Paperwork That Protects Profit: A Real Estate Investor’s Step-by-Step Guide to Contracts, Disclosures, and Deadlines

Learn about Paperwork for real estate investing.

Why Paperwork Decides Profit

When I help clients buy or sell their first investment property, we start with paperwork before we ever tour a home.

It’s not sexy, but it’s where profit is protected and risk is defined.

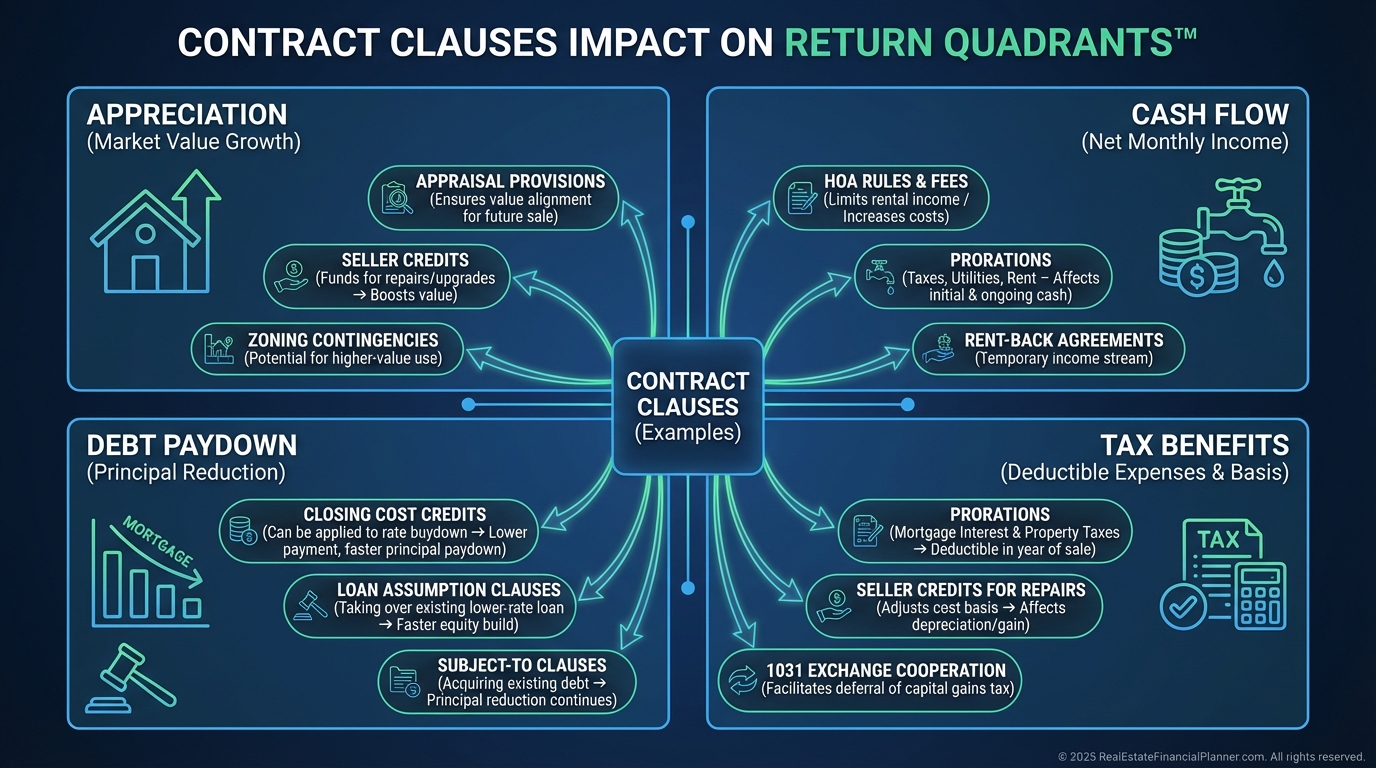

Contracts control cash flow, timelines, and outs. They touch every Return Quadrant™: appreciation, cash flow, debt paydown, and tax benefits.

Handled well, paperwork gives you options. Handled poorly, it takes them away.

