Creative Financing: The Win-Win Deals Most Investors Miss

Learn about Creative Financing for real estate investing.

Creative Financing Is Not A Trick, It’s A Tool

Creative financing is any method of buying real estate without using a brand-new traditional loan from a bank.

It’s not “free money.” It’s problem-solving with paperwork.

When I help clients evaluate deals, I treat creative financing like a wrench in a toolbox.

You don’t use a wrench on every screw. You use it when the problem calls for it.

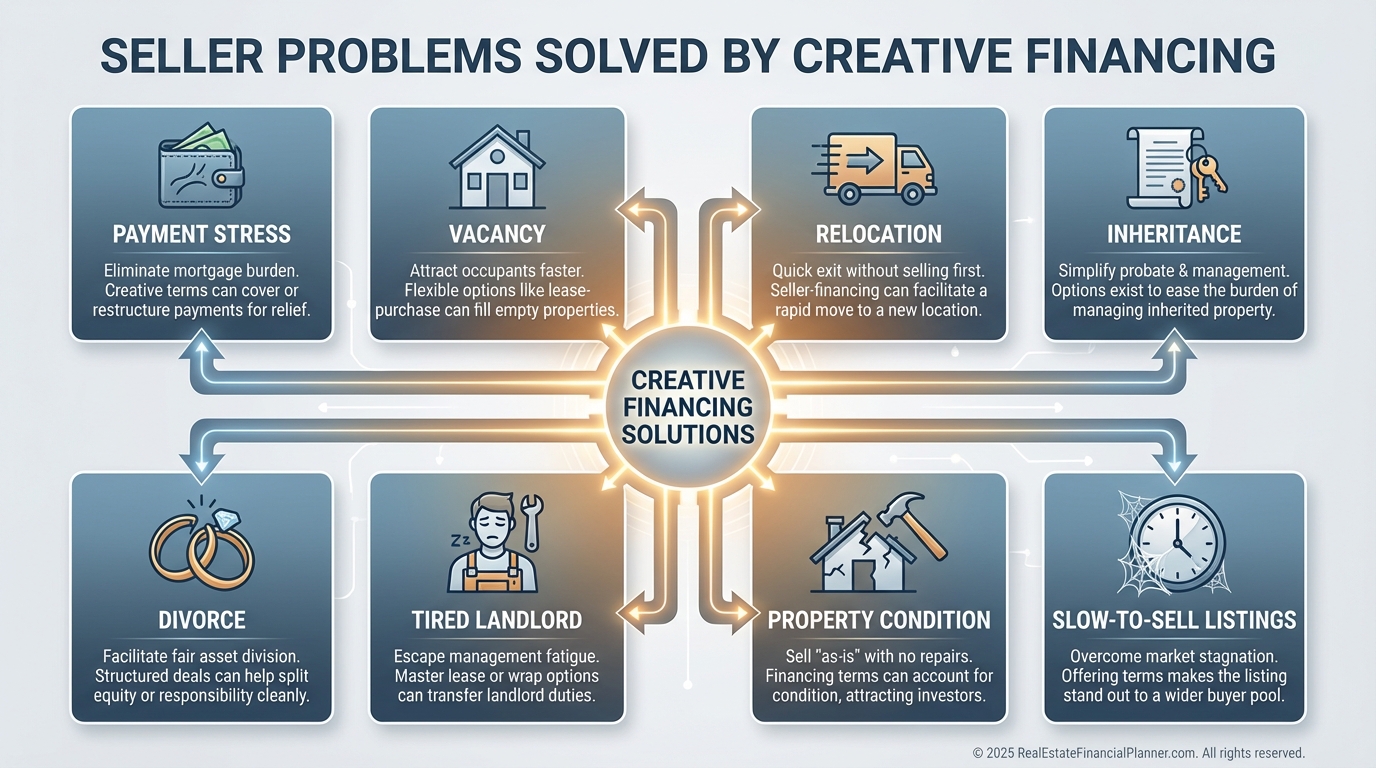

The Real Reason Creative Financing Works

Most sellers don’t wake up wanting “creative financing.”

