Umbrella Policies for Real Estate Investors: How Much Coverage You Really Need and What It Actually Covers

Learn about Umbrella Policies for real estate investing.

The Real Risk Most Investors Underestimate

When I help clients model worst-case scenarios, the lawsuit line items are always the quiet killers.

One icy walkway, one deck failure, one dog bite—and your portfolio can be on the line.

You can do everything right and still face a seven-figure claim.

That’s why I treat umbrella coverage as the safety net for your safety nets.

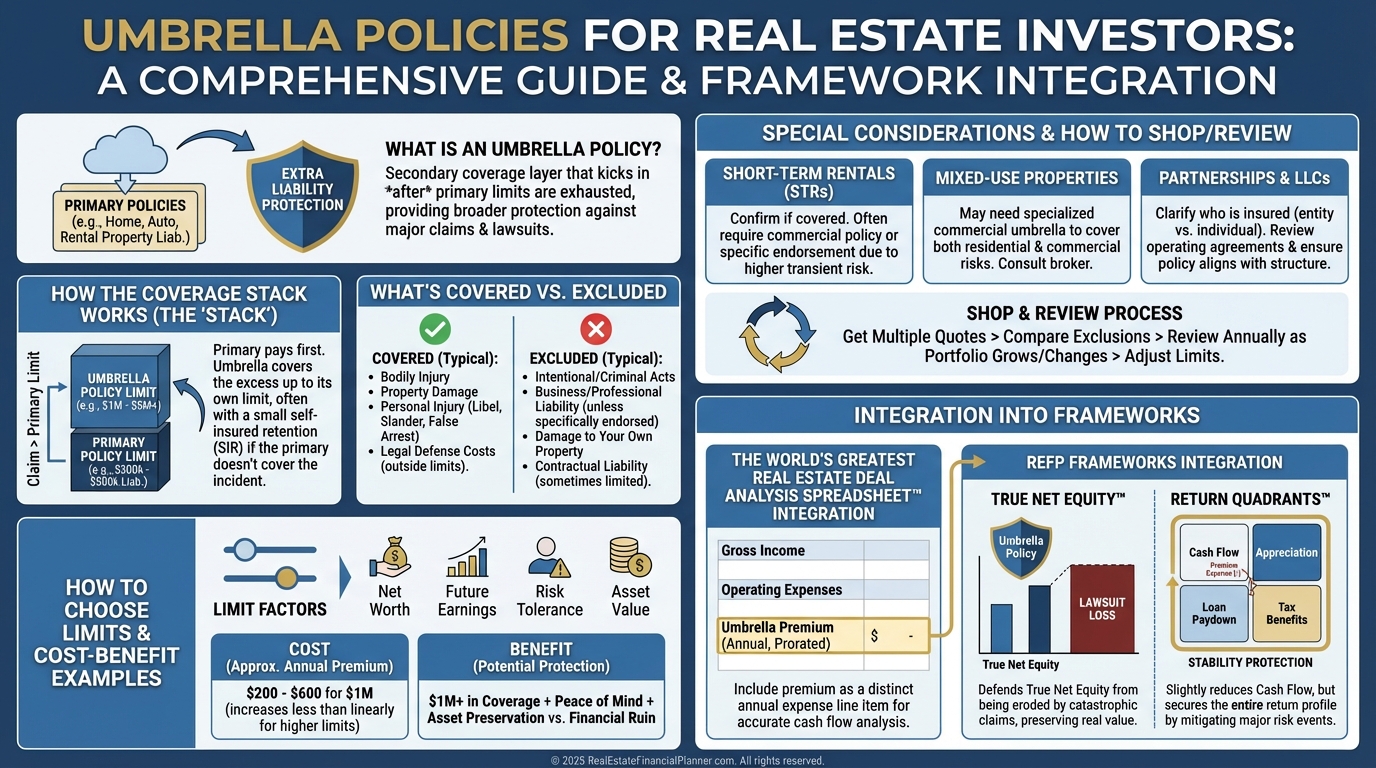

What Is an Umbrella Policy?

