Pro Forma Mastery: The Single Skill That Separates Pro Investors from Gamblers

Learn about Pro Forma for real estate investing.

The Cost of Misreading a Pro Forma

When I help clients review deals, the biggest leaks come from believing glossy projections.

A nurse named Sarah brought me a fourplex with a seller pro forma touting $4,000 monthly rents and day-one cash flow.

Six months after closing, actual collections averaged $2,800, two units needed big repairs, and she was negative $1,500 a month.

Her mistake wasn’t buying an investment.

It was buying a fantasy.

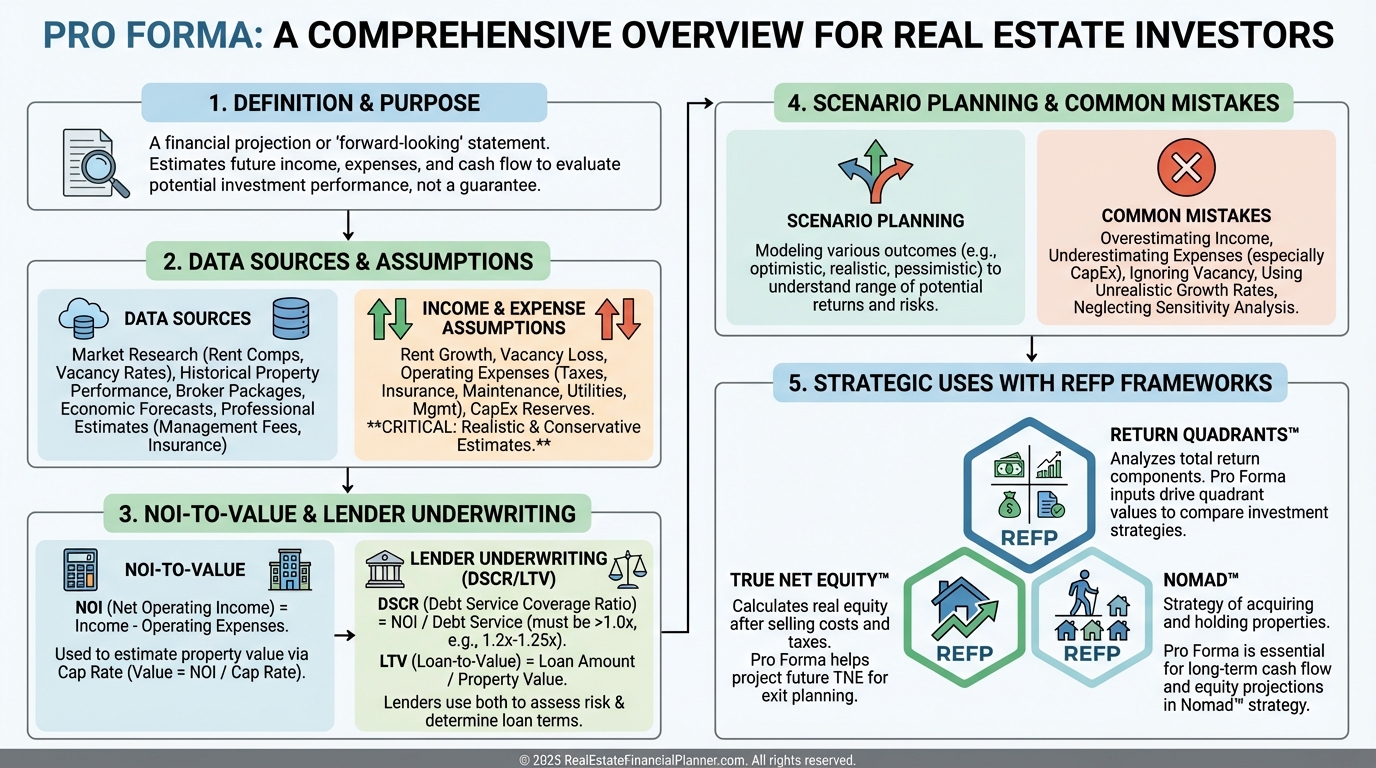

What a Pro Forma Really Is

A pro forma is a forecast built on explicit assumptions about future income and expenses.

It’s not history.

It’s a decision model that says, “If these inputs are true, here’s the likely financial outcome.”