They wake up wanting relief.

Relief from a payment, a vacancy, a property they hate managing, an out-of-state headache, a divorce timeline, an inheritance mess, or a listing that isn’t moving.

Your job is to understand the problem well enough to offer a clean solution.

Not a clever solution.

A clean one.

Win-Win Or No Deal

I’m going to borrow a line that’s actually useful in real estate.

“With great power comes great responsibility.”

If you build a deal where the seller feels trapped, confused, or misled, it’s not just unethical.

It’s unstable.

When I rebuilt after bankruptcy, I learned the hard way that you only get so many “trust chips” in a market.

Spend them carefully.

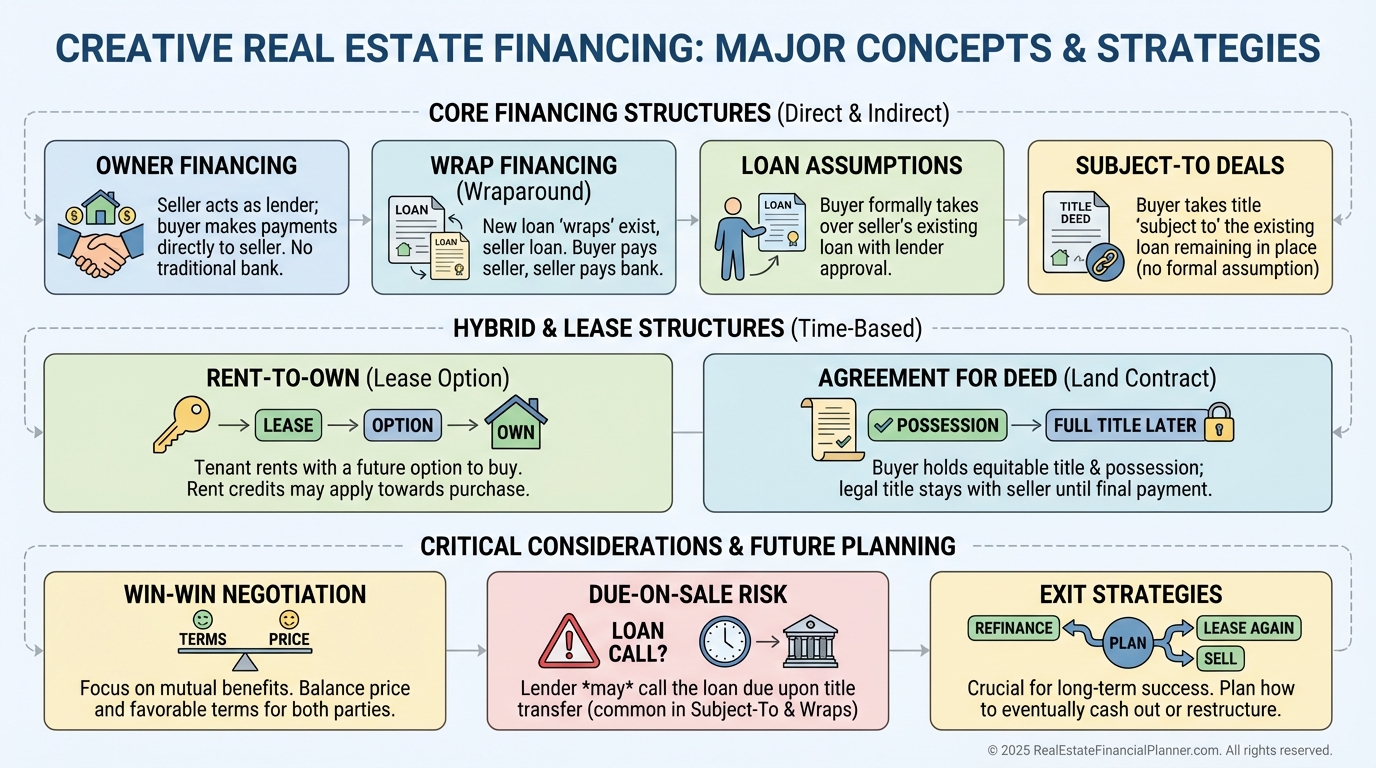

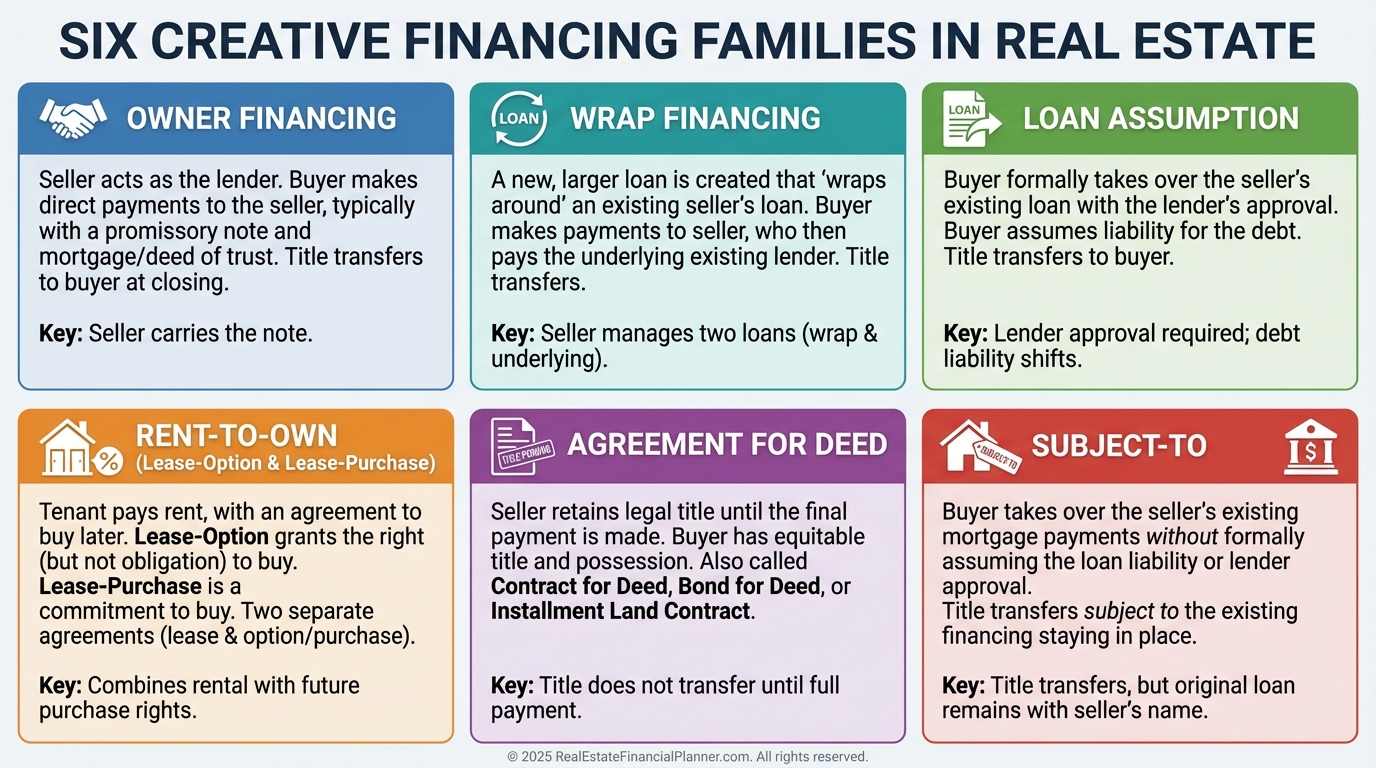

The Six Creative Financing Families

There are endless variations, but most creative deals fit into six families.

