Wrap Financing: How to Structure Profitable, Compliant Wraparound Mortgages in Any Rate Environment

Learn about Wrap Financing for real estate investing.

What Is Wrap Financing?

When I help clients navigate tight credit or high-rate markets, wrap financing is often the bridge between a dead deal and a win-win.

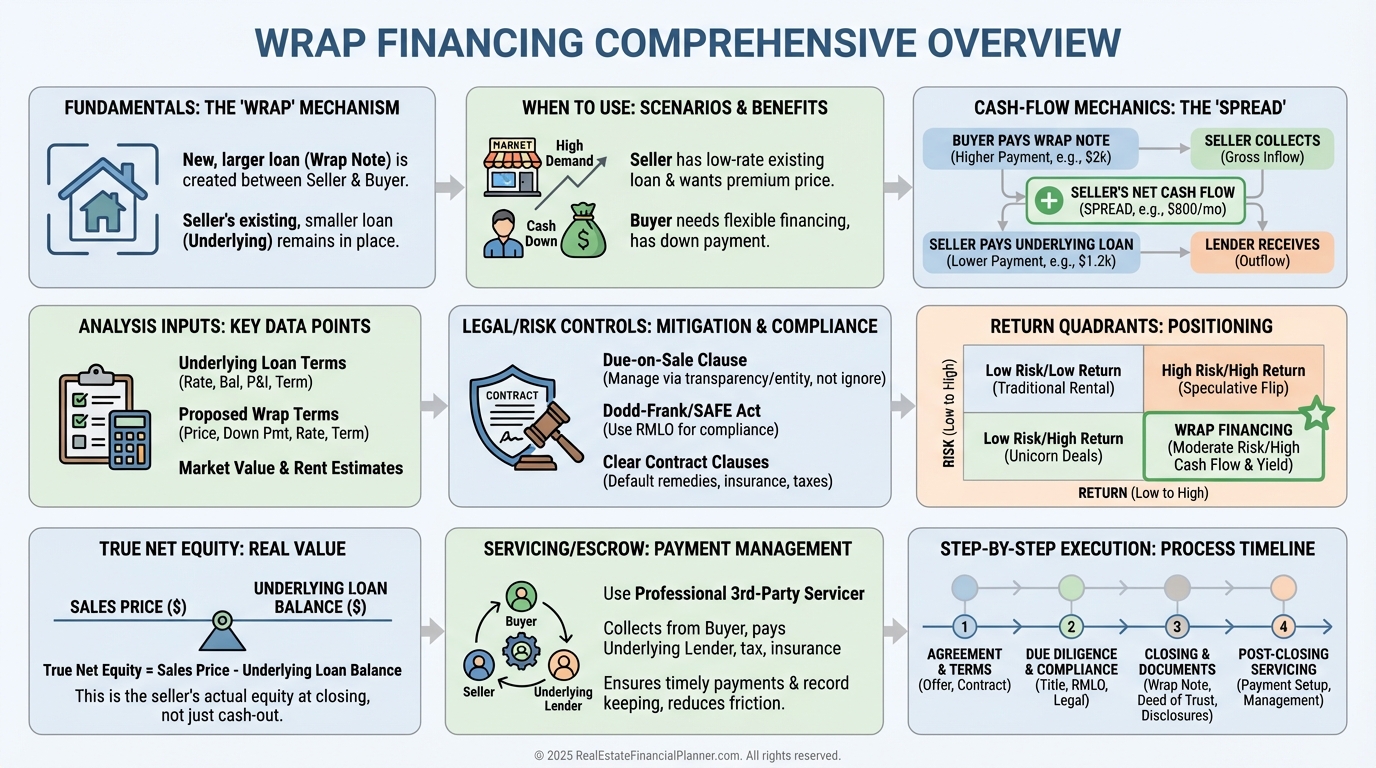

A wraparound mortgage is seller financing that “wraps” the seller’s existing loan with a new, larger note to the buyer.

You pay the seller on the full wrap amount.

The seller continues paying their underlying lender.

The spread between the two payments is the seller’s income for providing financing.

Think of it as the seller becoming your bank, with the property and the seller’s underlying mortgage stacked inside the structure.

