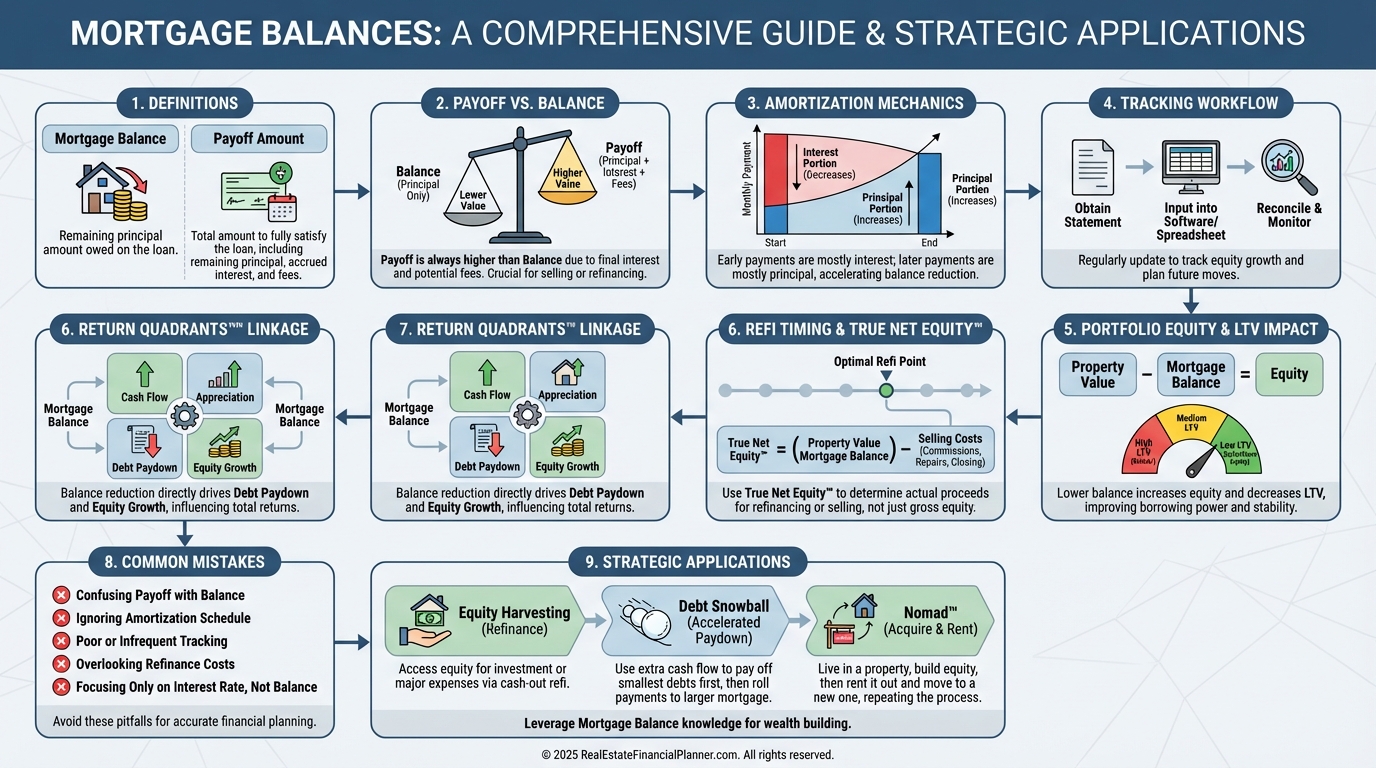

Mortgage Balances: The Overlooked Metric That Unlocks Equity, Refis, and Smarter Portfolio Growth

Learn about Mortgage Balances for real estate investing.

When I help clients, I often find they can quote rent and cash-on-cash, but they guess at what they actually owe.

That guess costs them refi windows, equity access, and deal velocity.

Years ago, when I rebuilt after bankruptcy, I tracked mortgage balances weekly.

It gave me control and revealed opportunities I couldn’t see before.

