Hard Money for Real Estate Investors: Costs, Calculations, and When to Use It

Learn about Hard Money for real estate investing.

Why Hard Money Exists

Speed and flexibility win deals that traditional lenders can’t touch.

When I help clients compete for distressed properties, hard money is often the only funding that closes in days, not weeks.

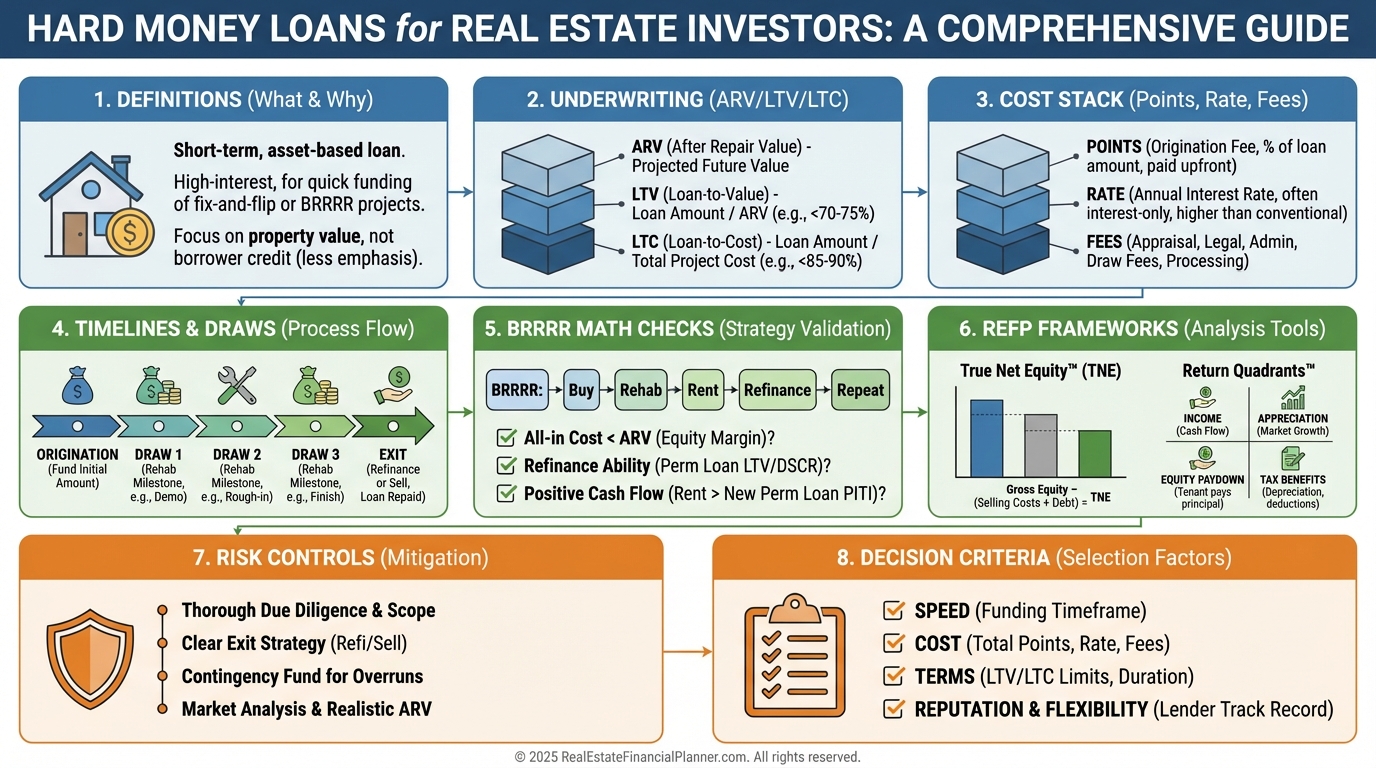

What Hard Money Is

