Lender Requirements: Qualify for Investment Property Loans

Learn about Lender Requirements for real estate investing.

Why Deals Fail When You Ignore the Gatekeepers

When I help clients post-mortem a dead deal, the autopsy almost always reads the same: lender requirements were discovered too late.

She ate $3,500 in sunk costs and lost months of momentum.

Marcus modeled aggressive financing for half a year.

He later learned reserve requirements cut his real borrowing power by nearly a third.

These aren’t edge cases.

They’re what happens when we treat underwriting as a checkbox instead of a design constraint.

What Lender Requirements Really Are

Lender requirements are the rules of the financing game.

They’re not arbitrary.

They are risk controls that protect lenders and, if you use them well, protect you.

Think of them like the building code for capital.

You wouldn’t frame a second story without sizing the joists.

Don’t frame your portfolio without sizing your underwriting limits.

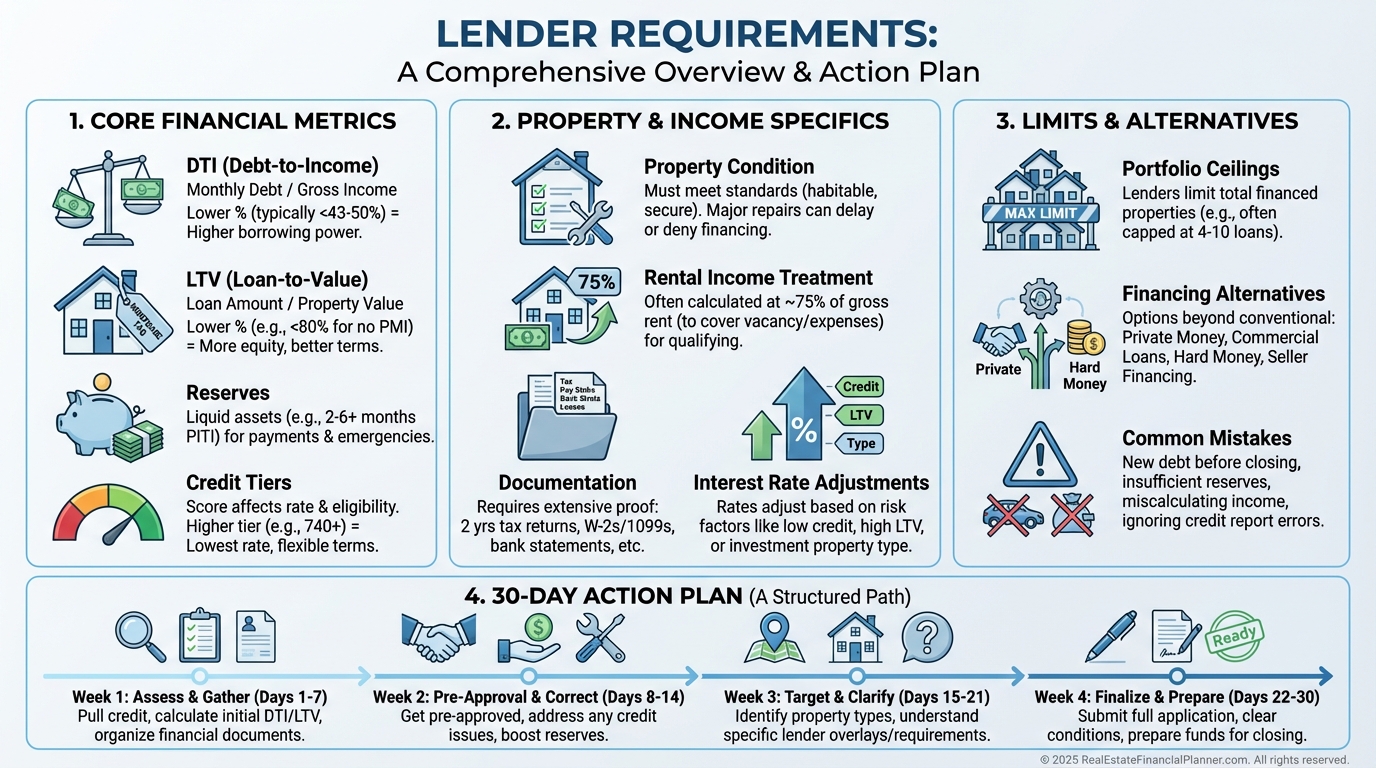

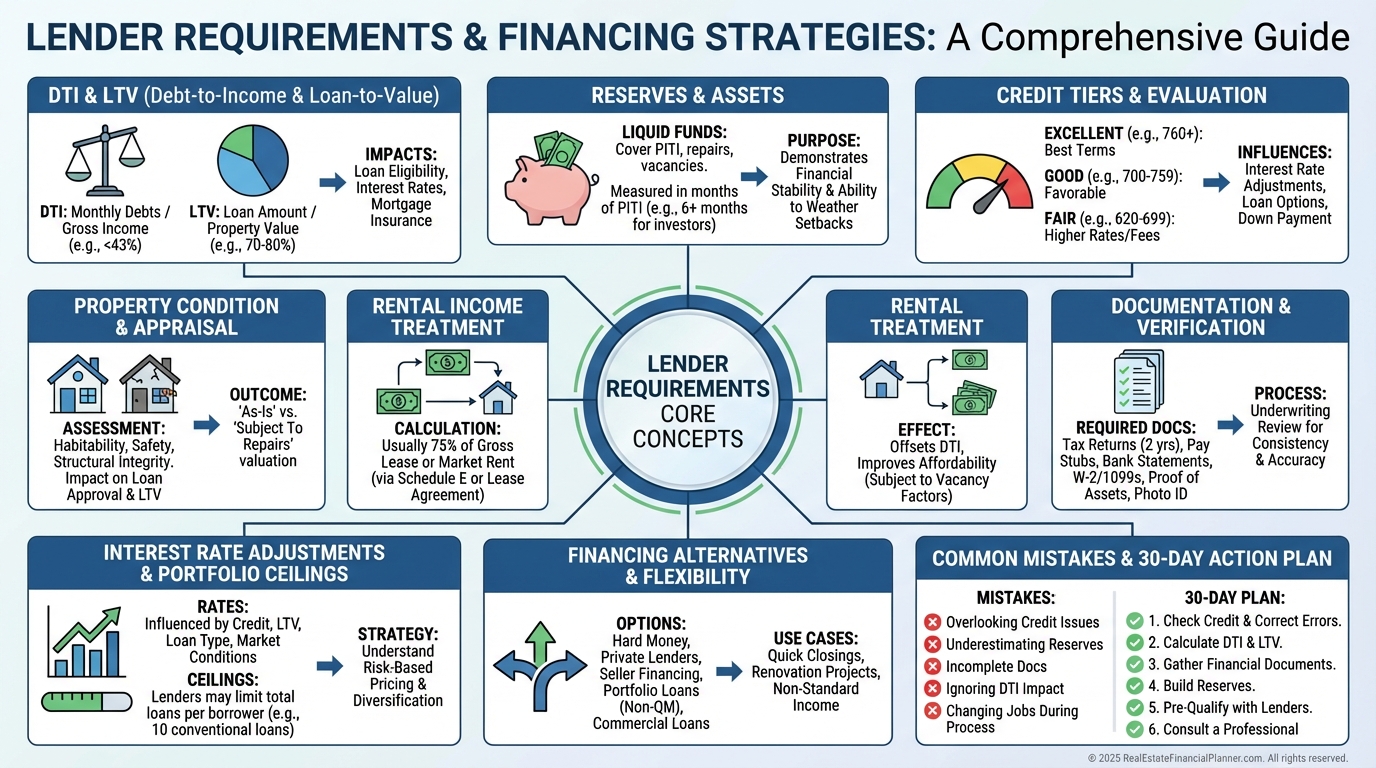

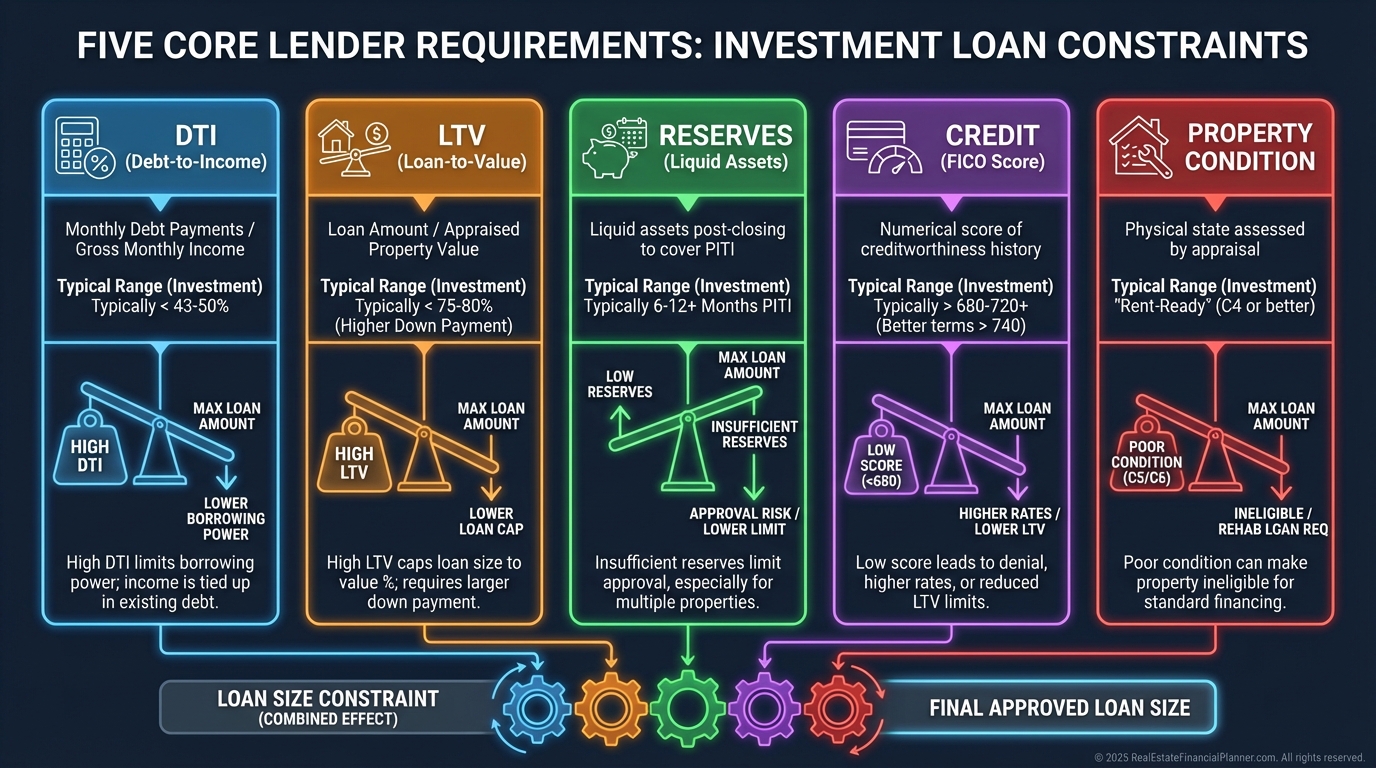

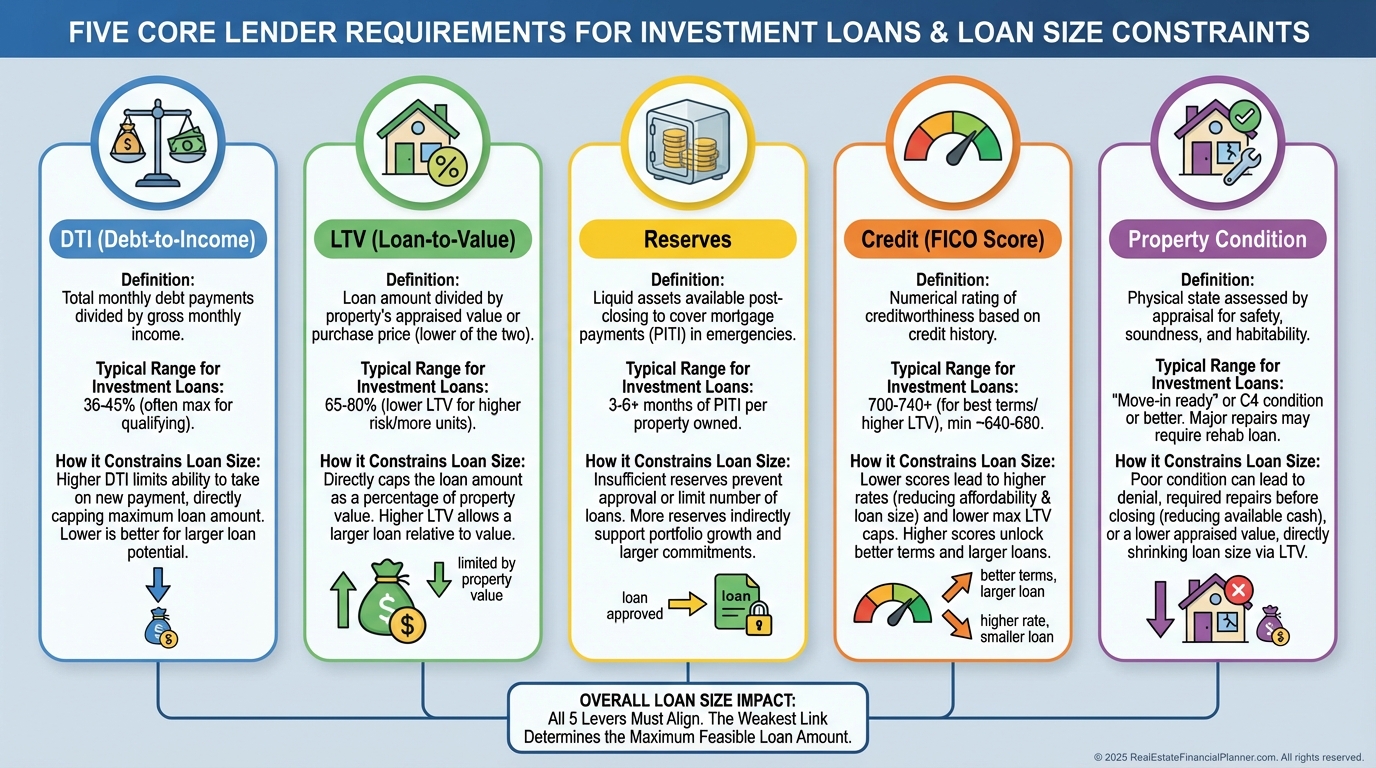

The Big Five You Must Model

•

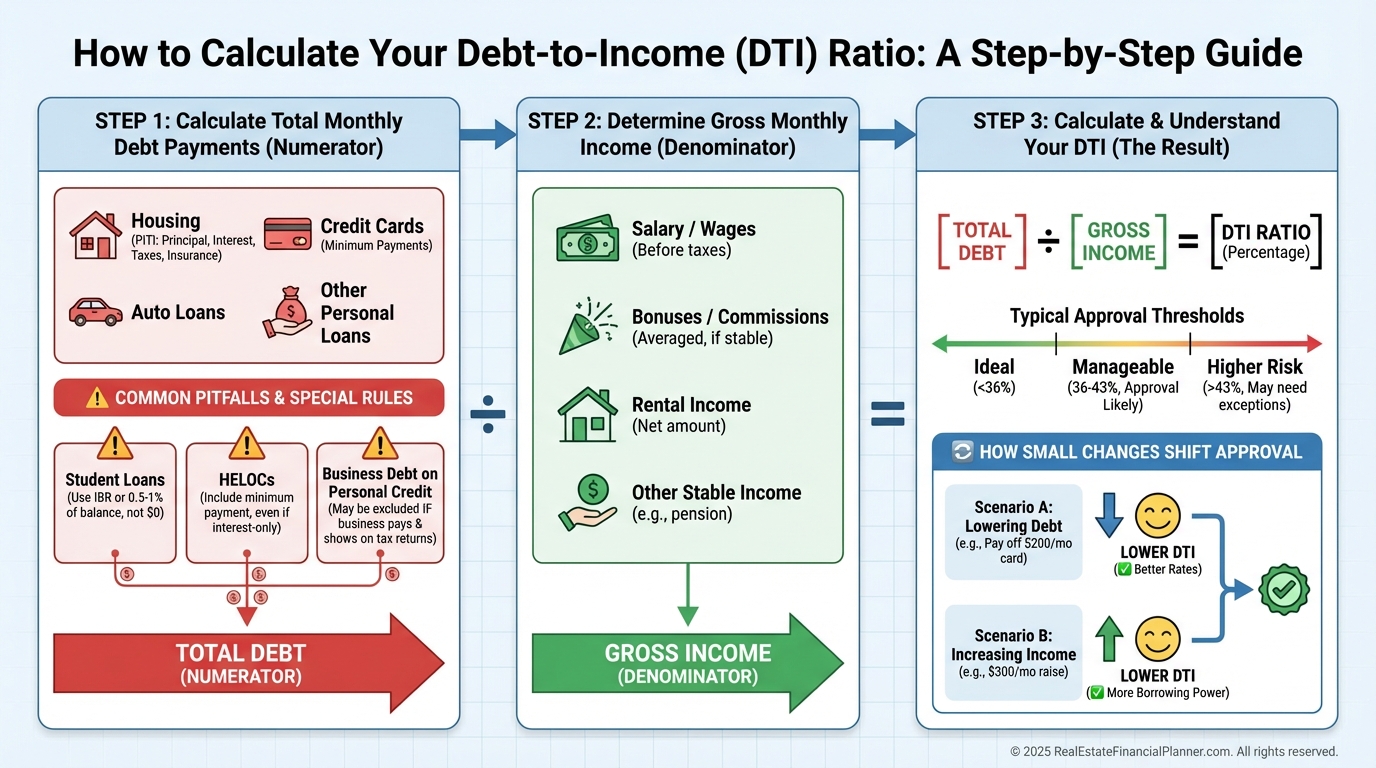

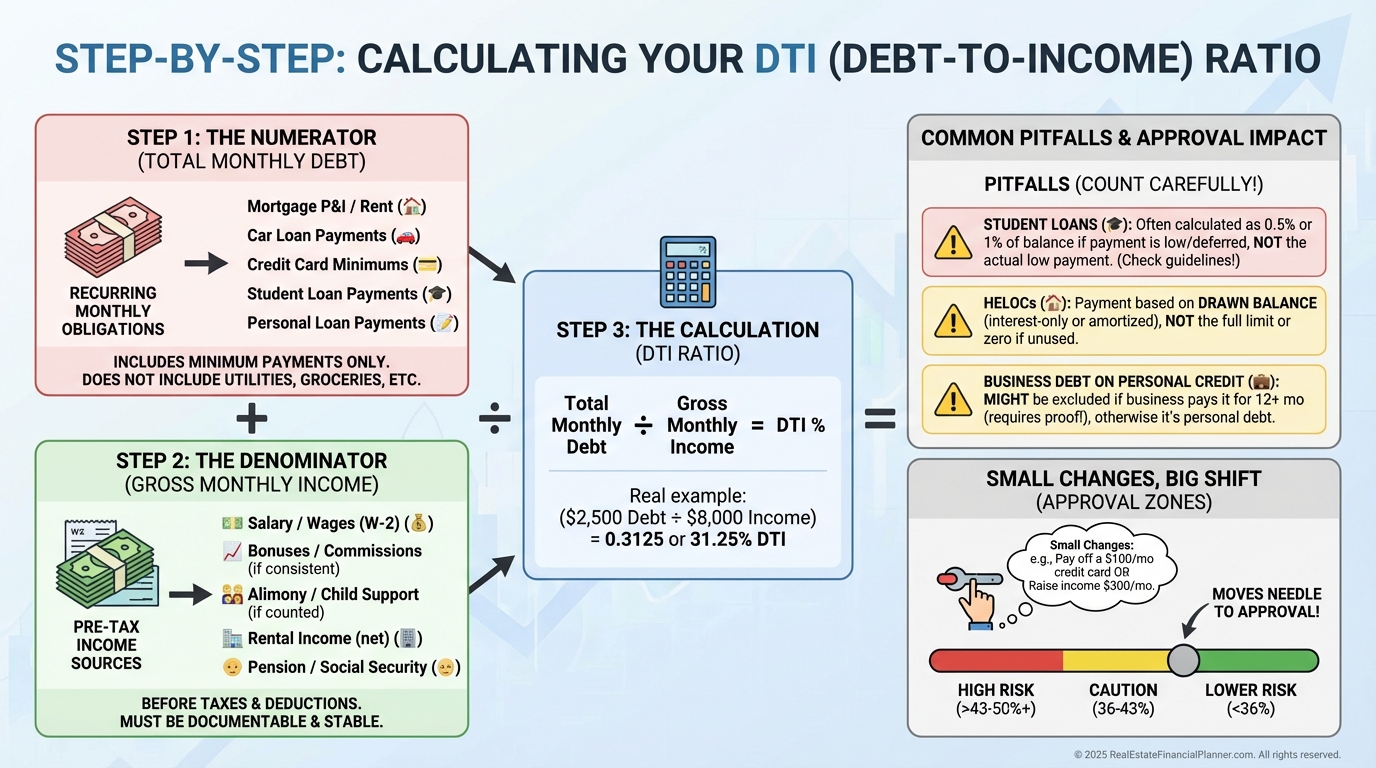

DTI (Debt-to-Income): The share of gross monthly income going to debt.

Most investors hit a 43–50% cap.

•

LTV (Loan-to-Value): The percentage of value the lender will fund.

Expect 75–80% for 1–4 unit investments.

