Title Seasoning Mastery: The Timing Rule That Makes or Breaks Your Refi, Flip, and BRRRR

Learn about Title Seasoning for real estate investing.

The Overlooked Timing Rule That Blocks Deals

Every week I talk to investors who did everything right—except for timing their title seasoning.

Their refinance gets denied, their flip stalls, and their portfolio plan slips a quarter or more.

When I model deals, the biggest gap I see is not cap rate or rehab scope.

It’s the missing calendar that governs when lenders will actually lend.

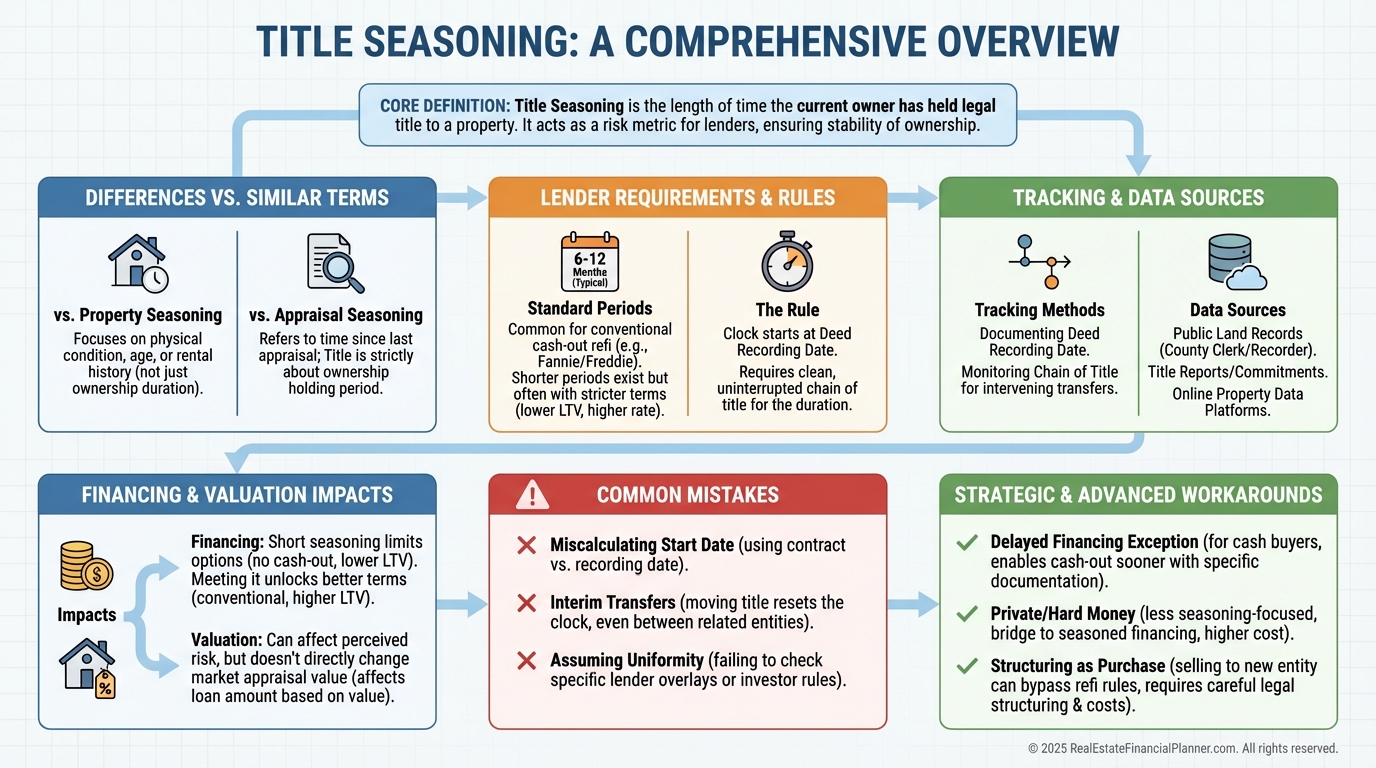

What Is Title Seasoning and Why It Matters

Title seasoning is the time a property has been owned by the current titleholder before a sale or refinance can occur without extra restrictions.

Lenders use it to verify a clean chain of title and prevent fraud and value manipulation.

It’s not just “how long you owned it.”

It’s “do we trust the ownership history enough to lend the amount you want on the timeline you want.”

After 2008, lenders tightened seasoning to reduce rapid flip fraud and inflated values.

