Real Estate Agent for Investors: How to Pick, Pay, and Profit in the Post‑NAR Settlement Era

Learn about Real Estate Agent for real estate investing.

Why your agent is your edge right now

Selecting an investor‑friendly real estate agent is one of the earliest calls that changes everything downstream.

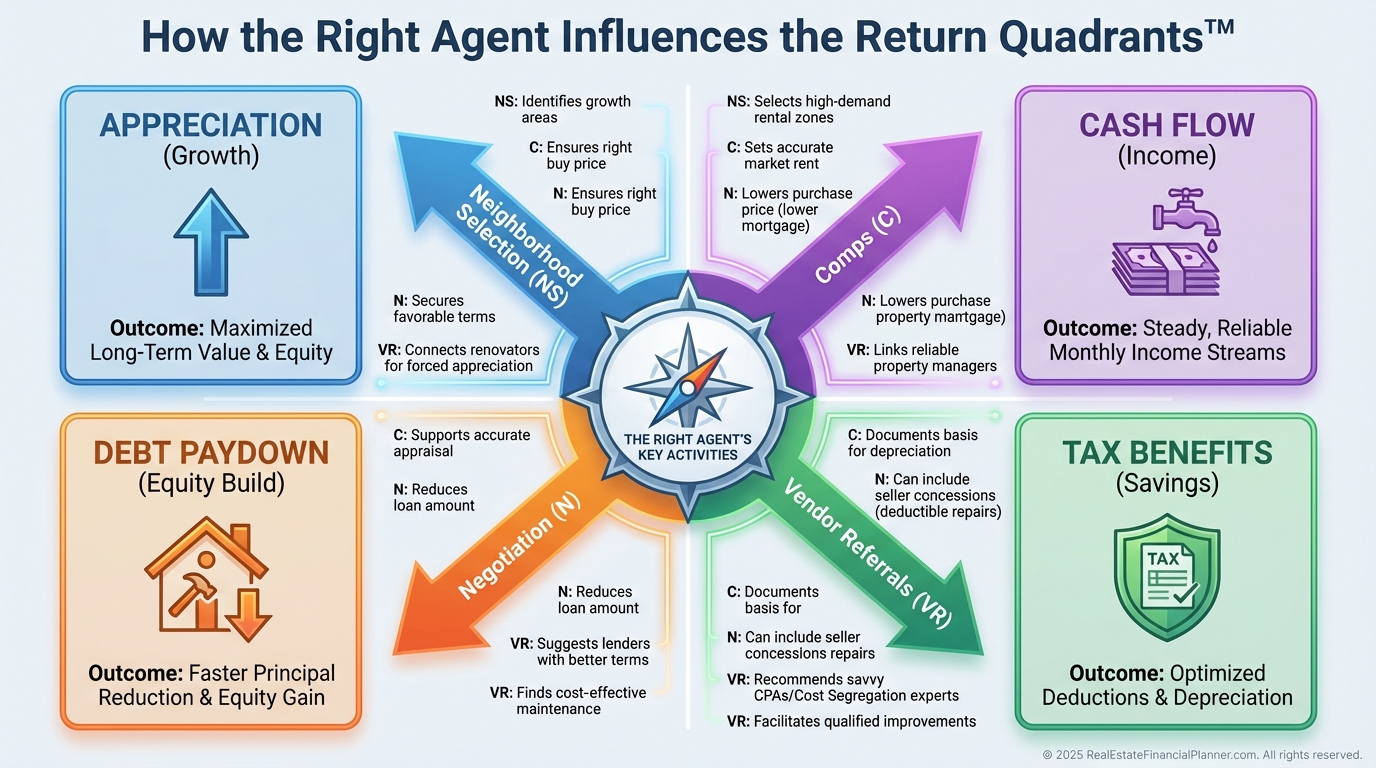

When I help clients map their plan, we forecast how the agent will affect the Return Quadrants™ and True Net Equity™ over the next decade.

A great agent helps you find the right strategy, the right property, and the right terms.

A poor fit quietly drags returns, adds friction, and increases risk.

