Student Rentals: The Proven Playbook for Financing, Managing, and Scaling Near‑Campus Cash Flow

Learn about Student Rentals for real estate investing.

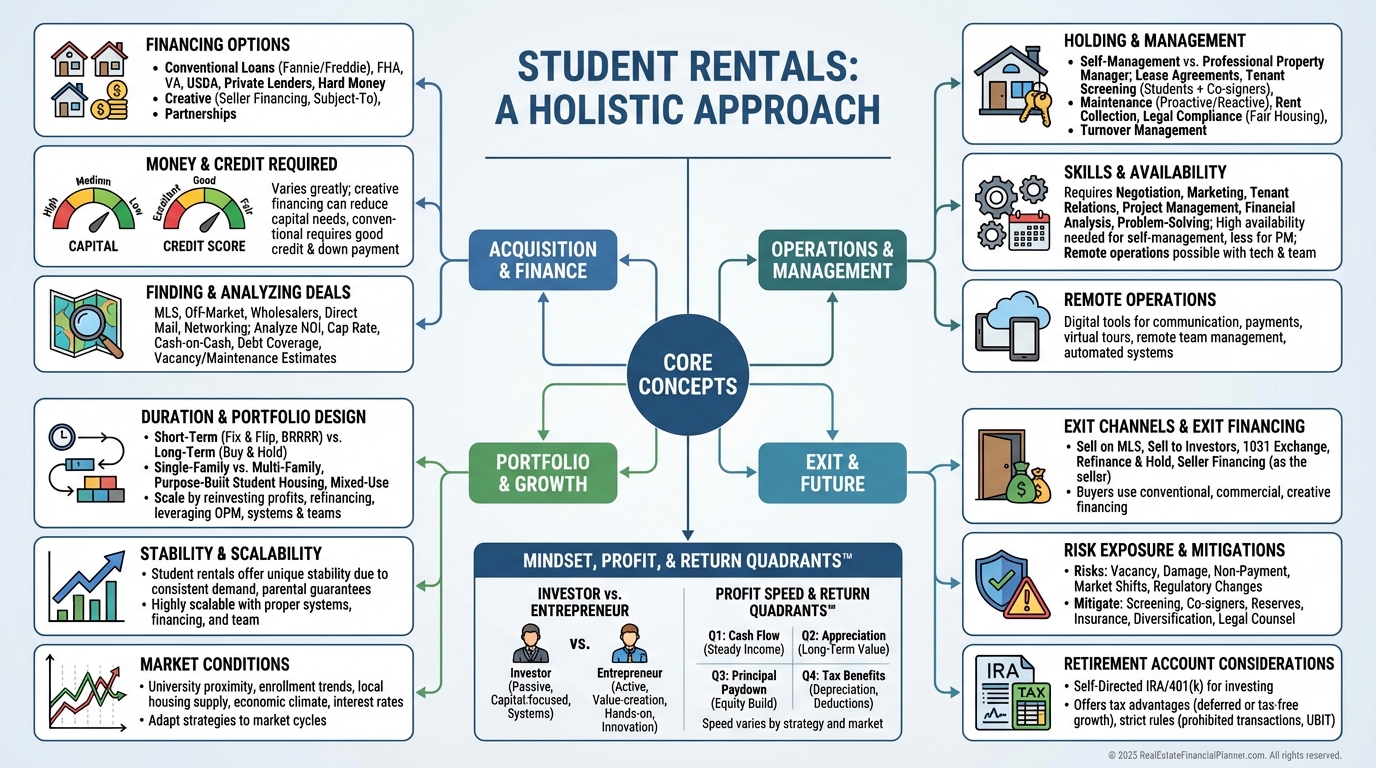

Why Student Rentals Belong in a Serious Buy-and-Hold Plan

When I help clients compare strategies, student rentals consistently deliver higher income per square foot with only a bit more active management.

Near stable or growing universities, they can be a reliable cash-flow engine that compounds wealth through appreciation and debt paydown.

Then I sanity-check True Net Equity™ to confirm what you really own after transaction costs and depreciation recapture if you sold.

