Net Operating Income (NOI): Formula, Examples & Tips

Learn about Net Operating Income for real estate investing.

Why Net Operating Income Rules the Deal

Most investors brag about rent.

When I help clients buy well, we obsess over Net Operating Income because that’s what prices the asset, qualifies the loan, and funds your plan.

NOI is the operating engine.

If it’s strong, you have options. If it’s weak, the deal owns you.

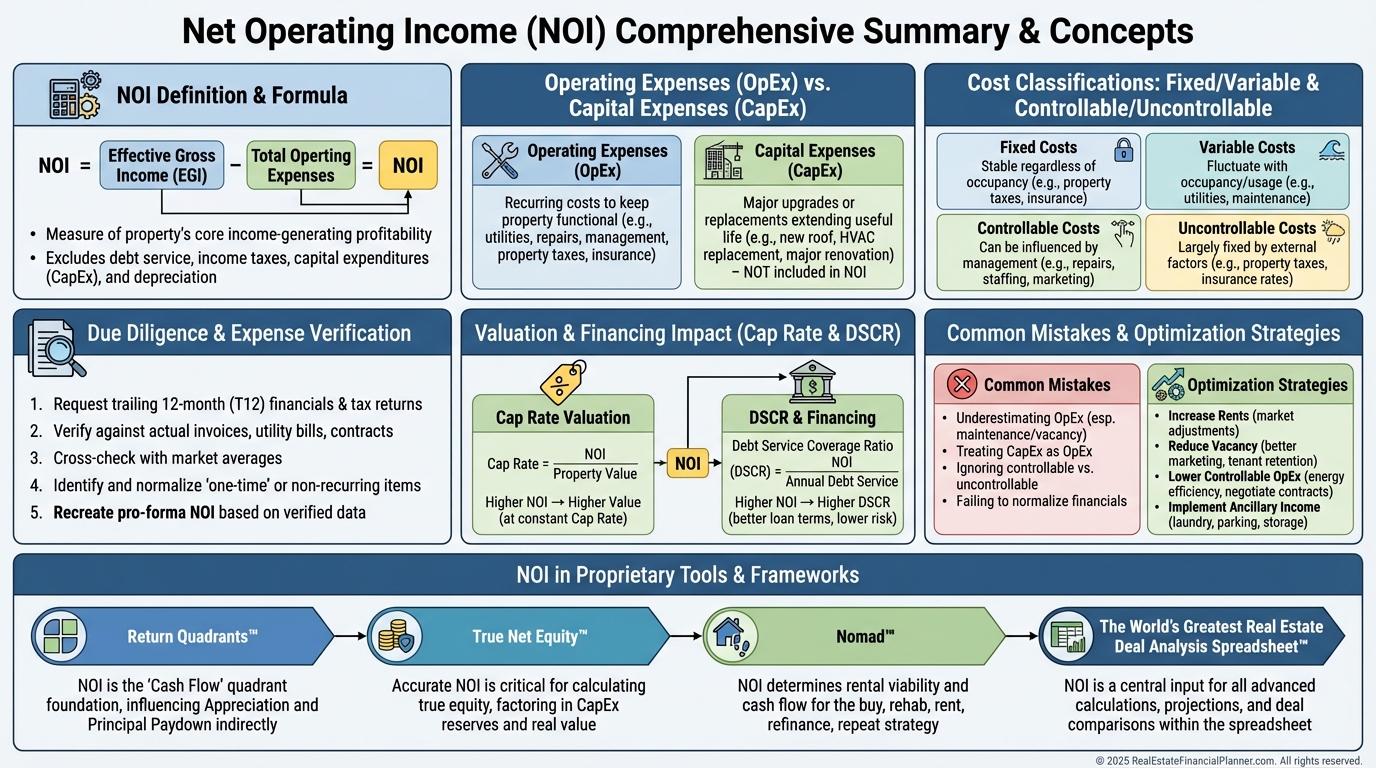

