Traditional Rentals: The Quiet, Scalable Path to Wealth (Numbers, Systems, and Mistakes to Avoid)

Learn about Traditional Rentals for real estate investing.

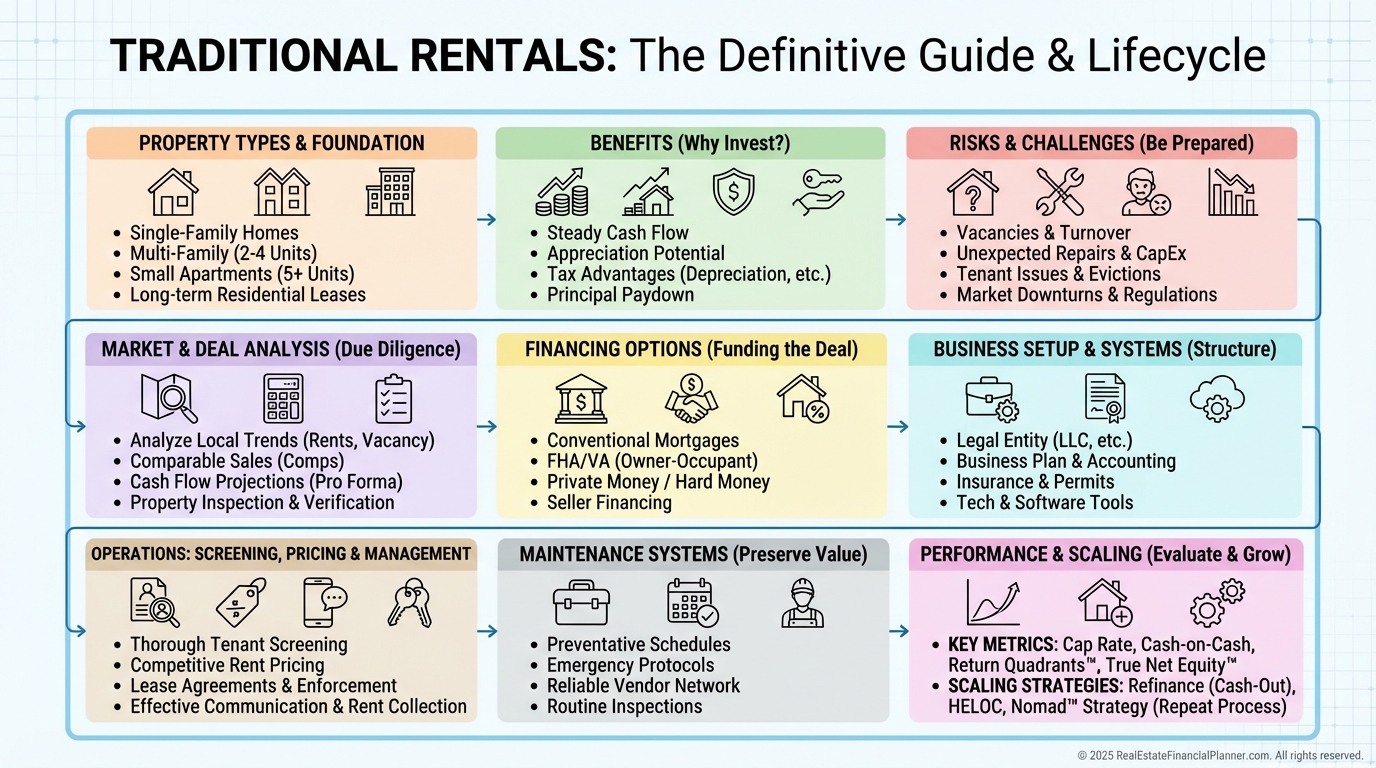

What Are Traditional Rentals?

Traditional rentals are residential properties leased for 12 months or longer.

You place a qualified tenant, collect rent, and let time do most of the heavy lifting through debt paydown and appreciation.