Why Mortgage Balances Matter

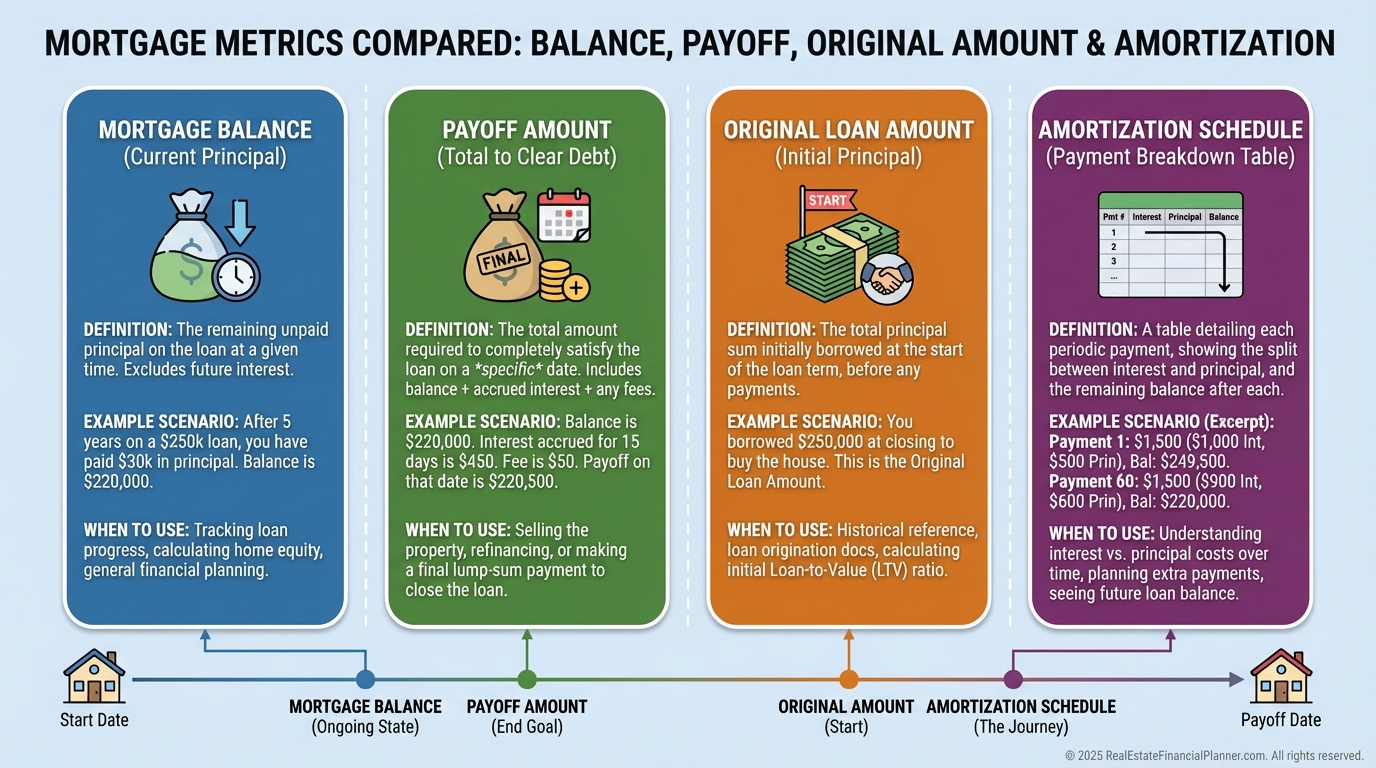

Your mortgage balance is the current principal owed right now.

It excludes accrued interest through a payoff date, fees, or penalties.

Most investors confuse it with other numbers.

•

Original loan amount is history. Your balance is today.

•

Payoff amount adds per-diem interest and lender fees to your balance.

•

Amortization schedule shows a projection. Your balance reflects reality after extra payments, modifications, or missed payments.

Your balance drives equity: Value minus Balance equals Equity.

Equity drives LTV, which drives your financing options and risk.

