Home Warranty for Investors: Coverage, Costs & ROI

Learn about Home Warranty for real estate investing.

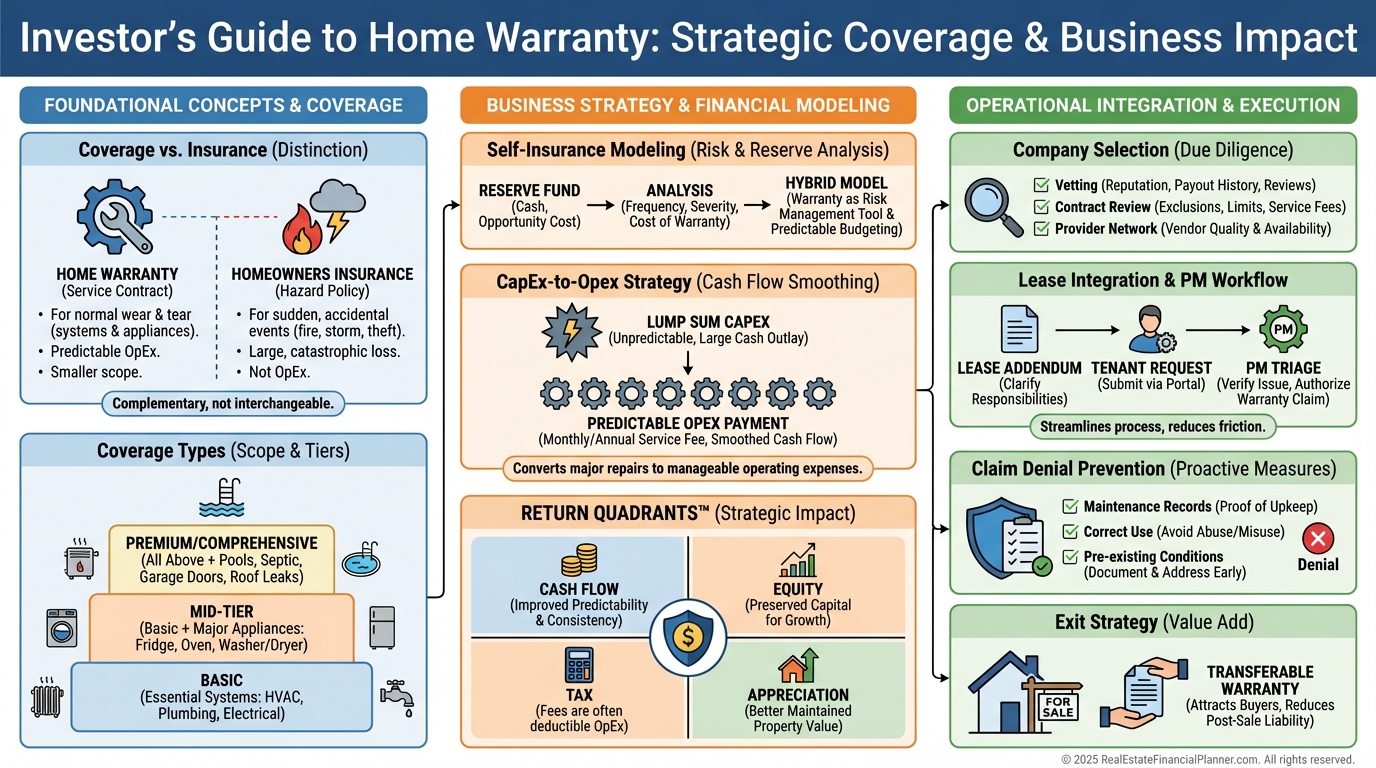

Why Smart Investors Treat Home Warranties Like Financial Tools

Home warranties, used correctly, convert lumpy repair shocks into predictable operating expenses. That alone can rescue deals that live on thin margins.

The goal is not “protection at any cost.” The goal is positive expected value and faster decision-making.

What a Home Warranty Covers (and What It Doesn’t)

A home warranty is a service contract for systems and appliances that fail from normal wear and tear.

You pay an annual premium plus a per-visit service fee, and the company coordinates the contractor.

