Free and Clear: The Investor’s Playbook for Verification, Financing Power, and Portfolio Strategy

Learn about Free and Clear for real estate investing.

Why Free and Clear Is the Leverage Everyone Misses

Most investors chase cash flow and appreciation while overlooking the most durable advantage in real estate: free and clear ownership.

When I help clients rework their plans, one unencumbered property often becomes the hinge that triples options and slashes risk.

Recent data suggests over 37% of US homes are owned free and clear, yet fewer than 15% of investors plan for it.

That gap is where missed refinancing terms, premium exits, and cash-flow stability slip away.

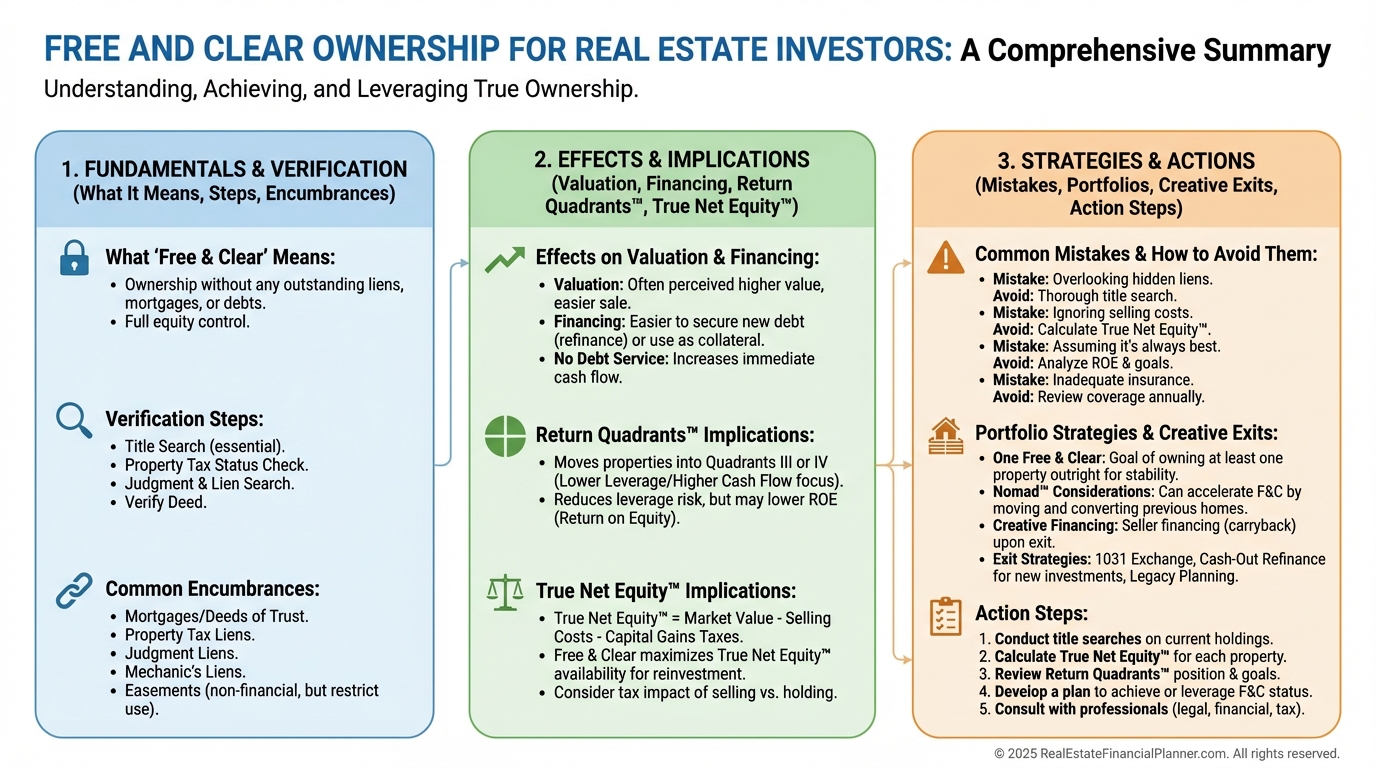

What “Free and Clear” Really Means

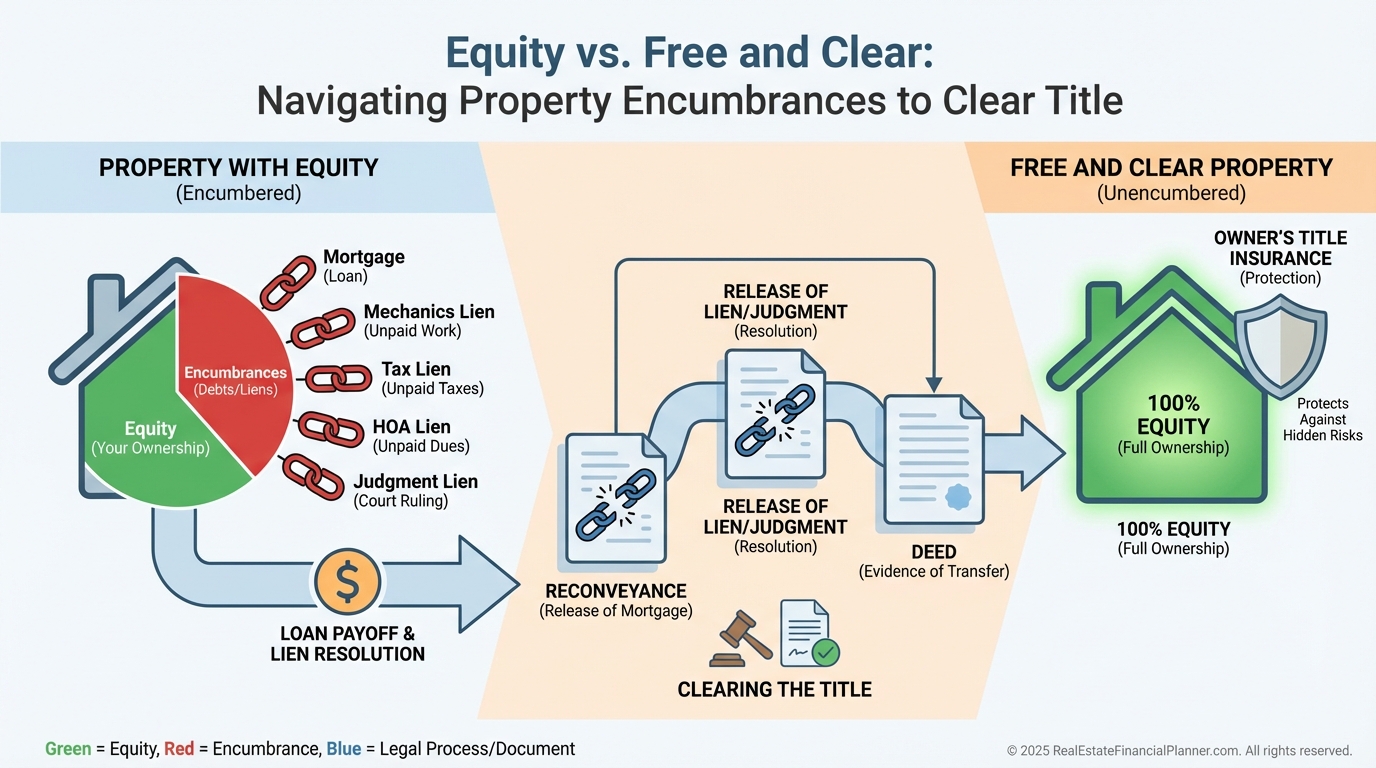

Free and clear means no mortgage, no liens, and no encumbrances—full title without clouds.

