C Corporations for Real Estate Investors: When Double Taxation Is Worth It

Learn about C Corporations for real estate investing.

Most real estate investors default to LLCs without a second thought.

That’s usually the right move.

But occasionally, I’ll sit across from a client who has outgrown the LLC playbook.

They want institutional capital, foreign investors, multiple investor classes, or a clear path to a large exit.

That’s when C Corporations enter the conversation.

This is where C Corporations shine, and where they can quietly destroy returns if used carelessly.

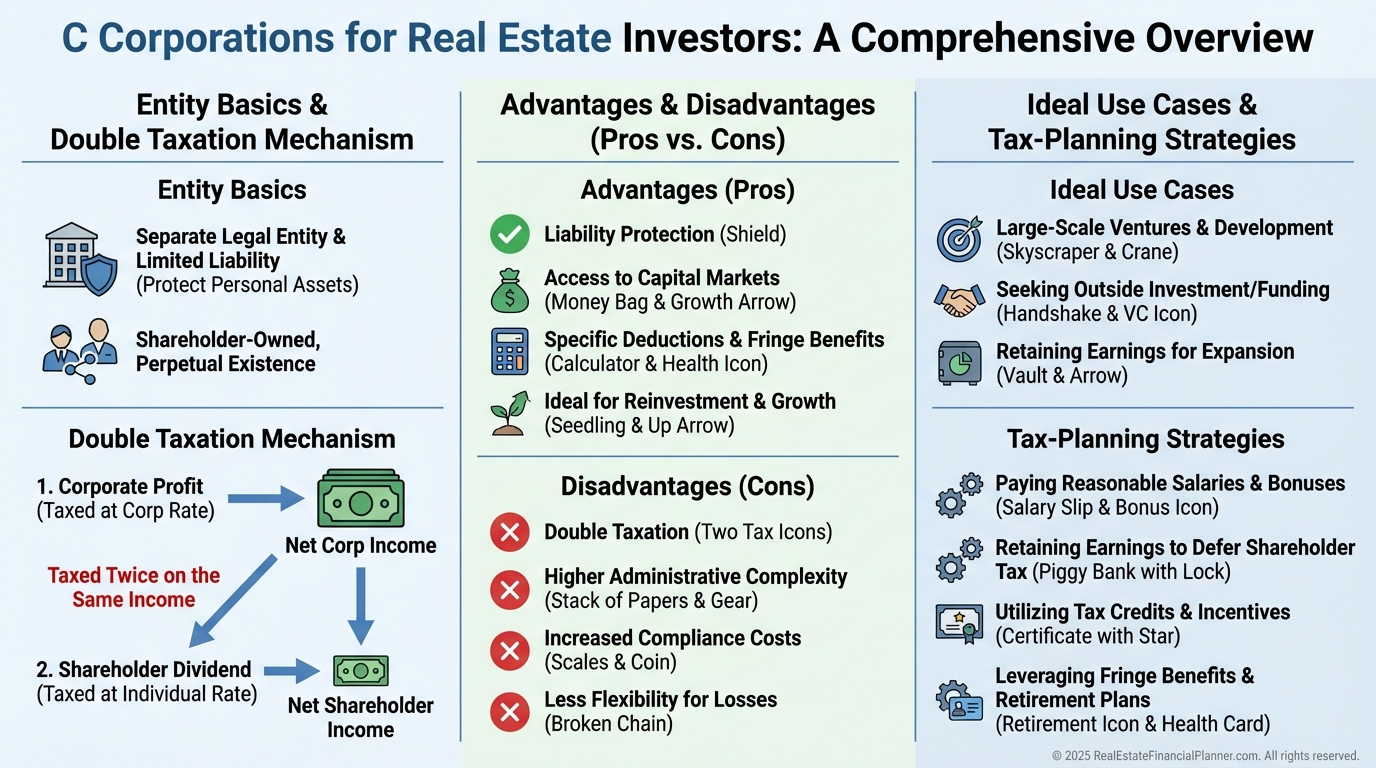

What a C Corporation Actually Is

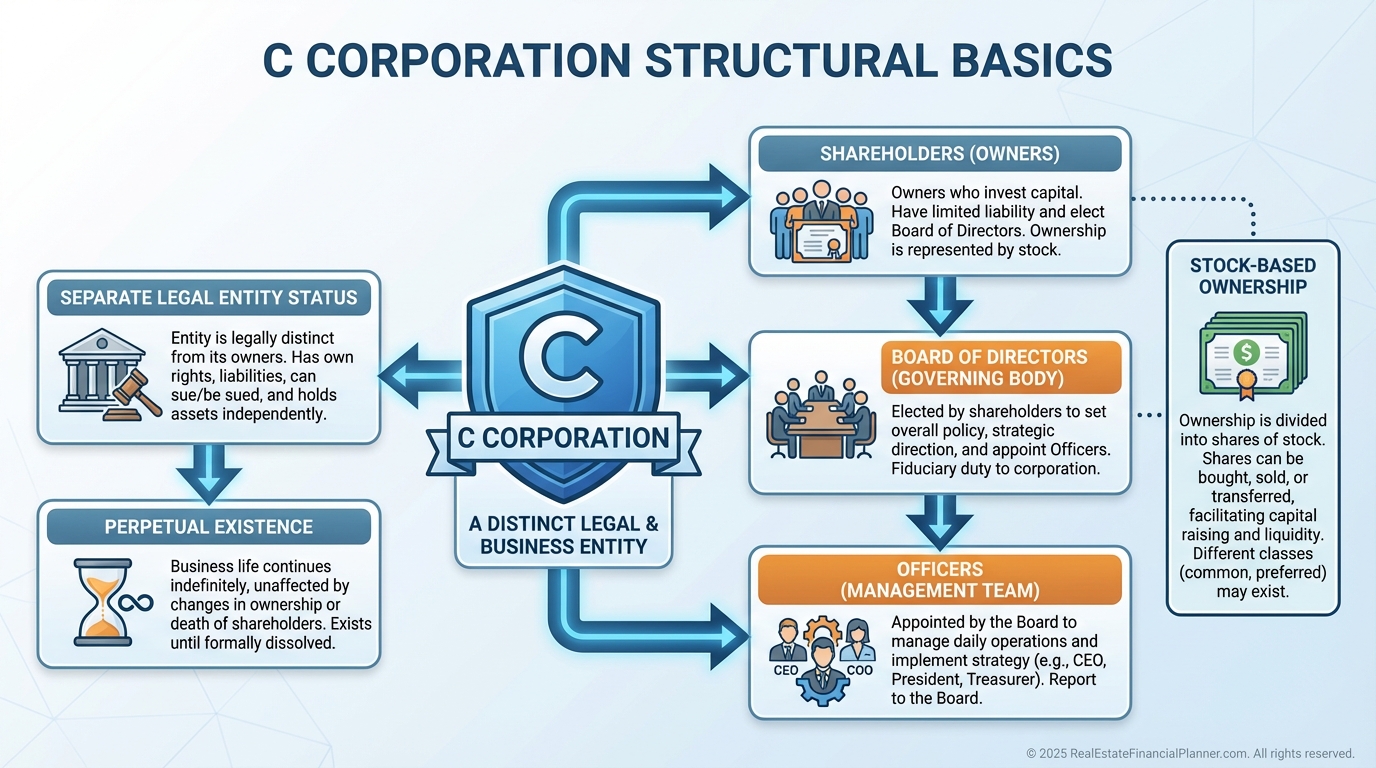

A C Corporation is a standalone legal entity.

It owns property, signs contracts, and pays taxes separately from you.

Unlike LLCs and S Corporations, income does not automatically flow through to your personal return.

The corporation pays its own tax first.

Key characteristics matter in real estate more than most people realize.

•

Separate Legal Entity means clean liability walls when formalities are respected.

•

Perpetual Existence makes ownership changes easier than reworking LLC operating agreements.

•

Stock Ownership allows precise control over voting, economics, and exit rights.

Those features sound boring until you need them.

Then they are everything.