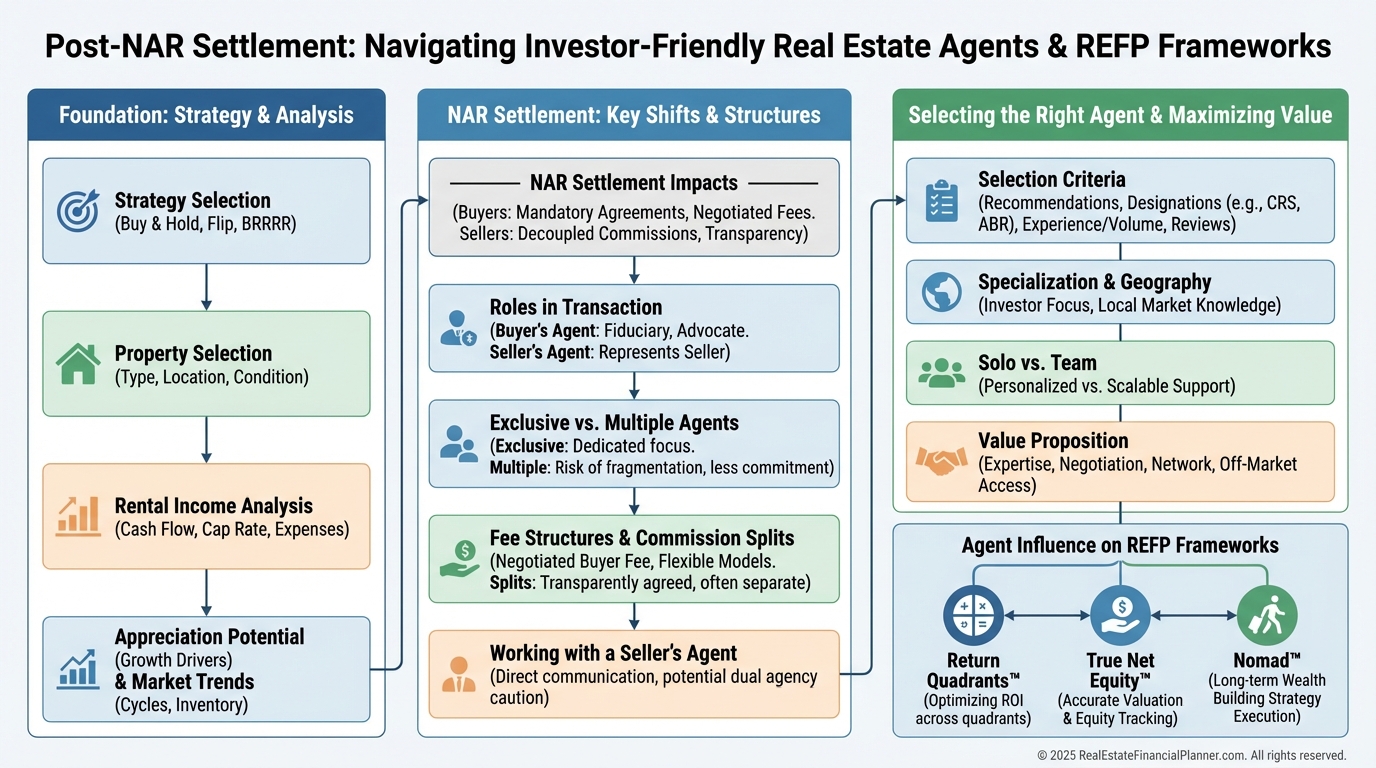

What changed with the NAR settlement

You’ll see more transparency in how compensation is discussed and documented.

Most markets now require a written buyer‑agent agreement before you tour homes, with clear, objectively ascertainable compensation.

Commissions remain negotiable, but “who pays” and “who represents” are different questions.

Representation is defined by your signed paperwork, not the funding source.

MLSs are removing co‑op commission fields, so offers of compensation, if any, are marketed off‑MLS or through allowed channels.

Local rules vary. Your agent should explain how this affects your search, your offers, and your cash at closing.

How an investor‑friendly agent moves your numbers

When I coach clients, I ask agents for three things first: rental comps, time‑on‑market context, and micro‑neighborhood appreciation drivers.

That lets us estimate cash flow and appreciation to feed your Return Quadrants™.

•

Strategy selection. Buy‑and‑hold, BRRRR, fix‑and‑flip, mid‑term, or short‑term rentals based on today’s absorption, inventory, and lending.

•

Income analysis. Real rental comps, vacancy norms, pet/garage/utility add‑ons, and seasonality.