Paying off a loan is necessary, but it’s not sufficient if a mechanics lien, judgment, or tax lien still attaches to your property.

Equity is not the same as free and clear.

You can have 83% equity and still be encumbered, which impacts borrowing capacity, exit strategies, and stress resilience.

When I model deals in The World’s Greatest Real Estate Deal Analysis Spreadsheet™, free and clear flips the math.

Cash-on-cash becomes pure net operating income divided by today’s value, and Return on Equity compresses, which changes hold vs. harvest decisions.

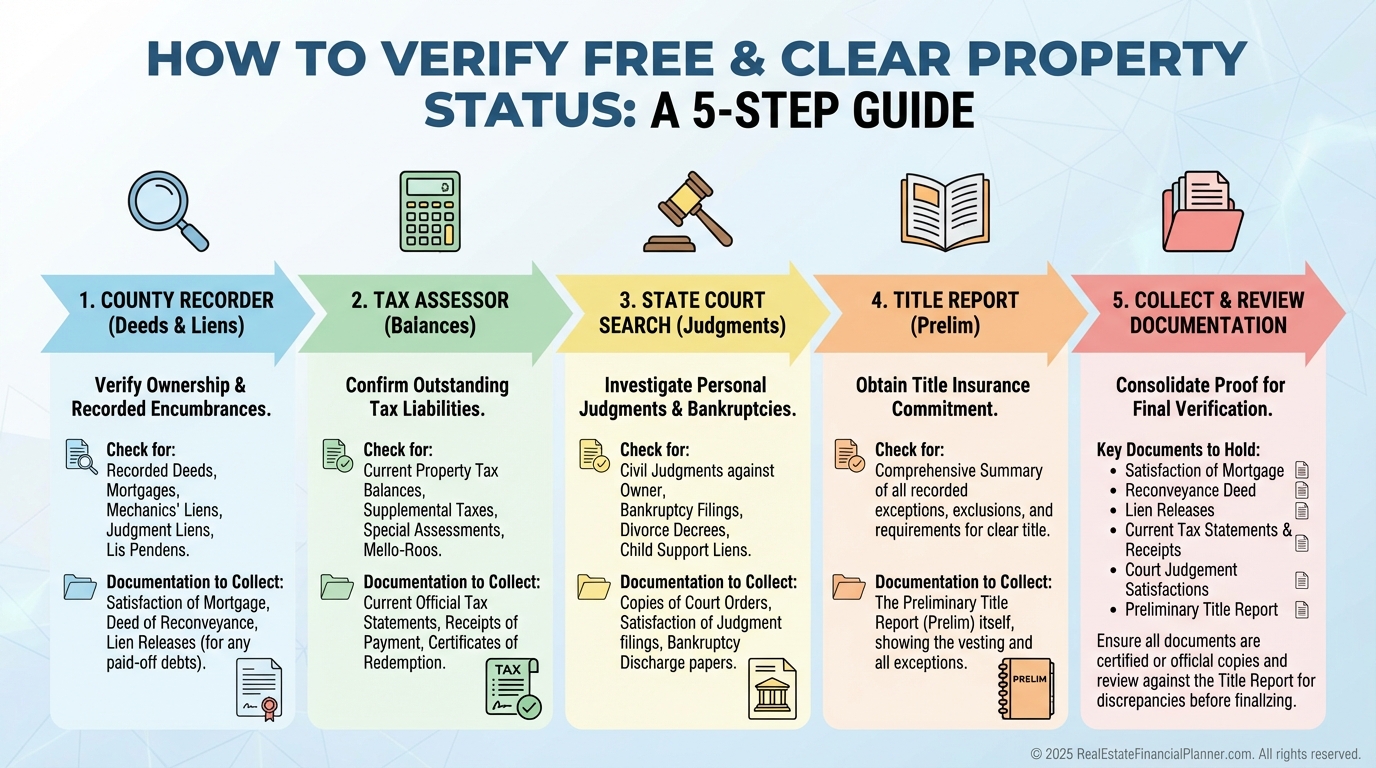

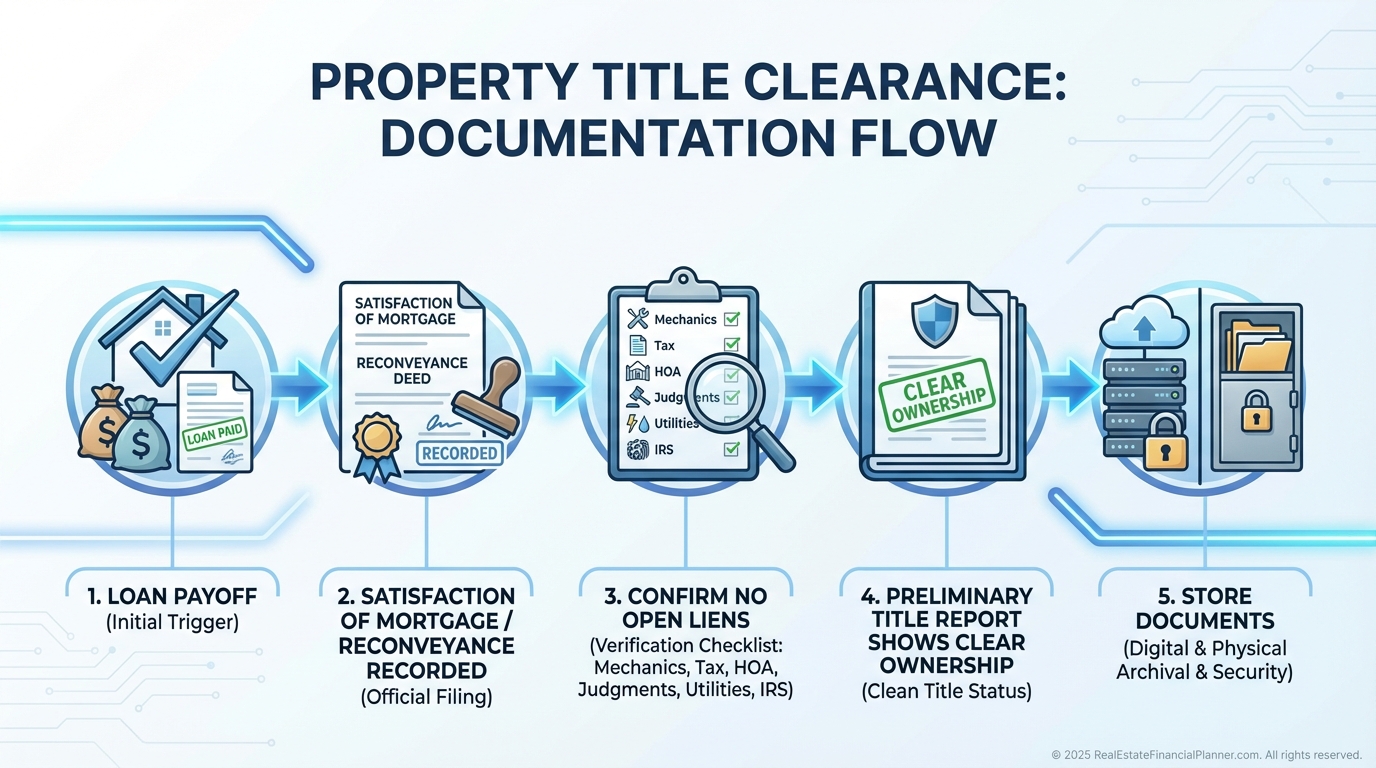

How I Verify True Free and Clear Status

I never assume a property is unencumbered because the mortgage shows paid.

I verify it.

Start at the county recorder and tax assessor.

Search by address and parcel number, and review all documents recorded after your purchase.

