Tenant Buyers: How I Structure Rent‑to‑Own Deals for Cash Flow Today and Profitable Exits Tomorrow

Learn about Tenant Buyers for real estate investing.

Why Tenant-Buyers Change the Game

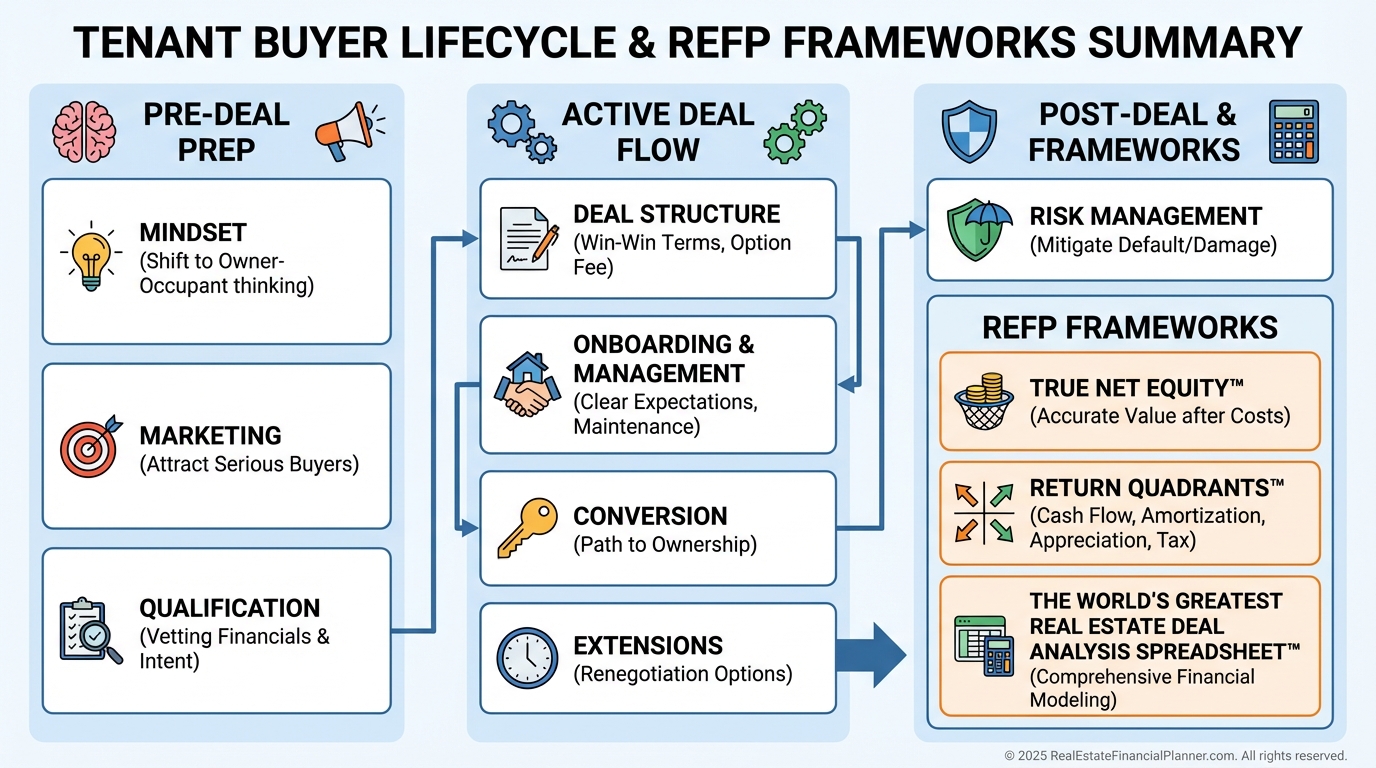

When I help clients transition from traditional rentals to lease-options, the first shift we make is mindset.