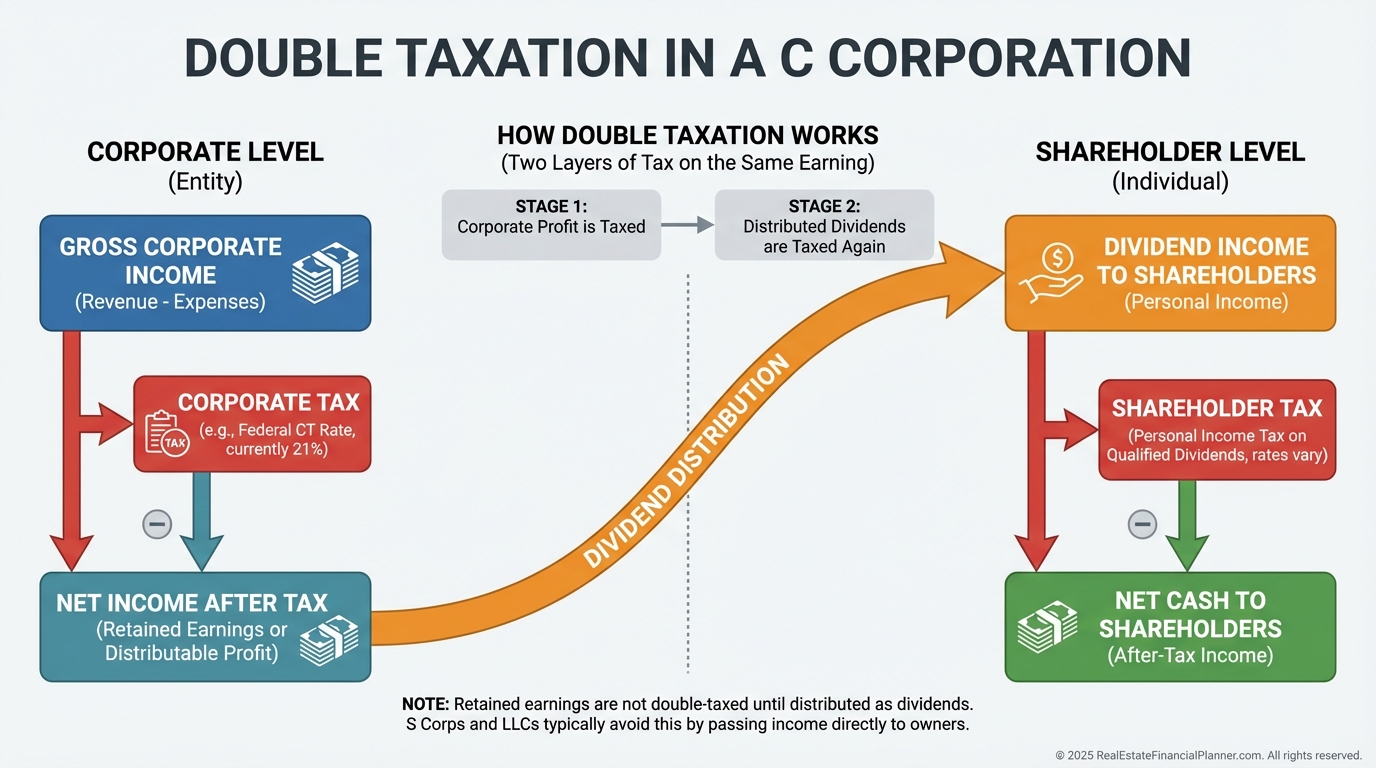

The Reality of Double Taxation

Double taxation scares people away before they run the numbers.

That fear is not irrational, but it is incomplete.

Here is what actually happens.

The corporation pays federal tax at a flat twenty-one percent.

Only after that do dividends get taxed again at the shareholder level.

On pure cash-flow rental income, this can be painful.

On growth-focused strategies, it is often irrelevant.

When I model this in Real Estate Financial Planner™, I rarely stop at tax rates.

I look at what the structure enables that would otherwise be impossible.

Why Sophisticated Investors Use C Corporations

C Corporations are not about saving taxes.

They are about accessing scale.

These are the advantages I see matter most.

•

Unlimited Shareholders removes artificial growth ceilings.

•

Institutional Capital Compatibility opens doors LLCs cannot.

•

Multiple Share Classes let you engineer returns instead of negotiating them.

•

Foreign Ownership avoids K-1 nightmares and withholding complexity.

When clients want pension funds, private equity, or international capital, C Corps stop being optional.

They become required.

