VA Loans: The Complete Investor’s Playbook for 0% Down, House Hacking, and Nomad™

Learn about VA Loans for real estate investing.

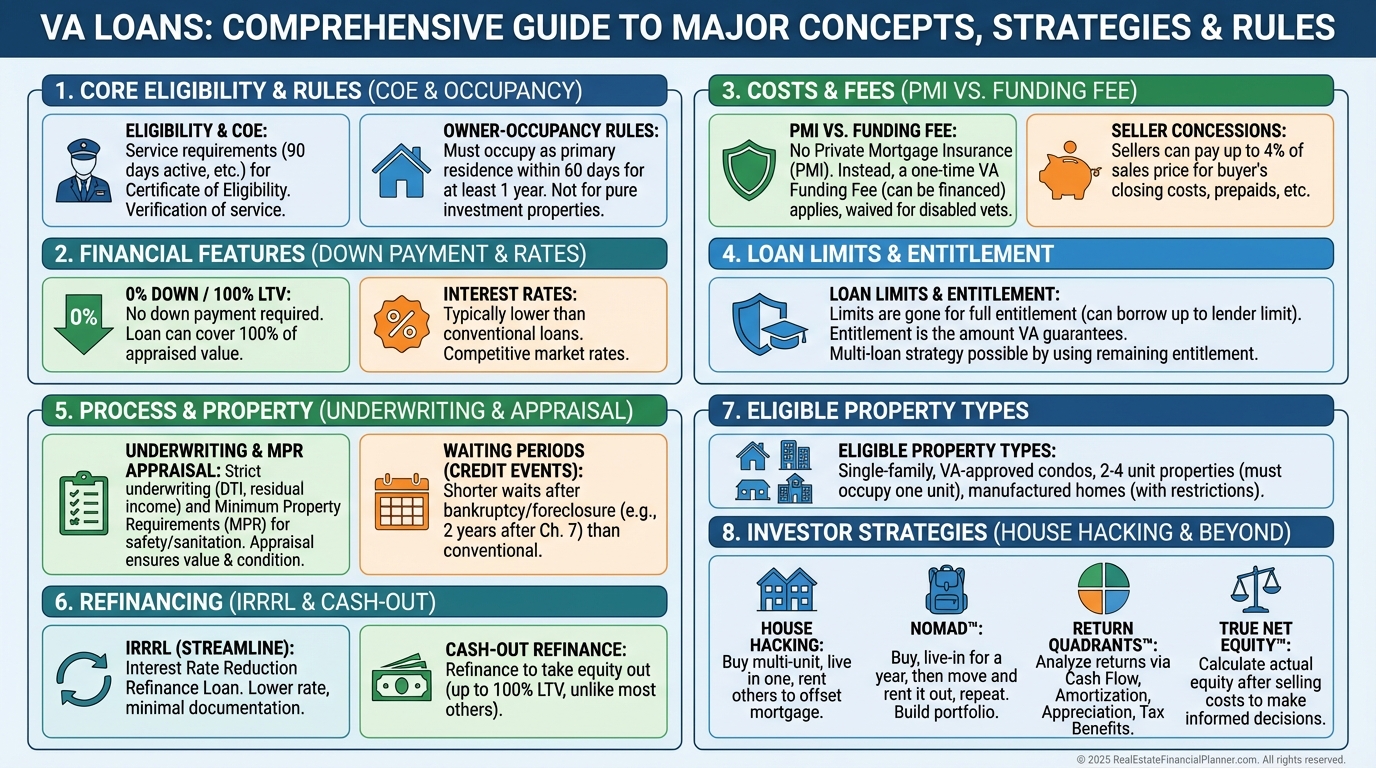

Why VA Loans Are a Power Tool for Investors

When I help clients plan their first rental, VA financing often unlocks a 0% down path the others can’t touch.

Used correctly, it accelerates house hacking, Nomad™, and long-term wealth without starving your cash reserves.