Great pro formas are conservative, sourced, and testable against reality.

Bad pro formas are hopeful, unsourced, and fragile.

It drives DSCR for loans and cash-on-cash for returns, and it feeds your IRR and refinance timeline.

In my own portfolio, I model three versions before I ever write an offer.

I want to know what breaks first.

Build a Conservative, Accurate Pro Forma

Start with data, not desire.

Then translate reality into assumptions you can defend.

•

Income you can actually collect.

•

Expenses you will definitely pay.

•

Reserves for what will eventually fail.

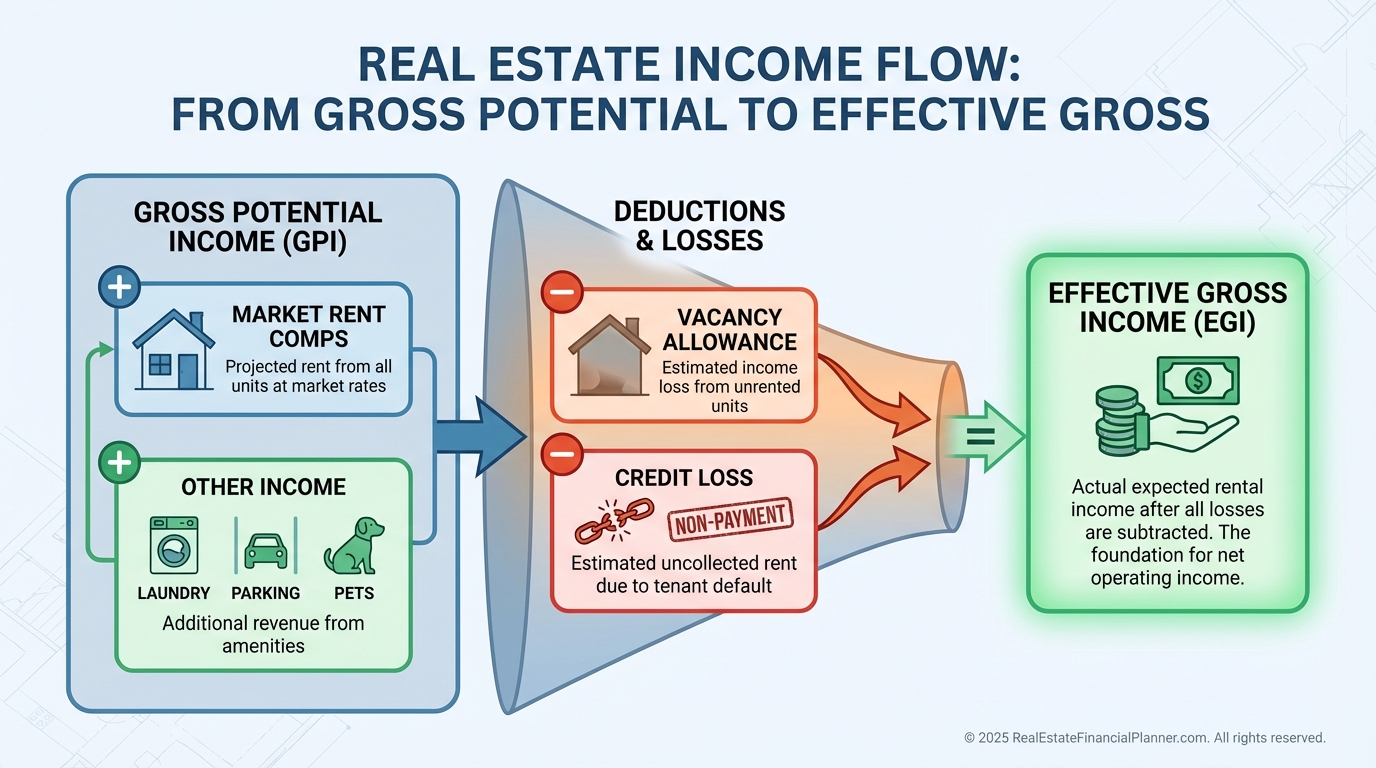

Income assumptions that hold up:

•

Market Rent: Use Rentometer, Zillow, Apartments.com, and real comps you or your agent pulled.