What Makes Student Rentals Different

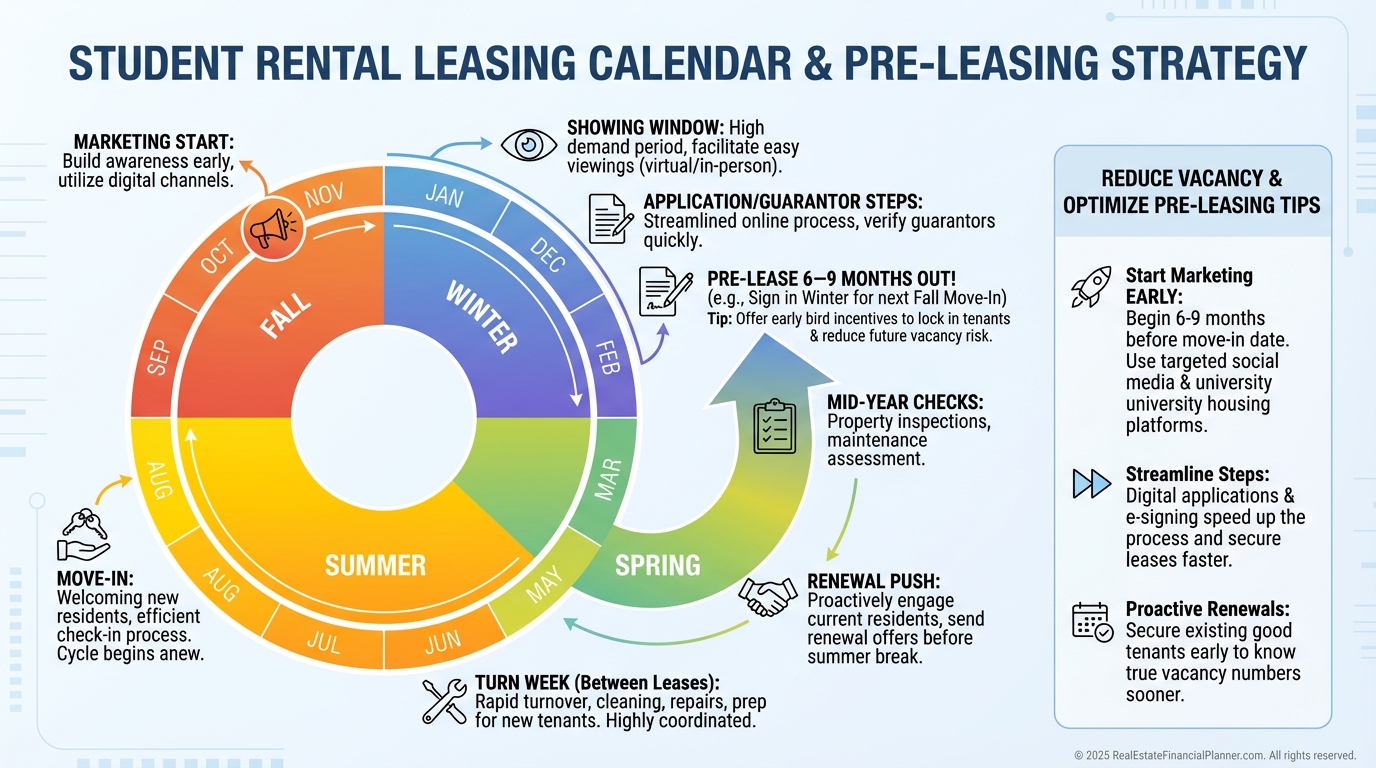

Tenant demand follows the academic calendar, so your leasing, turns, and cash flow cadence are seasonal.

Leases can be per-bedroom or joint-and-several, often with parental guarantees that materially reduce collection risk.

Properties usually perform best furnished, utility-bundled, and within a short commute or walk to campus or transit.

Local ordinances matter, especially occupancy limits for unrelated tenants, rental licensing, and inspection regimes.

