Installment Land Contract Mastery: How Investors Structure Safer, Win-Win Contract for Deed Deals

Learn about Installment Land Contract for real estate investing.

When I help clients close deals that banks reject, the tool that often saves the day is the installment land contract.

It’s simple in concept, powerful in practice, and unforgiving if you ignore the details.

What Is an Installment Land Contract?

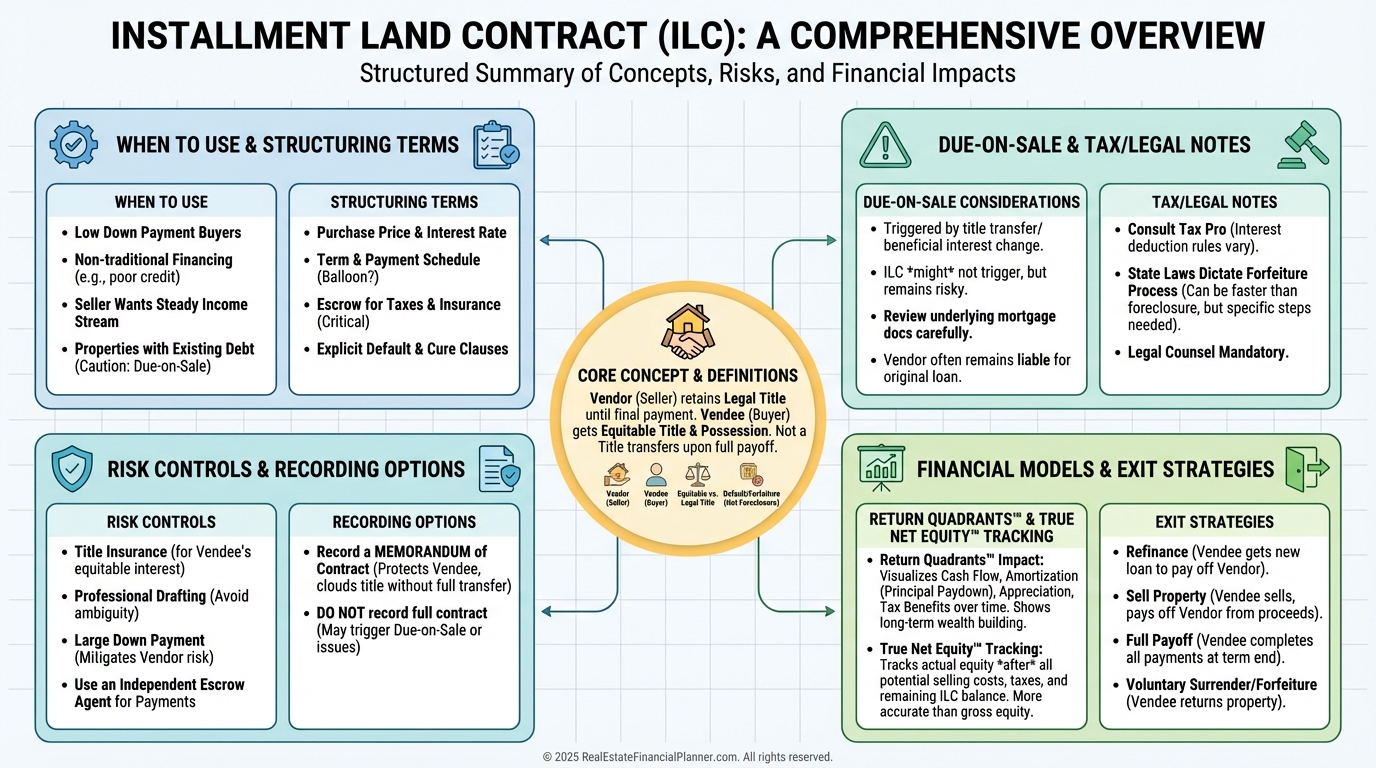