I look for reconveyance or satisfaction of mortgage, unpaid taxes, mechanics liens, HOA assessments, judgment liens, utility liens, and any IRS notices.

Then I order a preliminary title report from a title company, even on properties I already own.

It costs $150–$500 and prevents costly surprises later.

When I rebuilt after bankruptcy, I learned to save every proof of payment and every lien release.

I also calendar semi-annual checks—six minutes online saves six weeks in escrow.

Here’s why this matters.

David paid off his triplex and applied for a cash-out refi.

A three-year-old mechanics lien from a roofing job stalled the deal for six weeks and cost $2,000 to cure.

Jennifer inherited a “paid off” triplex, listed it, and learned in escrow there were $18,000 of back taxes and a $7,500 mechanics lien.

Her closing delayed two months, and her proceeds dropped by $25,500.

How Free and Clear Changes Valuation and Financing

Unencumbered assets open doors other properties cannot.

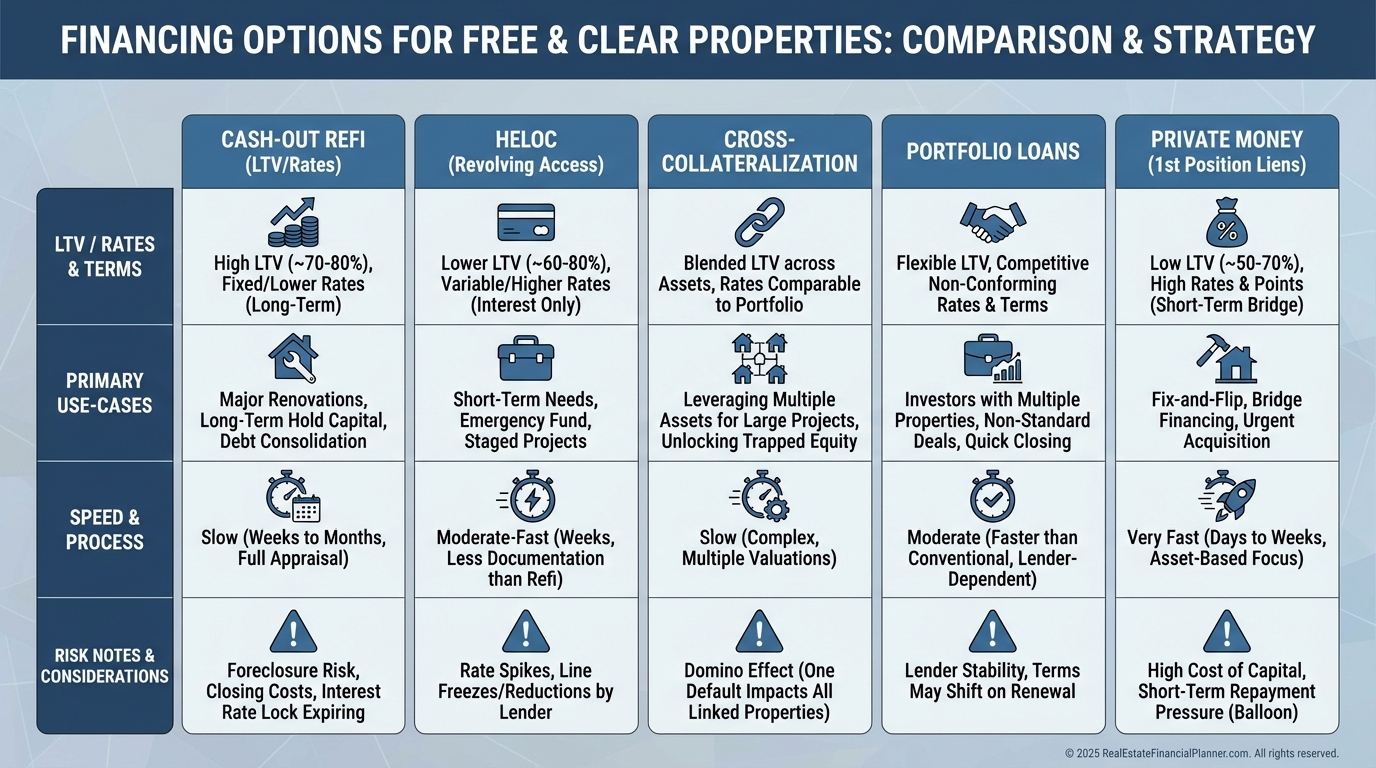

You can cash-out at 75–80% LTV, often at better pricing than purchase loans.