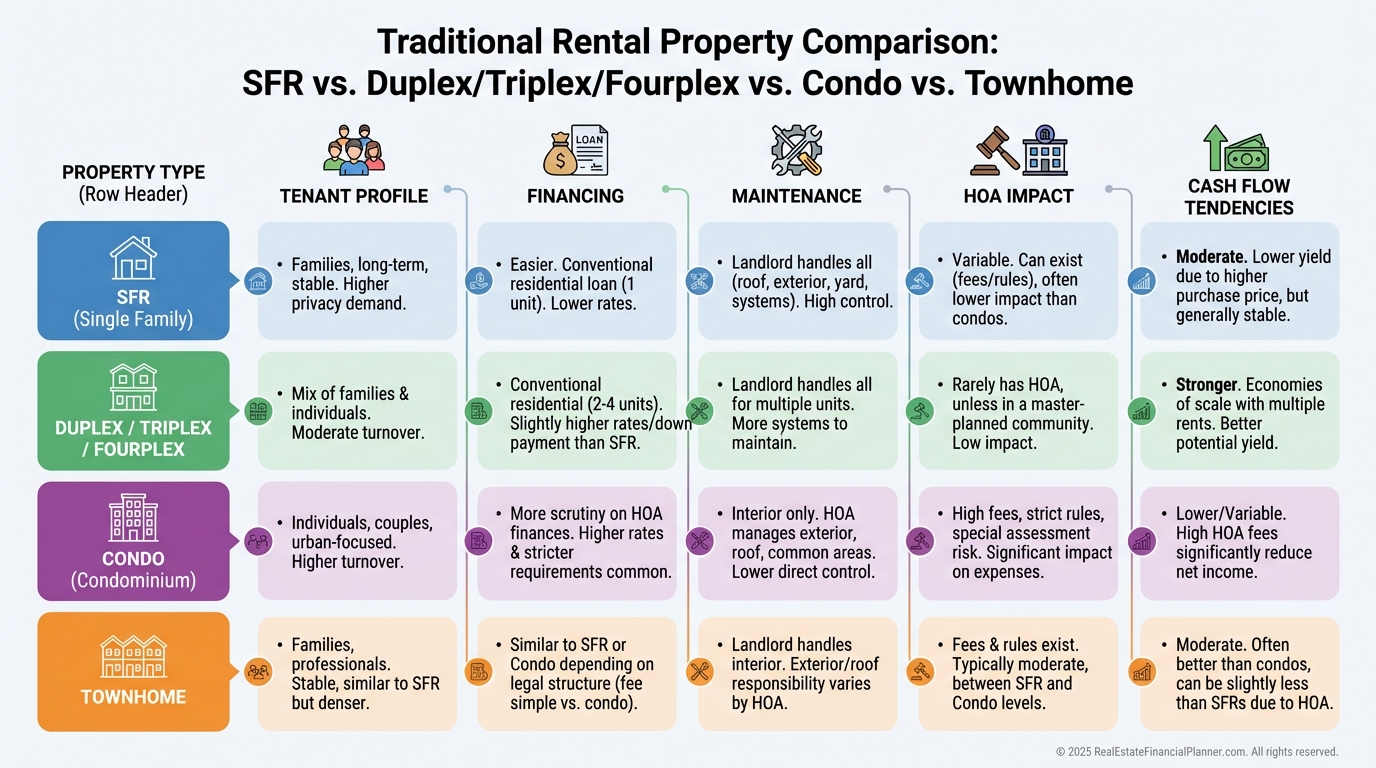

Almost any residential can work.

Single-family homes, small multifamily (2–4 units), condos, and townhomes each attract different tenant profiles and maintenance realities.

When I help clients pick a first property, I optimize for durability: solid schools, low crime, and employment drivers within a 20–30 minute commute.

Why Traditional Rentals Still Win

Traditional rentals tend to be calmer to operate than short-term rentals and less speculative than flips.