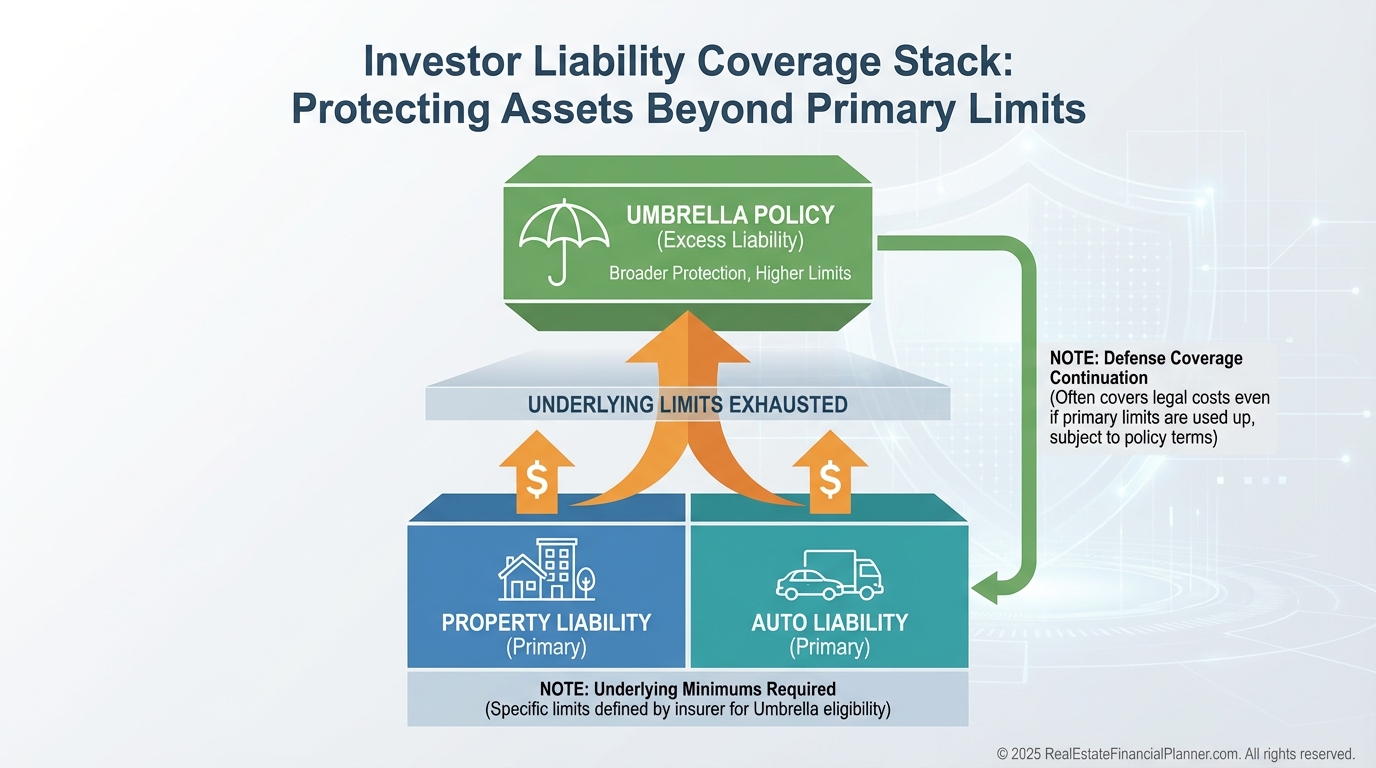

An umbrella policy is excess liability insurance that sits above your property and auto policies.

It doesn’t replace your underlying coverage; it extends it after those limits are exhausted.

To qualify, carriers require minimum underlying liability limits (often $300,000–$500,000 per property and $250,000–$500,000 for auto).

If underlying limits lapse or drop below minimums, the umbrella may not respond.