•

Appreciation potential. Job growth, permitting pipeline, school boundary shifts, and infrastructure.

•

Market trend insights. Population flow, zoning, tax shifts, and landlord regs.

When I help clients underwrite, we quantify each quadrant so you see how the agent’s work turns into dollars.

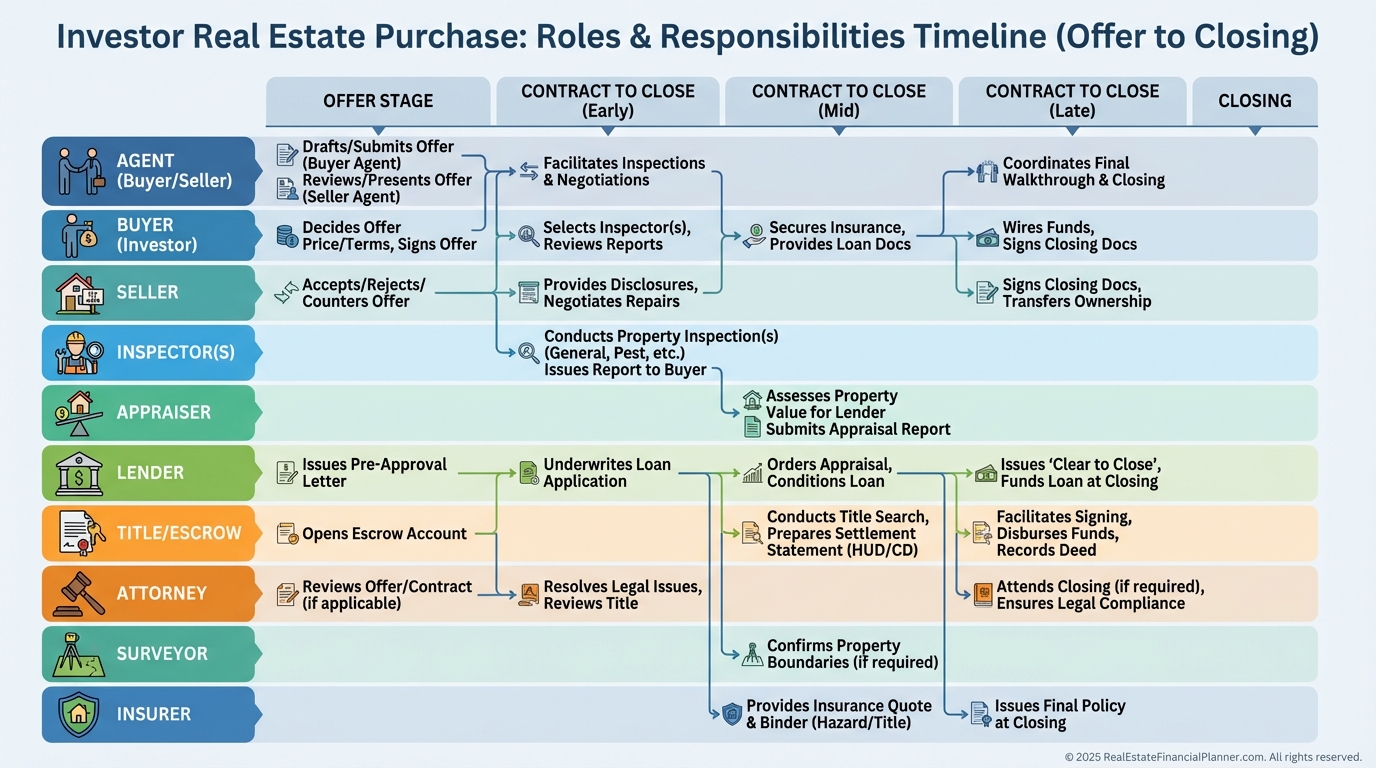

Roles in the transaction: who does what and who doesn’t

Your agent coordinates access, strategy, and negotiation.

•

Inspections. You choose inspectors. Your agent schedules, but they don’t diagnose.

•

Condition. Home inspector and specialists (roof, sewer, structure, termites, mold, meth, radon).

•

Title and closing. Title company or attorney examines and insures title.

•

Contract drafting. Attorney for custom language. Agent can prepare standard forms but not give legal advice.

•

Lending. You choose the lender, rate, term, and product.