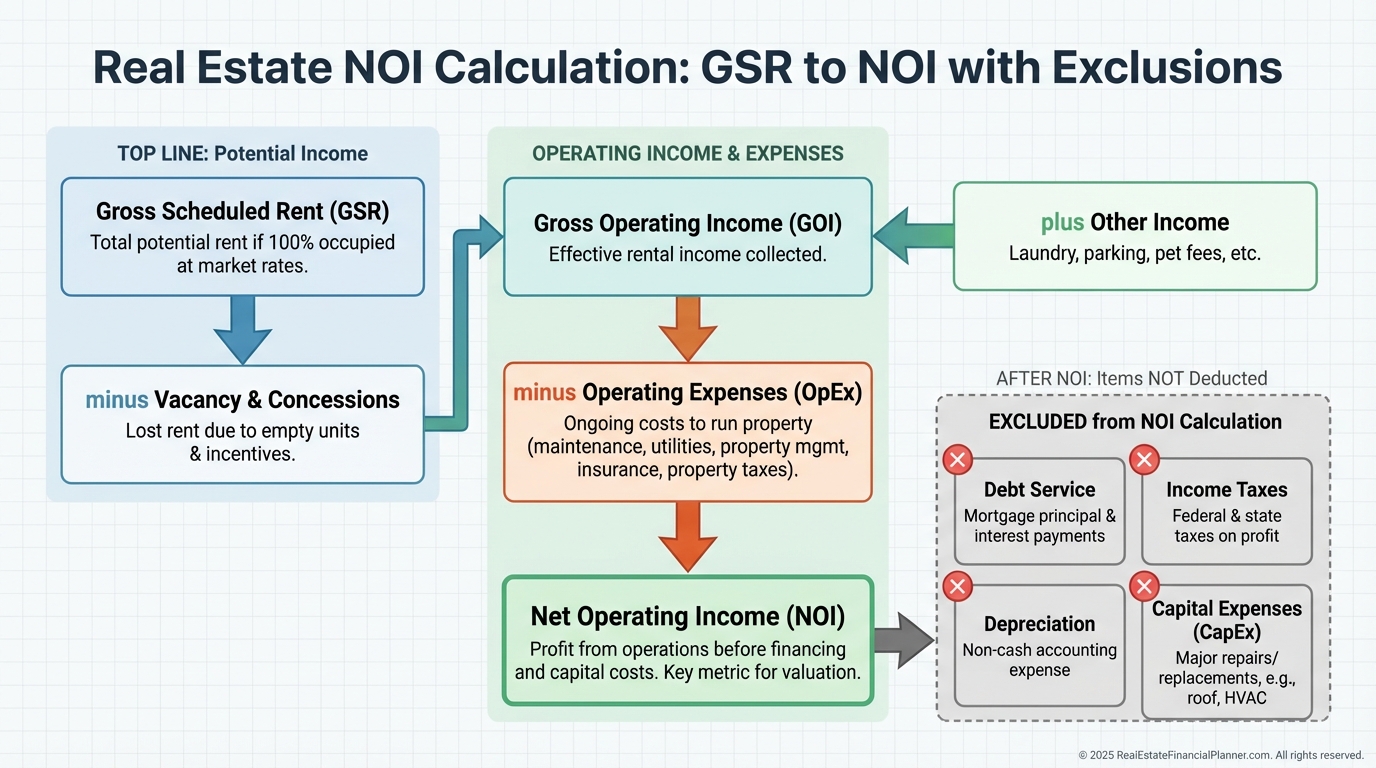

Exactly What Counts as NOI

Net Operating Income is the property’s annual income from operations minus operating expenses, before debt, depreciation, and income taxes.

It’s financing-neutral and taxes-neutral, so you can compare two deals cleanly, regardless of loan terms or tax profile.

On The World’s Greatest Real Estate Deal Analysis Spreadsheet™, NOI is the bridge from rent assumptions to returns.

