Rent To Own for Investors: Strategy, Risks, Cash Flow

Learn about Rent to Own for real estate investing.

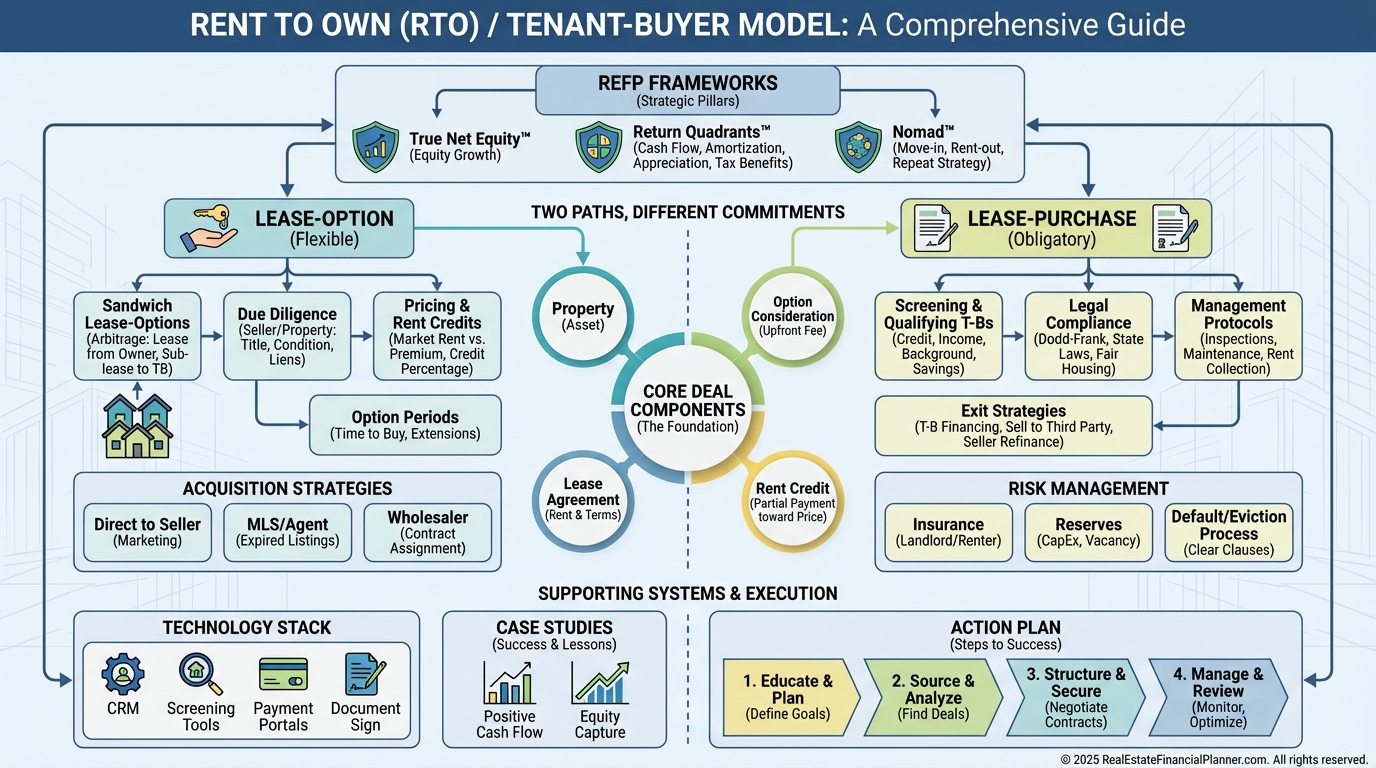

Why Rent to Own Belongs in Your Toolkit

When I help clients navigate tight lending or choppy markets, Rent to Own is often the bridge that keeps deals moving.

It lets you control property with terms when buying and harvest premium returns when selling.

I model it two ways before we write any offer.

First, with Return Quadrants™ to see how appreciation, cash flow, debt paydown, and tax benefits are expected to contribute.

Then with True Net Equity™ to reveal what you really keep after transaction costs, credits, and payoff.