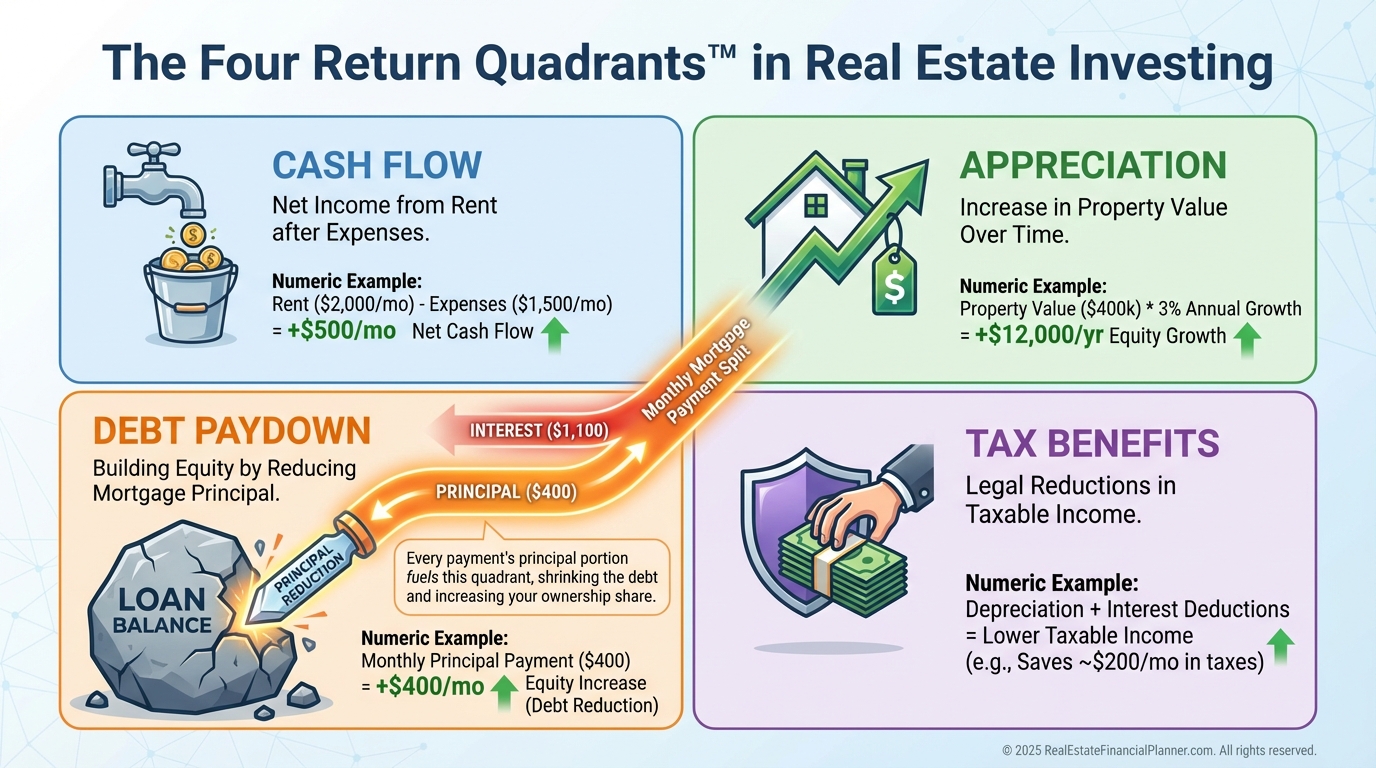

Inside The World’s Greatest Real Estate Deal Analysis Spreadsheet™, your balance touches Return Quadrants™ (especially Debt Paydown), DSCR, ROE, and taxable interest.

If you misstate balances, every downstream metric tilts off-center.

