How to Use Life Insurance Cash Value to Fund Real Estate Deals (With Clarity on Costs, Risks, and Returns)

Learn about Life Insurance for real estate investing.

What This Strategy Is—and Why Investors Use It

Borrowing against a permanent policy lets you turn cash value into deal capital without a bank, a lien on the property, or PMI.

When I help clients compete in tight markets, policy loans are often the fastest “yes” for earnest money, down payments, or rehab.

There’s no owner-occupancy rule because the collateral is your policy, not the property.

You can use the funds for residential, commercial, or buying into an entity.

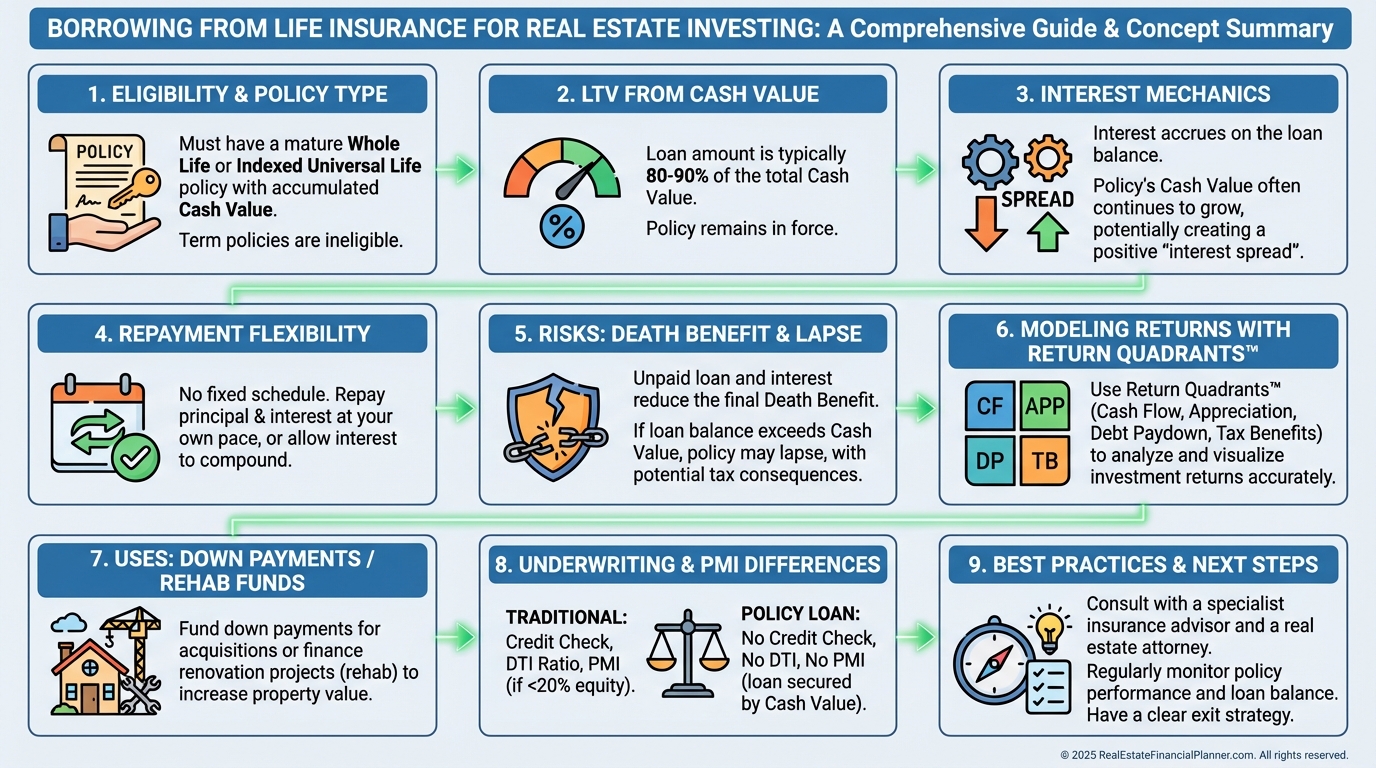

Eligibility and How Much You Can Borrow

You need a permanent policy—whole life or universal life—with sufficient cash value.

Term life has no cash value, so there’s nothing to borrow against.

