Utilities Mastery for Real Estate Investors: Model, Meter, and Monetize to Protect NOI and Increase Value

Learn about Utilities for real estate investing.

Why Utilities Decide Your Returns

I don’t. I model utilities like a lender underwrites DSCR, because a sloppy $200/month miss can wipe out your cash-on-cash and your valuation.

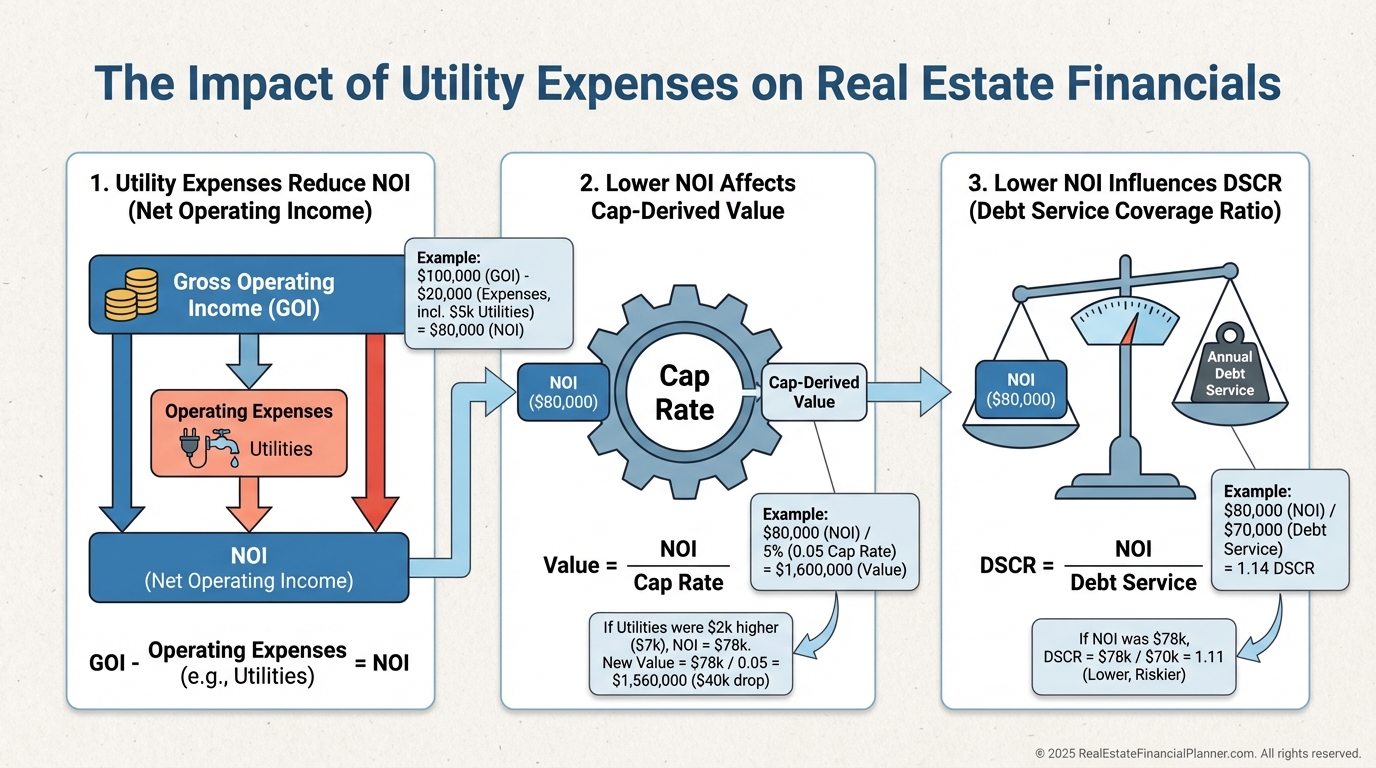

In The World’s Greatest Real Estate Deal Analysis Spreadsheet™, utilities live in operating expenses, which means every utility dollar reduces NOI, cap value, and DSCR.