Each family changes two things: who owns the property now, and who is responsible for the underlying loan (if there is one).

Here’s the quick map.

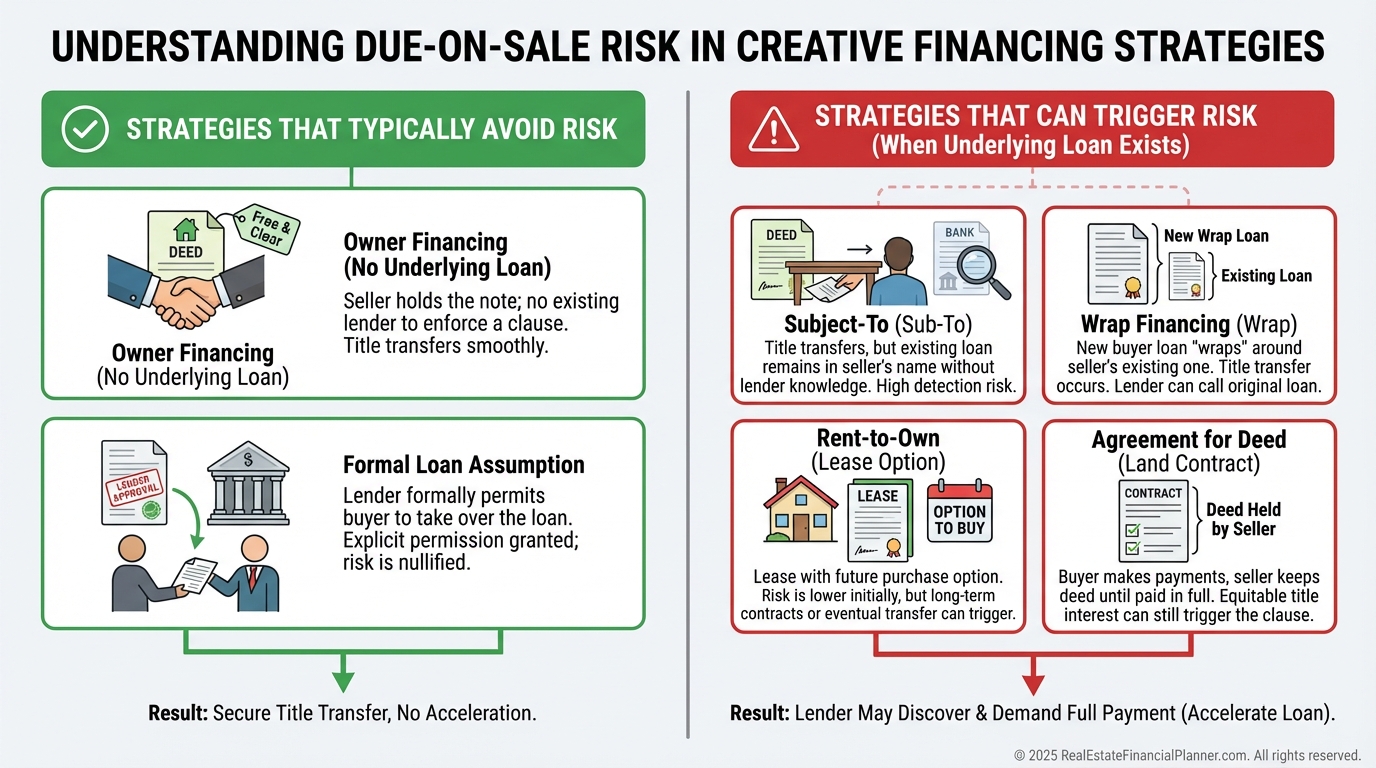

1) Owner Financing

The seller acts as the bank, usually because the property is owned free and clear.

You get the deed now, and the seller gets a note and lien.

This is the cleanest creative financing structure when it’s available.

2) Wrap Financing

The seller still has a mortgage, but they “wrap” it with a new loan to you.