Today, ignoring it can quietly crush BRRRR timelines, cash-out plans, and wholesale exits.

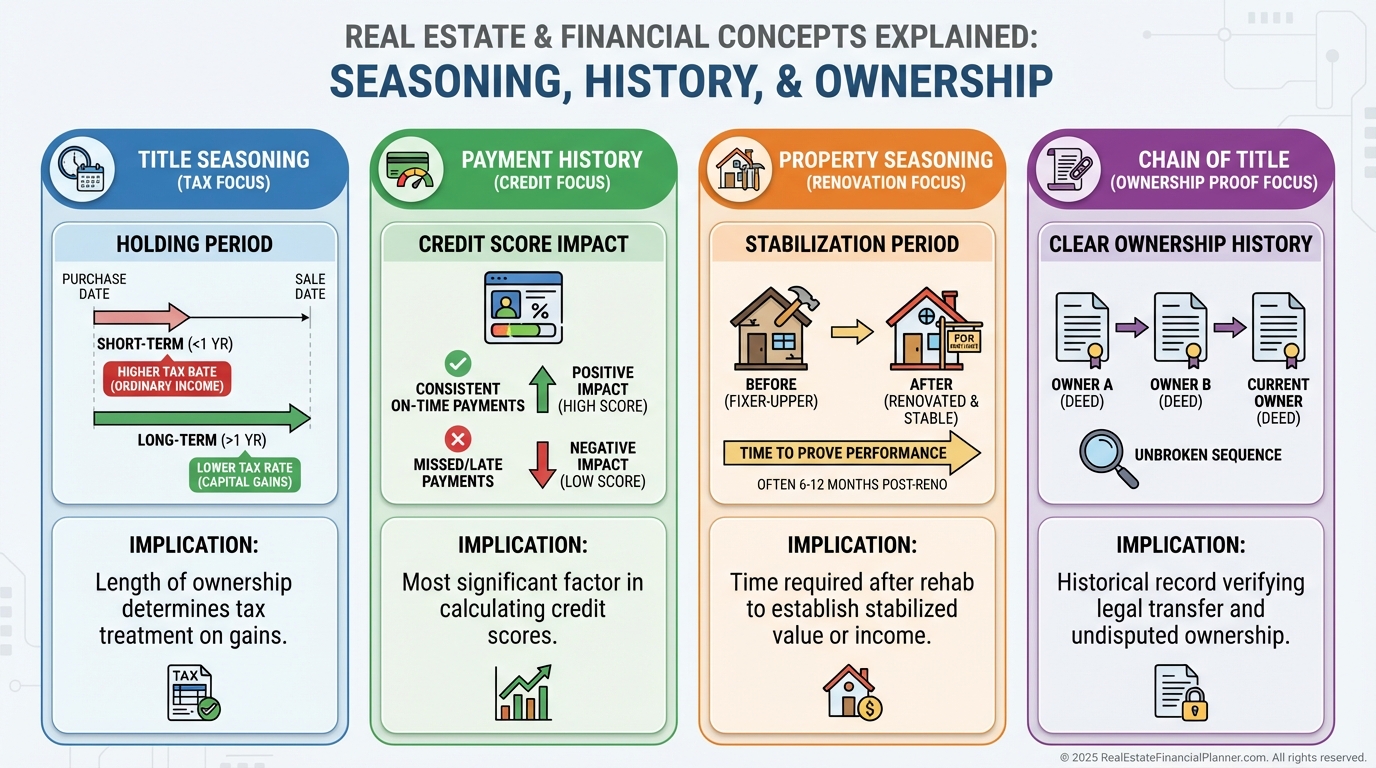

How Title Seasoning Differs From Similar Terms

Holding period is a tax concept for capital gains.

Title seasoning is a lending concept that controls refinance and resale eligibility.

Perfect payment history proves you pay on time.

It doesn’t shorten the seasoning clock if you haven’t owned the property long enough.

Property seasoning is about renovations and stabilization.

Title seasoning is strictly about who owns it and for how long.

How Title Seasoning Affects Your Deal Analysis

When I help clients analyze deals in The World’s Greatest Real Estate Deal Analysis Spreadsheet™, I add a seasoning timeline to every exit.

