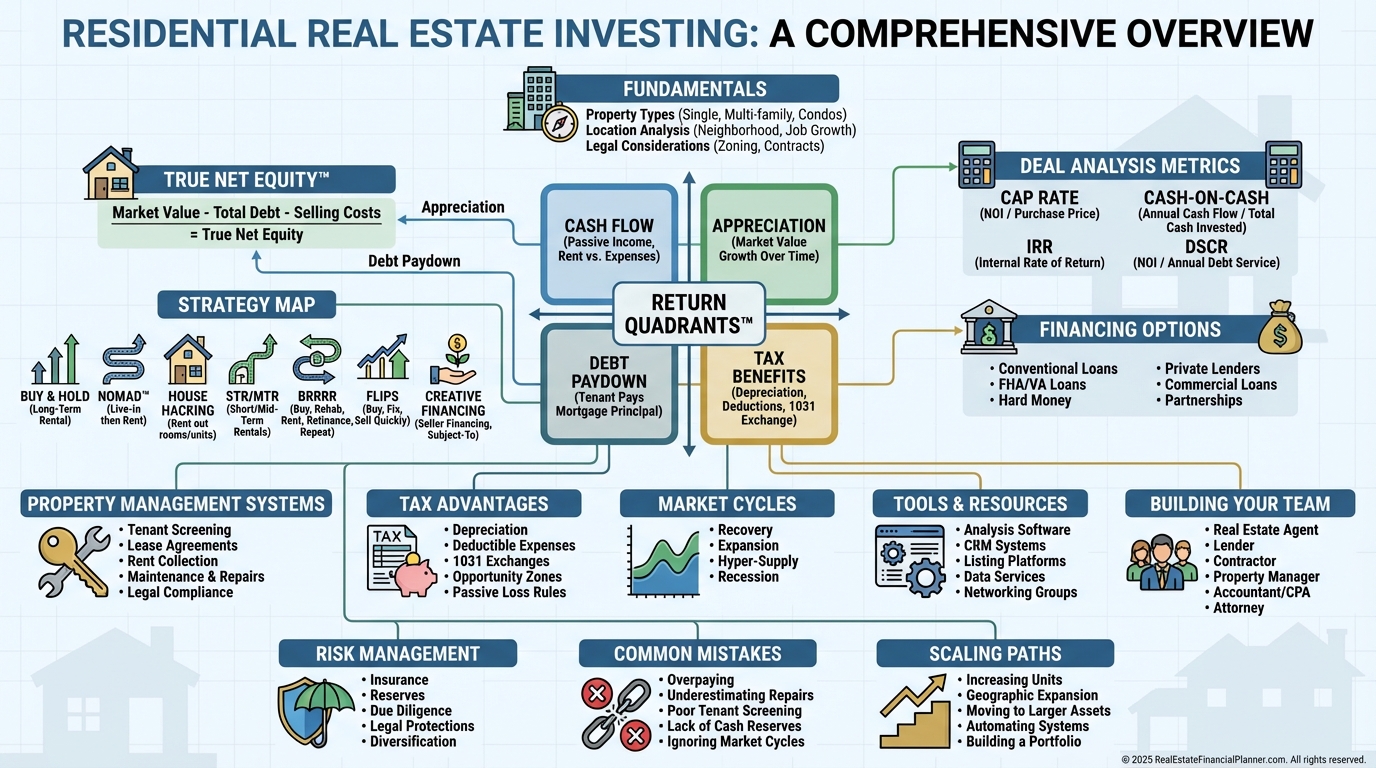

Residential Real Estate, Deconstructed: The Playbook I Use to Find, Finance, and Manage Profitable Rentals

Learn about Residential Real Estate for real estate investing.

Why Residential Real Estate Still Works

When I help clients make their first purchase, I don’t ask them to predict the market.

I ask them to master the four returns and buy with discipline.

Residential real estate is durable because it solves a basic need and pays you in multiple ways.

But it only works if you buy right, finance right, and manage right.