You pay the seller, and the seller pays their lender.

This can work, but it adds a huge rule: you must protect against the seller not paying the underlying loan.

3) Loan Assumption

You formally take over the seller’s loan with the lender’s permission.

This can be powerful when the existing rate is far below today’s rates.

It also means you’re dealing with lender guidelines, approval, fees, and timing.

4) Rent-To-Own Family

You lease now and have the right (or expectation) to buy later.

The two common variations are lease-option and lease-purchase.

These deals can limit your downside if the market drops, but you don’t get all the ownership benefits until you actually buy.

5) Agreement For Deed Family

You’re effectively buying over time, but the deed doesn’t transfer until terms are completed.

Different states use different names, but the core idea is the same.

These deals can be useful, but the paperwork and enforcement details matter a lot.

6) Subject-To

The seller deeds the property to you.

The loan stays in the seller’s name.

You make the payments, but you are not the borrower.

This can be very attractive, and it carries the most misunderstood risk in creative financing: due-on-sale.

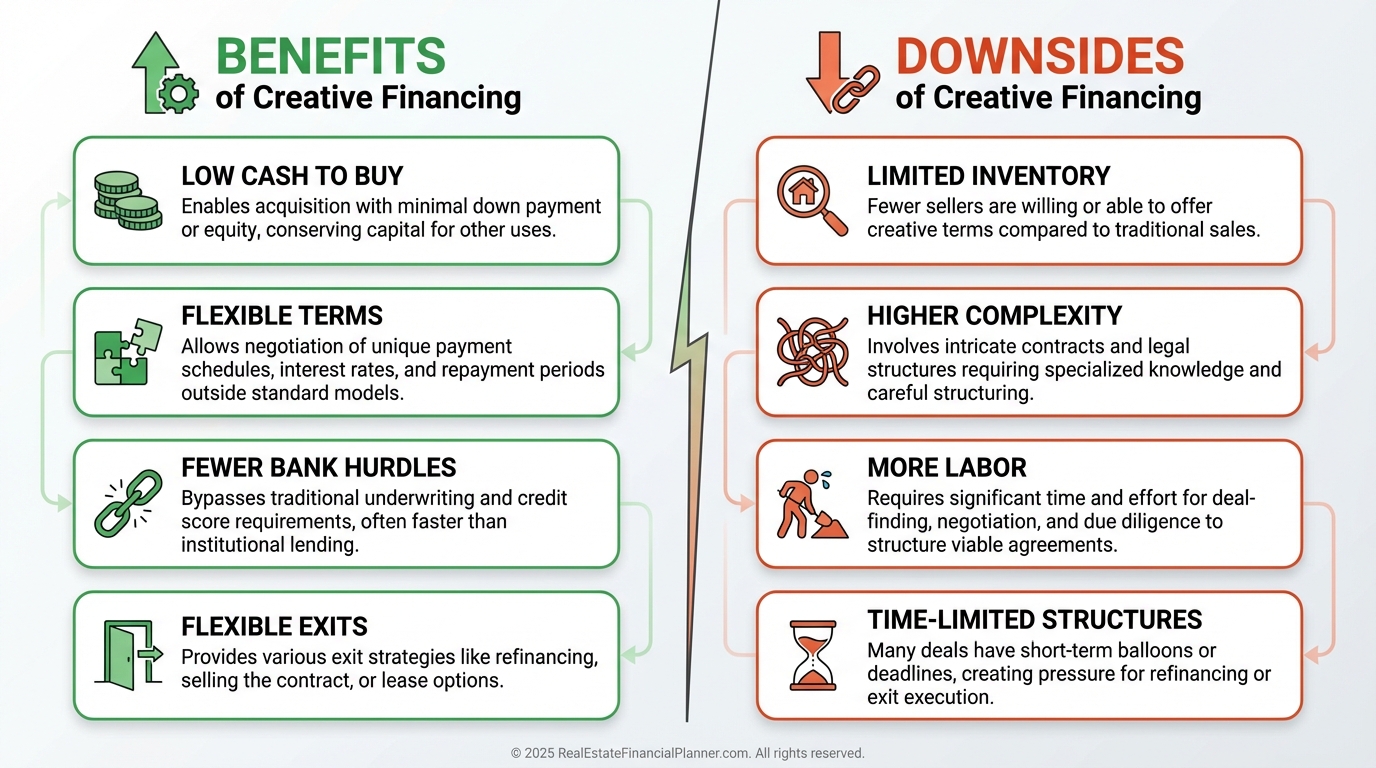

Benefits That Actually Matter

Creative financing is popular because it can change the math in your favor.

Not because it’s “easier.”

Here’s what it can do when structured correctly.

Reduce Cash Required To Buy. Lower cash in can let you buy more properties, faster, but it can also amplify losses if the deal is thin.

Bypass New Loan Qualification. Many structures don’t require a new loan, which can help if your income is uneven, your credit is rebuilding, or your timing is tight.

Negotiate Better Terms. Rate, amortization, balloon timing, payments, repairs, and even delayed closings can all be negotiated.