How Umbrella Policies Work for Real Estate Investors

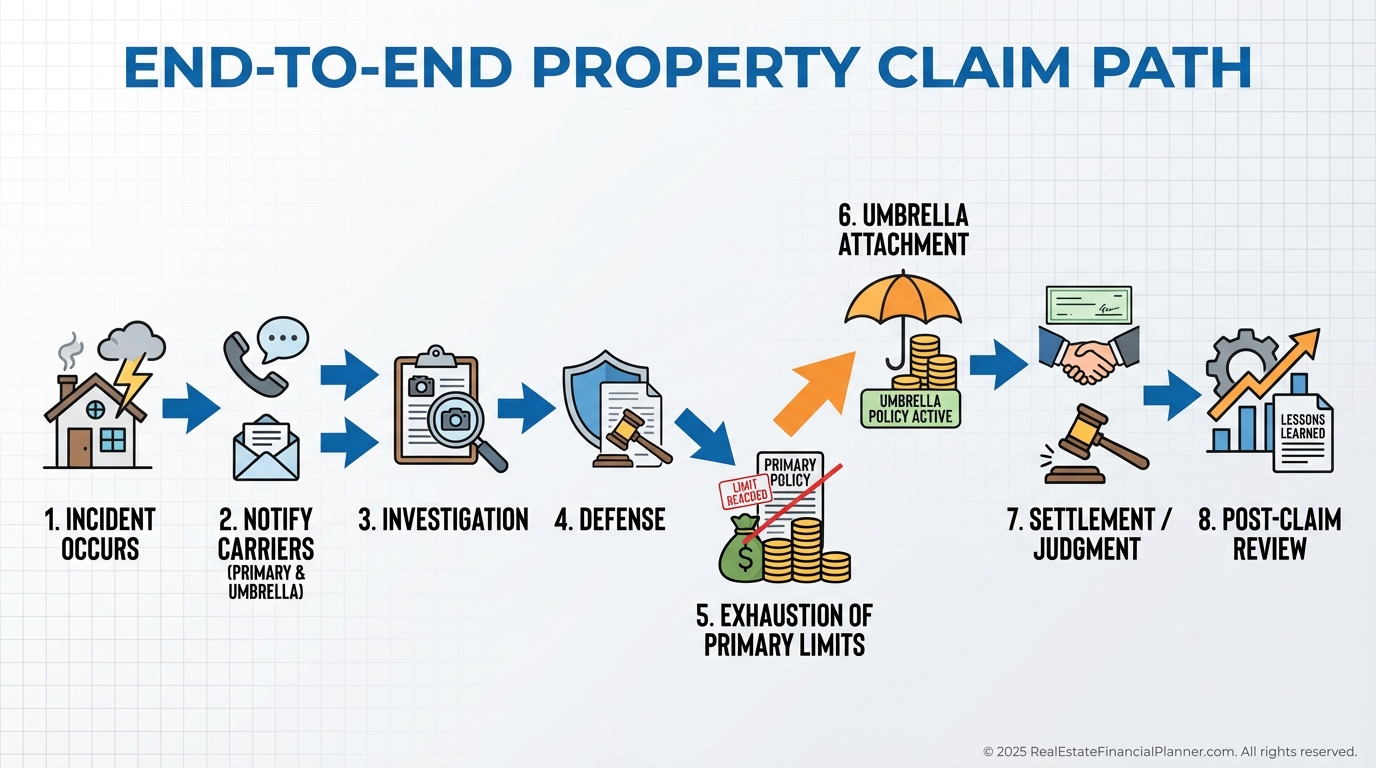

Here’s the trigger: a covered claim blows past your primary liability limit, then the umbrella kicks in up to its own limit.

Defense costs usually continue under the umbrella, which matters because legal bills can rival judgments.

When I’m coaching clients, we notify both carriers early so they coordinate defense and reserve properly.

Example: a deck collapse totals $1.8M in injuries and damages; your primary pays $500K, your $2M umbrella pays the remaining $1.3M.

