Offers That Win: Investor-Proven Tactics to Structure, Price, and Negotiate in Any Market

Learn about Offers for real estate investing.

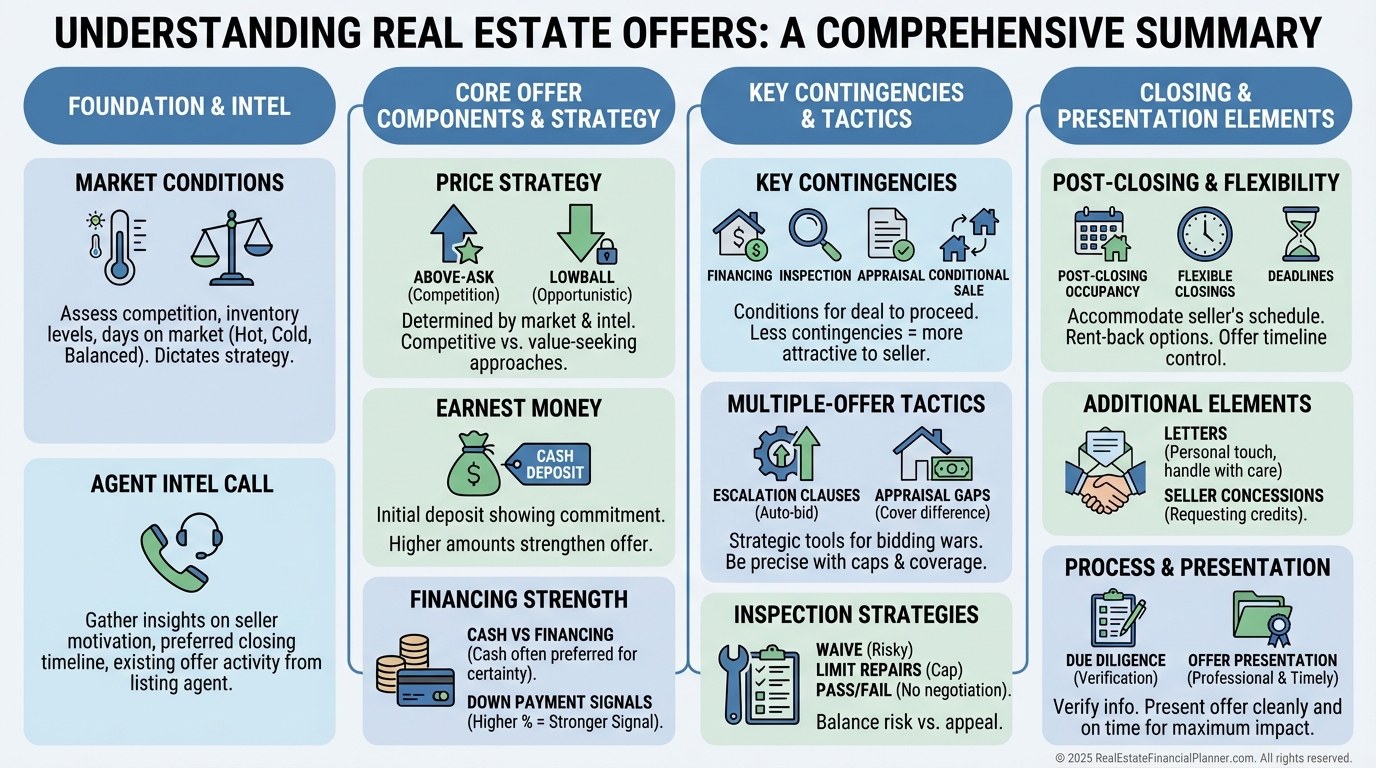

The Goal of a Great Offer

A great offer is a story the seller believes will end in a smooth closing.

Your price matters, but your terms are the plot twist that wins.

When I help clients, I write offers that sellers understand, trust, and prefer—even when we’re not the highest price.