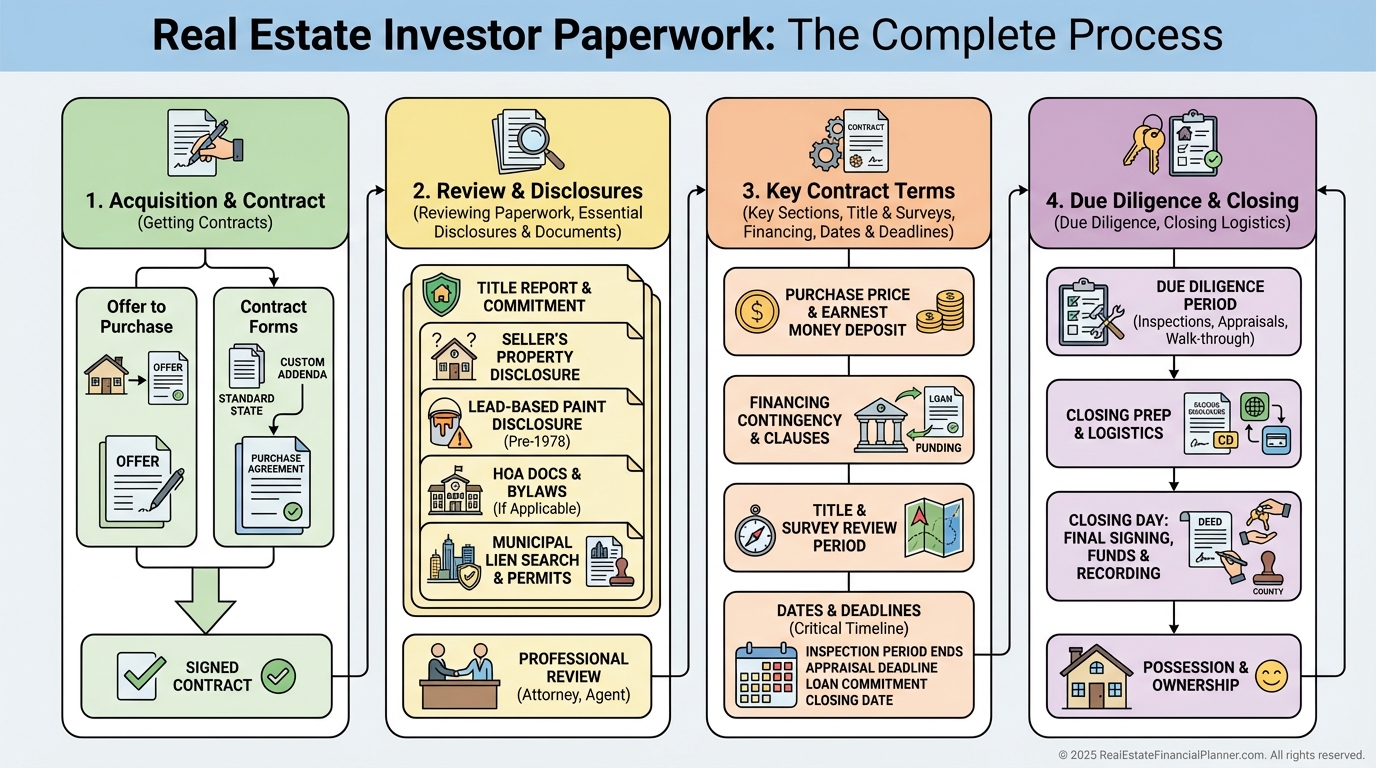

Where to Get Contracts That Won’t Sink Your Deal

In many states, the real estate commission publishes standardized contracts and disclosures. I prefer these as a starting point because courts and brokers know them.

Some markets rely on local associations or brokerage-drafted forms. These typically mirror state forms with local tweaks.