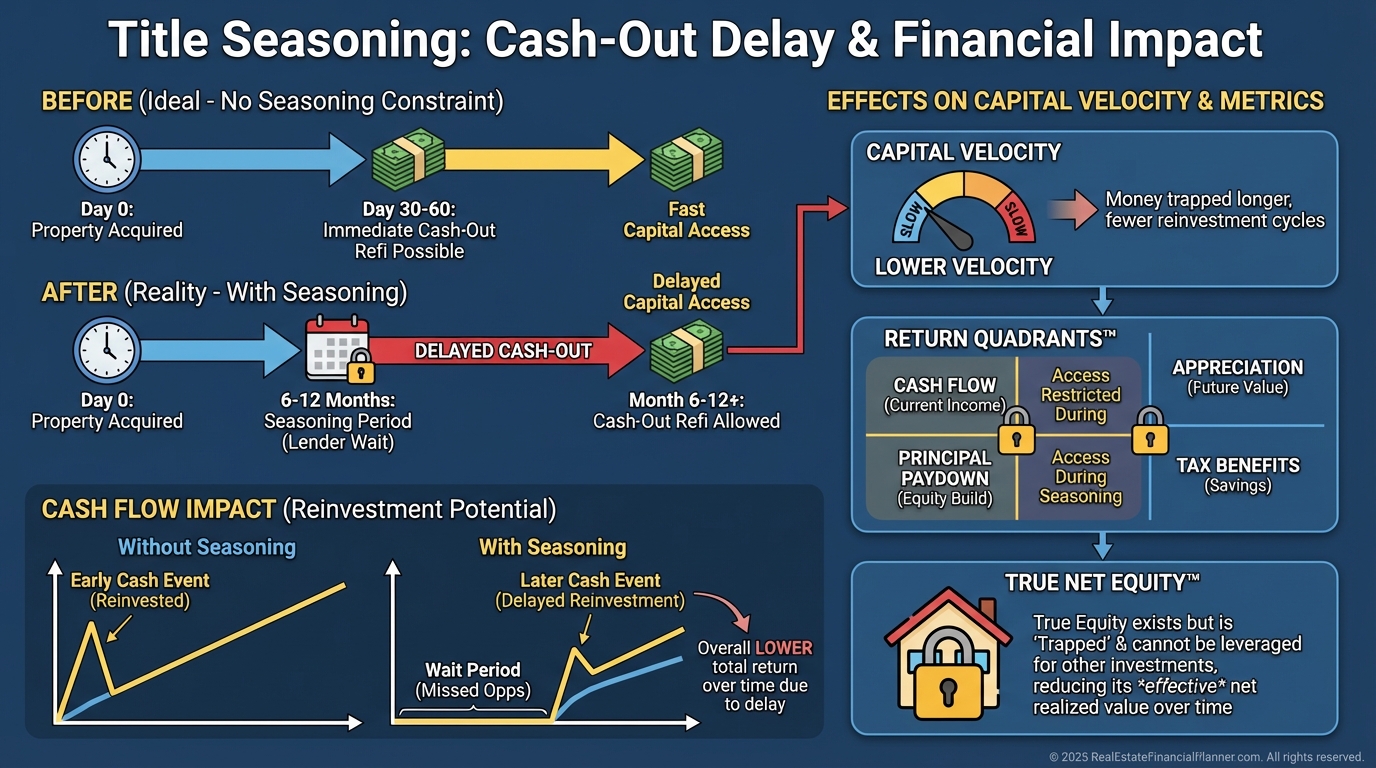

If you can’t refi when planned, your cash-on-cash and Return on Investment drop because your initial capital stays trapped.

Using our Return Quadrants™ framework, seasoning mostly hits the financing-dependent pieces of your return.

Appreciation and principal paydown keep accruing, but you can’t harvest equity or improve cash flow with better debt until the clock runs out.

True Net Equity™ also changes with seasoning.

You can have equity on paper, but its utility is delayed and its cost-of-waiting must be modeled.