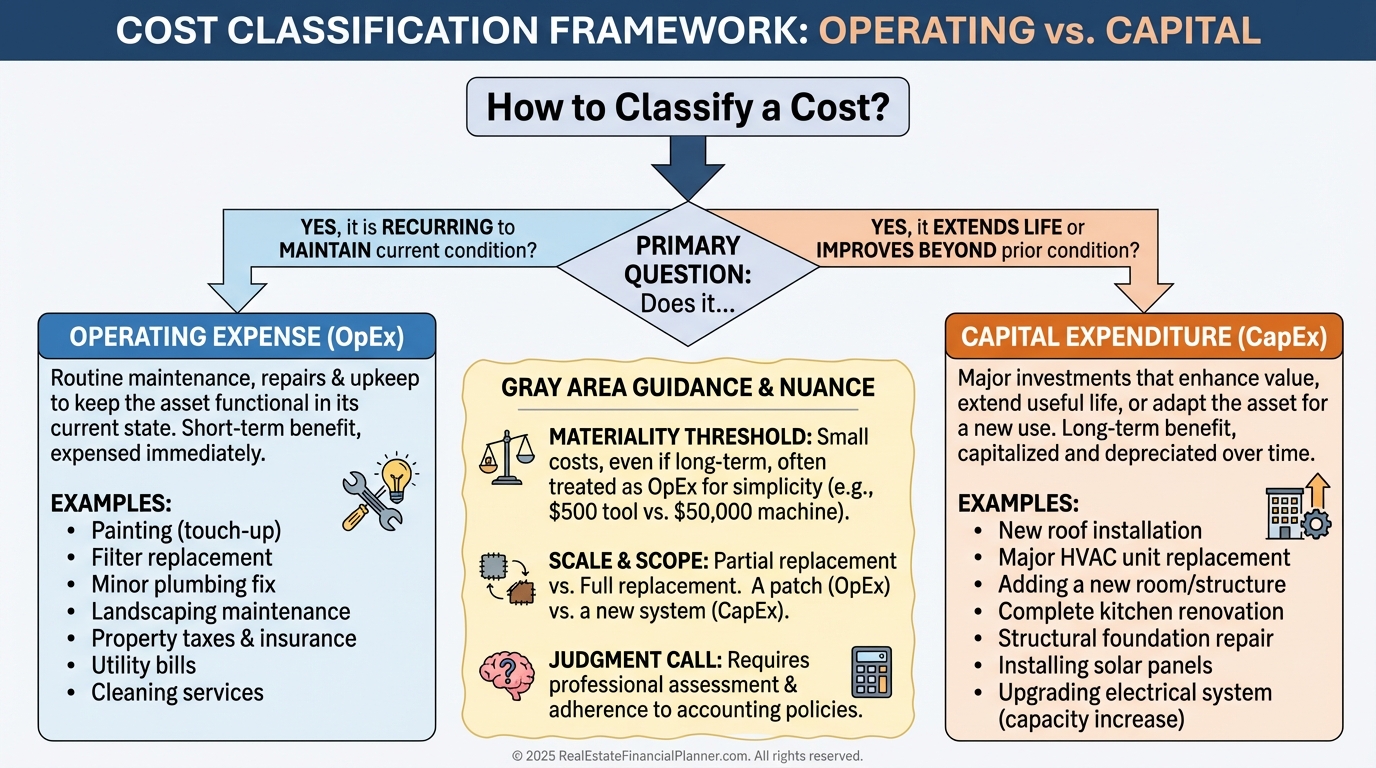

Operating vs. Capital Expenses (and the gray areas)

Operating expenses keep the property in its current condition and keep rent coming in.

Think taxes, insurance, management, maintenance, turns, utilities (if landlord-paid), leasing/marketing, admin, HOA, and ongoing compliance.

Capital expenses improve, extend life, or replace beyond like-for-like.

Roofs, HVAC systems, major exterior, full kitchen/bath upgrades—CapEx sits outside NOI and on the spreadsheet’s CapEx lines.

Borderline items are where investors get hurt.

Rule of thumb: restore = operating expense; improve beyond prior condition = capital expense.

Property taxes and insurance are usually your biggest fixed operating expenses.

They also tend to rise, so model that inflation explicitly.