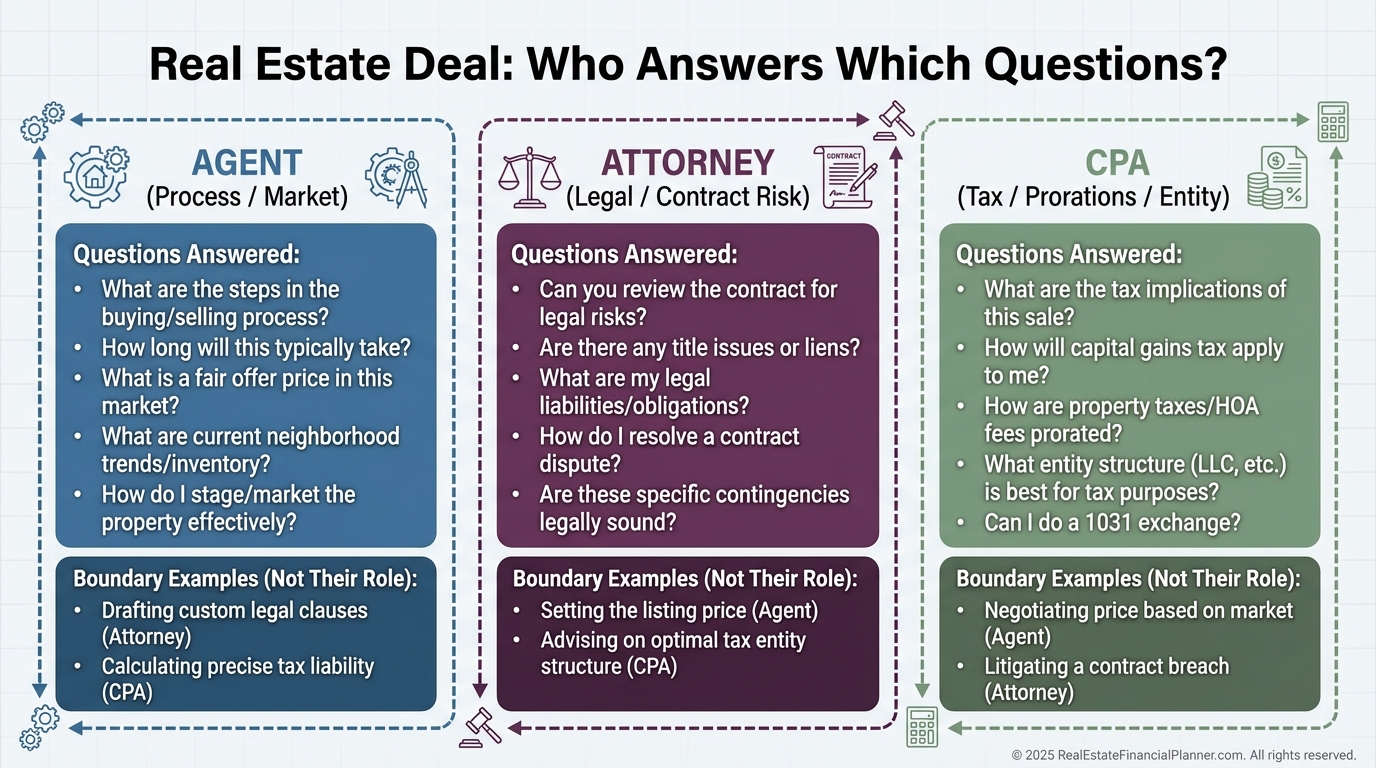

Your agent will pull the correct package and fill it out, but agents are not your attorney. When the risk is material, I bring in counsel.

For off-market or creative finance, I use attorney-drafted contracts. I often start with a state form and add rider language for seller financing or subject-to terms.

I keep a buyer-favored version and a seller-favored version. Default terms matter when a deadline is missed.

How I Review Paperwork With Clients

We review a blank purchase contract before you make your first offer. That cuts confusion and saves you from rushed decisions at 9:52 p.m.

I mark up a printed copy with questions. Clients do the same. We highlight anything we wouldn’t want to explain in court.

Your agent can explain process and standard practice. For legal interpretation or strategy, I loop in your attorney.

For tax consequences, especially on seller credits and prorations, I loop in your CPA.

Core Documents You’ll See

Seller’s Property Disclosure tells you what the seller knows. I compare it line-by-line to the inspection report for gaps.