Wrap vs. Subject-To vs. Seller Carry

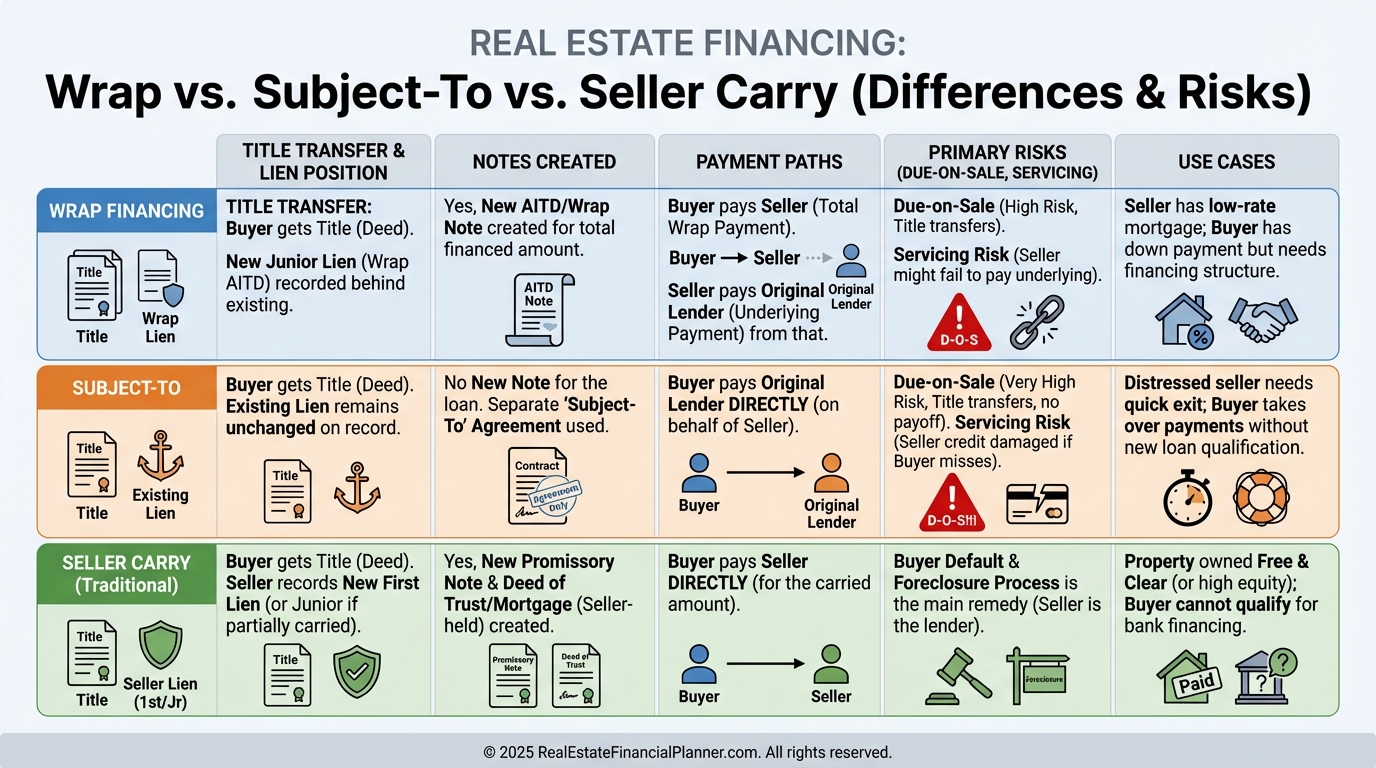

Wraps are not the same as taking a property “subject to.”

Subject-to transfers title and keeps the existing loan in place without a new note between buyer and seller.

Wraps create a new promissory note and security instrument, which gives clearer rights, remedies, and documentation for both parties.

Seller carry (no underlying loan) is simpler than either.

Wraps sit in the middle: new seller financing plus an existing loan underneath.

When Wraps Make Sense

I use wraps most when sellers have low-rate mortgages and buyers want speed, flexibility, or qualification relief.

High interest environments favor wraps because the seller can offer a better overall payment while still earning a spread.

Wraps work well on well-maintained single-family or small multifamily with favorable existing loan terms.

Motivations that align: steady retirement income, installment sale tax treatment, and selling in slower markets without deep price cuts.