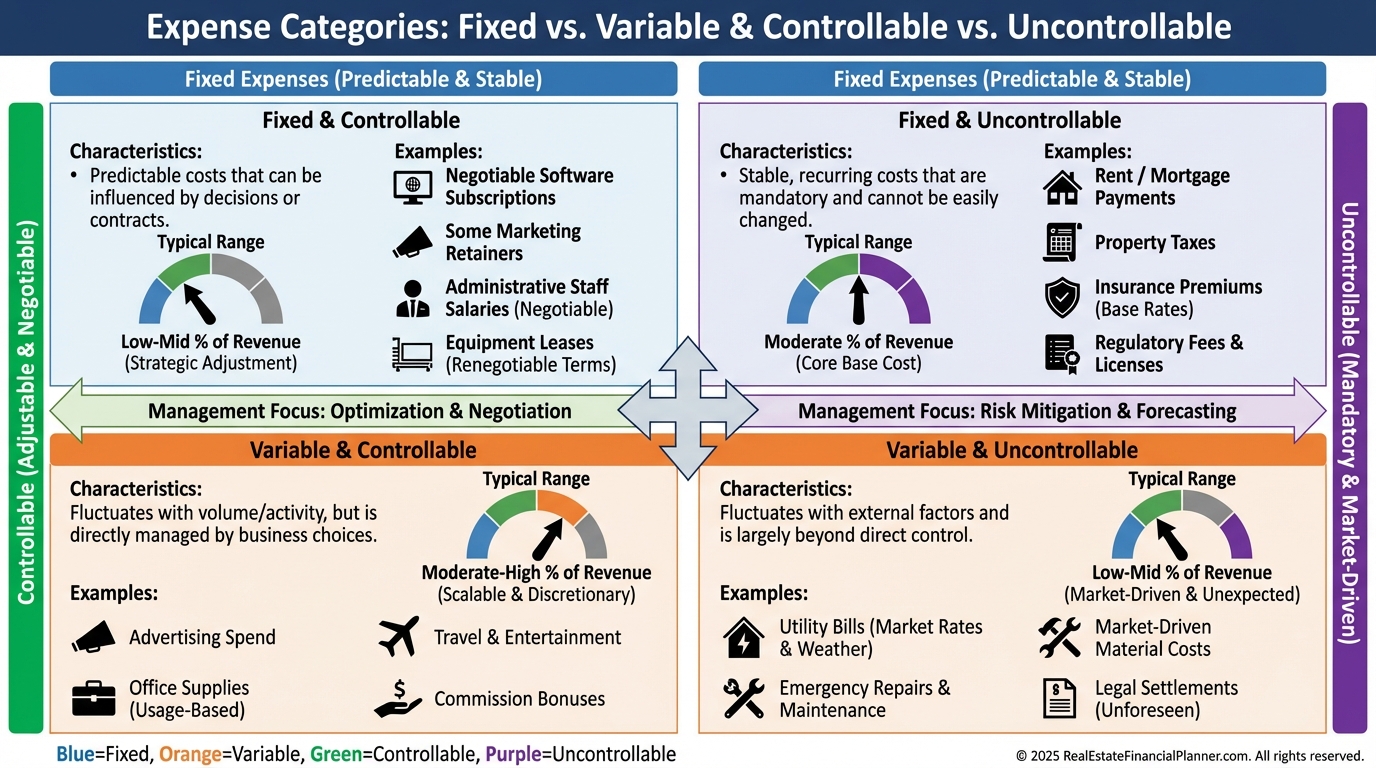

Building a Reliable NOI: Expense Categories and Assumptions

I model fixed expenses first: taxes and insurance.

Then I layer variable expenses: maintenance/repairs, turns, management, utilities, leasing, admin, landscaping, pest, snow, pool, and professional services.

I separate controllable from uncontrollable.

You can’t argue with the assessor, but you can bid vendors, reduce waste, and tighten processes.

Use inflation factors per category.

Taxes 2–5% annually. Insurance by local market. Maintenance often outpaces general CPI on older assets.

