How to Choose and Use a Mortgage Broker for Investors

Learn about Mortgage Broker for real estate investing.

Why Your Mortgage Broker Belongs on Your Deal Team

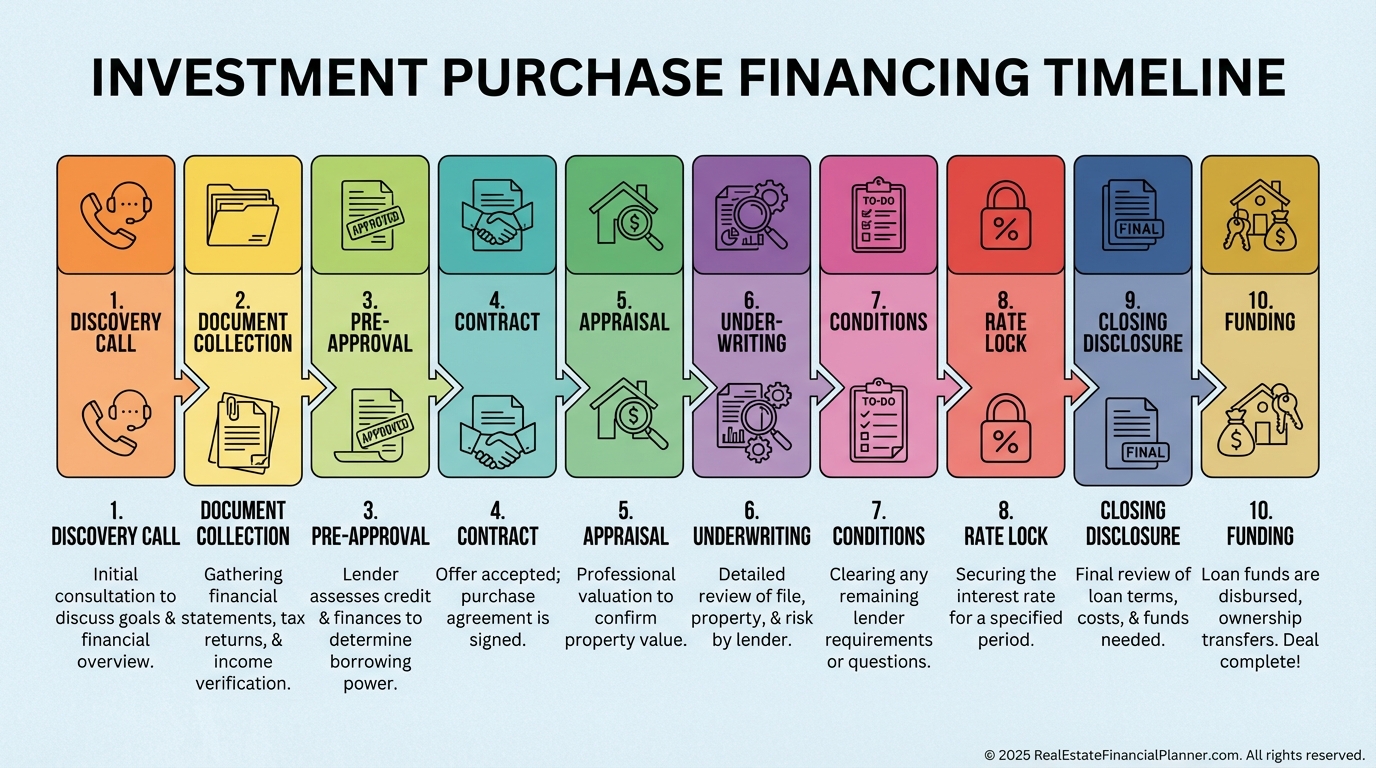

When I help clients buy their first rental, I put a mortgage broker in place before we write offer number one.

