Nomad™ Real Estate: The Step-by-Step Plan I Model to Build a Rental Portfolio with Owner-Occupant Loans

Learn about Nomad™ for real estate investing.

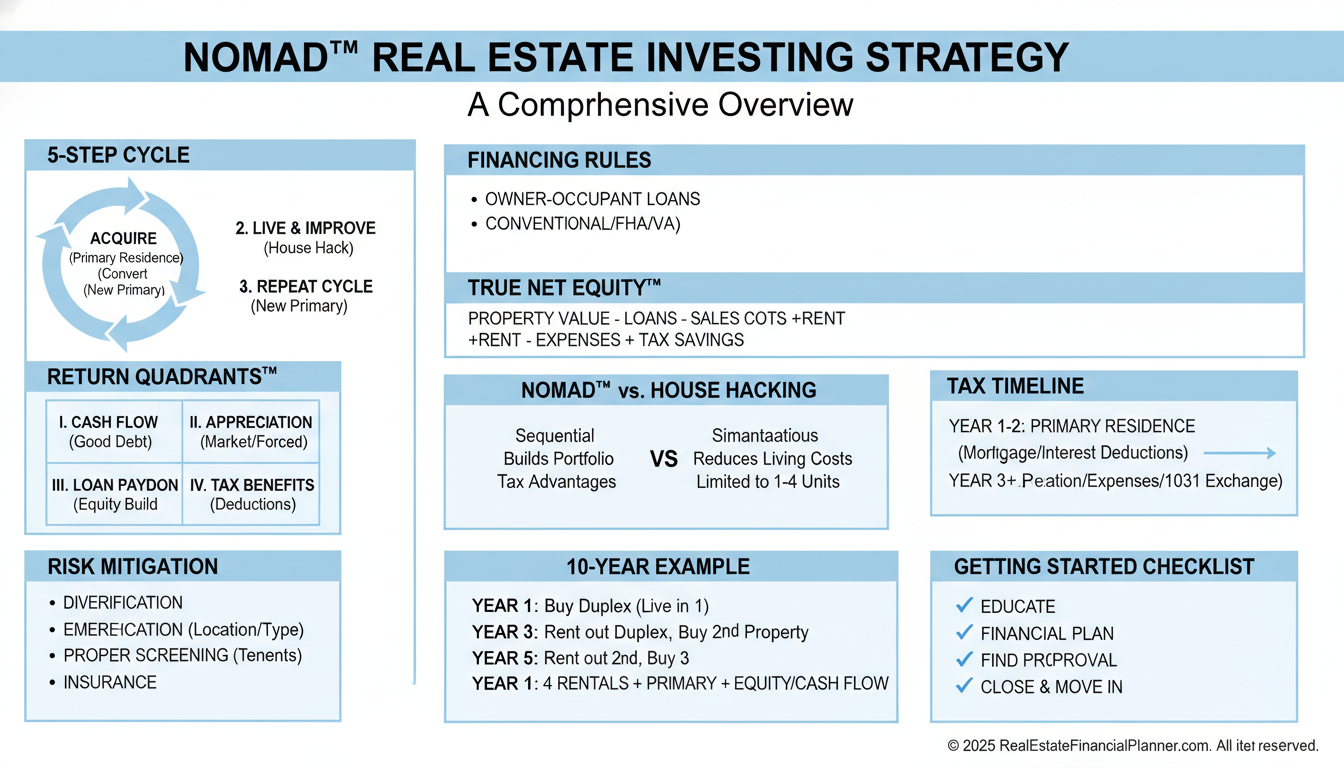

What Is Nomad™ and Why It Works

Nomad™ is a move-in, live-there, move-out, keep-as-a-rental system that leverages owner-occupant loans to acquire properties with lower down payments and better rates.

When I help clients implement it, we model each purchase, each move, and each conversion to a rental so the portfolio grows without betting the farm.