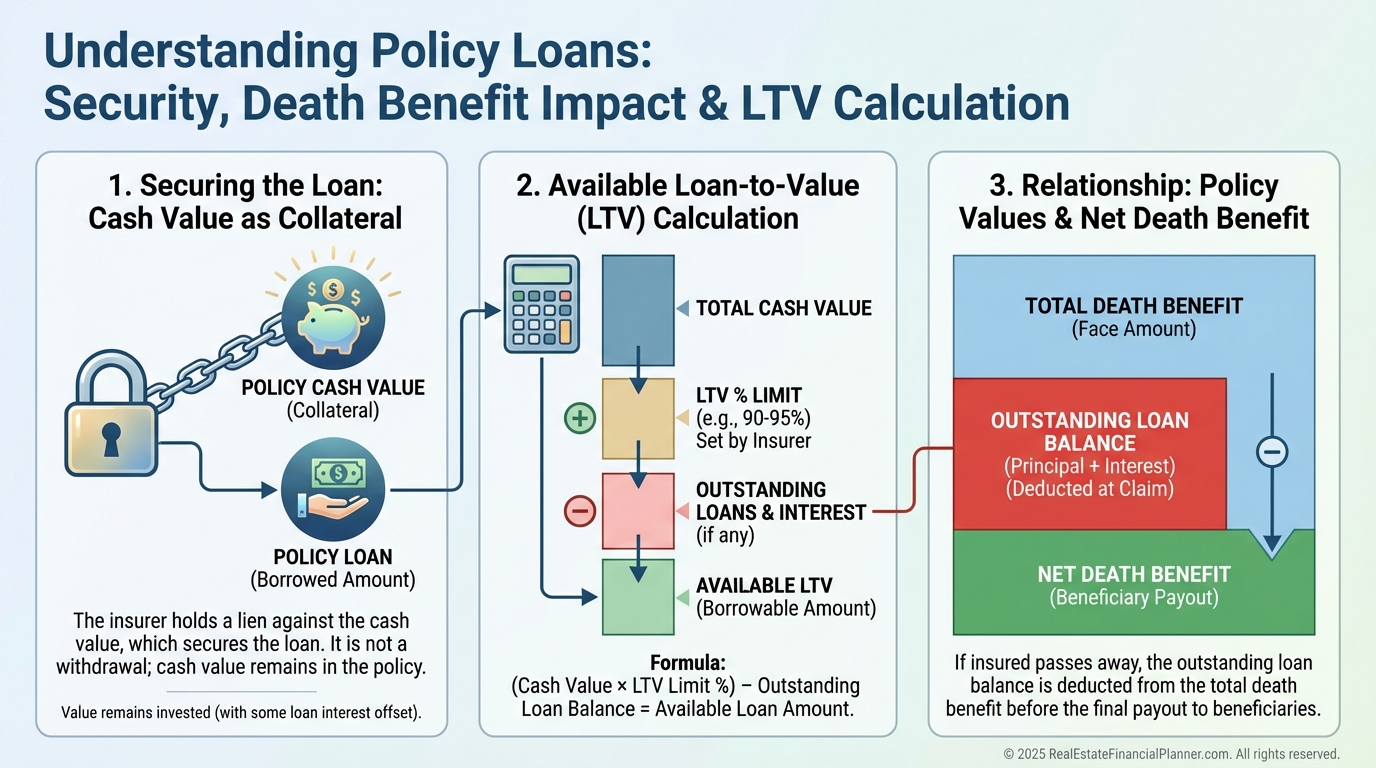

Most insurers lend up to roughly 90% of accumulated cash value.

There’s usually no credit check, no DTI calc, and no property appraisal.

How the Money Actually Flows

You request a loan from the insurer and they send funds to your bank.

The loan accrues interest until you repay, and any unpaid balance reduces your net death benefit.

