Limited Partners in Real Estate: How to Raise Capital, Structure Waterfalls, and Protect Investors

Learn about Limited Partners for real estate investing.

Why Limited Partners Accelerate Your Portfolio

When I help clients step from single-family rentals into 50–200 unit assets, the unlock is almost always Limited Partners.

You don’t need millions in the bank to buy million-dollar deals. You need aligned capital and a structure that rewards performance without ceding operational control.

Access to bigger, better-located assets improves economies of scale and smooths cash flow variability.

Spreading risk across investors and properties protects your downside while preserving upside.

And when you treat LPs like true partners—transparent, timely, and data-driven—they reinvest and refer.

What a Limited Partnership Really Is

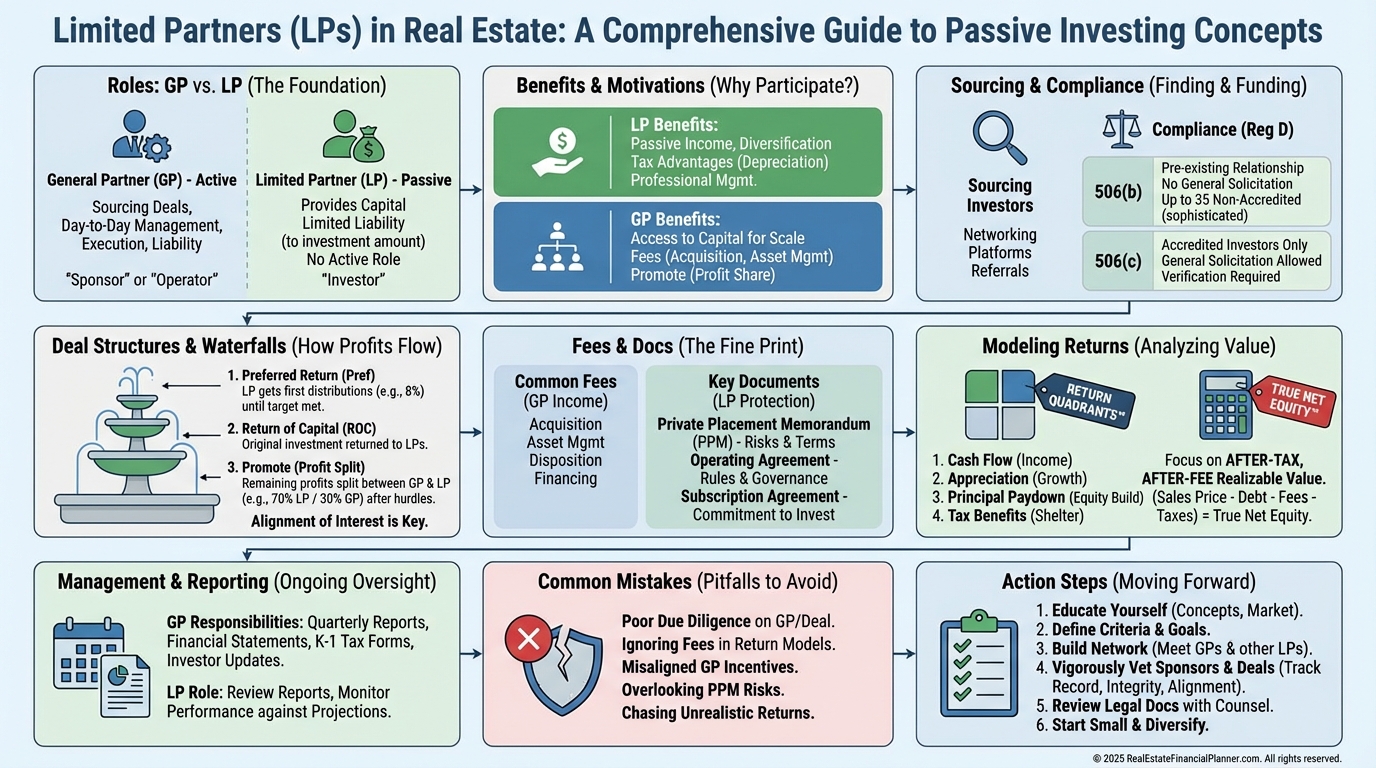