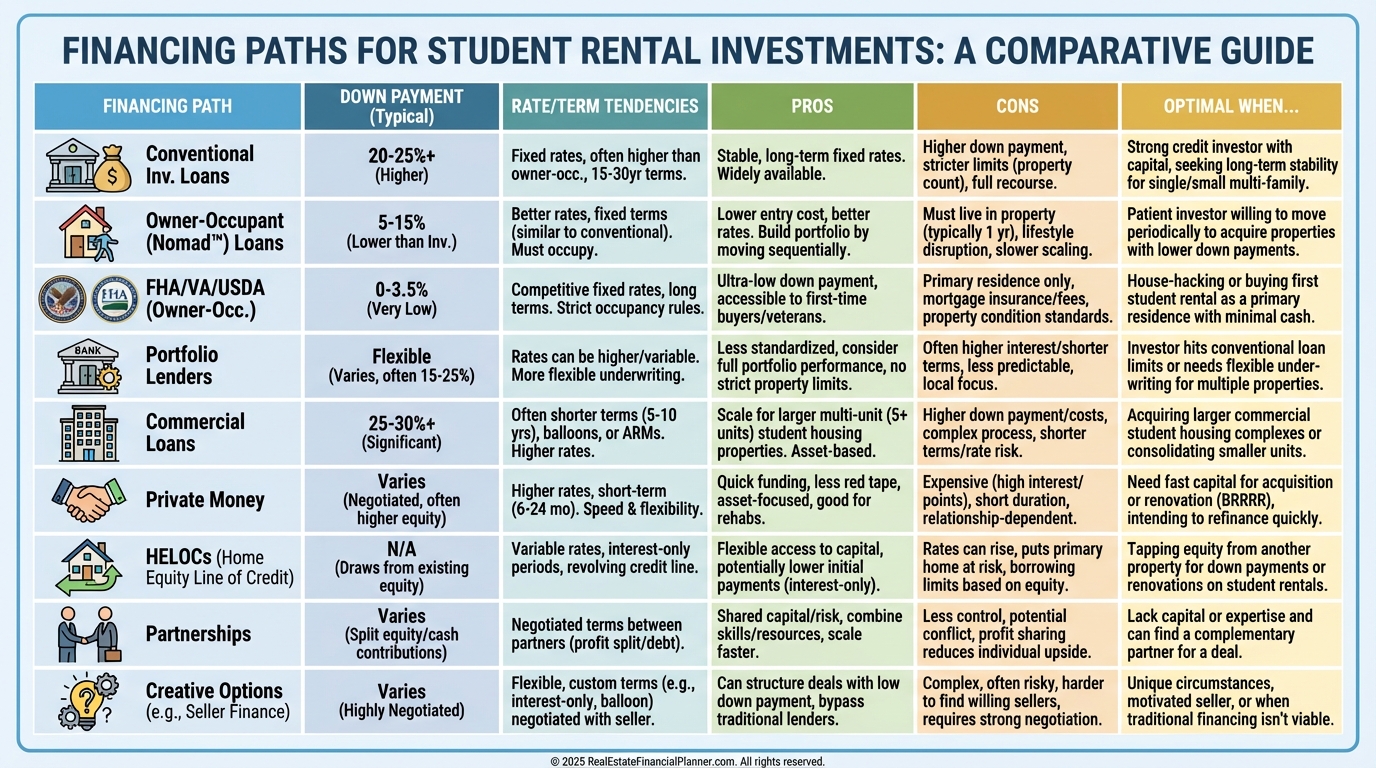

Financing Student Rentals

Most clients start with conventional investment loans needing 20–25% down and solid credit, because underwriting is predictable.