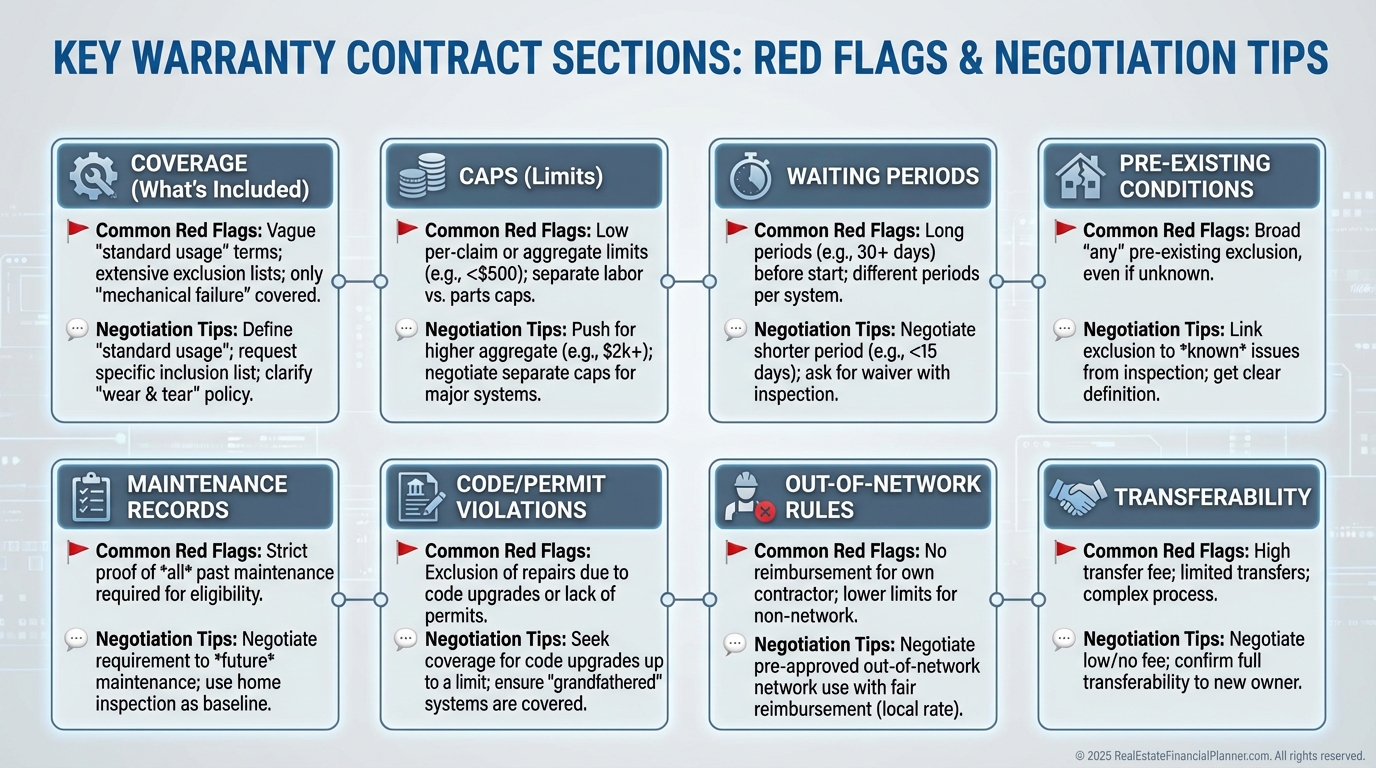

Coverage is real, but caps and exclusions are real too. Most plans cap per-item payouts and exclude code upgrades, improper installs, lack of maintenance, and cosmetic issues.

I teach clients to read the contract twice. Then we model the caps as ceilings in the deal analysis so we aren’t surprised.