Lead-Based Paint Disclosure is required for pre-1978 homes. If I see chipping paint, I budget for stabilization.

Natural Hazard disclosures flag flood, fire, and seismic risks. I match these to insurance quotes before waiver deadlines.

Source of Water and Water/Well Rights matter in rural deals. Reliability equals rentability.

Square Footage disclosures affect valuation and rent comps. I reconcile MLS, county, and appraiser numbers.

Wire Fraud disclosure is not boilerplate to me. I verbalize the protocol so no one wires to a spoofed email.

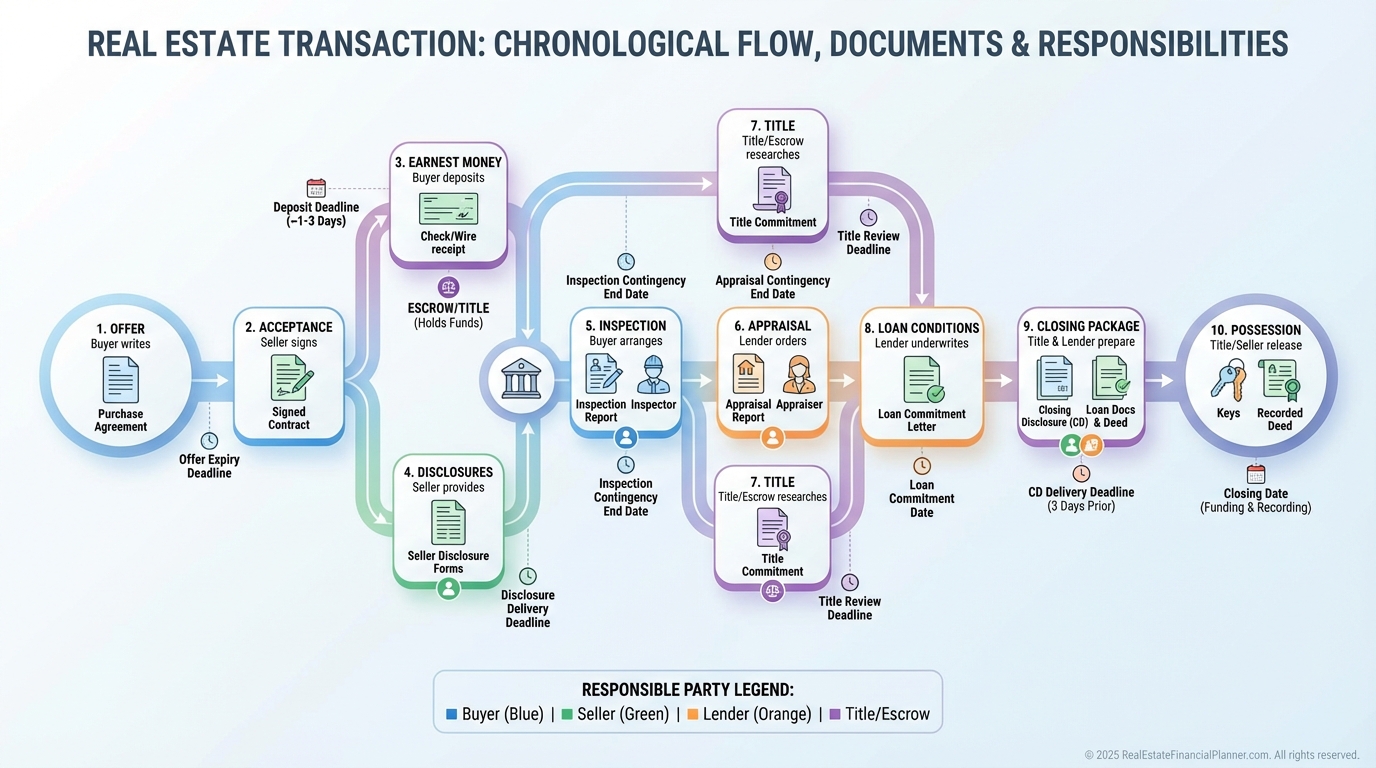

Earnest Money receipt documents who holds funds and on what terms they are released. I want a neutral escrow, not the other party.