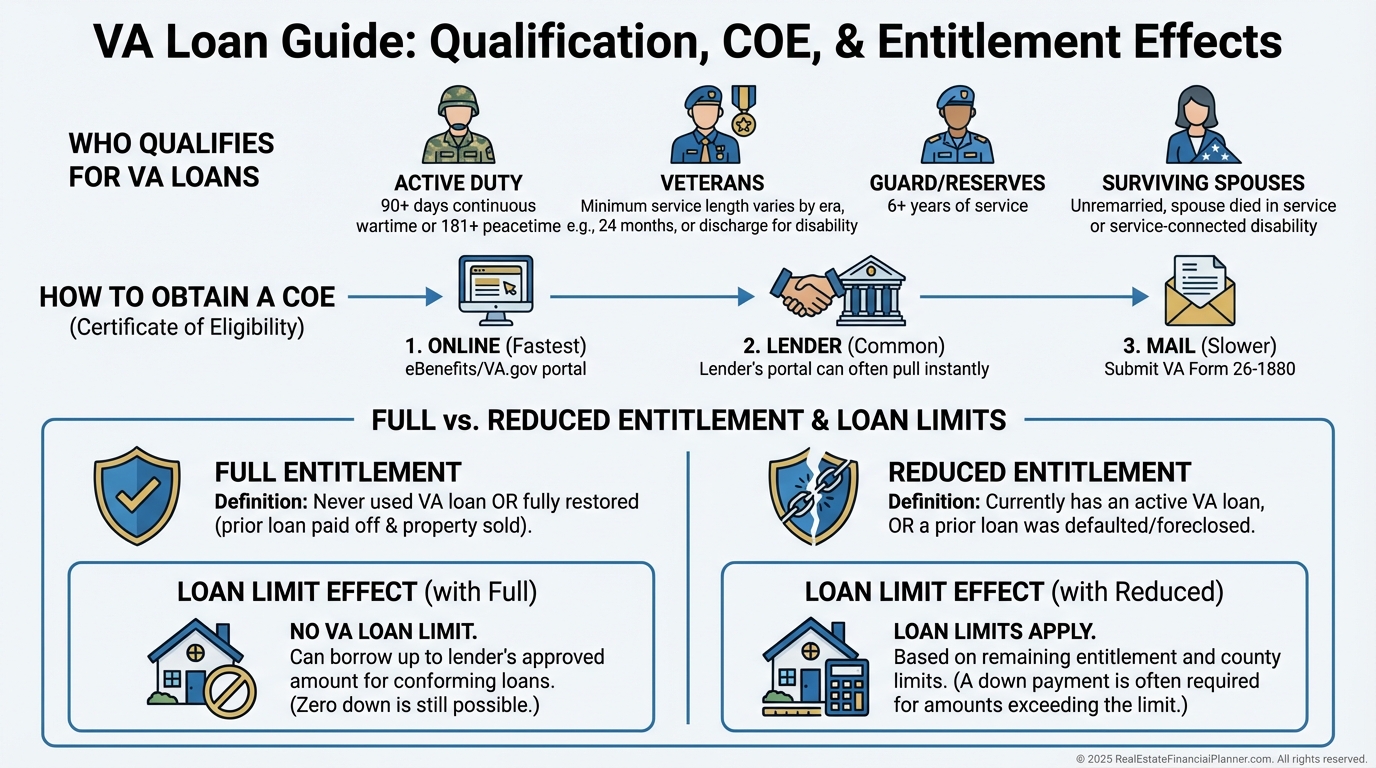

Eligibility and the COE

VA loans are a benefit for eligible veterans, active-duty service members, certain Guard/Reserve members, and qualifying surviving spouses.

The first step is getting your Certificate of Eligibility (COE). Most lenders can pull it for you.

The VA doesn’t set a minimum credit score, but lenders usually want 620+. I have lenders who will review applicants down to ~580 with strong compensating factors.

I verify debt-to-income (DTI) before we shop so we know what price point supports your plan.