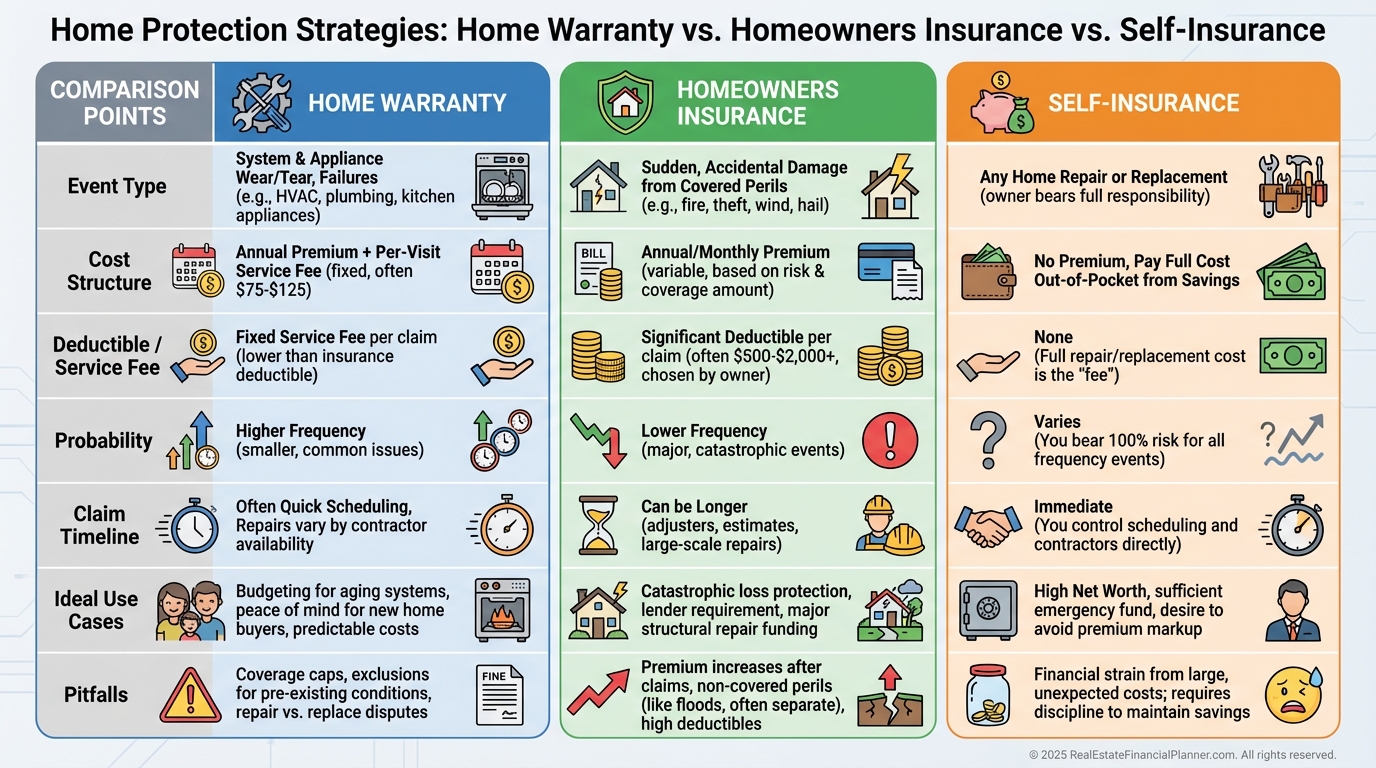

Warranty vs. Insurance vs. Self-Insurance

Insurance is for low-probability, catastrophic events with large deductibles. Think fire, wind, or sudden water damage.

Warranties are for high-probability, moderate-cost failures. Think HVAC, water heaters, and appliances aging out.

Self-insurance means you bank the premium and pay repairs directly. It wins if your expected repairs are below premium plus fees.