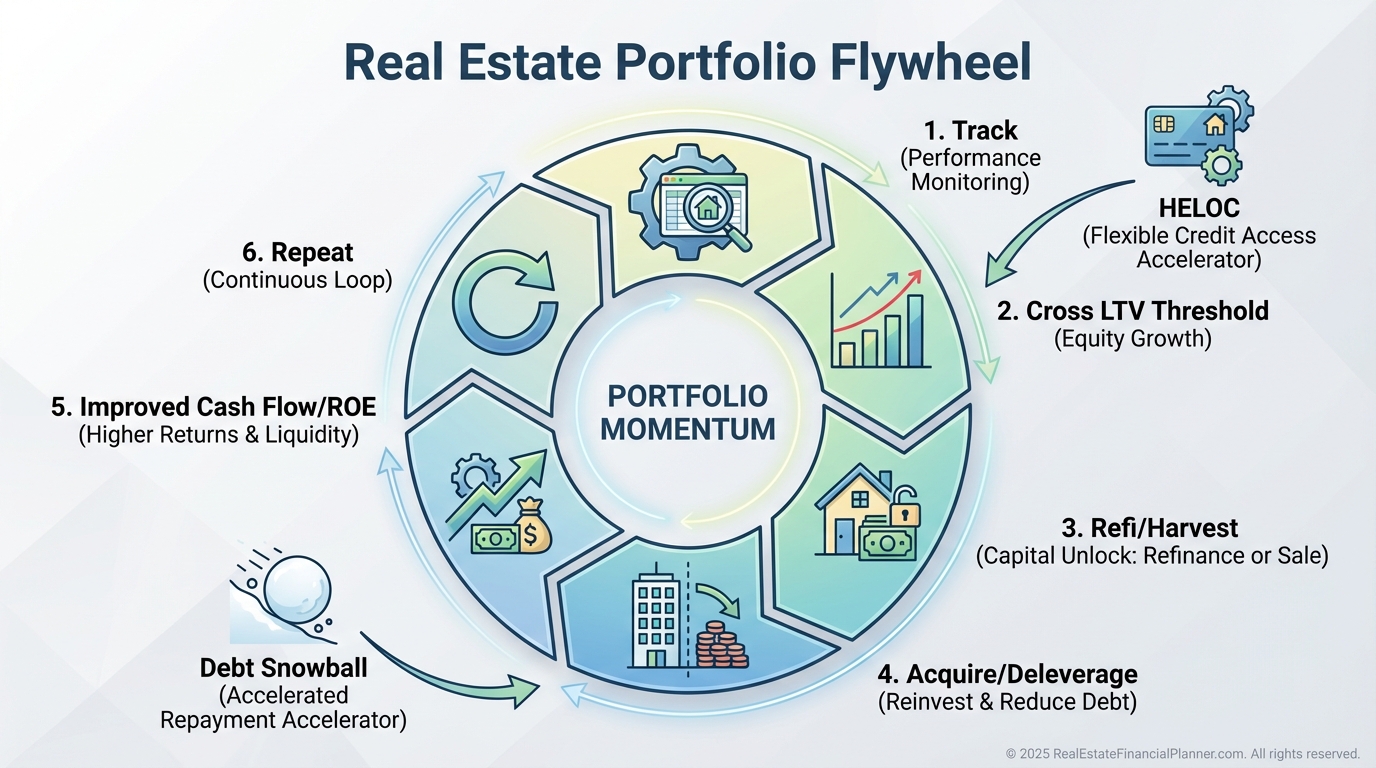

Mortgage Balances and the Return Quadrants™

In the Return Quadrants™, debt paydown is a core wealth driver.

Every dollar your balance drops is a dollar of equity created, even in a flat market.

When I audit portfolios, I plot cash flow, appreciation, principal reduction, and tax benefits by property.

The properties “winning” on principal paydown often deliver the steadiest wealth.