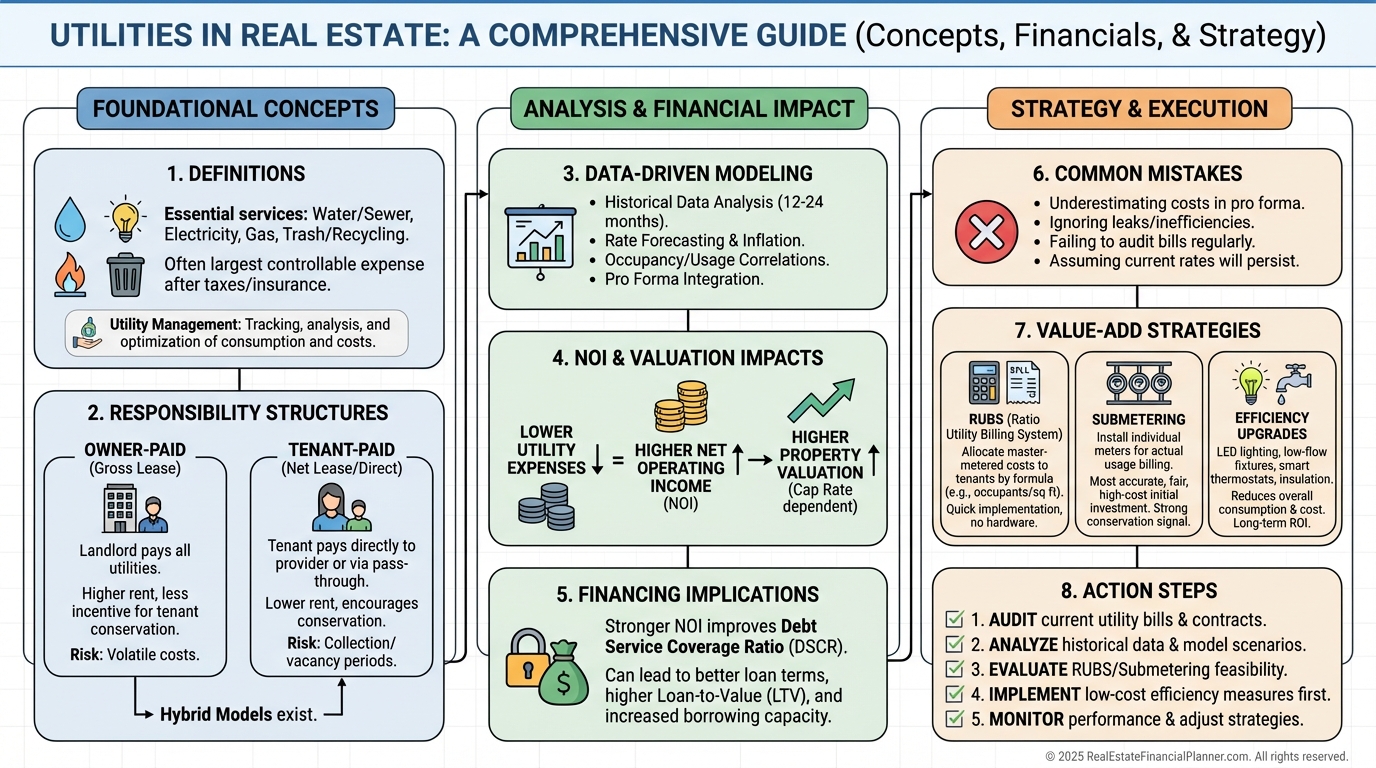

What Counts as Utilities (and Why They’re Different)

Utilities are continuous consumables: electric, gas, water, sewer, and trash.

Because they’re consumption-based, they fluctuate seasonally and respond to leaks, behavior, and rate changes. That’s where smart investors find yield.