Tenant-buyers aren’t just renting; they’re rehearsing ownership.

They pay more, care more, and stay focused because they have a path to the deed.

I model these deals to deliver strong cash flow today and a high-probability exit tomorrow.

Done right, this is a win-win that compounds into referrals and repeatable systems.

The Mindset and Personas You Want

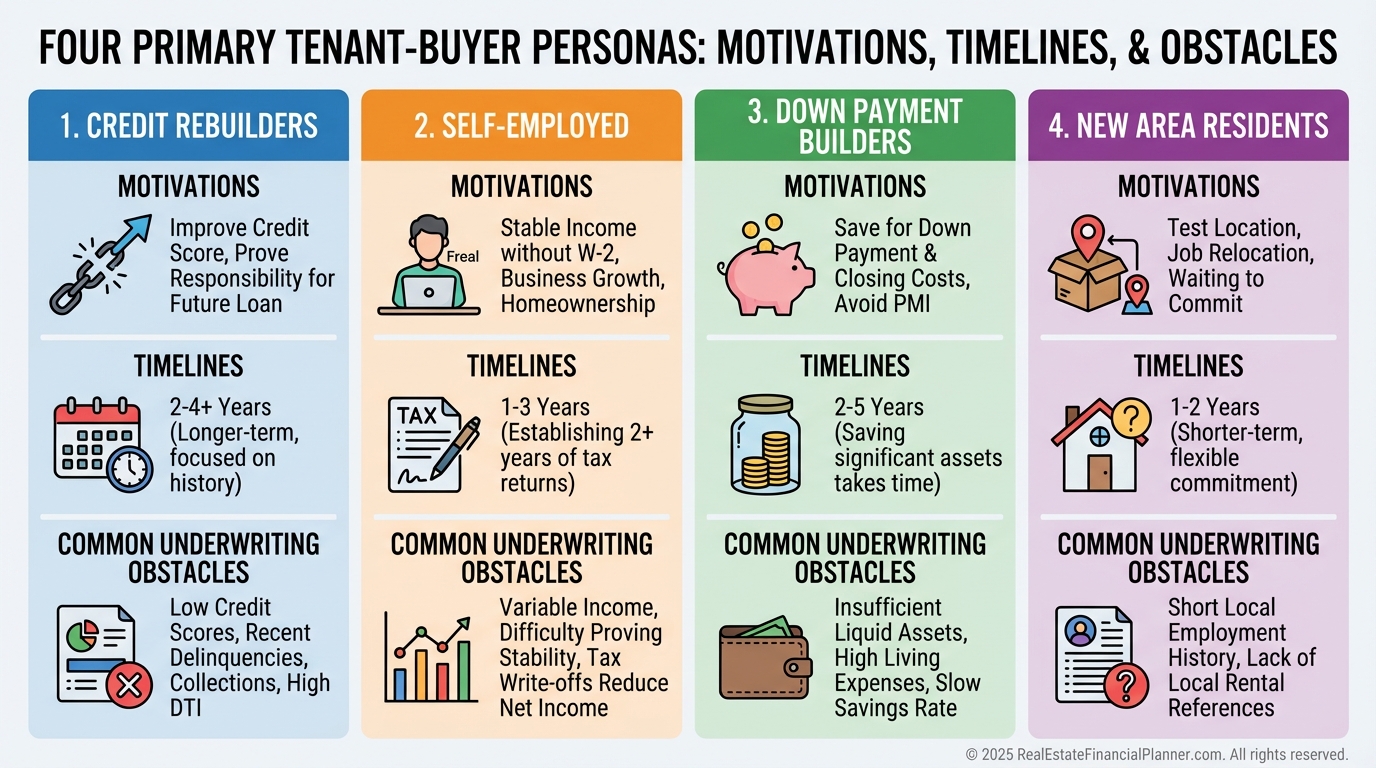

I look for people with stable income and a believable timeline to qualify.