Understanding Rent to Own: Core Mechanics

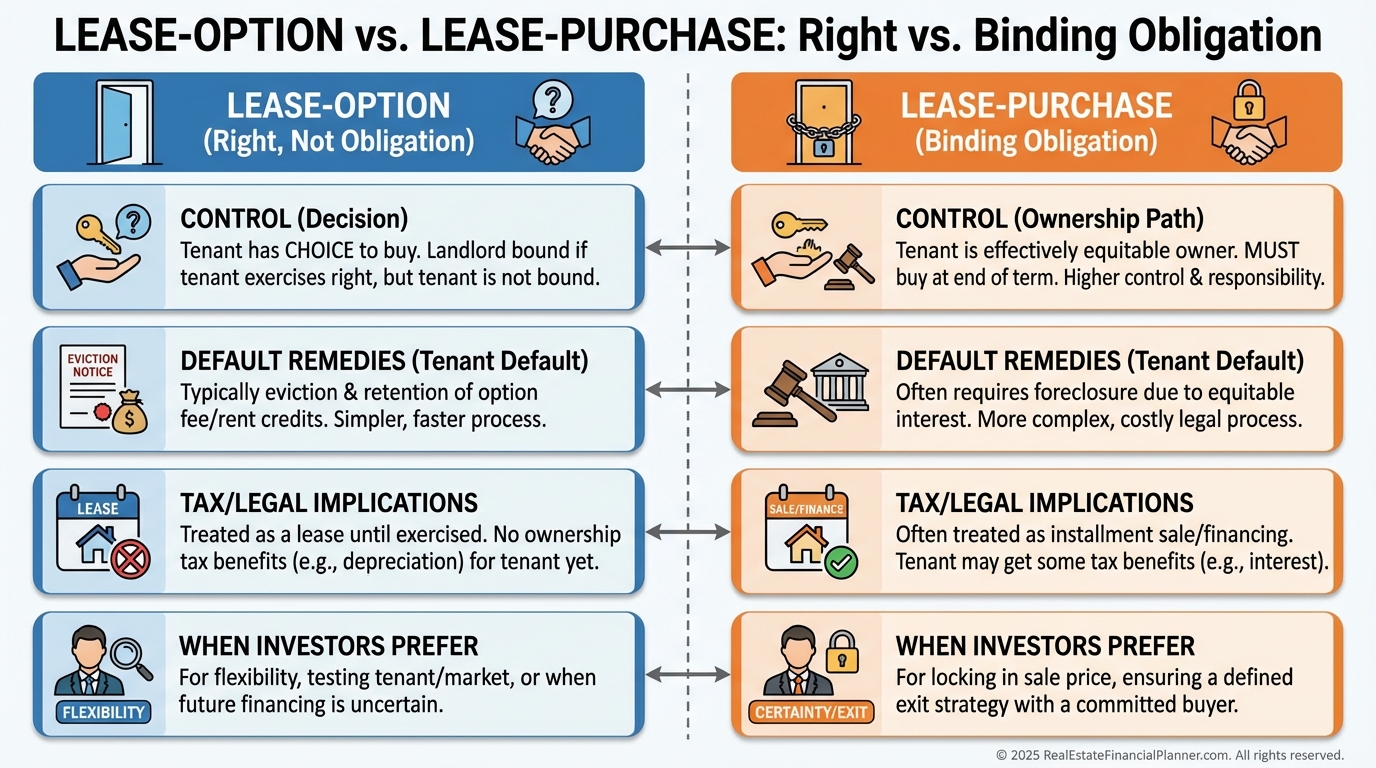

A rent-to-own deal is a lease plus either an option to buy (lease-option) or an obligation to buy (lease-purchase).

Which you choose changes flexibility, legal posture, and tax outcomes.