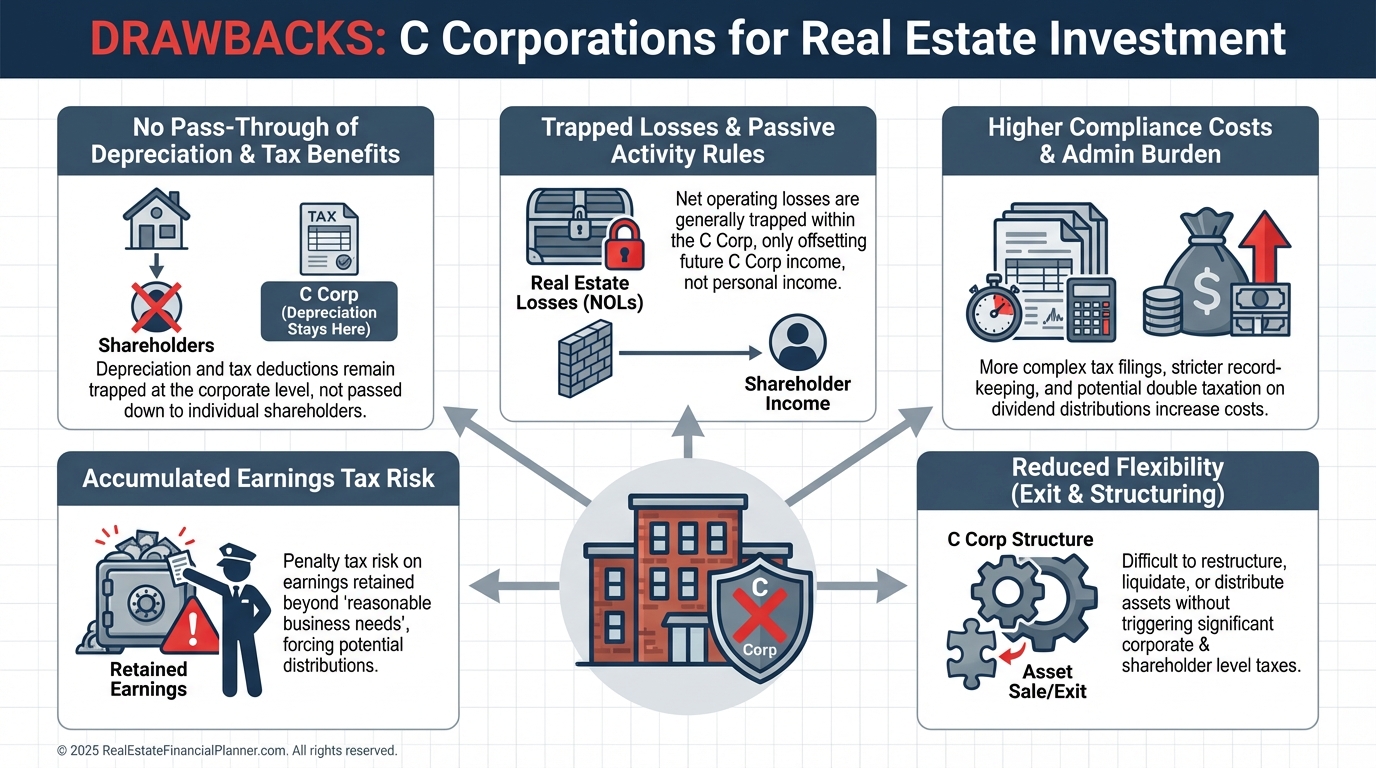

Where C Corporations Break Down

C Corporations are terrible passive-income vehicles.

This is where many investors get burned.

Here is what I warn clients about.

•

Depreciation Does Not Pass Through to offset personal income.

•

Losses Stay Trapped inside the corporation.

•

Compliance Costs Add Up quickly if you skip discipline.

This is why buy-and-hold rental portfolios almost never belong in C Corporations.

The Return Quadrants™ tilt heavily toward cash flow and tax efficiency, and C Corps fight both.

When C Corporations Actually Make Sense

There are specific scenarios where I actively recommend C Corporations.

Large development projects.

Pre-REIT structures.

PropTech companies that own real estate.

Build-to-sell strategies where appreciation dominates cash flow.

In those cases, I am modeling exits, not monthly income.

True Net Equity™ growth overwhelms annual tax drag.

When institutional capital allows ten times the deal size, the math changes completely.

Tax Planning Inside a C Corporation

Smart planning reduces friction, but it never eliminates structure tradeoffs.

I typically model these levers.

•

Reasonable salaries instead of dividends.

•

Aggressive but legitimate expense management.

•

Strategic debt to convert profits into deductions.

•

Exit planning before the first acquisition closes.

When these are ignored, double taxation hurts.

When they are integrated from day one, it often fades into the background.

The Real Decision Test

Here is the question I ask clients.

Are you building income, or are you building an institution?

If the goal is stable cash flow and depreciation, LLCs win.

If the goal is scale, capital access, and exit velocity, C Corporations deserve a serious look.

Entity structure is not about what is popular.

It is about what your future self will need.