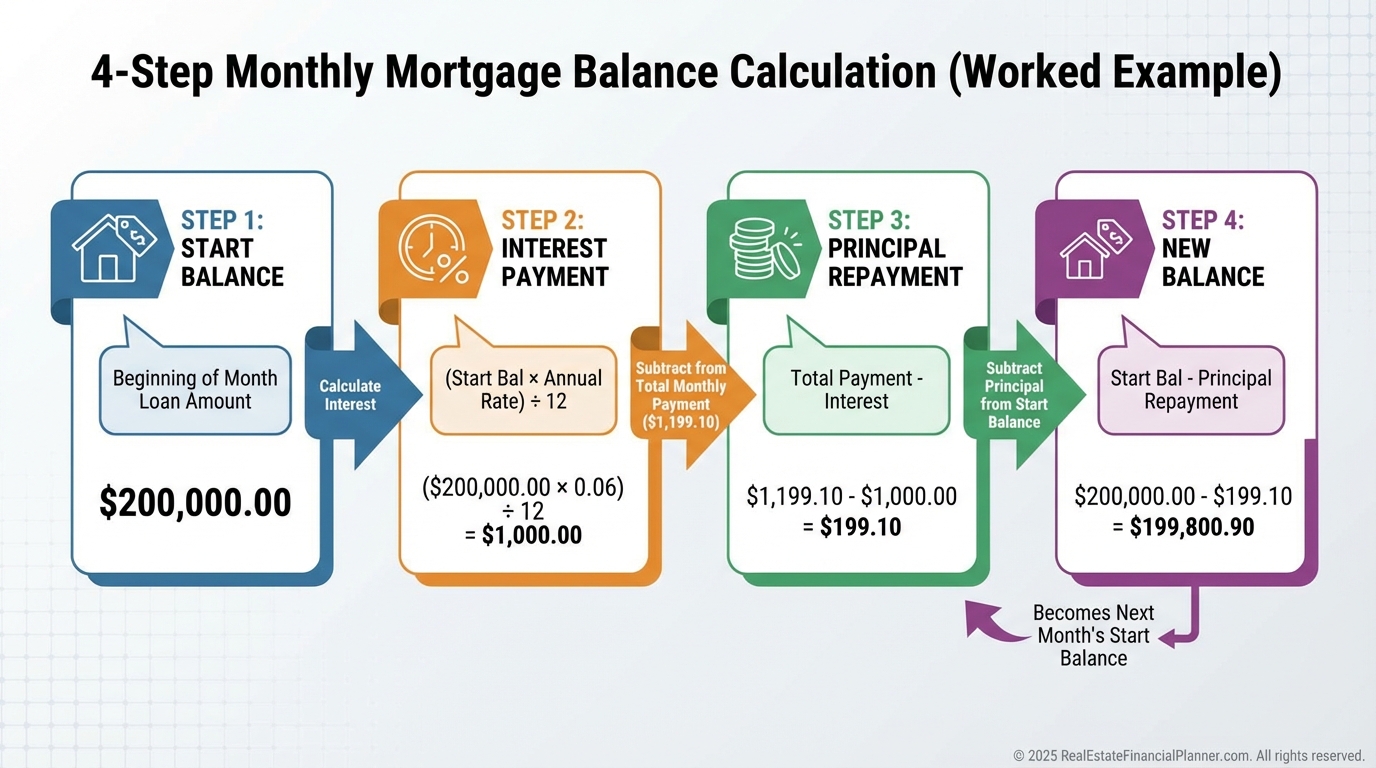

How to Calculate Your Mortgage Balance

Yes, your lender posts it.

But calculating it teaches you the mechanics and lets you project “what if” scenarios.

Use four steps each month.

•

Start with last month’s ending balance.

•

Compute monthly interest: Balance × (Annual Rate ÷ 12).

•

Principal = Monthly Payment – Monthly Interest.

•

New Balance = Prior Balance – Principal.

Here’s a quick pass with a $180,000 loan at 6.5% and a $1,137.72 payment.

Month 1 interest: $975.00.

Principal: $162.72.

New balance: $179,837.28.

Month 2 interest: $974.12.

Principal: $163.60.

New balance: $179,673.68.

Each month, principal ticks up and interest ticks down.

That’s amortization quietly compounding in your favor.

What I Track Every Month

I don’t rely on memory.

I triangulate.

•

Lender statement for the official posted ending balance.

•

Online portal for near-real-time updates.

•

Form 1098 each year to reconcile interest and back into principal.

•

My amortization model to forecast scenarios and verify lender math.

