True Net Worth™ Explained: The After‑Tax, After‑Cost Number Every Investor Must Know

Learn about True Net Worth™ for real estate investing.

Sarah opened her laptop at the kitchen table and smiled at the spreadsheet.

On paper, six rentals, retirement accounts, and a small stock portfolio pushed her to $1.7M.

When I asked, “If you sold everything and paid every bill the same day, how much would hit your bank?” the smile faded.

We modeled commissions, closing costs, depreciation recapture, capital gains, and early retirement account penalties.

Her “millionaire” label shrank to just over $1.1M.

That sober moment is why I teach True Net Worth™.

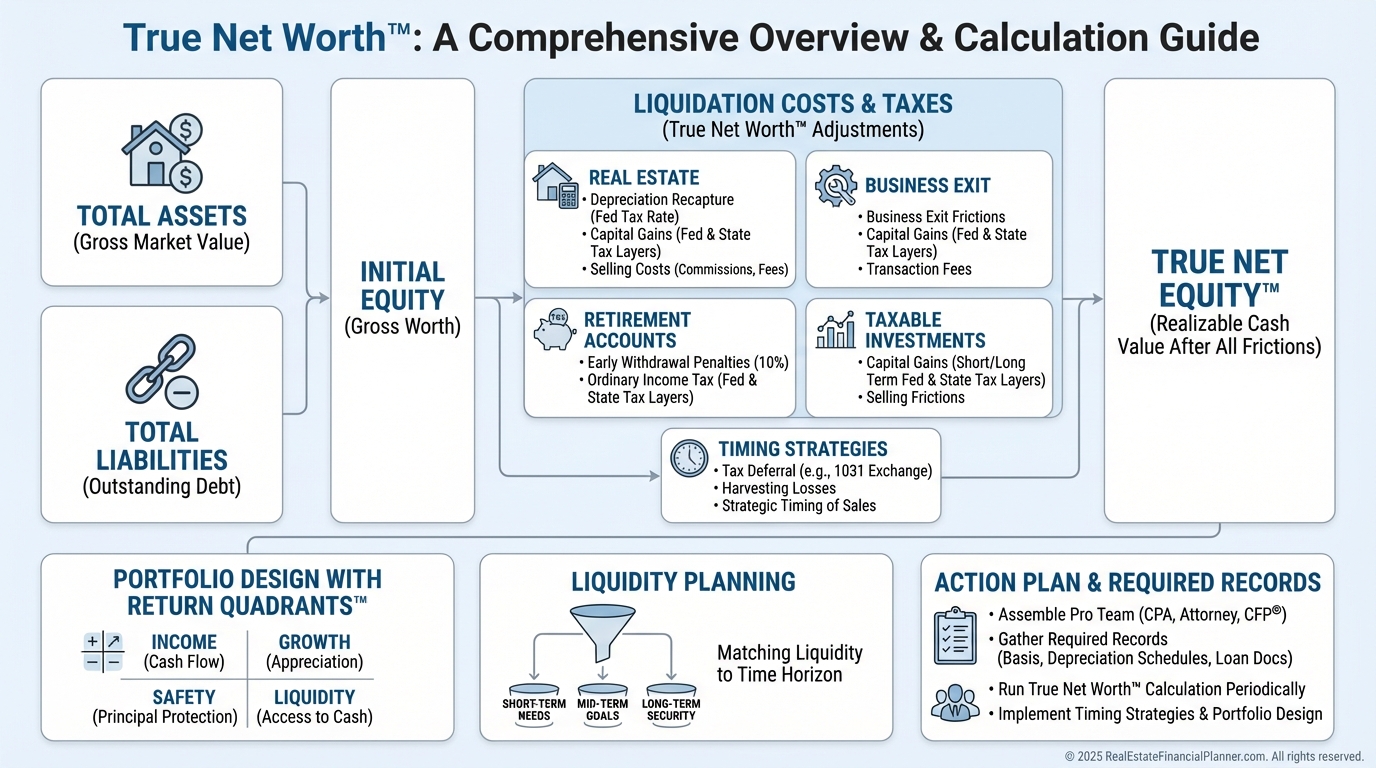

What True Net Worth™ Really Measures

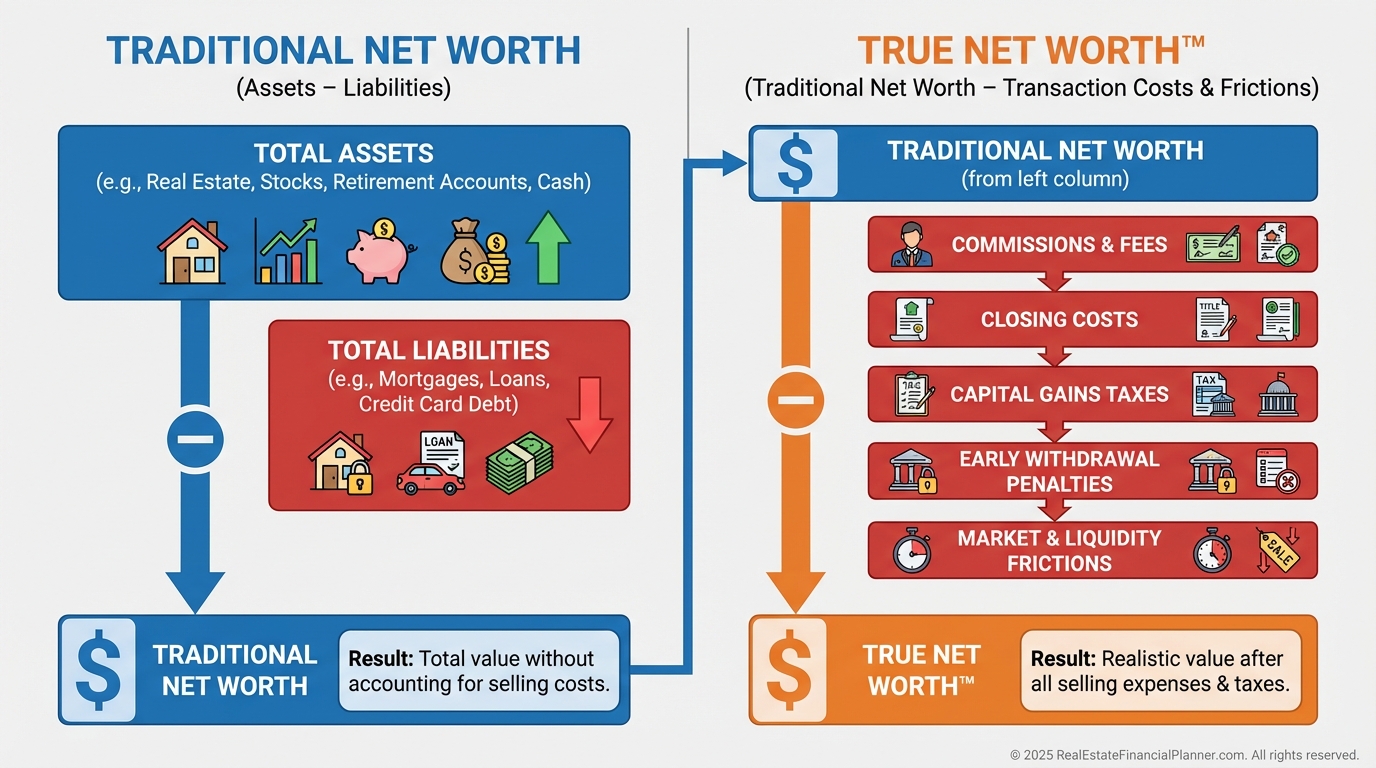

Traditional net worth is assets minus liabilities.

True Net Worth™ is what’s left after you actually convert those assets to spendable cash.

It removes the fantasy by subtracting selling costs, taxes, penalties, and market frictions.

When I help clients plan retirements, I refuse to use the sticker price of wealth. I only use the out‑the‑door number.