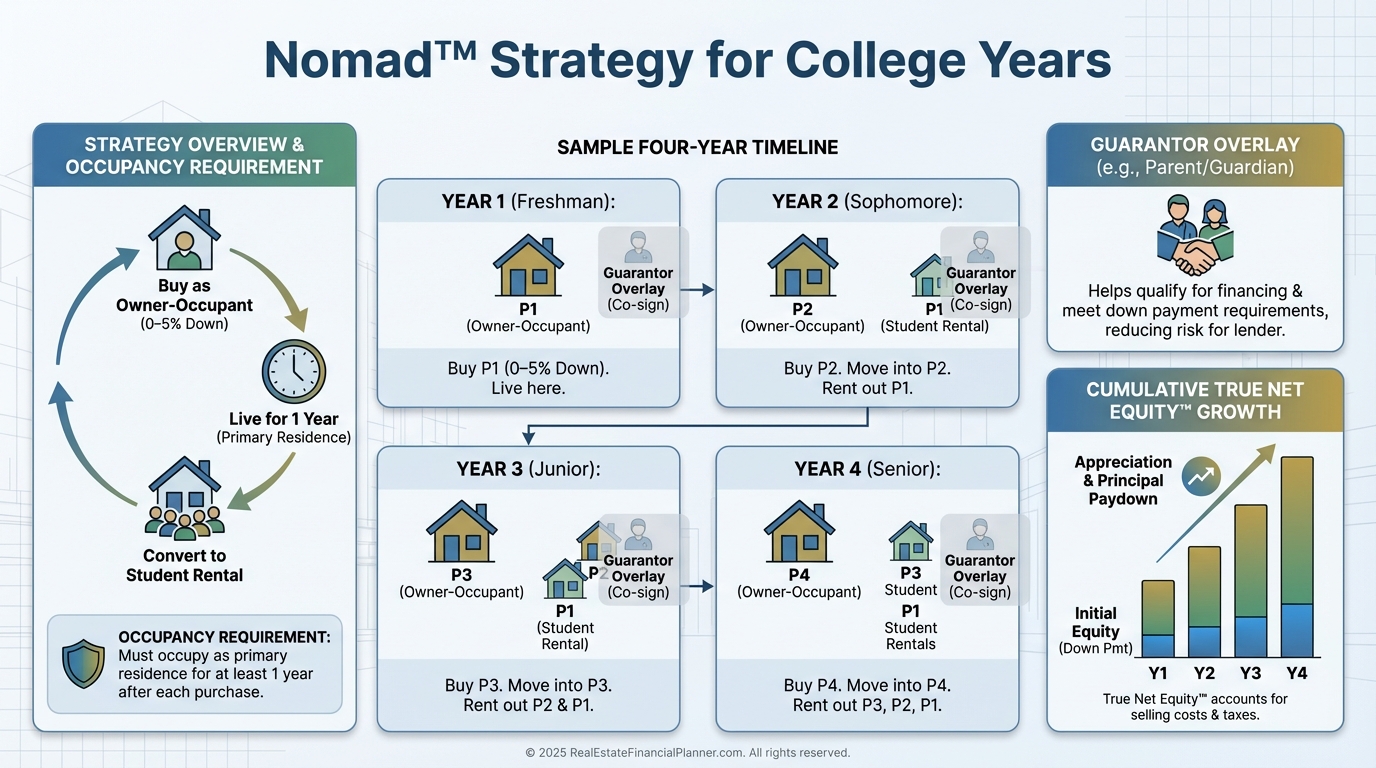

When a student client or their child will occupy, we lean on owner-occupant financing for lower down payments and rates, then transition to a student rental after the required one-year occupancy.

That opens the door to the Nomad™ approach: buy one owner-occupant per year during college, live in it for a year, then keep it as a student rental and repeat.

Portfolio lenders are flexible in college towns and may recognize stronger DSCR from by-the-bedroom income.

For 5+ units or mixed-use near campus, commercial loans with DSCR underwriting can price better on stabilized deals.

Private money, partnerships, and HELOCs can bridge down payments and speed closings when you need to win in a competitive market.