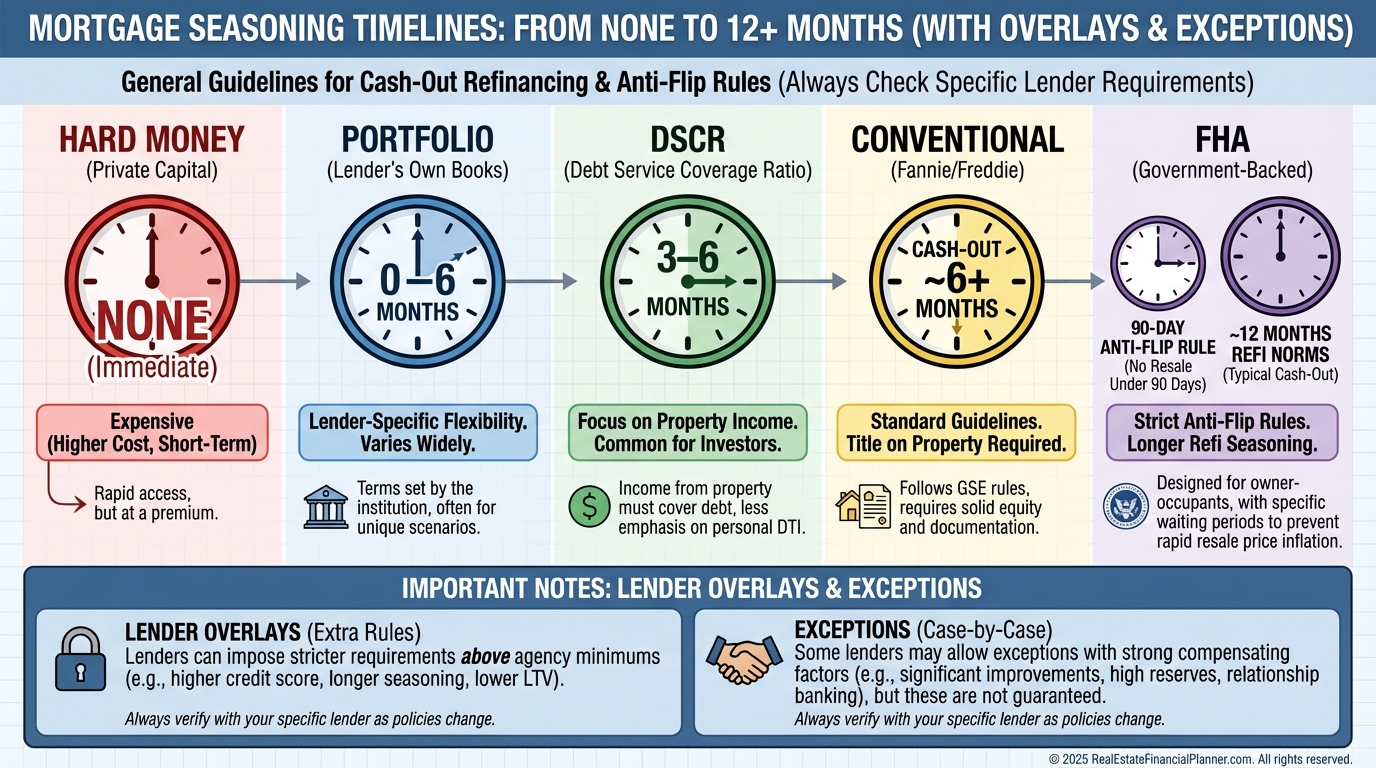

Typical Seasoning Requirements by Loan Type

Conventional loans often require six months for cash-out refinances on investment properties.

Some lenders add overlays to push it to 12 months.

Buyers using FHA create constraints on your flip exit.

DSCR loans usually want three to six months on title before cash-out.

They’re popular for rental-focused investors who don’t use traditional income documentation.

Portfolio lenders can be flexible from zero to six months.

That flexibility grows with relationship and track record.

Hard money lenders rarely require seasoning but are designed for acquisition and short bridges, not long-term holds.

They’re a tool, not a destination.