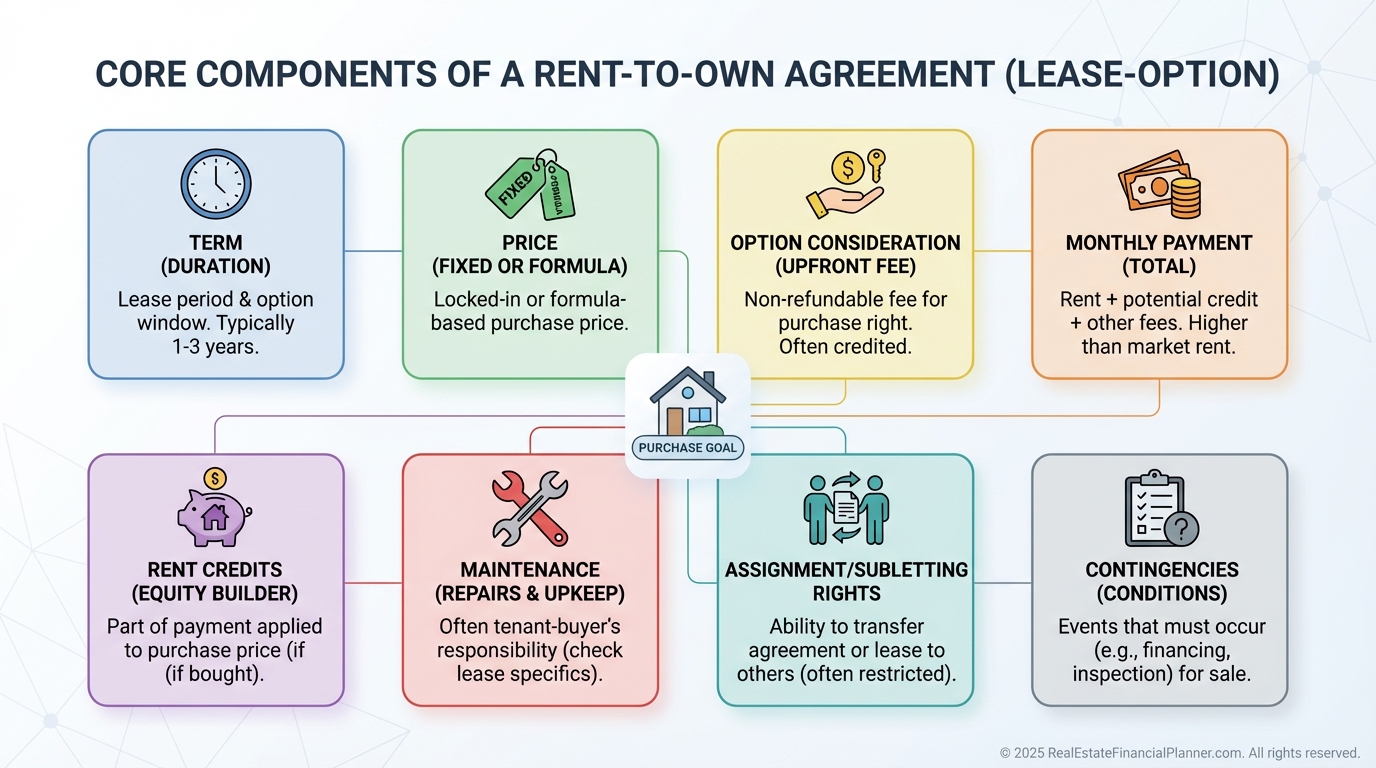

Every rent-to-own has a few moving parts I always verify.

Term length, monthly payment, option consideration, purchase price method, rent credits, and maintenance responsibilities.

The magic is control without immediate ownership.

As a buyer, you lock price and terms while benefiting from cash flow and potential appreciation.

As a seller, you keep title, earn premiums, and set a path to sale.

Acquisition with Terms: Finding and Negotiating

When I’m acquiring with a lease-option, I prioritize sellers who value terms over price.

Tired landlords, owners behind on payments but with equity, heirs, and properties needing repairs often trade price for certainty and relief.

I keep marketing simple and targeted.

Direct mail to absentee owners, networking with agents in distress niches, Craigslist and Marketplace posts, and “driving for dollars” all fill the pipeline.

Negotiation starts with clarity on the seller’s real problem.

I model current value scenarios, not speculative future value, using The World’s Greatest Real Estate Deal Analysis Spreadsheet™ so we know exactly how the deal performs.

I aim for payments that cover the seller’s costs while leaving a positive spread if I sub-lease.

On option consideration, I get creative—small cash, promissory notes, or fixing deferred repairs as non-cash value.