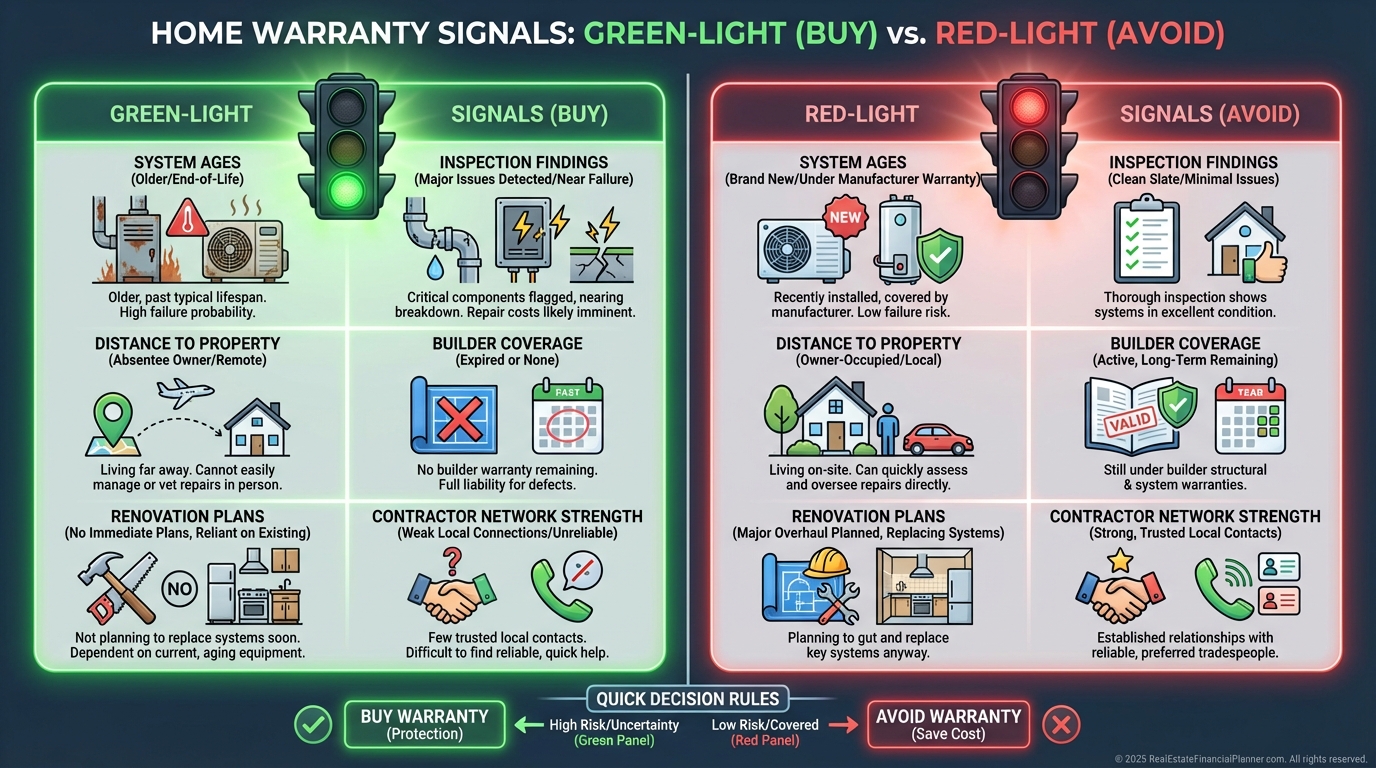

I avoid rules of thumb. I run the math for each property’s age profile and service history.