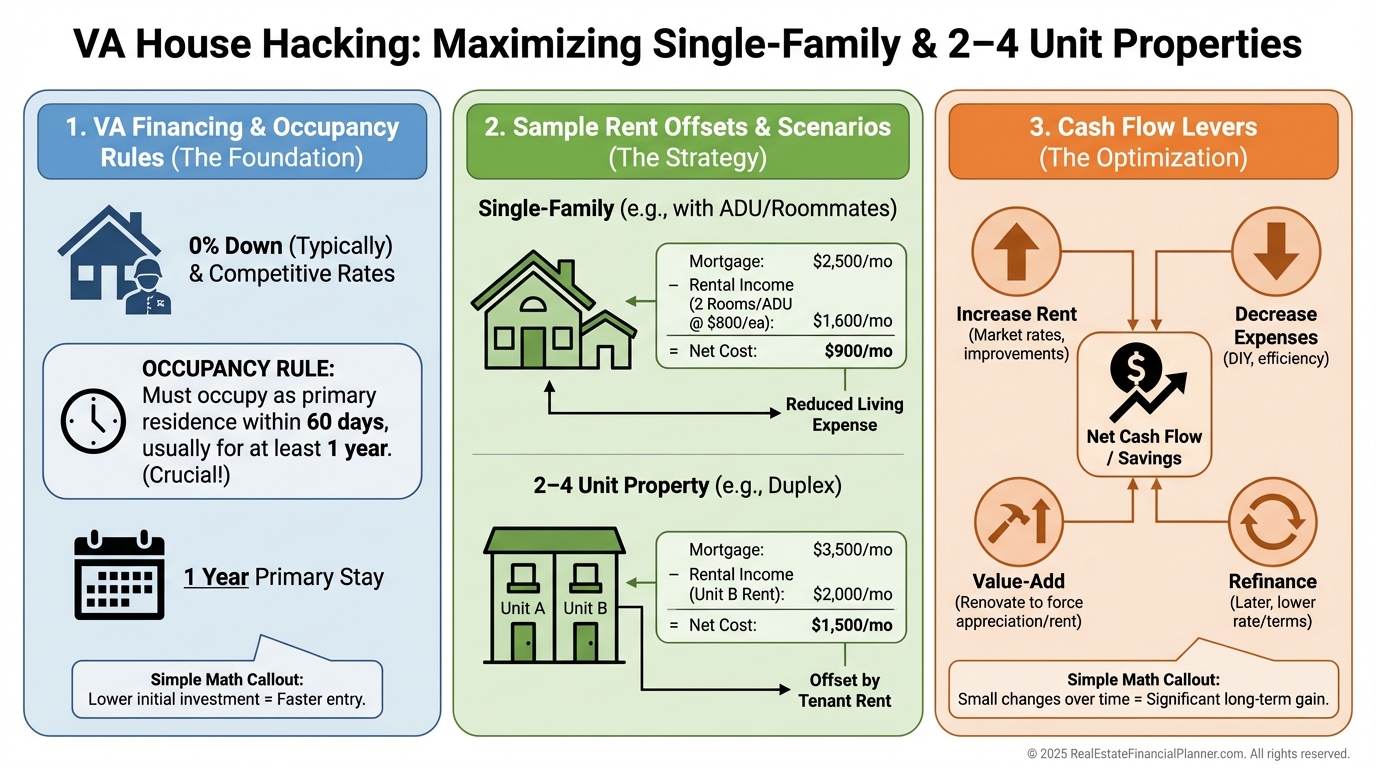

Owner-Occupancy Rules You Must Respect

You must intend to occupy within roughly 60 days. Active-duty deployments can justify delayed occupancy.

The VA doesn’t publish a fixed minimum occupancy term, but I coach clients to plan for 12 months to keep it clean and lender-compliant.

I warn clients not to misrepresent occupancy. It’s mortgage fraud and can jeopardize benefits.