•

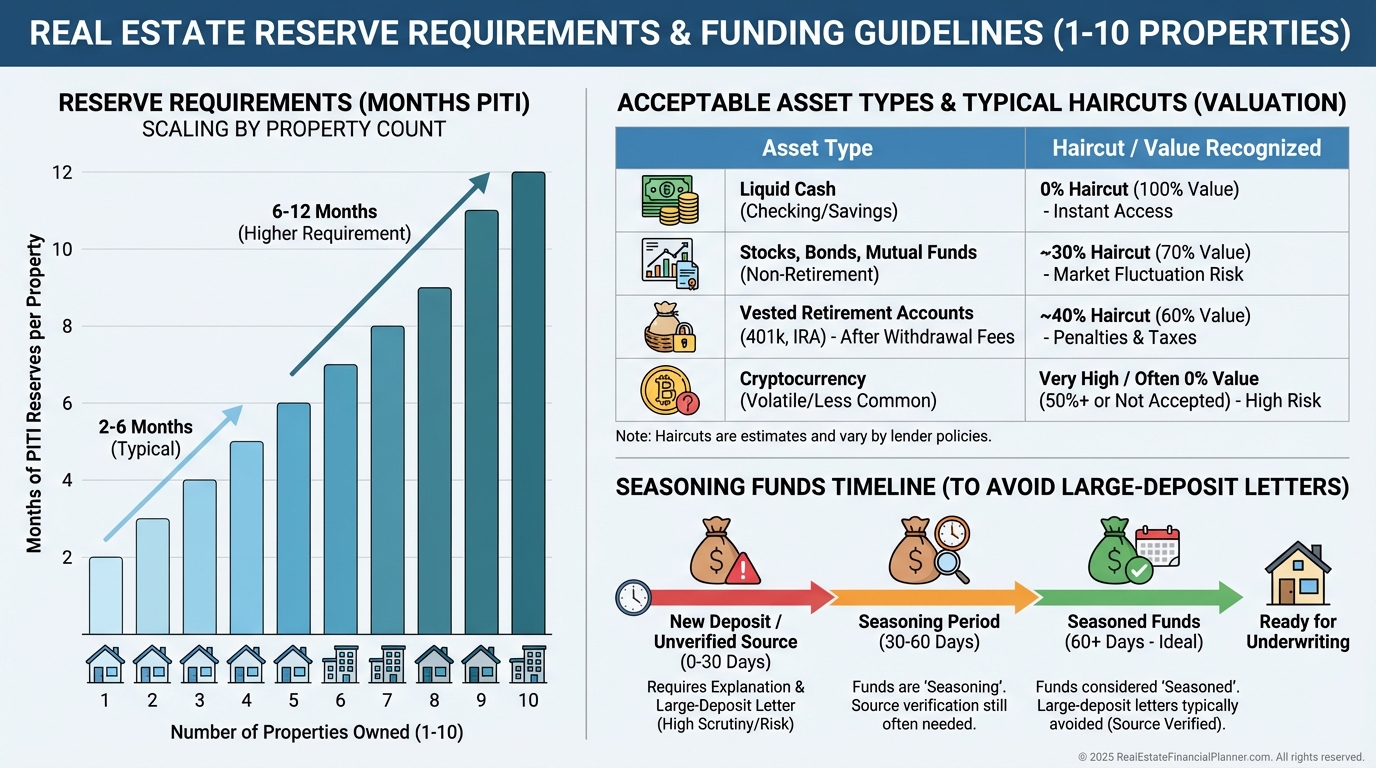

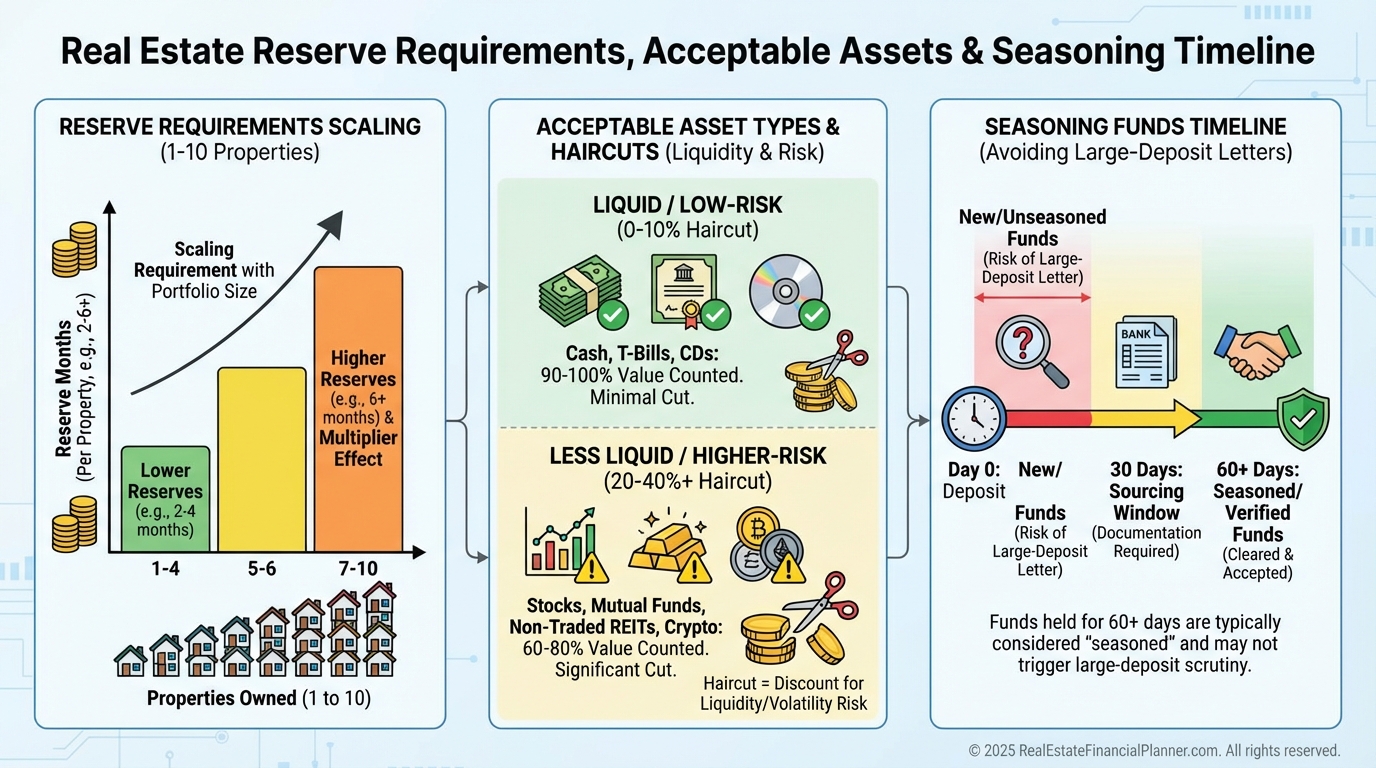

Reserves: Months of PITI you must hold in liquid or near-liquid accounts.

Plan for 3–6 months per mortgaged property.