•

Other Income: Laundry, parking, pet, storage—only if they exist or you budget the cost to add them.

•

Vacancy: I underwrite 5–10% in healthy markets and 10–15% when supply is rising or product is dated.

•

Credit Loss: I carry 2–3% for non-payment even with tight screening.

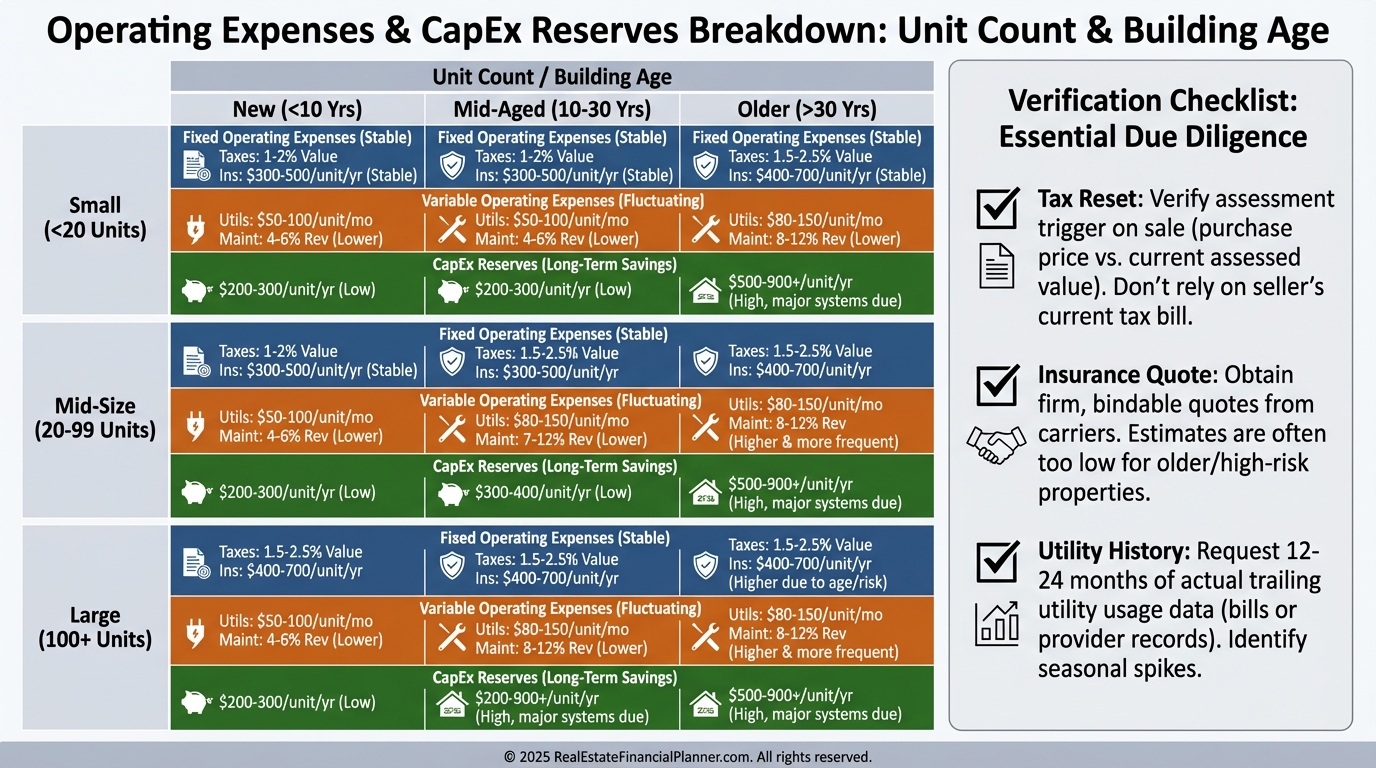

Expenses that kill weak deals:

•

Fixed: Taxes, insurance, HOA—verify with the assessor and real quotes, and reset taxes based on your purchase price.

•

Variable: Utilities you pay, management (8–10% for small multi), landscaping, snow, turns, leasing fees.

•

Repairs and CapEx: I budget monthly repairs plus a dedicated reserve.

•

Professional/Other: Legal, accounting, advertising, licenses, and admin.