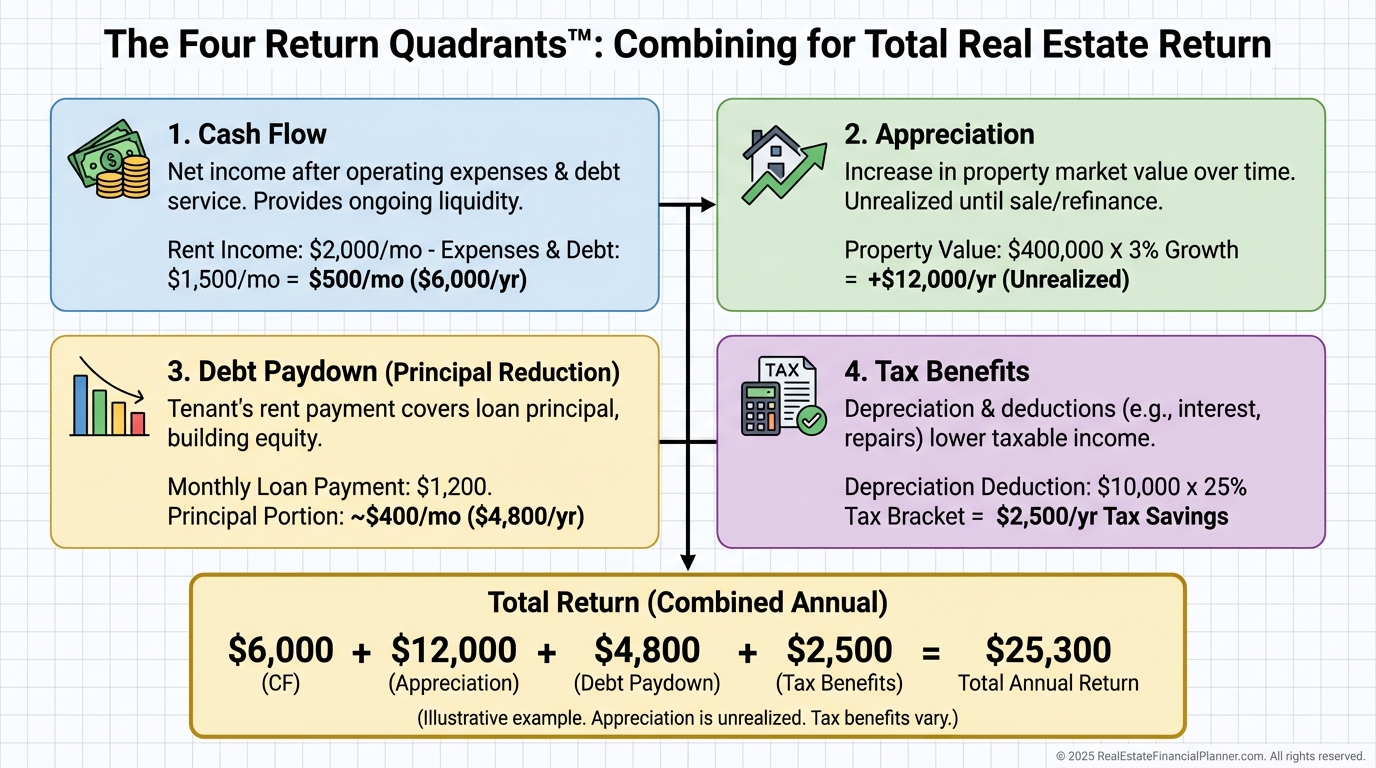

The Return Quadrants™ (Your Four Paychecks)

I teach every client to think in Return Quadrants: Cash Flow, Appreciation, Debt Paydown, and Tax Benefits.

Some months one quadrant carries the others, but over years the compounding is what changes your net worth.

Cash flow keeps you solvent.

Appreciation grows equity.

Debt paydown is forced savings your tenants fund.

Tax benefits accelerate everything.