I always negotiate the right to sub-lease or assign, and I push for longer options (3–5 years) to give appreciation and multiple exits a chance.

Due diligence goes beyond the property.

I pull title, check for liens and HOA issues, verify mortgage status, and record a memorandum of option to protect my position.

I also get professional inspections, photo-document the condition, and estimate repairs up front.

Creative Acquisition Plays

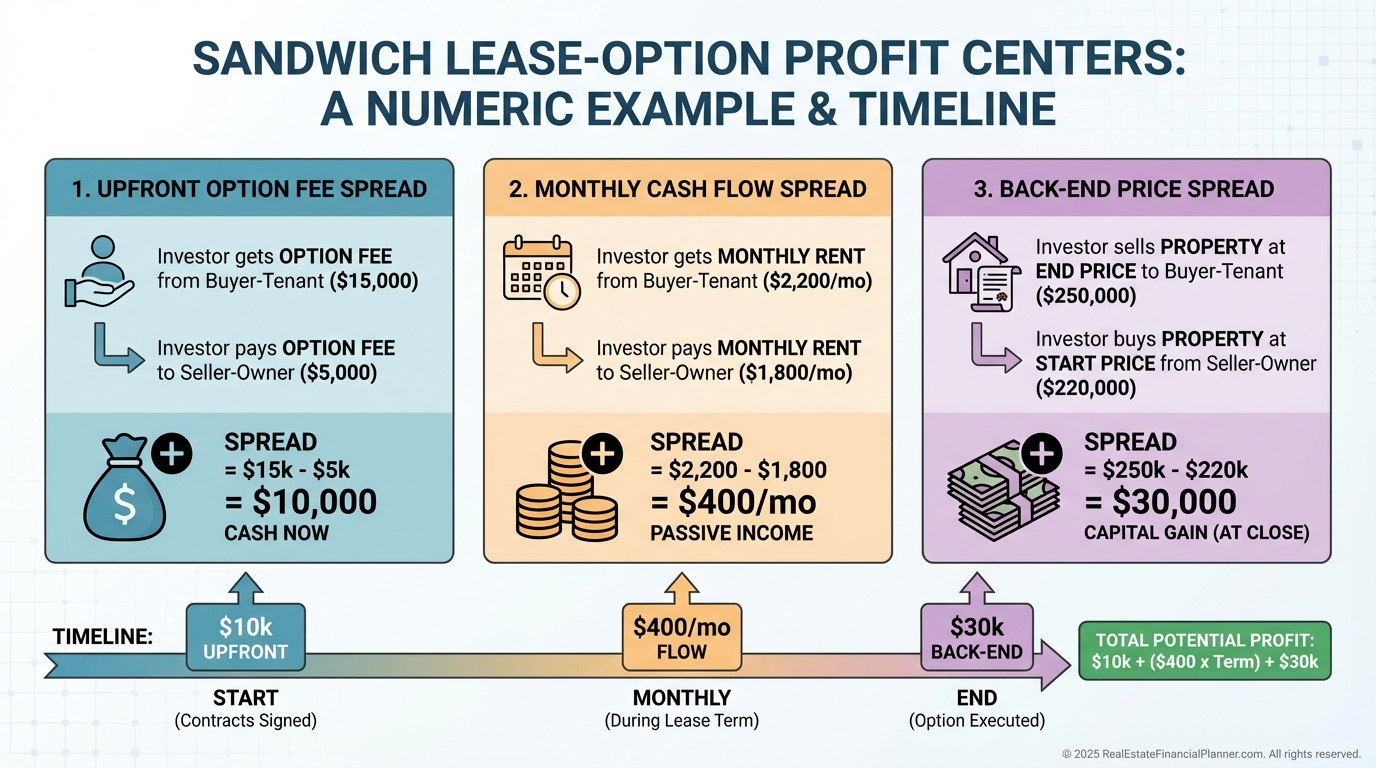

Sandwich lease-options let you acquire on terms and immediately sell on terms to a tenant-buyer.

You earn the option fee spread, the monthly spread, and potentially the price spread at closing.

Cooperative lease-options reduce risk by partnering with the seller to place the tenant-buyer and split fees.