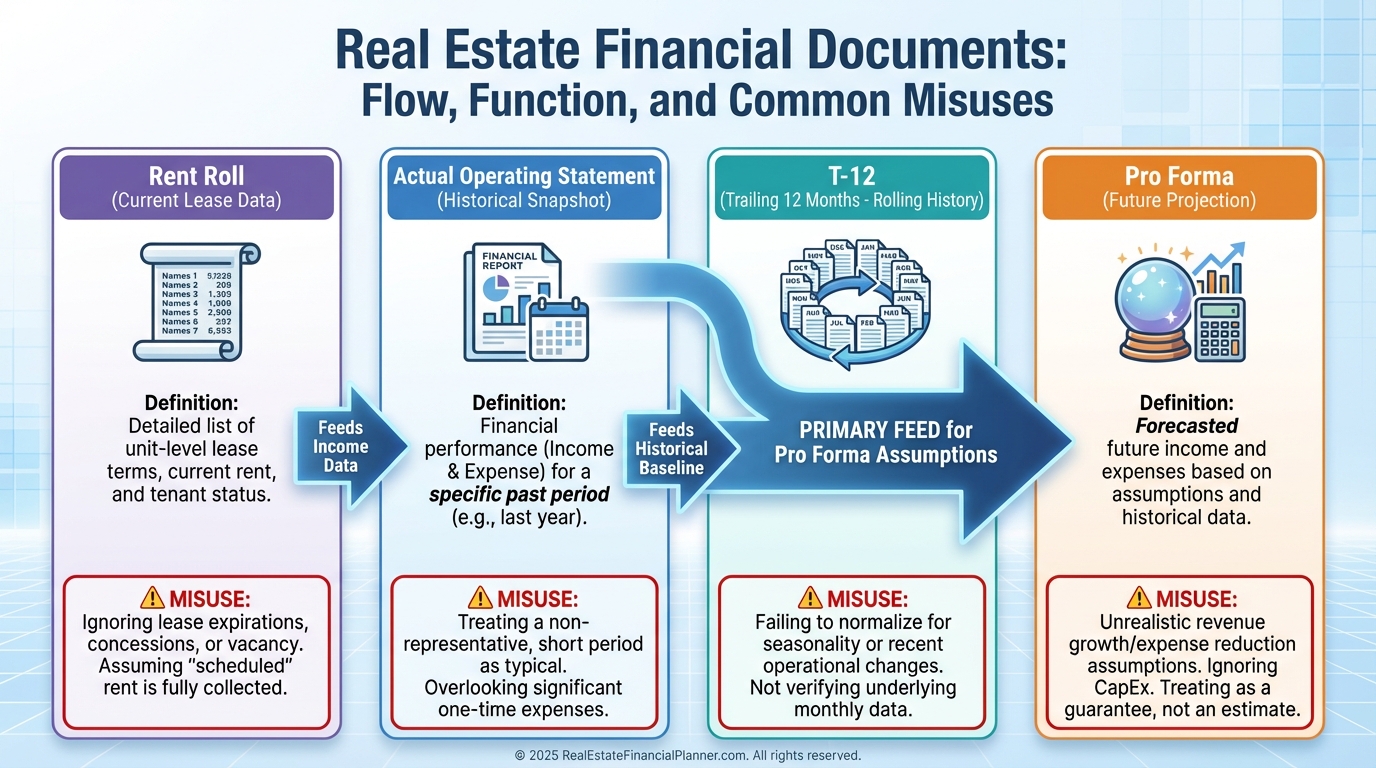

Data sources I always demand:

•

24 months of utilities to capture seasonality.

•

County tax records plus pending assessments.

•

Three insurance quotes for rental coverage.

•

Written management fee schedule, including markups and leasing fees.

Worked Example: Turning Hype Into Numbers

Mike is evaluating a triplex at $375,000.

Here’s the conservative pro forma we built.

Monthly Income:

•

Unit A 2/1: $1,300

•

Unit B 2/1: $1,300

•

Unit C 1/1: $950

•

Laundry: $75

•

Gross Potential Income: $3,625

Adjustments:

•

Vacancy 7%: -$254

•

Credit Loss 2%: -$73

•

Effective Gross Income: $3,298

•

Taxes: $469

•

Insurance: $285

•

Water/Sewer/Trash: $180

•

Landscaping: $125

•

Management 8%: $264

•

Maintenance/Repairs: $200

•

Reserves: $250

•

Legal/Professional: $100

•

Total Operating Expenses: $1,873

NOI:

•

Monthly NOI: $1,425

•

Annual NOI: $17,100

The seller claimed $24,000 NOI.