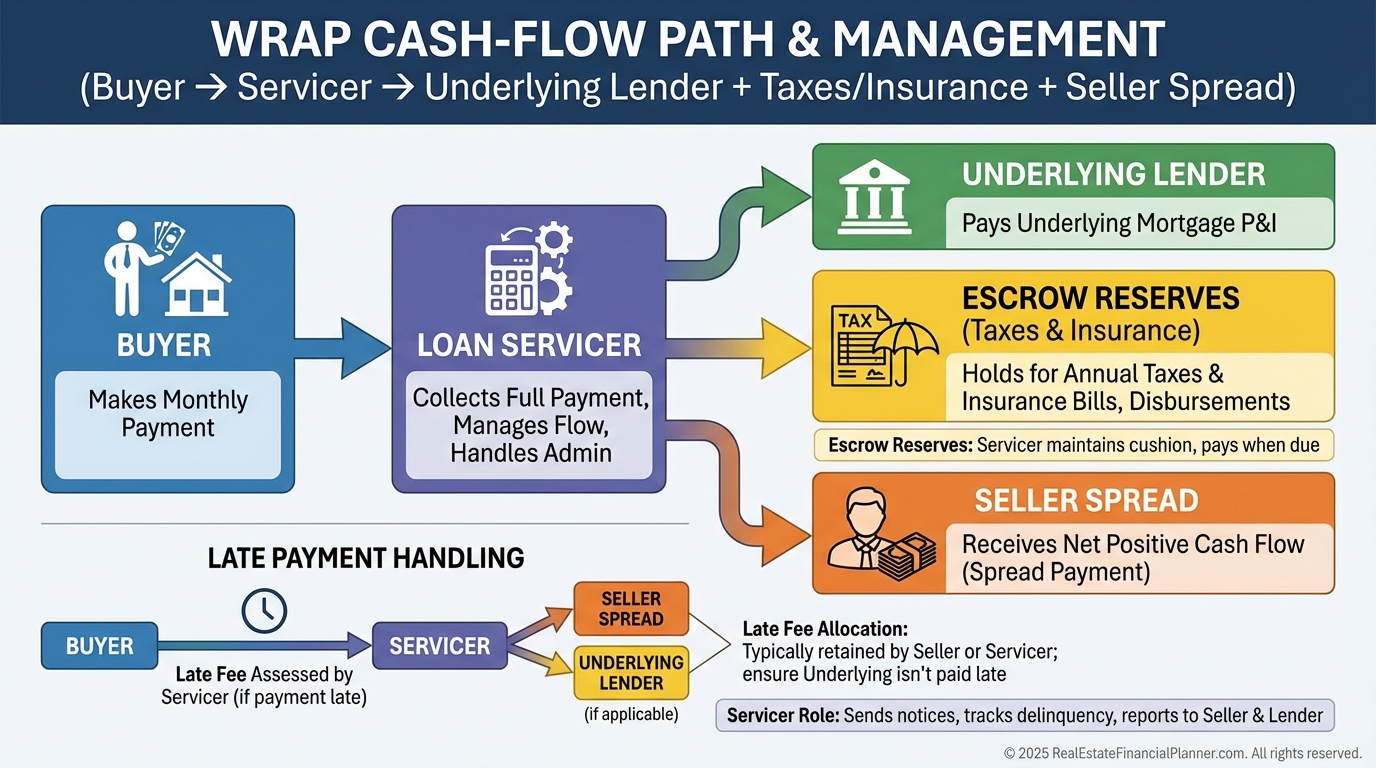

How the Money Flows

Payment logistics are where wraps succeed or fail.

That reduces finger-pointing and protects everyone if something goes sideways.