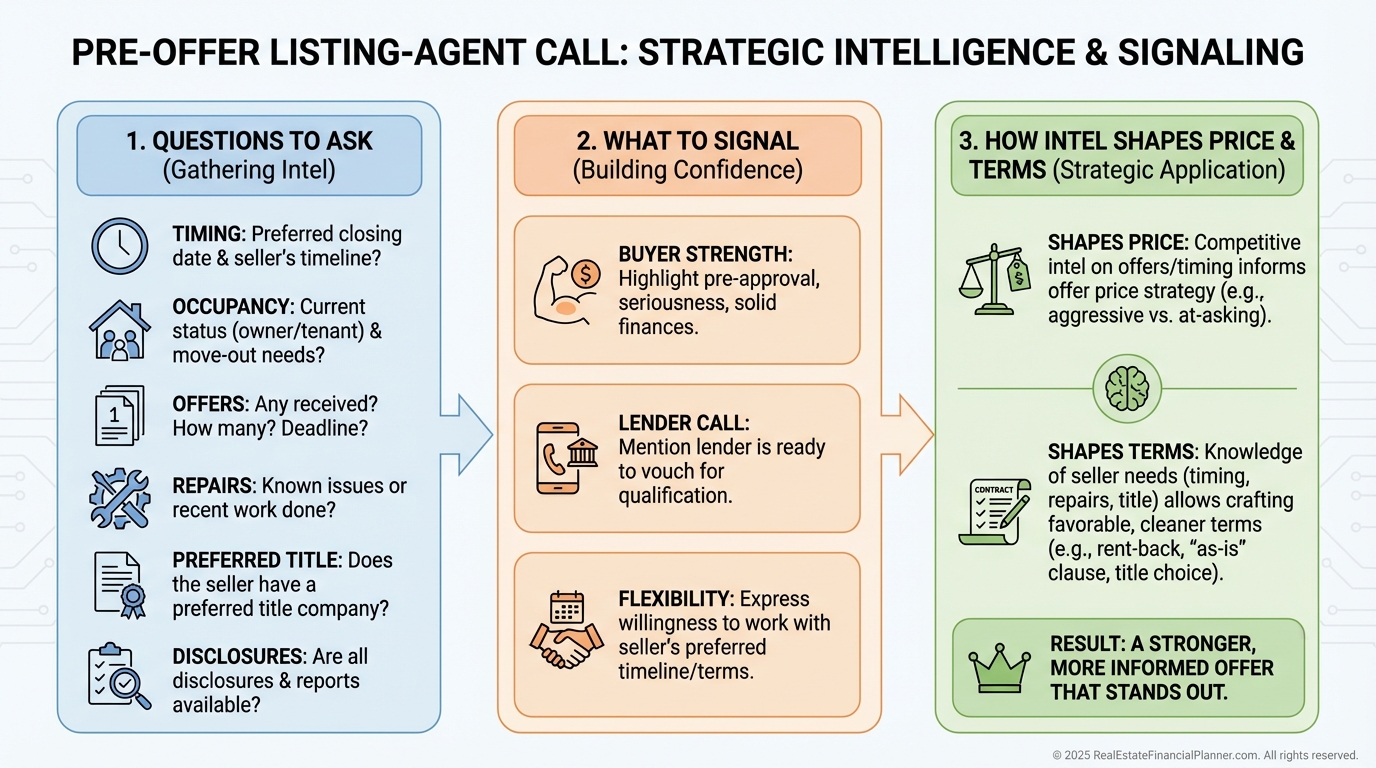

Call the Seller’s Agent Before You Write

Have your agent call the listing agent before drafting anything.

We’re collecting intel: seller’s ideal closing date, move-out flexibility, post-closing occupancy needs, due diligence already done, offer activity, and whether there are deal-breakers.

In that call, I also establish your credibility: funds, lender strength, and your track record. Credibility moves you ahead of higher but messy offers.