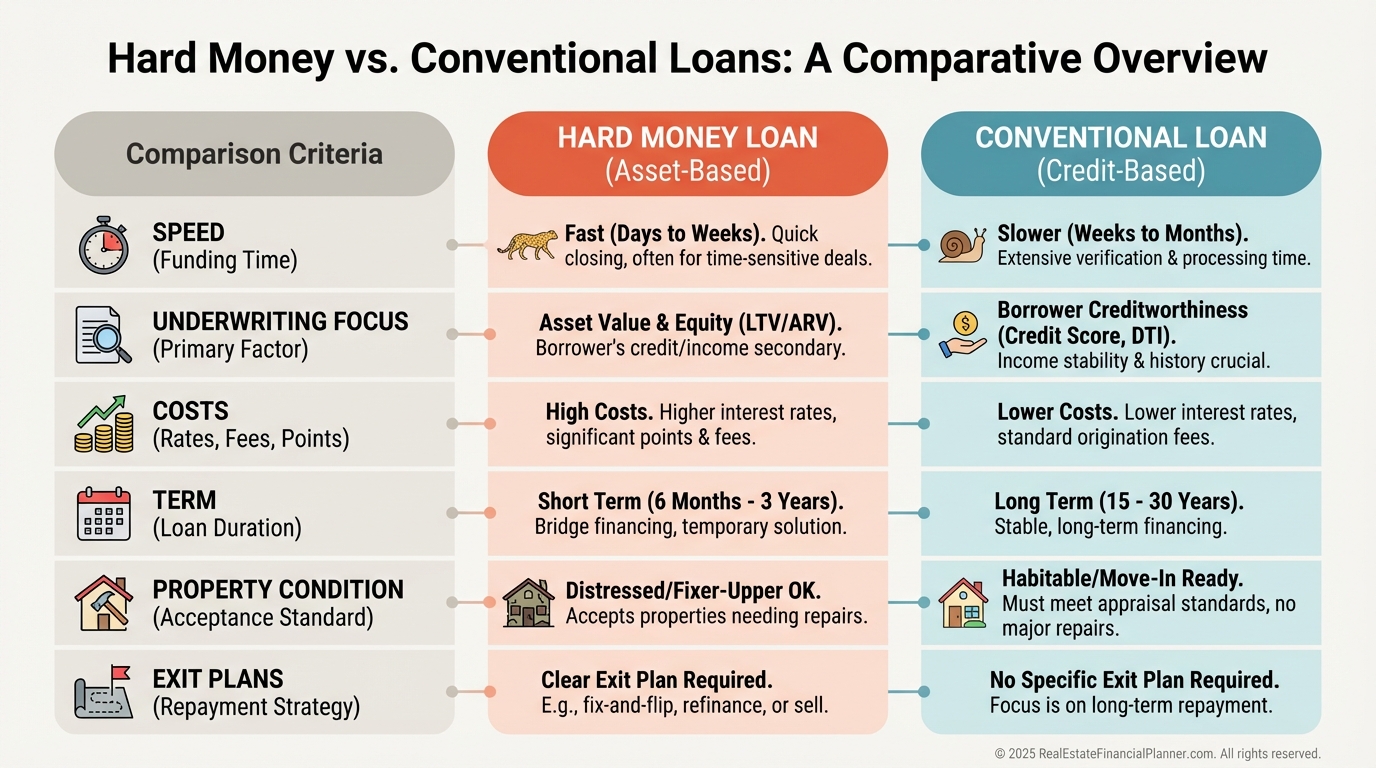

Hard money is a short-term, asset-based loan secured primarily by the property.

Private lenders or funds provide the capital, and they price for speed, risk, and execution.

Rates are higher, terms are shorter, and underwriting leans on the asset and exit rather than your W-2.

It’s built for flips, BRRRR projects, wholetail deals, and bridge situations—not owner-occupied purchases.