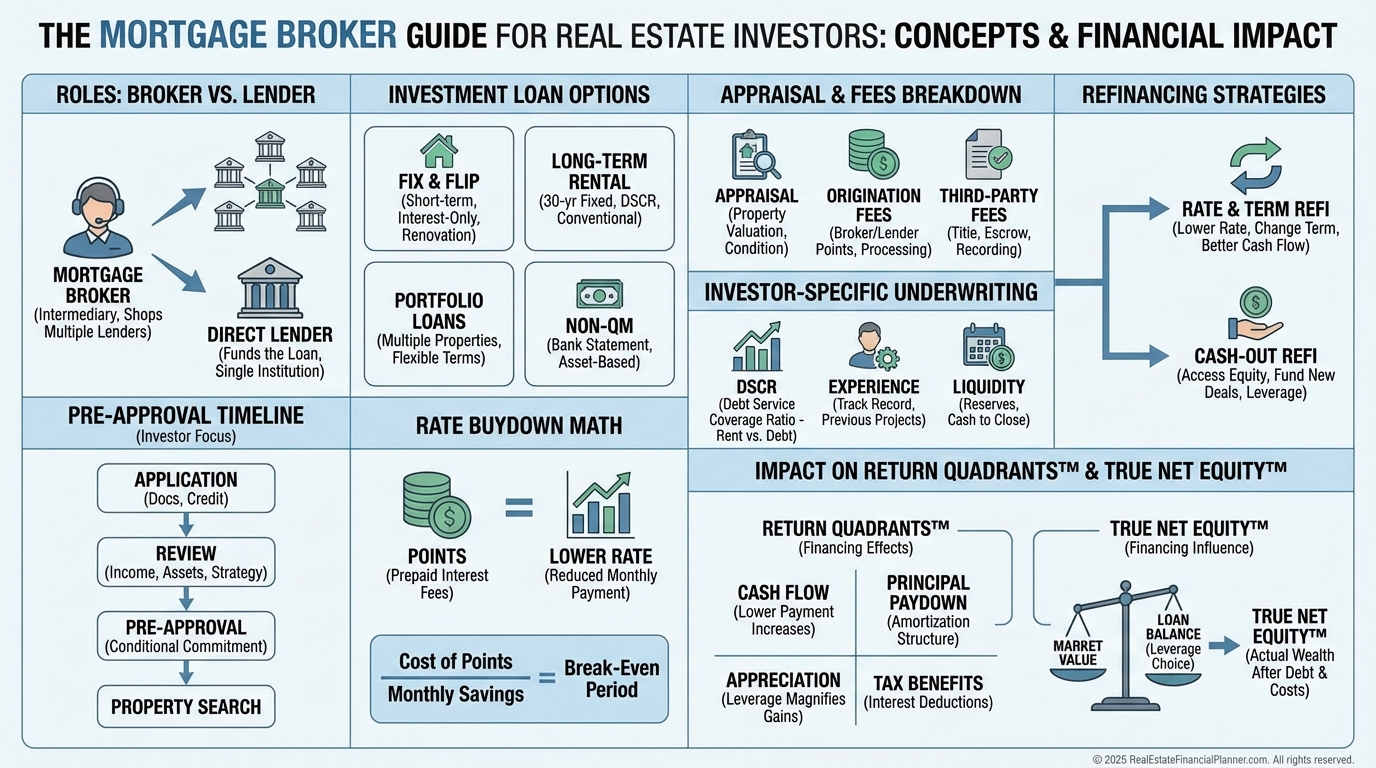

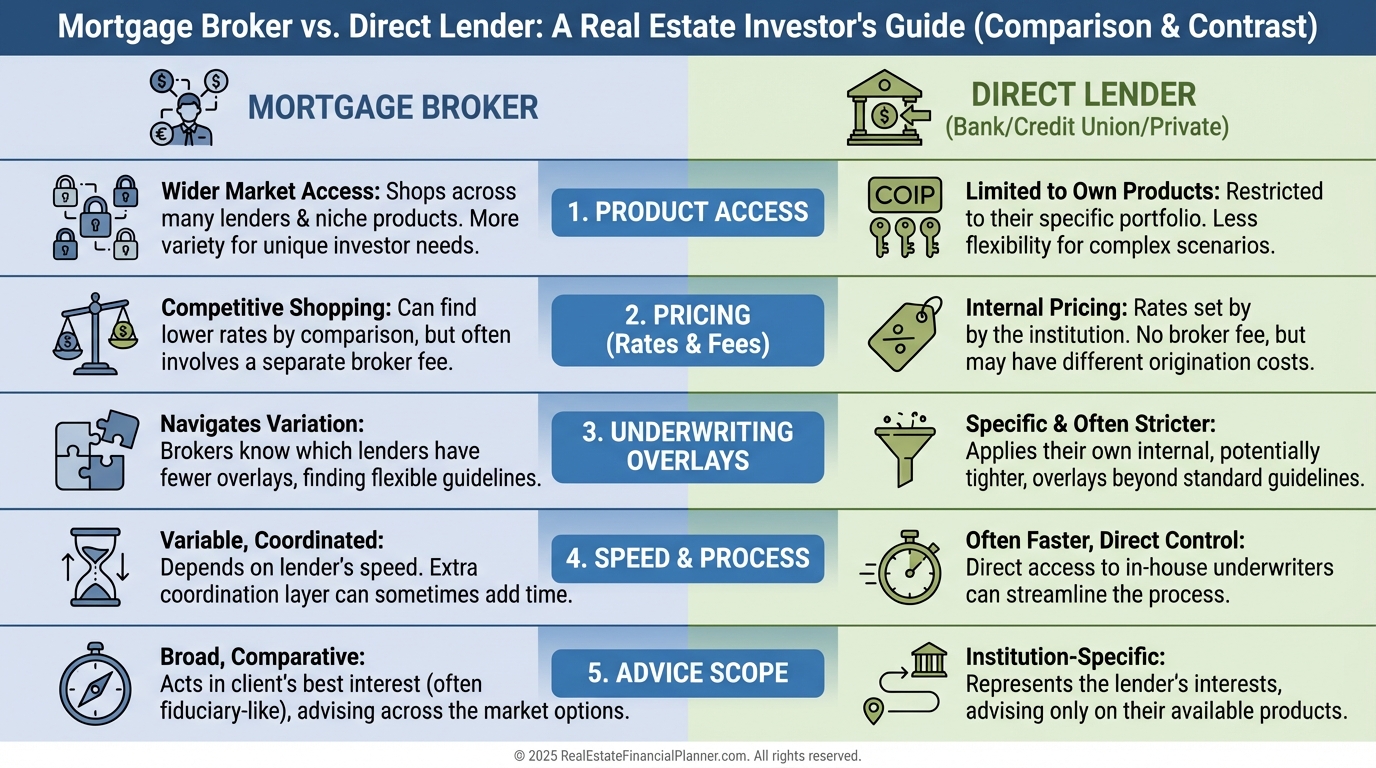

Brokers shop multiple lenders for pricing and products, while a direct lender only quotes what they sell.

Both can work, but investors usually benefit from a broker’s wider menu and candid guidance on overlays, reserves, and rental income rules.

What an Effective Mortgage Broker Actually Does

They pre-underwrite you by checking credit, income, debt-to-income, reserves, and your plan for future purchases.

They price multiple scenarios, including rate buydowns and lender credits, so you see the tradeoffs between cash now and cash flow later.

They secure a strong pre-approval and update it for each offer, so your agent can move fast without surprise conditions.

Once you’re under contract, they order the appraisal, coordinate conditions, and manage the clock for disclosures, rate locks, and the clear-to-close.

When I model deals with clients, I ask the broker to quote three lock periods and three points options, so our numbers reflect live market realities.

When to Involve Them

Call the broker when you start running serious numbers, not when you’re writing your first offer.

Pre-approval makes your offer competitive and sets honest limits for price, payment, and reserves.