Utility Responsibility Structures You Must Master

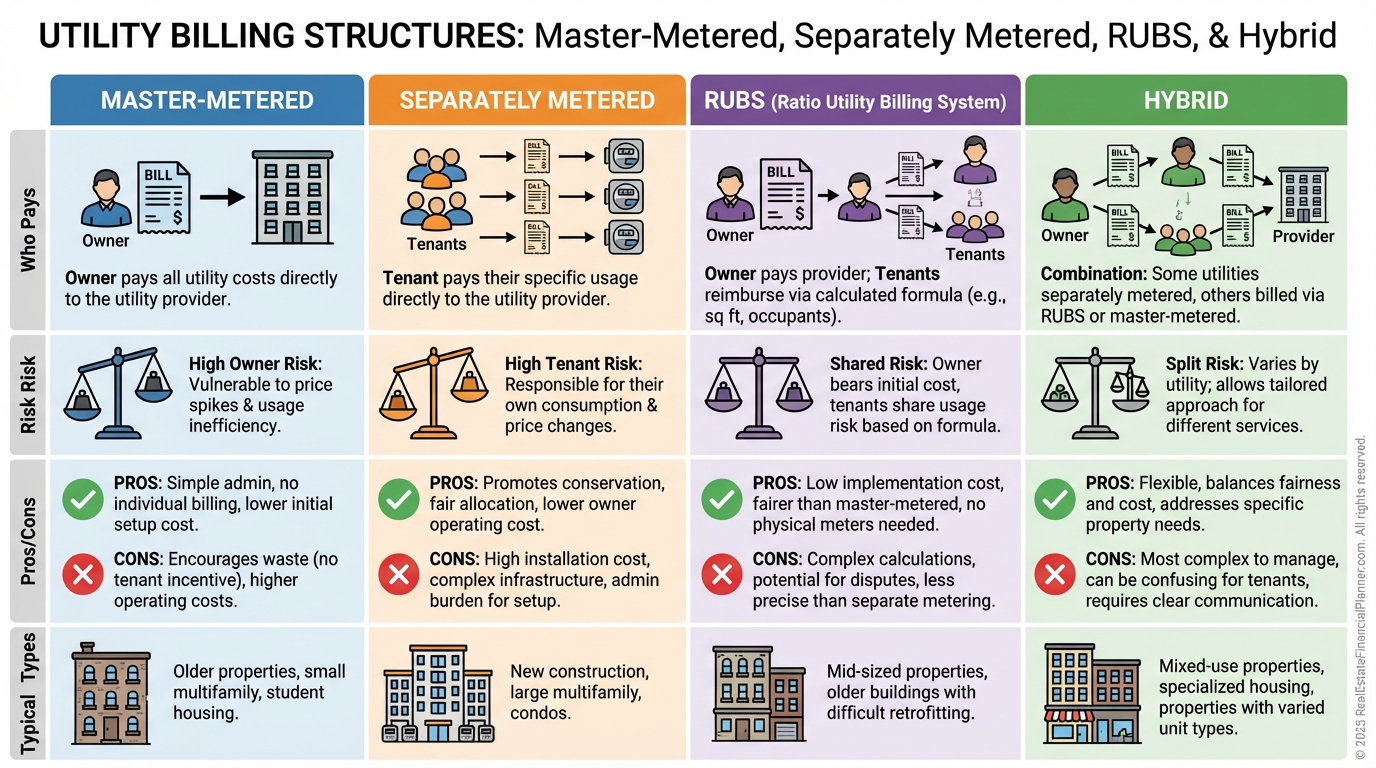

Master-metered puts all consumption risk on you. It’s common in older small multis and makes underwriting harder but management easier.

Separately metered shifts consumption to tenants and is ideal for single-family and many modern multis.