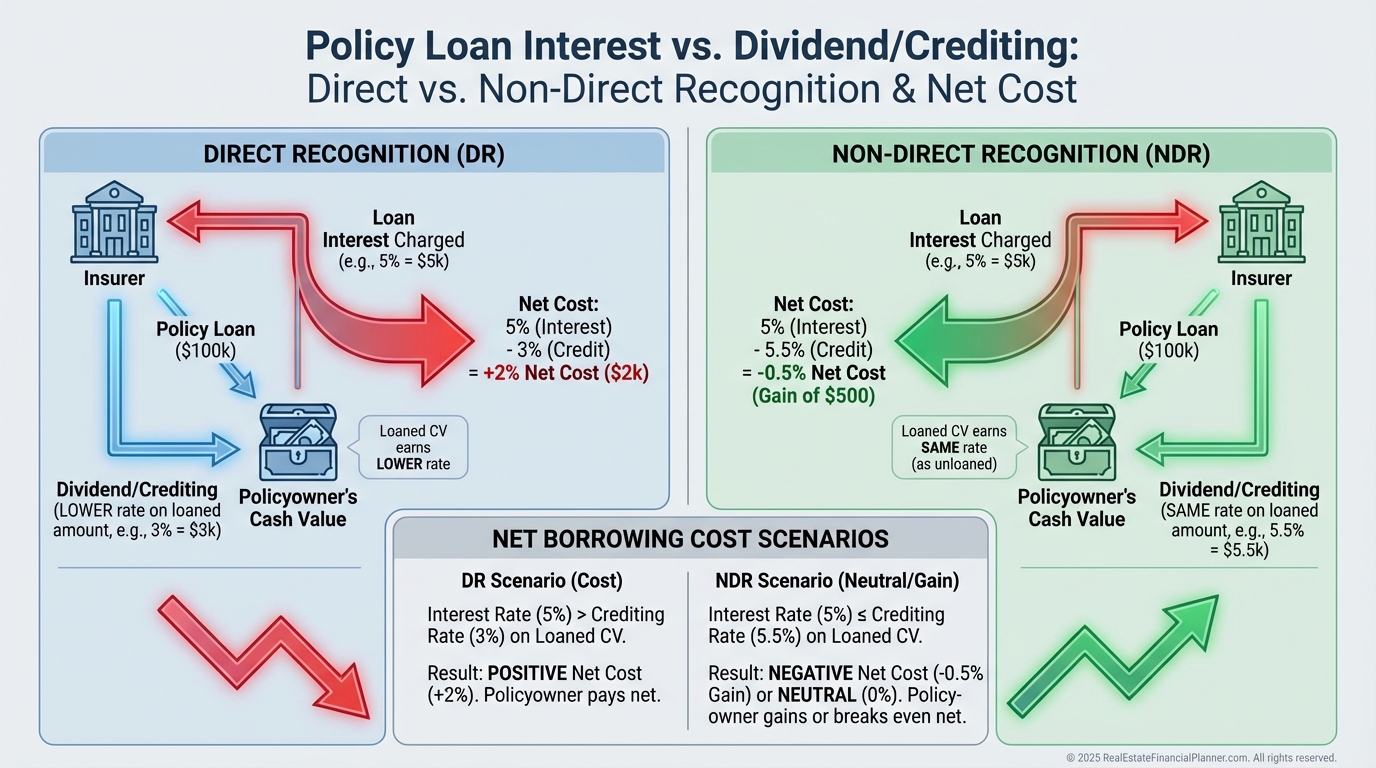

Many policies still credit dividends or interest on cash value while a loan is outstanding.

But the rate you pay is typically higher than what the policy credits.

Some policies are “direct recognition” and adjust dividends on borrowed cash value.

Others are “non-direct recognition,” but net borrowing cost still matters.

Costs, Opportunity Cost, and Policy Health

Typical policy loan rates cluster in the mid-single digits, but they vary by company and contract.

Your policy may credit 3–6% in dividends/interest, but that is not the same as a guaranteed offset.

What matters is your net borrowing cost after credits and fees.

Opportunity cost matters too.

If you borrow from your policy, those dollars aren’t available for other uses or to bolster policy stability.

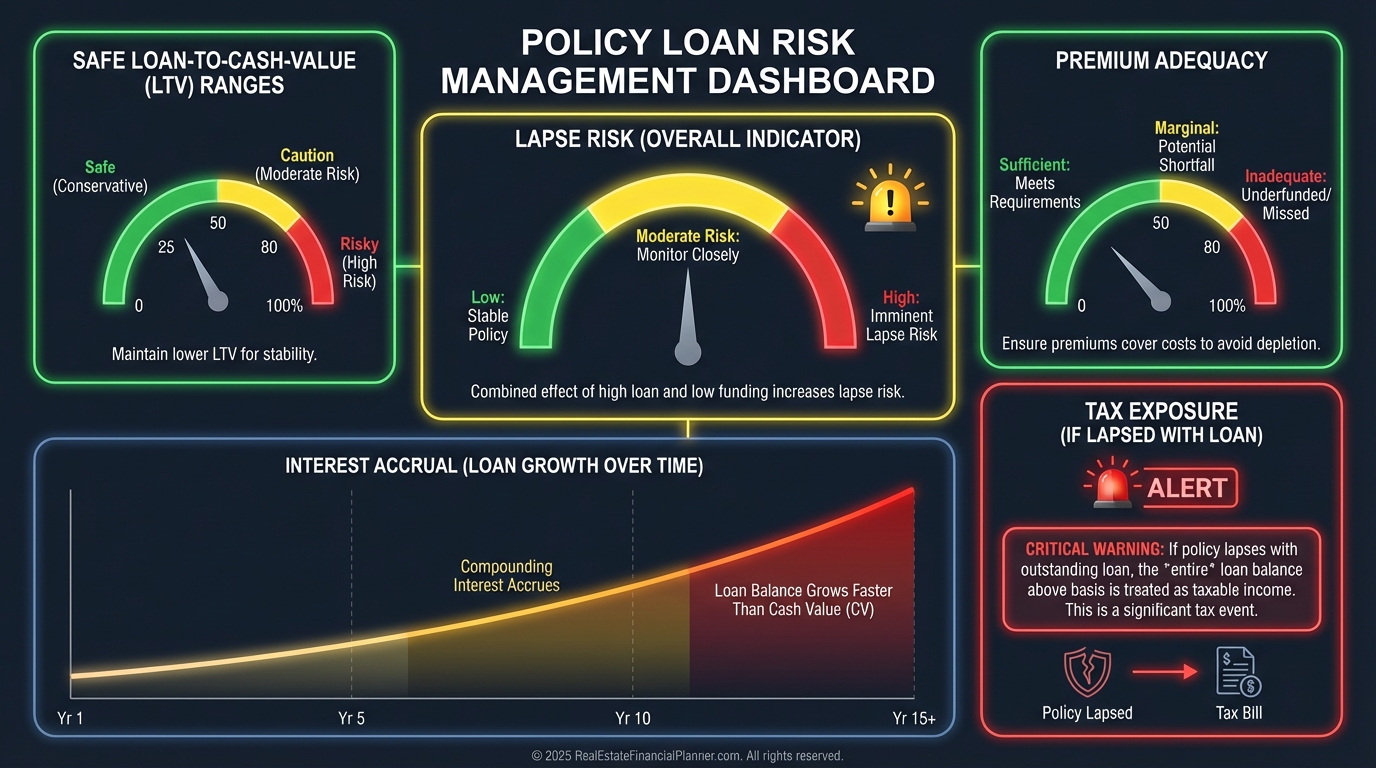

The bigger the loan relative to cash value, the higher the lapse risk if dividends fall or if you stop paying interest.