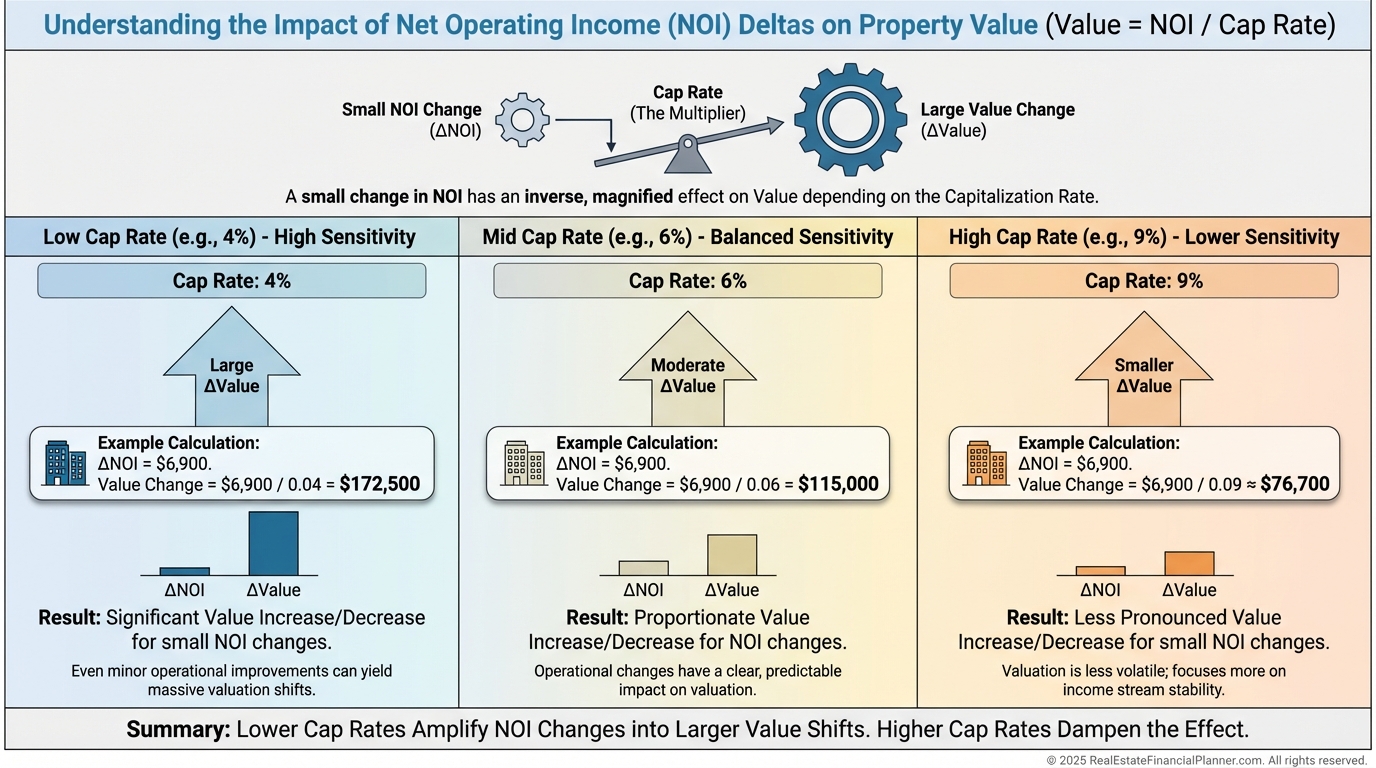

At a 6% cap, that $6,900 gap swings value by $115,000.