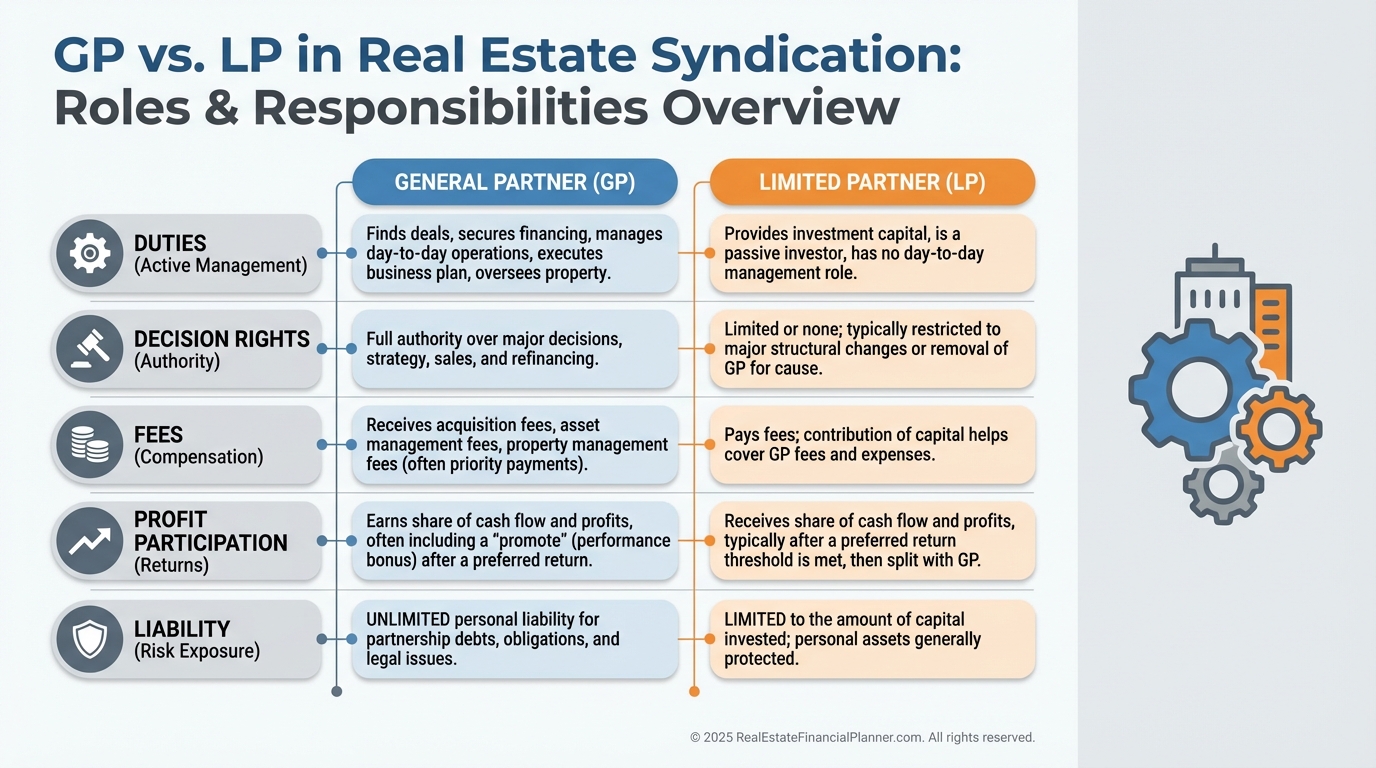

A limited partnership joins an operating partner (the General Partner) with passive investors (the Limited Partners).

The GP finds the deal, arranges financing, oversees renovations, and makes decisions. The GP also carries the management duty and liability.

LPs provide capital, benefit from pass-through taxation, and limit liability to their investment. They are not managers.

When I underwrite with clients, I separate “who runs” from “who funds.” That clarity drives cleaner documents, better expectations, and fewer surprises.

Benefits LPs Bring (Beyond Capital)

LPs help you qualify for larger loans, move faster on competitive bids, and fund stronger CapEx plans.

They also add accountability. Knowing you report to partners tends to sharpen underwriting and execution.

Over time, a satisfied LP base compounds. One good deal funds the next two, then five.