A Practical Example I Model With Clients

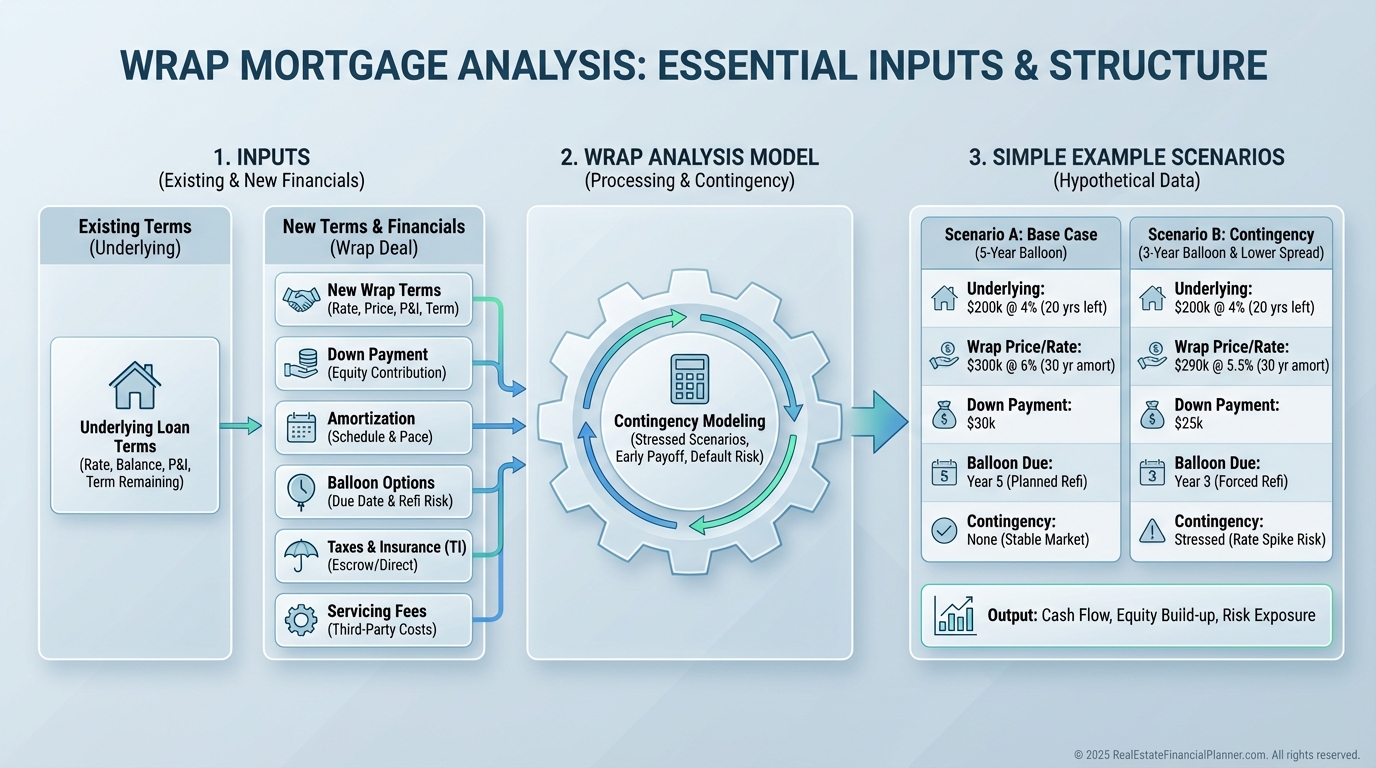

Here’s a clean, realistic scenario I often model in The World’s Greatest Real Estate Deal Analysis Spreadsheet™.

Property price: $400,000.

Underlying loan: $220,000 at 3.75% with a $1,450 P&I payment.

Wrap to buyer: $360,000 at 6.5% with a $2,340 P&I payment.

Down payment from buyer: $40,000.

The seller nets roughly a $890 monthly spread before taxes/insurance and servicing costs.

The buyer gets flexible terms and avoids bank underwriting delays.

When I toggle interest rates, amortization, and balloons in the spreadsheet, I quickly see sensitivities in cash flow, principal paydown, and exit timing.