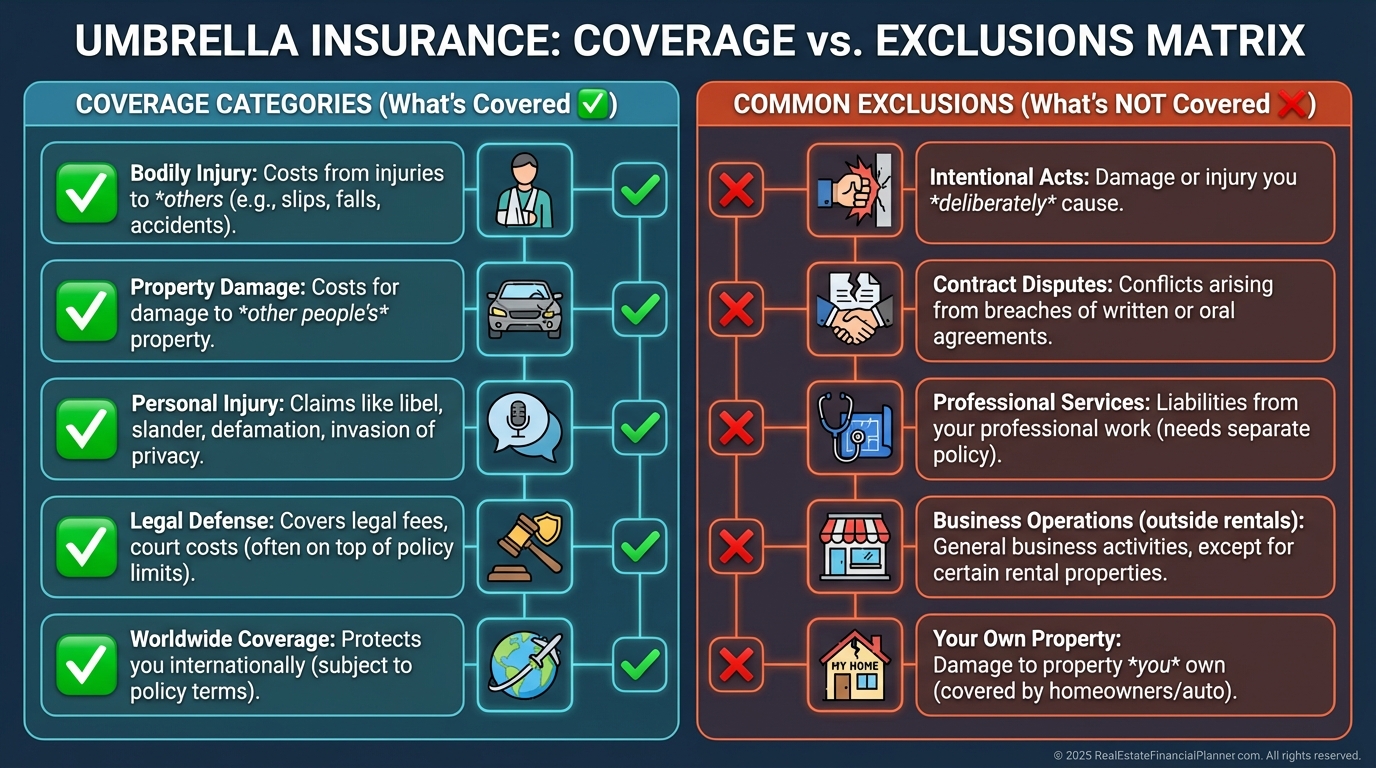

What Umbrella Policies Cover

Umbrella extends liability for bodily injury, property damage, and personal injury once your base policies cap out.

Think slip-and-fall, a tenant’s guest injured in a common area, a fire spreading to a neighbor, or a wrongful eviction claim that exceeds base limits.

It typically includes continued legal defense so you don’t run out of attorney money mid-case.

Worldwide coverage usually follows you personally, not just a street address.

What Umbrella Policies Don’t Cover

Intentional acts, criminal behavior, or deliberate harm are out.

Breach of contract, vendor disputes, or partnership fights aren’t covered—that’s a different policy type.

Your own property damage isn’t covered; that’s for your property policy.

Professional services (e.g., third-party property management for others) generally require separate E&O or professional liability.