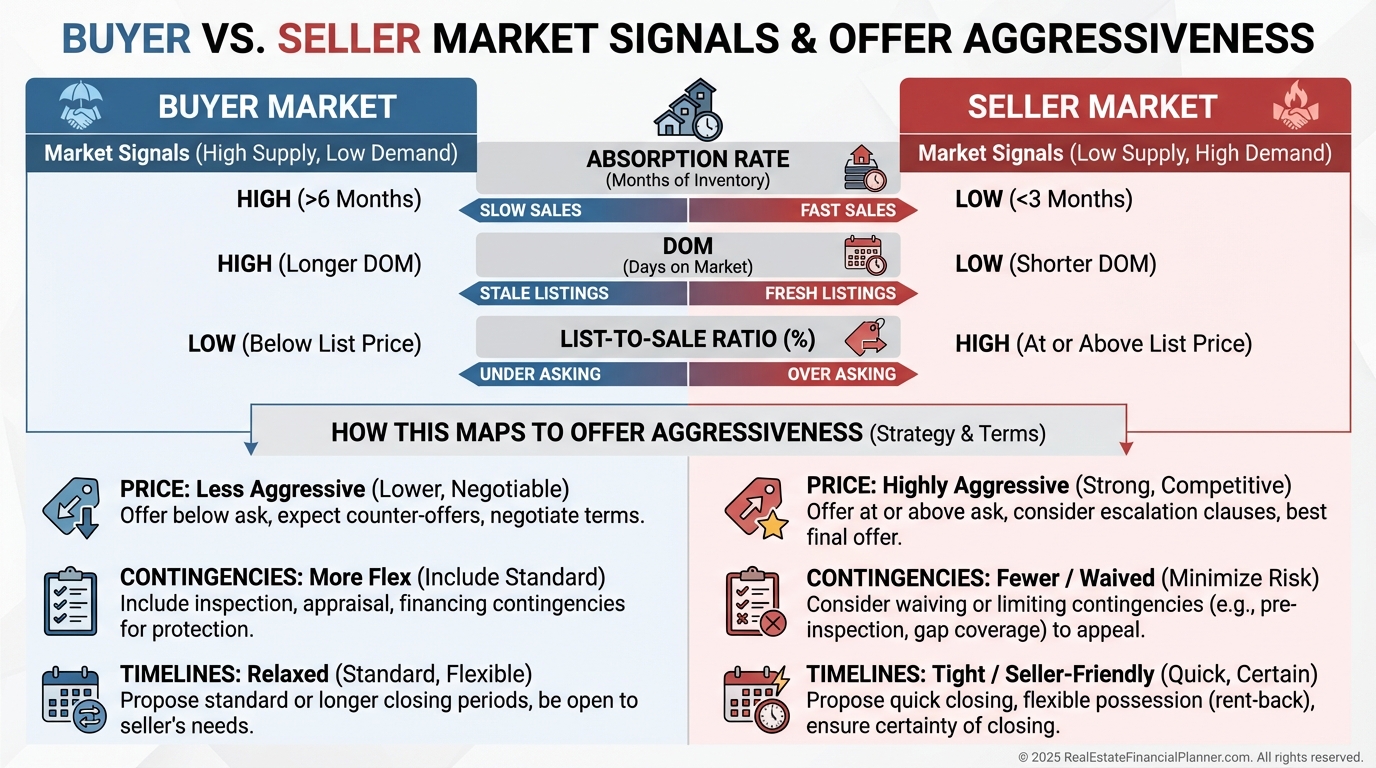

Read the Market Like an Underwriter

Know if you’re in a buyer’s or seller’s market and the neighborhood absorption rate.

I pull live data and tailor aggressiveness accordingly. Hot submarkets need cleaner terms; slower ones invite concessions.

Small shifts in days-on-market can change your tactic from “win now” to “wait and negotiate.”

What Your Agent Needs to Draft Clean Offers

Have these ready so your agent can turn offers fast and error-free.

•

Full contact info for all buyers

•

Price and max walk-away price

•

Seller concessions request (if any)

•

Financing type, down payment, lender contact

•

Closing date and occupancy needs

•

Contingencies to include/limit/waive

•

Due diligence docs you want in-contract (leases, solar/security agreements, receipts)

•

Post-closing occupancy terms (if needed)

•

Conditional sale needs (if unavoidable)

When I rebuilt after bankruptcy, speed and precision won offers I shouldn’t have won. Prep makes you fast.