•

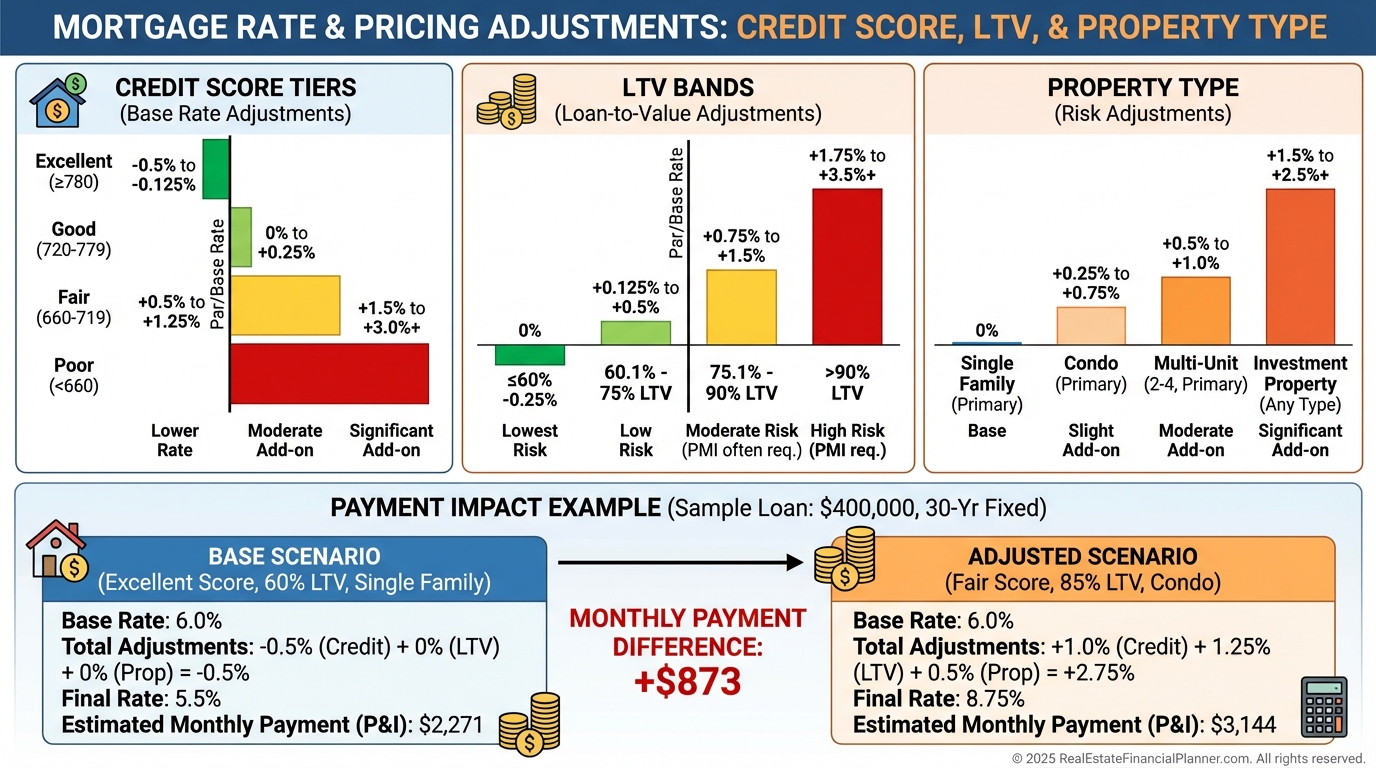

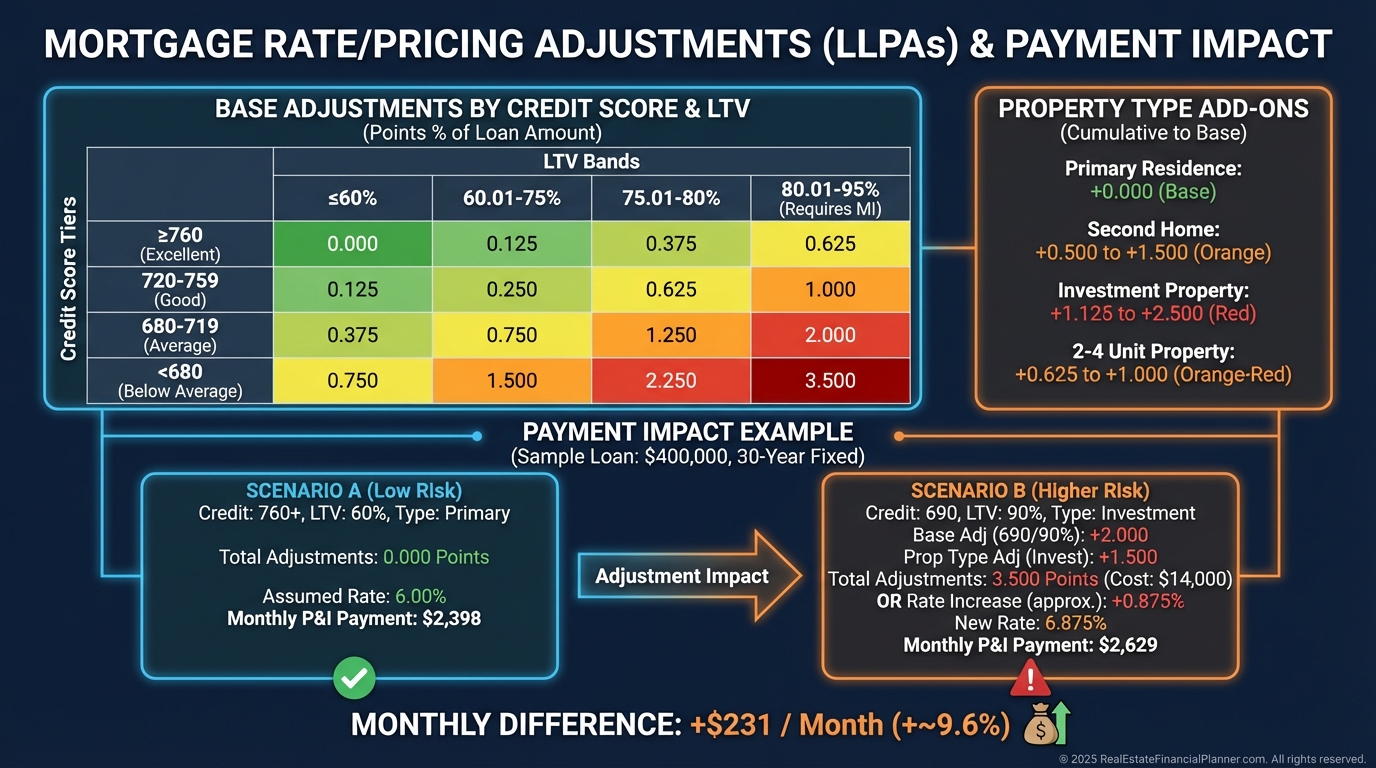

Credit: Score tiers move rate and fees.

Every 20 points can shift pricing.

•

Property Condition: Safety and habitability standards.

“Cosmetic fixer” can become “lender-required repairs before close.”

Investor Loans Are Not Owner-Occupied Loans

Down payments jump to 20–25%.

Rates carry a premium of roughly 0.75–1.25%.

Rental income is dissected, not assumed.

Some products require landlord experience.

When I coach first-time investors, we model today’s deal and the next three.

If your plan is Nomad™ (buy, move in, convert to rental), your path and pricing are different than pure non-owner-occupied loans.

Bake Requirements Into Your Deal Analysis

I never analyze a property without first modeling the financing constraints.

Use the World’s Greatest Real Estate Deal Analysis Spreadsheet™ and start on the financing assumptions.

Let it calculate the binding constraint between LTV and DTI.

Then run Return Quadrants™ to see how financing changes cash flow, principal paydown, appreciation, and depreciation.

Your spreadsheet is where heartbreaks are prevented.

Calculations You Must Master: DTI

DTI = total monthly debt payments ÷ gross monthly income.

It looks simple.

It isn’t.

Installment debts, minimum credit card payments, student loan imputed payments, and the new property’s PITI all count.

Let’s say you earn $8,500 gross per month.

You pay $1,800 for your primary, $400 for a car, and the new triplex will be $2,100 PITI.

Your total monthly debt is $4,300.

DTI is 50.6%.

That 0.6% over the cap is a denial.

Solutions I model with clients: increase income, pay off a small installment loan, buy down the rate, or pick a lower price point.