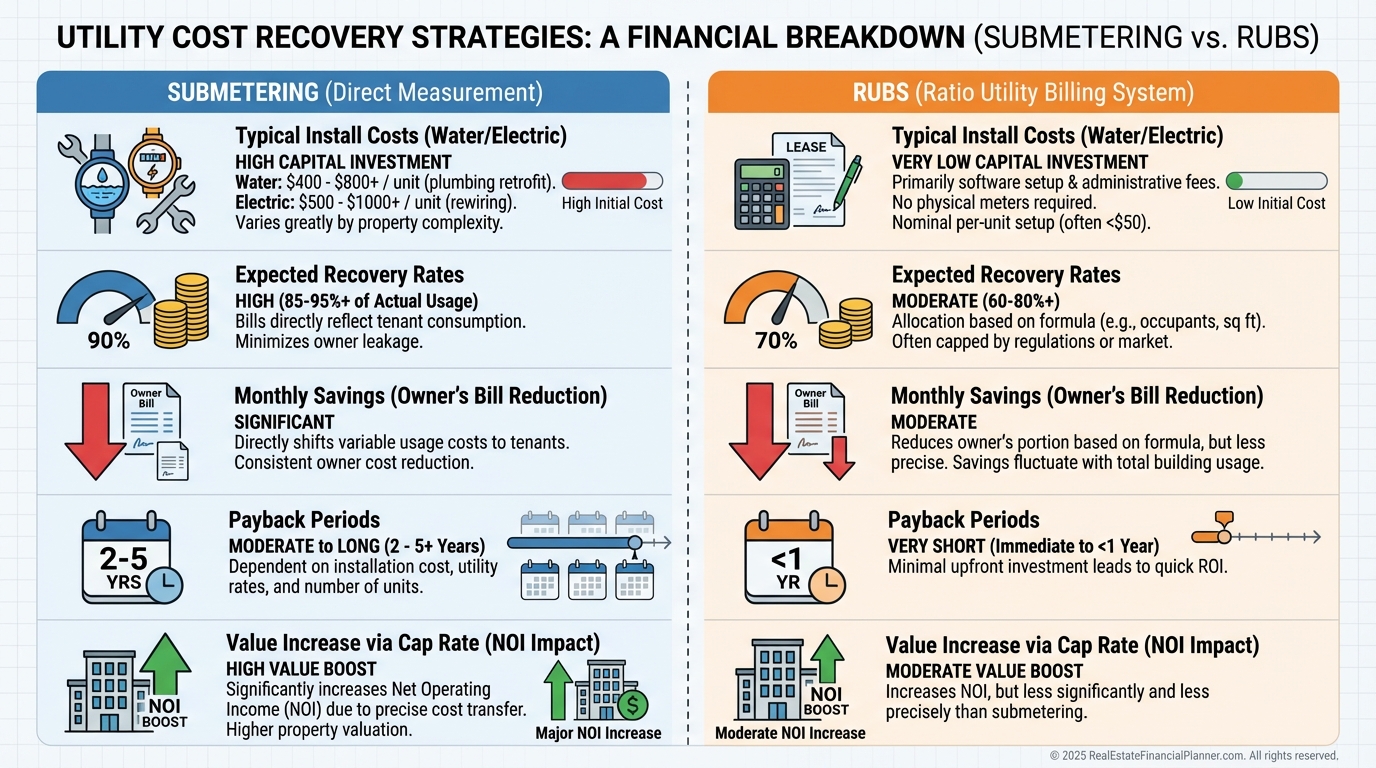

RUBS—Ratio Utility Billing System—allocates costs by square footage, occupants, or fixtures. It’s a legal, low-cost way to recover 80–90% without full submetering in many markets.

When I help clients screen deals, I tag responsibility in the first 30 seconds. If I can’t verify meters and bills, I assume owner-paid until proven otherwise.

How I Get Real Numbers (Not Seller Stories)

I never accept verbal estimates or cherry-picked bills.

I ask for 24 months of bills for each utility, then call each utility for usage history at the address. If I get pushback, that’s a tell.

I benchmark with local property managers and investor peers who own similar units. Their numbers anchor my pro forma more than MLS remarks.

When I rebuilt after a bad winter surprise early in my career, I started modeling seasonality instead of averages. It changed my returns overnight.