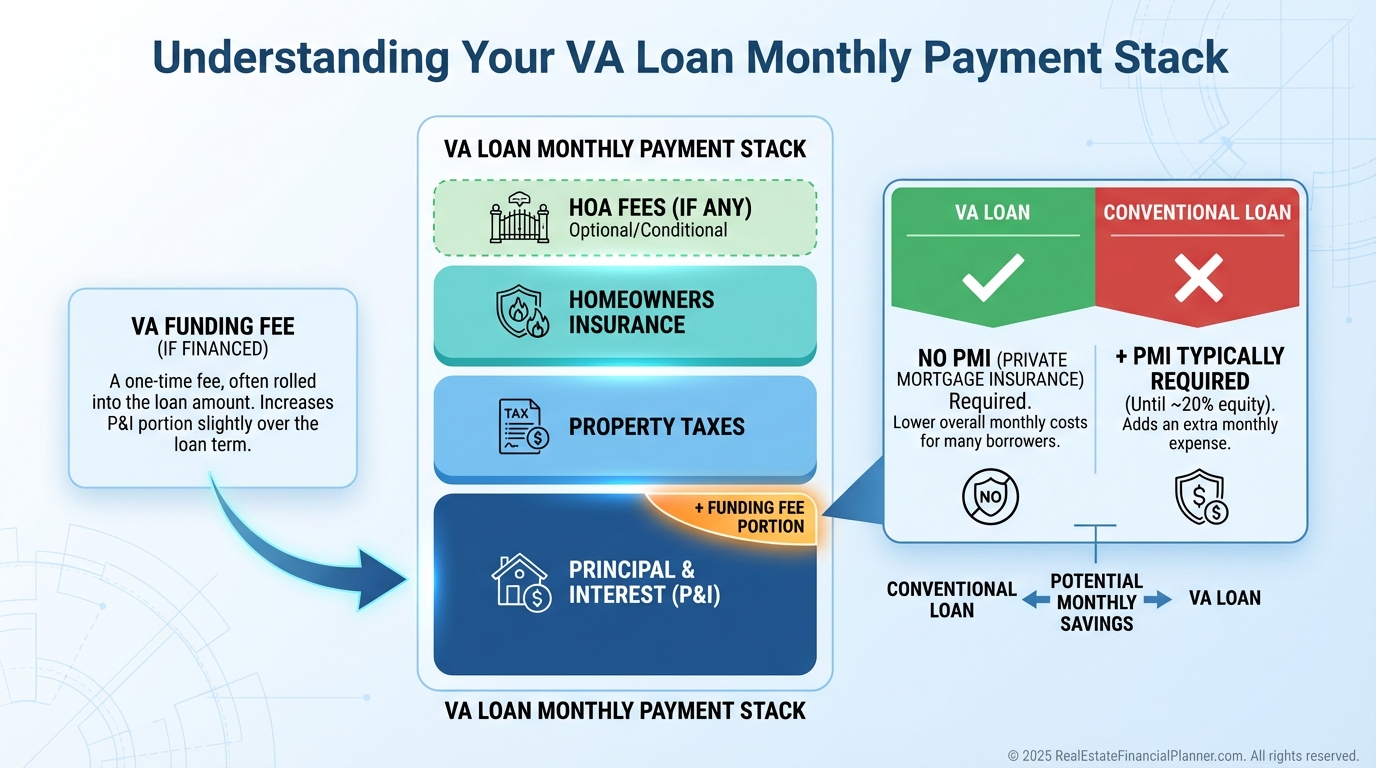

0% Down, LTV, Interest Rates, and PMI vs. Funding Fee

VA loans routinely offer 100% financing. Your starting loan-to-value (LTV) is typically 100% unless you choose to put money down.

Rates are often lower than conventional loans because of the VA guaranty. Fixed rates are common and great for predictable budgeting.

There’s no PMI. Instead, there’s a one-time VA funding fee. It varies by first-time vs subsequent use and down payment, and it can be financed.

I include the funding fee in your True Net Equity™ so you see your real position on day one.

Amortization Options

Thirty-year terms maximize cash flow and flexibility for future rentals.

Fifteen-year terms build equity faster but can thin early cash flow. I model both before we write an offer.

Entitlement, Loan Limits, and Multiple VA Loans

If you have full entitlement, there’s effectively no VA loan limit. Your cap is lender approval and your income/DTI.

If you have reduced entitlement due to another active VA loan or a previous one not fully restored, county-based limits apply and you may need a down payment.

It is possible to have more than one VA loan. I evaluate remaining entitlement before you plan your second purchase.

Seller Concessions and Closing Costs

Sellers can cover closing costs and provide concessions up to VA’s limits. Negotiation matters.

On tight cash plans, I structure offers to reduce out-of-pocket while preserving appraisal strength.

I still budget reserves. 0% down is not 0% risk.

Underwriting, Credit, and DTI

VA underwriting is often more forgiving on credit blemishes and higher DTIs than conventional.

I pre-underwrite income, variable comp, and rental offset assumptions so surprises don’t surface in week three of escrow.

Expect lender overlays. Different lenders can approve the same file differently.