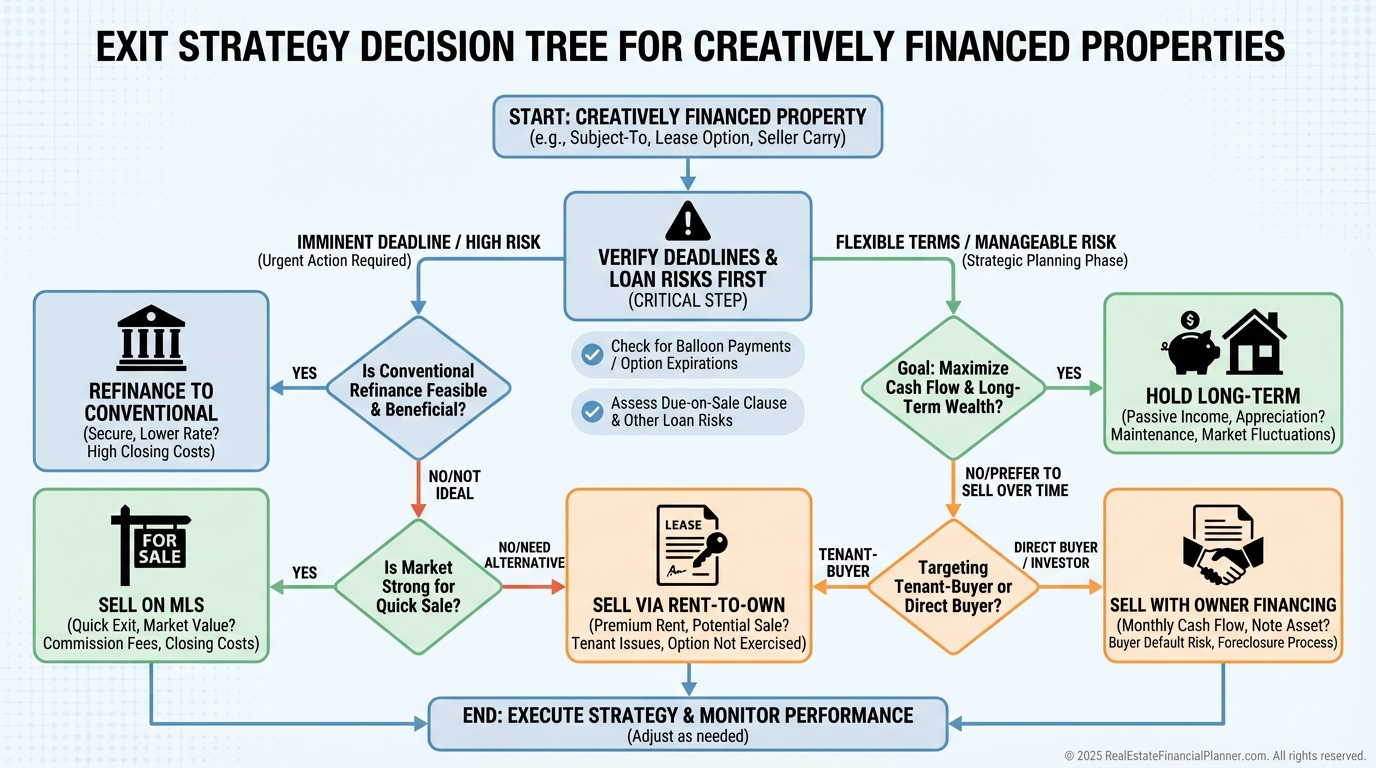

Create Flexible Exits. You can refinance later, sell traditionally, sell with another creative structure, or reposition the property.

When I run numbers with clients, I’m not just asking, “Can you buy it?”

I’m asking, “Is the deal resilient if things go wrong?”

The Downsides Most People Skip

Creative financing has real costs, even when there’s little money down.

Some are obvious, and some show up later.

You Work For The Deal. You’ll spend time marketing, negotiating, and structuring. This is entrepreneurial, not passive.

Inventory Is Smaller. You’re usually dealing with motivated or flexible sellers, not a giant MLS buffet.

Complexity Adds Risk. More moving parts means more ways for the deal to break.

Some Deals Imply A Shorter Hold. Options expire, balloons come due, or underlying loans create “get out later” pressure.

The One Risk You Must Respect: Due-On-Sale

If there is an underlying loan with a due-on-sale (or due-on-transfer) clause, certain creative structures can trigger it.

That doesn’t mean the lender will call the loan.

It means they can.

This risk shows up most often with subject-to, wrap financing, rent-to-own structures (because equitable interest can be created), and some agreement-for-deed structures.

Owner financing avoids this when there is no underlying loan.

Loan assumption avoids this because you’re getting permission.

Don’t Speak Jargon To Sellers

Use precise language in your analysis.

Use plain language in your seller conversations.

When I’m coaching clients through seller calls, I want the seller to understand the offer without needing a glossary.

Instead of “subject-to,” say, “You deed the house to me, and I’ll take over making your mortgage payments.”

Instead of “wrap,” say, “You keep your loan in place, and I pay you each month so you can keep paying it.”

Clarity closes deals.

Jargon kills trust.