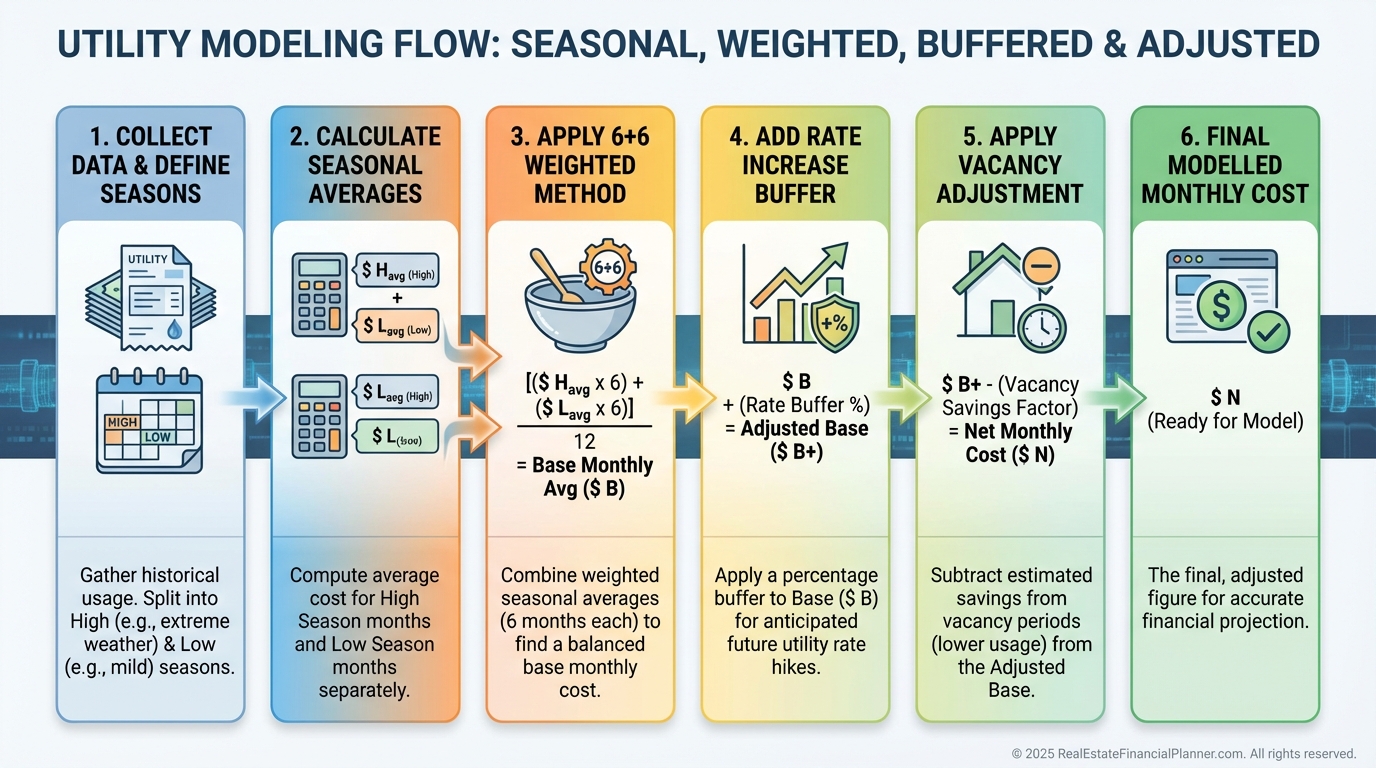

The Seasonal Model I Use in Every Pro Forma

I segment 12 months into high and low seasons based on heating or cooling.

Then I compute two averages and weight them: 6 months at the high average, 6 months at the low average.

I add a 5% buffer for rate creep and an allowance for vacancy consumption. Fridges, water heaters, and common-area lights don’t know a unit is empty.

Red flags I watch for: 300% month-to-month swings, YOY increases over 15%, missing months, and bills way below local norms.

How Utilities Change Value, DSCR, and Your Plan

Utilities flow through NOI, which sets value on income property.

If a fourplex grosses $4,000/month and landlord-paid utilities run $800/month, effective income is $3,200. At a 7% cap, that $9,600/year expense knocks about $137,000 off value.

It also drags DSCR. Lenders want 1.20–1.25 DSCR. Higher utilities shrink underwritten NOI, forcing bigger down payments or killing the loan.

Separately metered assets often underwrite cleaner, which can improve terms and confidence with lenders.