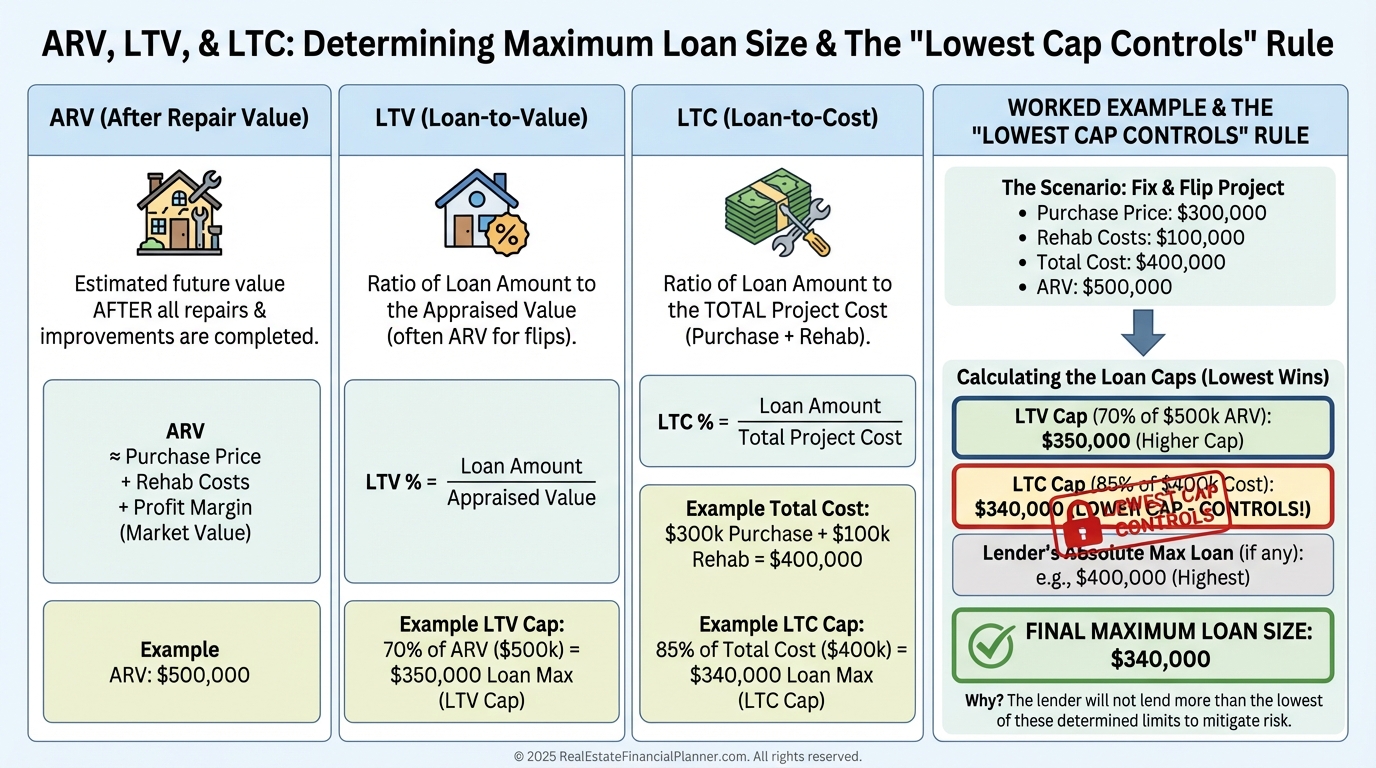

How Lenders Underwrite: ARV, LTV, and LTC

Most hard money lenders size the loan to a percentage of After Repair Value (ARV) or to total project cost.

Common caps include 65%–75% of ARV, 80%–90% of purchase price, and 100% of rehab budget (via draws), subject to the lower of LTV or LTC.

When I evaluate a deal, I model both constraints because the tighter metric is the real limit.

Example Deal Math You Can Copy

Assume ARV is $220,000, purchase price $120,000, rehab $40,000, and closing/holding $7,500.

A lender at 70% ARV caps you at $154,000, while 85% purchase caps you at $102,000 on acquisition but may fund 100% of the $40,000 rehab via draws.