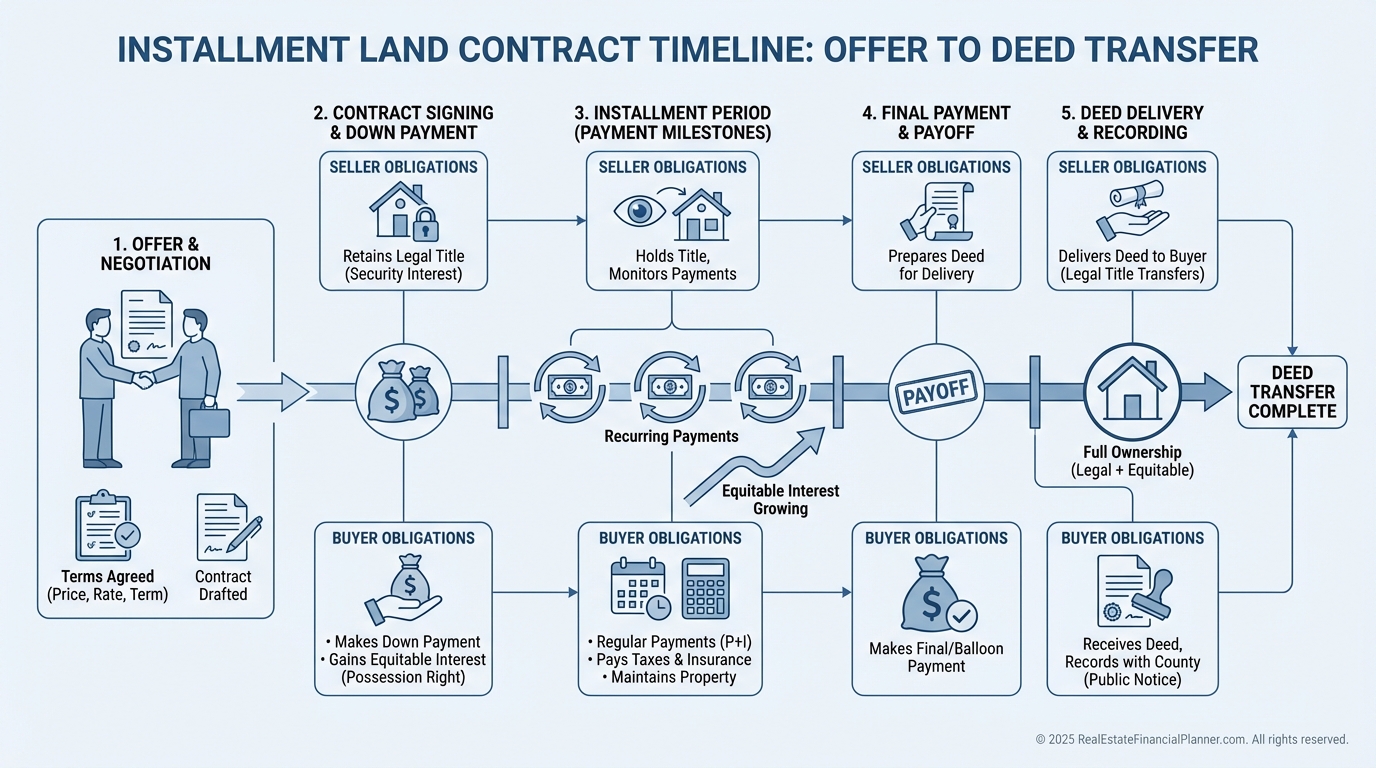

An installment land contract is seller financing where the seller holds legal title until you finish paying.

You get possession and equitable interest now, and the deed transfers when you complete the contract.

Depending on your market, you’ll hear it called contract for deed, agreement for deed, or bond for deed.

Same core idea: seller retains title as security; buyer pays over time and earns the right to the deed at payoff.