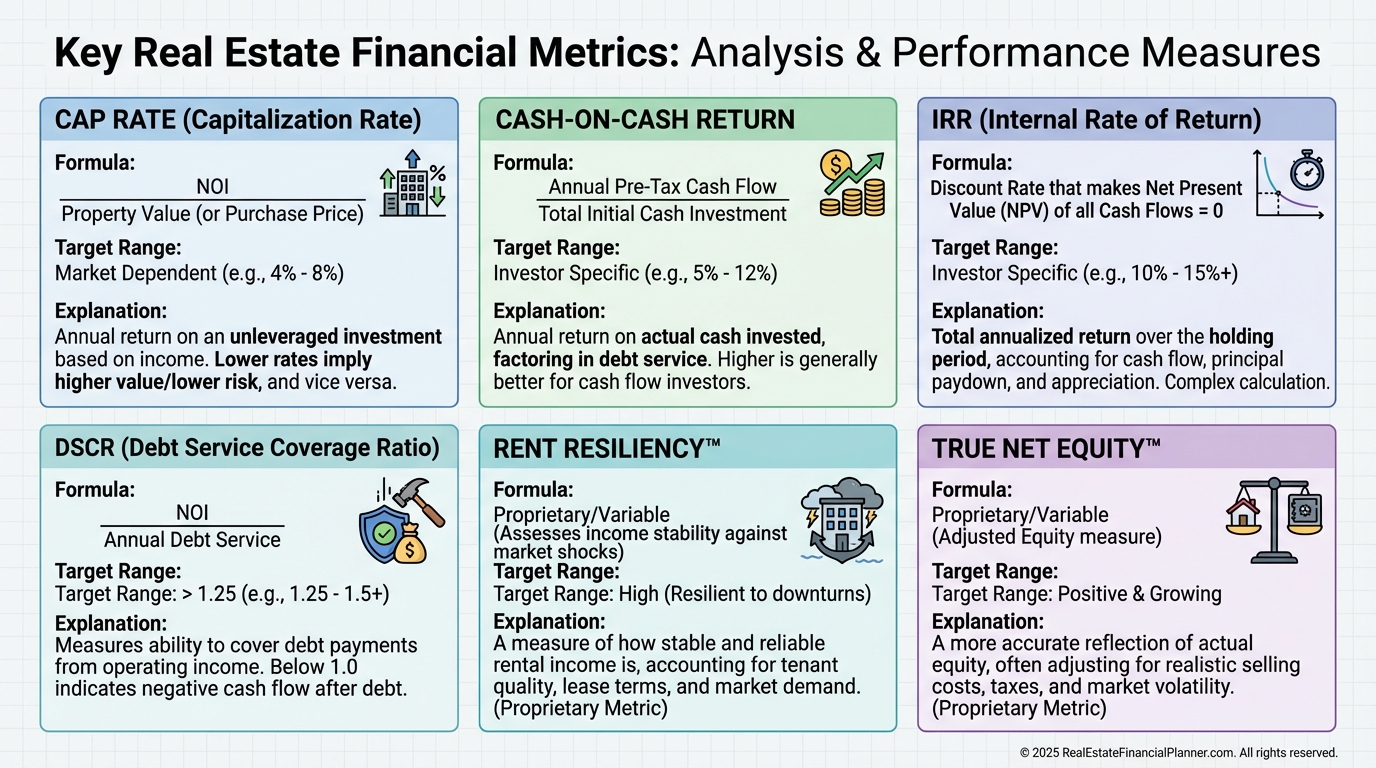

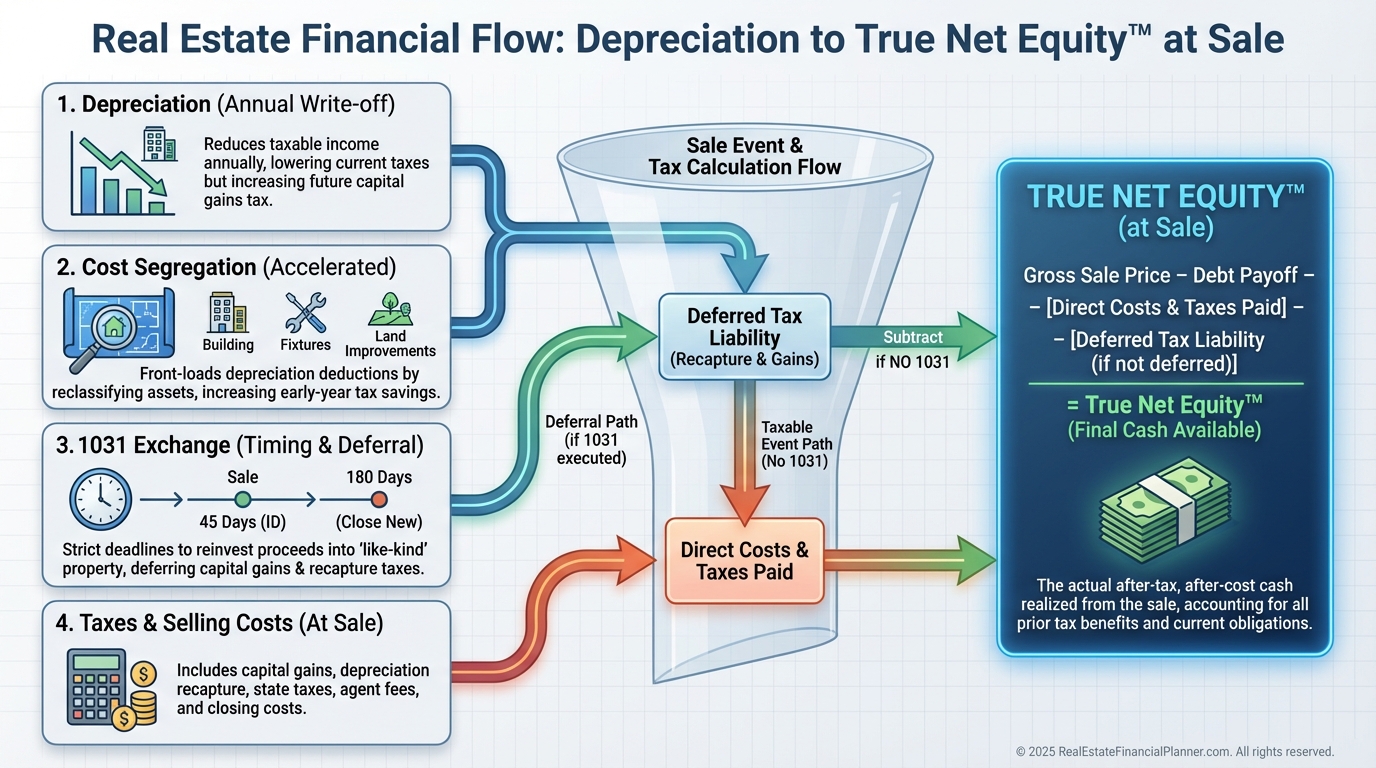

True Net Equity™ (What You Really Own)

On paper equity is market value minus loan balance.

In reality, True Net Equity is what you could walk away with after selling costs, capital gains, depreciation recapture, and payoff.

When I model deals in The World’s Greatest Real Estate Deal Analysis Spreadsheet™, I track TNE from day one.

I want to know what it costs to access equity before I need it.