Inspection Objection/Resolution is your leverage window. I plan objections from the first showing.

A Bill of Sale captures personal property like appliances. If it’s not in writing, it won’t be there at closing.

The Contract to Buy and Sell: What Actually Controls Your Deal

Parties and Property identify who is bound and exactly what real estate is being sold. I confirm legal description matches title.

Assignability determines whether you can assign or must close. If you need flexibility, negotiate it now, not later.

Inclusions and Exclusions, plus Parking/Storage and Water/Well Rights, define what conveys. I photograph included items during showings.

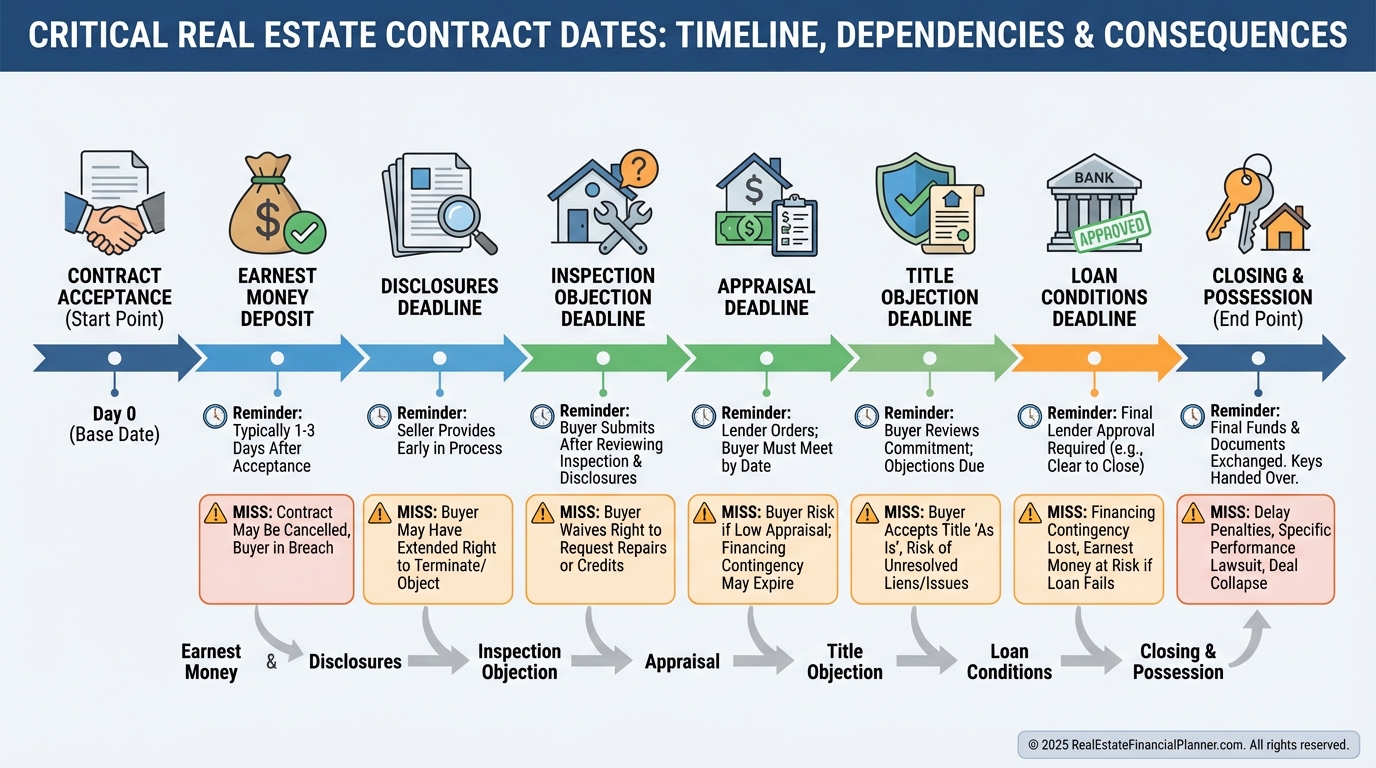

Dates and Deadlines run the deal. I reverse-schedule every task and set reminders 48 hours early.