Here are the four profiles that convert most consistently in my files.

•

Credit Rebuilders: Past hiccups, current stability, clear roadmap back to approval.

•

Self-Employed: Need time to season returns or document income cleanly.

•

Down Payment Builders: Strong borrower who needs months to stack cash.

•

New Area Residents: Relocating pros who want to lock price while building local history.

The best candidates ask about schools, plan improvements, and show early lender engagement.

I avoid anyone who treats the option fee like a deposit or wants “time” without a plan.

Marketing That Attracts Serious Tenant-Buyers

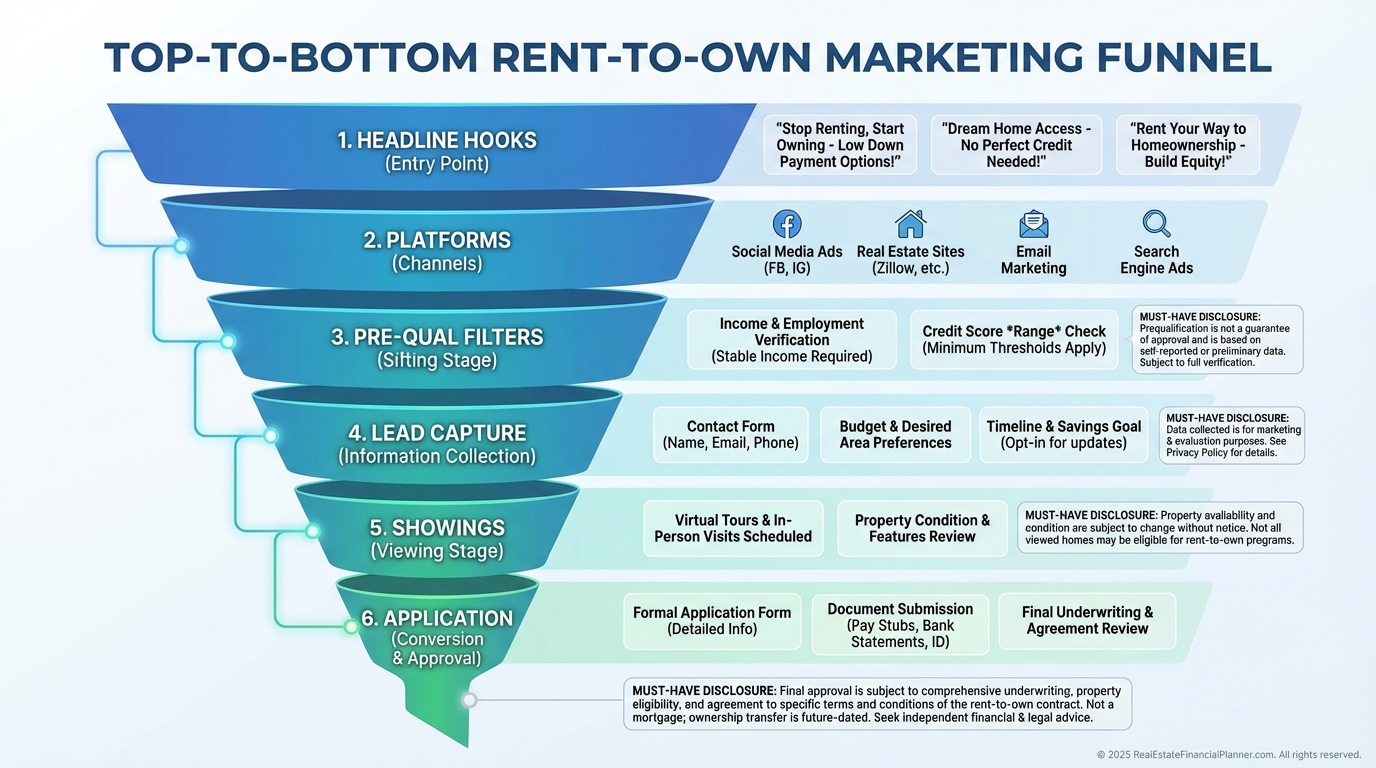

When I rebuilt after a business setback, I learned the value of clarity in marketing.