You can establish HELOCs to pounce on deals without dragging closing timelines.

You can cross-collateralize to secure multiple loans with one property, negotiate portfolio loans, or offer first-position liens to private lenders for premium terms.

Buyers pay more for flexibility.

Free and clear properties often command 5–10% premiums because they close faster and simplify seller financing and creative exits.

Marcus owned a free and clear fourplex worth $420,000 and pulled a portfolio loan at $350,000 and 5.75%, not 6.5%.

That negotiation saved him $2,625 a year and gave him an extra $35,000 to deploy.

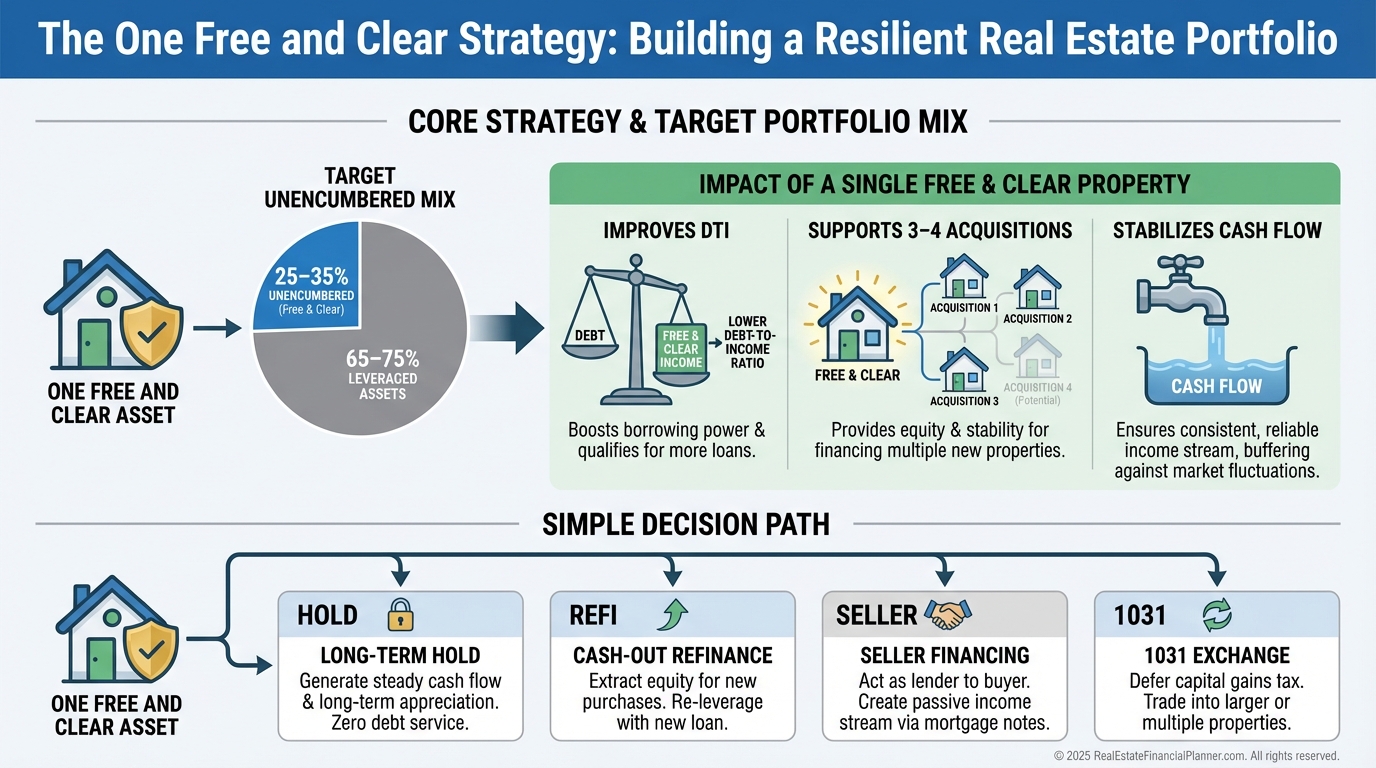

On portfolio modeling, I see each free and clear asset supporting three to four leveraged acquisitions while improving debt-to-income, stabilizing cash flow, and reducing overall risk.