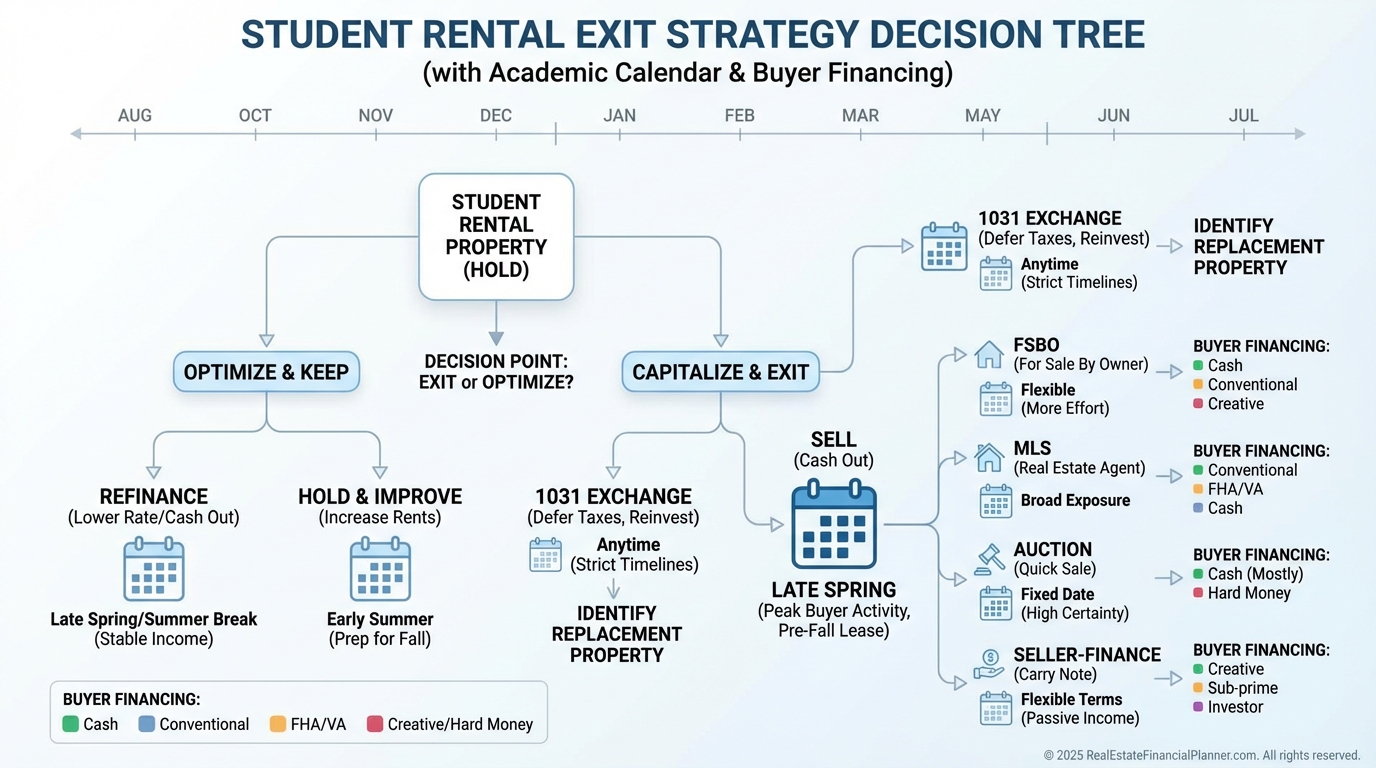

If you plan to 1031 later, I underwrite exit financing now so we’re not trapped by a narrow buyer pool.

Holding and Management

Student rentals are still buy-and-hold, but with a tighter operational rhythm.

I furnish durable core items, bundle internet and lawn/snow, and price a utility cap per tenant to reduce bill-shock disputes.

Leasing is a process I run 6–9 months in advance, timed to the academic cycle, to minimize vacancy.

I screen each tenant and collect parental guarantees, because they dramatically improve collections and reduce skips.

For compliance, I verify occupancy limits, required licenses, and inspection schedules before writing the offer.

Duration and Portfolio Design

Most investors hold indefinitely for cash flow plus appreciation near durable universities.

As retirement nears, I help clients prune to fewer, higher-quality assets in A-tier locations for lower oversight and better tenant profiles.

If return on equity drifts down, we consider refinance or 1031 to reposition into stronger DSCR or newer stock.

I time any sale to the academic calendar so an incoming investor inherits a full rent roll with clear guarantor files.

Exit Channels and Exit Financing

A 1031 exchange lets you defer both capital gains and depreciation recapture and trade into stronger markets or newer units.

Expect buyers to use owner-occupant loans (parents purchasing for a student), investor loans at 20–25% down, or cash.

Seller financing or rent-to-own can widen your buyer pool and potentially boost price, but you’ll want an attorney-structured note and servicing.

Investor vs. Entrepreneur

Student rentals are investing with an entrepreneurial tilt.

The operations are slightly more hands-on, but systems and a local team make it scalable.

When I rebuilt after bankruptcy, I favored strategies where effort translated to outsized cash flow and durable demand.

Student rentals met that bar in the right submarkets.

Money Required

Down payment ranges from 0% (VA/USDA) to 3–5% (owner-occupant conventional), 3.5% (FHA), or 20–25% (investment loans).

Plan 2–5% for closing costs, permits, and any rental licensing.

Budget rent-ready: furnishings, durable flooring, locks, study desks, and common-area upgrades that matter to students.

I also set aside Cumulative Negative Cash Flow as a “deferred down payment,” so we never feel squeezed by short-term rates.

Credit Required

Owner-occupant loans can be doable at 620 conventional or 580 FHA, which helps the Nomad™ play for students or parents.

Cash or partners can bypass credit for the purchase, but I still want your credit trending up for future refinances.