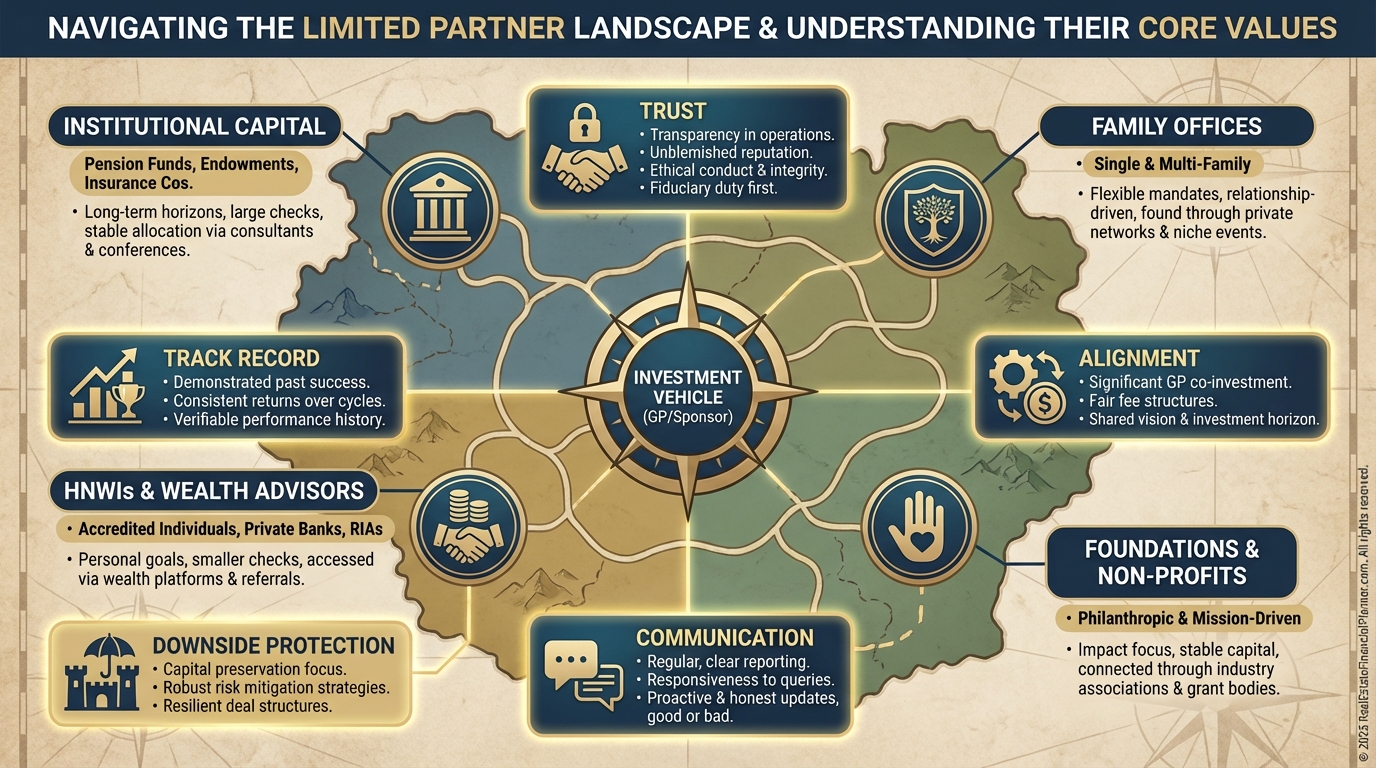

Where to Find and Attract Quality LPs

Start with your warm network. Professionals with capital but no time—doctors, attorneys, tech leads—are ideal.

Local REIAs, conference hallways, LinkedIn, and vetted online communities are next.

Your case studies matter more than your charisma. Show the numbers, the plan-versus-actuals, and what you learned when something went sideways.

When I rebuilt after bankruptcy, I led with transparency. I showed conservative assumptions, reserves policy, and exactly how we’d protect principal first.

Prepare a one-page summary, a tight deck, and a sample operating model. Keep the story consistent.