Why I Reach for This Tool

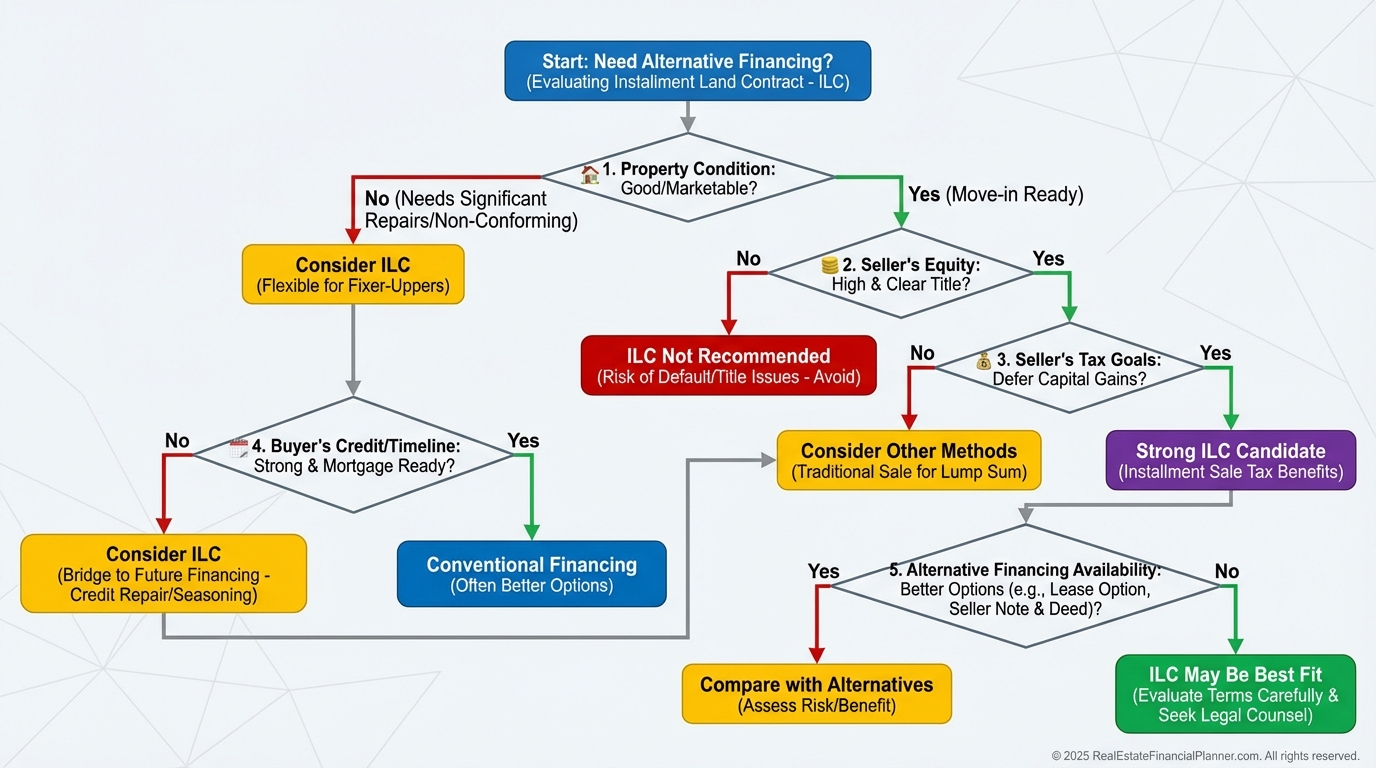

When a property needs work and a bank won’t lend, I can still buy, improve, and refinance later.

When a seller wants income, tax deferral, and relief from management, I can tailor terms to fit that exact need.

Where It Fits Best

Free-and-clear properties are ideal because we avoid the seller’s lender and most due-on-sale risk.

Ugly houses, light flips, and BRRRR-style rentals benefit when timing renovations doesn’t match bank timelines.

Credit-building investors gain control now and refinance after seasoning, higher income, or score improvement.