Master leases with options shine on small multifamily where you can optimize multiple units and create layered profits.

Exit Strategy: Selling on a Path to Ownership

When I choose rent-to-own as an exit, I’m seeking three profit centers.

Upfront option consideration, premium monthly cash flow, and a predetermined sales price that captures appreciation.

Tenant-buyers usually treat the home better, which cuts maintenance noise.

You also keep depreciation until transfer, and you can time the sale for tax planning with your CPA.

If the buyer doesn’t close, you keep the option consideration and premium rent and can resell the option.

That’s a built-in hedge in uncertain markets.

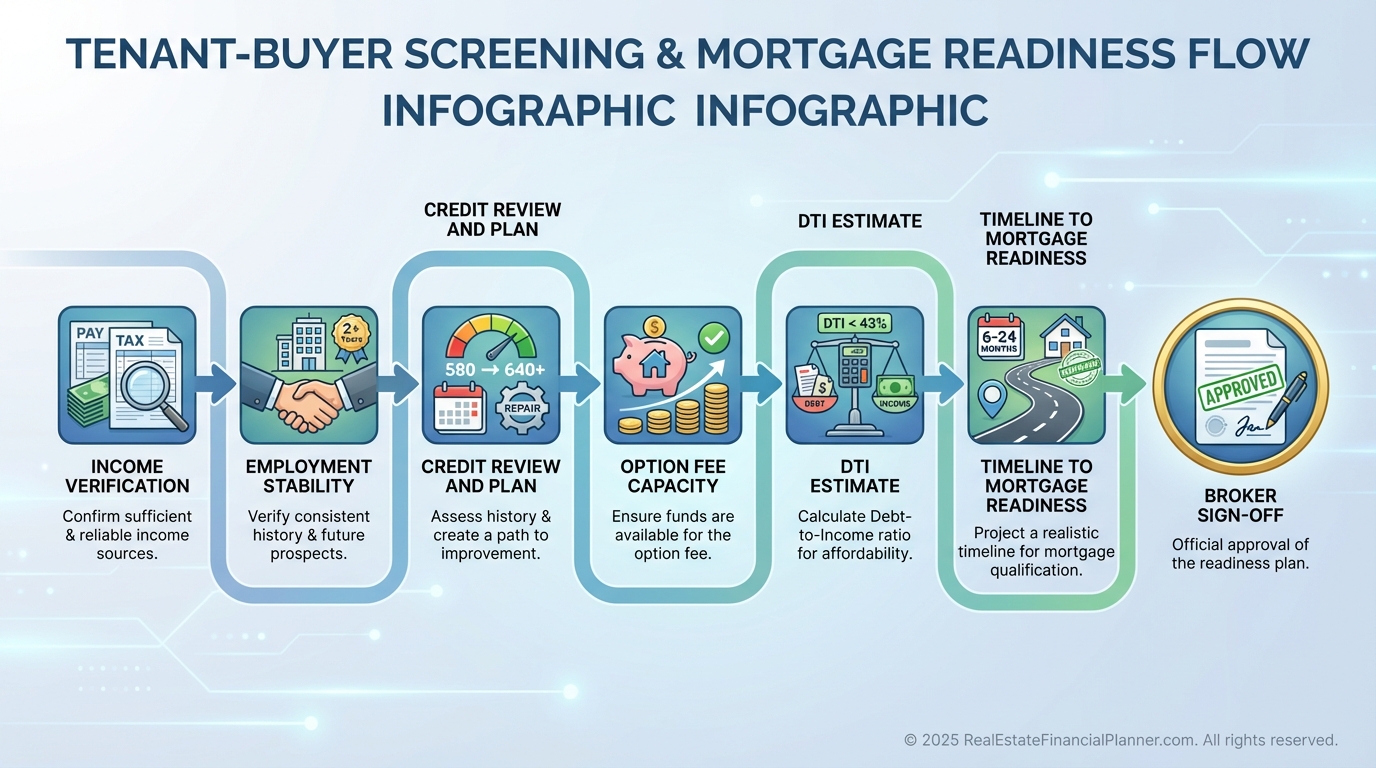

Attracting and Qualifying Tenant-Buyers

I don’t market a rental; I market an ownership path.