Compliance Comes First: How Capital Is Actually Raised

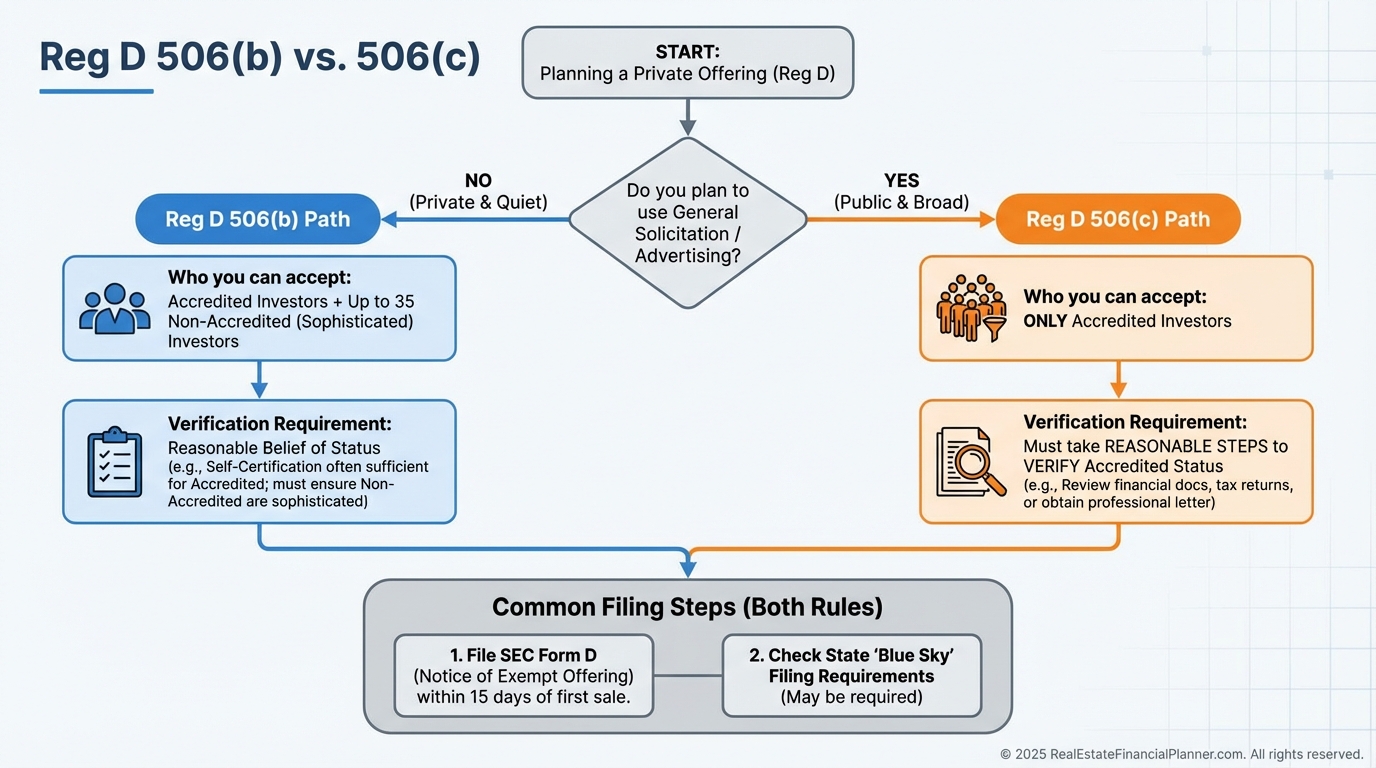

If you raise money, you’re selling securities. Treat it that way.

Most syndicators rely on Reg D exemptions—506(b) or 506(c). 506(b) allows up to 35 sophisticated, pre-existing relationships and no general solicitation. 506(c) allows public marketing, but investors must be verified accredited.

Before an “ask,” I document the relationship, sophistication, and suitability. Then I coordinate with a securities attorney for the PPM, Operating Agreement, Subscription, and investor questionnaire.

File Form D. Track blue-sky filings. Respect advertising rules. Your future self will thank you.

Structuring Deals With LPs That Align Everyone

Keep it simple, fair, and performance-based.