You’re selling a path to ownership, not a cheap rental.

Lead with benefits they can feel and numbers they can meet.

•

•

Message: Lock today’s price, build equity via credits, no bank approval needed now.

•

Filters: State option fee range and monthly payment upfront to pre-qualify.

Create scarcity by reminding prospects you only place one tenant-buyer per property.

It’s true, and it focuses the best applicants.

Qualifying for Today and Tomorrow

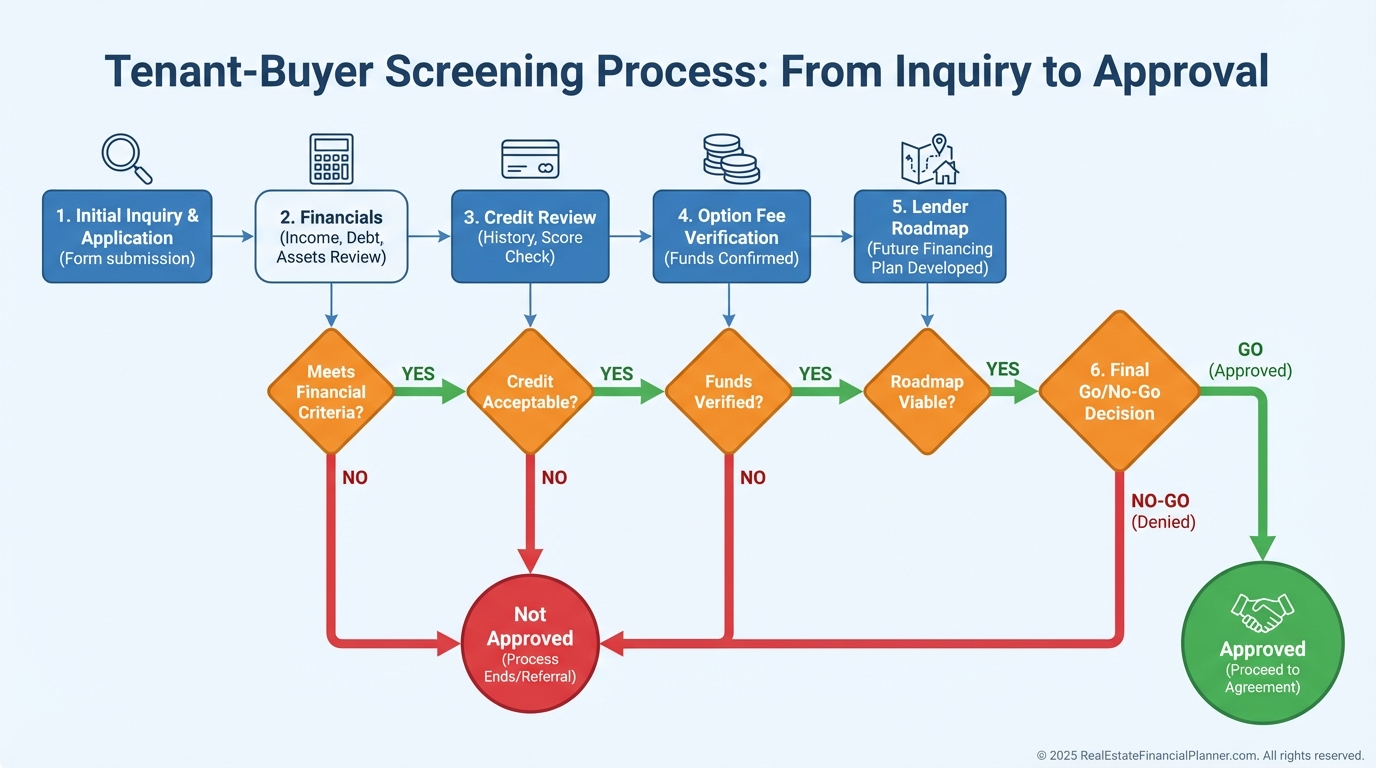

I screen tenant-buyers twice: can they pay today, and can they close tomorrow.