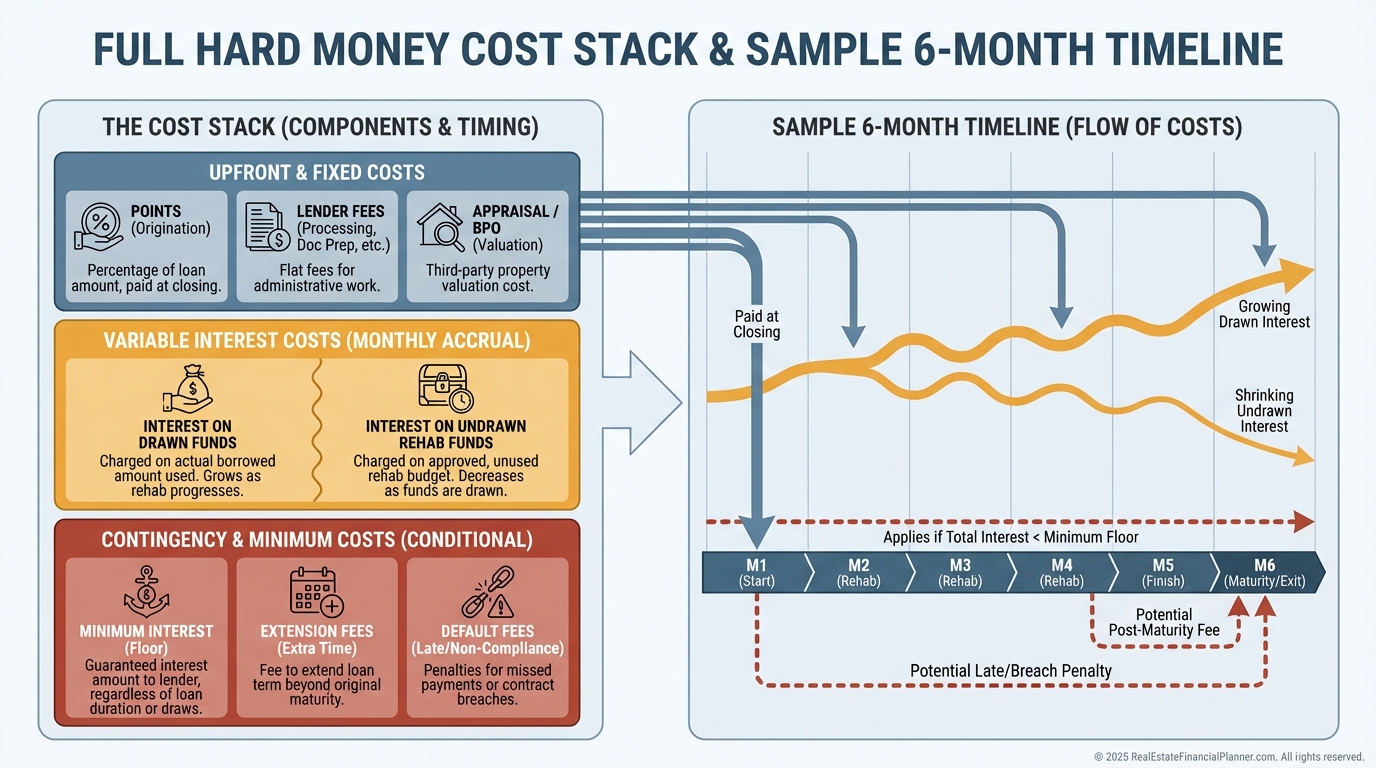

If you borrow $154,000 at 12% for 6 months with 3 points and finance the points, your points are $4,620 and interest is roughly $9,240 if fully drawn for the full term.

Most deals aren’t fully drawn day one, so I model a realistic draw schedule in the Real Estate Financial Planner to tighten interest estimates.

The Real Cost of Capital

Hard money pricing includes rate, points, underwriting and doc fees, appraisal/BPO, interest on draws, and sometimes minimum interest or extension fees.

Some lenders allow points to be financed into the loan; others require cash at closing.

I warn clients to budget a contingency for extensions at 0.5%–1% per month, plus default rate if timelines slip.

When Hard Money Shines

Use hard money when property condition disqualifies conventional loans, timelines are tight, or you need draw-based rehab funding.

It’s also a fit when the value-add plan is clear and fast, and exit certainty is high.

For BRRRR, it works when your all-in basis is at or below the refinance proceeds, including refi costs and reserves.