Legal, Compliance, and Due Diligence You Can’t Skip

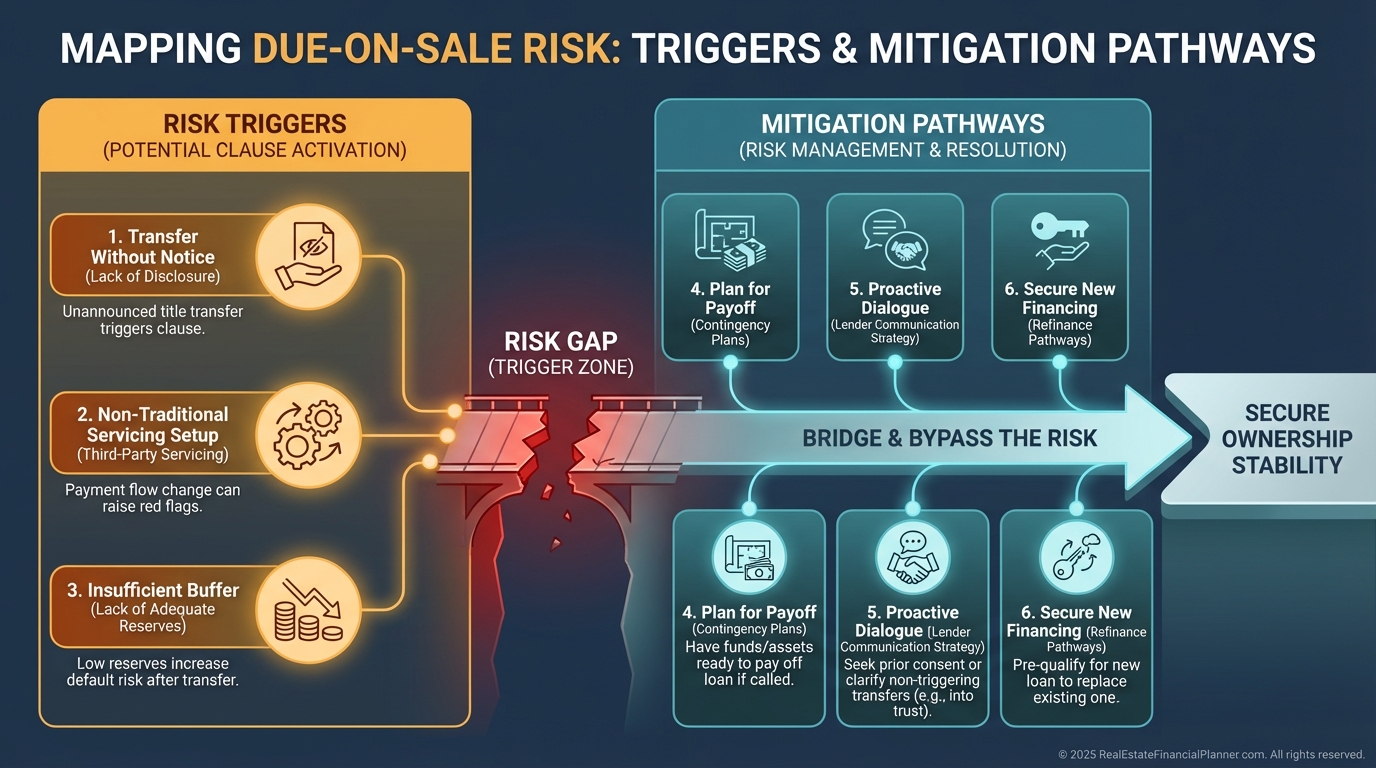

The due-on-sale clause is real.

Most conventional notes allow lenders to call the loan if title transfers.

Enforcement is uncommon when payments are current, but it’s a risk I disclose clearly to all parties.

State rules vary.

Texas has specific residential wrap statutes and disclosures.

Some title companies won’t insure wraps; I curate a closing team that does.

Due diligence must confirm the underlying loan balance, rate, escrow status, payment history, HOA, taxes, and insurance.

I verify everything in writing before we draft documents.

Documents I Require

I treat wraps like institutional loans.

I also set expectations for payoffs, early payments, and what happens if the underlying adjusts or is paid off.

If the existing loan is owner-occupied with strict occupancy language, I warn clients about added scrutiny and ethical considerations.