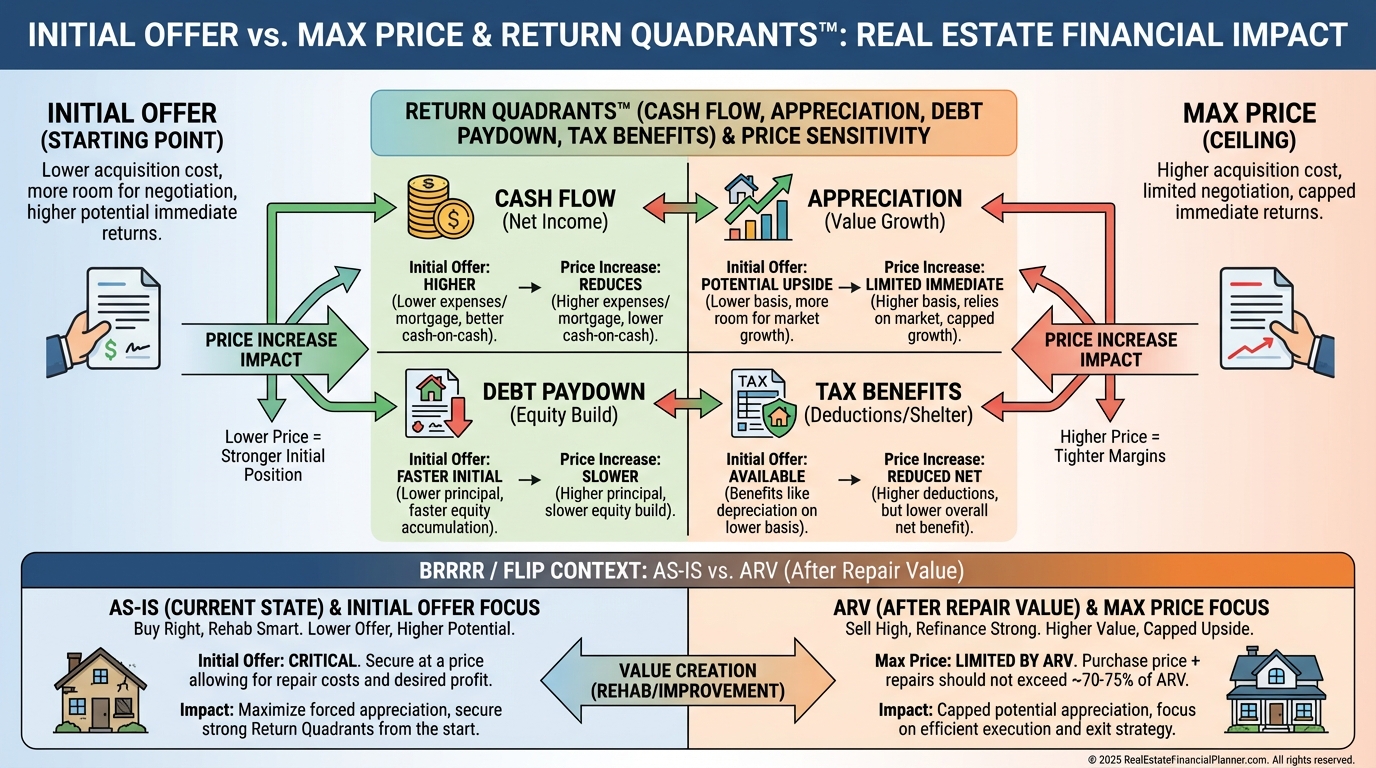

Price Strategy: Initial vs Maximum and Investor Math

Set two numbers: your opening price and your maximum.

I use The World’s Greatest Real Estate Deal Analysis Spreadsheet™ to model cash flow, Return on Equity, and impact on Return Quadrants™.

Sold Price ≠ Offer Price

Don’t mistake sold price for the original offer.

Inspection, appraisal, and repair credits often move the final number up or down.

I always ask listing agents what changed from list to close in nearby comps.