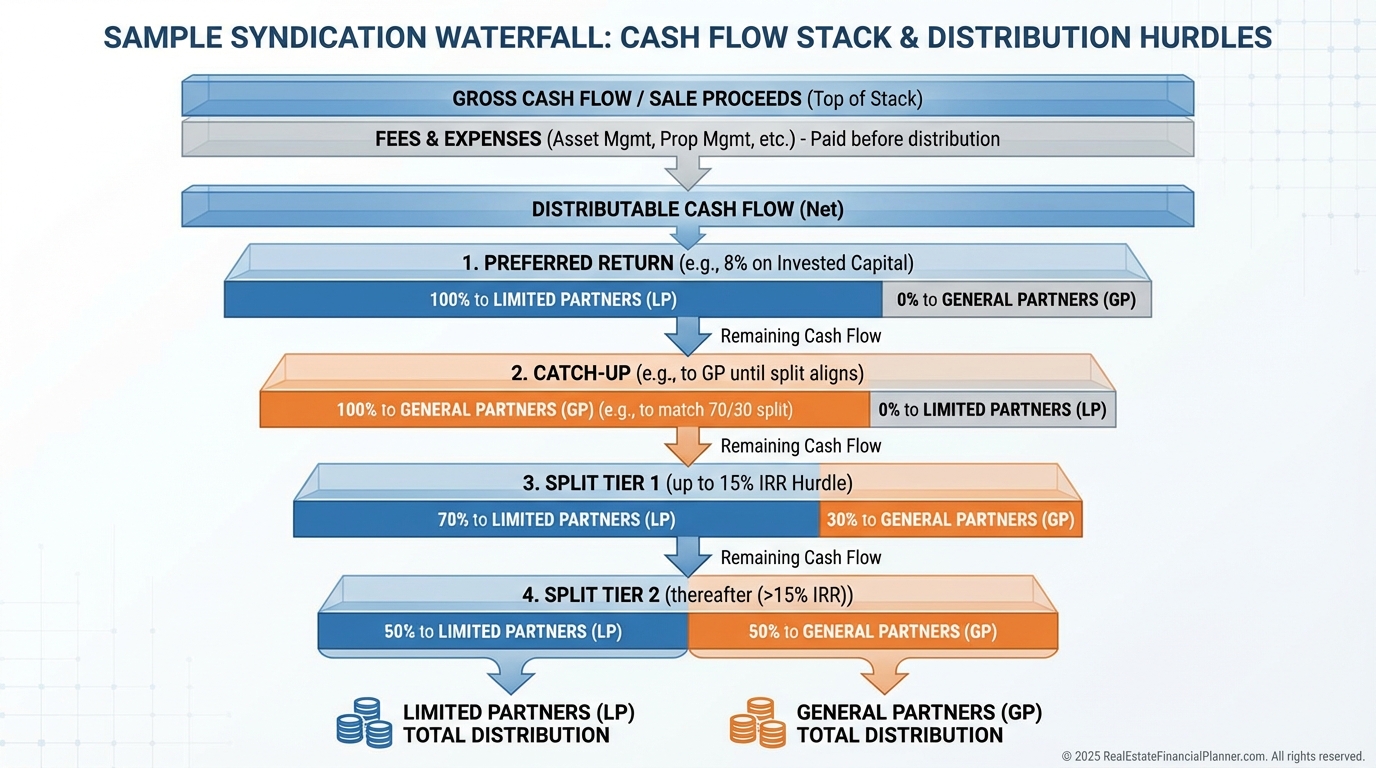

The foundation is often a preferred return with a profit split. For example, an 8% pref to LPs, then 70/30 to a certain IRR, then 50/50 above that.

Use fees to compensate real work, not to backfill thin deals.

Common fees:

•

Acquisition: 1–3% of purchase price

•

Asset management: 1–3% of EGI or collected revenue

•

Construction management: 5–10% of CapEx

•

Disposition: 0–2% of sale

Lock these into your docs with crystal clarity. No surprises.

Model Like a Pro: Projections LPs Can Trust

We use The World’s Greatest Real Estate Deal Analysis Spreadsheet™ to run sensitivities, waterfall scenarios, and timing of distributions. Clear outputs calm nervous capital.