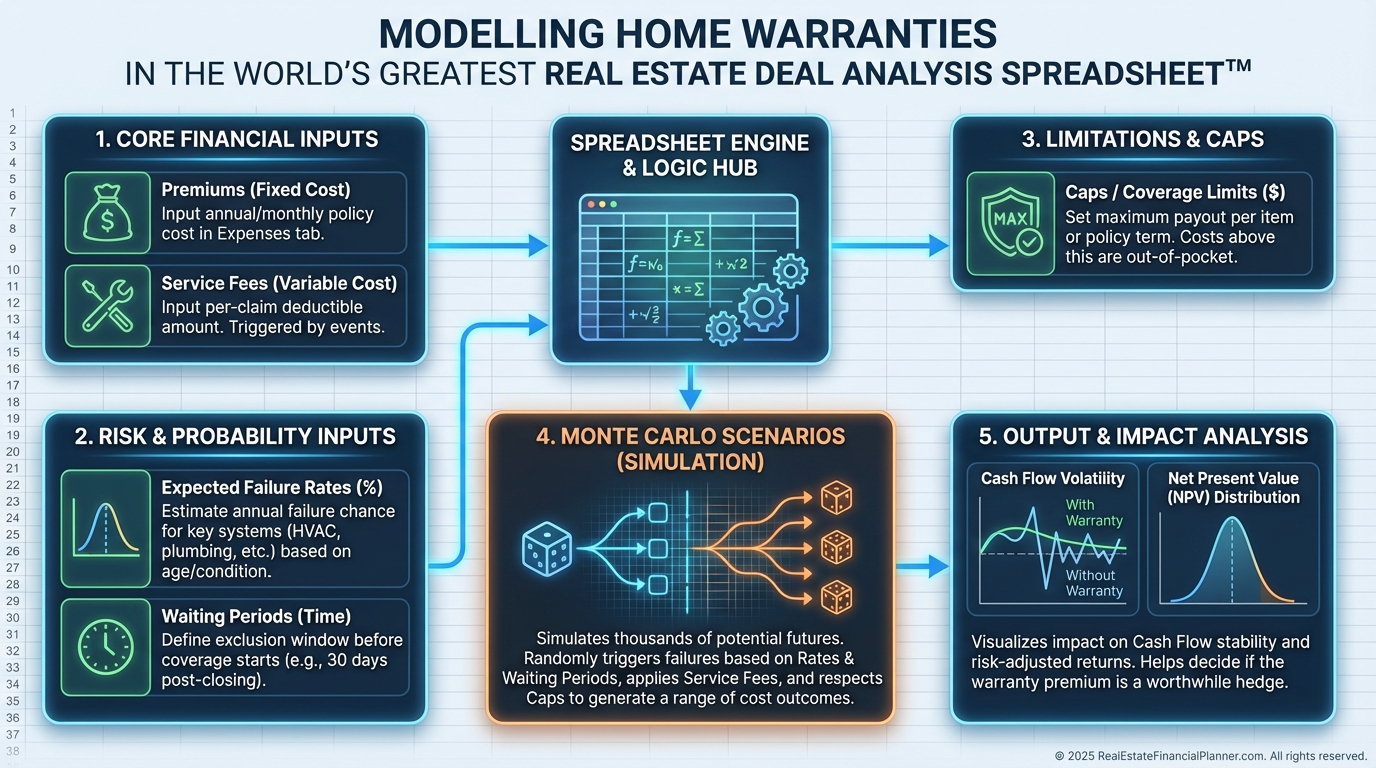

Modeling the Decision with The World’s Greatest Real Estate Deal Analysis Spreadsheet™

I input the annual premium as an operating expense and the service fee as a per-incident variable.

Then I model expected failures by age, brand, climate, and maintenance history.

Monte Carlo simulation shows the probability that warranty, self-insurance, or a hybrid wins over 1, 3, and 5 years. That timeline matters.

I also reflect payouts caps, likely denials, and out-of-pocket “non-covered” soft costs to keep results honest.