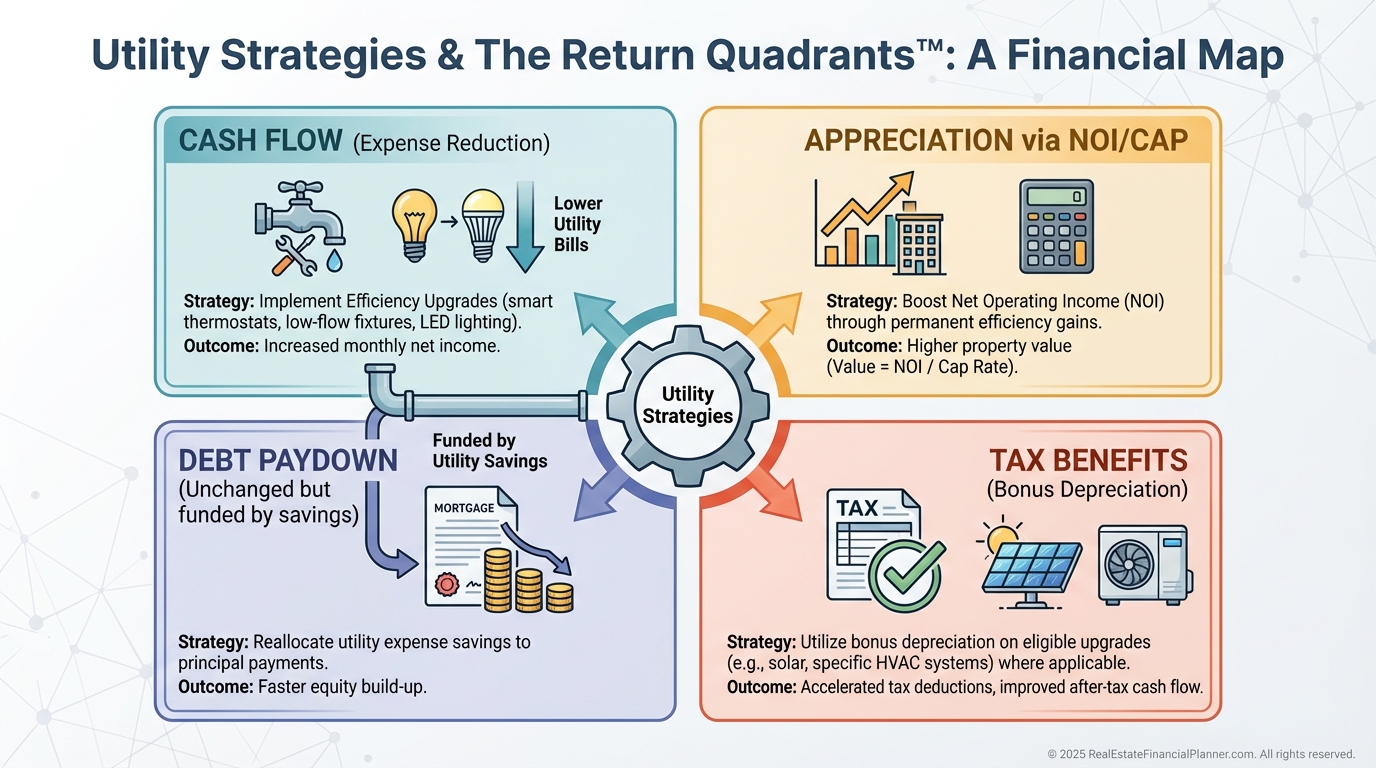

Return Quadrants™ and True Net Equity™ Impacts

In Return Quadrants™, utility savings show up primarily in the Cash Flow quadrant.

But the ripple hits Appreciation via cap-based valuation on small multis and commercial. Reduce expenses, raise NOI, increase value.

On True Net Equity™, a utility optimization that raises value while costing modest CapEx increases your equity after all selling costs and transaction friction. That’s durable wealth, not just better monthly cash flow.

When I coach Nomad™ investors moving from house to house, we structure leases so utilities are tenant-paid whenever possible—cleaner underwriting, easier qualification on the next loan.

Common Utility Mistakes I See (And Fix)

Underestimating true costs because a seller shared their 3 best months. I verify with utility companies.

Ignoring seasonal spikes. I budget peaks, not averages.

Assuming separate meters exist. I physically find and photograph every meter and main shutoff.

Forgetting rate increases. I model 3–5% annually, higher for water/sewer in fast-growing cities.

Missing leaks. One running toilet can burn hundreds monthly on a master meter.

Miscalculating closing prorations and deposits. I set cash-on-hand for transfers so DSCR isn’t pinched in month one.

Negotiating and Screening With Utilities

I use utility data as a price lever. If water is double the submarket average, I negotiate a price reduction or seller credit to fund submetering or fixture upgrades.