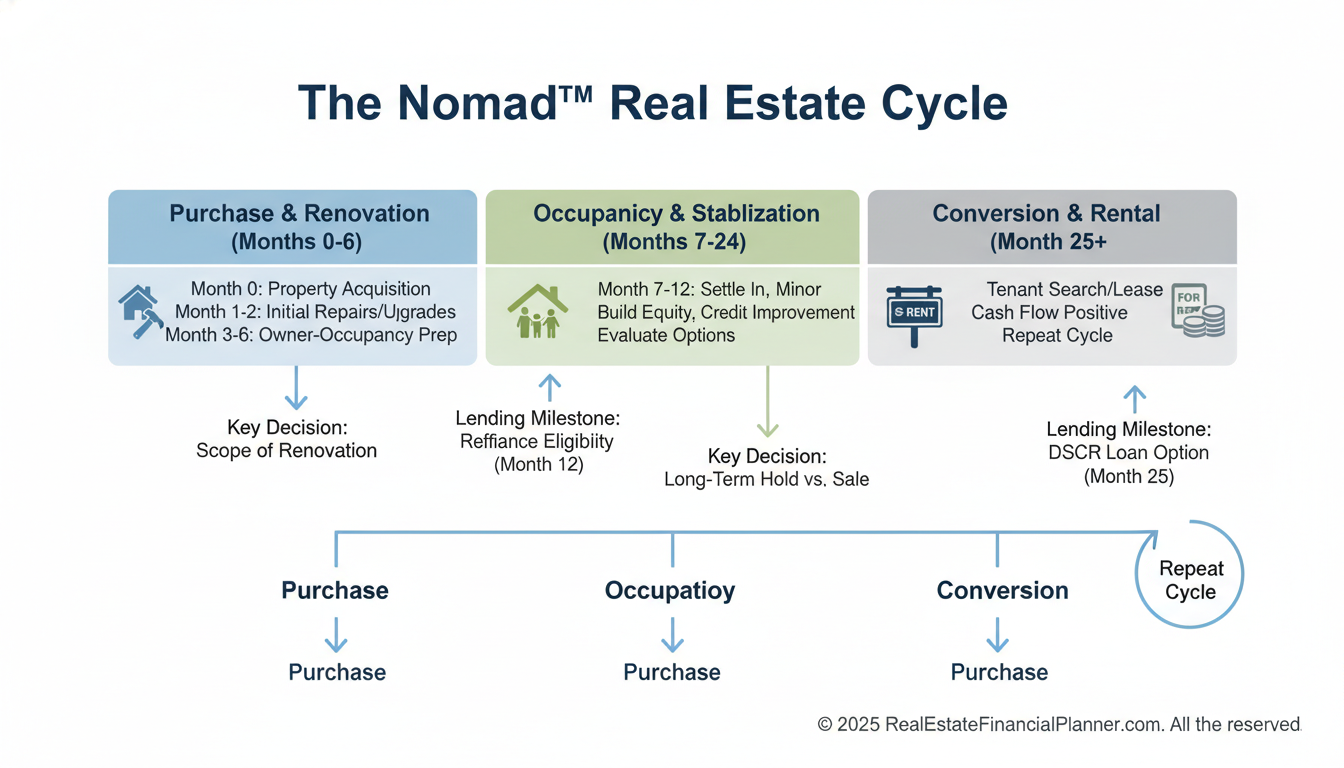

The Five-Step Cycle

Buy a property as an owner-occupant with a low down payment and a favorable interest rate.

Live there at least 12 months to satisfy the lender’s occupancy requirement.

Purchase the next owner-occupant property and move into it.

Convert the previous property to a long-term rental with a written property plan.

Repeat the cycle on a sustainable cadence aligned with your income, reserves, and lending capacity.