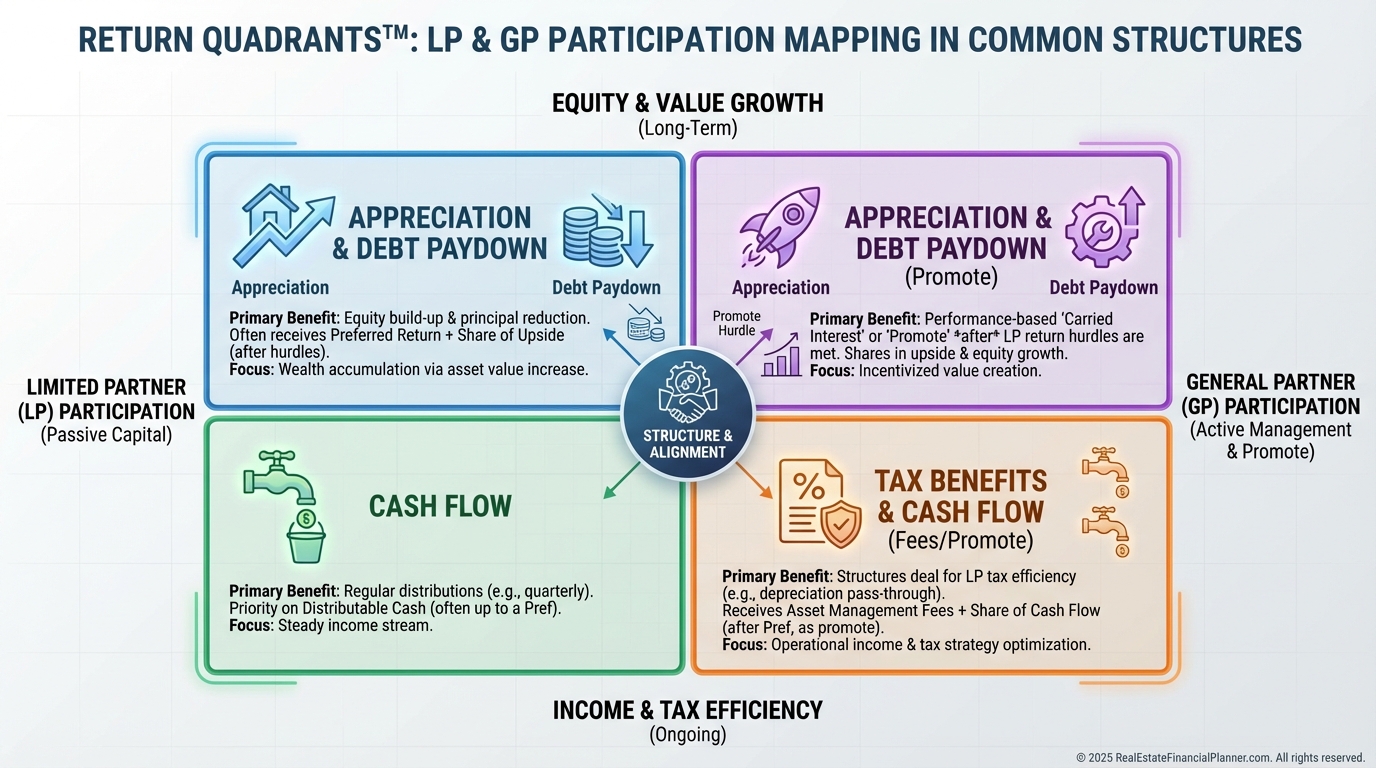

Tie results to Return Quadrants™ so investors see total return clearly: appreciation, cash flow, debt paydown, and tax benefits. Show how each quadrant contributes under baseline and stressed assumptions.

For equity discussions, use True Net Equity™. That’s market value minus selling costs, debt payoff, CapEx catch-up, and taxes. LPs appreciate when you present what they could actually walk away with.

Documents That Protect Everyone

Your core legal package should include:

•

Private Placement Memorandum (PPM) describing risks and terms

•

Operating Agreement detailing governance and distributions

•

Subscription Agreement binding each investor to the deal

•

Investor questionnaire verifying accreditation or sophistication

Work with securities counsel. Cut costs elsewhere, not here.

Managing LP Relationships Like an Asset

Your investor experience is a product. Design it.