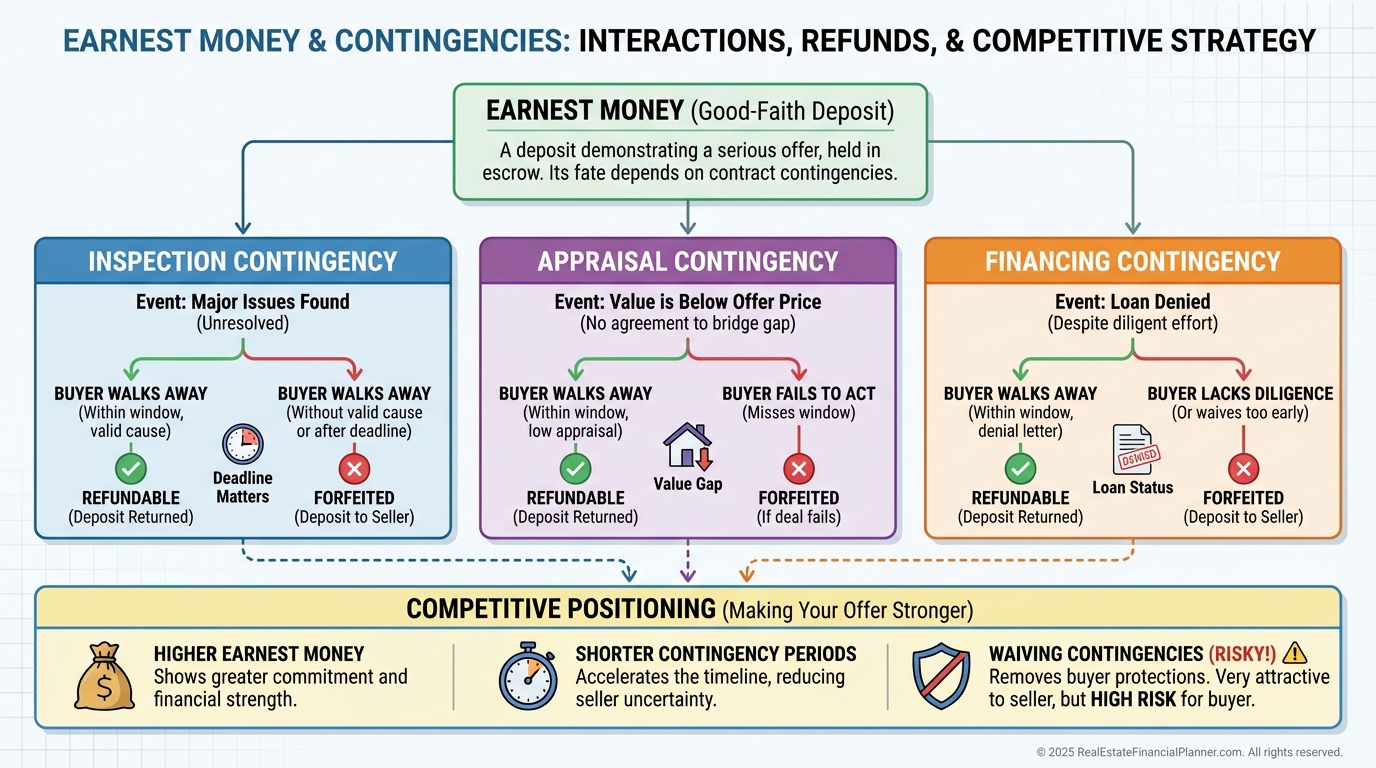

Earnest Money: Signal vs Risk

Earnest money tells the seller you’re serious, but your contingencies decide whether it’s refundable.

In clean-offer shootouts with waived contingencies, strong earnest money can be the tiebreaker.

If you keep key contingencies, earnest money is a smaller factor—but still needs to look credible.

If You Don’t Perform: Remedies and Reality

Know if your contract is earnest-money only or allows specific performance.

Failing to close can risk your deposit and invite legal action. It also burns your reputation.

I brief clients on out-of-pocket risk: inspections, appraisals, and rate-lock costs are typically sunk.

Contingencies: What to Keep, Limit, or Waive

Contingencies protect you and can cost you the house in a bidding war.

I coach clients to keep what we truly need, tighten timelines, and avoid “changed my mind” terminations that forfeit earnest money.

Use contingencies as scalpels, not sledgehammers.

Financing Strength and Pre-Approvals

A strong pre-approval beats a casual pre-qual every time.

I attach the lender letter and have the lender call the listing agent to confirm strength, reserves, and speed.

Sellers prefer conventional for fewer overlays. FHA/VA can win—just package the rest of the offer cleaner.

Cash Offers vs Financing Offers

Cash removes loan risk and shortens timelines.

Financing can still win with stronger terms, larger earnest money, and appraisal-gap solutions.

If financed, I show reserves and the ability to cover shortfalls to neutralize seller fear.

Down Payment: Perception and Strategy

Bigger down payments signal stability and the ability to solve appraisal gaps.

Smaller downs can draw more appraisal scrutiny. Tighten everything else.

Multiple-Offer Playbook

In a stack of offers, I aim for clean, believable, and fast.

Limit or time-box contingencies, solve occupancy needs, and let the lender vouch for you in real-time.

Always know your walk-away price. Discipline preserves returns.

Above-Ask Offers: When to Use Them

Use above-ask when competition is high and the deal still works at the higher basis.

I model appraisal-gap risk and the hit to True Net Equity™ and Return Quadrants™ before we stretch.

Winning is good. Winning with damaged returns is not.

Lowball Offers Without Burning Bridges

Low offers should be respectful and data-driven.

Lead with comps, condition, and time-on-market. Show your math in a way the seller’s agent can defend.

I protect client reputation; today’s “no” listing agent might be tomorrow’s “yes.”

Escalation Clauses: Use with Care

Escalations can win without overpaying upfront, but they telegraph your ceiling.

In some markets, I skip escalations and deliver my best, clean number with strong terms and a deadline.