•

Crime, Megan’s Law, environmental. You research official sources.

Your agent negotiates terms and timelines, but experts validate risk.

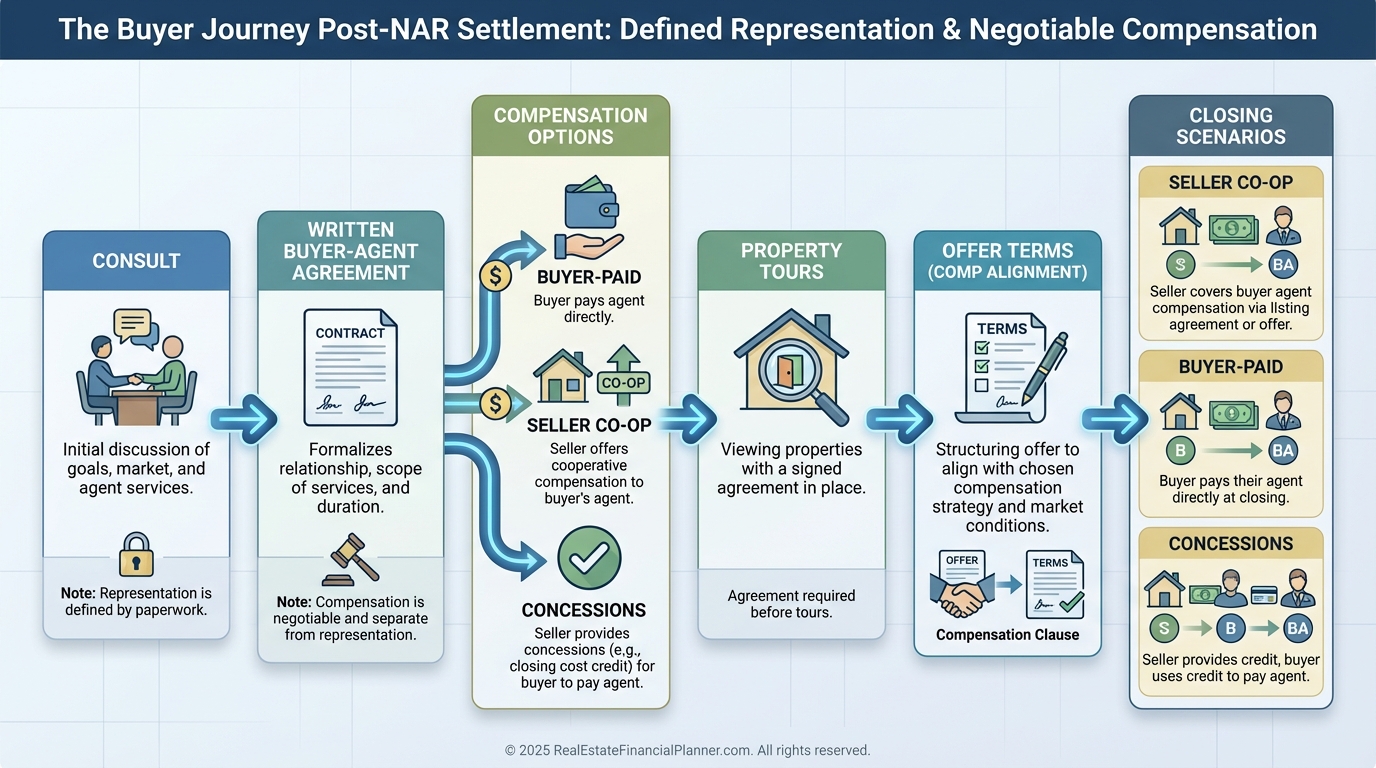

Buyers: what the NAR changes mean for you

Expect earlier commitment to an agent due to the written agreement requirement.