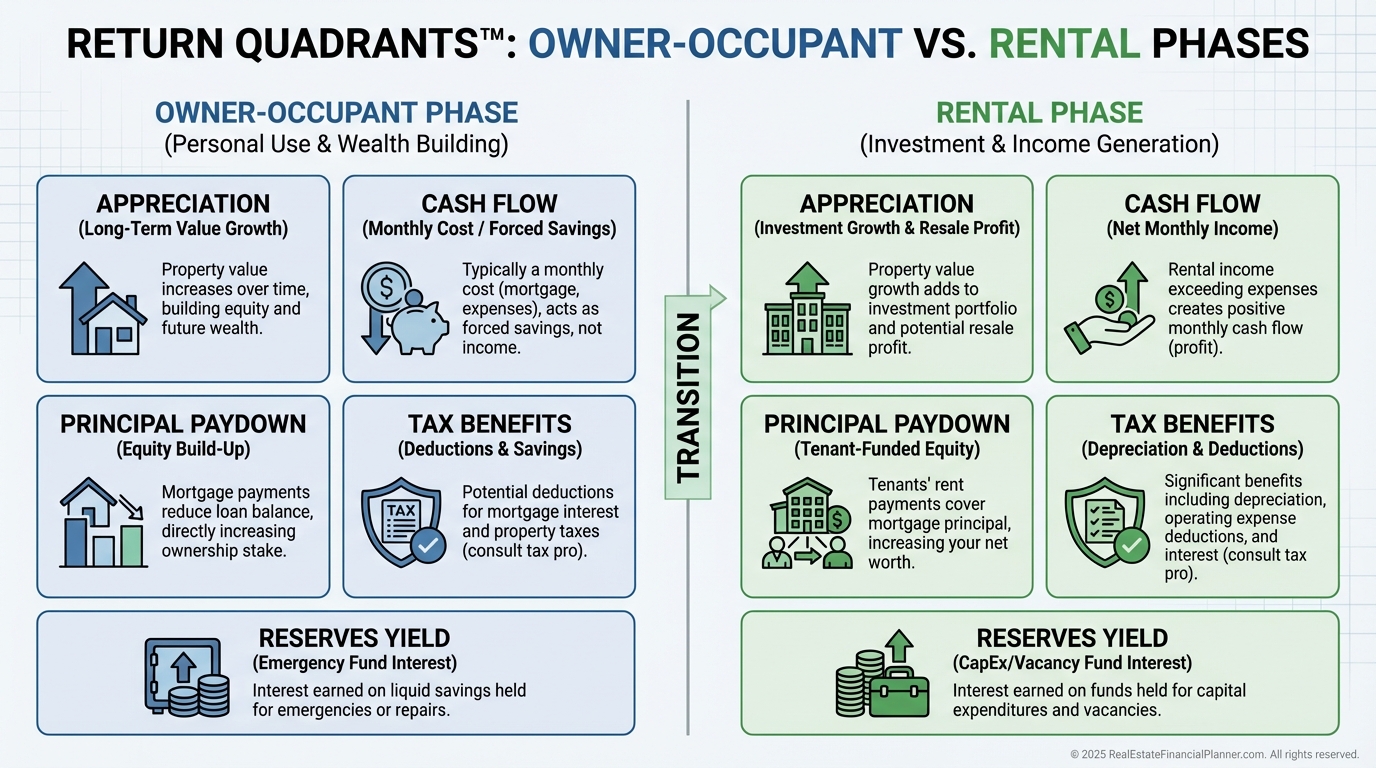

The Math That Makes It Work: Return Quadrants™

The Return Quadrants™ show how owners and rentals build wealth from four main drivers: appreciation, cash flow, principal paydown, and tax benefits.

When I model portfolios, I include a fifth input—safe yield on reserves—because your cash cushion is part of the strategy.