Skills Required

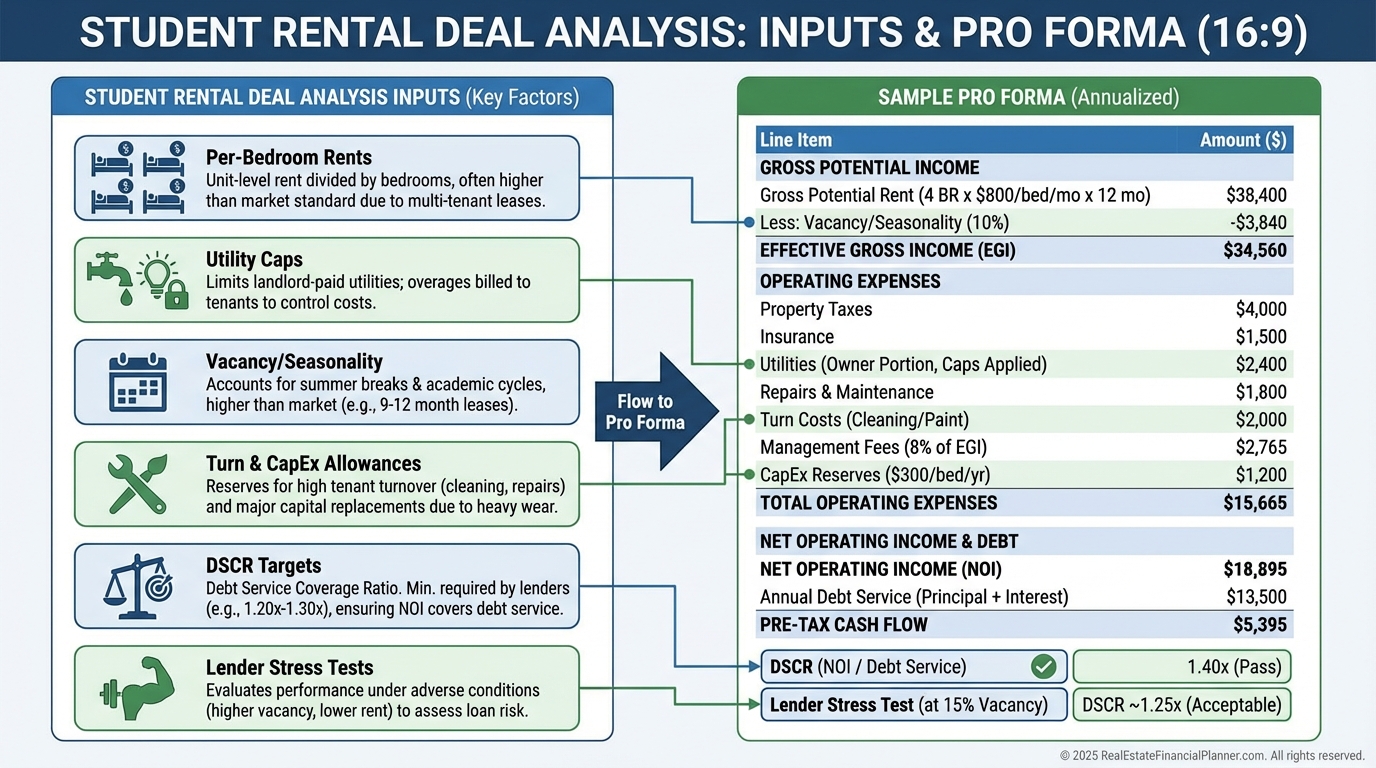

Deal analysis must account for per-bedroom rents, higher turnover, and utility structures.

Finding deals means staying close to campus growth plans, transit routes, and purpose-built student housing pipelines.

Acquisition financing can be a puzzle, so I match your timeline and goals to the right loan type from day one.

Property management includes guarantors, roommate matching, and periodic inspections without violating privacy laws.

Vendor orchestration is critical during tight turn windows, so I book painters, cleaners, and flooring well ahead.

Stability

Student rentals are actively stable.

They reward consistent effort with premium cash flow, but they will not run on autopilot.

I offset this by front-loading systems, then handing repeatable tasks to a well-trained property manager.

Scalability

Scaling is similar to Traditional Buy and Hold, with two advantages.

Higher income often improves DSCR and DTI, which helps you qualify for more loans.

Process documentation lets you hand off turns and leasing so you can focus on acquisitions and asset quality.