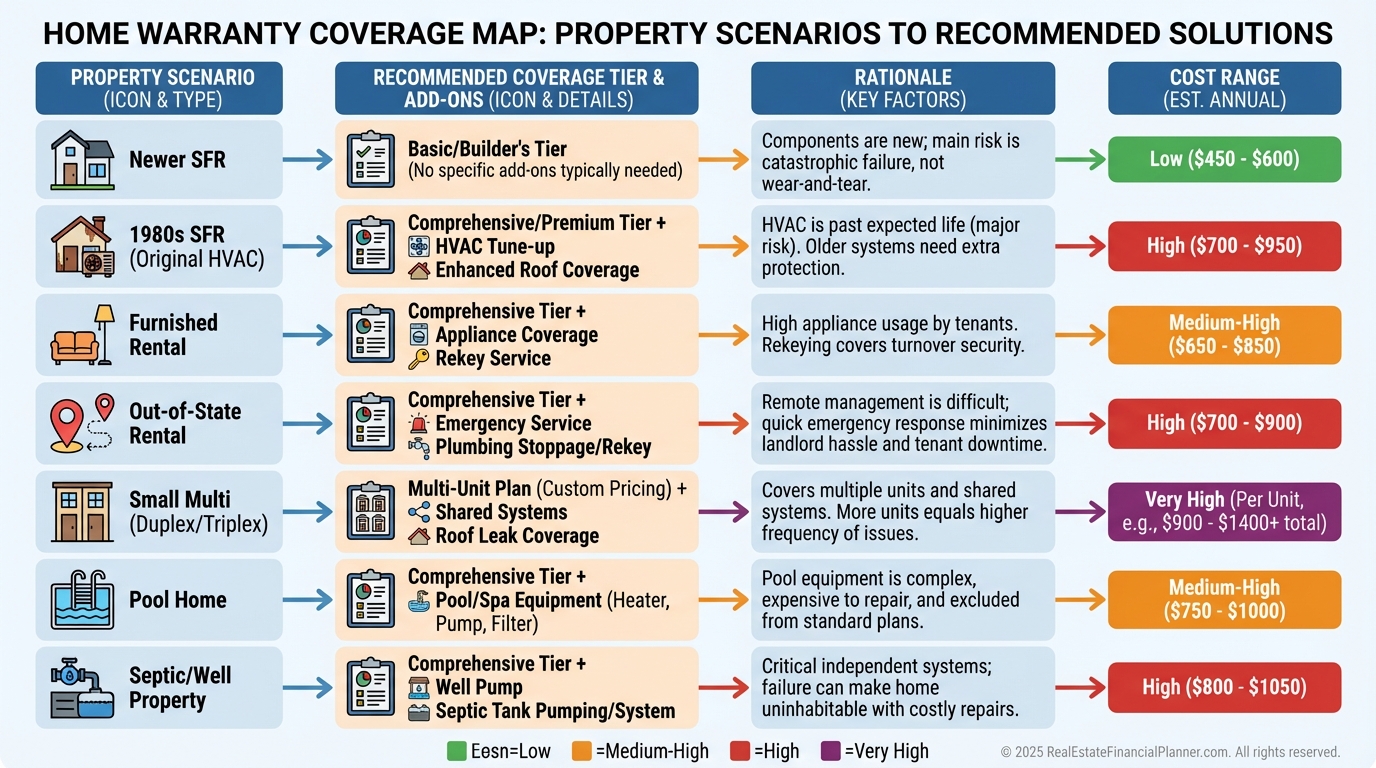

Coverage Types That Fit Common Investment Playbooks

Basic plans cover major systems cheaply. I like them for newer builds where appliances still carry manufacturer coverage.

Comprehensive plans add appliances. They shine for furnished rentals or properties where you supply the kitchen and laundry.

Portfolio or investment property plans can consolidate admin and unlock discounts. I want tenant portals and 24/7 dispatch for out-of-state holdings.

Add-ons for pools, wells, or septic are math problems. Price the add-on against the expected repair frequency and cost.

The Business Case: Where Warranties Shine

Aging systems with known life expectancy are the obvious use case. The warranty converts a probable $3,000–$8,000 hit into a $75–$125 fee.

Out-of-state properties benefit from the contractor network and scheduling support. That replaces hours of manager overhead.

First-time investors use warranties as training wheels while they learn local trades and true costs. Confidence is worth cash.

I skip warranties on flips, large renovations, and new construction under builder coverage. The timeline is wrong for the premium.