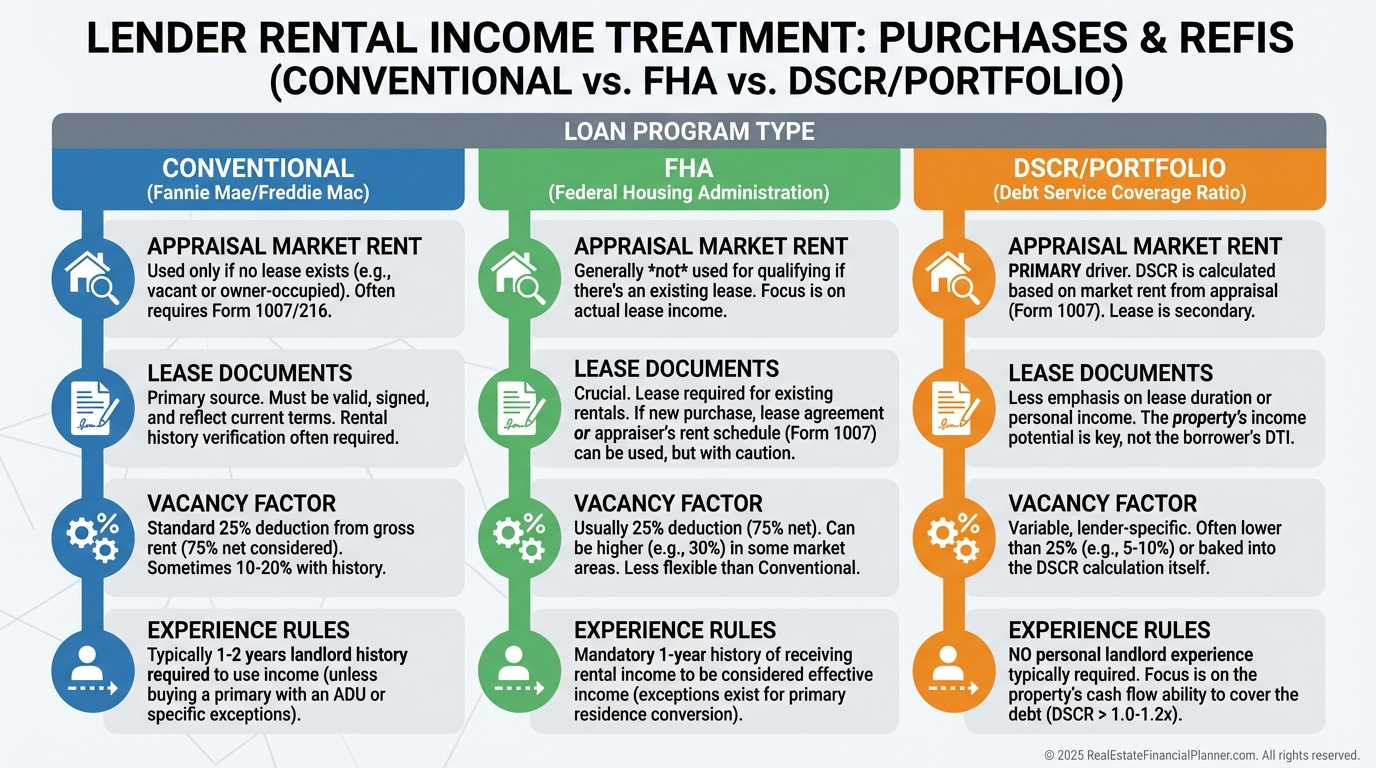

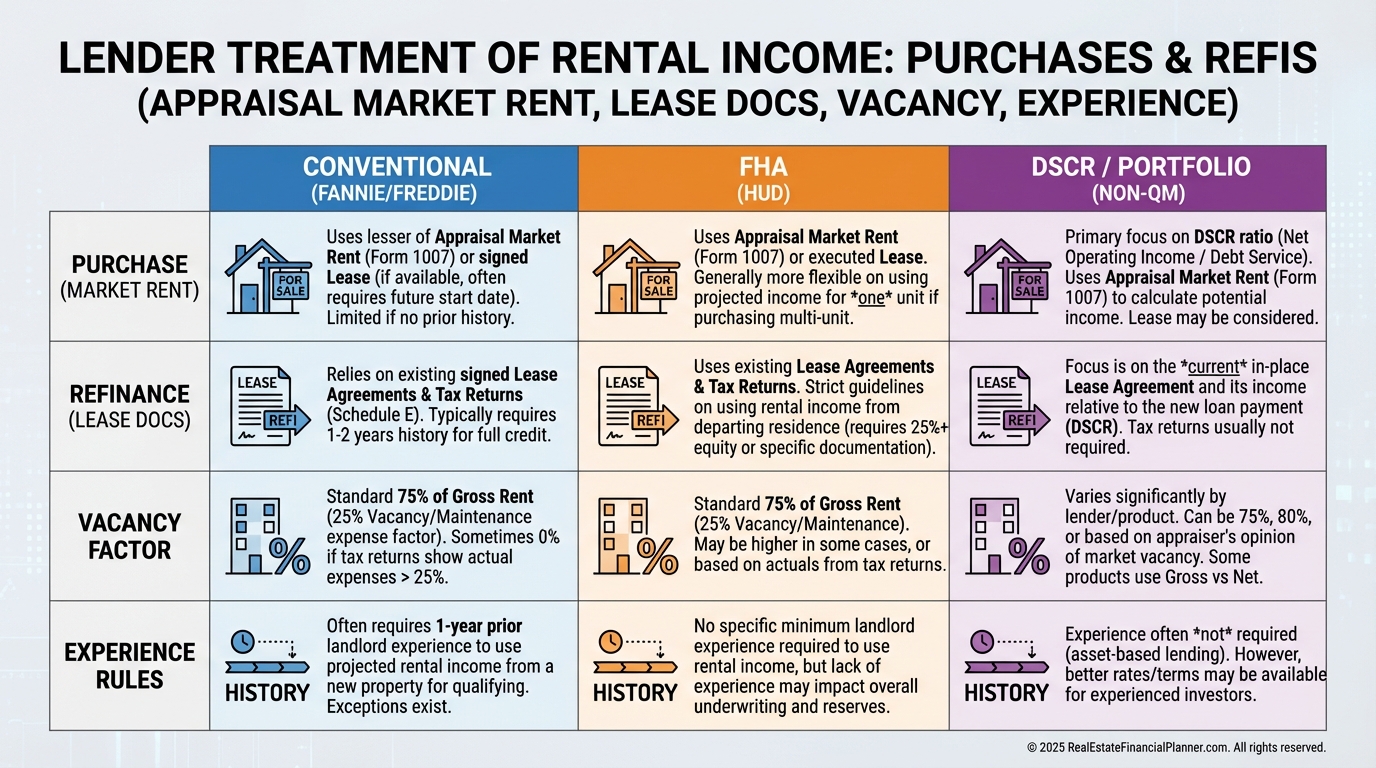

How Lenders Count Rental Income

Here’s where many investors overestimate capacity.

Conventional underwriting often uses 75% of market rent from the appraisal for new purchases.

If you lack landlord history, some lenders give you zero for existing rental income toward qualifying.

Portfolio lenders may allow 85–100% of in-place rent with strong documentation.

Jennifer’s duplex rents at $1,400.

Her lender counts $1,050.

That $350 gap can cut purchasing power by tens of thousands.

Reserves: The Silent Deal Killer

Reserves compound with each property.

One home with $2,000 PITI needs $6,000–$12,000 in reserves.

Three homes at $1,500 PITI each and a six-month rule demands $27,000.

Not all assets count equally.

Cash counts 100%.

Brokerage may be haircut to ~70%.

Retirement accounts are haircut more, especially if under age 59½.

When I rebuilt my own lending profile years ago, I staged acquisitions around reserve thresholds first, price second.

Documentation: Close Without Chaos

Underwriting loves complete files.

Expect two years of tax returns, W‑2s/1099s, recent bank statements (all pages), and for self-employed, a YTD P&L and balance sheet.

For properties, you’ll need leases, rent rolls, Schedule E, and proof of rent deposits.

Large deposits require letters of explanation.

When I prep clients, we build a lender-ready folder before shopping.

It cuts closing timelines and saves sanity.

How Requirements Set Your Max Price

You are constrained by the tightest limit.

LTV might allow a $240,000 loan on a $320,000 duplex at 75%.

But if your DTI supports only a $220,000 loan at today’s rate, DTI wins.

That means your workable purchase price drops to around $293,000 with the same down payment.

This is not bad news.

It’s clarity.

Pricing Adjustments That Move Your Payment

Pricing hits stack.

Credit score tiers move rate.

Higher LTVs often add pricing.

Two- to four-unit properties can add a bump.

On a $250,000 loan, a combined 1.00% rate increase can add about $200 per month.

That can flip a thin deal from cash-flow positive to negative.

When I model Return Quadrants™, I test a base rate and a “worst likely” rate so you see the range of outcomes.