A policy that lapses with a loan can trigger taxable income on the gain.

Modified Endowment Contracts (MECs) change tax treatment, so confirm your status before borrowing.

Loan Terms You Won’t See With Banks

There’s no fixed amortization.

You choose if and when to repay.

Interest accrues regardless, and unpaid interest compounds.

There’s no refinance or recast because you’re not in a traditional mortgage.

You can take multiple policy loans as long as you have cash value.

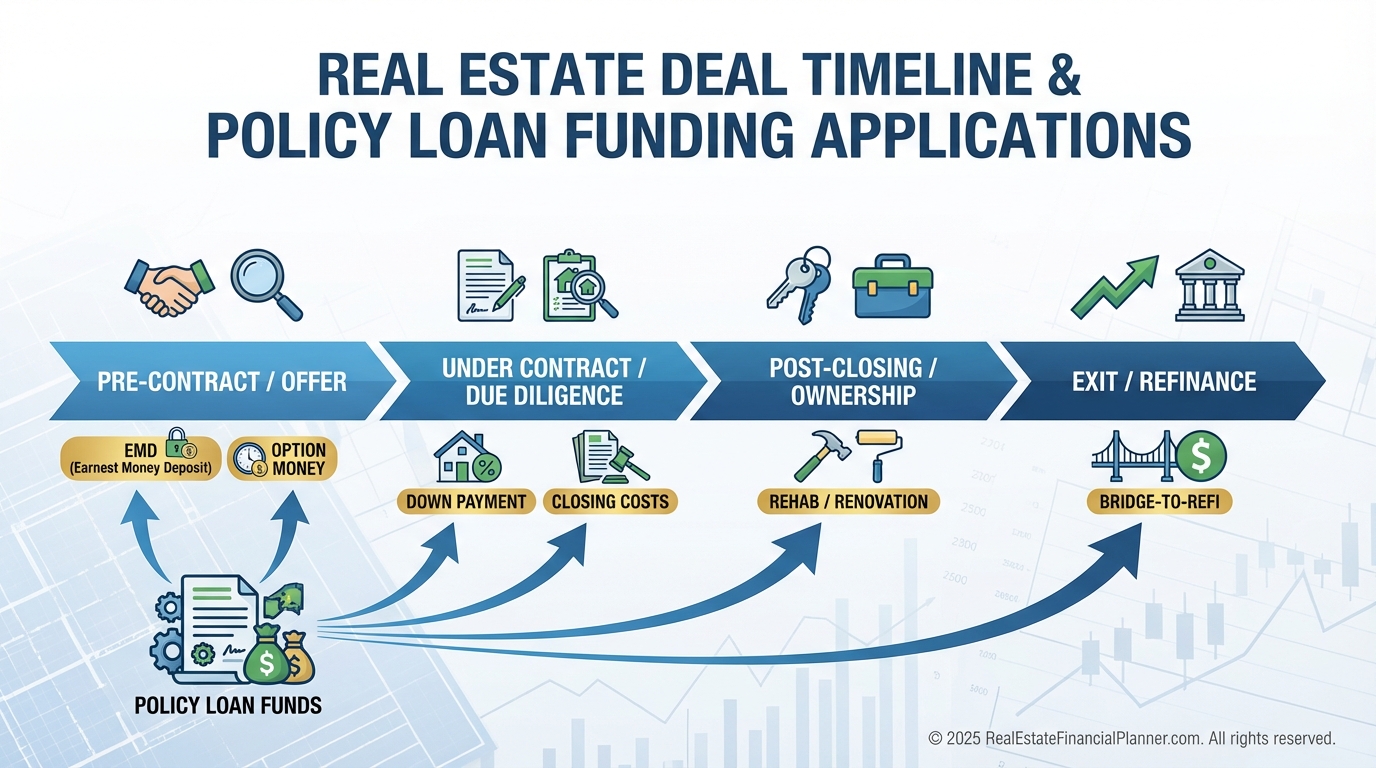

Where Policy Loans Fit in a Real Estate Plan

I see policy loans used for down payments, option fees, EMD, quick-close funds, rehab, and bridge capital.

They can also solve seasoning gaps before a refinance.

Because the loan is unsecured by the property, you can buy in your personal name or an LLC.

There’s no PMI, no seller-concession rules, and no occupancy requirement.