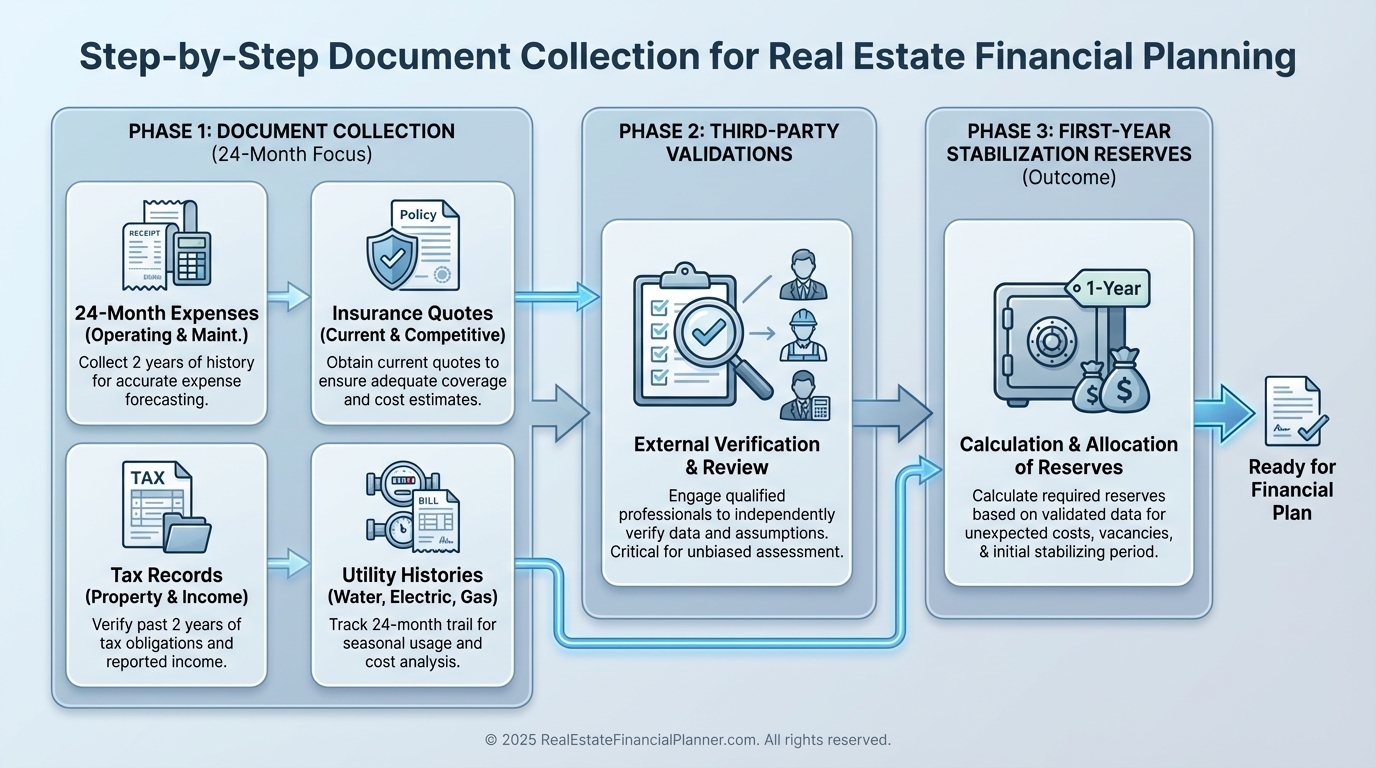

Due Diligence That Protects Your NOI

Seller numbers are a starting point, not truth.

When I underwrite, I verify 24 months of expenses with invoices, tax bills, insurance dec pages, and utility histories.

I get fresh quotes for insurance and management.

I call the utility providers for usage and rates.

I check public tax records for assessment trends and any pending increase after sale.

I ask a local property manager to sanity-check turnover, maintenance, and leasing costs.

I budget first-year stabilization work that won’t show in the seller’s P&L.