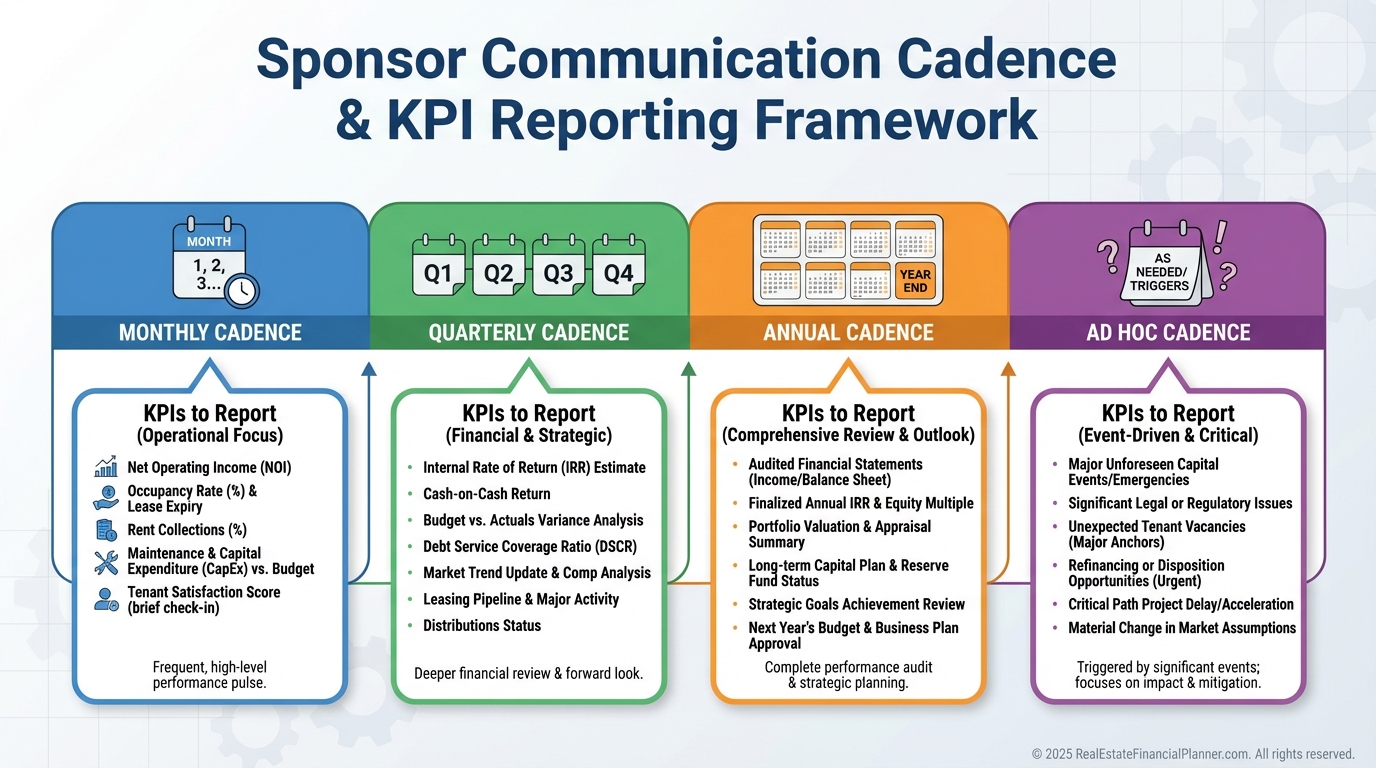

I set a communication rhythm before funding and keep it no matter what.

•

Monthly email: occupancy, collections, progress, issues

•

Quarterly financials: P&L, balance sheet, budget-to-actual, commentary

•

Annual meeting: strategy, tax timelines, major decisions

•

Ad hoc: immediate notice of material events—good or bad

Use a portal to track K-1s, distributions, and documents. Document every interaction in your CRM.

Bad news doesn’t get better with age. Tell it early, own the solution, and show the timeline.