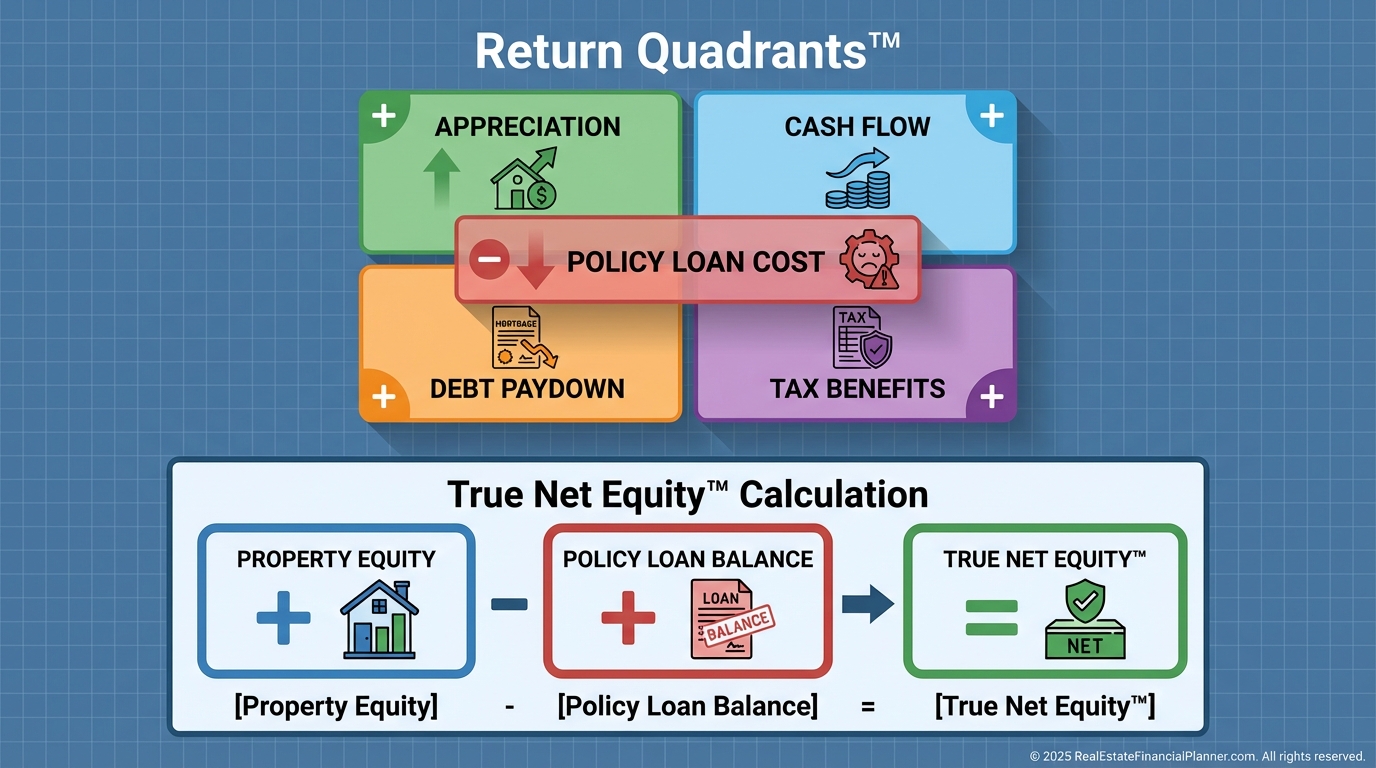

Modeling the Real Return with REFP Frameworks

When I model this for clients, I plug policy loans into the Return Quadrants™ to see the whole picture.

I track Appreciation, Debt Paydown, and Tax Benefits as usual.

Then I calculate True Net Equity™ by subtracting the policy loan balance from your property equity.

That prevents double counting because your down payment came from a new liability.

If you’re doing Nomad™, the approach is the same.

Your funding source changes, but the Return Quadrants™ stay intact.