Choosing the Right Mortgage Pro for Investors

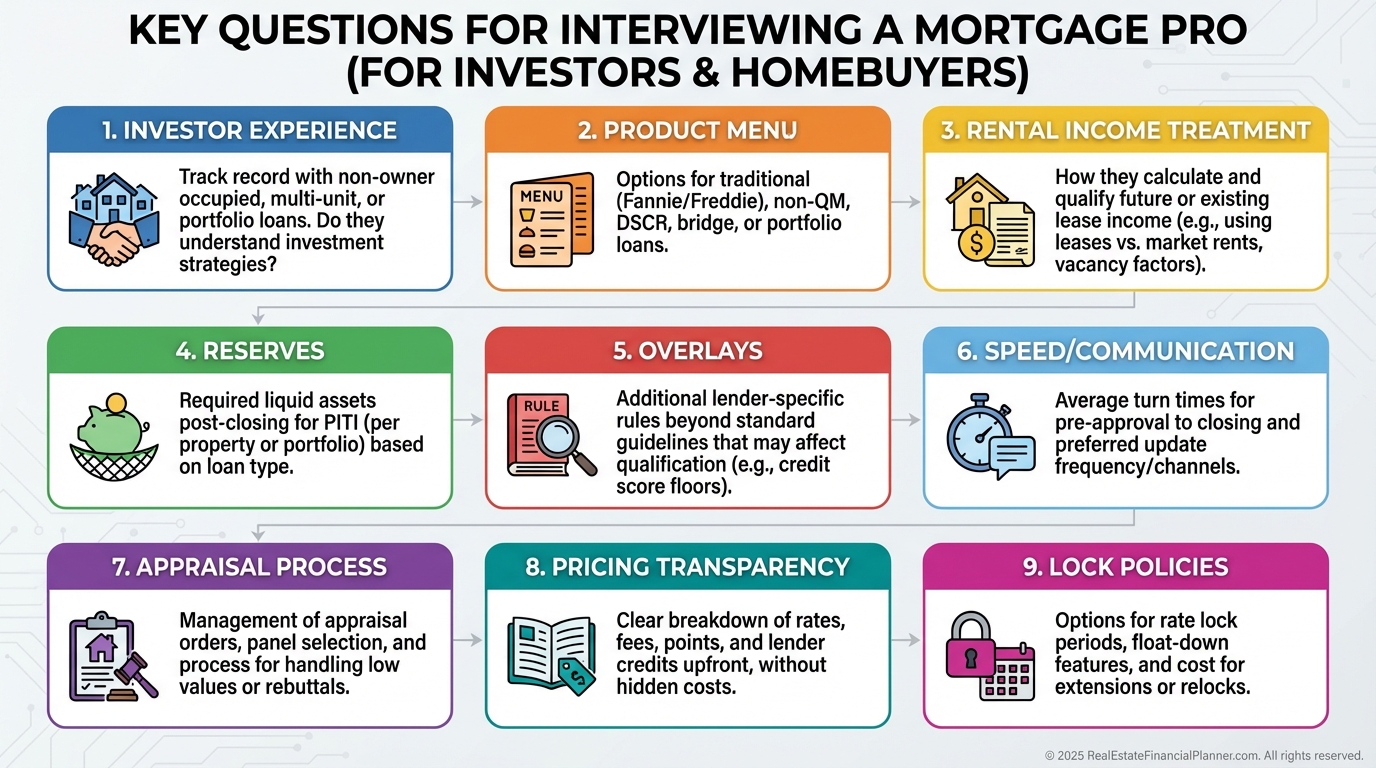

I quiz brokers on investor-specific guidelines before I let clients rely on them.

Ask how they treat rental income (lease vs. tax returns), reserve requirements, and property count limits.

Confirm their options for DSCR loans, portfolio lenders, and adjustable vs. fixed choices for short holds.

Press them on communication standards, appraisal turn-times, and whether they’ll price multiple lenders side-by-side.