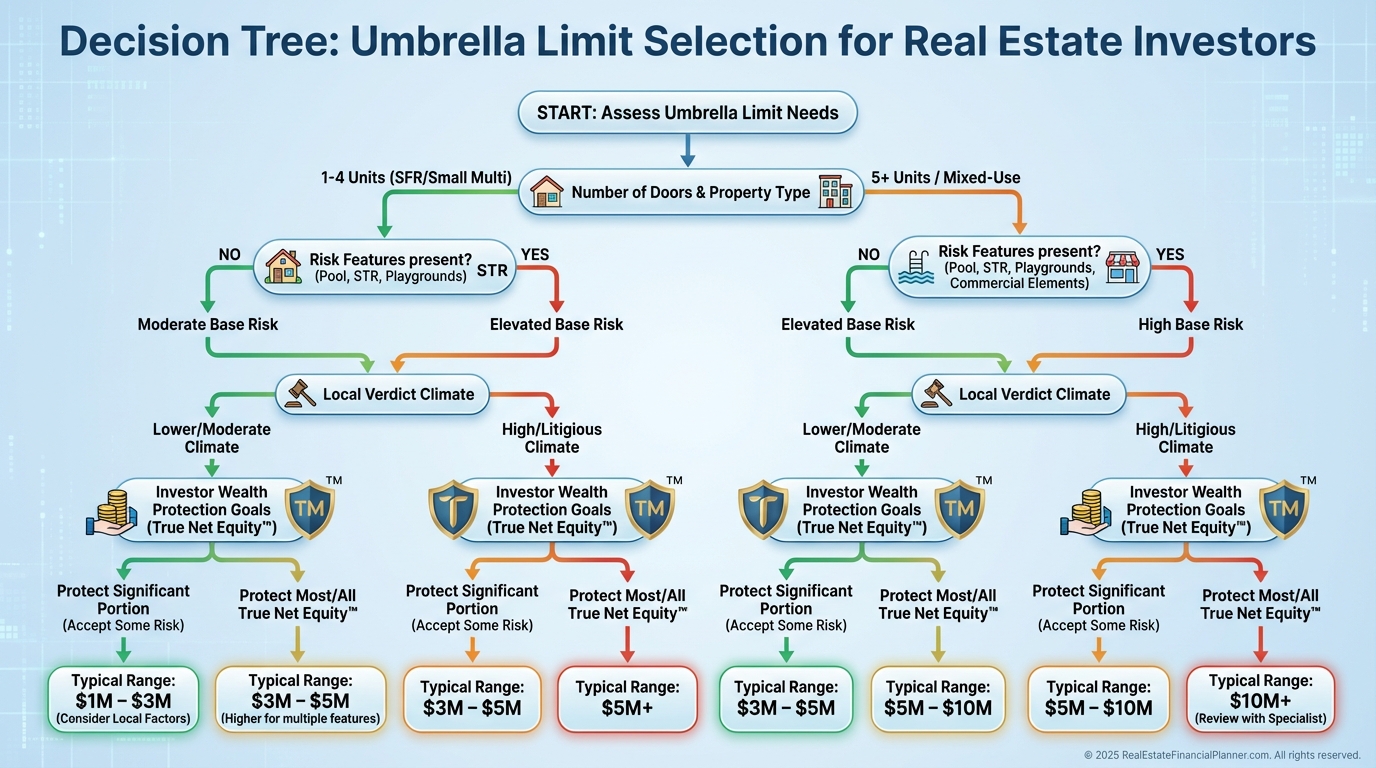

How Much Umbrella Coverage Do You Need?

I don’t size umbrella limits to “net worth.”

I size them to plausible worst-case claims in your markets and property types.

More doors mean more visitors, more maintenance exposure, and more risk vectors.

Pools, trampolines, short-term rentals, and high-density common areas increase potential verdicts.

I also look at venue risk—some counties reliably produce bigger judgments.

Then I map that to your True Net Equity™ so a single claim can’t unwind your wealth compounding.

For most investors, $2M–$5M is a practical starting range, with $5M–$10M for larger portfolios or higher-risk features.

Your decision isn’t about perfection—it’s about avoiding portfolio-ruining outliers.