Returns for Buyers and Sellers Using REFP Frameworks

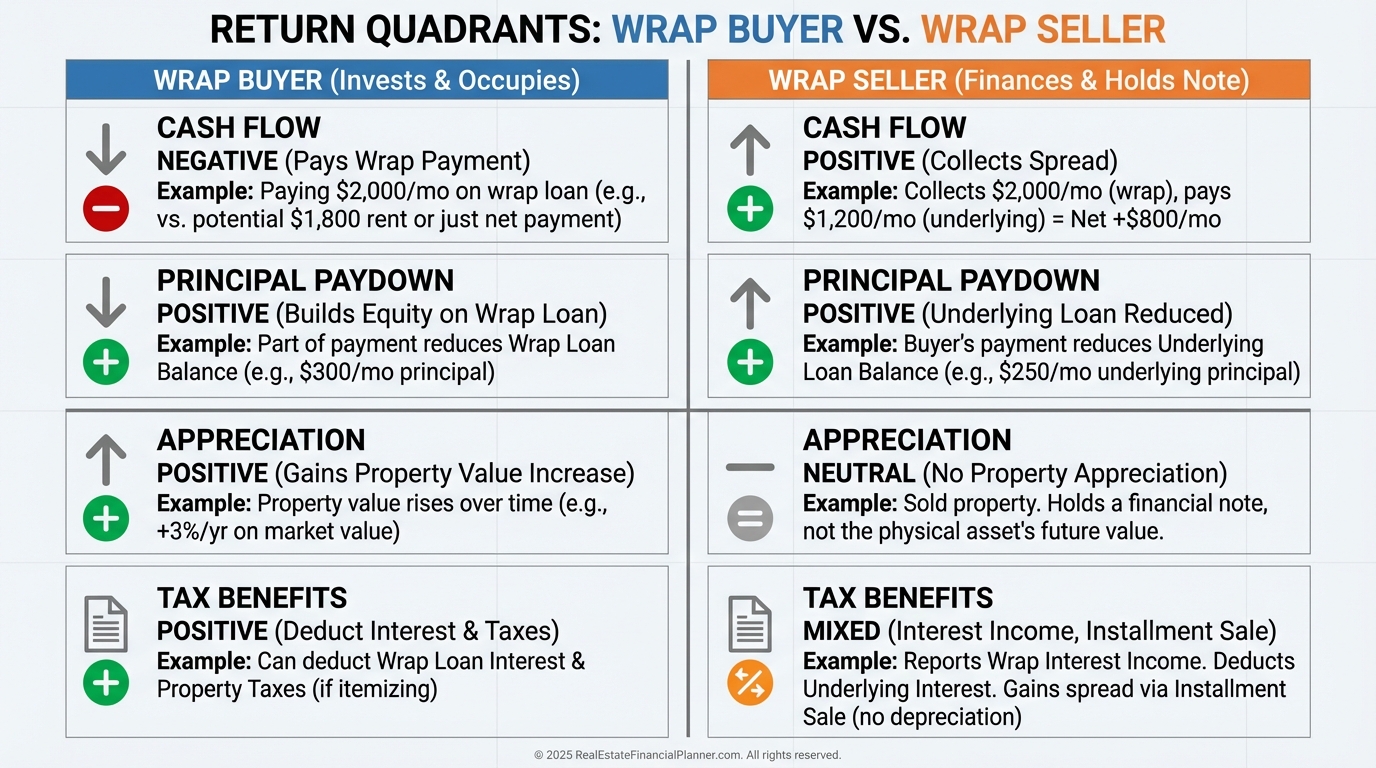

When I coach buyers, I break the deal into Return Quadrants™: cash flow, principal paydown, appreciation, and tax benefits.

Wrap terms alter all four.

Higher rate may trim cash flow but can be offset by lower down payment or better purchase price.

Principal paydown on the wrap belongs to the buyer; paydown on the underlying loan accrues to the seller until payoff.