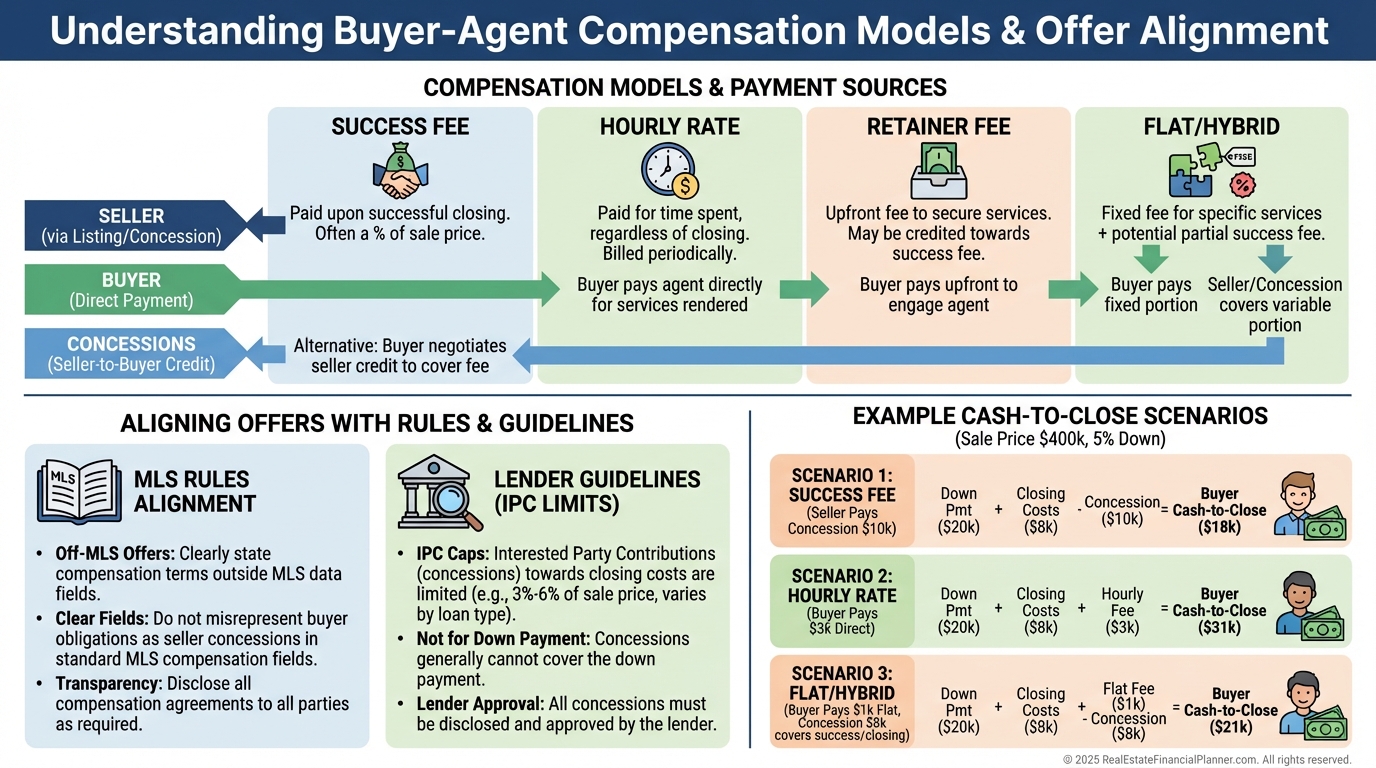

Compensation must be specific, not open‑ended, so you’ll decide how your agent is paid before you tour.

If a seller’s co‑op is less than your agreement, you may cover the gap, negotiate concessions, or target listings aligned with your terms.

I model these cash‑at‑closing scenarios so you’re never surprised.

Sellers: what the NAR changes mean for you

You can still offer co‑op compensation off‑MLS via allowed channels.

Some sellers will increase concessions to help buyers cover agent fees, but this varies by loan program and market.

Expect to be more explicit about any compensation you’re offering and how you’ll communicate it.

When I sell rentals with tenants in place, I script pricing, concessions, and investor‑only marketing to keep Days on Market tight.

Agents, brokers, and REALTORS®

•

Real estate agent. Licensed, works under a broker.

•

Real estate broker. Additional education; can supervise agents.

•

REALTOR®. Agent or broker who belongs to NAR and follows its Code of Ethics.

Titles matter less than investor competence, negotiation skill, and local knowledge.

I hire for results, not labels.