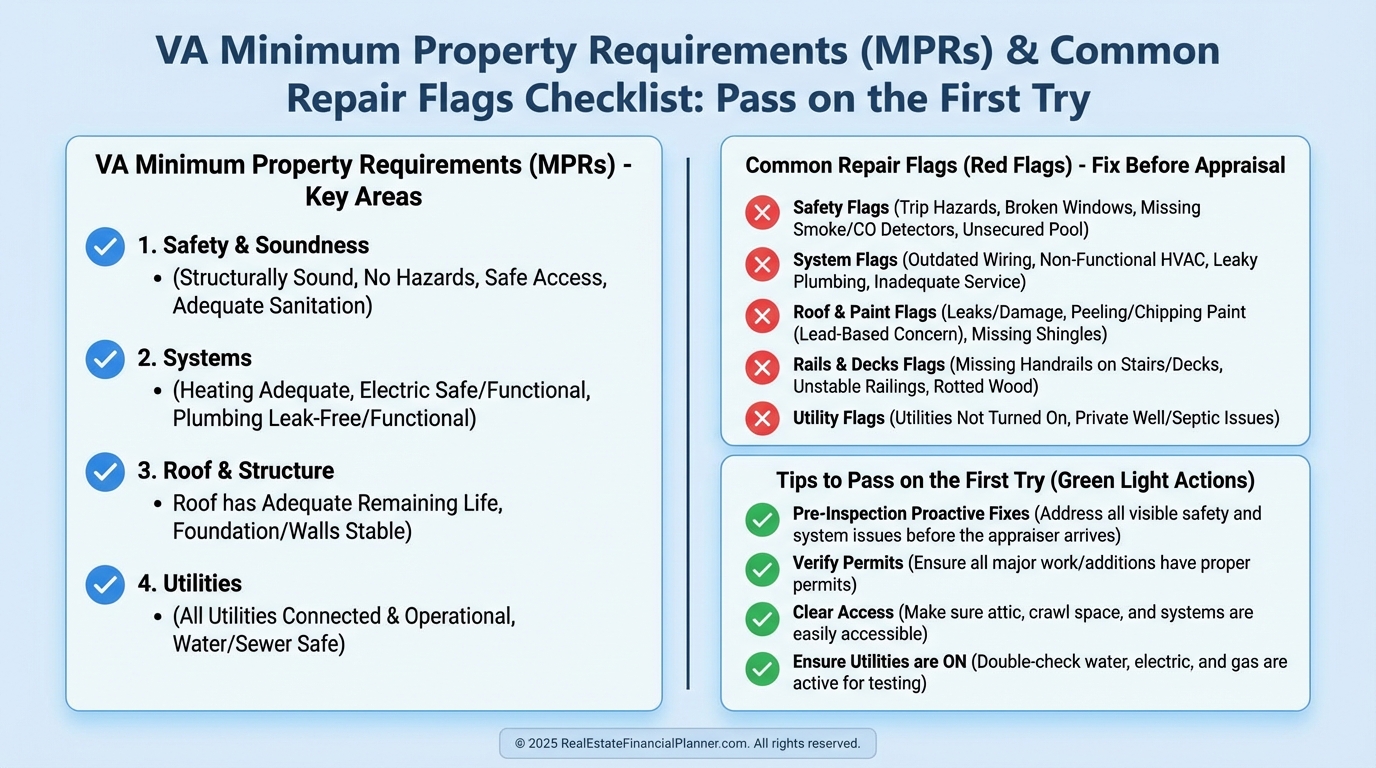

Appraisal and Minimum Property Requirements (MPRs)

VA appraisals test value and safety via Minimum Property Requirements.

I avoid borderline properties if you have a hard deadline. MPR repairs can delay closing.

Waiting Periods After Bankruptcy or Foreclosure

Chapter 7 bankruptcy typically requires a 2-year wait from discharge.

Chapter 13 can be eligible after 12 months of on-time payments with court approval.

Foreclosure waits are usually 2 years. I use this time to rebuild credit, reserves, and a clean rental plan.

When I rebuilt after bankruptcy, a simple secured-card plan and on-time utilities moved my FICO faster than I expected.