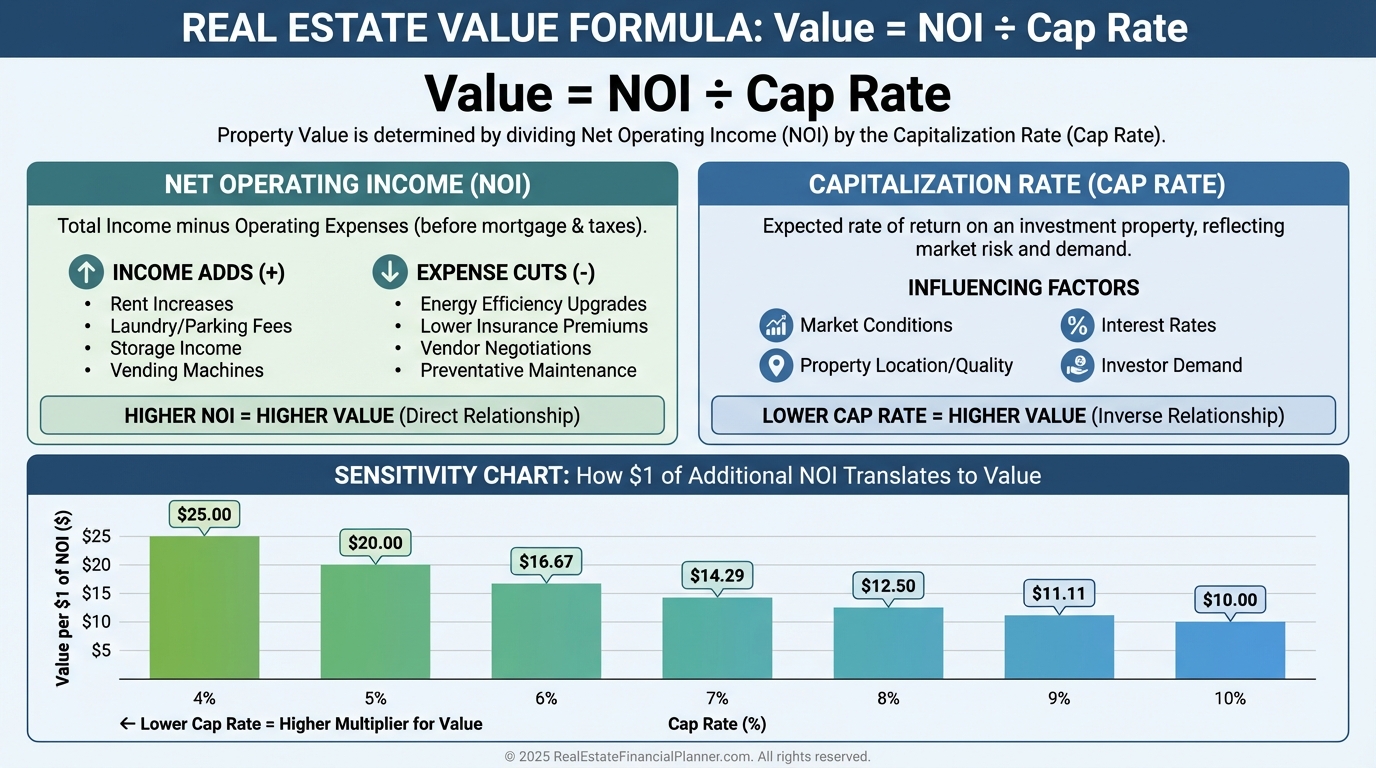

NOI Drives Value: Cap Rates and Instant Equity

Value (Income Approach) = NOI ÷ Cap Rate.

That’s why a $1 increase in NOI can add $10–$20 of value at typical 5–10% cap rates.

Reducing wasteful expenses is value creation.

Optimizing other income (utility billbacks, pet rent, storage, parking) is value creation.

Strong, documented NOI growth earns tighter cap rates because it reduces perceived risk.

Time your buy and sell, but build your returns on NOI improvements you control.