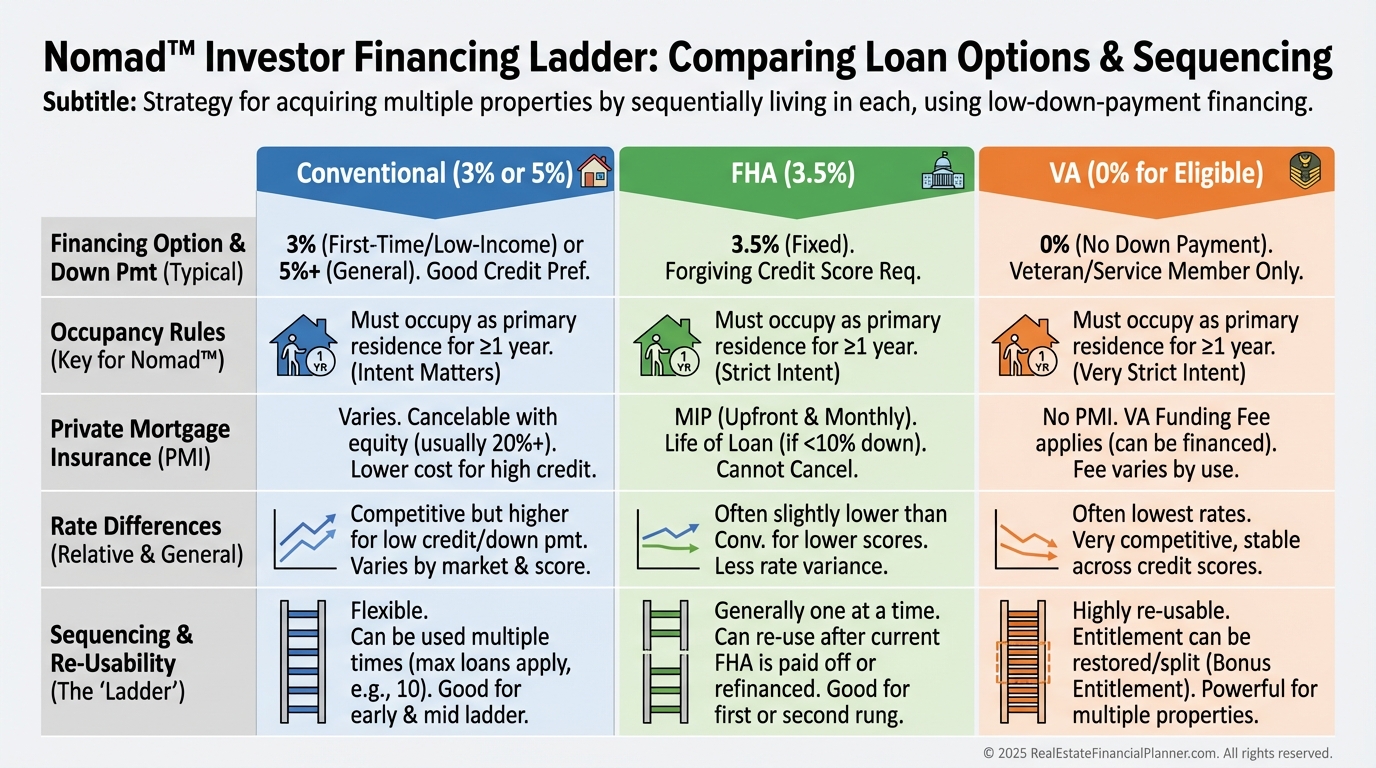

Financing Rules You Must Respect

Owner-occupant loans require genuine intent to live in the property for at least 12 months; I won’t model scenarios that try to game that rule.

FHA is powerful but you’ll likely use it once because of self-occupancy and multiple FHA constraints; conventional 5% down is the workhorse for most Nomads.

Owner-occupant rates and PMI often beat investor loan terms, which is the core advantage of the strategy.

Before every purchase, I check debt-to-income, reserve requirements, and how the next property’s payment interacts with likely rent on the one you’re converting.