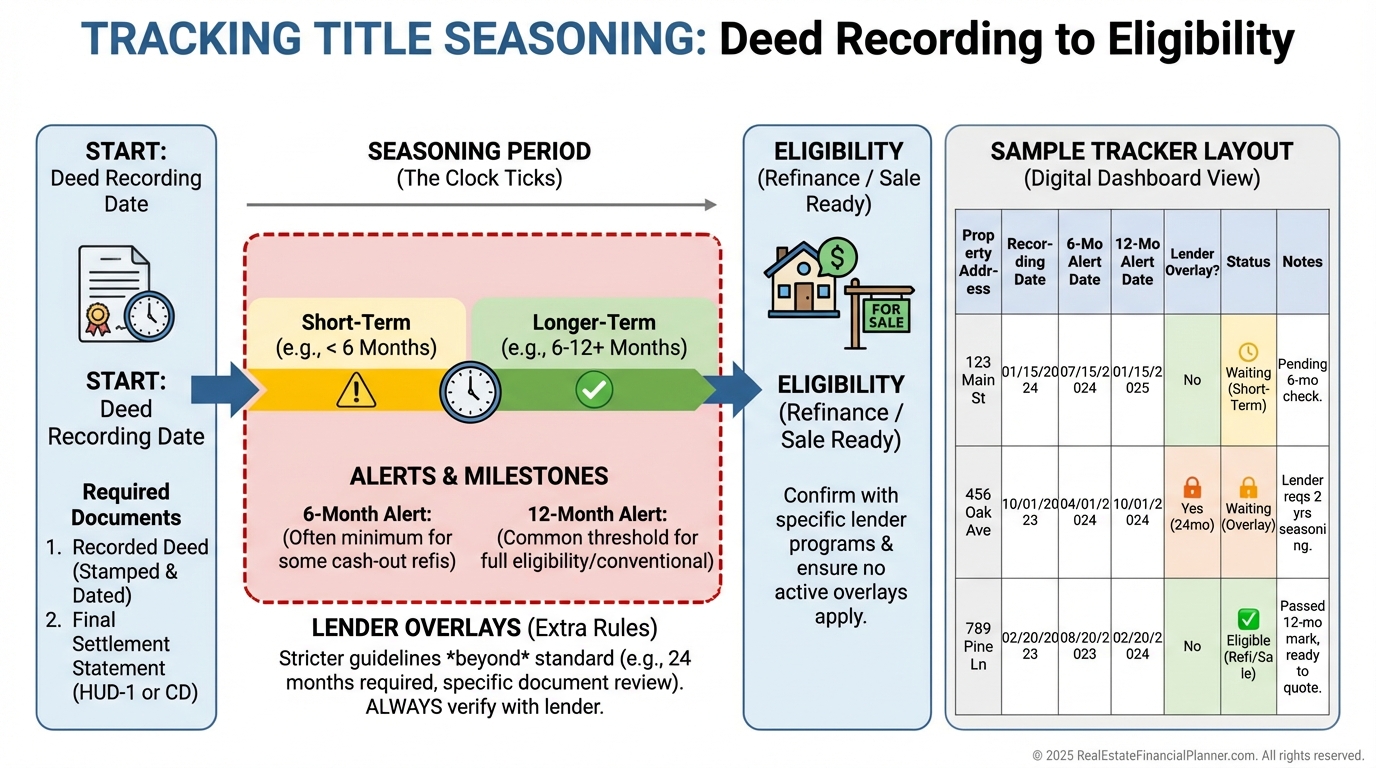

Tracking Your Seasoning Clock

The clock starts when the deed is recorded, not when you sign or even when you close.

In some counties, recording lags by days or weeks.

Always confirm the recording date using county records.

Then log it in your deal analysis and set reminders 60 days before you qualify.

If you transfer title to an LLC or via quitclaim, note that many lenders treat that as a new owner and restart the clock.

When I build trackers for clients, we add columns for deed recording date, soonest eligible refi date by lender, and any transfer events that could reset seasoning.

We also include a “Plan B lender” with different rules.

Data Sources You Can Trust

County recorder sites are the most reliable source for deed dates and ownership transfers.

Use them to verify the official clock.

Title companies can pull chain-of-title and flag risks that might complicate your refi or resale.

Build relationships with experienced title officers.

MLS data is helpful for comps and sale history.

It may miss off-market trades, so never rely on it for seasoning verification.

Tax records lag and should not be used for exact dates.

They’re a secondary check only.

Financing and Valuation Impacts You Must Model

A 75% LTV cash-out refi would return $187,500—enough to be all-in with minimal capital left.

Her lender required six months of title seasoning, and recording took two weeks.

That meant over $220,000 sat in one address for 6.5 months.

Her annualized return looked fine on paper, but capital velocity got cut in half.

In Return Quadrants™, her appreciation and tax benefits were intact, but the financing quadrant stalled.

In True Net Equity™, we showed significant equity with low liquidity until the seasoning date.

Appraisers also scrutinize rapid value jumps.

The shorter your ownership, the more support you need from strong comps and documented, line-item renovations.