Tax-conscious sellers like spreading gains, especially if they compare your interest rate to CDs or bonds.

Terminology Without the Headaches

“Contract for deed” and “agreement for deed” are interchangeable with installment land contract in most states.

“Bond for deed” is common in Louisiana and follows its civil law tradition—use a local attorney there.

I tell clients to ignore labels and focus on structure: title with seller, possession with buyer, deed at payoff.

Structuring a Win-Win

When I structure these, I begin with the seller’s real problem, not just the price.

Do they need cash now, secure income for retirement, or relief from landlording?

For sellers, I often design a down payment that solves today’s need and payments that feel like safe yield.

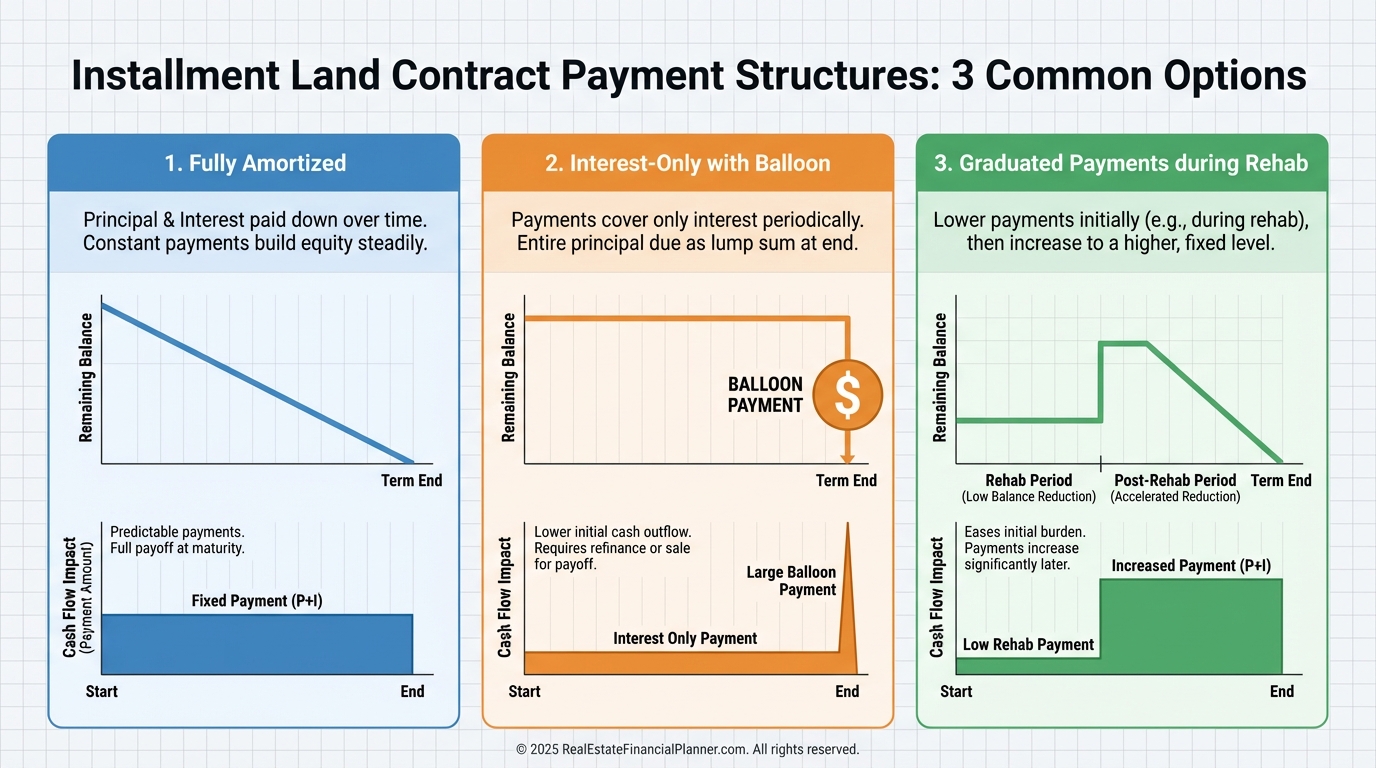

For buyers, I push for flexible payment ramps during rehab and prepayment rights to refinance without penalty.