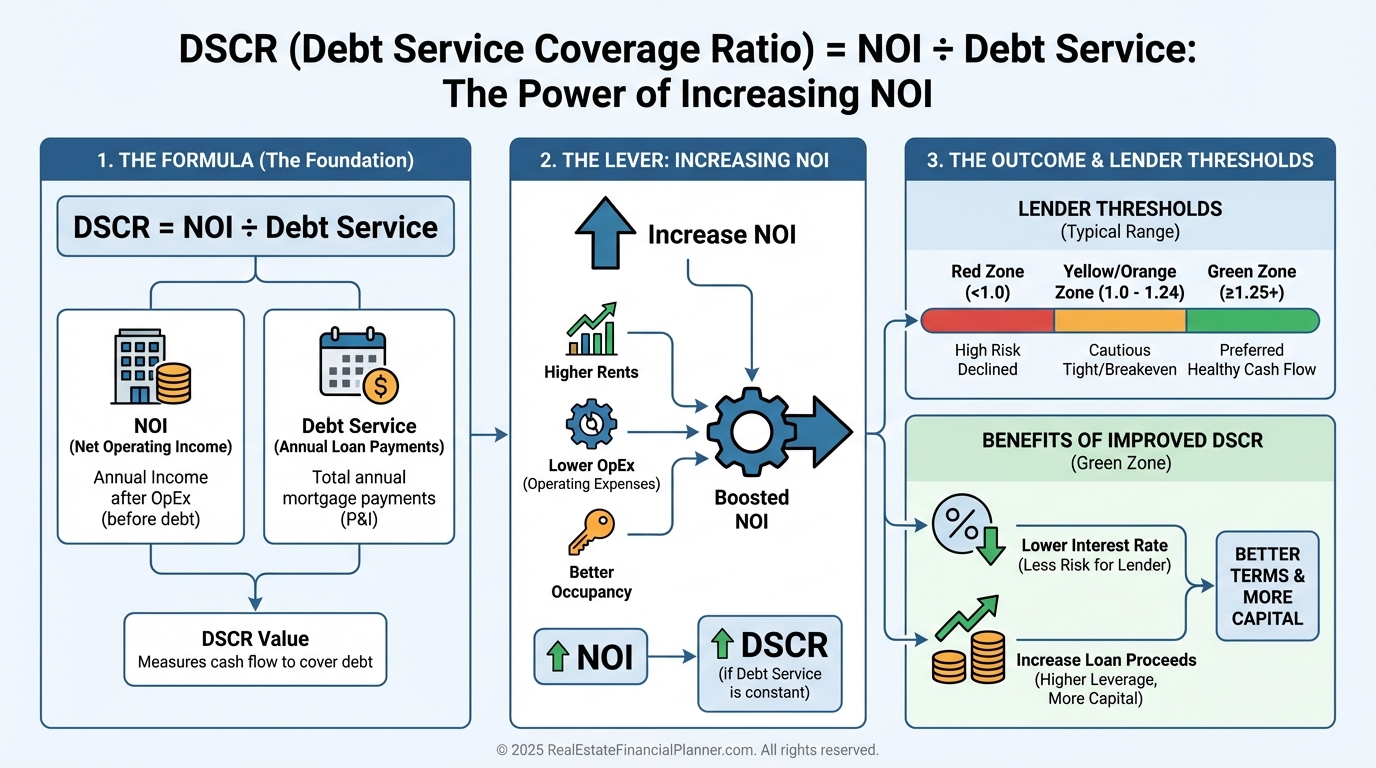

Financing and DSCR: Why Lenders Care About Your NOI

DSCR = NOI ÷ Annual Debt Service.

Most lenders want 1.20–1.25+.

Higher NOI means larger proceeds or better terms.

When I prep a refinance, I bring a clean trailing-12 with line-item notes.

I highlight durable expense reductions and recurring other income.

Temporary cuts don’t count. Systematic operations do.

Common Mistakes I See and How to Avoid Them

Confusing NOI with cash flow.

Debt service, depreciation, income taxes, and CapEx are not in NOI.

Underestimating expenses.

Add the “little” stuff: leasing, pest, landscaping, snow, admin, tech, compliance, bank fees, and legal/accounting.

Believing seller P&Ls without verification.

Always normalize property taxes post-sale and re-quote insurance.

Ignoring climate and tenant mix.

Cold markets have heat and snow; vacation markets have more turnovers; student markets have heavy turns.

Leaving out management on self-managed properties.

Your time has a cost. Price it in to be honest with your returns.