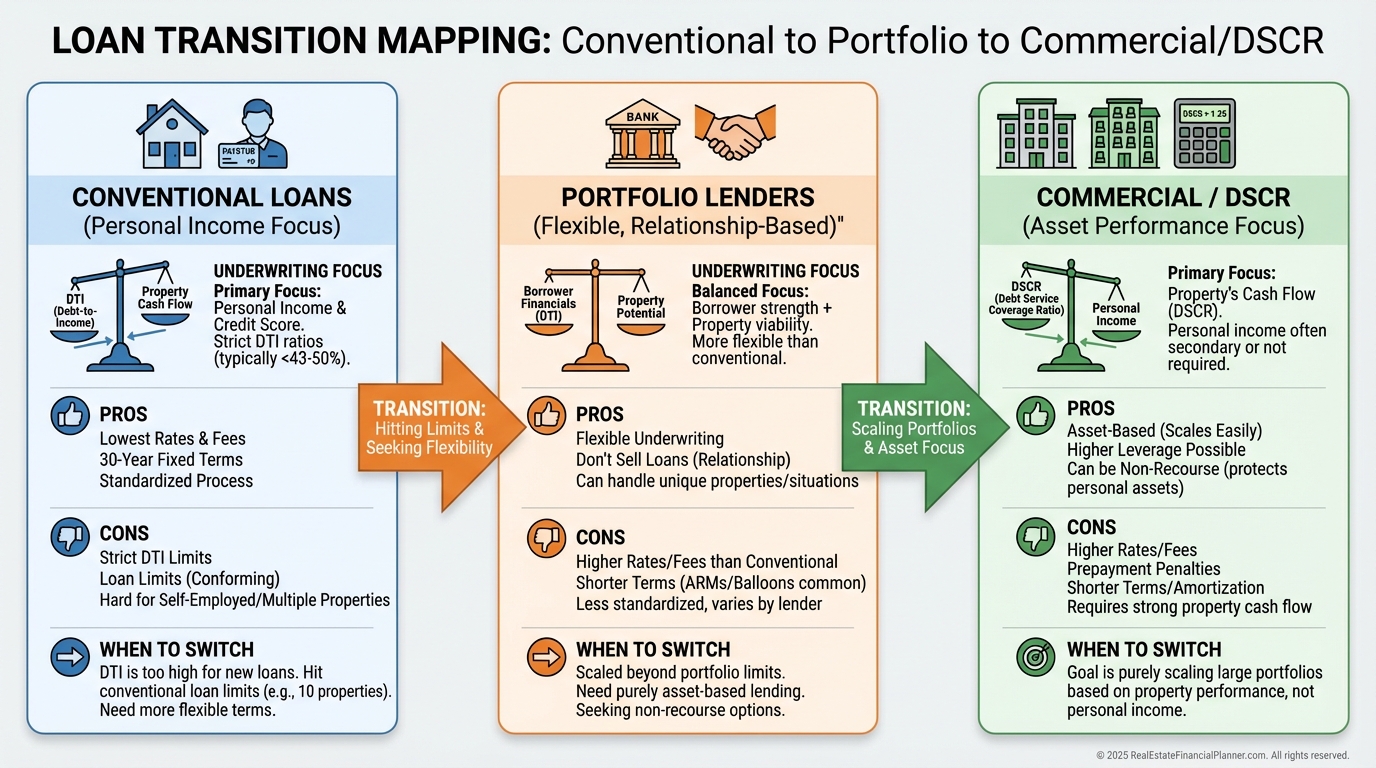

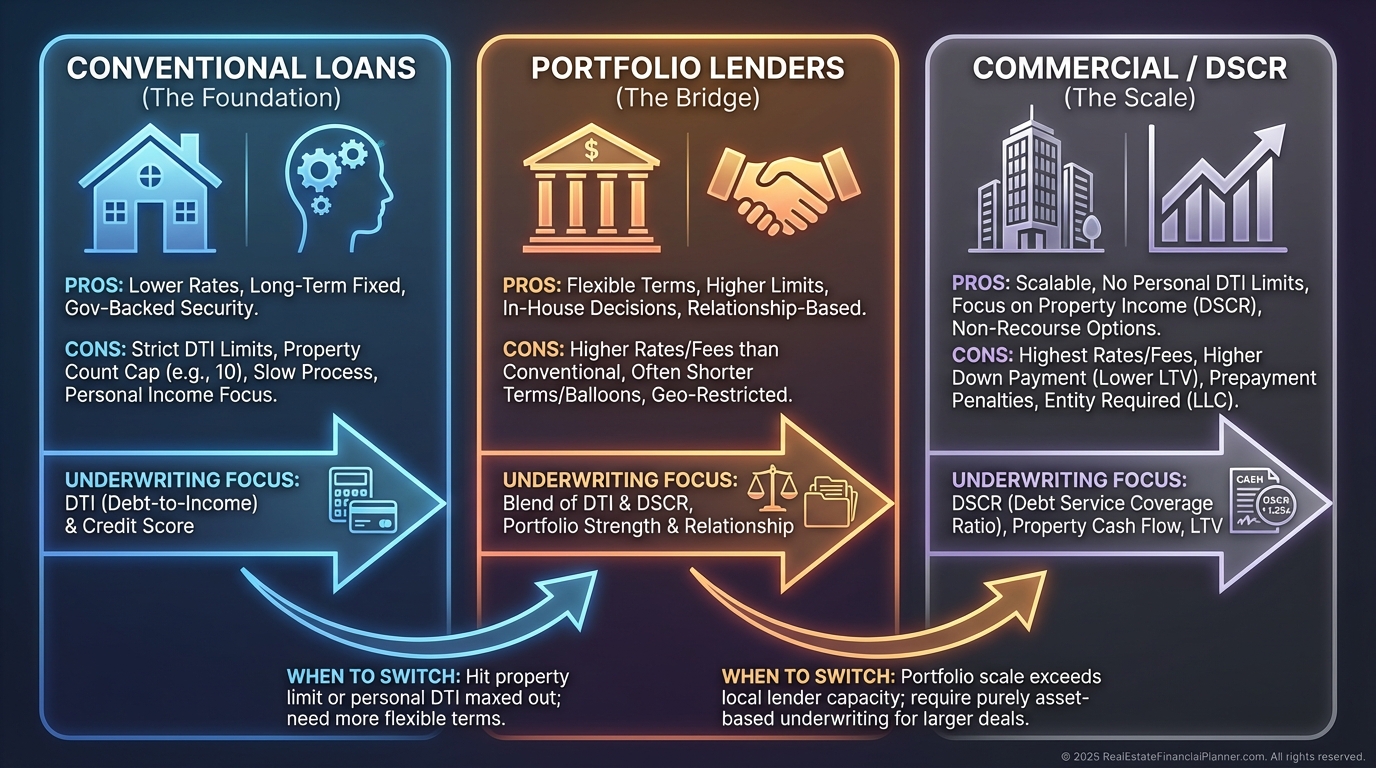

Natural Ceilings on Portfolio Growth

Most investors hit one of three walls.

•

DTI maxes near 50%.

•

Reserves balloon with each added mortgage.

•

Conventional agency caps at 10 financed properties.

When a client is approaching these limits, I map a financing runway for the next 24–36 months so we sequence acquisitions, refinances, and seasoning.

Strategic Alternatives When You Hit the Wall

Portfolio lenders can underwrite more to property cash flow and global income.

Commercial loans for 5+ units focus on DSCR and property performance.

Partnerships can spread DTI and reserves across multiple borrowers.

Hybrid structures—seller seconds behind a conventional first—can reduce cash in while staying inside guidelines when properly disclosed and allowed.

Always confirm with the first-lien lender before structuring.

Common Mistakes I See Weekly

•

Assuming rental income counts 1:1 without experience or leases.

•

Forgetting reserves stack across every mortgaged property.

•

Not checking credit 60–90 days before shopping.

•

Expecting a 30-day close on an investment loan.

•

Picking the wrong product when a portfolio loan fits better.

•

Missing lease pages, unsigned addenda, or rent deposit proof.

•

Commingling funds and creating verification headaches.

Turn Requirements Into a Competitive Edge

Pre-purchase, I have clients:

•

Pay down small installment balances to drop DTI and lift scores.

•

Time applications so tax returns reflect maximum income.

•

Target credit thresholds (e.g., 740+) for better pricing.

Portfolio structuring matters too.

•

Use single-member LLCs where allowed without forcing commercial terms.

•

Stagger closings to conserve conventional “slots.”

•

Diversify lenders to avoid concentration caps and cultivate relationships.

Exit planning closes the loop.

•

Track seasoning for cash-out refis.

•

Prefer individual mortgages over blanket loans when future liquidity matters.

•

In rising-rate markets, value assumable loans as a resale feature.

For advanced optimization, I model:

•

Cross-collateralization to unlock equity for down payments.

•

Seller-finance hybrids that comply with the first-lien rules.

•

Rate buydown math tied to your expected hold to break-even.

Relationship banking wins deals.

Good customers get exceptions.