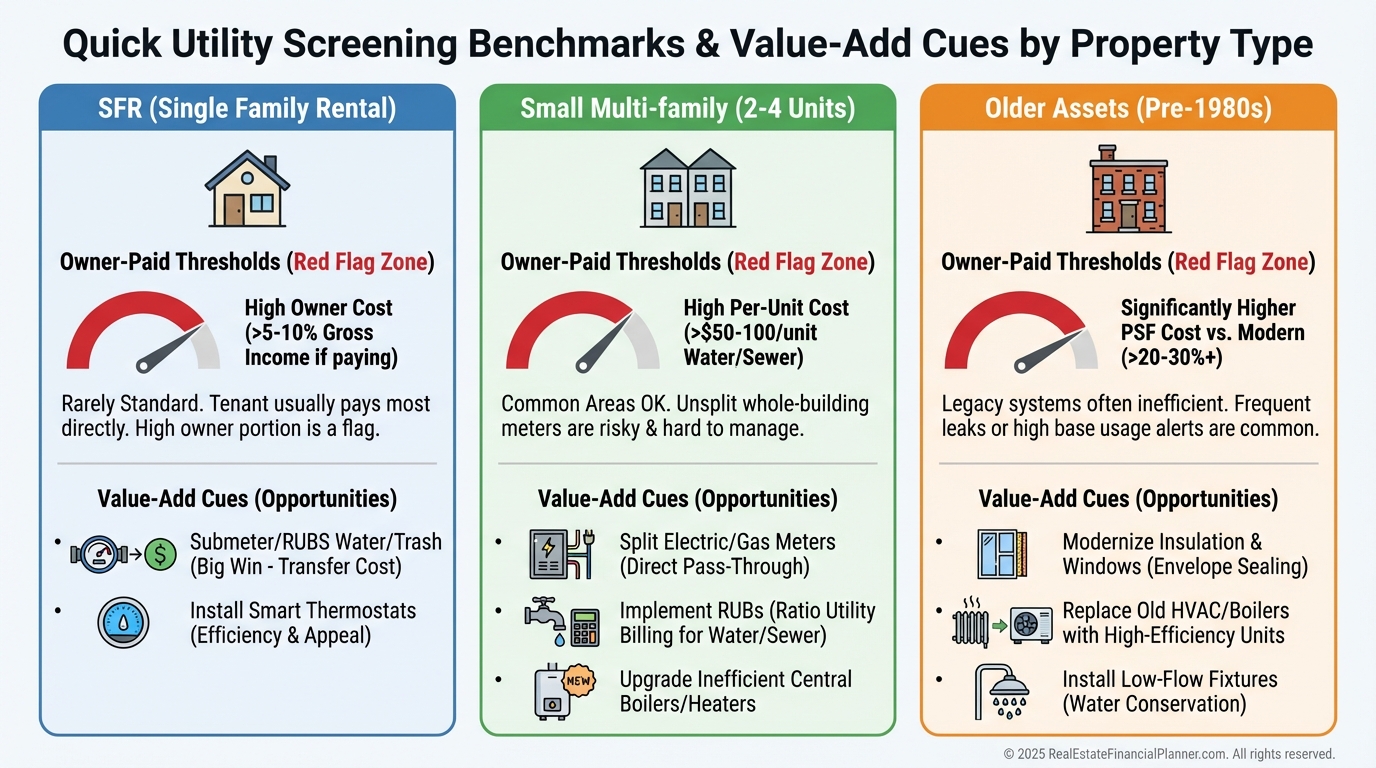

For quick screening, my rules of thumb are simple.

Single-family: tenants pay all. If not, I pass unless price reflects the drag.

Small multis: owner-paid utilities should stay under 10% of gross rents or I need a value-add plan to recover.

Older assets: I pad 20% against local utility benchmarks unless proven efficient.

Value-Add: Submetering, RUBS, and Efficiency

I helped a client buy a sixplex with $1,500/month owner-paid utilities. We installed water submeters and implemented RUBS.

Tenants took on $1,200/month. At a 7% cap, that single change added roughly $205,000 in value. Payback was under 24 months.

That’s not theoretical. That’s how professionals create spread where amateurs see headaches.

Advanced Tactics I Implement

Before submetering, I run the math.

Water submeters often cost $300–$500 per unit. Electric can be $500–$800 per unit depending on panels.

I expect to recover 70–90% of the bill via submetering or RUBS, with an 18–36 month payback. Then I convert annual savings to value using the market cap rate.

On implementation, I give tenants 60–90 days’ notice, include a clear rubric in the lease, and sometimes offer a small concession during the transition.

For efficiency, I target low-hanging fruit.

LEDs for common and exterior areas. Low-flow showerheads and aerators. Smart thermostats for common areas and turnovers. These typically return 15–70% savings on the targeted line item.

Solar can pencil when rates are high, roofs are unshaded and south-facing, incentives cover 30%+, and your hold is long. I model degradation, maintenance, and vacancy assumptions before I greenlight it.

Special Situations: Section 8 and Utility Allowances

If tenants receive assistance, utility allowances matter. They reduce the allowable contract rent.

When I lower a tenant’s expected utility burden with efficiency upgrades, the allowance can drop at recertification, effectively raising my net rent.

I document improvements and provide before/after bills to the housing authority when appropriate.

Portfolio Management: What I Track Quarterly

I benchmark utilities per unit, per square foot, and as a percent of rent.

If a property runs 20% above my portfolio baseline, I investigate consumption, leaks, and behavior.

I update my model with actuals every quarter and re-forecast the next 12 months, including planned rent and rate changes.

Lease language stays tight. I specify who pays what, RUBS formulas, caps or protections if I must stay master-metered, and inspection rights for suspected leaks or misuse.

Financing: How Lenders View Utilities

Commercial lenders expect operating expenses around 35–45% of gross on small multis. Heavy owner-paid utilities push you over, triggering more scrutiny.

DSCR is sensitive to utilities. A $300/month miss can drop DSCR below 1.20, which can kill leverage.

Lenders like separate meters and predictable RUBS collections. Clean, documented histories make approvals easier and terms better.