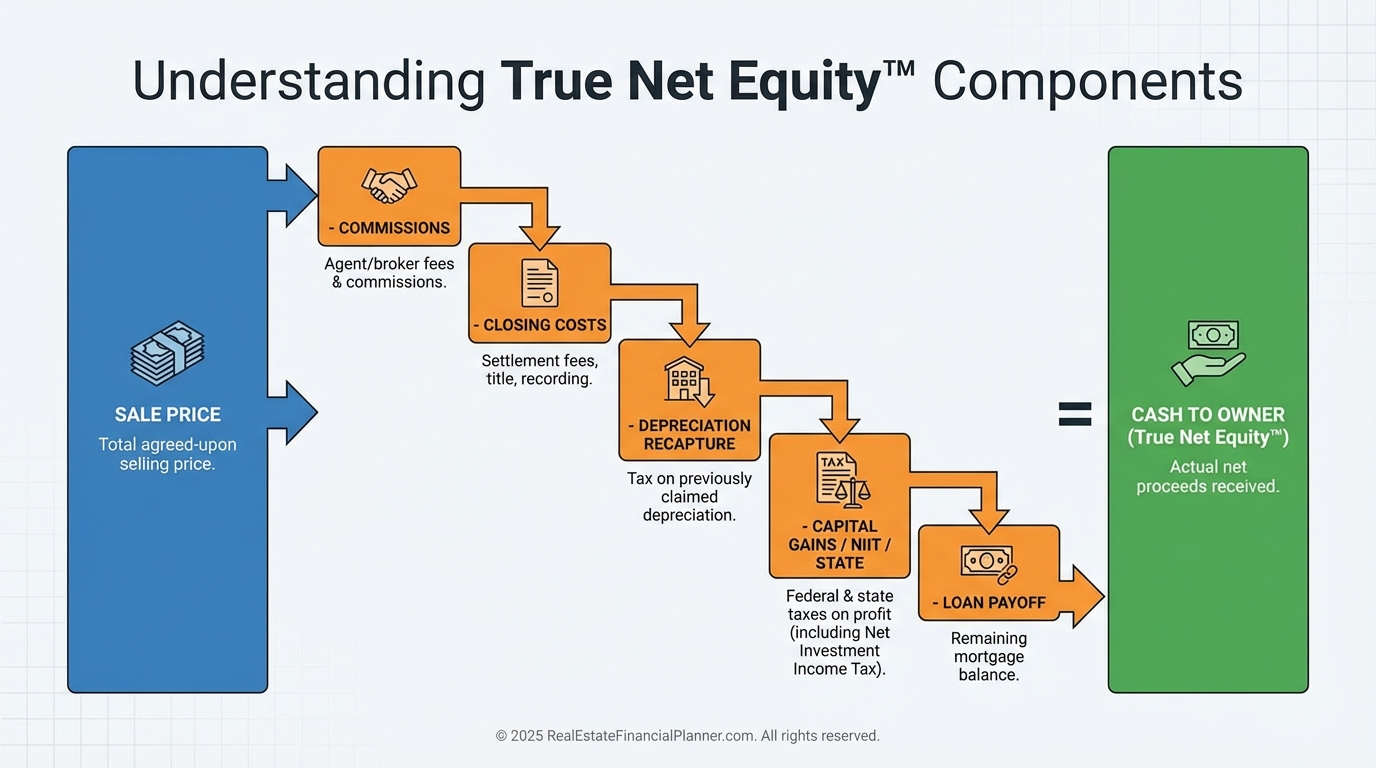

Start With Real Estate: True Net Equity™

For properties, we begin with True Net Equity™—the realistic proceeds from a sale after all costs and taxes.

I calculate four buckets before we count a dollar:

•

Real estate commissions

•

Seller closing costs

•

Capital gains taxes (plus state and potential 3.8% NIIT)

Only then do we have True Net Equity™ for that address.

Across portfolios, I often see a 25–35% haircut from gross equity to True Net Equity™.