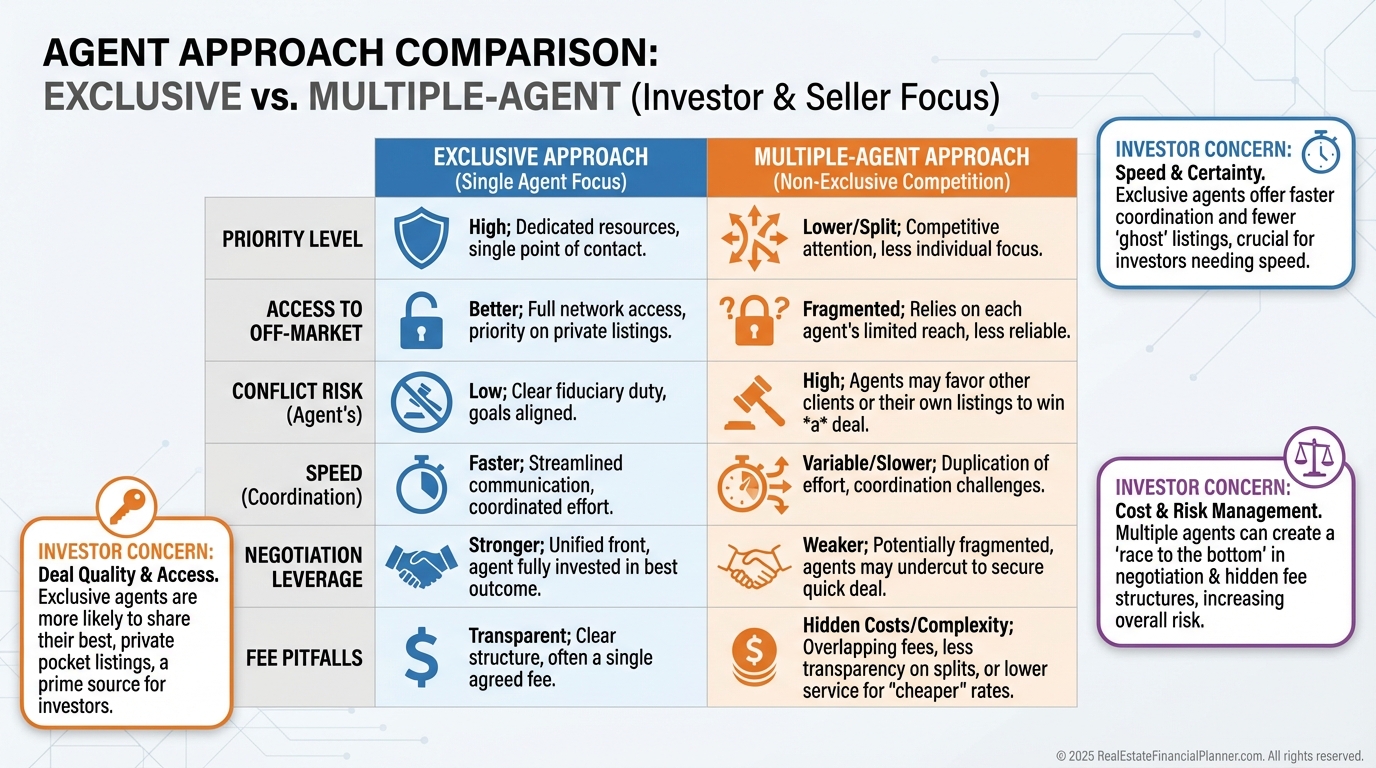

Exclusive vs multiple agents

Working exclusively can unlock priority, advocacy, and speed.

Working with multiple agents can broaden networks, but often lowers your priority and risks duplicate obligations.

When I represent buyers, exclusive clients get first looks at properties that fit their buy box because I already know their numbers, timeline, and financing.

Paying your agent: structures, splits, and scripts

Comp is negotiable.

Agree on value, scope, and structure before you tour.

•

Success fee. Paid at closing for purchases or leases. Aligns incentives.

•

Hourly. Good for consulting, underwriting, or strategic advice.

•

Retainer. Useful when you need deep search or custom sourcing; may credit at closing.

•

Flat or hybrid. For defined scopes.

Behind the scenes, brokerages split commissions with agents on their own terms.

You negotiate the overall fee and who pays it, not the internal split.

I script three versions of your buyer agreement so you can choose: “seller pays,” “buyer pays,” or “either party can pay; we’ll align per deal” and then we target properties accordingly.

“What if the cost is the same?”

Often, a veteran and a rookie charge similar fees.