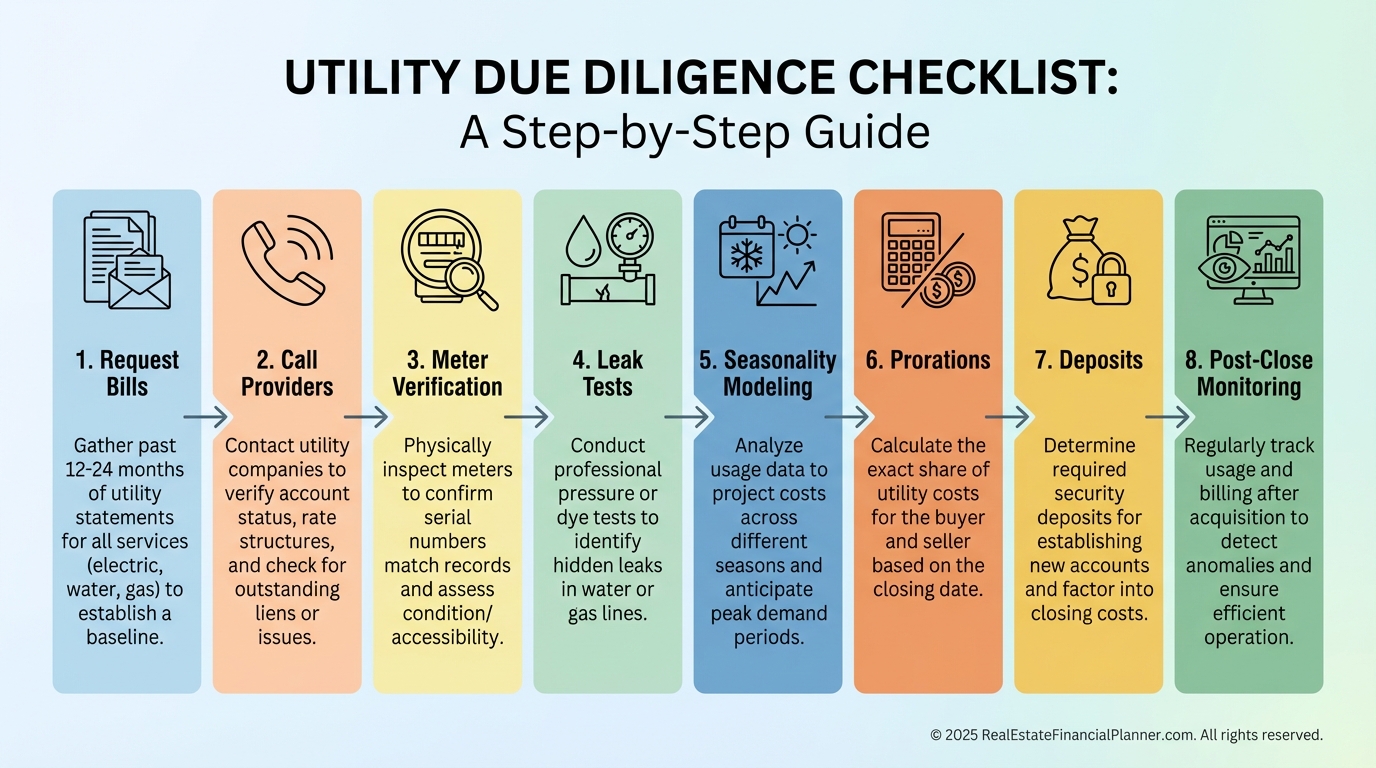

Due Diligence: The Checklist I Use

I collect 24 months of bills and utility company usage histories.

I photograph every meter, main shutoff, and common-area control. I confirm meter count equals unit count plus common.

I test for silent water leaks and watch the main when fixtures are off. I verify billing cycles and set proper prorations at closing.

I budget deposits and turn-on fees so the first month’s DSCR isn’t tight.

Action Steps You Can Take This Week

For current properties, pull 24 months of bills, compute cost per unit and as a percent of rent, and flag any property 20% above your benchmark.

Schedule energy audits where costs run hot. Price LEDs, low-flow fixtures, and smart thermostats, and prioritize the fastest paybacks.

For acquisitions, never write an offer without at least 12 months of utility data. Verify meters during inspection. Call providers for usage history. Bake a 5% annual increase into your pro forma.

Negotiate price or credits when utilities are high relative to comps. Bring a submetering or RUBS plan to the table so the seller knows you did the math.

The Bottom Line

Utilities separate average operators from professionals.

Every $1 you cut in utilities drops straight to NOI, increases value at the market cap, and raises True Net Equity™.

I’ve seen a simple $400/month reduction add $4,800 in annual cash flow and roughly $68,000 in value at a 7% cap. That compounding across a portfolio is career-defining.

Control utilities like a lender underwrites DSCR, and your returns will show it.