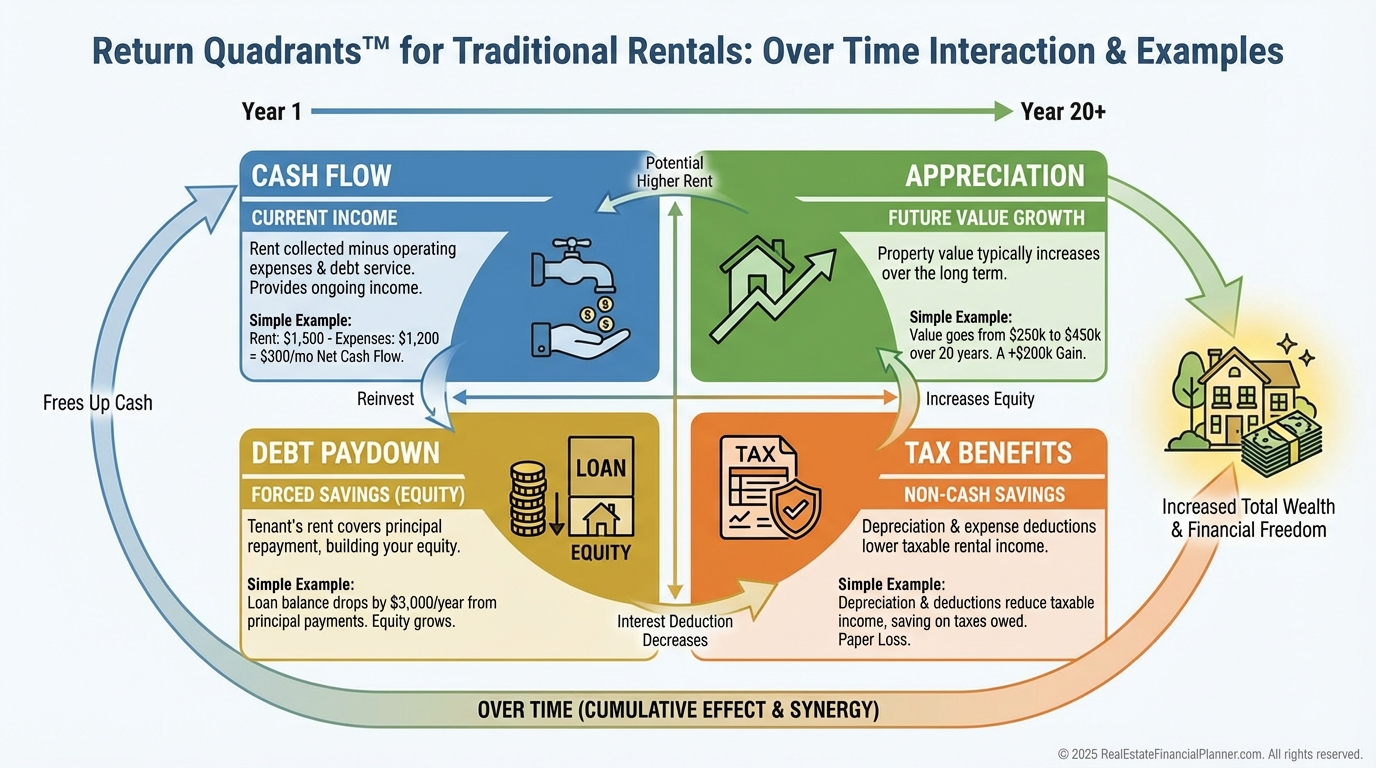

They win with systems, stable leases, and four simultaneous returns.

When those four work together, long-term wealth compounds in ways that monthly cash flow alone cannot.