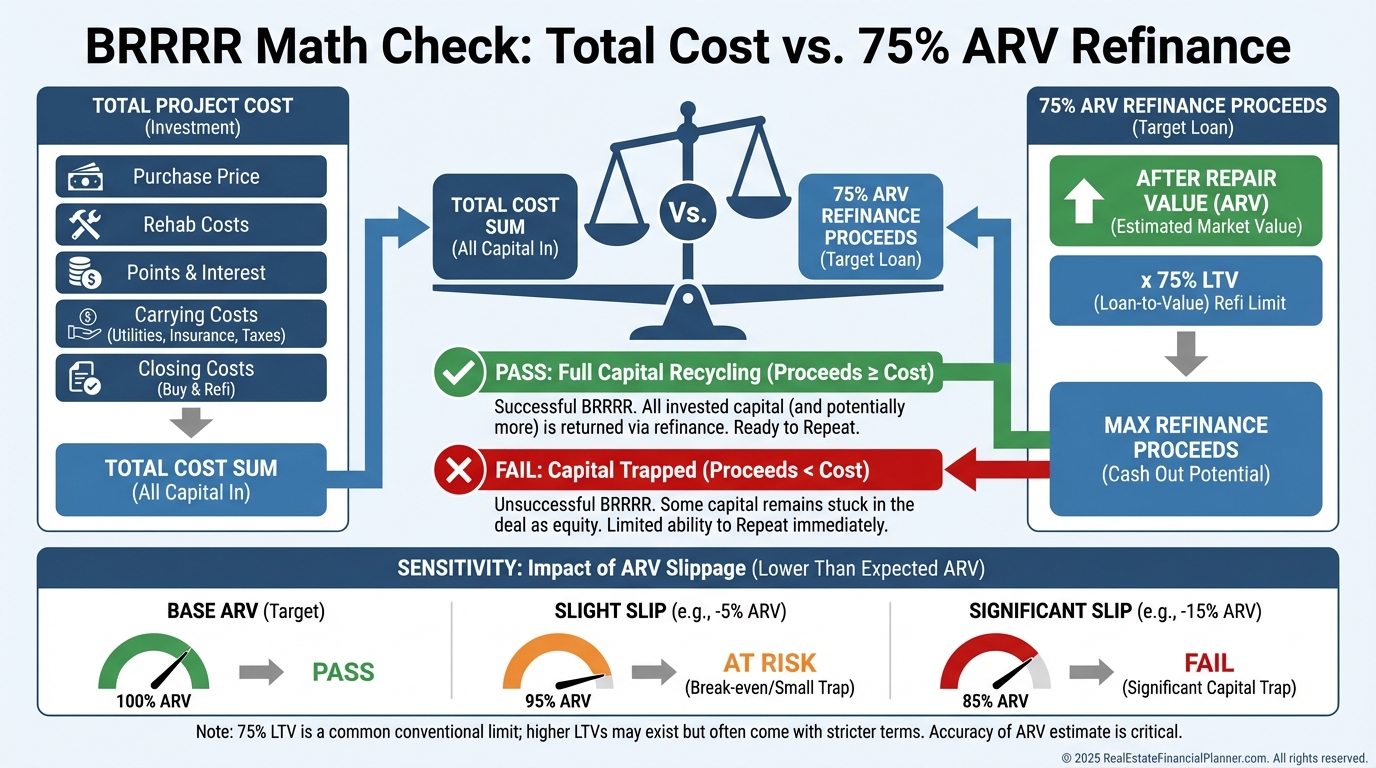

BRRRR With Hard Money: The Math Gate

For a typical 75% LTV refinance, your all-in cost must be below 75% of ARV after counting every dollar you’ll spend.

If ARV is $220,000, 75% refi proceeds are $165,000.

If your all-in is $172,000, you’re short at refi and will need to leave cash in or renegotiate.

Using REFP Frameworks to Decide

True Net Equity™ tells you what you’d net if you sold today after paying off loans, closing costs, and taxes.

I use it mid-project to ensure a forced-sale still leaves acceptable equity after hard money payoff.