The second screen is where most investors miss.

•

Income: I verify at least 3.5x monthly rent, with stability and lender-acceptable sources.

•

Credit: I pull scores, identify hurdles, and map the timeline to mortgage-ready.

•

Commitment: I look for a plan, not promises—broker intro, credit action steps, savings automation.

Then I model the path in The World’s Greatest Real Estate Deal Analysis Spreadsheet™.

We set rent credits, track savings targets, and ensure the plan bridges the full down payment plus closing costs.

Structuring the Lease-Option for Profit and Performance

Great outcomes come from great structure.

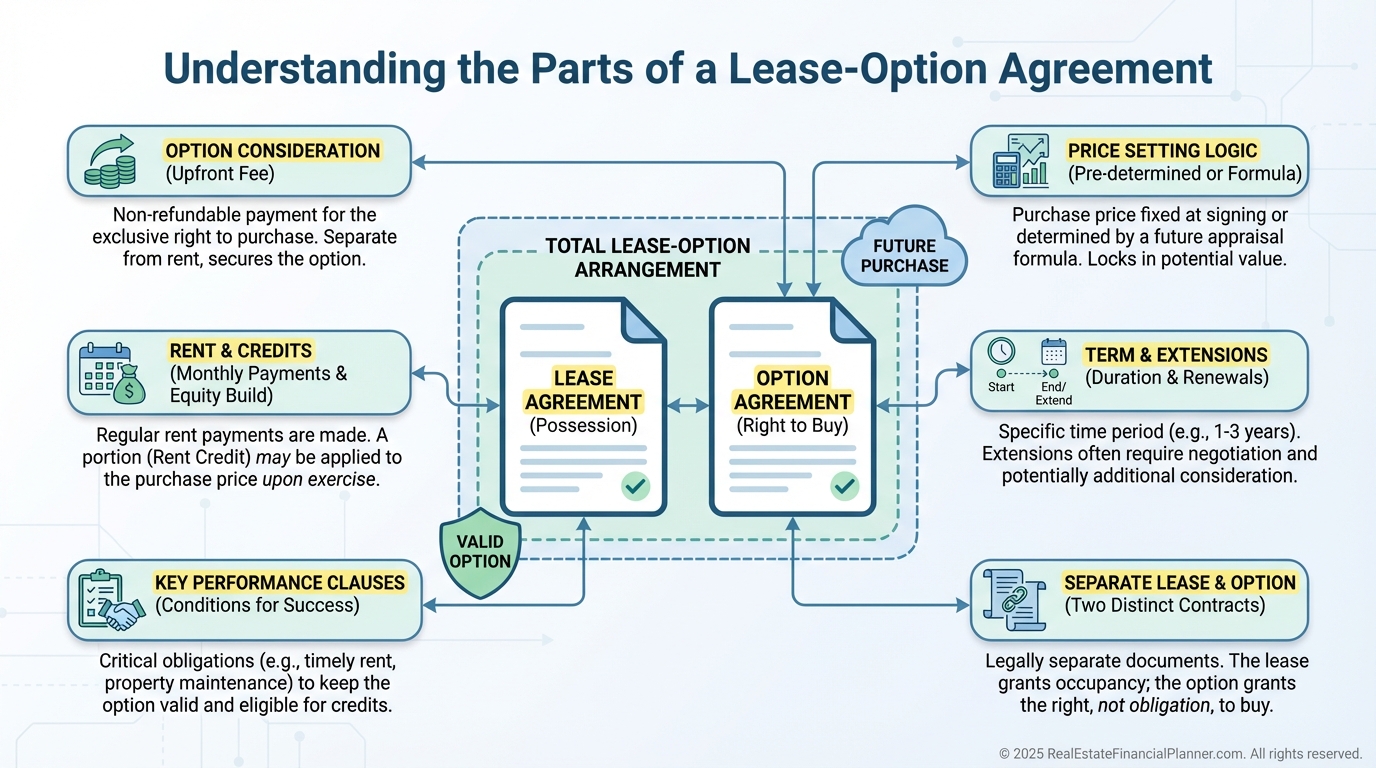

I separate the lease from the option to preserve landlord protections and clarify purchase rights.

•

Option Consideration: Usually 3–5% non-refundable, credited at closing, with higher amounts for premium homes or longer terms.

•

Purchase Price: Today’s value plus projected appreciation and risk premium, modeled in the Spreadsheet for sensitivity.

•

Rent and Credits: Rent 10–20% above market, with 25–40% credit tied to on-time payments only.

•

Term: 24–36 months with paid extensions, plus periodic lender check-ins.

I include performance standards for property care, prompt payment, and financing progress.

When appropriate, I add an acceleration clause that increases price if they need time beyond the initial term.