Common Mistakes That Reset or Delay Seasoning

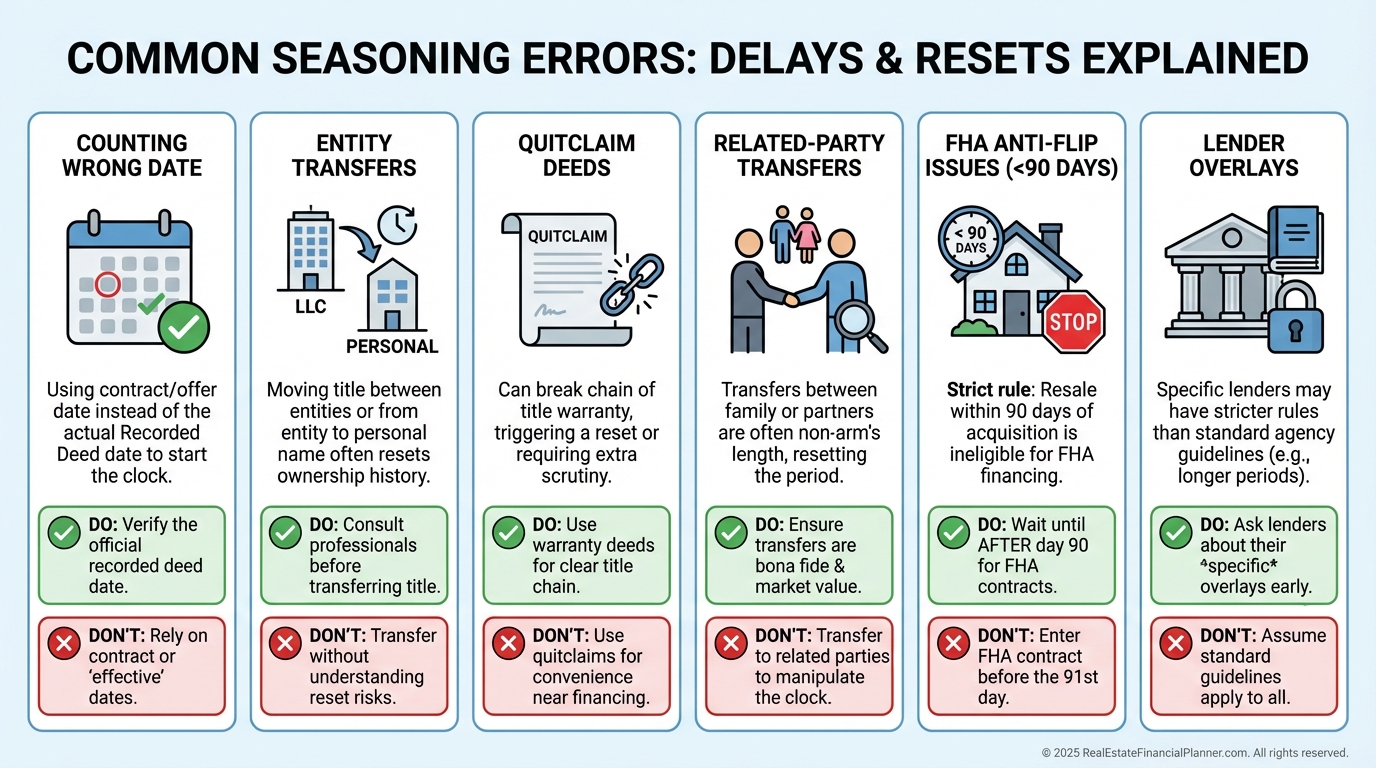

Assuming all lenders follow the same rules.

They don’t, and overlays vary constantly.

Counting from the contract date or closing date instead of the recording date.

Only the recorded deed date matters.

Quitclaiming to an LLC after closing for asset protection.

Many lenders treat that as a new owner and restart seasoning.

Transferring between related parties or trusts without checking the impact.

Chain-of-title clarity matters more than intent.

Ignoring FHA anti-flip constraints on your buyer’s financing.

Your exit might be fine, but your buyer’s loan could be blocked.

Marcus learned this the hard way.

He bought a fourplex personally for rate reasons, immediately transferred it to his LLC, renovated quickly, and applied for a cash-out at month eight.

His lender required 12 months of seasoning in the current owner’s name.

He waited four more months, paid $3,200 per month in carry, and rates rose 0.75%, which reduced his proceeds and cash flow.