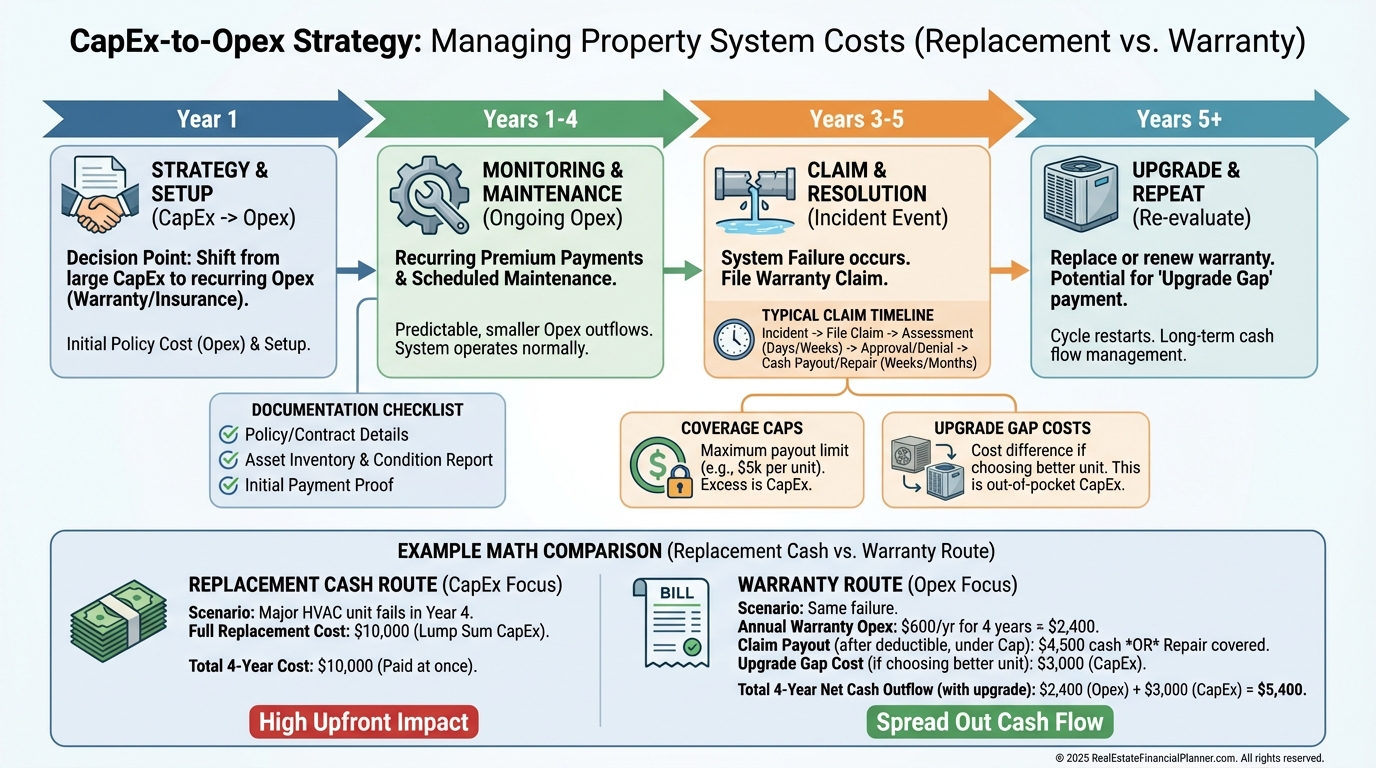

Advanced Strategy: Turn CapEx into Opex

This is where sophisticated investors pull ahead. We intentionally cover end-of-life systems to shift CapEx to operating expenses.

Example: 25-year-old AC, $6,500 replacement cost. Warranty premium $600 and a $100 service fee. One failure can justify years of premiums.

Timing matters. Buy before the failure, document maintenance, and respect waiting periods.

I tell clients to budget for non-covered upgrades like code changes or line-set replacements. The delta is still attractive.

Choosing a Home Warranty Company Like a Pro

I start with BBB ratings, state licensing, and investor reviews. Longevity and transparency matter.

Then I read the full contract, not the brochure. Pre-existing condition language and caps determine the real value.

Network quality is the experience. I ask about local coverage, emergency response, and out-of-network options with pre-approval.

Price second, claims performance first. A cheap plan that denies is expensive.

Taxes, Accounting, and Return Quadrants™

Premiums and service fees are generally deductible operating expenses for rentals. That improves after-tax cash flow.

In Return Quadrants™, warranties primarily affect the Cash Flow and Tax Benefits quadrants. Appreciation and Debt Paydown are unchanged.

True Net Equity™ improves when you reduce expected future CapEx. Lower surprise liabilities mean more equity you can actually use.

Track premiums as Insurance/Other and service fees as Repairs and Maintenance. Clean books simplify audits and exits.

Lease Language and Tenant Experience

When I rebuild leases, I make warranty roles explicit. Clarity prevents angry calls and denied claims.

Use plain language like: “Property is covered by a home warranty for major systems and appliances. Tenant reports failures within 24 hours.”

Split fees by cause. “Landlord pays for normal wear; tenant pays service fees for misuse or negligence.”

Give tenants a one-page guide with claim steps, emergency contacts, and what to expect on response times.

Property Management Workflows

Authorize your manager to initiate claims and approve service fees. Keep authorization letters on file.

Set rules for after-hours and emergencies. If the warranty can’t respond in time, allow local dispatch with documentation.

I track claim resolution time, denials, and tenant satisfaction. Underperformance is a sign to switch carriers.