Your local norms matter—ask your agent what works there.

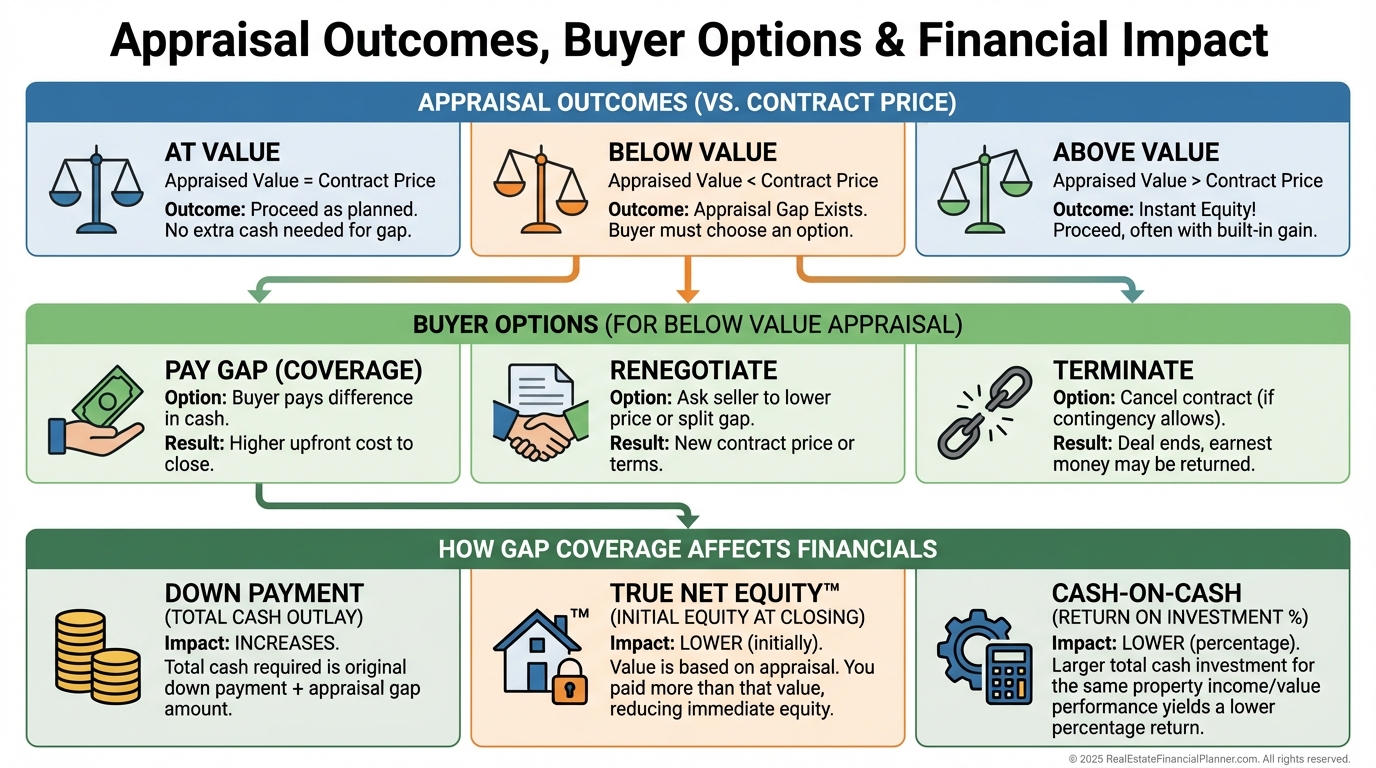

Appraisal Issues and Options

If value comes in low, you have three standard paths: pay the gap, renegotiate, or terminate if you kept the contingency.

When I expect competition, I pre-plan appraisal-gap coverage and how it impacts returns.

Use the Spreadsheet to test higher cash-in and its effect on your True Net Equity™ and cash-on-cash.