How the Math Shifts: Return Quadrants™ and True Net Equity™

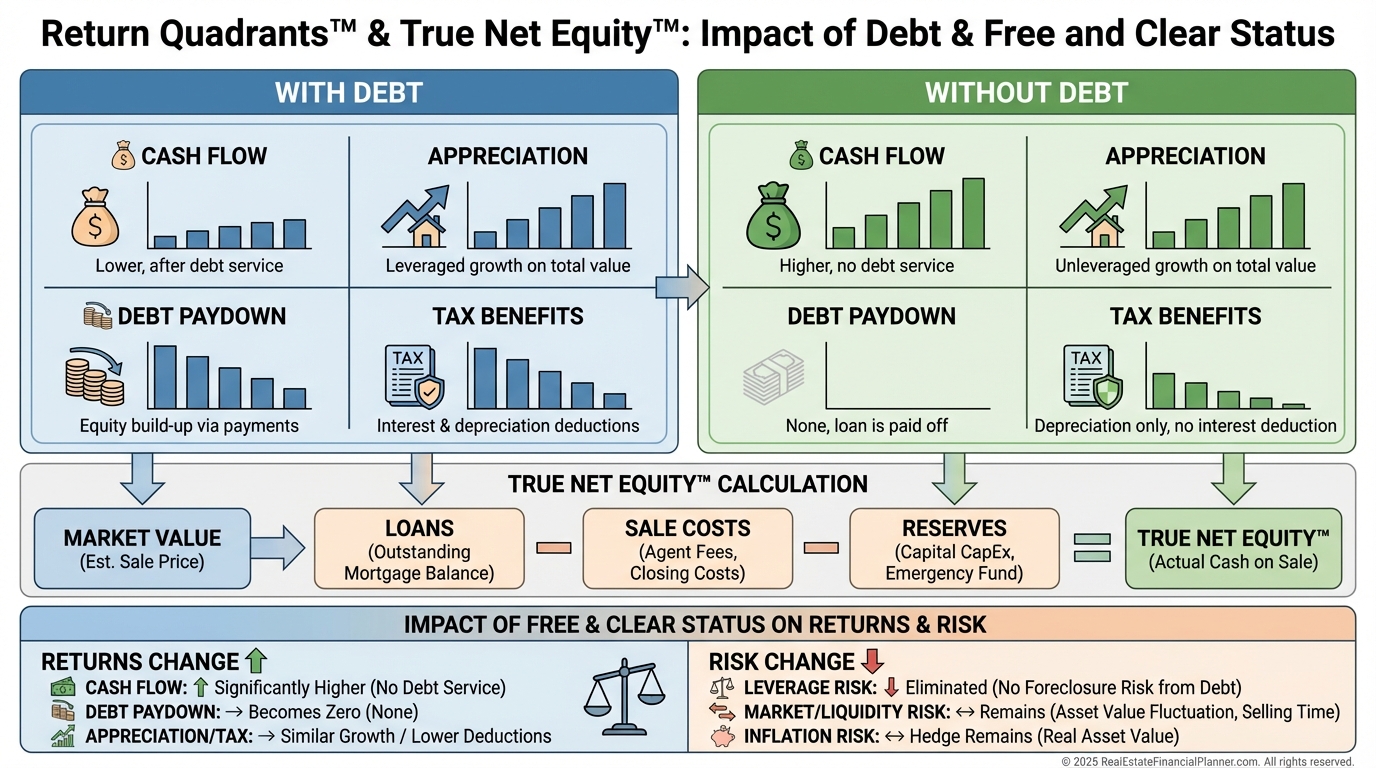

When we run Return Quadrants™ on a free and clear property, principal paydown disappears as a return source, and volatility from debt is gone.

Cash flow becomes dominant, appreciation remains, and tax benefits persist.

With True Net Equity™, I subtract sales costs, loan balances (if any), and required reserves to see the spendable equity.

On free and clear properties, True Net Equity™ is larger and more reliable, which often justifies 1031s, cash-out refis, or seller financing.

In The World’s Greatest Real Estate Deal Analysis Spreadsheet™, I compare ROE to after-tax alternatives.

If ROE compresses below my hurdle, I either refinance prudently or sell using an installment note to convert equity into income.

Common Mistakes I See (And How to Avoid Them)

Rushing to refinance is the big one.

Treating a free and clear property like an ATM destroys your optionality right before a downturn.

Ignoring hidden liens creates last-minute disasters.

Calendar semi-annual checks and keep a digital vault for all releases and proofs.

Over-leveraging after payoff brings back all the risk you just eliminated.

Set LTV caps and minimum DSCR thresholds before you borrow a dollar.

Poor record keeping turns small issues into legal bills.

Scan and label every satisfaction, reconveyance, lien release, and tax statement.

Tax surprises appear when you don’t plan for reassessments, transfer taxes, installment sale taxation, or depreciation recapture.

Loop in your CPA before you sign.

When clients forget to update insurance after payoff, they sometimes lose coverage improvements tied to lender requirements.

I review insurance at payoff and again annually.

Strategic Applications for Portfolio Growth

I coach clients to adopt the One Free and Clear strategy early.

One unencumbered property that covers minimum lifestyle becomes your sleep-at-night asset and your financing Swiss Army knife.