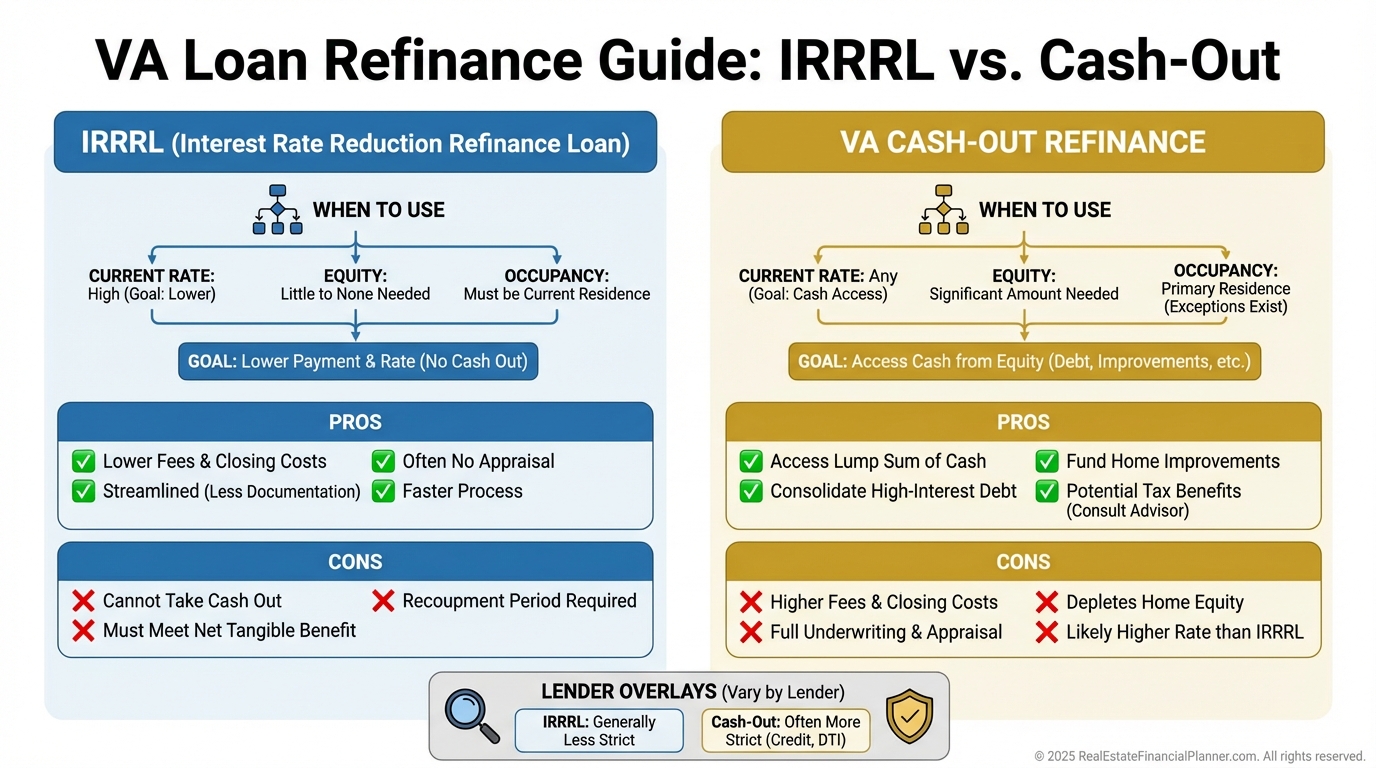

Refinancing Options: IRRRL, Cash-Out, and Recast Reality

The IRRRL is the VA streamline refi. If rates drop, you can reduce payment with minimal paperwork and only certify prior occupancy.

Cash-out refinances can go high on LTV (often up to 100% by VA rules), but many lenders cap lower. You must occupy at the time of cash-out.

Most VA loans cannot be recast with a lump-sum principal payment. I coach clients to plan payment levels they can live with long term.

Eligible Property Types

You can buy single-family homes, townhomes, condos (if VA-approved), and 2–4 unit properties.

You must occupy one unit. Short-term rental rules depend on local law and HOA, not the VA.