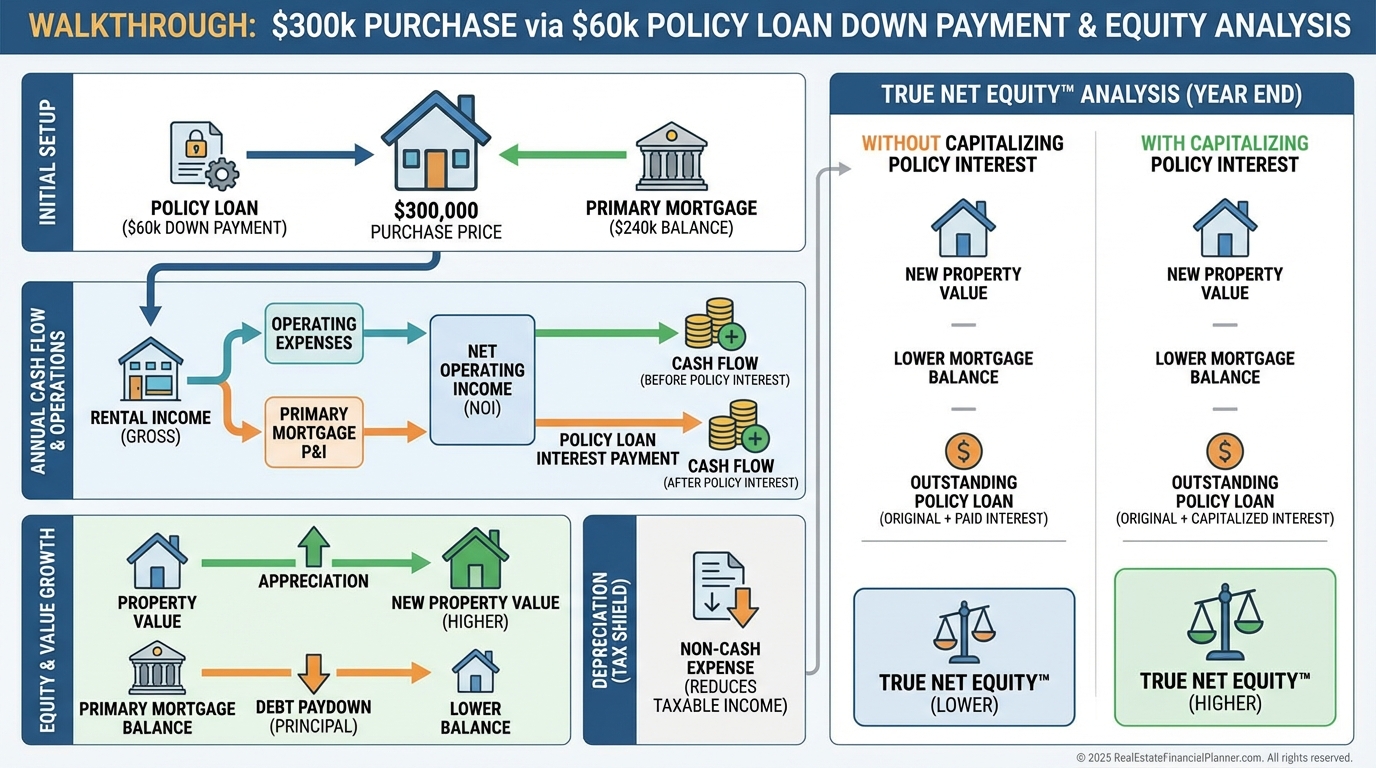

A Numbers Walkthrough

Assume a $300,000 rental at 20% down.

You borrow $60,000 from your policy at 6% simple interest.

The first-year interest is $3,600 if you pay it out of pocket.

The property loan is $240,000 at 6.75% for 30 years.

Estimated PITI/expenses yield about $1,128/year positive cash flow before policy interest.

After paying $3,600 policy interest, net cash flow is roughly -$2,472.

At 3% appreciation, that’s $9,000 in year one.

Debt paydown is about $4,200 in year one.

Depreciation could be about $8,700 (building value assumptions apply and tax rules vary).

If you pay policy interest from cash flow, your Return Quadrants™ look like this:

•

Appreciation: +$9,000

•

Cash Flow (after policy interest): -$2,472

•

Debt Paydown: +$4,200

•

Tax Benefits (paper): +$8,700

Total economic benefit ≈ $19,428 before your personal tax situation.

For True Net Equity™, subtract the policy loan balance from property equity.

At purchase, TNE is near $0 because you created equity with borrowed funds.

After year one, TNE grows primarily from appreciation and paydown, less any unpaid policy interest.

If you capitalize interest instead of paying it, the policy loan grows by $3,600, which lowers TNE by the same amount.

When I present this to clients, I show both cases side-by-side so you can decide whether to service interest or allow it to accrue.