Why Lenders Care: Underwriting Through Your Pro Forma

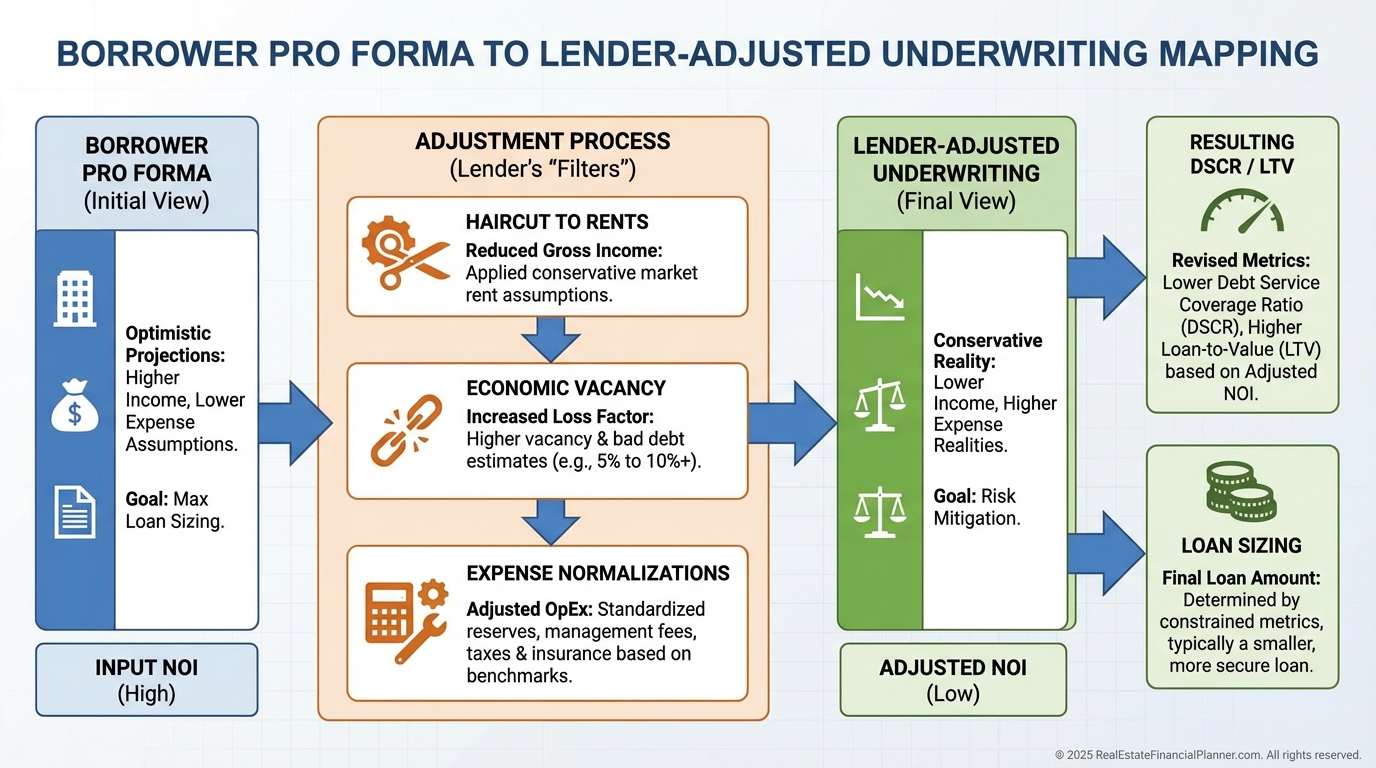

Lenders recast your pro forma with their own assumptions.

They test DSCR, LTV, and stabilized income before they decide rate and proceeds.

Most want 1.20–1.25x DSCR.

If your NOI is $20,000 and annual debt is $17,000, that 1.18 DSCR can sink approval or shrink loan size.

They’ll also value off their NOI, not the seller’s.

If their value is lower, your down payment goes up.