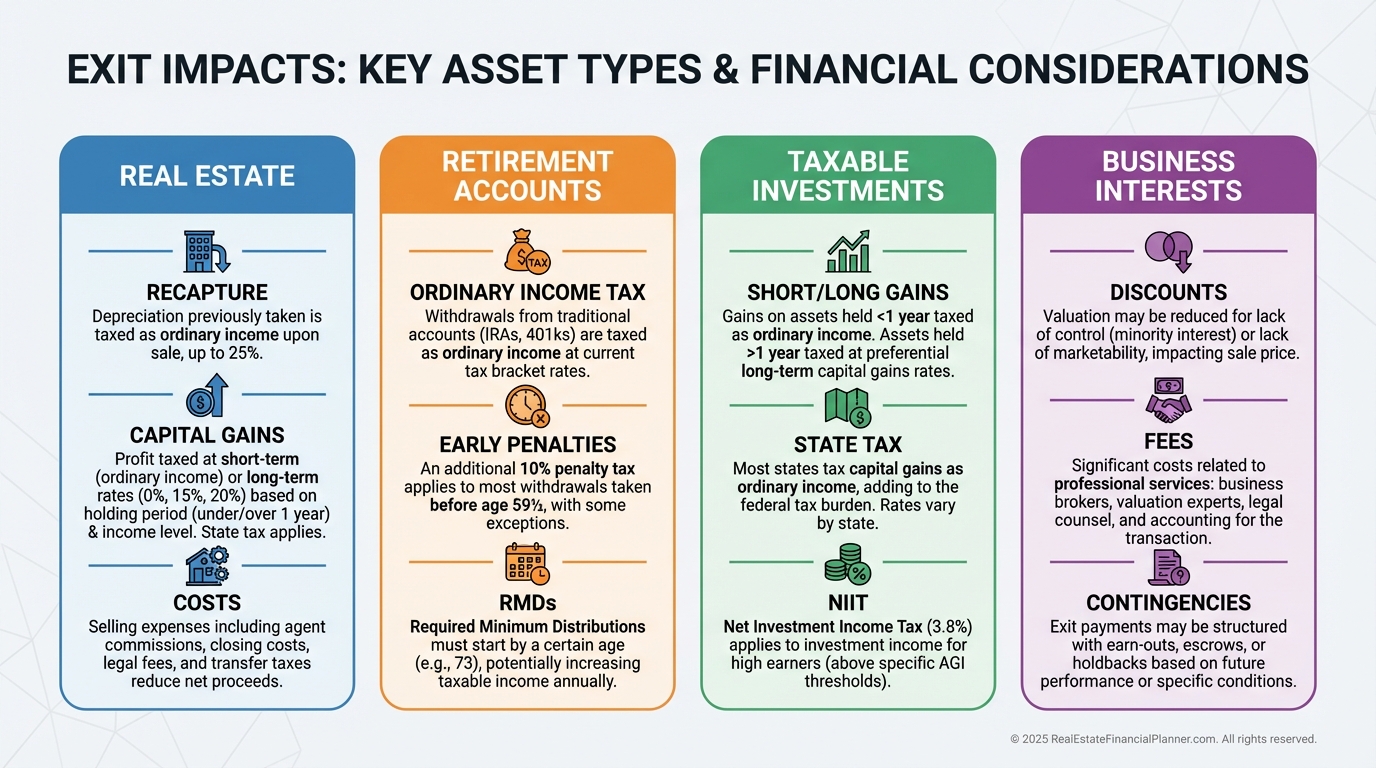

Beyond Property: The Rest Of Your Balance Sheet

If you plan to spend it, model the exit costs first.

Retirement accounts aren’t face value if you’re under 59½ or in a high bracket.

Taxable brokerage accounts have basis, holding period, state tax, and NIIT considerations.

Business interests rarely transact at their appraisal and often include fees, discounts, and earnouts.

When I rebuilt after bankruptcy, I promised myself I’d never count a dollar I couldn’t reasonably access after friction. That promise became this framework.

The Tax Mechanics That Shrink Paper Wealth

Depreciation recapture is taxed up to 25% on prior depreciation taken. It surprises investors more than anything else I see.

Long‑term capital gains are 0–20% federally, plus state, possibly plus the 3.8% NIIT.

Ordinary income tax applies to traditional IRA/401(k) withdrawals, with a 10% penalty if early.

Some states tax gains as ordinary income. A few add exit taxes on moves.

I model federal and state together, year by year, because brackets and surtaxes are staircase problems, not straight lines.