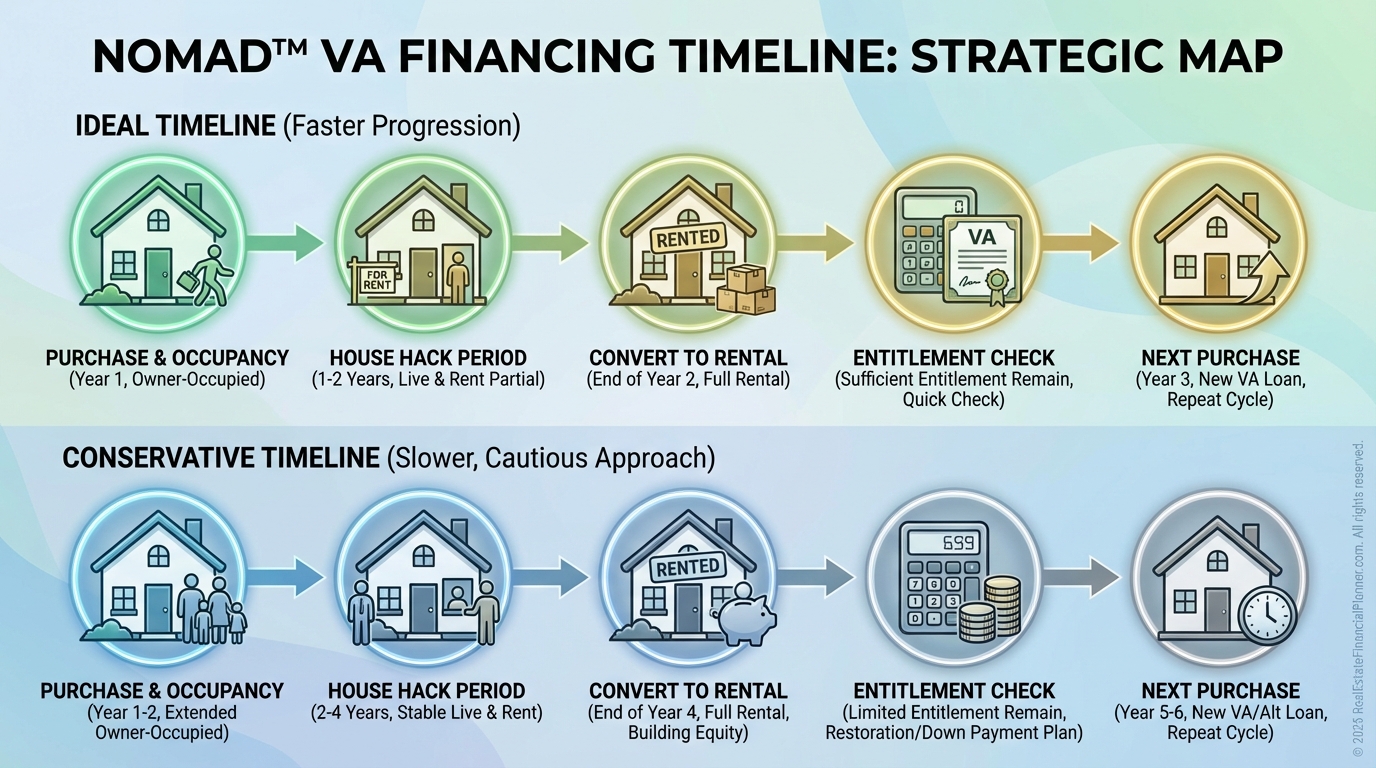

Strategy: House Hacking and Nomad™ With VA

House hack a 2–4 unit or a single-family with roommates to lower your payment.

After you’ve met occupancy, convert to a rental and move into the next primary home. That’s classic Nomad™.

If entitlement remains, you may keep the VA loan in place and buy again. If not, we pivot to FHA or conventional next.

I align lease-up dates, utility transfers, and lender timelines so you don’t trip occupancy requirements.