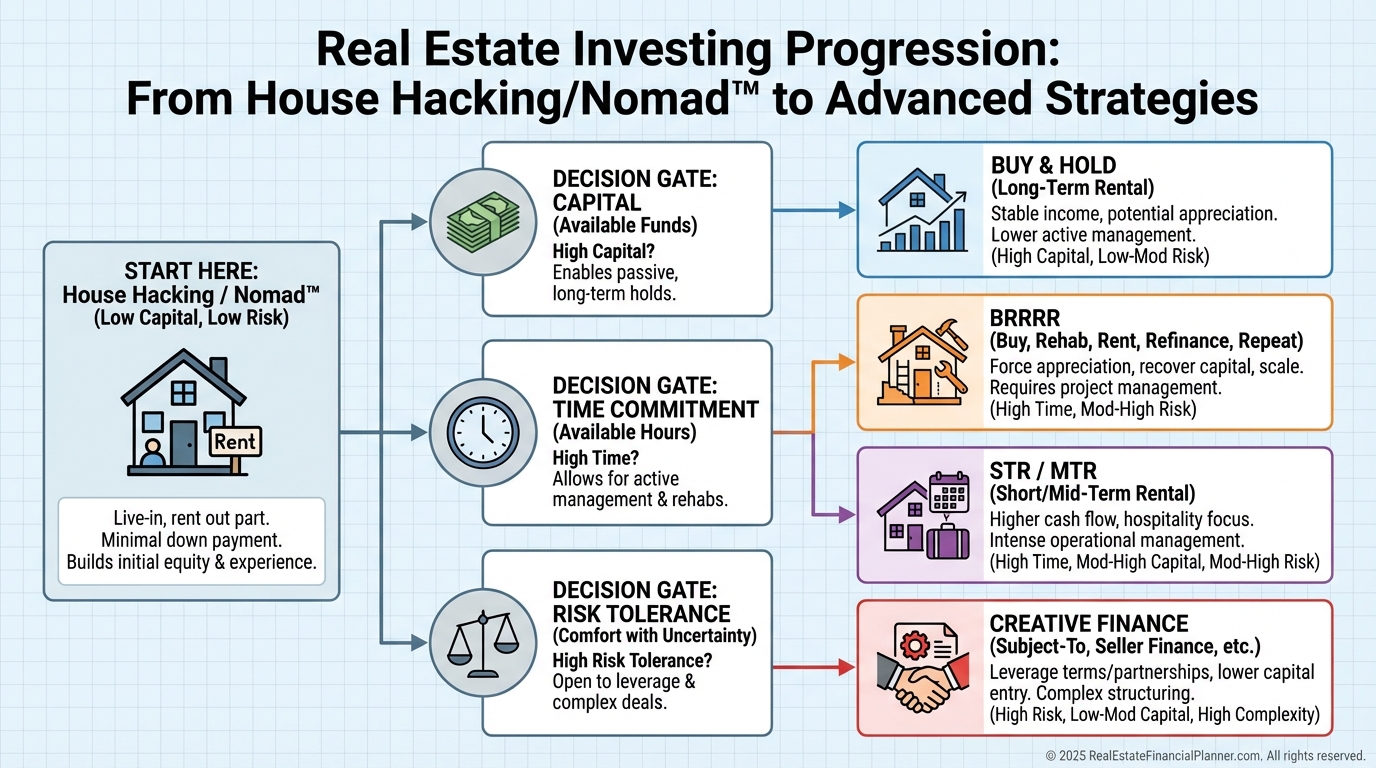

Strategy Selection: Pick Your Path, Then Your Property

When clients ask where to start, I match the strategy to their capital, time, and risk tolerance.

There is no perfect strategy, only the one you will execute well.

Buy & Hold

Simple leases.

Durable returns.

I target neighborhoods with diverse employment, landlord-friendly laws, and rent-to-price ratios that meet my minimums.

Nomad™

Buy as an owner-occupant with low down, live there a year, then convert to a rental and repeat.

When I rebuilt after a rough flip early in my career, Nomad™ let me scale safely with better financing and lower risk.

Nomad™ with house hacking can reduce housing costs to near zero while you save the next down payment.

House Hacking

Live in one unit or bedroom and rent the rest.

You lower your living cost and learn landlording with training wheels.

This is the fastest on-ramp for most new investors.

Short- and Medium-Term Rentals

Short-term rentals can 2–3x income in the right locations, but they are an operations business.

Medium-term rentals (travel nurses, corporate stays) often hit a sweet spot of higher income with less turnover.

I check regulations first, then seasonality, then revenue against a conservative 50–55% expense load.

BRRRR

Buy, Rehab, Rent, Refinance, Repeat.

It works when you buy right and control rehab.

I require multiple exit options and a refinance that still cash flows at today’s rates.

Quick Turns

Flip, wholetail, or live-in flips.

I only flip when I can make money three ways: on the buy, in the rehab, and via buyer demand.

Live-in flips with the 2-year tax exclusion are my favorite way to create tax-efficient cash.

Creative Financing

Finding Deals Without Gambling

I source deals three ways: MLS with investor-minded agents, off-market direct-to-seller, and relationships with wholesalers.

I’m not hunting unicorns.

I’m stacking small advantages other buyers miss.

When a property fits the model, I move fast because my analysis is already built.

Analyze Like a Pro (Before You Offer)

I calculate Cap Rate for apples-to-apples comparisons.

I demand Cash-on-Cash returns that compensate me for work and risk.

I model IRR across a realistic hold period because sequencing matters for returns.

I verify DSCR >= 1.25 for safety, and I stress-test rent down 10% and interest up 1%.

Then I sanity check True Net Equity over 3, 5, and 10 years.

When I underwrite, I use The World’s Greatest Real Estate Deal Analysis Spreadsheet™ to model multiple exit strategies.

I also check Rent Resiliency™—how far rents can drop before break-even—and Price Resiliency™ for equity shocks.

Due diligence is not a formality.

It’s how you buy certainty at a discount.

I over-budget 10–20% on inspection-revealed repairs and confirm rents with three independent comps.