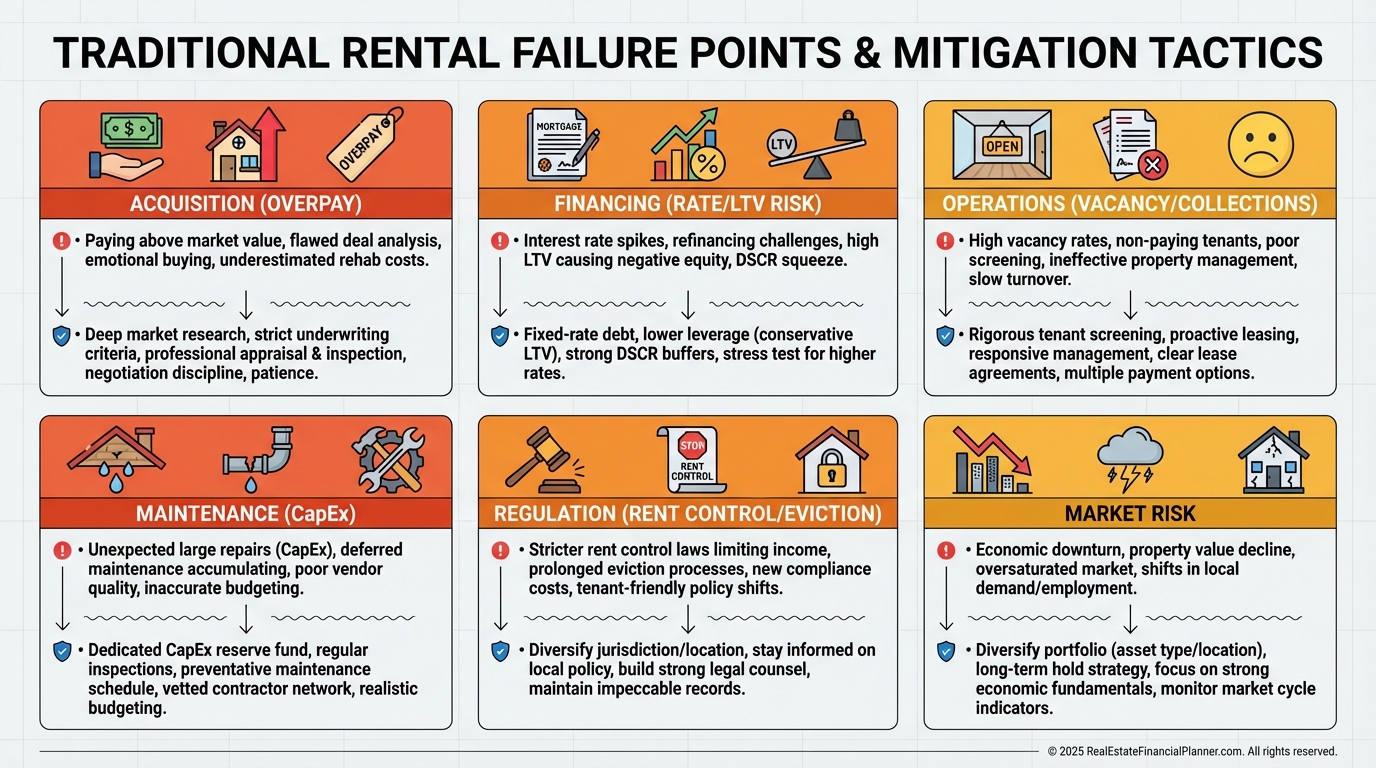

Risks, Friction, and What I Model

When I rebuilt after a setback, I stopped hoping and started modeling vacancy, repair reserves, and rent-growth ceilings conservatively.

I also underwrite to today’s interest rates, not tomorrow’s dreams.

If a deal only works with rosy assumptions, I pass.

How to Pick Markets and Properties

Start with demand drivers: job growth, population trends, household formation, school quality, commute patterns, and crime data.

Then study rent comps and time-on-market so you see not only price, but leasing velocity.

Use rules of thumb only as a filter.

The 1% rule can screen fast, but it breaks in high-cost markets and ignores taxes, insurance, HOA, and CapEx.

I analyze every candidate with The World’s Greatest Real Estate Deal Analysis Spreadsheet™ so we capture PITI, HOA, repairs, management, and realistic vacancy.

I prefer B-class neighborhoods with modest homes near transportation, services, and outdoor space.

Nice, boring properties make the best long-term rentals.

Financing That Matches Your Plan

Conventional loans with 20–25% down remain the workhorse for traditional rentals.

Portfolio lenders can be flexible on property quirks, and DSCR loans can qualify based on property income when W-2 income is complicated.

House hack with FHA or conventional if you can.

Live there a year, then convert and repeat the Nomad™ path to stack properties with lower down payments.