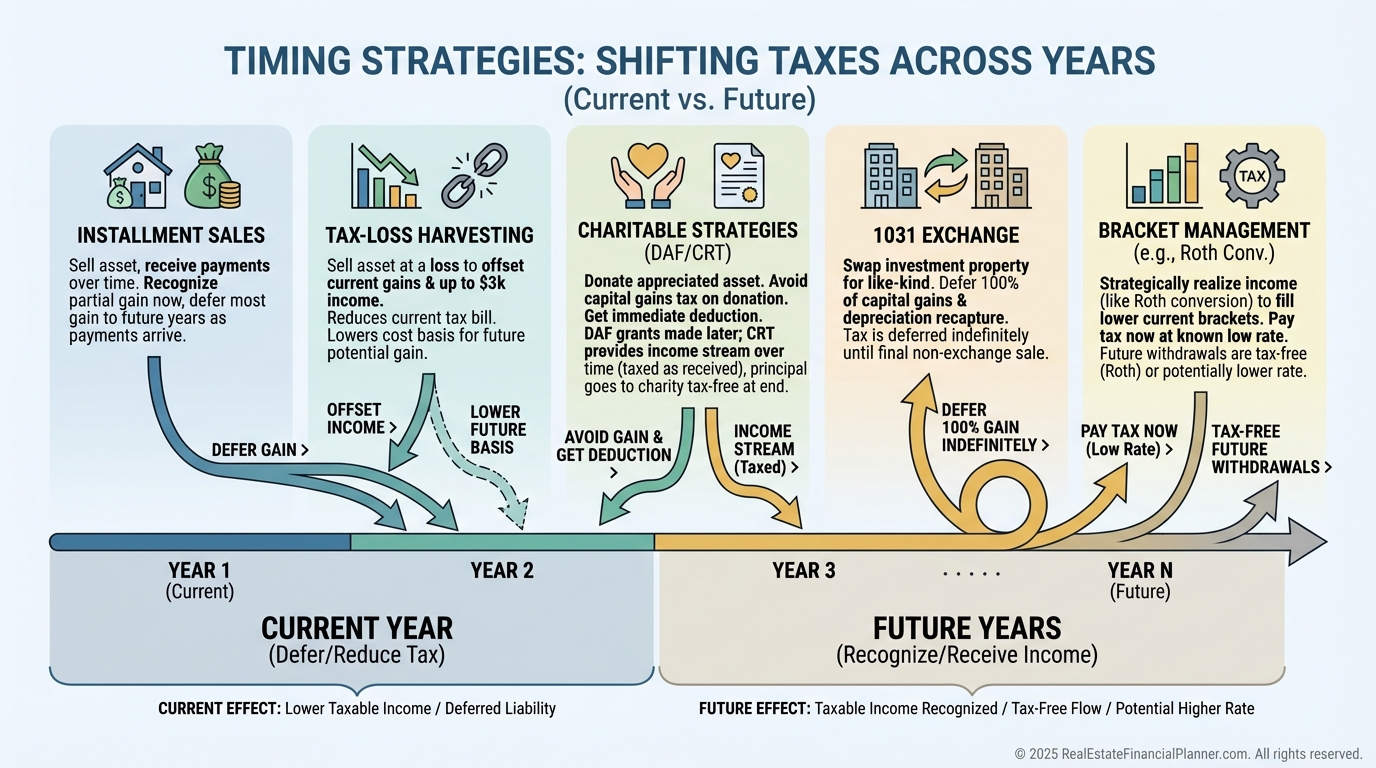

Timing and Strategy Levers

Your calendar can be worth six figures.

Spreading gains across years via installment sales can keep you in lower brackets.

Harvesting losses can offset realized gains.

Charitable tools (donor‑advised funds, charitable remainder trusts) can shift or shrink tax.

1031 exchanges defer real estate tax, but for True Net Worth™ I still show the “sell-today” number alongside the “defer-and-hold” track so you see both realities.

Planning With True Net Worth™: How I Use It With Clients

Retirement dates stop being guesses when you base draws on after‑tax, after‑cost dollars.

Withdrawal sequencing improves when we coordinate real estate sales, Roth conversions, and capital gains years.

Portfolio design gets sharper when we balance illiquid equity with accessible reserves.