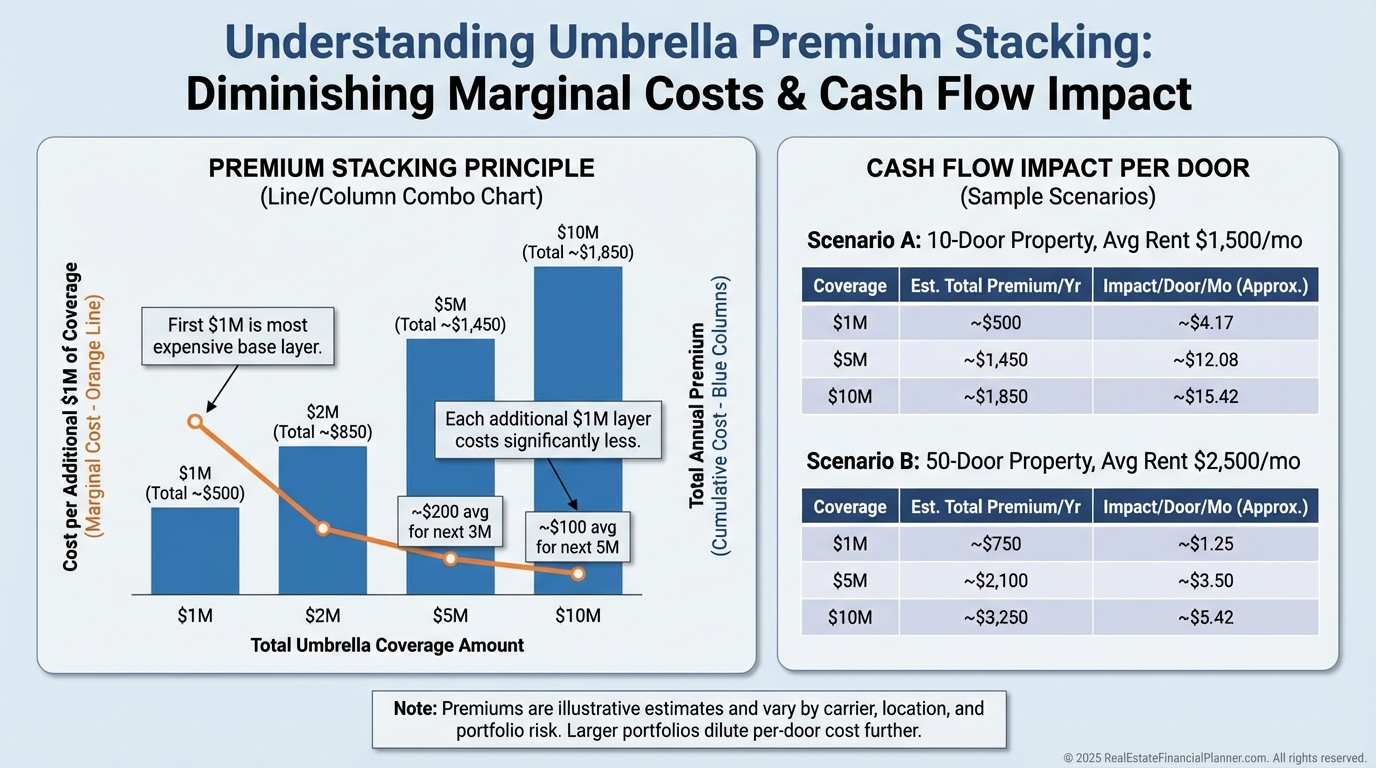

Cost-Benefit Reality Check

Umbrella coverage is usually inexpensive: often $150–$300 for the first $1M, then $50–$150 per additional million.

On a $5M umbrella, I routinely see premiums around $400–$600 per year depending on carrier and risk profile.

When I model Return Quadrants™, umbrella premiums barely move cash flow but massively cap tail risk.

In The World’s Greatest Real Estate Deal Analysis Spreadsheet™, I spread the premium pro rata across doors to keep underwriting honest from day one.