Critical Terms I Negotiate Every Time

Price, down payment, interest rate, amortization, and balloon date must be stated plainly.

I include exact dates, payment method, a late-fee schedule, and a right to cure before default accelerates.

I add prepayment rights without penalty so I can refinance or sell when it benefits the plan.

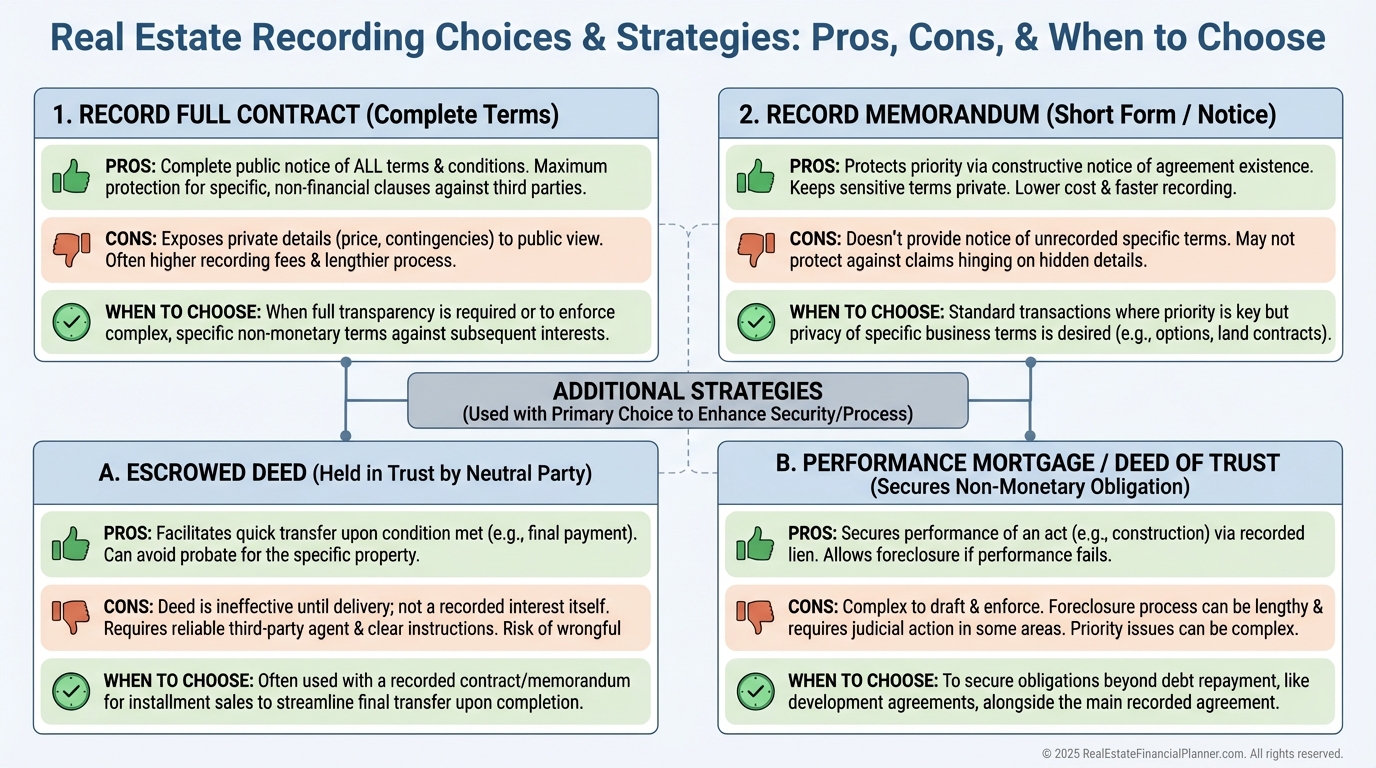

I decide whether we’ll record the contract or a memorandum, and I secure my position with a performance mortgage or deed of trust if the state allows it.