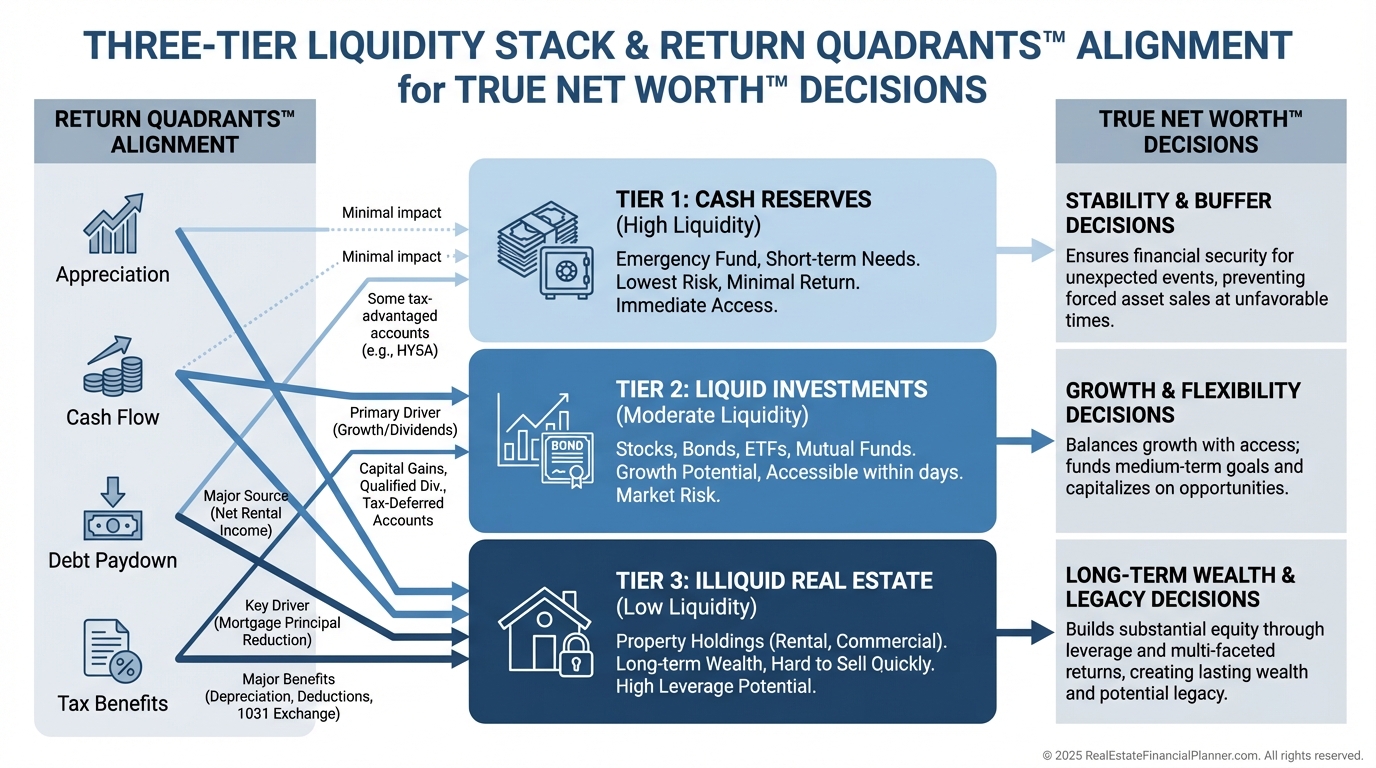

I lean on Return Quadrants™ to show where your results come from: appreciation, cash flow, debt paydown, and tax benefits.

Then I pair that with liquidity tiers so you won’t be rich on paper but cash‑poor when life hits.

What I Model, Check, Avoid, and Warn About

I model: federal/state brackets, NIIT thresholds, depreciation schedules, adjusted basis, commissions by market, and seller closing norms.

I check: holding periods, passive activity losses, suspended losses, capital improvement records, and whether a partial sale or refinance is smarter.

I avoid: counting lines of credit as “cash,” assuming today’s cap rates hold, or ignoring state residency rules before a big sale.

I warn clients: recapture is real, selling costs are sticky, and “average” tax rates are lies when a one‑time sale stacks income into top brackets.

Real Estate Tactics That Change The Math (Without Pretending)

Nomad™ can build wealth with low down payments and owner‑occupant loans, but it still needs a True Net Worth™ lens when you exit.

Refinancing or HELOCs increase liquidity, not True Net Worth™, because debt proceeds are not spendable without repayment risk.

Lease‑options and partial sales can spread gains and improve bracket management.

1031 exchanges defer, not erase, taxes. I model both the deferral path and the step‑up potential for heirs so you see the tradeoffs clearly.