Purchase Price and Terms plus Seller Concessions impact True Net Equity™ at closing. I model various credit structures to optimize after-tax outcomes.

Earnest Money, Good Funds, Time of Payment, and Available Funds spell out when money moves. I never rely on same-day wires without backups.

Financing sections cover New Loan, Loan Assumption, Seller or Private Financing, and Financing Conditions. I include appraisal-gap or rate buydown strategies when needed.

Appraisal Provisions decide what happens if value comes in low. I add pathways to renegotiate or cure.

Homeowner’s Association language triggers your right to review docs. I read rental restrictions before due diligence expires.

Title Insurance, Record and Off-Record Title Matters, Special Taxing and Metro Districts, and Tax Certificate reveal liens, assessments, and surprise taxes. I object early and in writing.

Third-Party Rights to Purchase/Approve can derail timing. I flag any ROFR or developer approvals.

Right to Object/Resolution to Title and Title Advisory define your remedies. I keep title deadlines separate from inspection.

Surveys and ILCs confirm boundaries and improvements. I require a new survey when fences, additions, or easements look off.

Seller’s Property Disclosure, Inspection, Insurability, Due Diligence, Source of Water, Existing Leases and Tenant Estoppel Statements, Lead-Based Paint, Carbon Monoxide, Meth, and Radon create your safety net. I never waive health or habitability items.

Closing and Closing Docs, Transfer of Title, Payment of Liens and Encumbrances, Closing Costs, Prorations, Possession, Damage While Under Contract, Right to Walk-Through, and Home Warranty govern the finish line. I verify prorations with actual tax rates and rent rolls.

Legal and Tax Counsel, Time of Essence, Default and Remedies, Legal Fees, Mediation, Earnest Money Disputes, Termination, Entire Agreement/Modification/Survival, Notice/Delivery/Choice of Law, Notice of Acceptance, Counterparts, Good Faith, Additional Provisions, Other Documents, Signatures, and Agent/Broker Acknowledgements define how fights are avoided or resolved. I treat these as the rules of engagement.

What I Model Before You Sign

I calculate True Net Equity™ at closing two ways: with and without seller credits, buydowns, and repairs. The higher number isn’t always better after taxes.

I map each clause to a Return Quadrants™ impact. Appraisal and loan terms touch appreciation and debt paydown. HOA and occupancy rules touch cash flow. Tax credits and prorations touch tax benefits.

If you’re running a Nomad™ plan, I verify owner-occupant loan occupancy periods against HOA rental rules and local ordinances.

I also stress-test appraisal gaps, rate shocks, and inspection surprises. I want pre-agreed cures, not panic.