I use The World’s Greatest Real Estate Deal Analysis Spreadsheet™ to model at least three term sets before I make a final offer.

Due-On-Sale and Existing Mortgages

If the seller has a mortgage, the due-on-sale clause can apply even under an installment land contract.

Enforcement varies, but I always explain the risk to the seller in writing and plan for what we’ll do if the lender calls the loan.

We can use third-party servicing, keep taxes and insurance current, and maintain excellent communication to reduce attention.

When due-on-sale risk is unacceptable, I pivot to other structures, like a wraparound or a lease-option, or I pass on the deal.

Title and Recording Decisions

Because the seller keeps legal title until payoff, I treat title like a living risk to be monitored.

I always order title insurance and either record the contract or record a memorandum for public notice.

In some states, I secure my interest with a performance deed of trust that can be foreclosed if the seller fails to perform.

I confirm property taxes are paid and set calendar reminders to re-check quarterly for new liens.

Insurance, Maintenance, and Servicing

I require sufficient hazard insurance with both parties named appropriately and the buyer as additional insured.

I use third-party servicing to collect and disburse payments, taxes, and insurance so nothing falls through the cracks.

I schedule quarterly walk-throughs and keep photos and receipts to document improvements.

If a default fight ever happens, the paper trail protects my equity and the seller’s collateral.