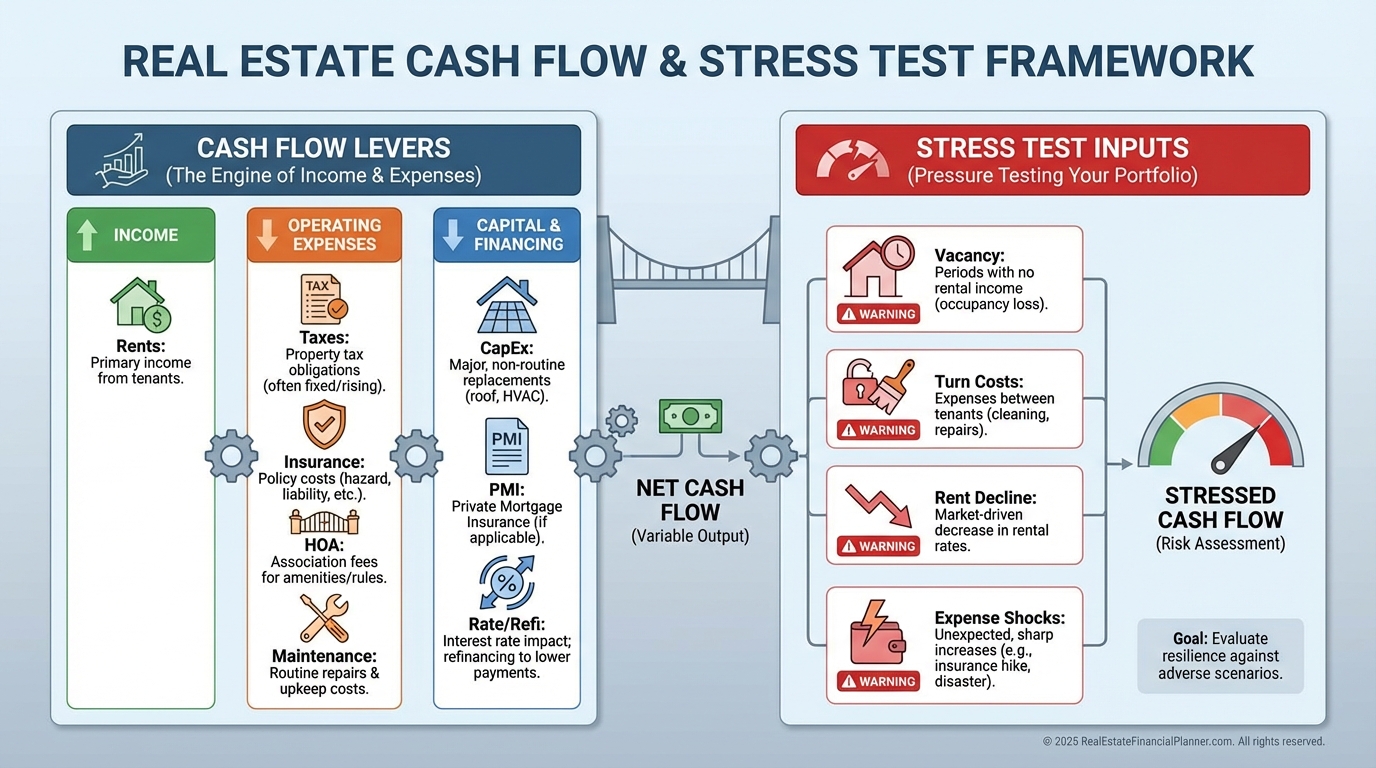

Cash Flow Reality and Stress Testing

Your first few rentals might be close to break-even on cash flow; the equity engine is doing most of the work early.

When I help clients, we stress test for vacancy, turns, rent dips, rate shocks, insurance spikes, property tax reassessments, and HOA increases.

I also model CapEx separately from maintenance so we’re not surprised by roofs, furnaces, or exterior paint in the lean early years.

We hold 6–12 months of total expenses per property in reserves and we model the drag and the safety that those reserves add.

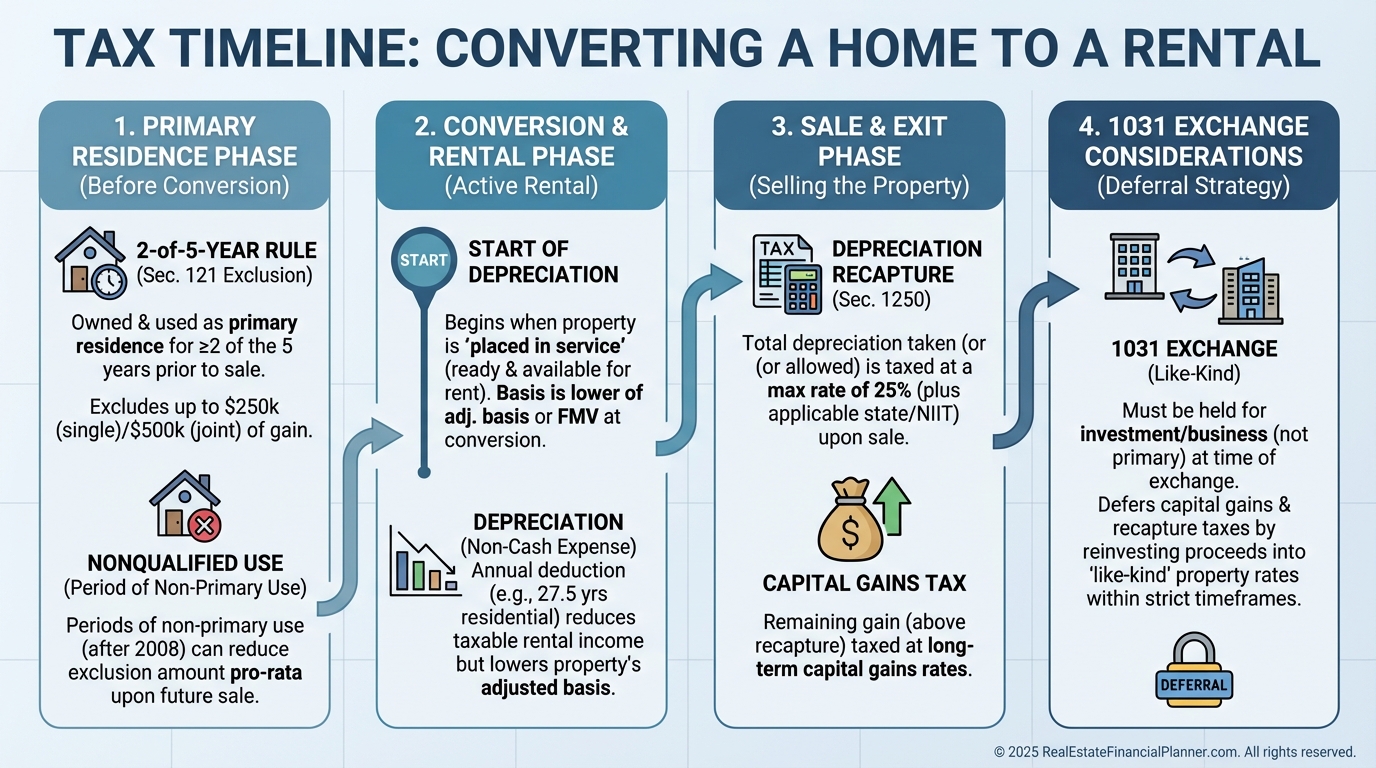

Taxes When You Convert to a Rental

Depreciation starts when you place the property in service as a rental, using building value over 27.5 years and excluding land.