The spread is in negotiation skill, network, and investor fluency.

If price is equal, I choose the agent who can win terms that add cash flow, reduce capex exposure, and compress timelines.

That is worth multiples of any fee difference.

Going straight to the listing agent

You might think bypassing a buyer’s agent gets you a discount.

Sometimes the listing agreement already obligates a full commission whether or not a buyer’s agent is involved.

In dual agency or customer status, you lose dedicated advocacy.

When I model this with clients, any “savings” frequently vanishes once you account for lost negotiation leverage, missed inspection credits, or simple errors.

Where to find investor‑friendly agents

Ask investors doing your strategy in your target zip codes.

Call managing brokers at larger firms and ask who handles multi‑family, BRRRR, or STRs.

Ask lenders, insurance agents, and title reps who consistently close investor deals.

I listen for specifics: vacancy assumptions, rent‑ready turns, ADU overlays, and eviction timelines.

Generalists talk in platitudes. Investor agents talk in numbers.

Do designations matter?

Designations signal education, not necessarily investor results.

CRS requires transactions and can be a proxy for experience.

I still hire based on investor deal history, negotiation outcomes, and the quality of their comp packages.

Experience, sales volume, and reviews

Volume matters, but fit matters more.

Check their sales by property type, price band, and neighborhood.

Read reviews for investor takeaways: rents achieved, days‑to‑lease, contract credits won.

Remember, off‑market closings may not show up online.

Specialization and geography

Pick an agent who lives in your strategy and submarket.

If you buy small multis, work with a small‑multi pro.

If you execute Nomad™, choose someone fluent in owner‑occupant loans, rent‑ready turns, and lease‑up timing.

Local block‑by‑block knowledge is an edge you can’t fake.