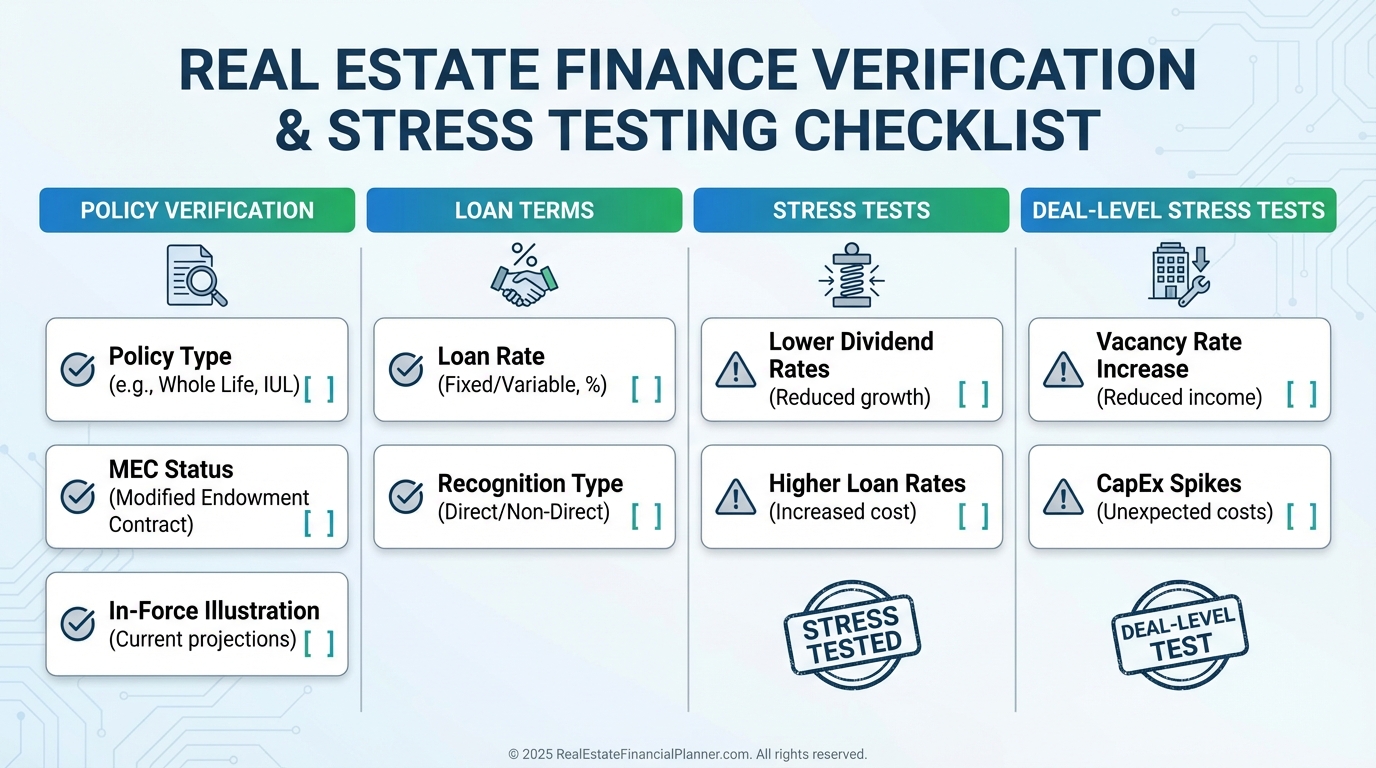

What I Double-Check Before Clients Borrow

I verify the policy type, current cash value, surrender charges, and whether it’s a MEC.

I read the in-force illustration to see loan rates, dividend assumptions, and direct/non-direct recognition.

I stress test dividends down 100–200 bps and raise loan rates.

I test the deal at higher vacancies and repairs.

Then I confirm how interest will be paid and set a cadence to review annually.

Practical Details and FAQs

Eligibility and LTV.

You need permanent coverage with cash value, and most insurers lend up to ~90% of that value.

Owner-occupancy.

Not required.

Down payment.

There is no separate “down payment” requirement; your policy cash value is the collateral.

Amortization.

No set schedule, but interest accrues until repaid.

PMI.

Not applicable.

Loan limits and number of loans.

Limited by cash value, and you can take multiple loans as long as total loans stay within limits.

Not applicable because this is a separate funding source.

Waiting periods.

No formal waiting period after events like BK or foreclosure if the policy and cash value exist.

Refinancing rules.

There’s no refinance or recast; you control repayment.

Property types.

Use funds for residential, commercial, or entity purchases.

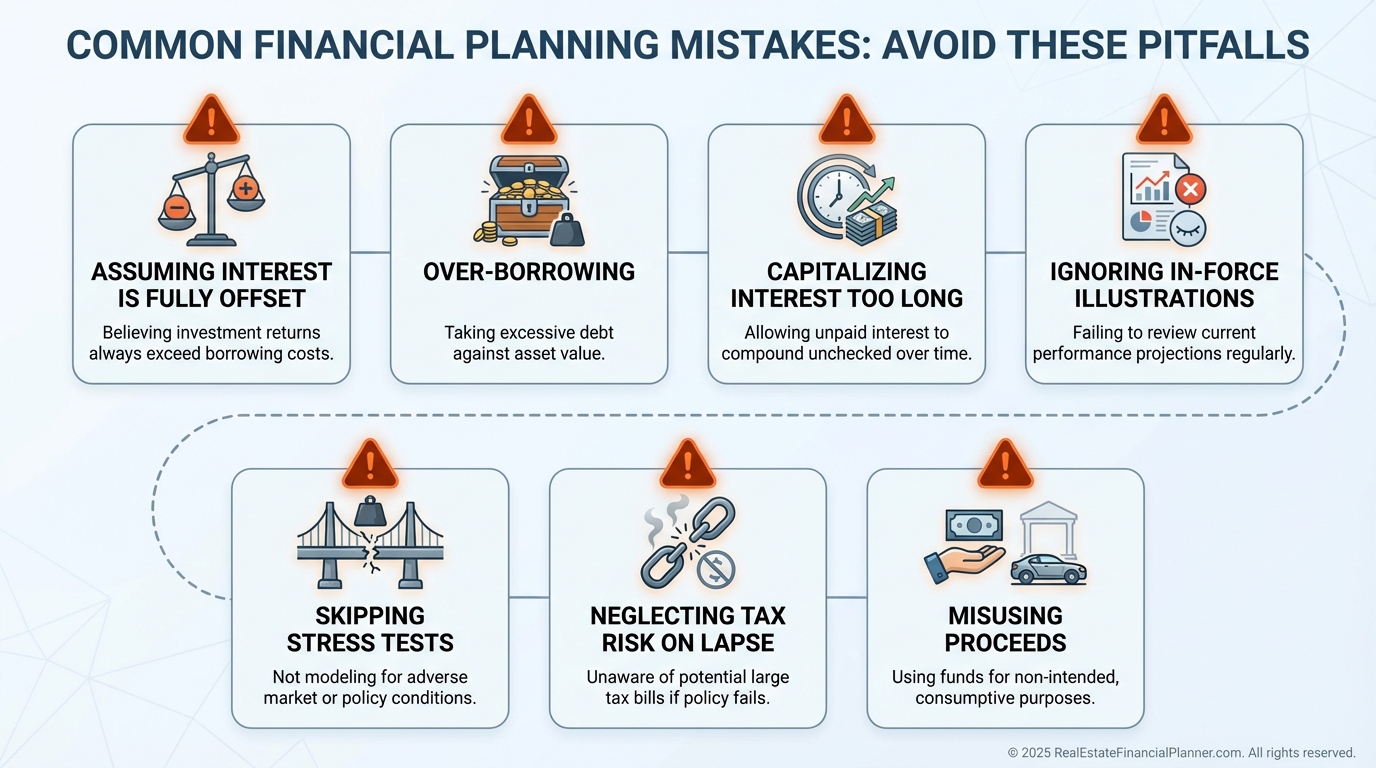

Risks, Misconceptions, and Mistakes I Want You to Avoid

Thinking dividends “cancel out” interest.