Returns, Strategy, and REFP Frameworks

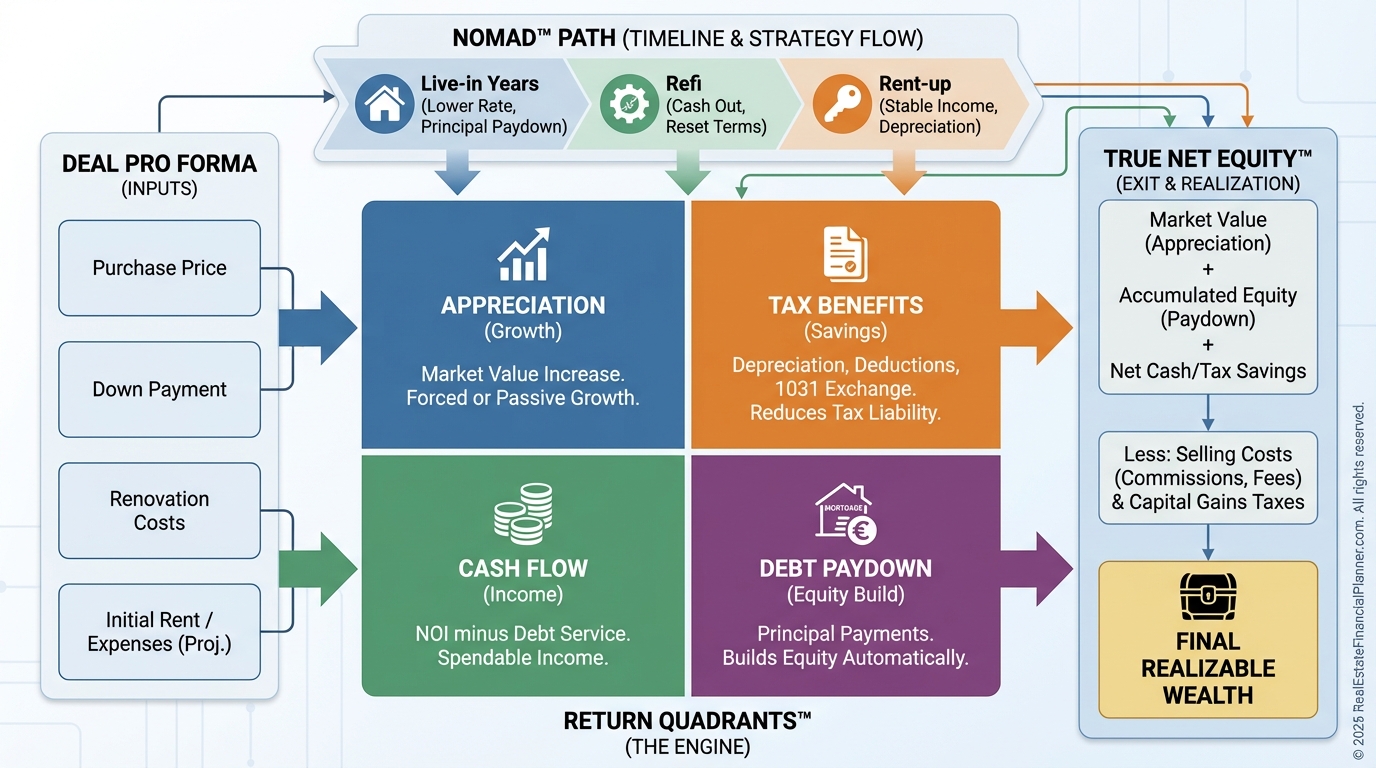

Your pro forma powers every Return Quadrants™ input—cash flow, appreciation, debt paydown, and tax benefits.

When I coach clients, we build all four, then sanity-check with True Net Equity™ after selling costs, capital gains, depreciation recapture, and loan payoff.

For Nomad™ strategies, I layer owner-occupant terms, PMI, and future rent after move-out to ensure the unit makes sense both as a home and an investment.

Pro formas are where strategy gets real.

Mistakes I See (And How to Avoid Them)