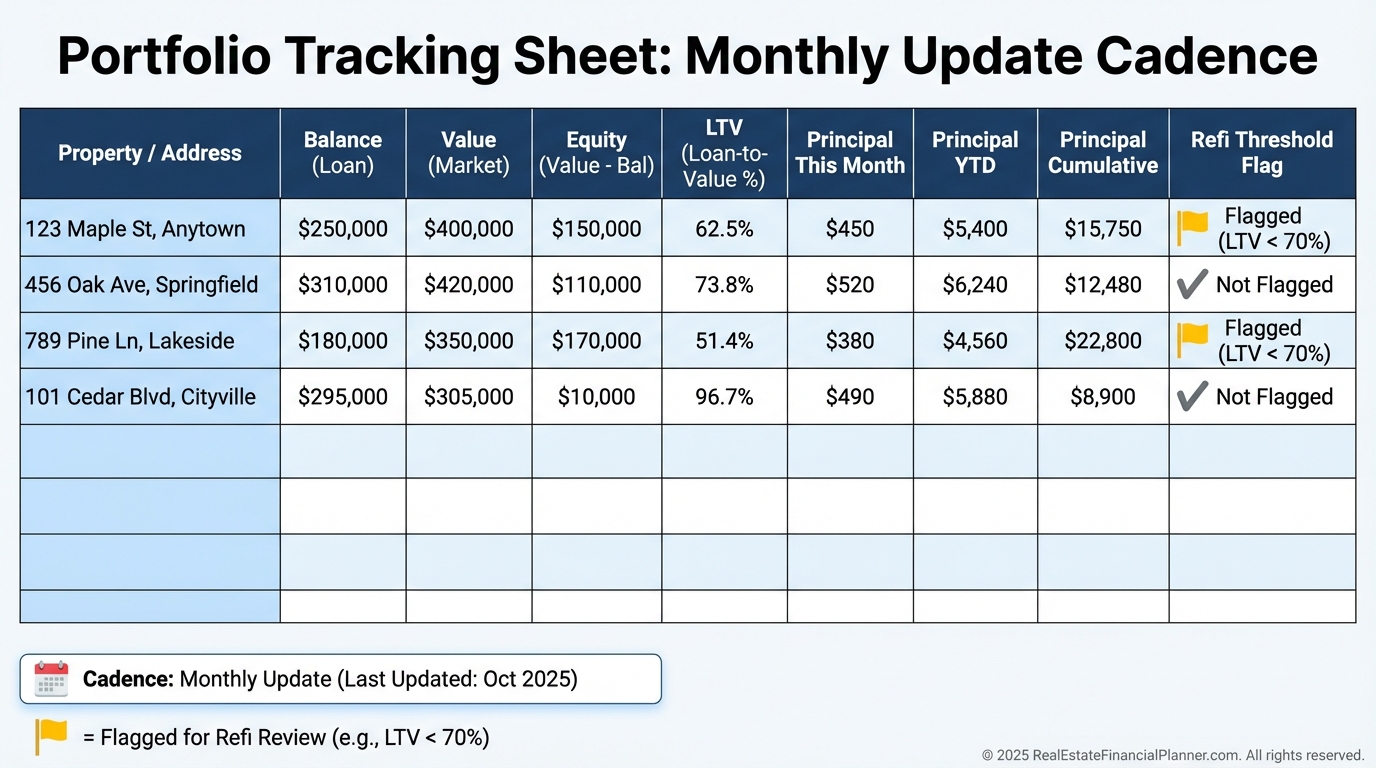

I keep a master sheet with one row per property.

Columns include balance, value, equity, LTV, principal paid this month, YTD, and cumulative.

I color-code properties nearing refi thresholds like 75% LTV.

I also track principal reduction velocity to see which loans deserve extra payments.