If you sell, depreciation recapture is taxed up to 25% and must be planned for; I model recapture explicitly so True Net Equity™ isn’t overstated.

The primary residence exclusion (Section 121) can reduce capital gains if you lived there 2 of the last 5 years, but post‑2008 “nonqualified use” rules matter.

You may 1031 exchange investment property, but coordinating 121 and 1031 is nuanced; I involve a CPA and accommodator before we lock a plan.

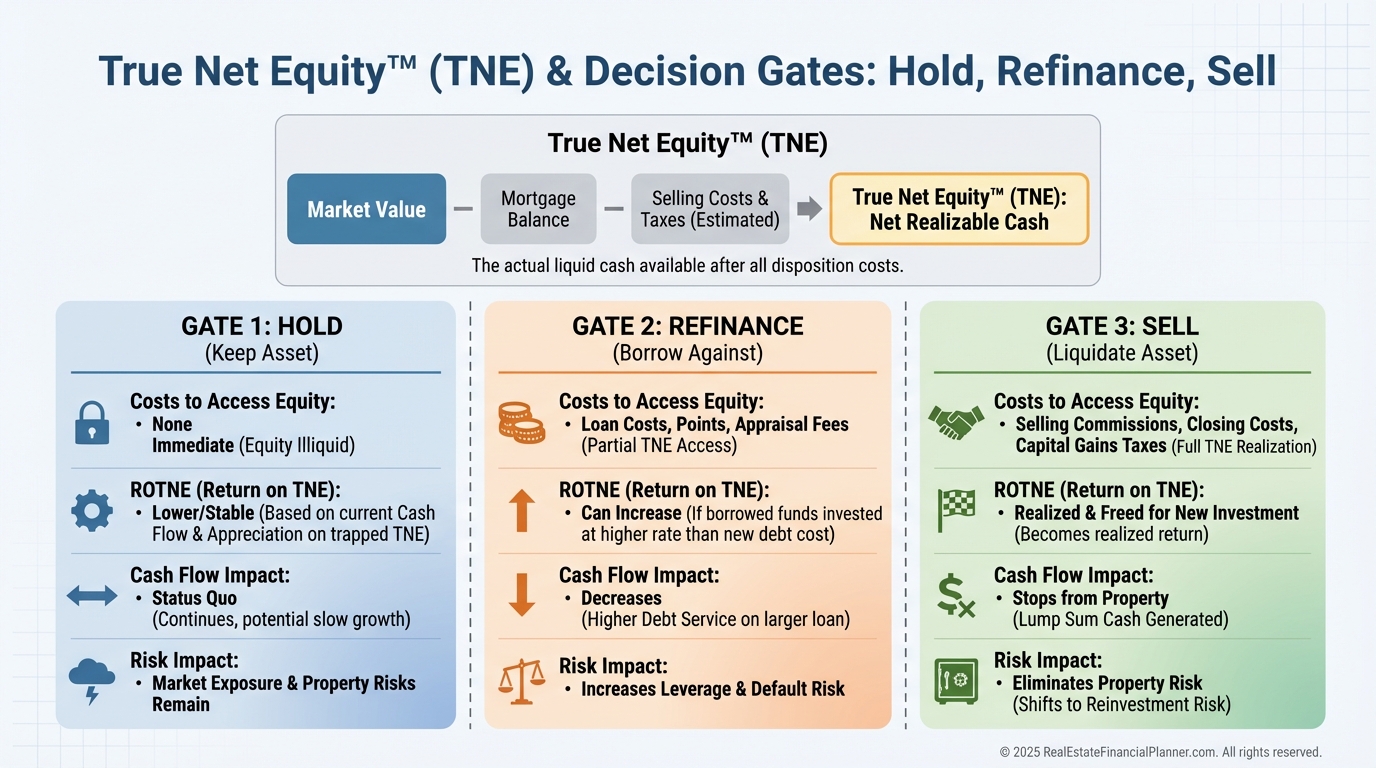

Track True Net Equity™ and Decide When to Refi or Sell

True Net Equity™ is what you could actually access after selling costs, taxes, recapture, and loan payoff, not just Zestimate minus mortgage.

I compare return on True Net Equity™ to your next best use of capital; if a property’s ROTNE falls behind, we discuss refi, sell, or hold.