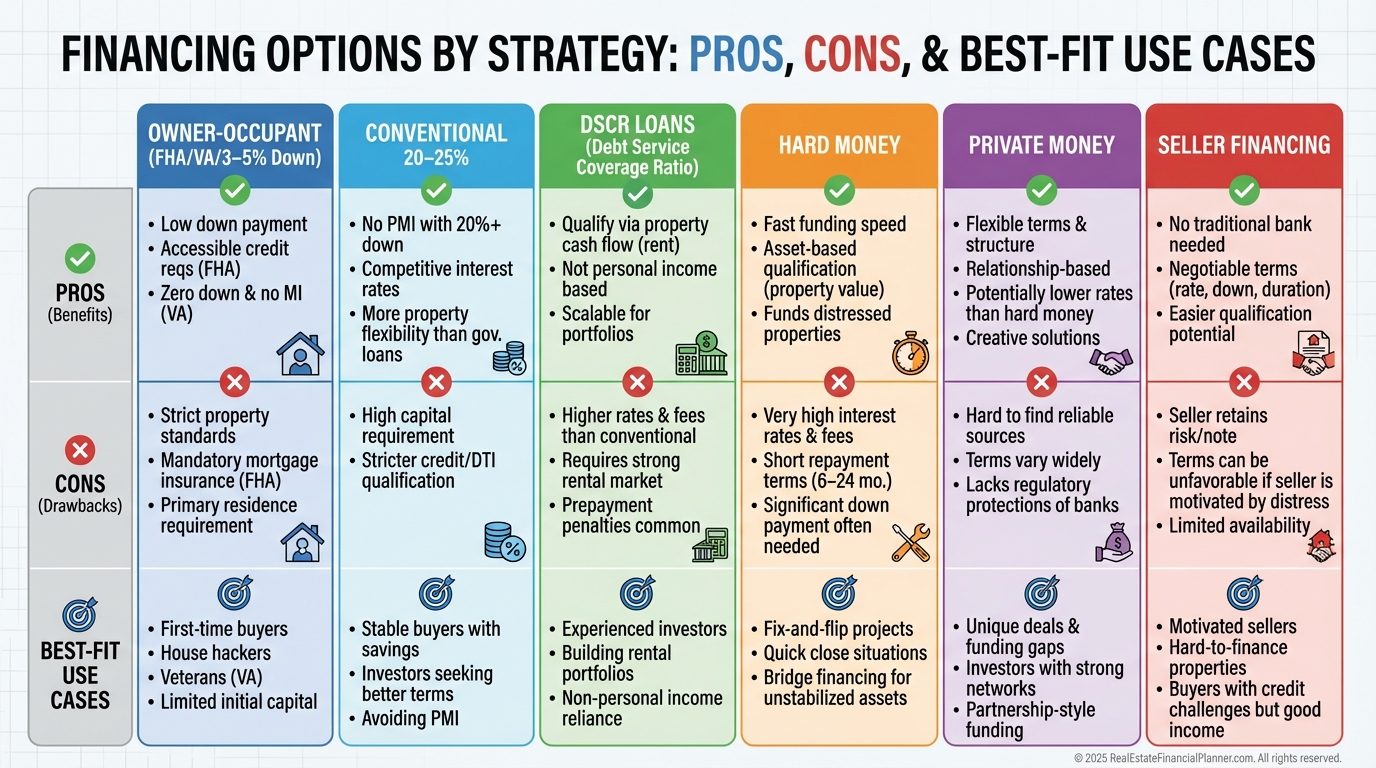

Financing: Match the Money to the Mission

Great deals die with the wrong loan.

I pair strategy to capital so the financing amplifies returns instead of constraining them.

Owner-occupant loans (FHA, VA, conventional 3–5% down) are ideal for Nomad™ and house hacking.

Conventional 20–25% down works for most Buy & Hold.

Hard and private money fuel BRRRR and flips when speed matters.

Seller financing can lower cash required and smooth cash flow with interest-only or step payments.