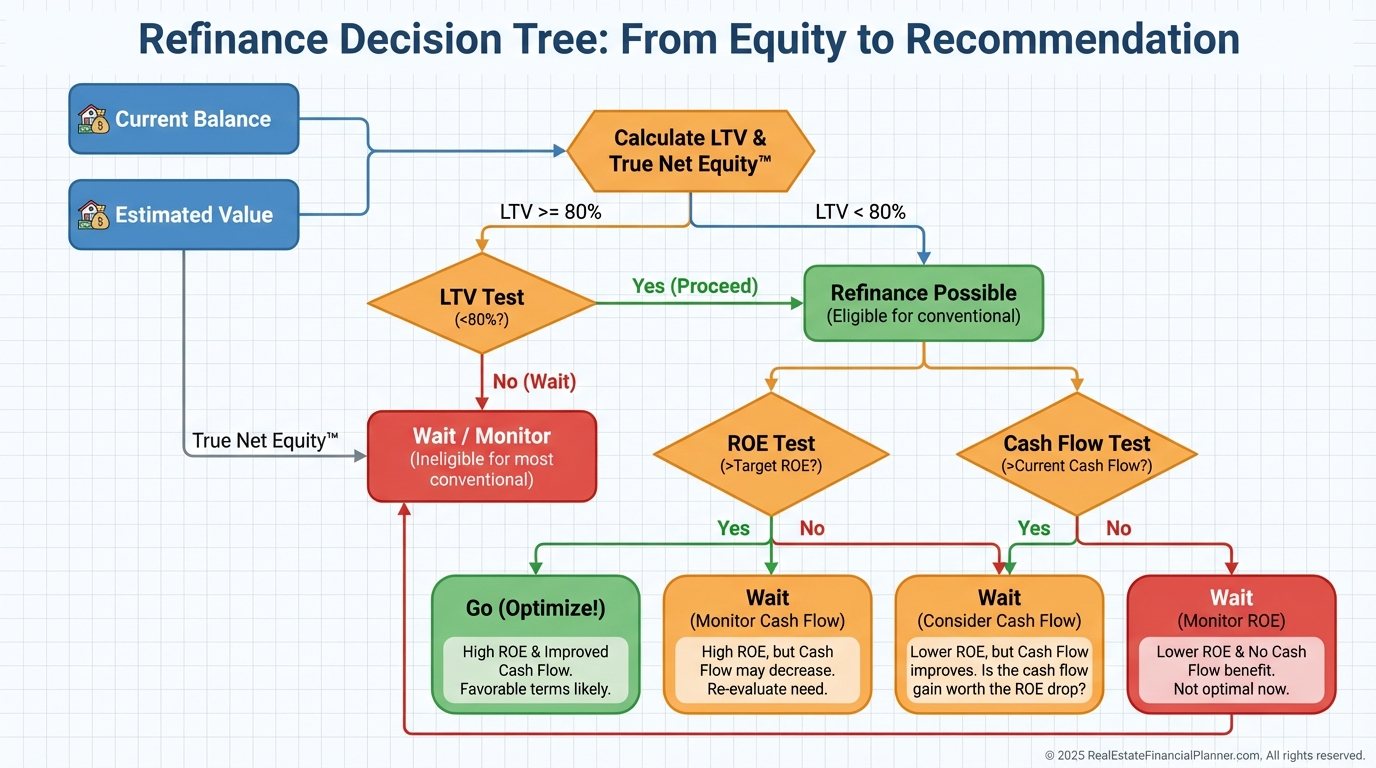

From Balance to Action: Valuation, LTV, and True Net Equity™

Equity is not just Value minus Balance.

Sophisticated investors use True Net Equity™: Estimated Sale Price minus Costs of Sale minus Loans.

That’s the equity you can actually harvest.

When I evaluate refis, I look at LTV on both appraised value and True Net Equity™ after costs.

I ask two questions.

•

Will the new loan improve cash flow, ROE, or strategic optionality?

•

What is the opportunity cost if I wait three, six, or twelve months of additional paydown?

One client thought she needed to wait a year.

Her balance had quietly dropped under the 75% LTV mark.

We refinanced six months earlier, locked a better rate, and freed capital for the next deal.