Modeling the Money: How Financing Changes Returns

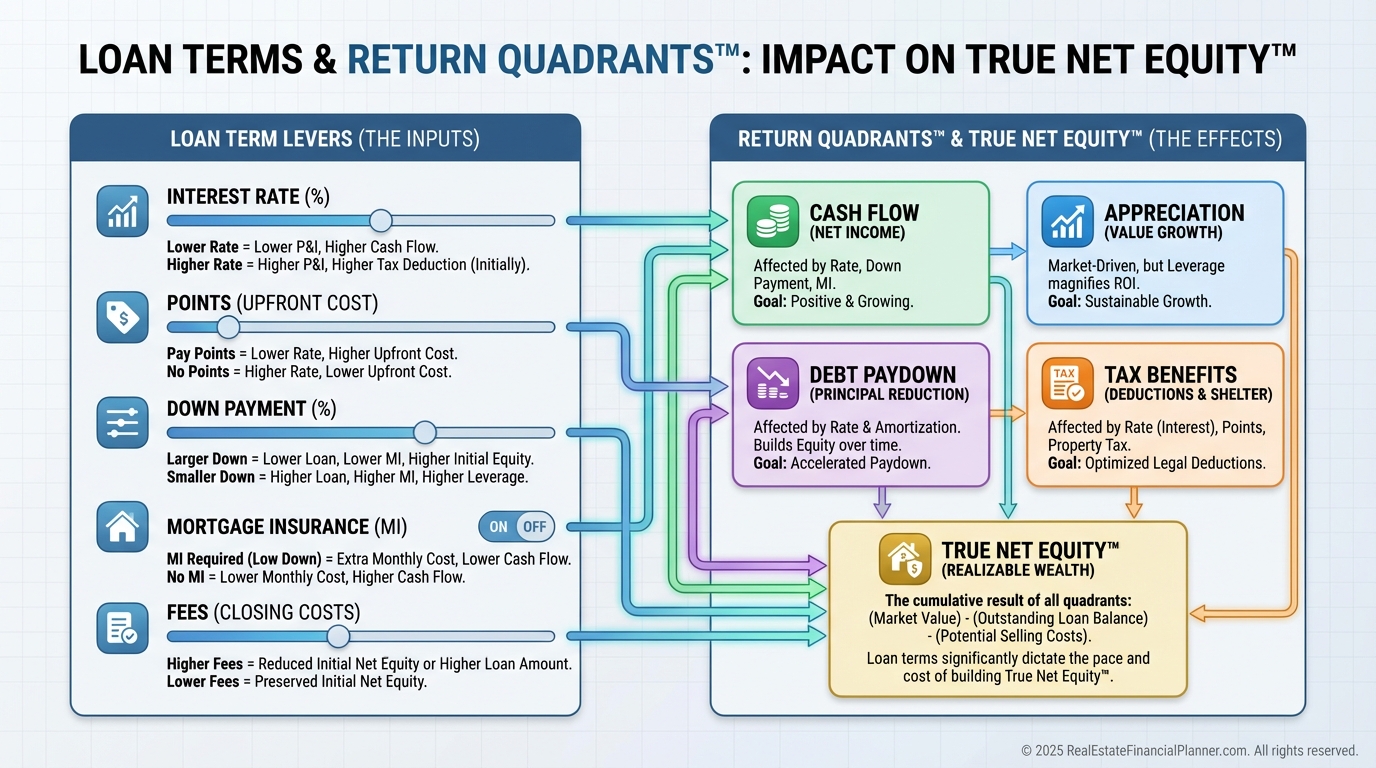

Financing alters your Return Quadrants™: cash flow, appreciation, debt paydown, and tax benefits.

Rate, points, PMI, and fees primarily move cash flow and debt paydown, while leverage magnifies both upside and risk.

When I evaluate a loan choice, I update True Net Equity™ to reflect closing costs, points paid, and payoff balances over time.

Then I compare the risk-adjusted return per dollar of liquidity left after closing, so we’re not blind to the cost of cash.

One change in rate or MI can flip a deal from negative to positive cash flow; we verify with a full property analysis, not a napkin guess.