Using REFP Frameworks to Check the Math

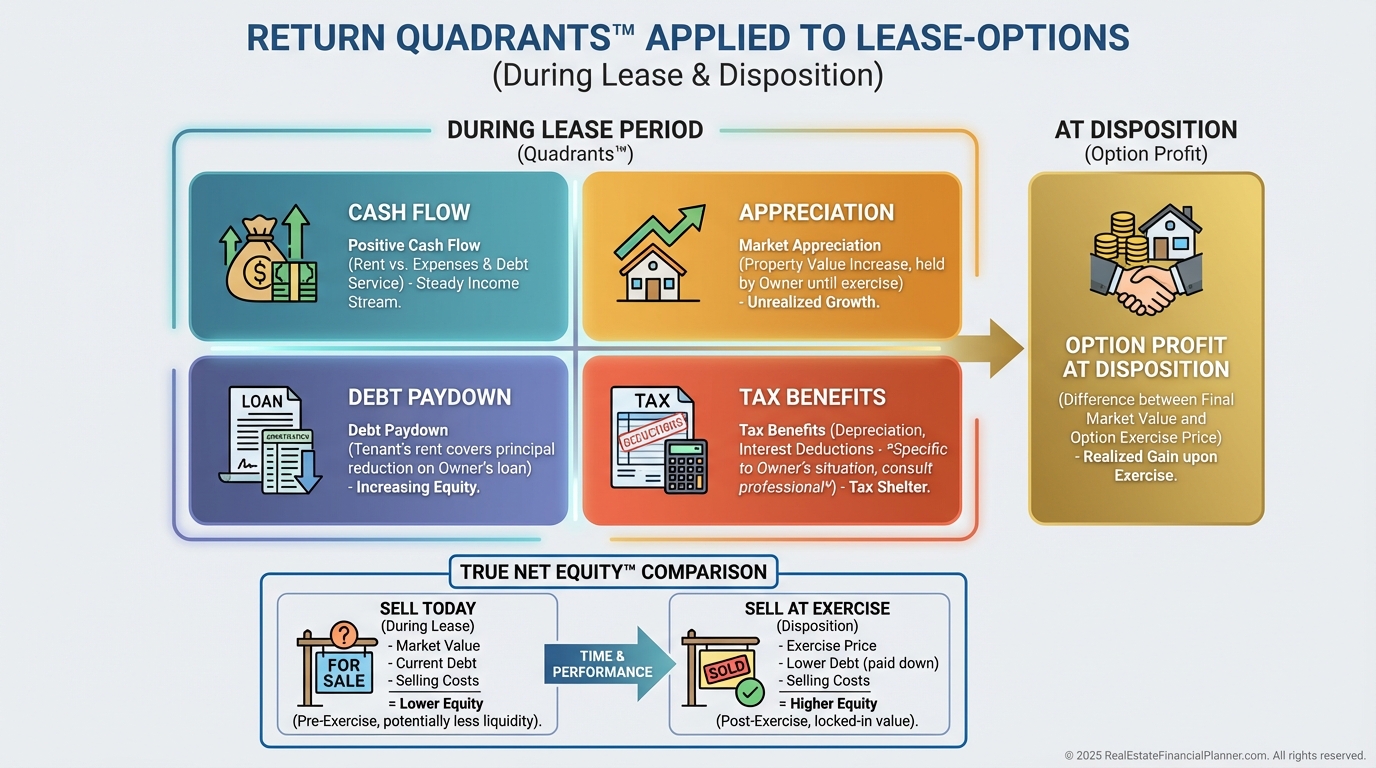

Before I sign, I run the Return Quadrants™ and True Net Equity™ snapshots at multiple points.

Return Quadrants™ shows my total return from cash flow, appreciation, debt paydown, and tax benefits across the lease term.

True Net Equity™ reminds me what I’d really net if I sold today versus at option exercise after costs, taxes, and credits.

I model best, base, and worst-case values so I’m compensated for time and risk even if the option extends.

And I sanity-check affordability using the lender’s projected ratios so the buyer can actually close.