“Own this home—no bank qualifying today” with clear terms, a video tour, and a realistic timeline to mortgage readiness outperforms generic ads.

I partner with mortgage brokers and reputable credit educators to pre-assess applicants.

Before signing, I want a broker’s written plan: what needs to improve, by how much, and how long it should take.

Financially, I want income ≥3x the monthly payment and a meaningful option fee that signals commitment.

I prefer rent credits that reward on-time payments only, not as automatic discounts.

Structuring Profitable Deals

I price using today’s comps plus reasonable appreciation assumptions verified in The World’s Greatest Real Estate Deal Analysis Spreadsheet™.

In balanced markets I model 3–4% annual appreciation; in hot markets I cap it lower than headlines to stay conservative.

I set rent 10–25% above market to reflect the option value and the extra support we provide.

Credits are paid only when rent is on time, and I keep them modest to avoid over-discounting the future sale.

Option periods of 12–36 months keep incentives aligned.

I sometimes use renewable 12-month options with progress checks and paid extensions for buyers who are close.

Before anything goes live, I run Return Quadrants™ side-by-side for “keep as rental,” “sell retail,” and “rent-to-own exit.”

It’s shocking how often the rent-to-own path outperforms on cash flow and total return with lower headache risk.

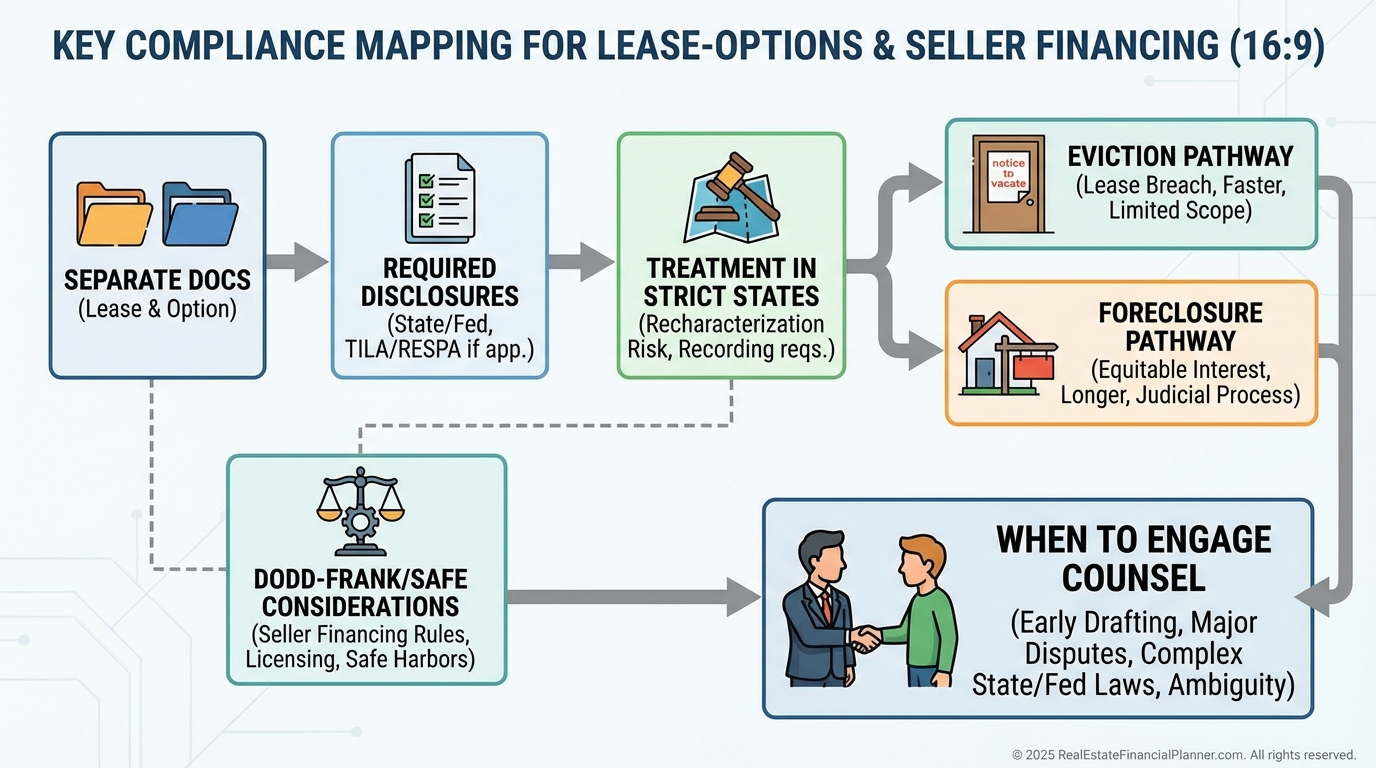

Legal and Compliance Essentials

Laws vary by state, and courts may recharacterize deals if you blur lease and sale.

I use separate lease and option documents, clear disclosures, and I avoid granting ownership-type rights before closing.

Some states regulate these as credit sales or have strict rules for contracts-for-deed.

Discuss Dodd-Frank, SAFE Act, and state consumer laws with a local attorney who drafts your templates.

I also record a memorandum of option to cloud title and protect my position.

And I never let the seller control critical payments if a mortgage is in place; third-party servicing is cheap insurance.

Managing Rent-to-Own Properties

I set maintenance like homeownership training wheels.

Tenant-buyers handle repairs under a defined threshold (often $300–$500), while I retain responsibility for major systems until sale.

I send monthly statements that separate base rent, any rent credit earned, and option balance.