Rate Buydowns and Points: When Paying More Now Pays Less Later

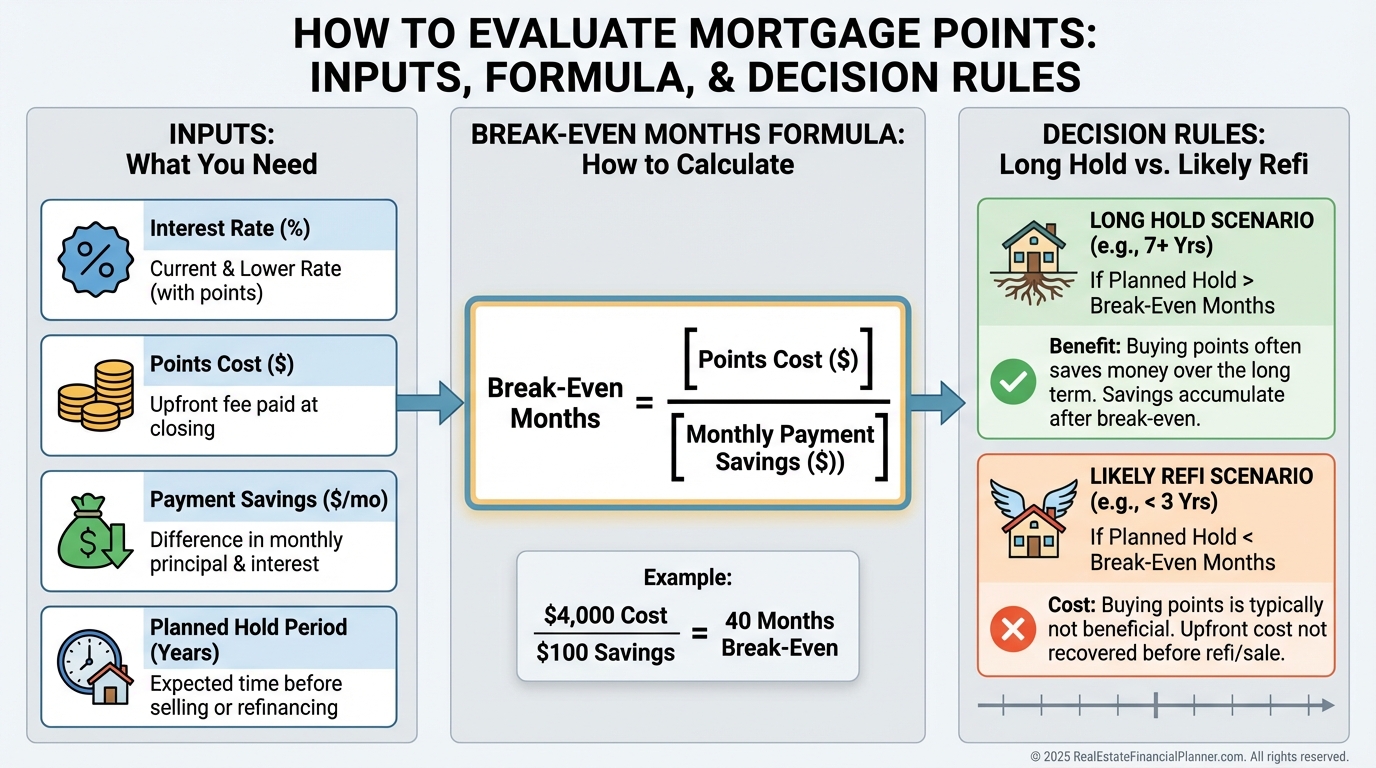

Permanent buydowns cut your rate for the life of the loan; temporary buydowns (2-1/1-0) ease year-one cash flow.

My quick test is simple: break-even months = cost of points ÷ monthly payment savings.

If you expect to sell or refinance before break-even, paying points usually fails.

If you plan to hold long-term and rents are rising, points often improve lifetime cash flow and total return.

I have brokers price 0-, 1-, and 2-point options at 30-, 45-, and 60-day locks, then we select based on hold period and refinance odds.