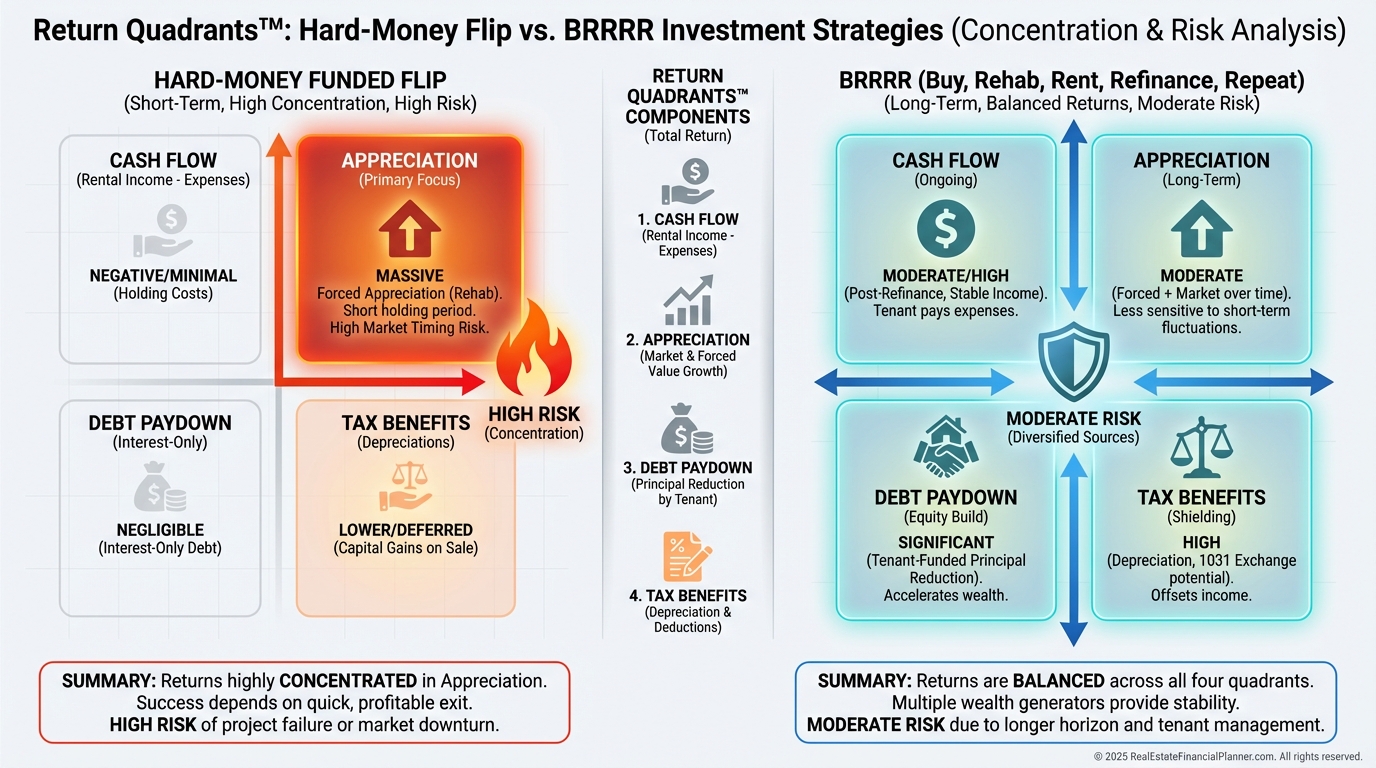

Return Quadrants™ compare where your profit is coming from: flips are concentrated in forced appreciation, while BRRRR diversifies into cash flow, amortization, tax benefits, and market appreciation.

When I model both exits, I prefer the path with safer True Net Equity™ and more balanced Return Quadrants™—not just the one with the highest projected IRR.