Risk Exposure

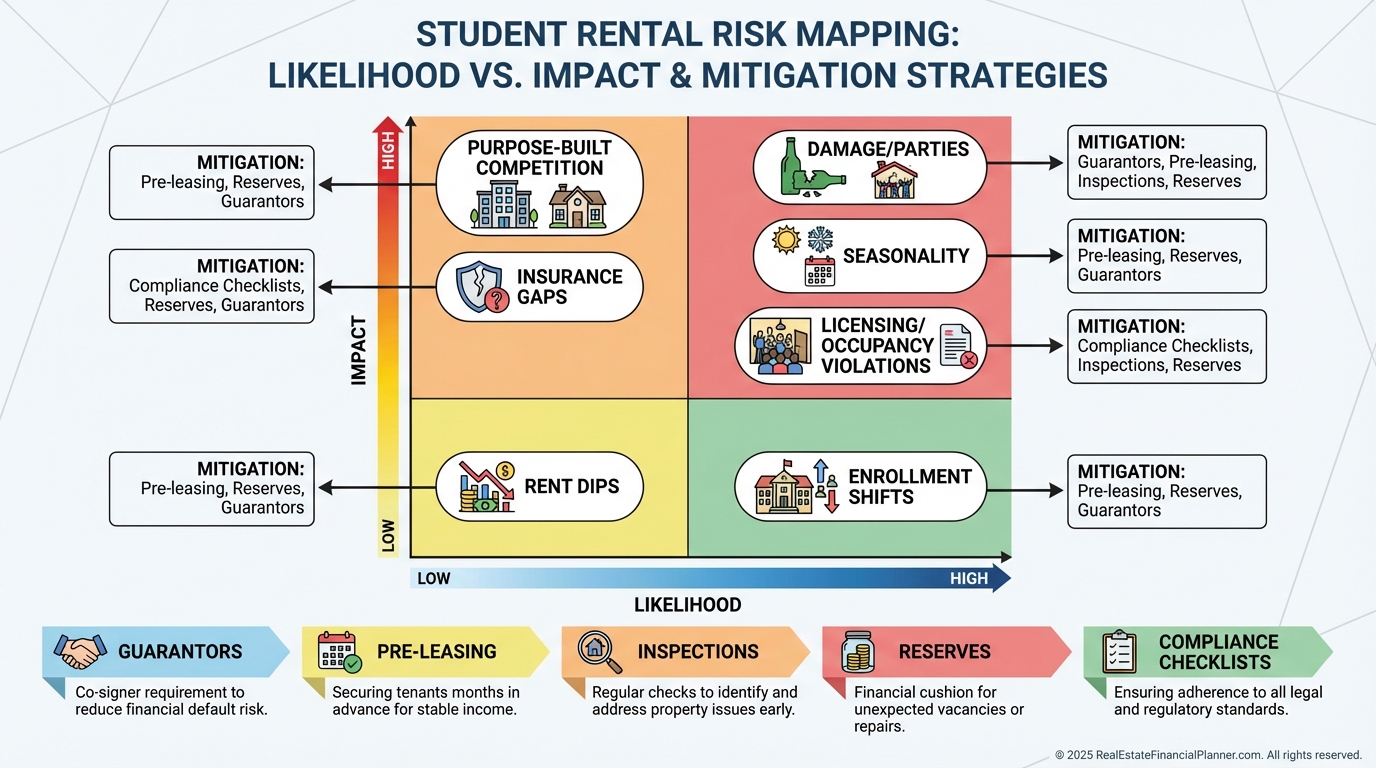

I watch four categories: market risk, tenant/operational risk, legal/compliance risk, and financing risk.

Market risk includes enrollment trends and new purpose-built supply; I underwrite against both.

Operational risk includes parties, damage, and turnover; I mitigate with guarantors, inspections, and durable finishes.

Compliance risk focuses on occupancy limits and licensing; I verify pre-offer and keep files audit-ready.

Financing risk is biggest at acquisition and refi; I model rate shock and hold ample reserves.

Profit Speed and Return Modeling

Cash flow can start quickly if you time closing before peak leasing.