Common Loan Types Your Mortgage Broker Can Source

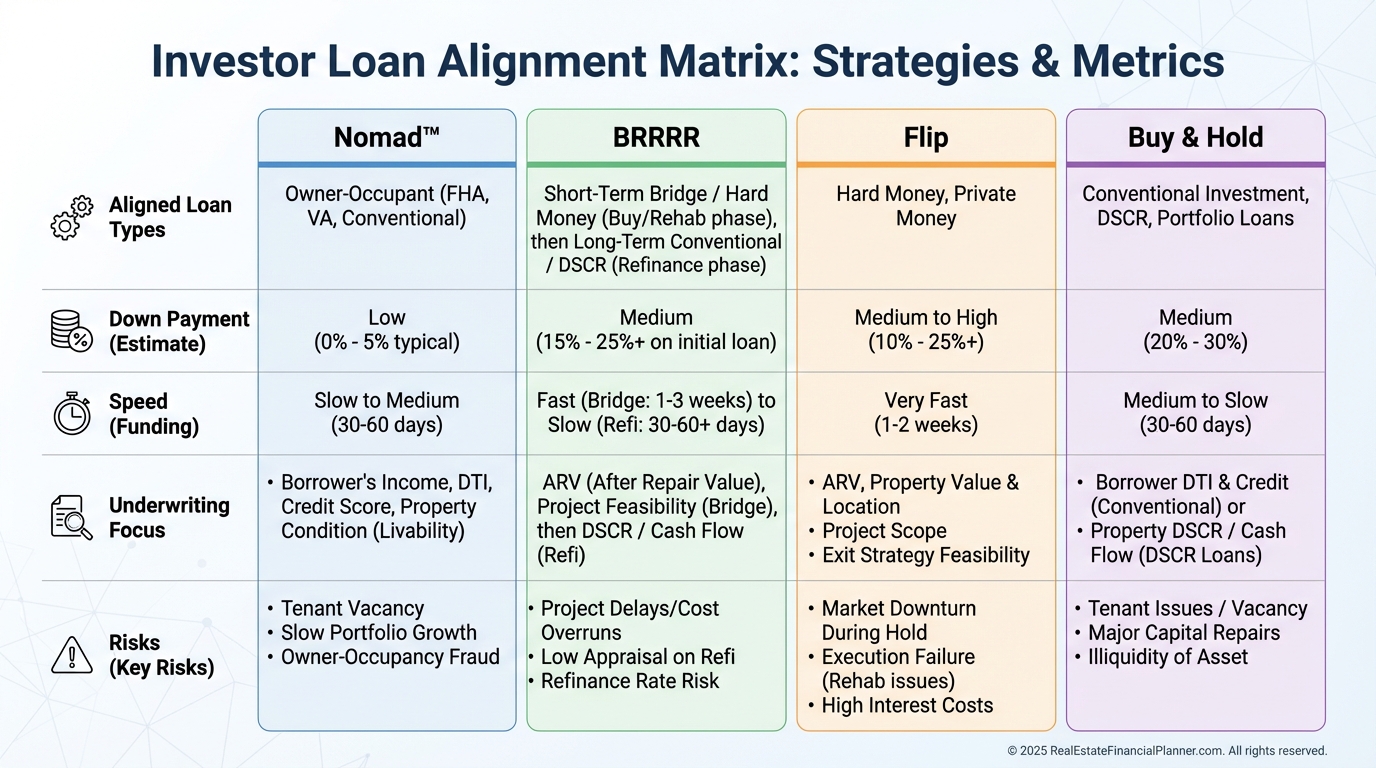

Conventional loans suit many rentals with 20%–25% down, strict DTI, and competitive rates.

VA offers zero-down for eligible buyers, including small multis with occupancy and no PMI.

USDA can fit Nomad™ in rural areas with zero down and income limits.

Portfolio and local bank loans add flexibility on unique properties, seasoning, and higher property counts.

DSCR loans qualify on property income rather than your W-2, helpful for scaling or self-employed investors.

Private and hard money fund BRRRR and flips quickly, with costs tied to speed and asset value.

HELOCs and business lines of credit create down payments or rehab budgets from existing equity.

Commercial loans focus on NOI for 5+ units, with different underwriting, prepayment penalties, and reserves.

Creative financing (owner carry, subject-to, lease options) can work, but legal and risk management must be precise.

Refinancing and Optimizing After You Own

When rates drop or equity grows, I compare three paths: recast, second lien/HELOC, or full refinance.

I calculate the blended rate and payment impact against closing costs to see if a refi actually pays.

For cash-out, I stress-test the new payment against realistic rents and vacancies, not best-case.

Your broker can run pricing for rate-term vs. cash-out and help you avoid prepayment penalties.

Costs, Fees, and Appraisals: No Surprises

Expect origination, processing, underwriting, appraisal, credit, title, and escrow fees.

Your Loan Estimate arrives early; your Closing Disclosure must match within tolerances.

The lender orders the appraisal via an AMC, and for rentals you may see a 1007 rent schedule and 216 operating income statement.

If value misses, your broker can guide a reconsideration with factual comps and time-on-market data.

Documents and Underwriting: How to Make It Easy

Have two years of W-2s or returns, recent pay stubs, bank statements, IDs, and full leases for current rentals.

Source large deposits, show reserves, and avoid opening new credit during the loan.

For Nomad™, document intent to occupy; for DSCR, provide rent rolls, lease terms, and insurance quotes.

I keep a ready-to-send doc packet so my clients can lock quickly when pricing is favorable.

Red Flags and Mistakes to Avoid

Writing offers before pre-approval invites delays and weakens your negotiating power.

Letting a lock expire can erase your cash flow in one day of market movement.

Moving down payment funds late can trigger sourcing headaches and closing delays.

Ignoring the CD until the final day is how junk fees and unexpected points sneak in.

Action Plan

Define your strategy and hold period so your broker can match the right loan.

Interview two to three investor-savvy brokers and demand side-by-side pricing.

Get pre-approved and assemble your document packet before touring.

Have your broker price points vs. no points across multiple lock windows.

Run full property analyses with Return Quadrants™ and True Net Equity™ to confirm performance.

Lock when pricing hits your target, then manage appraisal, conditions, and CD deadlines.

After closing, calendar a 6–12 month review to assess refi, recast, or HELOC options as the market shifts.