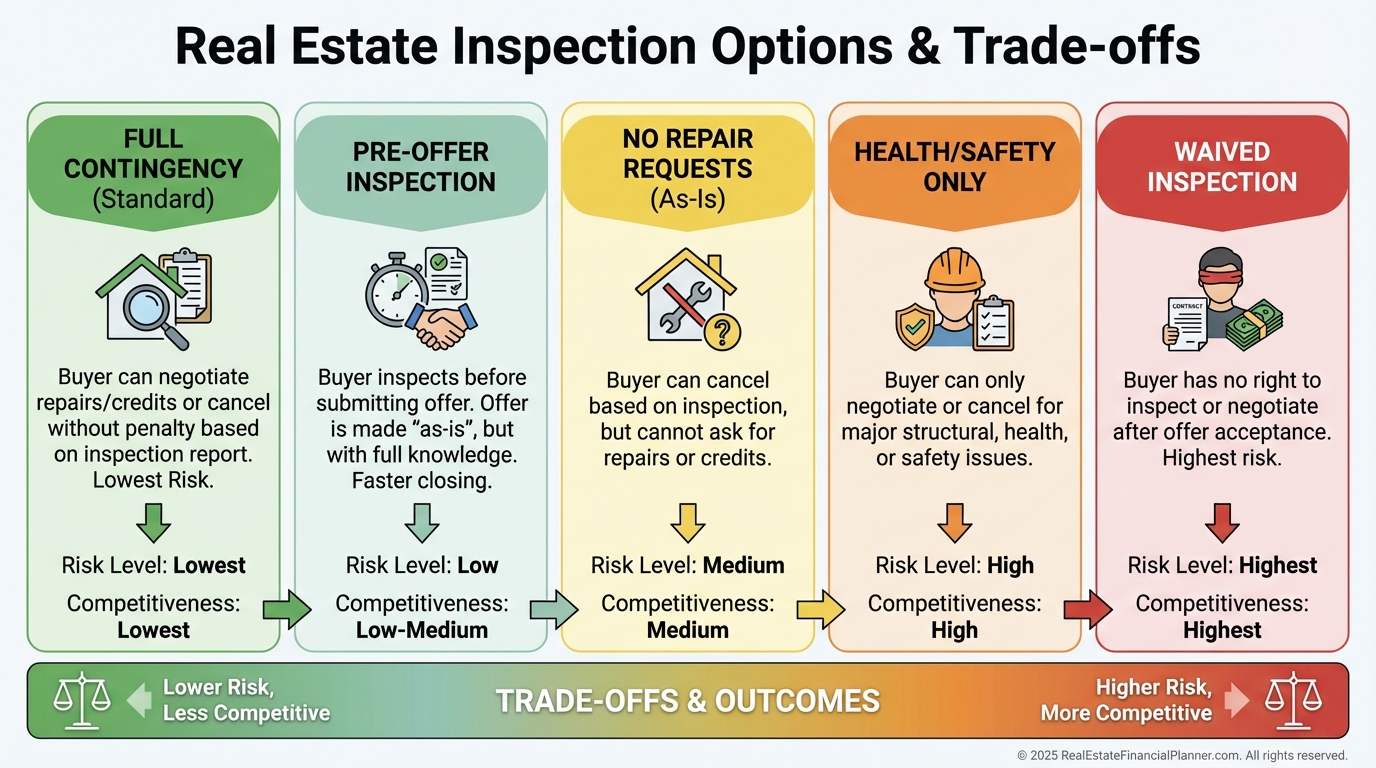

Inspection Strategy in Competitive Markets

Default: inspect. In bidding wars, consider limited versions.

Options include pre-offer inspection, waive with no termination rights, or limit to health/safety.

I only waive fully when the plan and budget already assume a remodel or heavy CapEx.

Post-Closing Occupancy Agreements

Sometimes the seller needs sale proceeds before they can move.

Offer a short post-closing occupancy with a simple lease, clear daily holdover fee, security deposit, and condition photos.

If you’re a Nomad™, confirm you can still occupy within your lender’s 60-day requirement.

Letters: Personal vs Broker

Personal letters can raise fair housing risks and distract from performance.

I prefer a broker letter that vouches for you: on-time closings, clean inspections, responsive communication.

For investors, credibility beats sentiment.