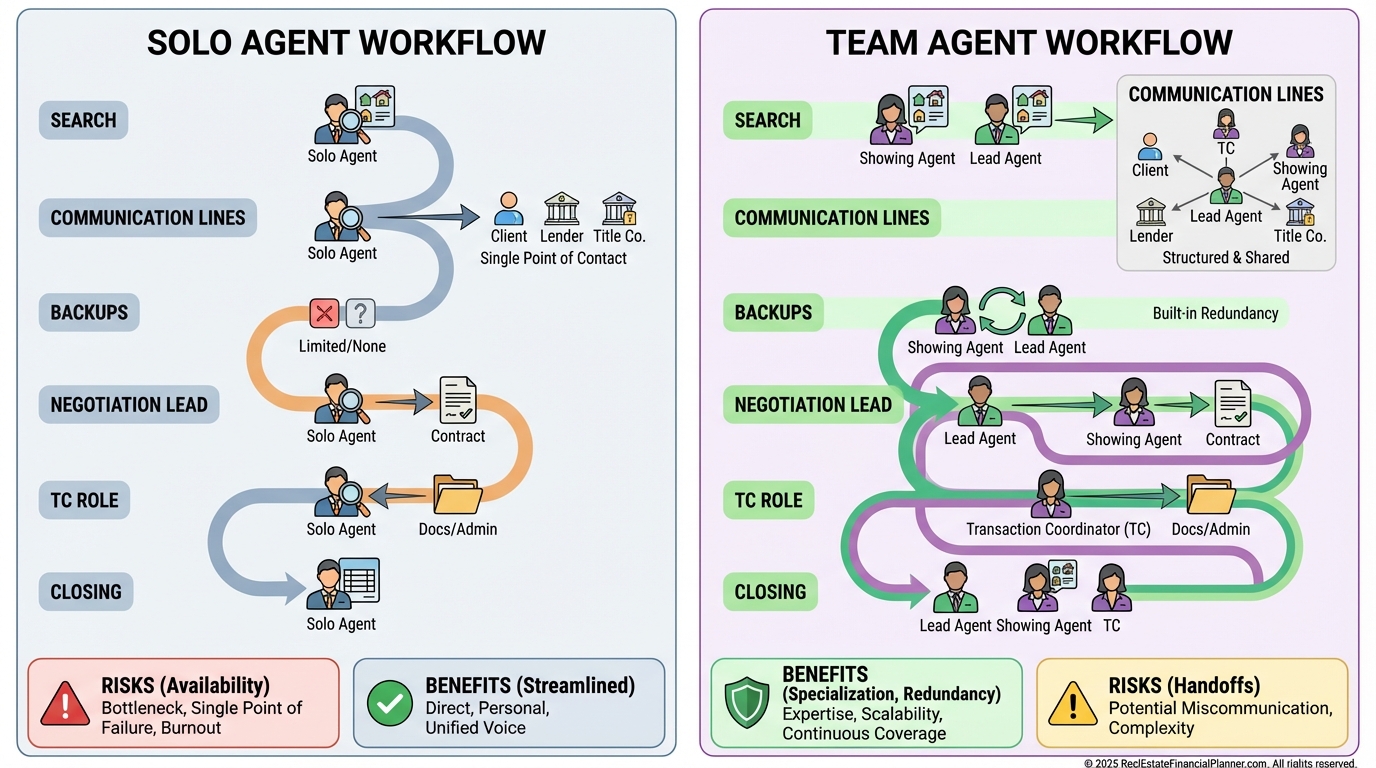

Solo agent vs team

Solo agents offer one‑throat‑to‑choke accountability and consistent communication.

Teams bring redundancy, specialists for negotiation and paperwork, and speed.

When I run fast in competitive markets, teams with a strong transaction coordinator can shave days off timelines.

Just confirm your point person and escalation path.

The investor value stack you should expect

You’re paying—directly or indirectly—for value.

Ask for it.

•

Investor‑grade comps. Rents, concessions, vacancy, and time‑on‑market.

•

Tools. Deal spreadsheets, checklists, and offer templates.

•

Market intelligence. Zoning shifts, permit backlog, STR/MTR rules, tax reassessments.

•

Vendor bench. Inspectors, PMs, lenders, contractors, attorneys, and 1031 accommodators.

•

Paperwork proficiency. Clean addenda, clear deadlines, and lender‑friendly concessions.

When I help clients, I align agent output to your Return Quadrants™ and True Net Equity™ so you see how each service affects your 1‑, 5‑, and 10‑year outcomes.

Top buyer priorities that matter most to investors

The right property, the right price, and the right terms.

An investor‑friendly agent finds properties that pencil, negotiates credits and timelines, and manages paperwork cleanly.

I want agents who win on appraisal gaps, repair escrows, rent‑back agreements, and closing cost allocations that your lender will accept.

Key benefits during the purchase

Clarity on process, sharp eyes on faults and hidden value, and stronger contracts.

Better vendor lists accelerate due diligence and reduce rework.

A smarter search saves time and increases offer quality.

When I prepare clients, we pre‑decide our “walk‑away” thresholds for inspection, financing, and rents so decisions are fast and unemotional.

Titles vs results

Agent, broker, REALTOR®—helpful context.

But you’re hiring outcomes: speed, certainty, and net returns.

Insist on investor evidence.

Agent income by tenure (what it signals)

New agents can be hungry and overdeliver.

Mid‑tenure agents typically demonstrate pattern recognition and better counsel.

Long‑tenure agents can be elite negotiators—or stuck in old playbooks.

Ask how they stay current and what they closed for investors in the last 12 months.

Practical scripts and checks I use with clients

•

“Before we tour, let’s align your buyer‑agent agreement with your financing and target listings.”

•

“Please provide three rental comp sets: conservative, likely, and stretch, with actual days‑to‑lease.”

•

“Show me seller‑paid concession norms at this price band in the last 90 days.”

•

“Which inspection credits are common here, and which lenders allow seller‑paid buyer‑agent fees as concessions?”

These answers separate investor agents from everyone else.

A quick word on sellers and marketing compensation post‑NAR

You can still attract financed buyers who need help with their own agent’s fee.

That might be via off‑MLS compensation offers, property‑specific websites, or allowed signage and print.

We test what your local MLS and lender overlays will permit, then price and position to net you more True Net Equity™ after costs.

Action checklist to pick your agent this week

•

Choose your strategy and buy box in one page.

•

Interview three agents who already serve investors in your zip codes.

•

Review sample rental comp packs and offer templates.

•

Align your buyer‑agent agreement, compensation, and lender path before touring.

•

Run your Return Quadrants™ and True Net Equity™ for the next deal with each agent’s assumptions.

•

Decide based on who improves your numbers, not who talks the loudest.

When I help clients get this right, their offers get accepted more often and their properties perform closer to pro forma.

That is the quiet compounding you want.