That transparency keeps motivation high and disputes low.

Quarterly check-ins with the mortgage broker keep the path to closing on track.

When progress stalls, we adjust the plan early instead of hoping for a last-minute miracle.

Advanced Strategies and Scaling

I optimize portfolios by matching the strategy to the property and market cycle.

Value-add or soft-demand properties lean toward acquisition via terms; stabilized homes in steady markets make great rent-to-own exits.

The Nomad™ strategy can pair nicely here.

Live in a property to secure owner-occupant financing, move out, and then sell it via rent-to-own to harvest premiums while helping the next buyer.

As you scale, build a bench.

An attorney fluent in creative finance, mortgage pros who love edge cases, property managers who understand option accounting, and credible credit educators are non-negotiable.

I track performance using dashboards in The World’s Greatest Real Estate Deal Analysis Spreadsheet™.

Option exercise rates, average time to close, total return per property, and marketing channel ROI drive better screening and pricing next time.

Case Studies: Field Notes

Sarah secured a 5-year lease-option from a tired landlord, invested $15,000 in repairs, raised rents, and sold her option for $25,000 two years later.

She never took title and still captured value from her improvements and market appreciation.

Marcus converted five rentals to rent-to-own.

Across 18 months he collected $73,000 in option fees, $1,750/month in rent premiums, and three buyers closed for an additional $67,000 in back-end profit.

Two did not close, but the properties appreciated and he retained all option consideration.

David executed a classic sandwich lease-option.

He paid $1,300 out, collected $1,650 in, banked a $7,000 option fee, and closed a $25,000 back-end spread when his buyer exercised.

Risk Management You Can’t Skip

On acquisitions, I protect title with a recorded memorandum and sometimes a deed in escrow.

I route payments through a servicer, verify taxes and insurance, and build attorney-fee provisions into performance clauses.

On exits, I collect meaningful option consideration and require renter’s insurance plus appropriate liability coverage.

I maintain reserves to handle a turnover if a buyer walks.

Markets change, so I diversify property types, zip codes, and option terms.

I also build conservative margins so deals survive slower appreciation or temporary price dips.