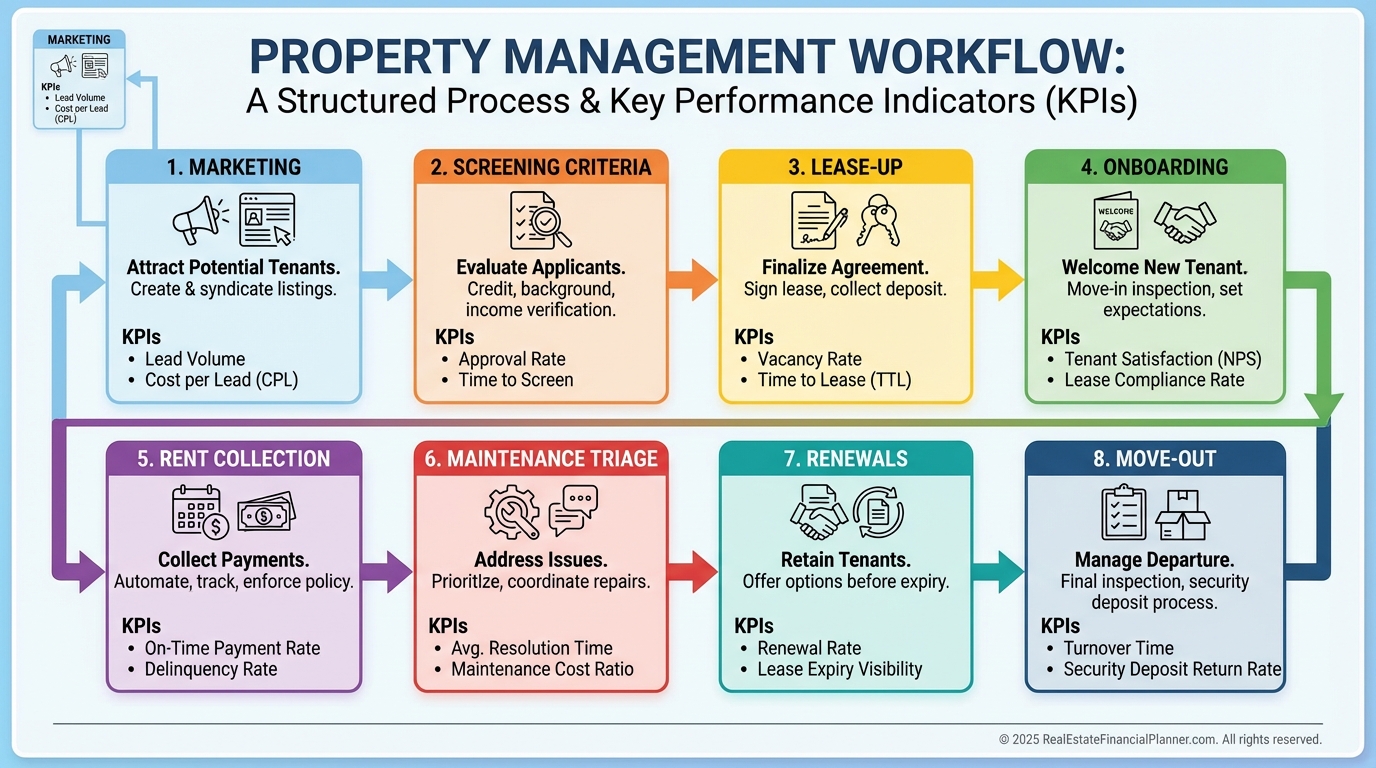

Property Management Is the Business

Profit follows process.

When I self-manage, I standardize screening, maintenance, rent collection, and legal compliance.

When I use professional management, I audit vacancy, delinquency, response times, and Google reviews quarterly.

Great tenants and fast maintenance make great returns.

Tax Advantages You Can Plan Around

Depreciation can shelter cash flow even as your property appreciates.

Mortgage interest, operating expenses, and travel are deductible when properly documented.

1031 exchanges defer capital gains, and cost segregation can front-load depreciation.

If you qualify for Real Estate Professional Status, losses can offset active income.

I model after-tax returns, not just pre-tax.