That can mean counting 85% rent instead of 75%, or shaving a reserve requirement when your global picture is strong.

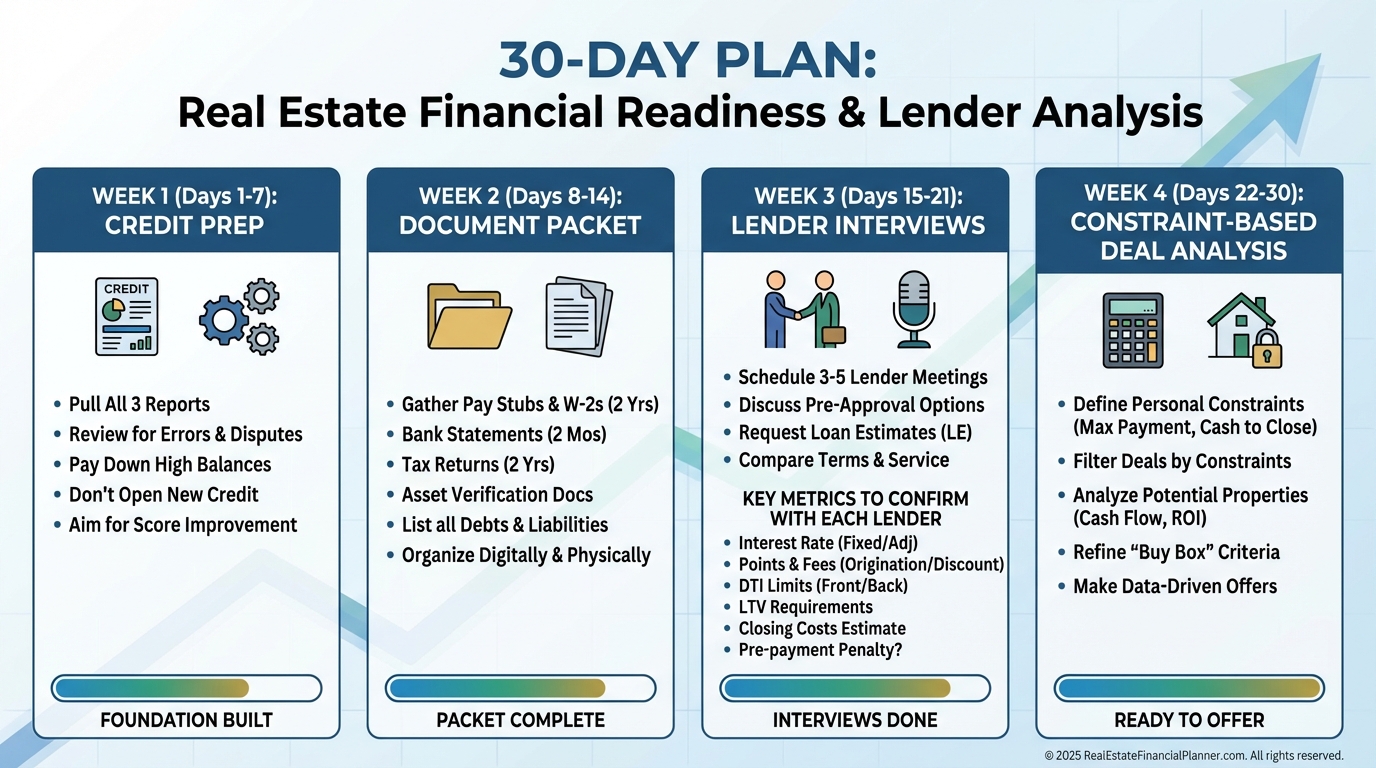

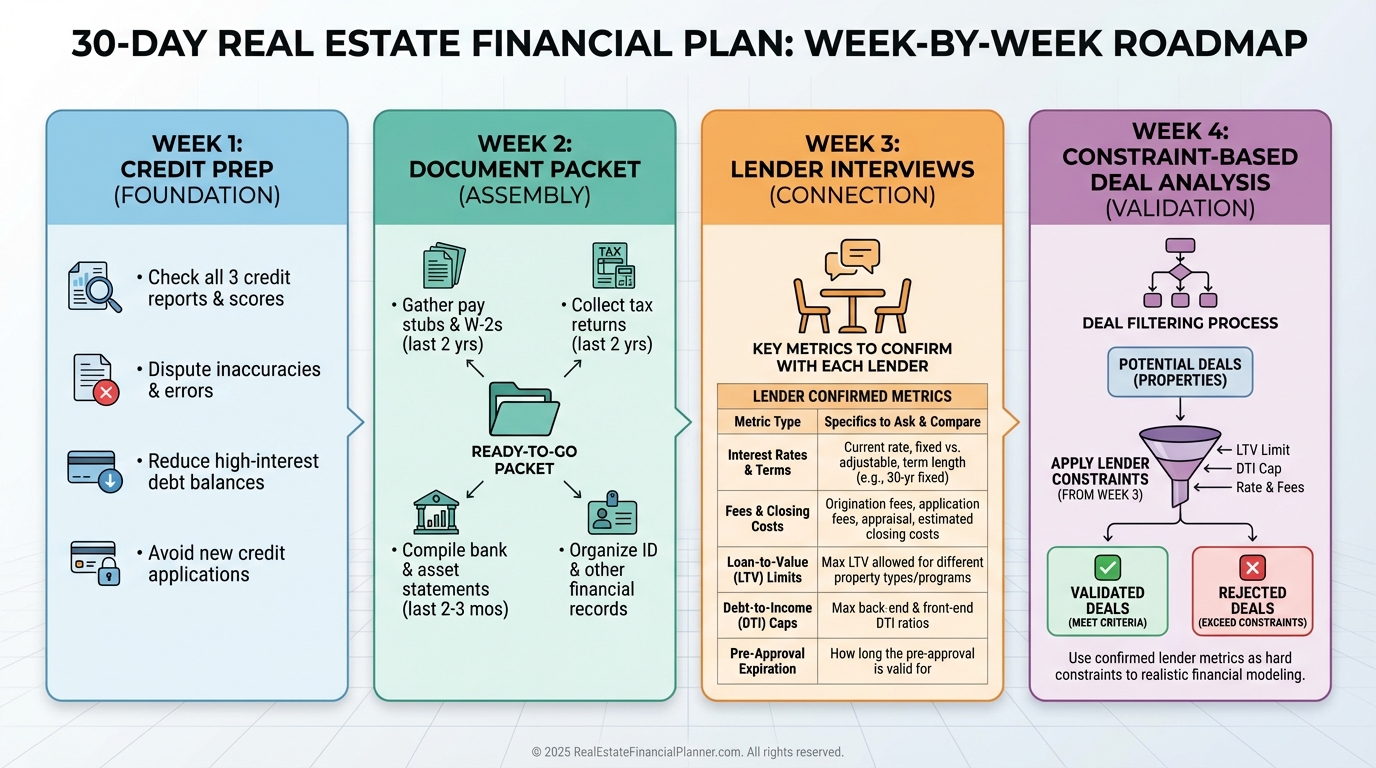

First Steps: Your 30-Day Action Plan

Week 1: Pull credit, freeze fraud alerts, and fix errors.

Pay revolving balances to under 10% utilization.

Week 2: Build your lender-ready folder.

Tax returns, W‑2/1099s, bank statements, leases, rent rolls, entity docs.

Week 3: Interview three lenders—conventional, portfolio, and commercial.

Collect written term sheets and their underwriting overlays.

Week 4: Analyze deals only inside your true constraints.

In the World’s Greatest Real Estate Deal Analysis Spreadsheet™, set DTI and LTV to the stricter of the two.

Re-run Return Quadrants™ and True Net Equity™ so you see real risk-adjusted outcomes.

The Payoff

Investors who master lender requirements waste less time, negotiate from strength, and close smoothly.

They build portfolios that actually fund, not just spreadsheets that almost work.

Do the unsexy work up front.

Your future self—and your lenders—will thank you.