Common Mistakes I Coach Sponsors to Avoid

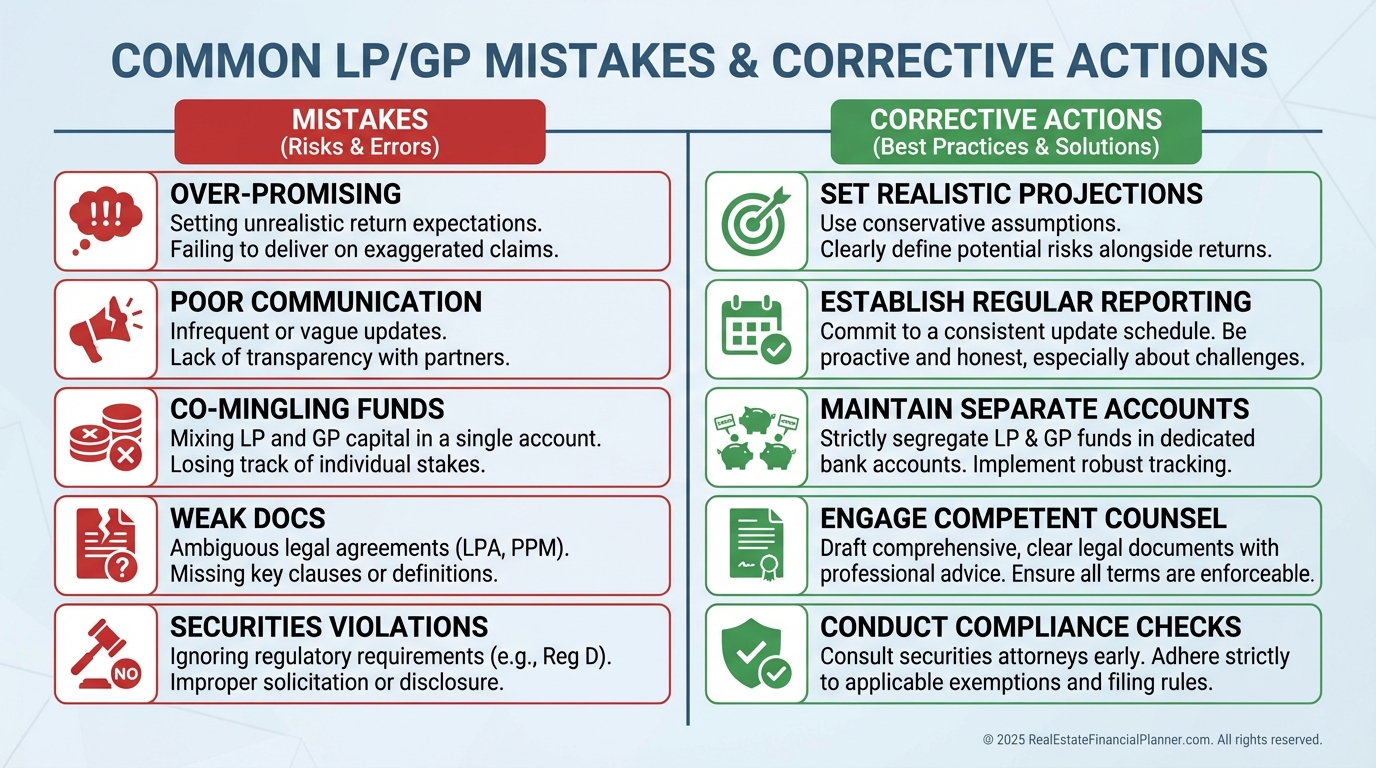

Over-promising is the fastest way to lose a lifetime of capital. Underwrite conservatively and beat the print.

Going dark during turbulence destroys trust. Even a short “here’s what happened, what we’re doing, and when we’ll update next” can save a relationship.

Mixing funds invites disaster. Open dedicated accounts per deal and reconcile monthly.

DIY legal documents are false economy. Use a syndication attorney who lives in this world.

Respect securities law. File what needs filing. Advertise only when permitted. Verify accreditation when required.

Building Your Track Record (Even Before Syndication)

You can build credibility without a 200-unit purchase.

Use the Nomad™ strategy to acquire properties sequentially, live-in, then convert to rentals. Document your systems, maintenance plan, and returns.

Publish short case studies with before/after photos, budget-to-actuals, and tenanting timelines. That proof becomes the seed for your first LP raise.

A Simple, Repeatable Action Plan

•

Learn securities basics and pick a compliant path (506(b) or 506(c))

•

Build a tight deck and one-page summary anchored in conservative underwriting

•

Underwrite with The World’s Greatest Real Estate Deal Analysis Spreadsheet™

•

Map outcomes with Return Quadrants™ and present True Net Equity™

•

Line up legal: PPM, Operating Agreement, Subscription, Form D, blue-sky

•

Establish your communication rhythm and tech stack now, not after closing

•

Start with people who know you, then scale by asking for referrals

When I help clients execute this plan, their second and third raises get easier. Capital follows clarity and consistent execution.

Your future LP is already watching how you communicate today. Show them you’re ready.