They rarely do perfectly, and net cost is what matters.

Letting a policy approach max loan-to-cash-value.

That raises lapse risk if dividends fall or if you skip interest.

Capitalizing interest year after year without a plan.

Compounding can sneak up and shrink your death benefit and TNE.

Trusting illustrations blindly.

Ask for current in-force illustrations and test lower crediting rates.

Forgetting taxes.

A policy that lapses with a loan can create taxable income on the gain.

Treating this like “free money.”

It’s a real loan with real interest and real consequences.

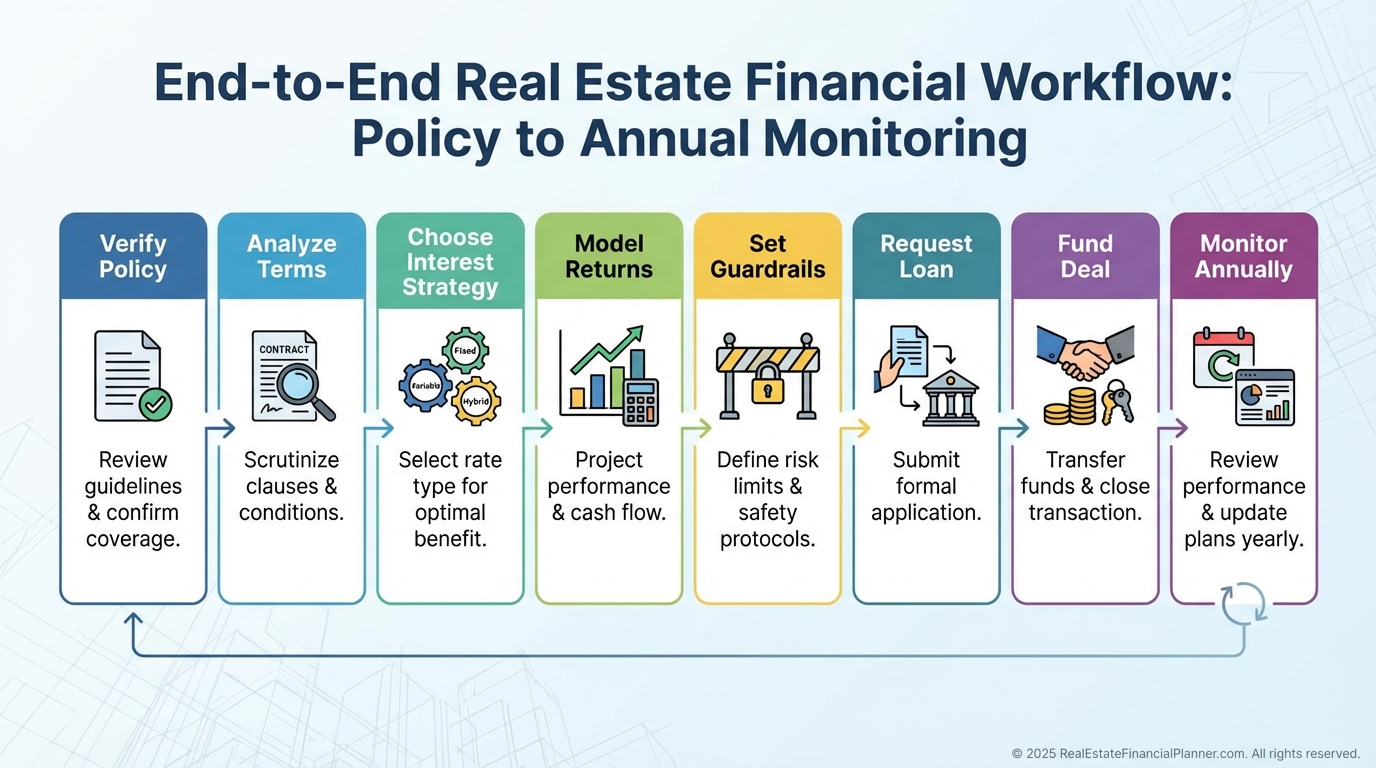

Step-by-Step: From Policy to Closing Funds

•

Confirm policy type, cash value, and MEC status.

•

Request an in-force illustration and loan terms in writing.

•

Decide how you will service interest (pay or capitalize).

•

Model the deal in Return Quadrants™ and compute True Net Equity™.

•

Set safe loan-to-cash-value guardrails (for example, stay under 70–80%).

•

Request the loan and document internal controls for repayment.

•

Deploy funds for down payment, EMD, or rehab.

•

Review policy annually and adjust payments if dividends or rates change.

Final Take

Policy loans can be fast, flexible capital when the real estate deal is strong and your policy is healthy.

Run the math, respect the risks, and manage the policy like the valuable asset it is.

When I help clients do that, the strategy supports the portfolio instead of threatening it.