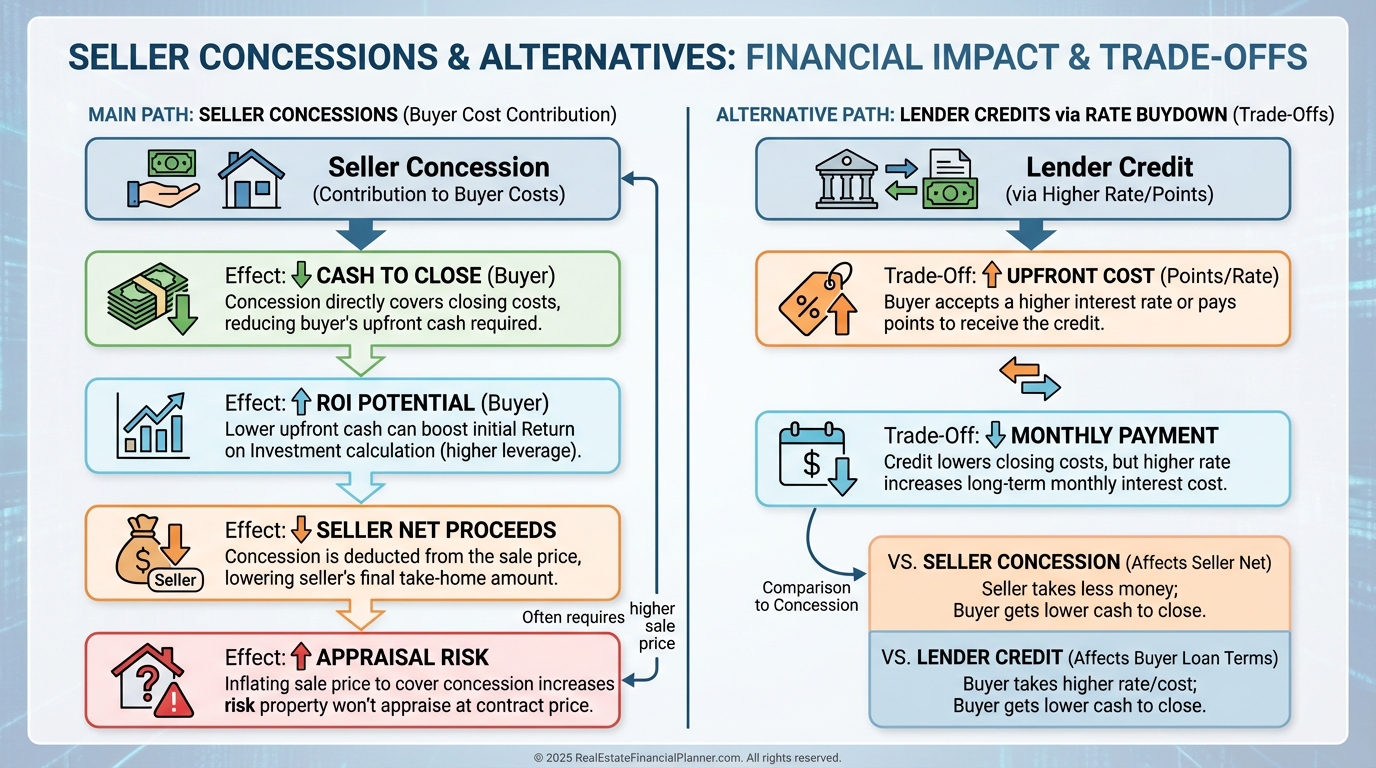

Seller Concessions: ROI and Appraisal Math

Concessions reduce your cash to close and can boost ROI, especially with small down payments.

But concessions reduce seller net and can break the appraisal if you’re already at the top of value.

If concessions don’t fly, I sometimes trade a small rate bump for a lender credit and re-check Return Quadrants™.

Due Diligence Requests: Smart, Not Heavy

Ask for what you can’t get yourself and what matters: leases, estoppels, solar/security contracts, HOA docs.

Don’t clutter your offer with busywork that telegraphs uncertainty.

Signal competence. Make it easy for the seller to say yes.

Conditional Sale Contingencies and Workarounds

Tying your purchase to selling another home makes winning harder—especially in a seller’s market.

Alternatives I use: qualify carrying both loans, sell first with post-closing occupancy, or bridge short-term via reserves.

Most Nomads™ avoid this entirely by keeping the prior home as a rental.

Flexible Closing Dates

Flexibility wins. Align your closing date with the seller’s move and financing.

Offer a window or add post-closing occupancy to absorb friction.

Just confirm your lender’s timing and any owner-occupancy rules.

Acceptance Deadlines: Timing the Ask

Short deadlines only work if your offer is strong enough to shut down shopping.

I align deadlines with the seller’s availability and showing schedule to avoid becoming a stalking horse.

Sometimes I submit near the deadline so competitors can’t anchor off us.

Offer Presentation: Clean, Complete, Credible

A perfect contract package beats a sloppy higher price.

I double-check every blank, attach proof of funds or the lender letter, and include the broker letter. Then my lender calls.

That presentation—plus the story your terms tell—is how we win offers you’re proud to own.