Onboarding: The First 90 Days Decide Everything

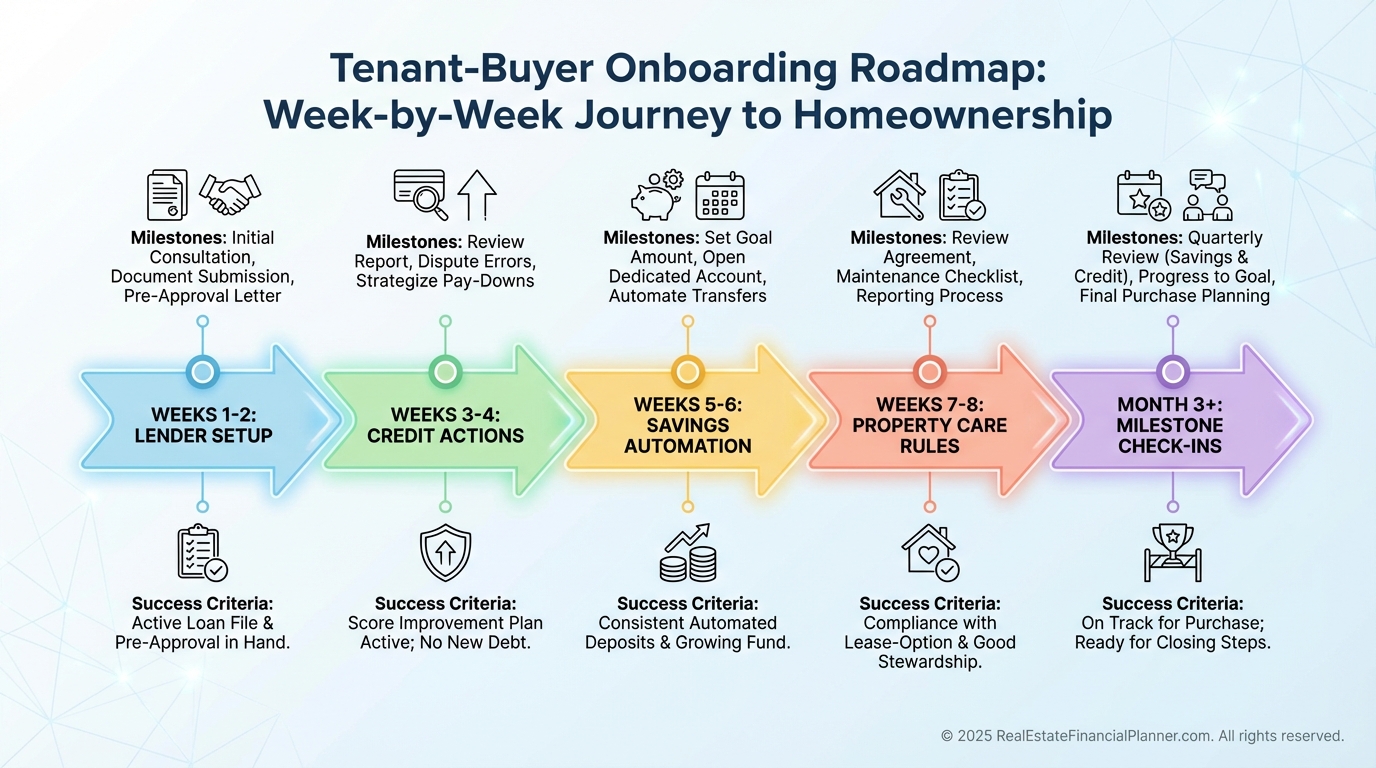

I treat onboarding like pre-approval boot camp.

We set expectations, timelines, and communication rhythms that keep momentum high.

•

Mortgage Prep: Broker intro in week one, document list started, and a readiness calendar.

•

Credit Plan: Specific actions, due dates, and monthly score checks.

•

Savings System: Automated deposits aligned with closing funds needed.

•

Property Care: What they can improve, which vendors to use, and what to call me for.

I deliver a welcome packet with timelines, contractor contacts, and the Spreadsheet printout showing their path to the closing table.

Then I schedule a 30-day review so no one drifts.

Managing Tenant-Buyers for Momentum

My management style shifts from rent collection to progress coaching.

We celebrate small wins so they stay engaged with the goal.

•

Quarterly lender check-ins and score pulls.

•

Tracking savings versus target and rent credit accumulation.

•

Approving value-add improvements and documenting sweat equity.

•

Monthly ownership tips and market updates to keep excitement high.

I also quantify their progress visually in the Spreadsheet.

A picture of growing equity beats another reminder email.

Converting Tenant-Buyers to Owners

Six months before expiry, I move from qualified to closed.

We gather docs, resolve credit noise, and get underwriting comfortable early.

I prepare the home for appraisal, document improvements, and provide comps that support price.

I use a title company that understands lease-options so every credit and fee lands exactly where it should.