Modeling Returns the REFP Way

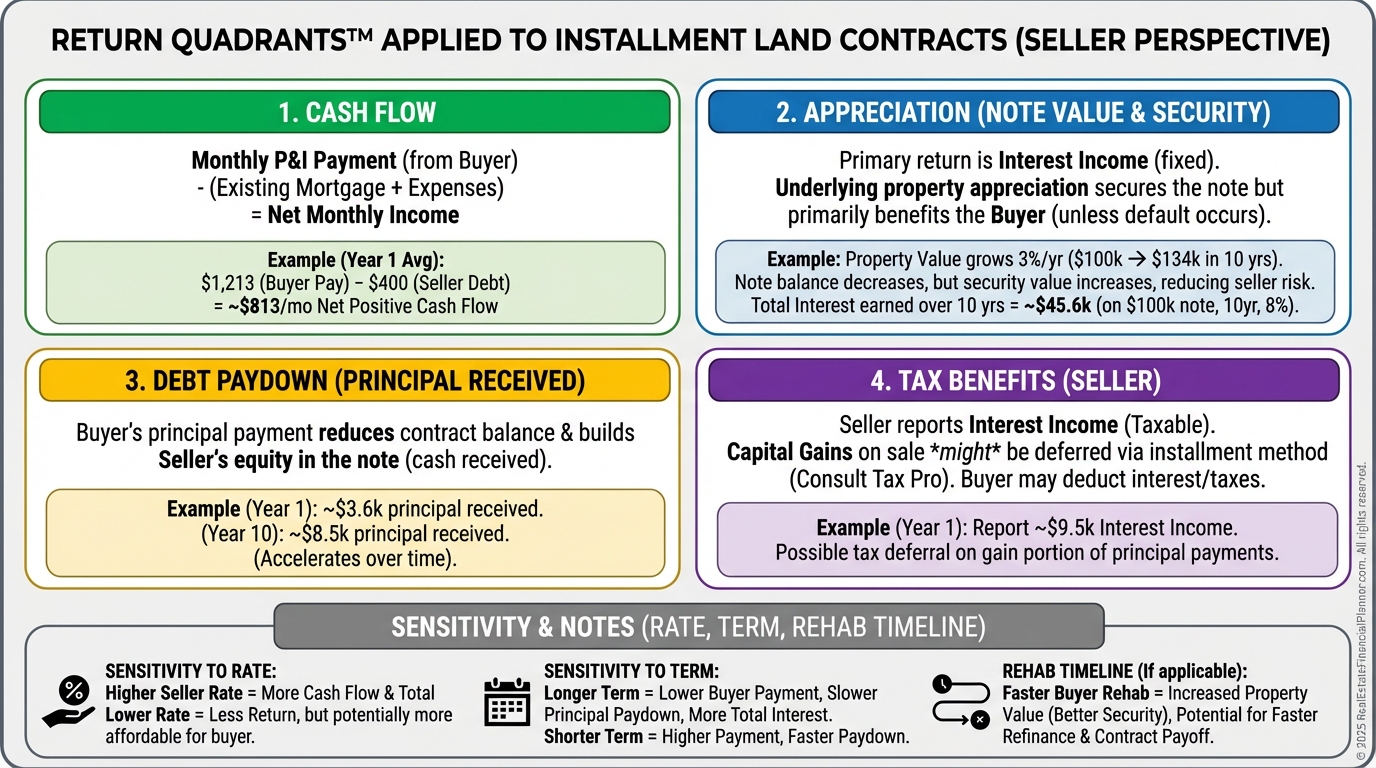

Before I sign, I run Return Quadrants™ to see where the deal pays me: cash flow, appreciation, debt paydown, and tax benefits.

Installment land contracts can shine on debt paydown and appreciation while cash flow is thin during rehab.

Then I calculate True Net Equity™ as down payment plus principal reduction plus appreciation minus selling and refinance costs and reserves.

If True Net Equity™ growth doesn’t compensate for risk and effort, I don’t do the deal—no matter how “creative” it feels.

Legal and Tax Notes You Can’t Ignore

Sellers may get installment sale treatment on capital gains but must recognize depreciation recapture in year one.

Buyers may deduct property taxes and interest in many cases, but I verify with a CPA before relying on it.

States regulate contracts for deed differently; some require specific disclosures and default timelines.

If you sell on contract to an owner-occupant, expect federal and state compliance (SAFE Act, Dodd-Frank, and state rules). Get a specialized attorney.

Default, Remedies, and Your Equity

I negotiate reasonable cure periods, explicit notice requirements, and clarity on what happens with improvements if default occurs.

Where allowed, I use language that credits documented improvements or requires judicial foreclosure instead of instant forfeiture.

I keep six months of payments in reserves so a temporary vacancy doesn’t become a permanent problem.

I also add a clause requiring the seller to keep any underlying loan current, with buyer step-in rights if needed.

Example: Light Rehab with Refinance

Purchase price $300,000 with 10% down, 6.5% interest-only for 24 months, then balloon.

Monthly payment is $1,462.50 plus taxes and insurance; I plan $35,000 in repairs and $25,000 ARV lift.

At month 14, I refinance at 70% of new value, pay off the seller, and convert to a long-term rental.

Return Quadrants™ show negative cash flow during months 1–6, then neutral, with strong equity from appreciation and principal payoff at refi.

True Net Equity™ after refi reflects new loan costs, broker credits, and reserves so I’m not fooling myself with vanity equity.