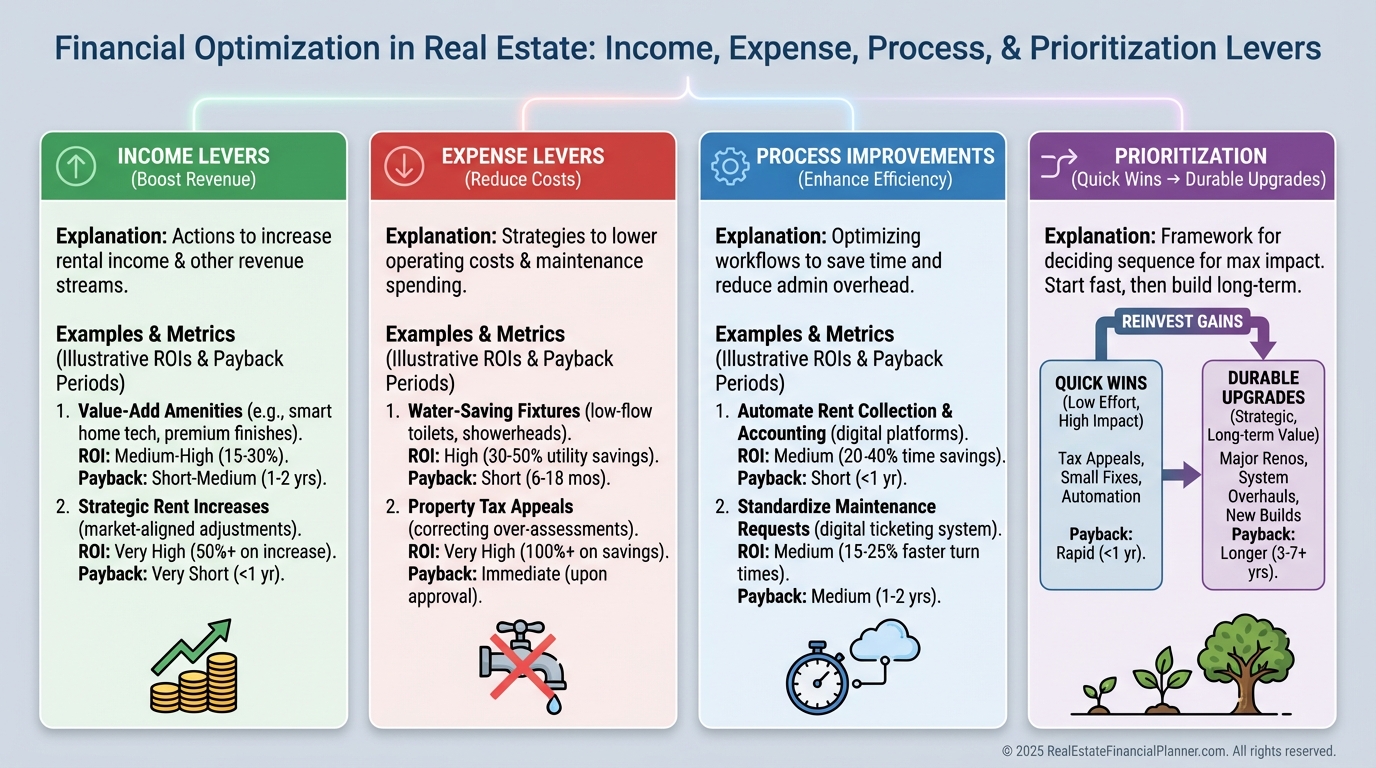

Optimizing NOI: Practical Levers

When I rebuilt after a painful downturn, I focused on operational levers I could control.

That became the backbone of my playbook.

Increase income.

Add pet rent, storage, parking, rubs/billbacks, tiered amenities, and smart premium packages.

Reduce controllable expenses.

Bid vendors, implement preventive maintenance, standardize materials, and install efficiency upgrades.

Cut waste.

Address water leaks, drafty envelopes, and inefficient lighting.

Improve process.

Online rent, digital leasing, smart locks for turns, and documented make-ready standards.

Sequence matters.

Tackle high-ROI items first, then reinvest into durable improvements.

How NOI Fits RealEstateFinancialPlanner Frameworks

Return Quadrants™ split returns into appreciation, cash flow, debt paydown, and tax benefits.

NOI powers the cash flow quadrant and supports debt coverage so you can safely capture the other three.

True Net Equity™ is market value minus true costs to access that equity.

Better NOI pushes value up and improves refinance/sale math, increasing True Net Equity when transaction and tax costs are included.

Nomad™ investors who move in, then convert to rentals, often underestimate operating expenses.

Baking in full operating costs from day one makes the future rental perform the day it converts.

Putting It All Together in the Deal Analysis Spreadsheet

On The World’s Greatest Real Estate Deal Analysis Spreadsheet™, enter realistic income, vacancy, and other income.

Then itemize every operating expense with inflation factors and reserves for the ugly surprises.

The spreadsheet calculates NOI, DSCR, and valuation at your chosen cap rate.

I model base case, conservative, and stress-case scenarios before making an offer.

If the deal only works in the rosiest case, I pass.

Action Checklist

•

Verify 24 months of actuals and normalize taxes and insurance.

•

Price in professional management, even if you self-manage today.

•

Separate OpEx from CapEx and fund CapEx reserves.

•

Add inflation by category, not just a single global rate.

•

Build a stabilization budget for year one.

•

Underwrite DSCR at current and stress rates.

•

Model value as NOI ÷ cap rate, then ask: which lever moves NOI fastest?

•

Document improvements so future buyers and lenders believe your story.

Conclusion

NOI is the scorecard for operations and the steering wheel for strategy.

Get it right, and you buy better, finance better, manage better, and exit better.

Focus on durable, verifiable improvements, and let the cap rate math compound your results.