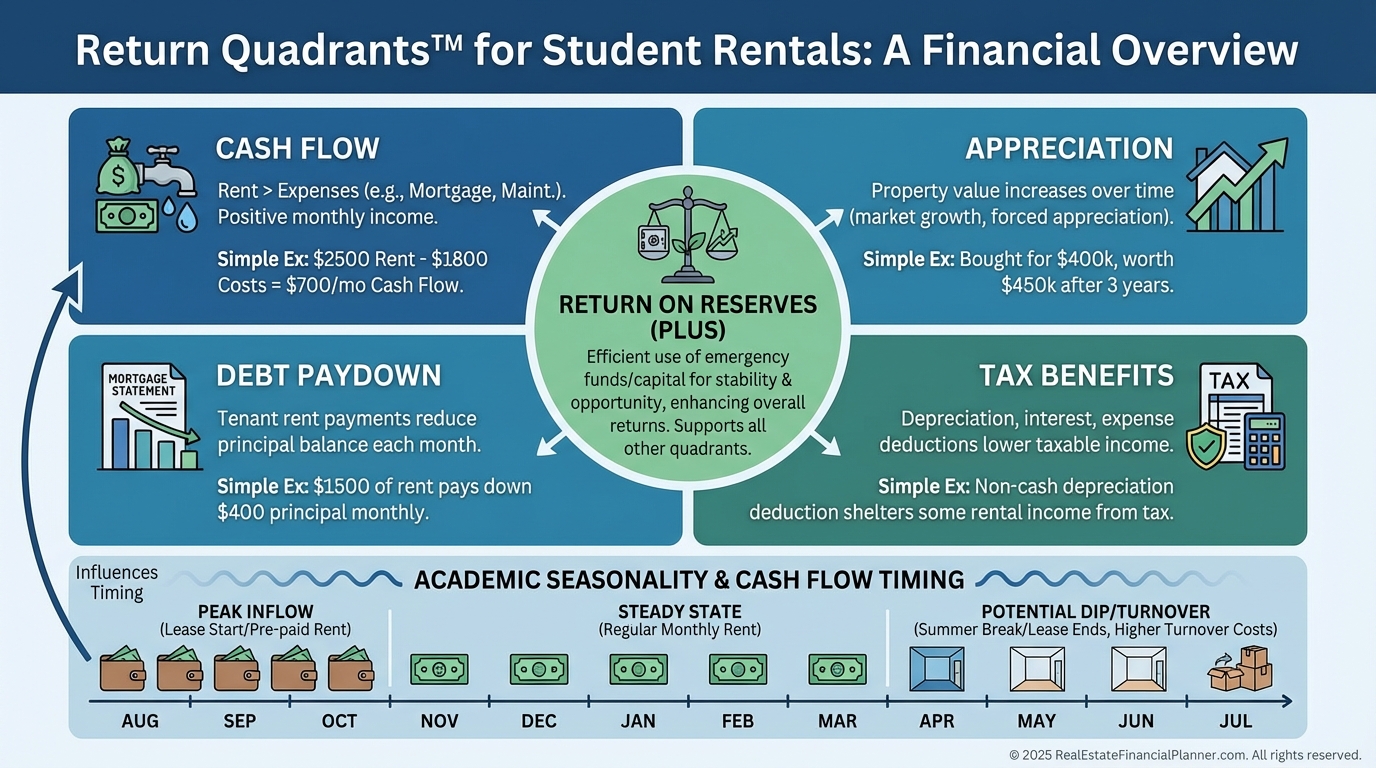

I evaluate returns with Return Quadrants™: cash flow now, appreciation later, debt paydown monthly, and taxes annually.

Return from Reserves matters too, so I park reserves where they earn safe yield while staying liquid for turns.

True Net Equity™ keeps us honest by subtracting selling costs and taxes so you know what you’d walk away with.

Finding Deals

I start on the MLS within a one-to-two-mile radius of campus, filtering for bedroom count and layouts that convert well.

FSBOs are common around campus; I mail and call with a clean, easy close.

Wholesalers, auctions, and occasional REOs can work, but I hold a firm standard on proximity, safety, and transit.

I skip anything outside practical commute bands unless the transit route is fast and frequent.

Analyzing Deals

I underwrite by the bedroom with a realistic utility cap, higher turn costs, and slightly higher wear.

Vacancy is “structural” if you miss the leasing window, so I include a seasonality factor rather than a flat vacancy rate.

I want DSCR at or above 1.25 on conservative assumptions and stress-test rates, rents, and turns.

Use The World’s Greatest Real Estate Deal Analysis Spreadsheet™ to model your next student rental.

You can download it free at: https://RealEstateFinancialPlanner.com/spreadsheet

Market Conditions

Ideal markets show stable or rising enrollment, constrained near-campus supply, and friendly rental policies.

Challenging markets show enrollment declines, oversupply from new dorms, or strict occupancy caps.

I read campus master plans and housing reports the way I read a city’s comprehensive plan for non-student rentals.

That’s where you see demand coming or going.

Accessibility and Remote Operations

You can run student rentals remotely with a local leasing agent and turn team.

I use video tours, lockbox showings with ID verification, and e-leases with guarantor portals.

Competition is fiercest within walking distance or along primary bus routes, so be ready to write clean offers.

Using Retirement Accounts

Self-directed IRAs/401(k)s can buy student rentals, but you cannot occupy or let your child occupy.

Expect larger down payments, potential UDFI/UBIT taxes if you use leverage, and limited access to cash flow before retirement age.

Sometimes the better move is keeping retirement money in the market and using conventional financing for flexibility.

Run both scenarios through Return Quadrants™ and True Net Equity™ before deciding.

Compliance Guardrails I Check Before Writing an Offer

Maximum unrelated occupants allowed and how bedrooms are counted.

Rental license type, inspection cadence, and any fire/life-safety standards for student housing.

HOA or city rules about parking, noise, and lawn/snow compliance.

Insurance requirements, including an umbrella policy sized to the property count and risk profile.

What I Model, Check, and Avoid

I model conservative rents by room and never count parking or storage until I confirm demand.

I check enrollment trends, purpose-built pipeline, and transit upgrades that could shift demand.

I avoid funky layouts that don’t convert to bedrooms cleanly or that compromise egress and safety.

If I can’t pre-lease 6–9 months in advance, I won’t buy it.

A Simple Action Plan

Pick one target campus with stable or growing enrollment.

Build a local team: agent, lender, property manager, leasing coordinator, and turn vendors.

Underwrite five deals with the spreadsheet, then walk the top two and verify compliance.

Write one offer you’d be proud to own for 10 years.