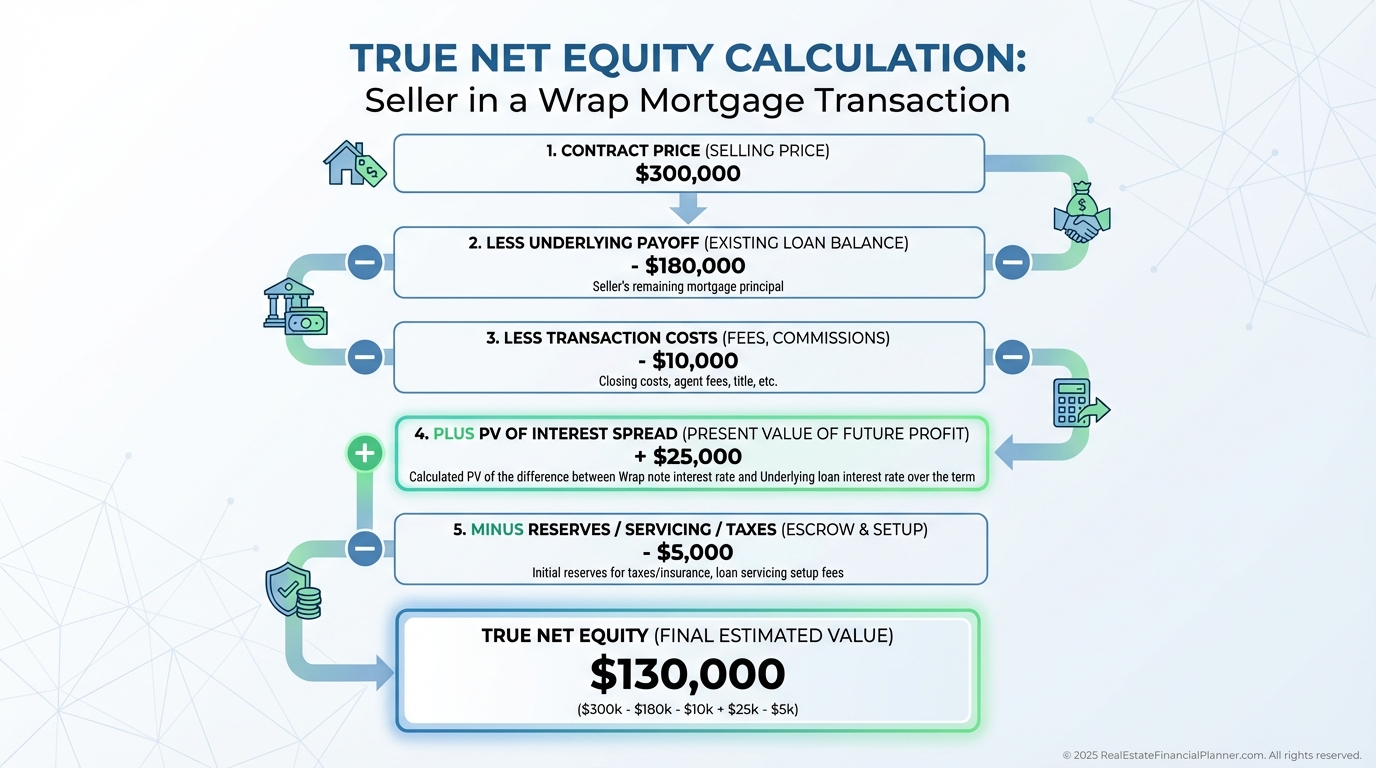

For sellers, True Net Equity™ clarifies reality.

It’s not just price.

It’s price minus payoff of the underlying, closing costs, servicing/escrow, taxes, and the present value of the interest spread.

I avoid “phantom equity” by discounting the income stream at a realistic rate.

When Not to Use a Wrap

If the property needs major rehab, a wrap can complicate renovation financing.

If the underlying loan is an adjustable with large potential resets, I model worst-case and often add rate-adjustment clauses to the wrap note.

If the title company balks or the attorney is unsure, I pause the deal until we have the right team.

If the only path relies on hiding the transfer from the lender, I advise against it.