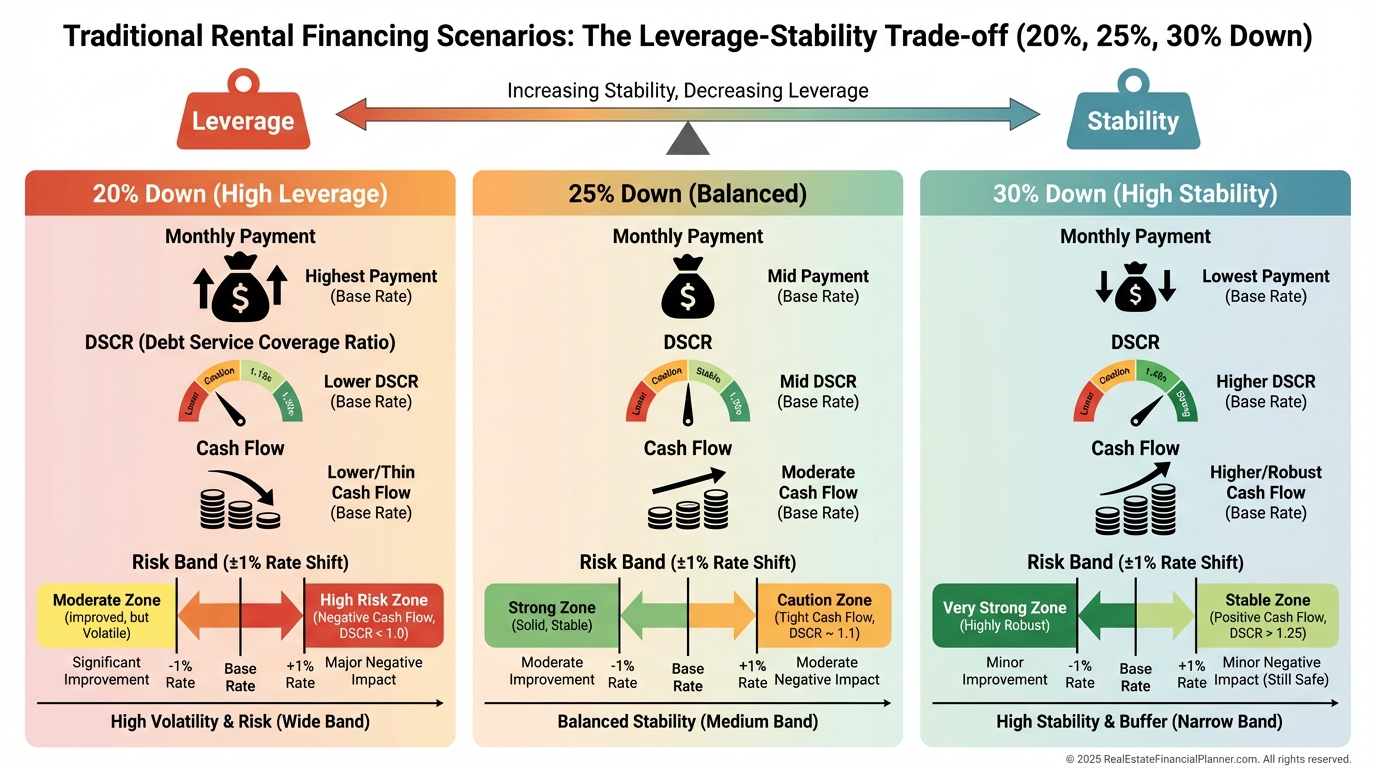

I test leverage scenarios in the spreadsheet.

Often, 25% down creates a safer DSCR and calmer cash flow than 20% down for only a slightly lower return on equity.

Set Up Like a Real Business

Carry proper landlord insurance and an umbrella policy, and separate banking from day one.

I create digital folders for leases, invoices, ledgers, and CapEx logs so tax time is a 30-minute task, not a month-long excavation.

Tenant Selection and Rent Strategy

Written criteria keep you compliant and consistent.

I verify income at 3x rent, pull credit looking for payment behavior, and call prior landlords to confirm notice given, balances paid, and property condition.

Price to minimize vacancy, not to win a $50 trophy.

One empty month erases a year of pushing rent too high.

If your unit outclasses comps with a garage, fenced yard, or in-unit laundry, bump rent a notch.

If the kitchen lags, price to move and plan a targeted upgrade between tenancies.

Manage or Hire: The Decision

Self-management teaches you the business fast, but it costs time and attention.

Good managers earn their fee with systems, vendor pricing power, and consistent collections.

I tell clients to self-manage until the opportunity cost of their time exceeds the management fee, or when distance and temperament dictate a pro.

Maintenance: Systems Prevent Surprises

Schedule seasonal tasks and budget for them.

I set aside 5–10% of rent for repairs and more for true CapEx like roofs, HVAC, and windows depending on age.

Build a bench of a plumber, electrician, handyman, HVAC tech, and a make-ready crew before you need them.

When something breaks, speed and clarity with tenants preserves both goodwill and NOI.