Strategies to Work With—Not Against—Seasoning

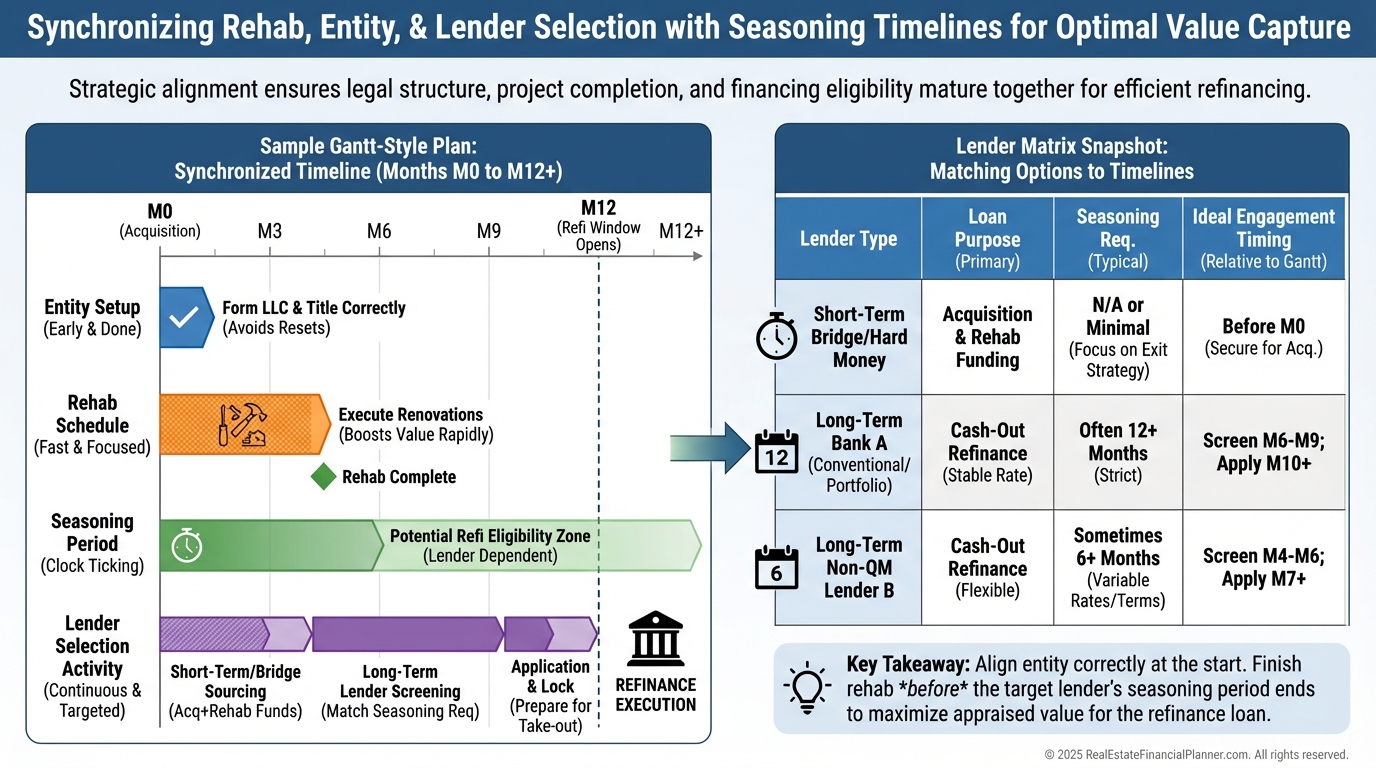

Time your acquisitions so renovation wraps near your seasoning date.

There’s no prize for finishing a two-month rehab when your refi can’t start for six months.

Set up your entities, banking, and insurance before closing.

Buying directly in the correct entity avoids resets later.

Maintain relationships with at least two portfolio lenders.

I maintain a living lender matrix with terms, seasoning rules, and current appetites.

When I coach Nomad™ investors, we map their move-in, move-out, and refi windows against seasoning.

This keeps their plan aligned with lender reality and their growing equity accessible on schedule.

