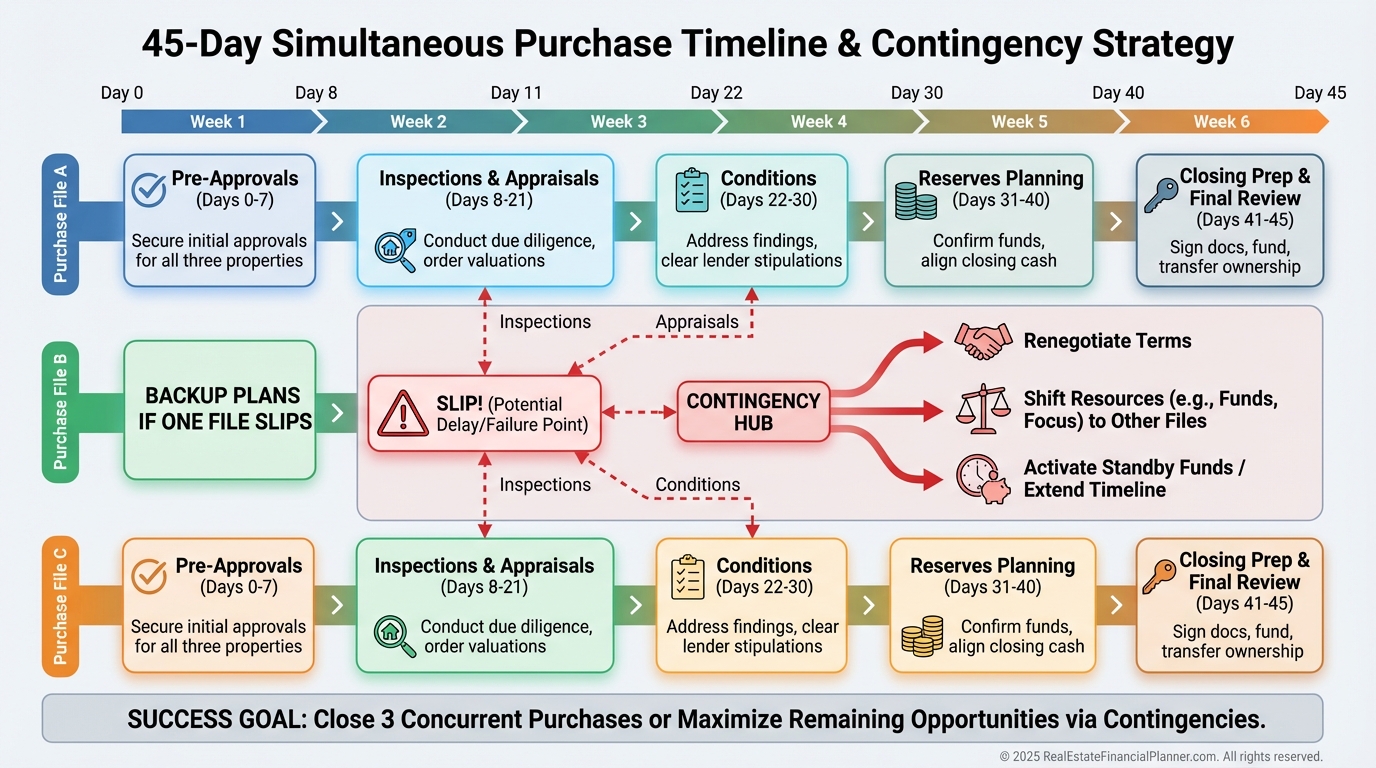

Savvy investors coordinate multiple applications to scale faster with the same capital.

I’ve helped clients open three files in the same week, close within 45 days, and 4x their control versus a single cash purchase.

This requires multiple lender relationships, synchronized inspections and appraisals, and documented reserves.

Have contingency plans if one loan is delayed, including alternate lenders and adjusted closing order.

Positioning Your File For Approval And Better Pricing

Time your application after income peaks, not valleys. Bonuses count best once deposited and sourced.

Pay down revolving balances first. Installment loans hit ratios less than credit utilization.

Consolidate scattered small accounts into fewer, stronger balances. Keep your oldest credit lines open.

Consider a co-borrower if they add income or credit strength without harmful debt.

Long-Term Planning With REFP Frameworks

I build financing plans using Return Quadrants™ to align loan choice with your hold strategy. Lower rates boost cash flow, but leverage shifts risk.

Use True Net Equity™ to decide when a refinance actually creates value after costs and tax impacts. Don’t chase lower rates if it erodes net position.

Keep “lender-ready” books year-round. That means clean P&L, rent rolls, leases, and bank statements—ready to refinance when rates and values align.

Turn Your Application Into A Persuasive Business Case

Think like an underwriter and make their job easy.

Attach a one-page deal summary with conservative pro forma, DSCR, comps, and exit strategy.

Include The World’s Greatest Real Estate Deal Analysis Spreadsheet™ outputs so your assumptions are transparent and defensible.

When I present files this way, approvals are faster, pricing is sharper, and appraisers mirror our rent and expense story more closely.

Your 30-Day Action Plan

Day 1–3: Pull credit, fix errors, and set utilization targets.

Day 4–10: Gather 24 months of returns, full statements, leases, and operating history.

Day 11–20: Price programs with three lenders and lock reserve plans.

Day 21–30: Dry-run your file with me or your broker. We pre-clear issues before underwriting sees them.

Treat loan applications as strategic financial presentations, and you’ll stop losing deals to paperwork. Treat them casually, and you’ll keep writing post-mortems about “the one that got away.”