The Numbers That Matter

Track monthly cash flow, but decide with bigger lenses.

Cap rate helps compare assets.

Cash-on-cash reveals return on invested cash.

The Return Quadrants™ show the total engine of wealth: cash flow, appreciation, debt paydown, and taxes.

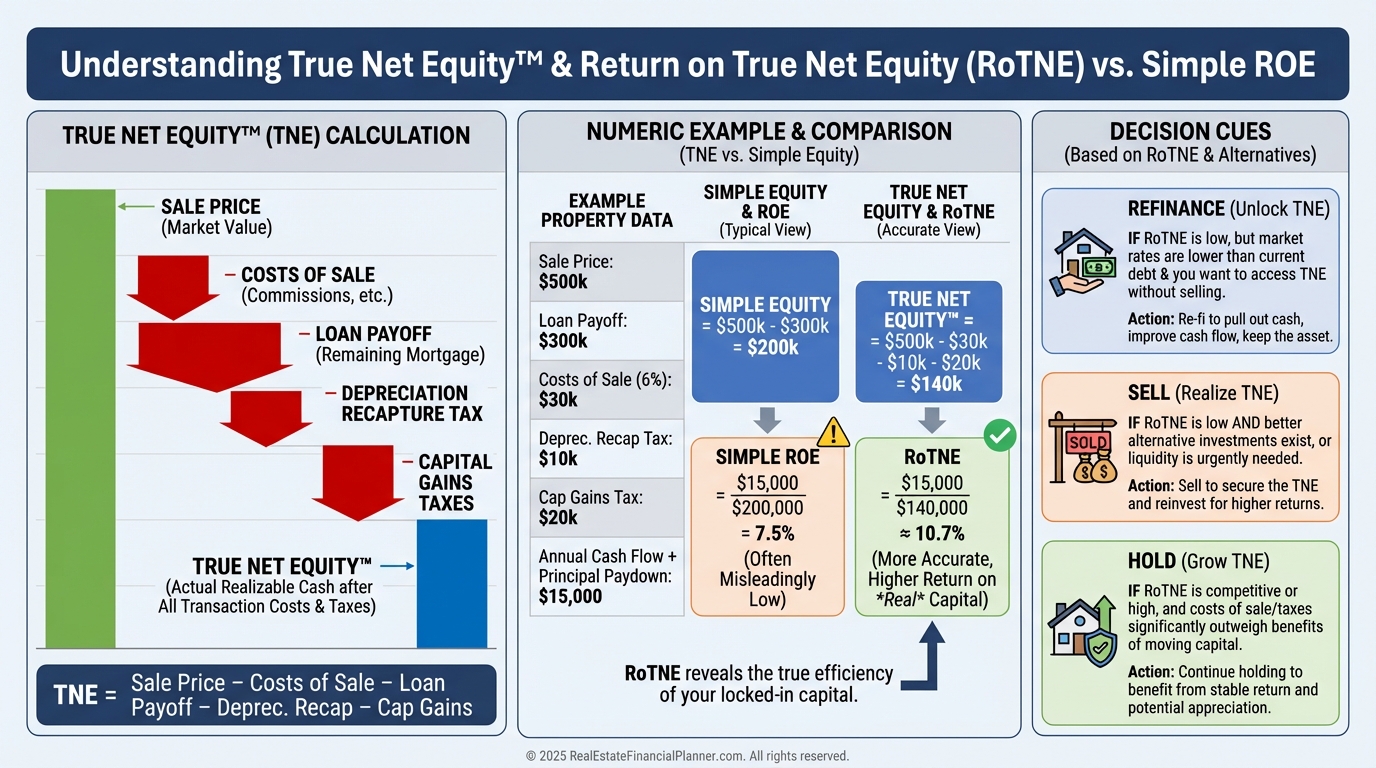

I also calculate True Net Equity™: the equity you could actually access after selling costs, payoff, depreciation recapture, and capital gains.

Then I compute Return on True Net Equity to see if a property is underperforming and should be refinanced or traded.

The World’s Greatest Real Estate Deal Analysis Spreadsheet™ handles these automatically so you’re not guessing.