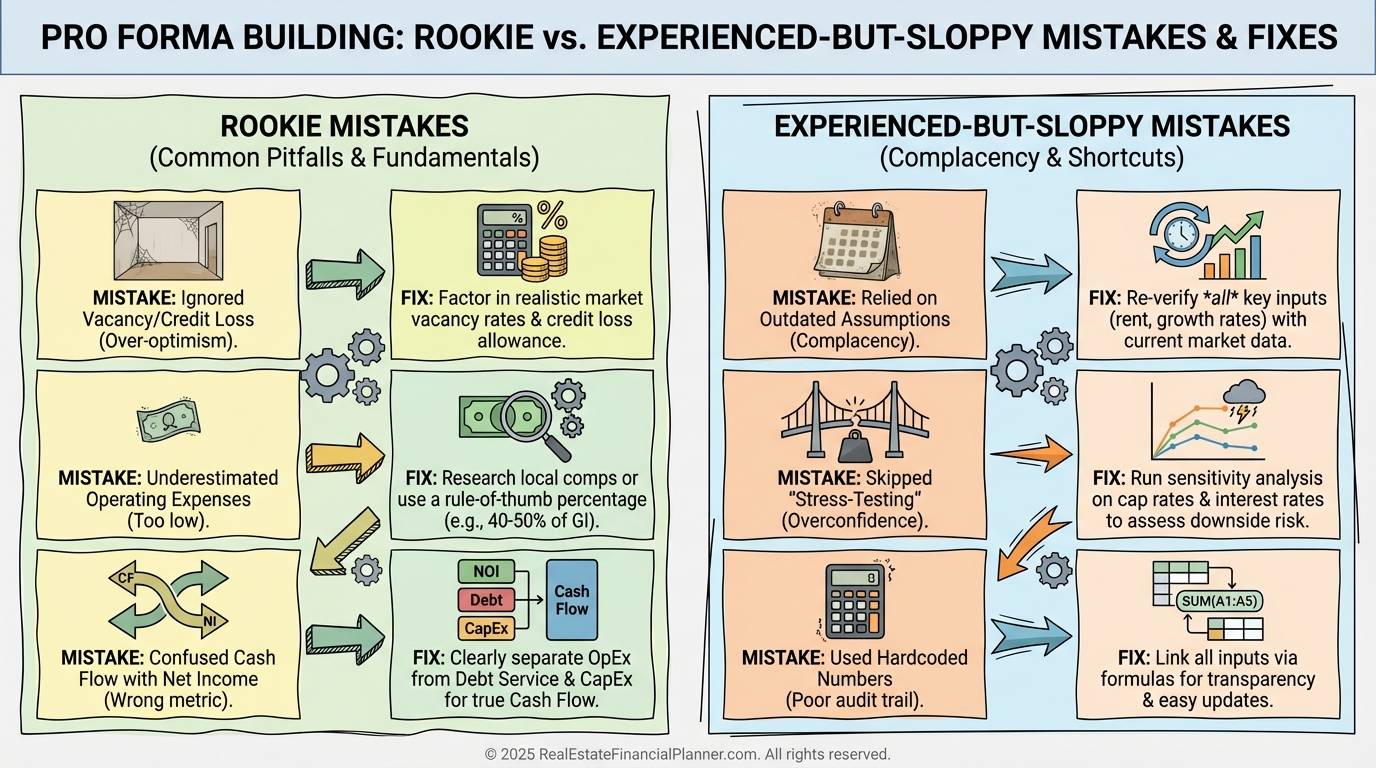

Rookie traps I correct weekly:

•

Believing the seller sheet.

•

Zeroing out reserves.

•

Ignoring management cost “because I’ll self-manage.”

•

Planning 100% occupancy forever.

•

Assuming 30% rent jumps without vacancy or turn costs.

Experienced-but-sloppy errors:

•

Using Class A cap rates on Class C assets.

•

Keeping seller’s tax bill instead of post-sale reset.

•

Flat expenses in an inflationary world.

•

Treating weakening demand like it’s temporary.

Use Pro Formas to Decide, Negotiate, and Protect Downside

I run three scenarios on every deal: conservative, base, and upside.

If it only works in the upside case, I pass or reprice.

During negotiations, I present my line-by-line pro forma with comps, taxes reset, and utility history.

Sellers respect data.

For risk management, I stress test 20% vacancy, 25% tax hikes, and a year-one roof.

If the deal survives the storms on paper, I sleep well owning it.

When Jennifer brought me a duplex marketed at 15% cash-on-cash, our rebuilt pro forma showed 7%.

She split her capital between a better SFR and a war chest instead of going all-in.

That decision was worth six figures over five years.

Your Next Step

Build your own reality-based pro forma before you tour the property.

Then verify every assumption before you write the offer.

Download The World’s Greatest Real Estate Deal Analysis Spreadsheet™ and wire it to your process so one changed assumption updates every metric automatically.

Conservative pro formas create pleasant surprises.

Optimistic ones create expensive lessons.