And I make closing day memorable, because hard-earned ownership deserves a celebration.

When the Buyer Isn’t Ready Yet

Not every story ends on the original timeline.

What matters is how early we catch the gap and what options we provide.

I offer extensions for an additional option fee, with updated pricing that reflects market changes.

If needed, I may convert to a straight lease or help them relocate while preserving goodwill.

I document everything—check-ins, instructions, and missed milestones—so the file tells a clear, fair story.

Some who miss today become tomorrow’s best clients when their lives align.

A Quick Example to Tie It Together

On a $400,000 home, I might set a 3% option fee, rent at 15% above market, and a 36-month term.

Credits are 30% of rent for on-time payments, with a purchase price set at today’s value plus a reasonable appreciation factor.

Return Quadrants™ shows robust cash flow and debt paydown during the term, with option profit at exercise.

True Net Equity™ validates that, even after costs and credits, my net at closing exceeds my sell-today alternative.

That’s the bar I ask every deal to clear.

Final Notes from the Field

When I coach clients, I warn them not to shortcut screening, documentation, or math.

The right buyer, in the right home, on the right timeline, creates a low-drama, high-profit outcome.

Use The World’s Greatest Real Estate Deal Analysis Spreadsheet™ to illuminate the path for both sides.

Then lead like a guide, not a gatekeeper.

That’s how you create cash flow now and closings later—consistently.