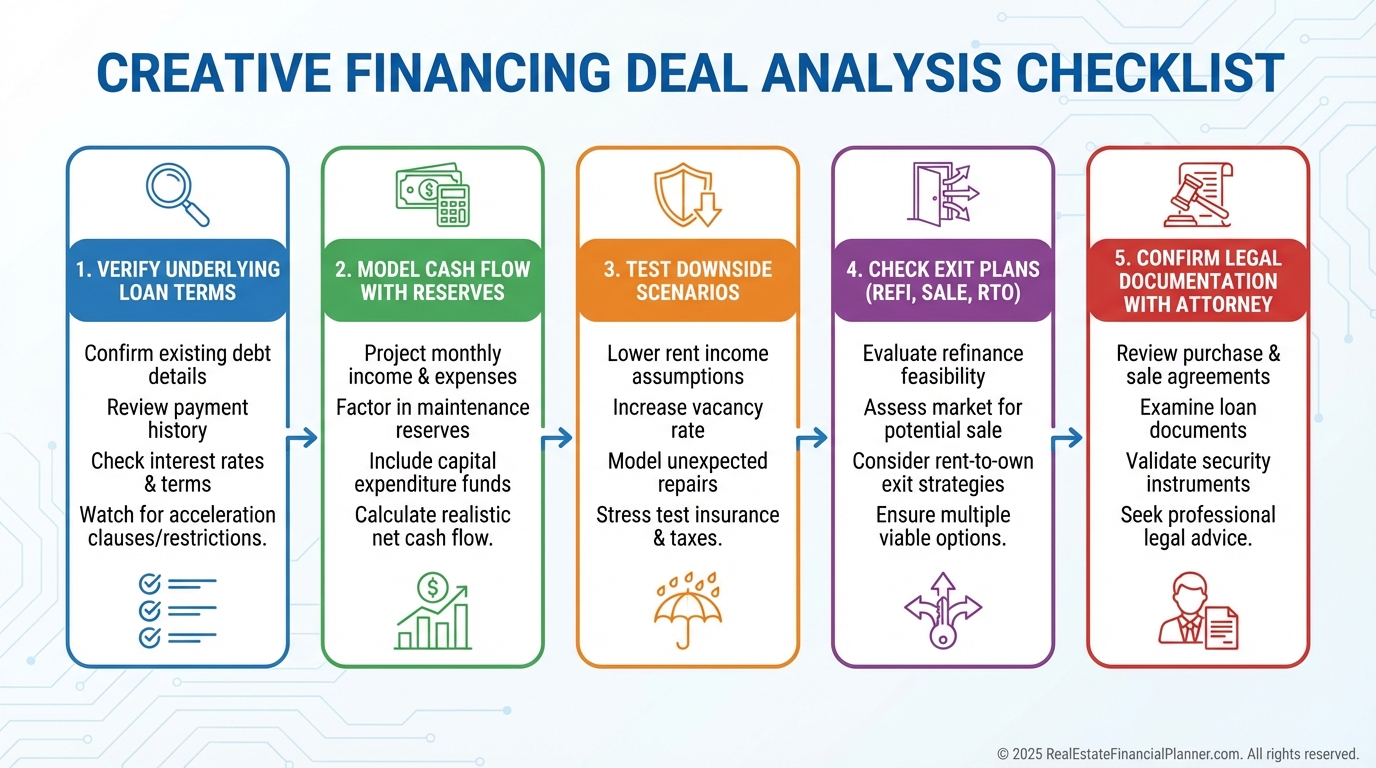

Analyze Creative Deals Like An Adult

Creative financing can make bad deals look good, because the monthly payment can be low.

That’s the trap.

When I’m modeling a deal, I treat financing as one line item.

I still want the fundamentals to work: rent, expenses, reserves, maintenance, and realistic vacancy.

Then I want to stress test it.

What happens if rent is five percent lower than expected?

What happens if insurance jumps?

What happens if you have a large repair early?

This is where your reserves matter.

This is also where your Return Quadrants™ thinking helps.

A deal can look “good” on cash flow and still be weak if it requires fragile assumptions.

How Creative Financing Fits Common Investing Strategies

Creative financing isn’t a strategy by itself.

It’s a way to enter or exit a strategy.

Long-Term Buy And Hold. Owner financing, assumptions, and some subject-to deals can accelerate acquisition when the terms are stable.

Nomad™ Or House Hacking. Assumable loans can be especially interesting if owner-occupancy rules line up with your plan.

BRRRR. You can buy with a creative structure, rehab, stabilize, then refinance into long-term debt.

Rent-To-Own As An Exit. You can sell to a tenant-buyer when a traditional buyer pool is tight.

Your best deal is the one you can hold through a bad year.

Not the one that only works in a perfect year.

Plan Your Exit Before You Buy

Every creative deal should start with an exit plan.

Not because you want to flip.

Because creative structures often come with deadlines.

Balloon payments, option periods, seller expectations, and lender risks are all timers.

When I look at a creative offer with a client, I want at least two exits that work.

A primary plan and a backup plan.

And both should be based on realistic financing and realistic buyers.

The Bottom Line

Creative financing can help you buy when other investors can’t.

It can also help you avoid deals that look “cheap” but are actually fragile.

Use it to solve real seller problems, structure clear win-win terms, and analyze the deal like you’re planning to hold it for a decade.

Because if you buy it wrong, you’ll spend years trying to undo it.