Due Diligence Playbook

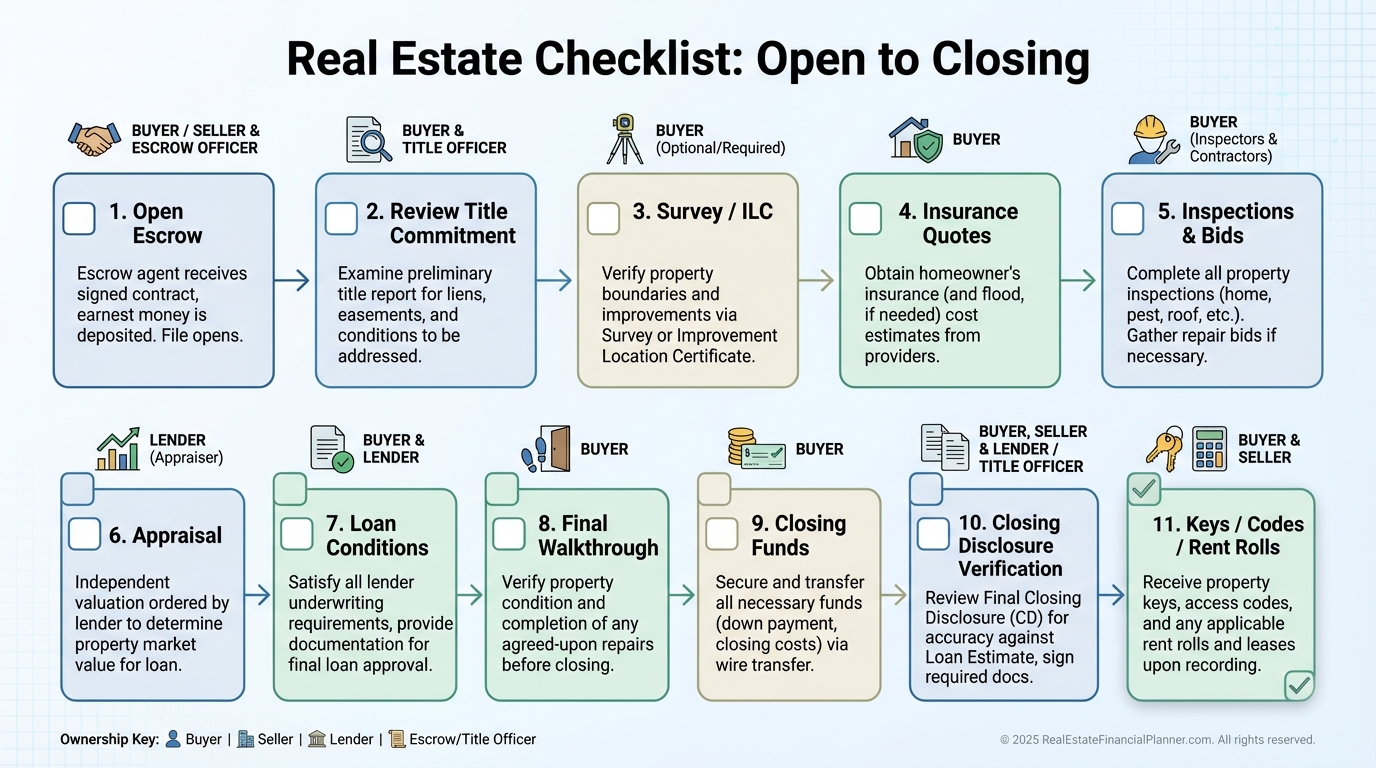

I open escrow with neutral title immediately and order a title commitment. I scan Schedule B for easements, liens, and HOA super-priority risks.

I verify insurance quotes during the objection window. If I can’t insure at a reasonable premium, we cure or terminate.

I order inspection early so I have time for bids. I attach bids to the Inspection Resolution to make remedies concrete.

For rentals, I collect leases, tenant estoppels, deposits ledger, and rent rolls. I align prorations with the rent schedule day-by-day.

On wire fraud, I require voice verification with a known phone number before any wire. No exceptions, ever.

Closing Day: Zero-Defect Execution

I confirm “good funds” with the closer the day before. If a wire cutoff is missed, I have a cashier’s check plan.

I do the final walk-through after the seller is fully out. I verify repairs, utilities on, and no new damage.

At the table, I compare the Closing Disclosure to our contract: credits, fees, prorations, and lien payoffs. Pennies count.

I collect keys, remotes, codes, warranties, manuals, and a signed Bill of Sale for personal property. I also get HOA gate info and mailbox keys.

Common Mistakes I See and How to Avoid Them

Using a random online template for a creative deal. Use an attorney or a state form with a rider.

Missing a deadline by hours. Calendar two reminders and delegate a backup.

Letting the other side’s closer hold earnest money in a dispute-prone deal. Use neutral escrow.

Relying on your agent for legal or tax advice. They’re valuable, but they’re not counsel or your CPA.

Skipping HOA review because “it’s probably fine.” Rental restrictions can nuke your plan.

Final Prep: Pack Your Paperwork Go-Bag

I keep digital and printed copies of the contract, all amendments, disclosures, inspection bids, title commitment, wire instructions, and the Closing Disclosure.

If anything is unclear, I don’t guess. I go back to the contract. It is the final word.

Local forms and clauses vary. Review them with your agent first, then get your attorney and CPA to bless the plan before money goes hard.

When the right property appears, you’ll be ready to move fast without sacrificing safety or returns.