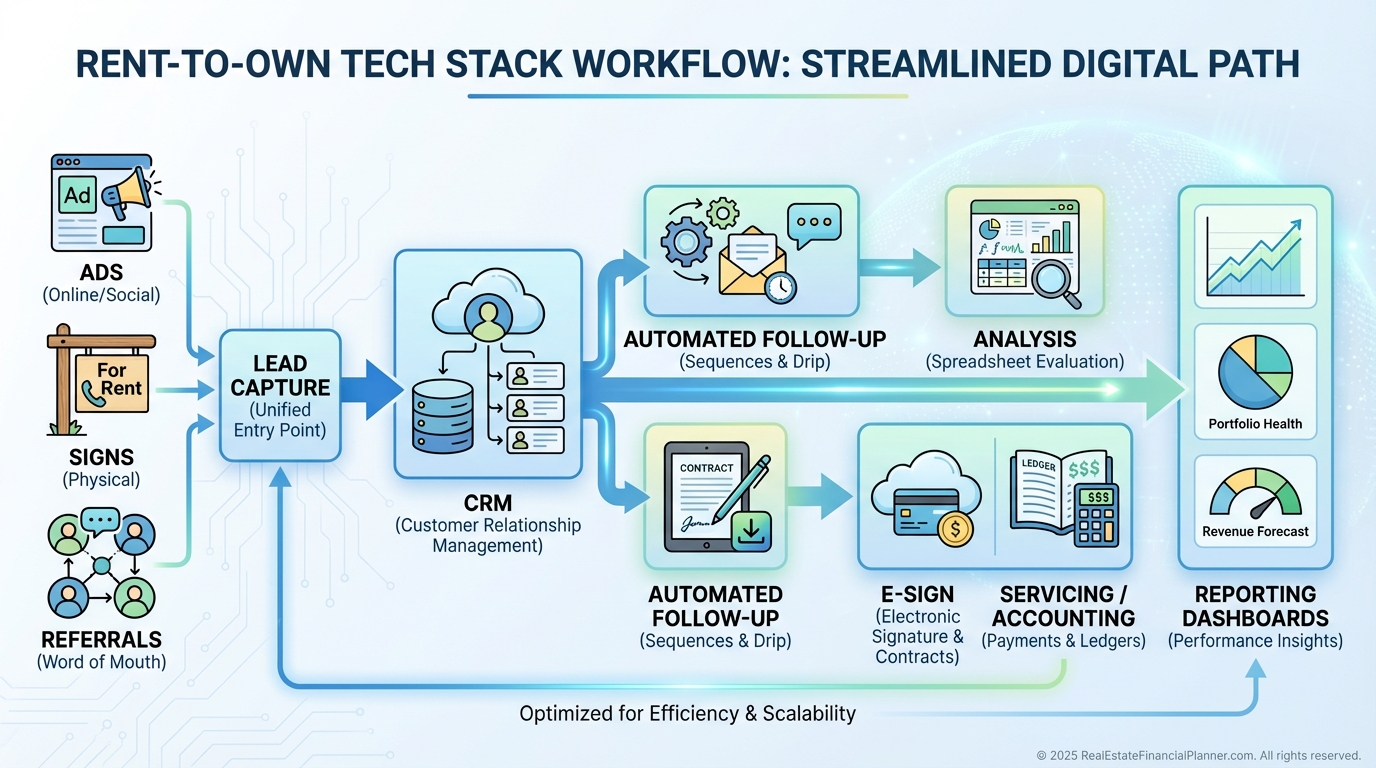

Technology and Tools

I run lead flow through a CRM and automate follow-ups for both sellers and tenant-buyers.

Video tours pre-qualify interest, and e-signature platforms speed execution.

For analysis, I rely on The World’s Greatest Real Estate Deal Analysis Spreadsheet™.

I compare structures in minutes, then I track actuals against pro formas in a shared dashboard.

Cloud storage with organized folders per property prevents lost documents.

Zapier-style integrations cut retyping and reduce mistakes as you scale.

Your Action Plan

If you’re new, pick a lane first.

Acquire with terms if capital is tight, or convert one property to rent-to-own if you already own rentals.

Meet a local attorney to finalize state-specific docs and disclosures.

Then model three deals in The World’s Greatest Real Estate Deal Analysis Spreadsheet™ and send two offers this month.

If you’re experienced, mine your portfolio for candidates where rent-to-own boosts Return Quadrants™.

Standardize your screening and documentation, and run a 90-day marketing sprint for tenant-buyers or motivated sellers.

Finally, commit to quarterly reviews using True Net Equity™ so you know exactly when to exercise, assign, or extend.

The investors who master Rent to Own don’t wait for the perfect market.

They write offers with terms, manage risk with systems, and let smart analysis guide every decision.