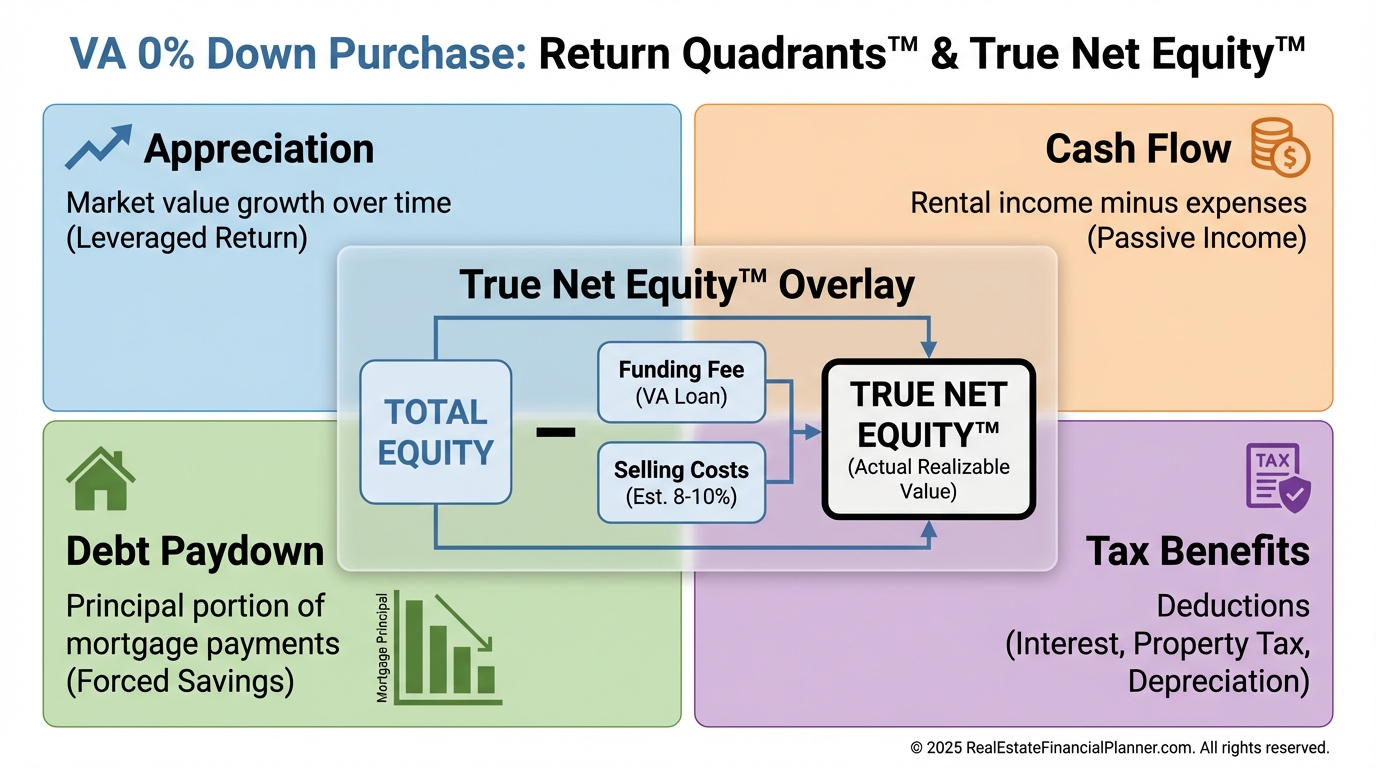

Modeling Returns the Right Way

With 0% down, cash-on-cash can look strange early. That’s normal.

I use Return Quadrants™ to show your four returns: appreciation, cash flow, debt paydown, and tax benefits.

I also track True Net Equity™ after paying selling costs and your loan payoff. Your first year’s equity includes principal paydown and any appreciation minus the funding fee you financed.

For decisions, I model stress cases: higher rates, slower rents, and a repair hit in month two. If it still pencils, we proceed.

Risks and What I Warn Clients About

Don’t stretch to the edge of your payment comfort, especially with roommates or unit vacancies.

Plan reserves. I recommend at least 6 months of PITI plus a CapEx buffer for MPR-related surprises and turnovers.

Be transparent on occupancy. Choose properties that pass MPRs without drama.

Choose lenders who actually understand VA. Overlays and execution quality matter more than rate alone.

Action Checklist

•

Pull COE and confirm entitlement.

•

Get a pre-underwrite with a VA-proven lender.

•

Select a property likely to pass MPRs.

•

Model returns with Return Quadrants™ and True Net Equity™.

•

Align occupancy and house hack plan.

•

Negotiate seller credits strategically.

•

Prepare reserves and backup rent plans.

•

Revisit IRRRL watchlist if rates improve.

VA loans are a powerful tool. Used with discipline, they speed up your path to the next front door and the rental portfolio you came here to build.