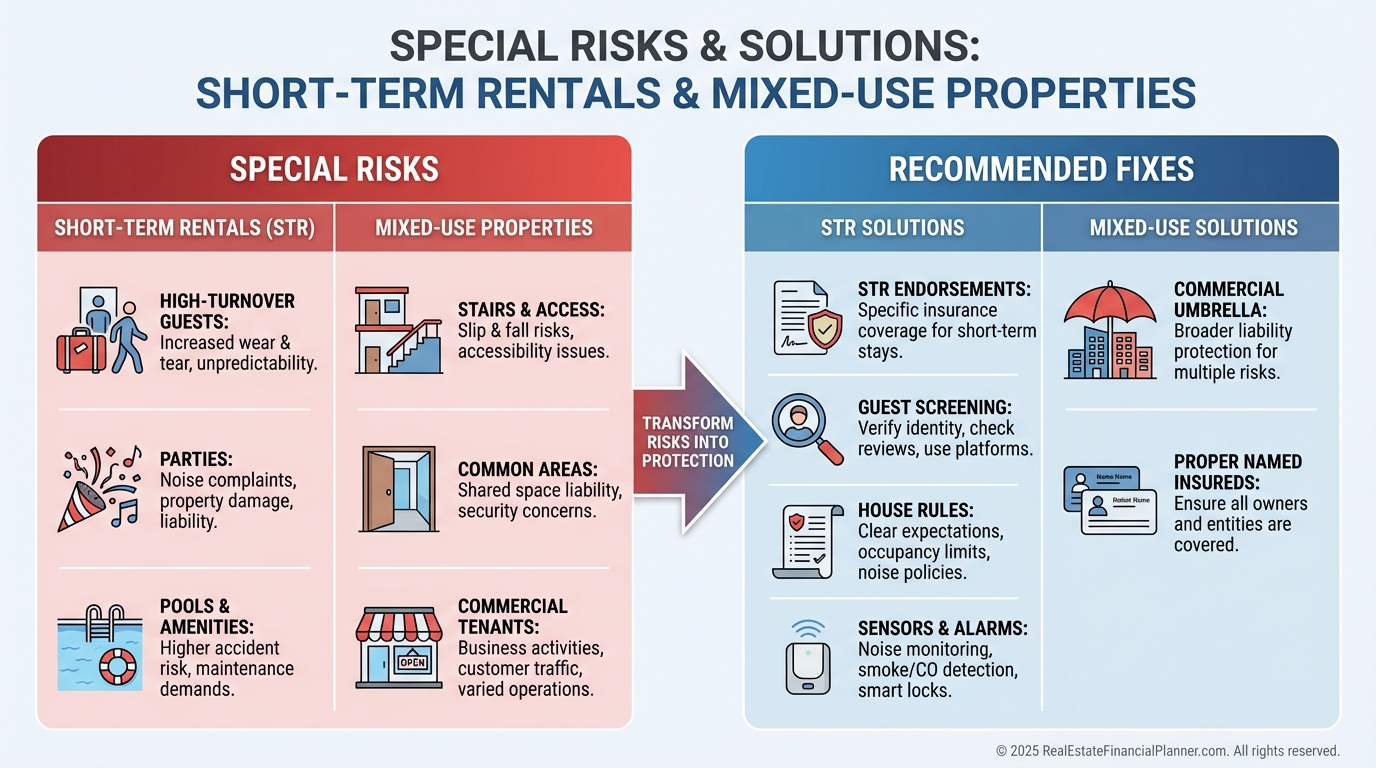

Special Considerations for Real Estate Investors

Multiple properties are fine—one umbrella can sit above them all, provided each has required underlying limits.

Short-term rentals often need endorsements or a carrier comfortable with STR risk, especially for party-prone locales.

Mixed-use buildings may need a commercial umbrella or hybrid approach—don’t assume a personal umbrella will follow.

If you self-manage only your own properties, many umbrellas will extend; manage for others and you likely need separate business coverage.

Partnerships and LLCs matter: the umbrella typically protects the named insured’s liability, not necessarily every entity in your structure.

When I review client structures, I map named insureds, additional insureds, and entity ownership so the umbrella aligns with reality, not assumptions.

Getting the Right Umbrella Policy

Shop coverage quality first, price second.

Ask whether defense costs are outside limits or erode limits, confirm territory, and scrutinize exclusions tied to rentals and business activities.

Confirm underlying minimums and what happens if a property sells, is acquired, or if limits accidentally lapse.

Watch for red flags: unusually low premiums with broad exclusions, one-carrier-only requirements, or vague rental language.

I prefer carriers that understand real estate investors and have a solid claims reputation.