Implementation: My Step-by-Step Process

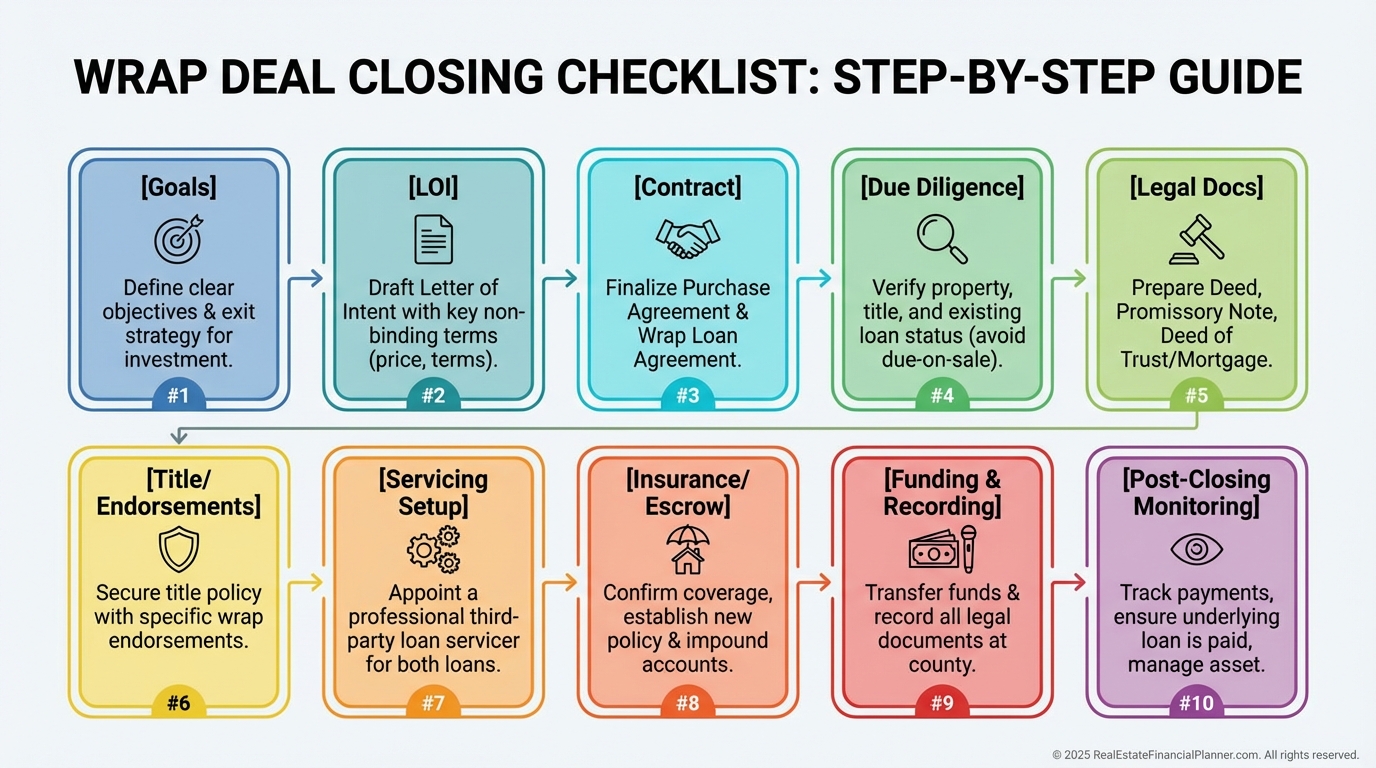

I start by diagnosing the seller’s goals: speed, income, tax, privacy, or price.

After verbal agreement, I outline terms in a letter of intent, then draft the purchase agreement with wrap financing provisions and contingencies.

Title opens.

My attorney drafts the note and deed of trust/mortgage, disclosures, and servicing agreement.

We verify insurance, set up escrow, and confirm tax status.

We close through title with clean money trails.

Servicing, Monitoring, and Exit Strategies

Post-closing, I monitor monthly statements from the servicer, confirm underlying payments post, and verify escrow balances.

I require evidence of continuous insurance with all parties properly listed.

For exits, I plan at day one: refinance windows, balloon dates, early payoff rights, and assignment clauses.

When a buyer refinances, I calculate the seller’s remaining spread and the payoff to deliver clear title without surprises.

Special Notes for Nomad™ and House Hackers

If you’re using Nomad™ (move in, then convert to rental), wraps can occasionally help when bank financing isn’t available.

But be cautious with underlying owner-occupied loans, due-on-sale risk, and occupancy certifications.

I’d rather see Nomads™ use clean owner-occupant financing when possible, then use wraps as a strategic tool later in the portfolio for disposition or acquisitions when conventional caps loom.

Common Mistakes I See—and How I Coach Clients to Avoid Them

Skipping third-party servicing.

Ignoring due-on-sale and failing to disclose.

Assuming title companies will insure any structure.

Overestimating True Net Equity™ by not discounting the spread.

Underinsuring the property.

Forgetting to model adjustable-rate risk on the underlying.

Each of these can be fixed in the design phase if you slow down and structure it right.

What I Model, Check, and Put in Writing

I model two stress cases in The World’s Greatest Real Estate Deal Analysis Spreadsheet™: a payment shock on the underlying and a 90-day buyer default.

I check title seasoning issues and HOA transfer requirements.

I put explicit cure periods, late fees, insurance standards, lender contact protocols, and refinance/payoff procedures into the documents.

Clear rules make for quiet portfolios.

Action Steps

Pull your current pipeline and flag any sellers with low-rate loans and strong equity.

Model at least two wrap scenarios in the spreadsheet, including a balloon and a fully amortizing path.

Interview a wrap-experienced attorney and title company before you negotiate terms.

Set up a third-party servicer and build your insurance/escrow standards into your templates.

Talk to sellers about options, not ultimatums.

The best wraps solve their problems and satisfy your return requirements.