I aim for 25–35% of portfolio value to be unencumbered over time.

That buffer increases borrowing capacity and lets you play offense during market stress.

If you invest using Nomad™, target the strongest cash-flowing property to pay off first once you stabilize the portfolio.

That single asset will backstop rents, vacancies, and turns across the rest of your holdings.

Free and clear enables creative exits.

Seller financing typically commands 1–2% higher rates than bank loans and creates installment-sale tax benefits.

Master lease options, life estates, charitable remainder trusts, and self-directed IRA transfers all get simpler without debt.

Robert used a free and clear duplex worth $275,000 as additional collateral to buy a $1.2M 12‑unit at 90% financing.

He preserved cash, scaled faster, and protected his downside.

Action Steps: 30 Days and Beyond

Within 30 days, audit your portfolio, list balances and payoff dates, and flag candidates for accelerated payoff.

Order preliminary title on anything you think is free and clear and organize documents in a digital vault with backups.

Meet two lenders and one portfolio lender to discuss free and clear collateral programs, terms, and HELOCs.

Model payoff vs. acquisition in The World’s Greatest Real Estate Deal Analysis Spreadsheet™ using True Net Equity™ and your hurdle ROE.

Over the next year, set payoff priorities based on cash flow to debt service, and define when you’ll borrow against a free and clear asset.

Update your estate plan and insurance, and coordinate tax strategies for installment sales and depreciation recapture.

The investors who thrive in any market are the ones who stay flexible.

Free and clear provides that flexibility, while still letting you engineer growth.

Your next move is simple.

Pick one property to target for free and clear status, schedule a title review, and commit to a written borrowing policy so you keep the advantage you just earned.