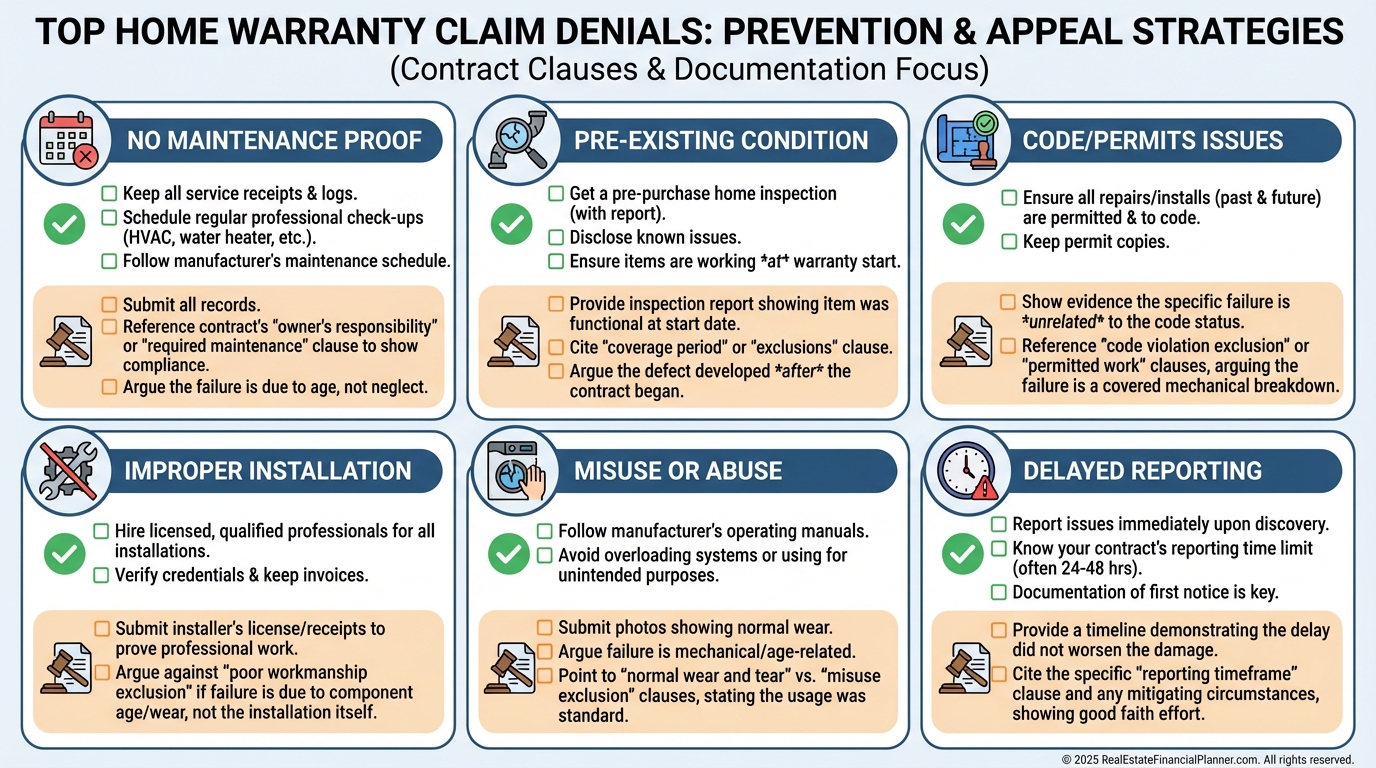

Your manager should document denied claims with photos and contract cites. Appeals work when you present facts.

Exit Strategy and Dispositions

Offering a paid first-year warranty signals confidence and reduces buyer friction. It can speed time-on-market.

Transfer existing warranties when selling. The small transfer fee often buys goodwill.

For investor-to-investor sales, warranties can differentiate a portfolio and smooth due diligence. Market the reduced risk, not fear.

Before listing, handle known issues through claims if permitted. List a clean, freshly serviced home.

Avoiding Claim Denials

Maintenance wins or loses most disputes. Keep dated HVAC service receipts and photos.

Be honest about pre-existing conditions, and document the normal wear path. Language matters in the appeal.

Permits and code upgrades are usually excluded. Budget the gap to avoid stalls.

Improper installs get denied. Use licensed pros and keep proof.

Putting It All Together

There is no universal yes or no. There is only your property, your timeline, and your math.

Use The World’s Greatest Real Estate Deal Analysis Spreadsheet™ to compare strategies side-by-side. Then choose with intent.

If you’re Nomad™-ing, a warranty can cover appliances and systems during the owner-occupant year and transfer when you convert to a rental. That smooths the handoff.

Smart investors plan repairs before they happen. Home warranties are one tool to make that plan profitable and calm.