When I test a refi, I underwrite the new rate, costs, PMI, and reserves impact, then re-run cash flow and debt paydown to see if the move improves total returns.

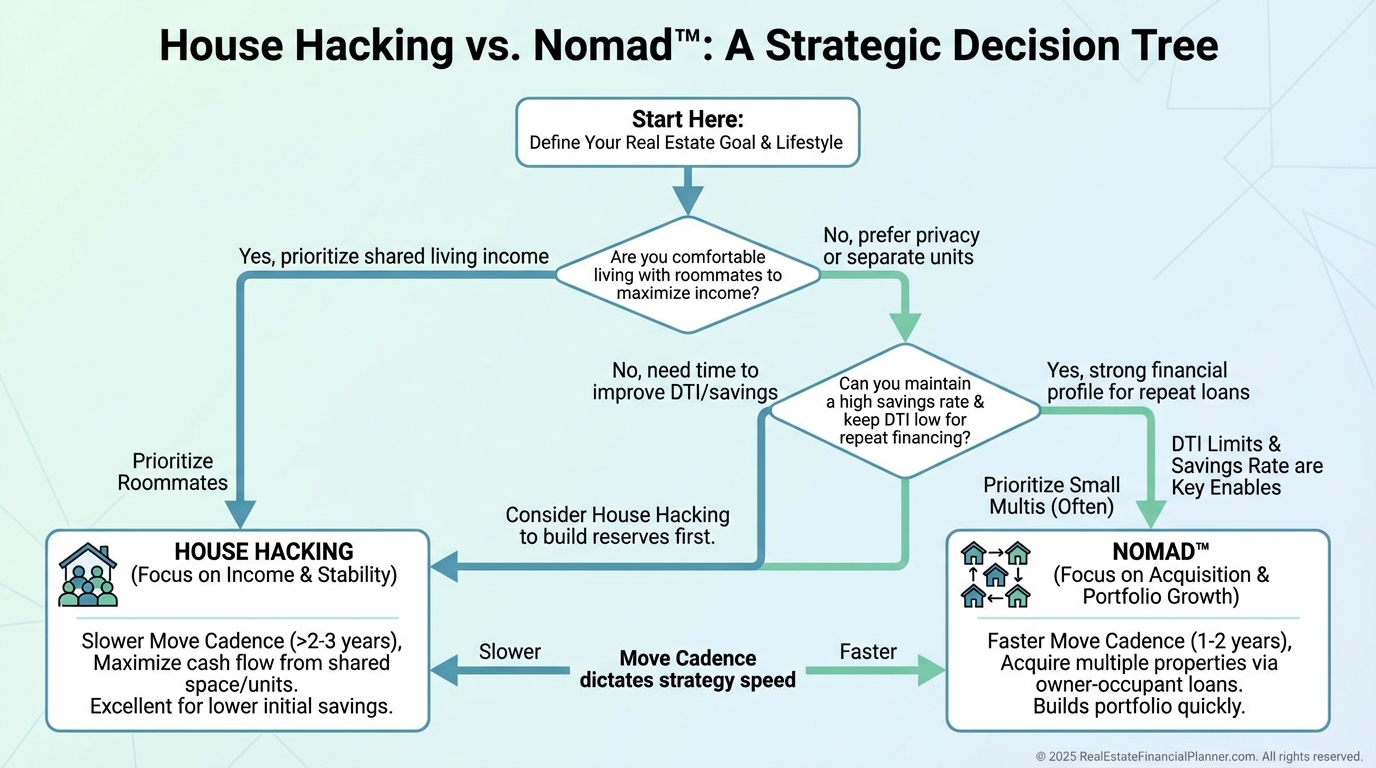

House Hacking vs Nomad™

House hacking is living in a property and renting bedrooms or units for income; Nomad™ is the repeatable system of moving annually and keeping prior homes as rentals.

Many clients combine them by hacking while they live there, then converting to a rental when they move; this accelerates savings for the next down payment.

If you use FHA on a 2–4 unit, mind self-occupancy rules and local ordinances on rooming or unrelated occupants.

I model both approaches side-by-side so you can see where cash flow, savings rate, and lending capacity intersect.

Risks Most People Miss

Move-out turns can cost more than a normal make-ready because you’re transitioning from owner-occupant to tenant-grade durability.

Local rent control or licensing requirements can change mid-plan; I check city and HOA rules before we model returns.

Concentration risk matters; owning five doors in one submarket can amplify a local downturn.

I use sensitivity analysis in the Real Estate Financial Planner™ to map best, base, and worst cases before you commit to the next purchase.