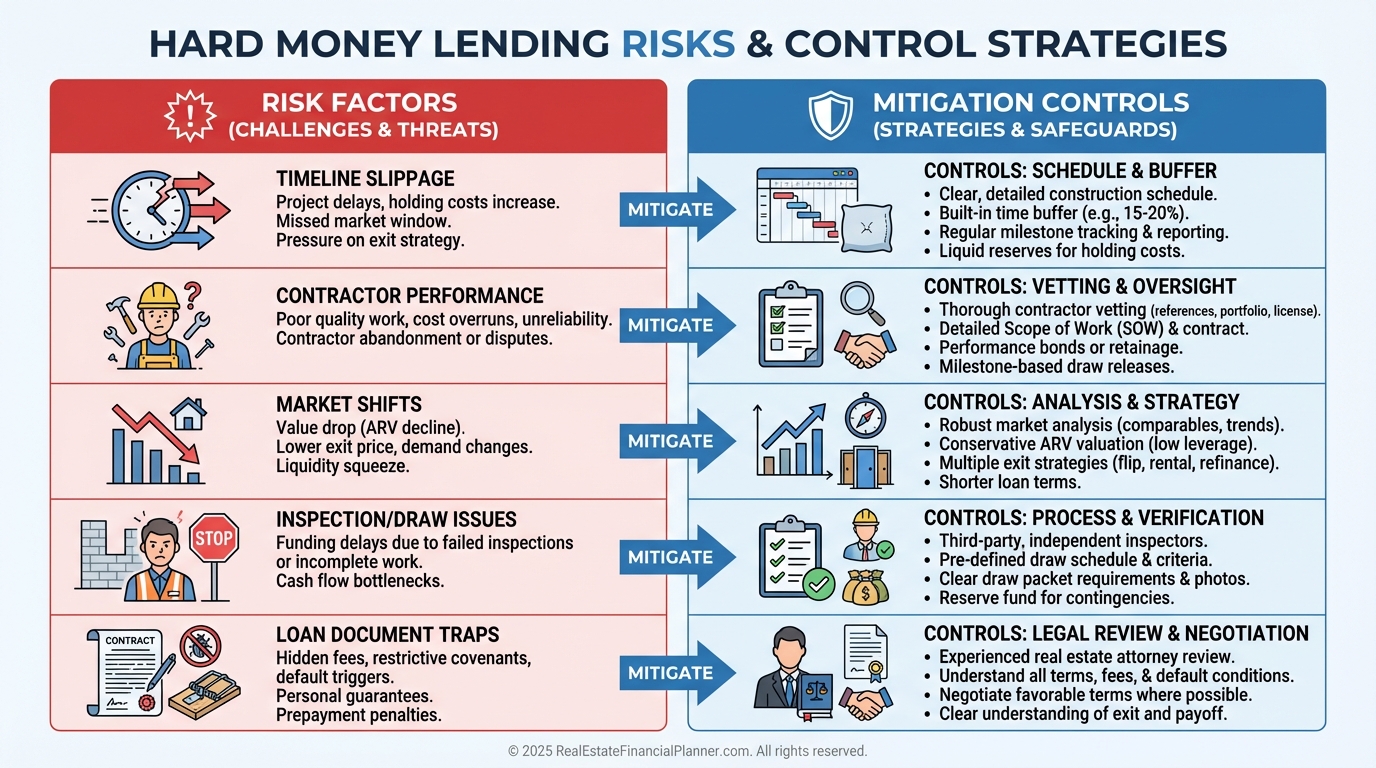

Risks I Model, Check, and Avoid

Timeline risk is the biggest killer because interest, taxes, and insurance keep ticking.

Contractor risk follows: scope creep, change orders, and permit delays.

I insist on builder’s risk insurance, written draw schedules, lien waivers, and two-week look-aheads on the construction calendar.

In the loan docs, I scan for minimum interest, prepayment penalties, junk fees, personal guarantees, and cross-default provisions.