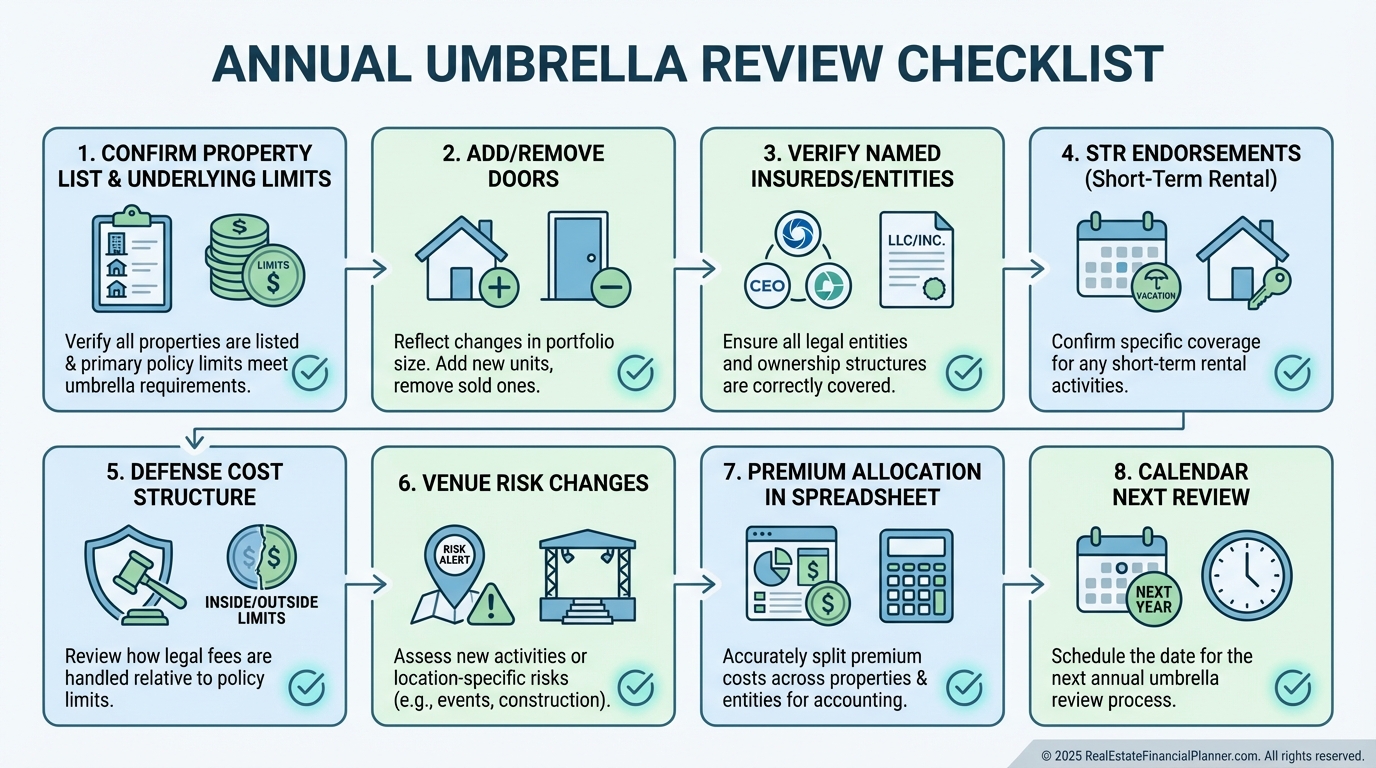

Calendar an annual review or whenever you add doors, change ownership structures, or materially increase True Net Equity™.

Implementation Plan: 30-Minute Playbook

Step 1: Pull declaration pages for all property and auto policies and confirm liability limits meet umbrella minimums.

Step 2: Request quotes for $2M, $5M, and $10M to see the marginal cost curve.

Step 3: Verify defense costs treatment and all rental language in writing.

Step 4: Map named insureds and entities to ensure your umbrella covers how you actually own.

Step 5: Allocate the final premium across your portfolio in The World’s Greatest Real Estate Deal Analysis Spreadsheet™ so cash flow and Return Quadrants™ reflect reality.

Step 6: Set a calendar reminder 45 days before renewal to review changes, add acquisitions, and update True Net Equity™.

Final Thoughts

Umbrella policies are the cheapest way I know to cap portfolio-ruining tail risk.

They don’t make you bulletproof, but they turn catastrophic into survivable so your compounding can continue.

If you do one thing this week, get three umbrella quotes, verify the language for rentals and STRs, and update your Spreadsheet.

Your future self—and your future cash flow—will thank you.