Scale Without Losing Your Life

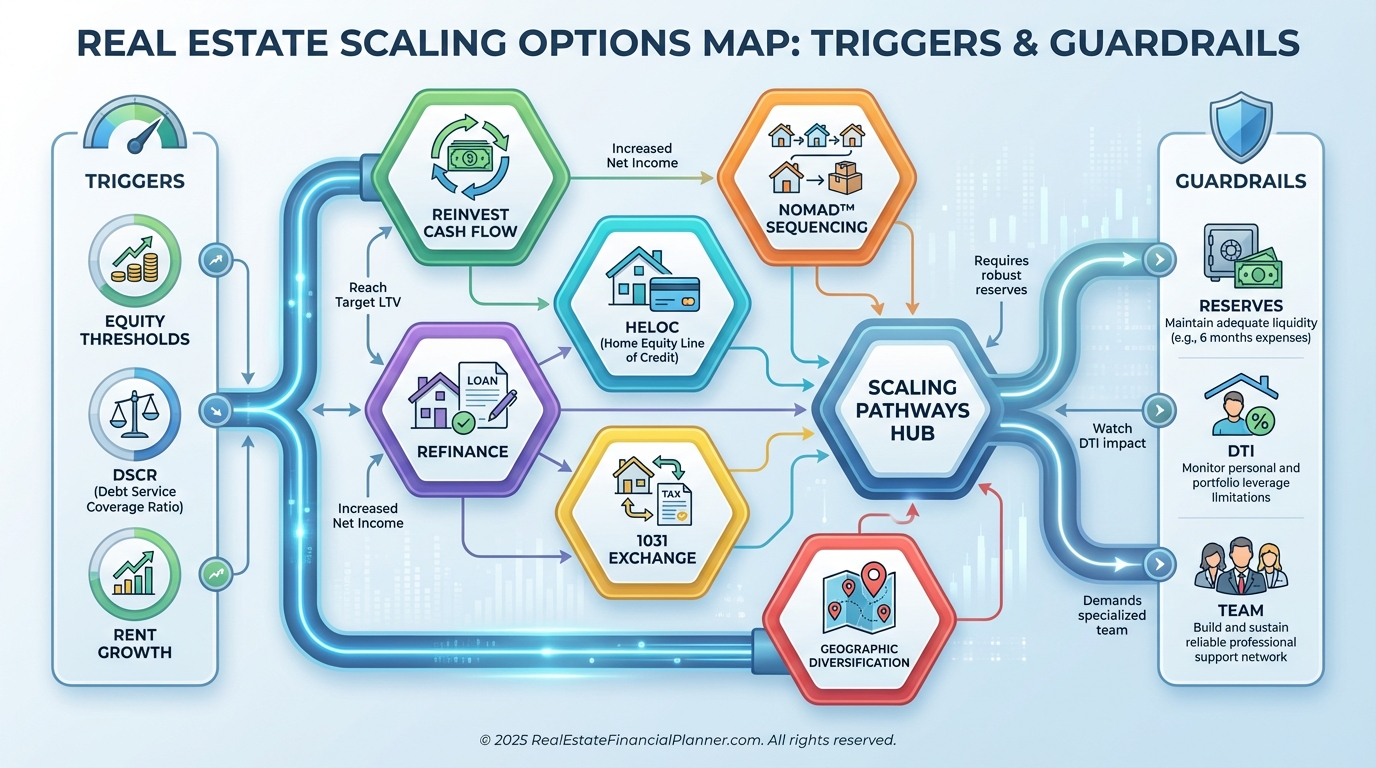

Reinvest cash flow, raise rents with the market, and harvest equity via rate-and-term refis or HELOCs when safe.

Diversify across submarkets and, later, regions to balance cash flow and appreciation.

Document processes for leasing, make-ready, renewals, and turns so your team can execute without you.

The Nomad™ approach remains my favorite for newer investors who want more doors with less cash while learning operations on training wheels.

When I help clients go from 1 to 10 doors, we expand only when each property runs smoothly for 6–12 months.

Next Steps

Pick one submarket, run rent comps, and analyze three properties in The World’s Greatest Real Estate Deal Analysis Spreadsheet™ this week.

Tighten your screening criteria, set your maintenance calendar, and choose self-manage or hire by a date on your calendar.

Traditional rentals are calm, compounding machines when you buy right and operate by system.

Start small, learn fast, and let time and the Return Quadrants™ do their work.