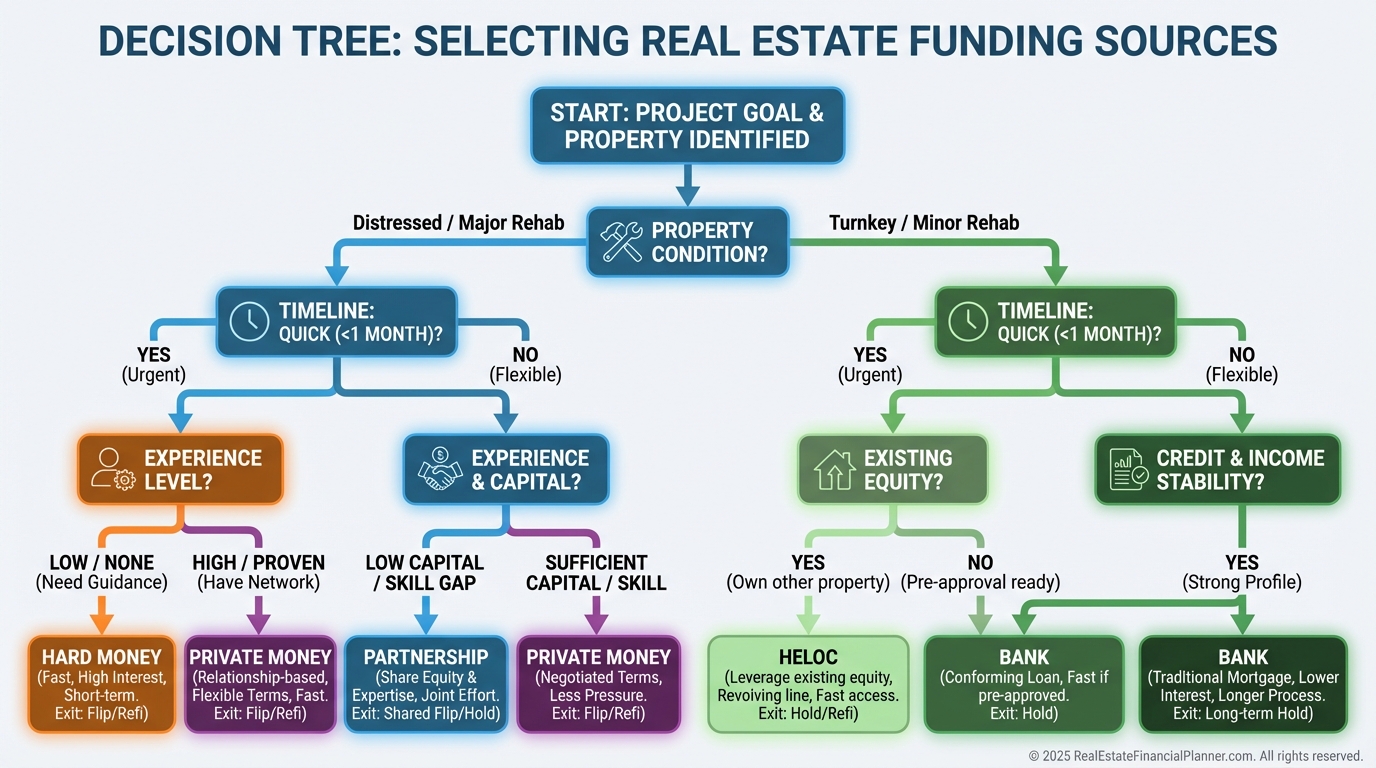

Alternatives and When to Choose Them

Private money can be cheaper and more flexible but depends on your relationships and track record.

Bank portfolio lines and HELOCs are great for seasoned operators with strong financials.

Partnerships trade equity for certainty and speed, which can be wise on complex rehabs.

Nomad™ and long-term rentals rarely need hard money; use conventional, DSCR, or portfolio loans instead.

Your Step-by-Step Playbook

•

Validate ARV with comps, not hope.

•

Build a scope of work and lock fixed bids with clear milestones.

•

Get written term sheets from lenders and compare total cost of capital, not just rate.

•

Verify draw process, inspection timing, and interest on undrawn rehab funds.

•

Budget extensions and set weekly project reviews with your contractor.

•

Model both exits in the Real Estate Financial Planner: sell vs refi.

•

Close, execute, and keep liquidity for overruns.

Final Thoughts

Hard money is a tool, not a strategy.

Used correctly, it creates velocity; used casually, it taxes profit and sleep.

Model before you commit, document before you demo, and keep your exit certain.