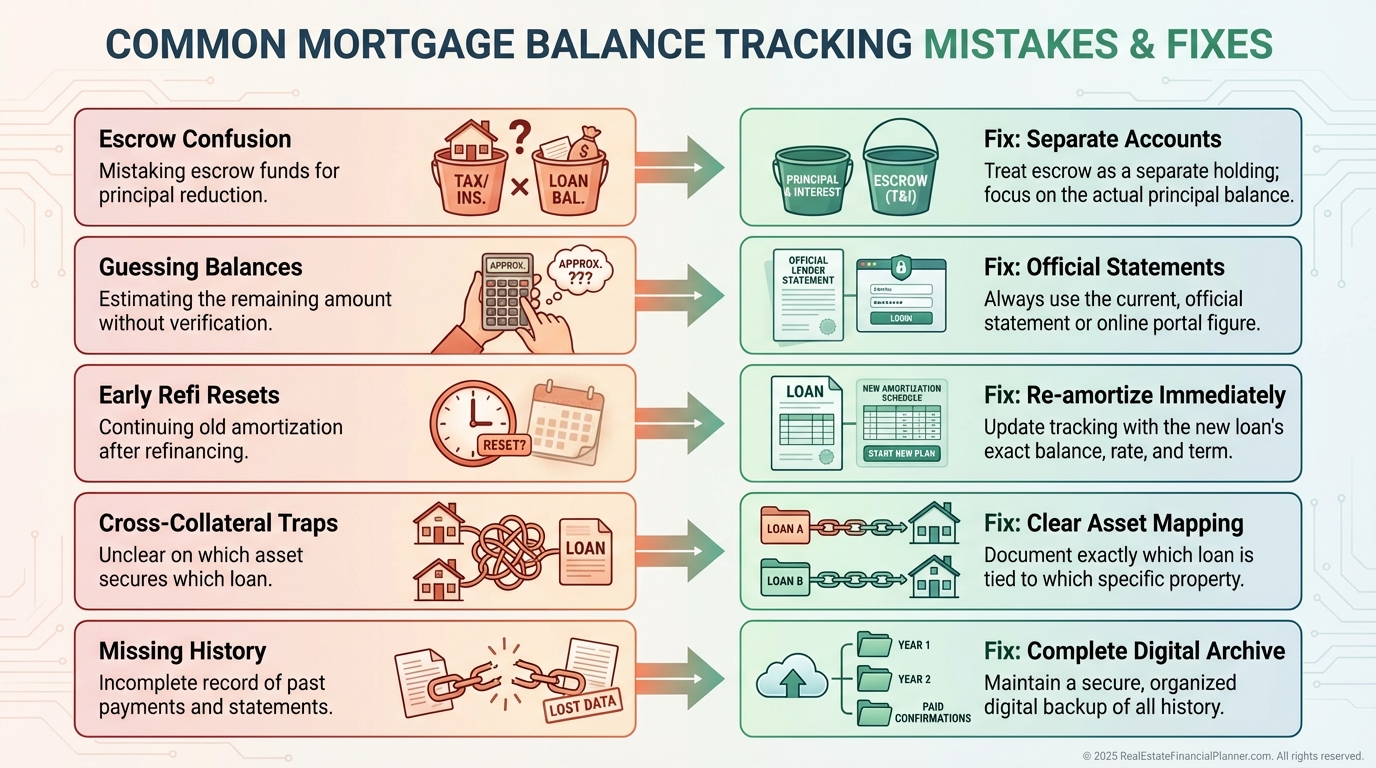

Common Mistakes I See

Payment changes from escrow do not accelerate paydown.

They change taxes and insurance, not principal.

Investors forget about extra principal payments and understate equity.

They guess balances and miss refi windows by months.

Others refinance too early, reset amortization, and pay tens of thousands more in long-run interest.

Cross-collateralized loans trip people up.

One balance can block moves on another property.

And many don’t keep a balance history, so they can’t validate lender math or analyze velocity.

Strategic Plays That Leverage Mortgage Balances

Equity harvesting.

Track balances and values quarterly.

When LTV crosses your target, evaluate cash-out options against ROE and DSCR.

Debt Snowball.

I sometimes direct all extra principal to the smallest balance with the weakest cash-on-cash to free one property completely.

Optionality often beats a small rate arbitrage.

If 60% of your equity sits in one asset, consider a sale or refi there to diversify income streams.

Tax planning.

Interest declines as balances drop.

Forecast your Schedule E and plan moves before you lose deductions.

Advanced moves.

Use a HELOC to target a high-impact principal chunk and recast when possible.

Set balance milestones as automatic triggers: “At 70% LTV, order a desktop valuation and pre-approval.”

Where Nomad™ and Mortgage Balances Intersect

With Nomad™, you buy as an owner-occupant, live there a year, then convert to a rental.

That lower owner-occupant rate accelerates principal reduction.

When I coach Nomads, we set balance checkpoints at months 12, 24, and 36.

We pair those with rent and value updates to time refis or recasts that boost cash flow when the property converts.

A disciplined Nomad can stack properties faster by watching balances instead of waiting for “big” appreciation.

Set Up Your System in 30 Minutes

Open a sheet.

List each property.

Add columns for Balance, Value, Equity, True Net Equity™, LTV, Principal This Month, YTD, Cumulative, and Refi Threshold.

Schedule a recurring monthly reminder.

Pull portal balances, paste values, and let formulas update equity and LTV.

If you use The World’s Greatest Real Estate Deal Analysis Spreadsheet™, plug balances directly to sync Return Quadrants™ and ROE.

In six months, you’ll see patterns.

In a year, you’ll act sooner with more confidence and better results.