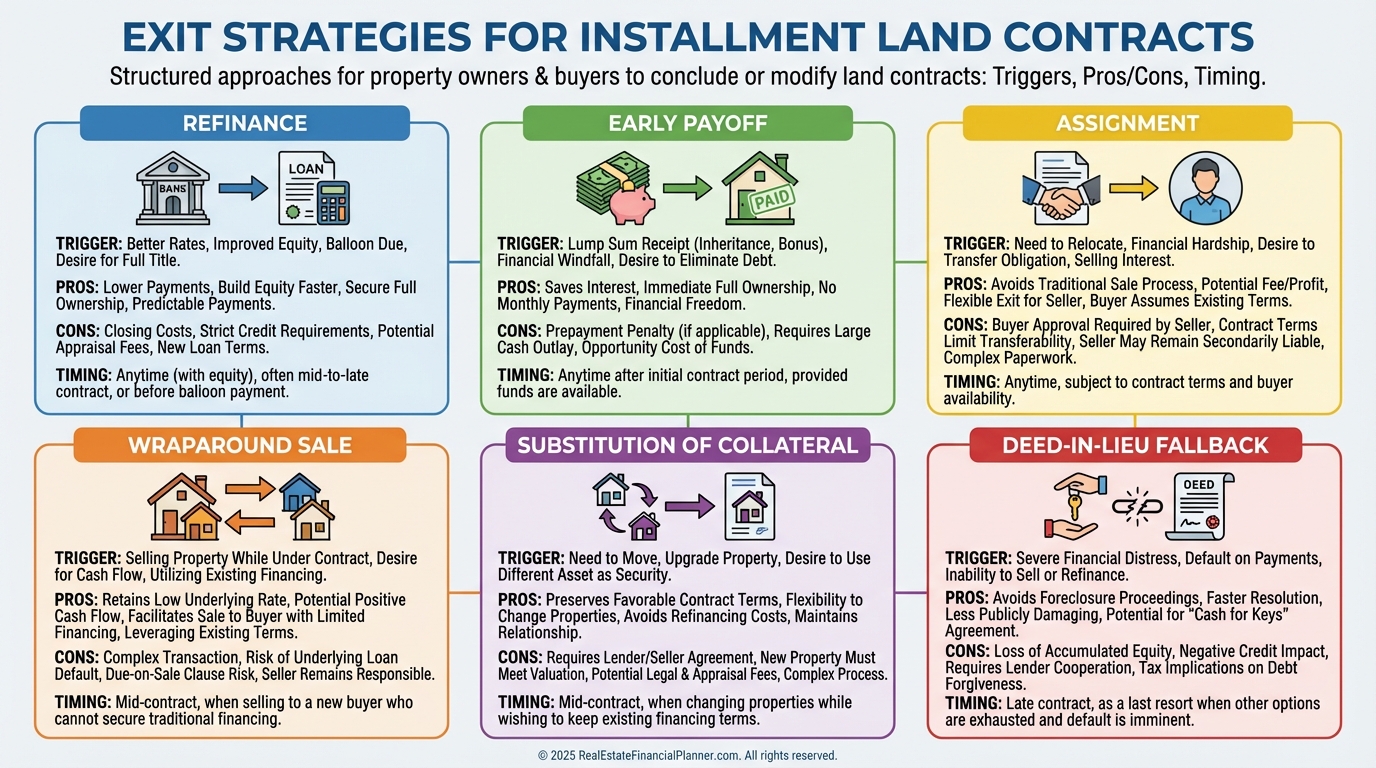

Exit Strategies I Plan on Day One

I prefer traditional refinance when the property is stabilized and rates make sense.

If I need liquidity earlier, I may assign my buyer’s interest if the contract allows it.

Sometimes I sell with wraparound financing that mirrors my obligation, but I build in servicing and reserves.

On rare occasions, I negotiate substitution of collateral to free up the property after partial paydown.

My Checklist Before I Sign

I model at least three term sets in The World’s Greatest Real Estate Deal Analysis Spreadsheet™ and stress test vacancies, rehab overruns, and rate changes.

I confirm title, taxes, insurance, servicing, recording strategy, and a clear default timeline with cure rights.

I write a due-on-sale disclosure, define communication protocols, and set reserves.

If I can’t explain the contract to a smart teenager in under five minutes, I still have work to do.

Final Thought

Installment land contracts are not magic; they are a precise tool.

Used well, they turn “no” into “closed,” grow True Net Equity™, and keep risk where it belongs—managed and measured.

Used poorly, they evaporate your equity and goodwill in one default letter.

Approach them with discipline, model the outcomes, and negotiate terms that protect both sides.