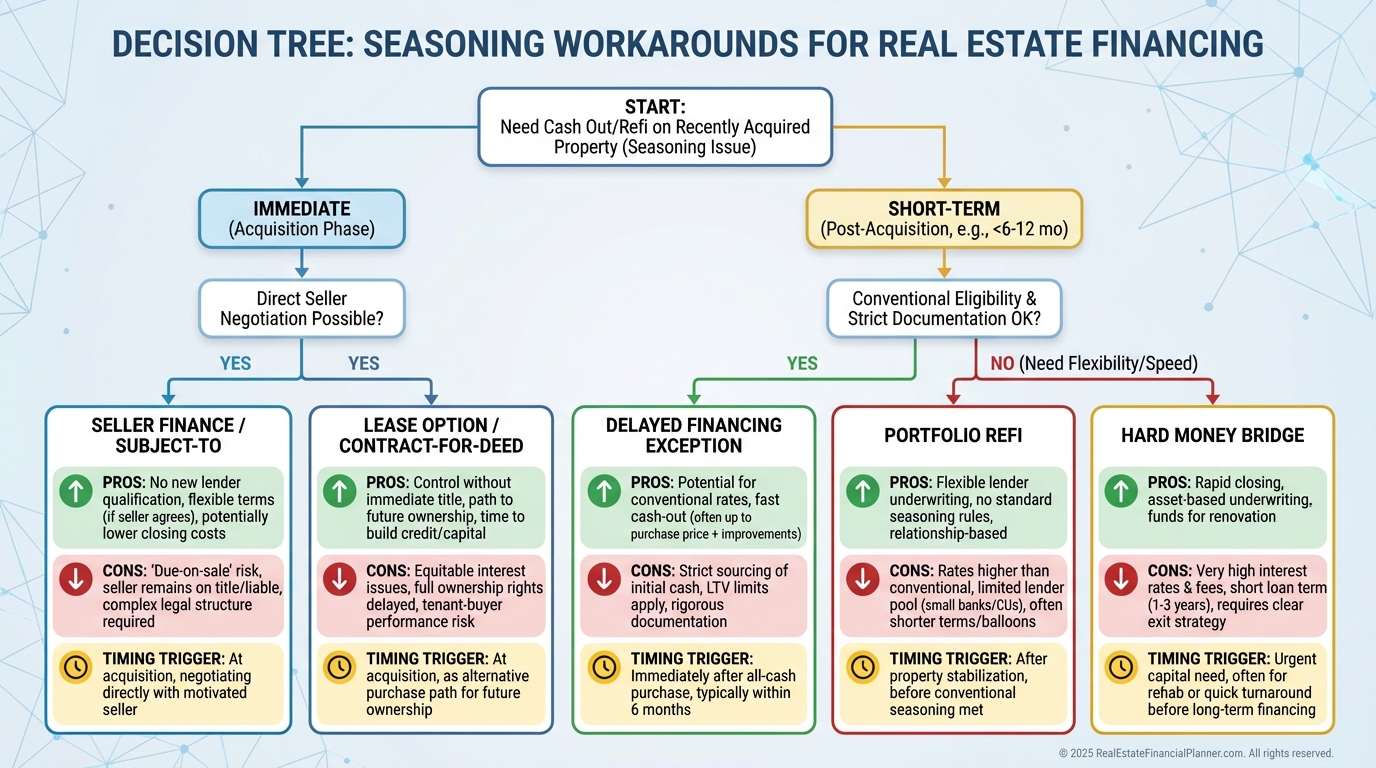

Advanced Workarounds and When to Use Them

Use the Fannie Mae “delayed financing” exception when you buy with cash and want your money back sooner.

If you document the source of funds and meet program criteria, you may avoid the six-month cash-out rule.

Subject-to and seller financing can postpone the need for a refi.

Plan your exit early, because seasoning will matter when you eventually replace the debt.

Hard money bridges can carry you to the seasoning date.

Price the cost of funds versus the cost of missing the next deal and pick the lesser pain.

Lease options and contract-for-deed can help you sell during early ownership.

Know your state rules and your buyer’s loan constraints to avoid dead ends.

Implementation Checklist

Confirm your deed recording date for every property and log your soonest eligible refi or sale date.

Document chain-of-title and avoid mid-hold transfers unless your lender approves in writing.

Add seasoning fields, alerts, and Plan B lenders to The World’s Greatest Real Estate Deal Analysis Spreadsheet™.

Model carrying costs and opportunity costs during the wait.

Update your lender matrix quarterly with overlays and exceptions.

Call before you need them, not after a denial.

Align rehab scope and contractor schedules to the timeline lenders require.

Protect your capital velocity first, then optimize rate and fees.

Conclusion

Title seasoning isn’t red tape.

It’s a calendar that decides whether your plan becomes a profit.

When I rebuilt after setbacks, I learned that mastering “boring” timing rules compounds returns faster than a perfect paint color or backsplash.

Review your portfolio, update your trackers, and brief your lenders this week.

Your future refi approvals are earned on today’s calendar.