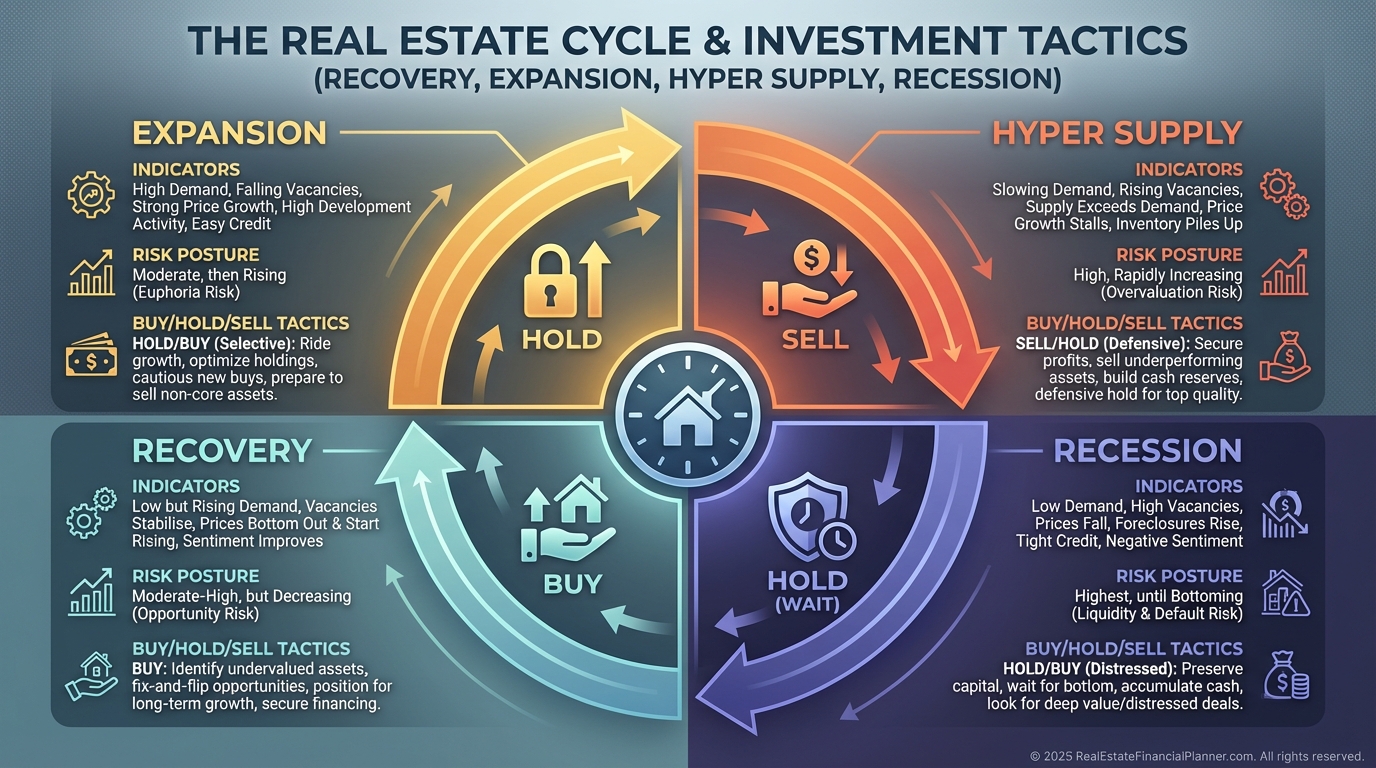

Read the Market Without Guessing

I don’t time peaks.

I buy with margins that work across cycles.

Locally, I watch population trends, job diversity, supply pipelines, and school ratings.

Nationally, I map the cycle: Recovery, Expansion, Hyper Supply, and Recession.

I adjust leverage and reserves to where the market sits, not where I hope it goes.

Tools That Compound Your Edge

I run every deal through The World’s Greatest Real Estate Deal Analysis Spreadsheet™.

I centralize operations with property management software and digital rent collection.

I use virtual tours to pre-qualify tenants and a CRM to track sellers and private lenders.

Data beats gut.

Systems beat heroics.

Build a Team Before You Need One

I work with investor-savvy agents, portfolio lenders, a real estate attorney, a proactive CPA, trustworthy contractors, and a responsive insurance broker.

I verify each pro with references from investors who own similar assets.

A great team prevents expensive lessons.

Risk Management: Protect the Downside

I carry adequate dwelling coverage, high-limit liability, and a 1–2 million umbrella.

Loss-of-rent coverage is non-negotiable for me.

In flood or quake zones, I price the proper riders into the deal or I pass.

Reserves are my first line of defense: six months of expenses per door plus planned CapEx.

Mistakes I See (And How We Avoid Them)

Overleveraging turns small shocks into big problems.

Weak screening invites your most expensive “partner.”

Deferred maintenance compounds quietly, then loudly.

Analysis paralysis delays your tuition.

We buy right, maintain well, and decide with models, not emotions.

Scaling Without Losing Sleep

As cash flow grows, consider syndications, small development, or moving into larger multifamily.

But only after your systems, reserves, and reporting are boringly reliable.

Your first job is survive.

Your second job is scale safely.

Your Next Step

Pick the strategy you can execute in the next 90 days.

Analyze five deals a week until your offers feel routine.

Use the spreadsheet, protect the downside, and let the Return Quadrants do their work.

Ten years from now, you’ll wish you’d started today.