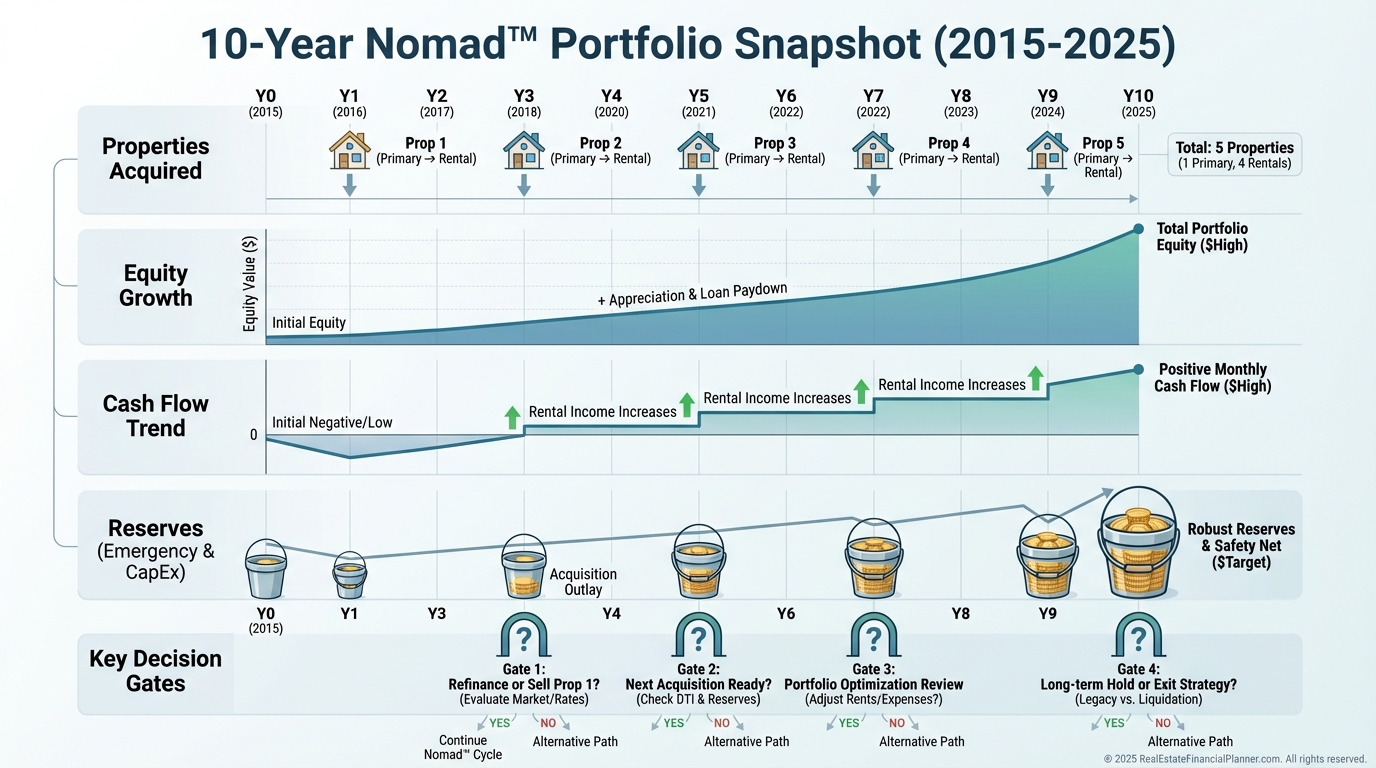

A 10-Year Walkthrough Example

Year 1 you buy with 5% down, live there, and stabilize your budget.

Year 2 you move to a better-located home, place the first into service as a rental, and start depreciation.

By Year 5 you may own four doors with modest cash flow but strong principal paydown and equity from appreciation.

By Year 10 many clients hit a crossover point where total cash flow plus safe yield on reserves can cover a meaningful slice of living expenses.

In my models, we track ROTNE for each property, set refi/sell gates, and plan CapEx so holdings stay tenant-ready without surprise assessments.

Your First 30 Days: Getting Started

Define your buy box with clear criteria for price, neighborhoods, rent targets, and condition.

Interview a lender who understands owner-occupant sequencing and document your move timeline in writing.

Set your reserve target and open a separate account; I like 6–12 months of total expenses per property.

Build a property plan template that covers rent comps, turn scope, lender rules, and your next purchase date.

Run a full Nomad™ scenario in the Real Estate Financial Planner™ so you know your numbers before you write offers.

This is not tax, legal, or lending advice; involve your CPA, attorney, and loan officer early so the plan survives contact with the real world.