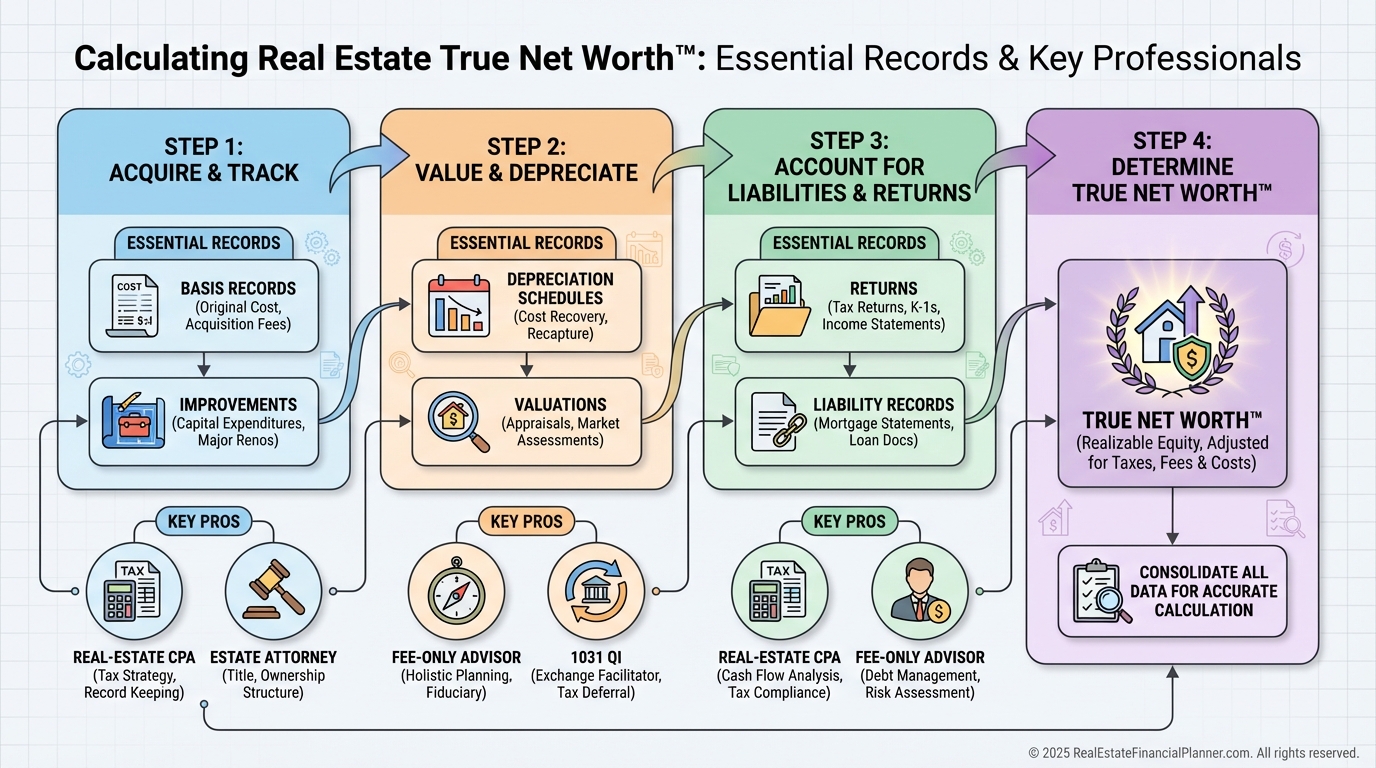

Records, Team, and Tools You’ll Need

Keep cost basis and improvement receipts. They are tax money in a file drawer.

Hold depreciation schedules and past returns. I want at least seven years handy.

Get current valuations: CMAs, appraisals, or broker opinions.

I use the RealEstateFinancialPlanner.com platform to track properties, True Net Equity™, and liquidation scenarios alongside your broader plan.

Your Action Plan

This week: inventory assets, gather mortgages and statements, pull tax returns, and list improvements with dates and dollars.

This month: get property valuations, meet your CPA, estimate recapture and capital gains, and compute True Net Equity™ per property.

Quarterly: refresh values, update tax projections, and revisit sales timing, 1031 opportunities, and charitable plans.

Annually: run a full True Net Worth™ calculation, then set cash‑flow targets, reserve levels, and sale/refi decisions for the coming year.

When Sarah saw her true number, she delayed retirement by two years, optimized sale timing, and trimmed taxes.

She didn’t give up on the goal; she removed the guesswork.

That’s the power of True Net Worth™—it replaces hopeful math with reliable decisions.