Down Payments: The Hidden Lever That Controls Your Real Estate Returns

Learn about Down Payments for real estate investing.

Most investors think of down payments as a hurdle.

Something to get past so the “real investing” can begin.

When I help clients analyze deals, I see this misunderstanding constantly.

They ask, “How much do I need down?” instead of, “What should my down payment do for me?”

That distinction matters more than almost anything else in your investment plan.

When I rebuilt my portfolio after bankruptcy and foreclosure, I had limited capital and no margin for error.

Every down payment decision had to serve multiple purposes at once: control risk, preserve flexibility, and maximize future options.

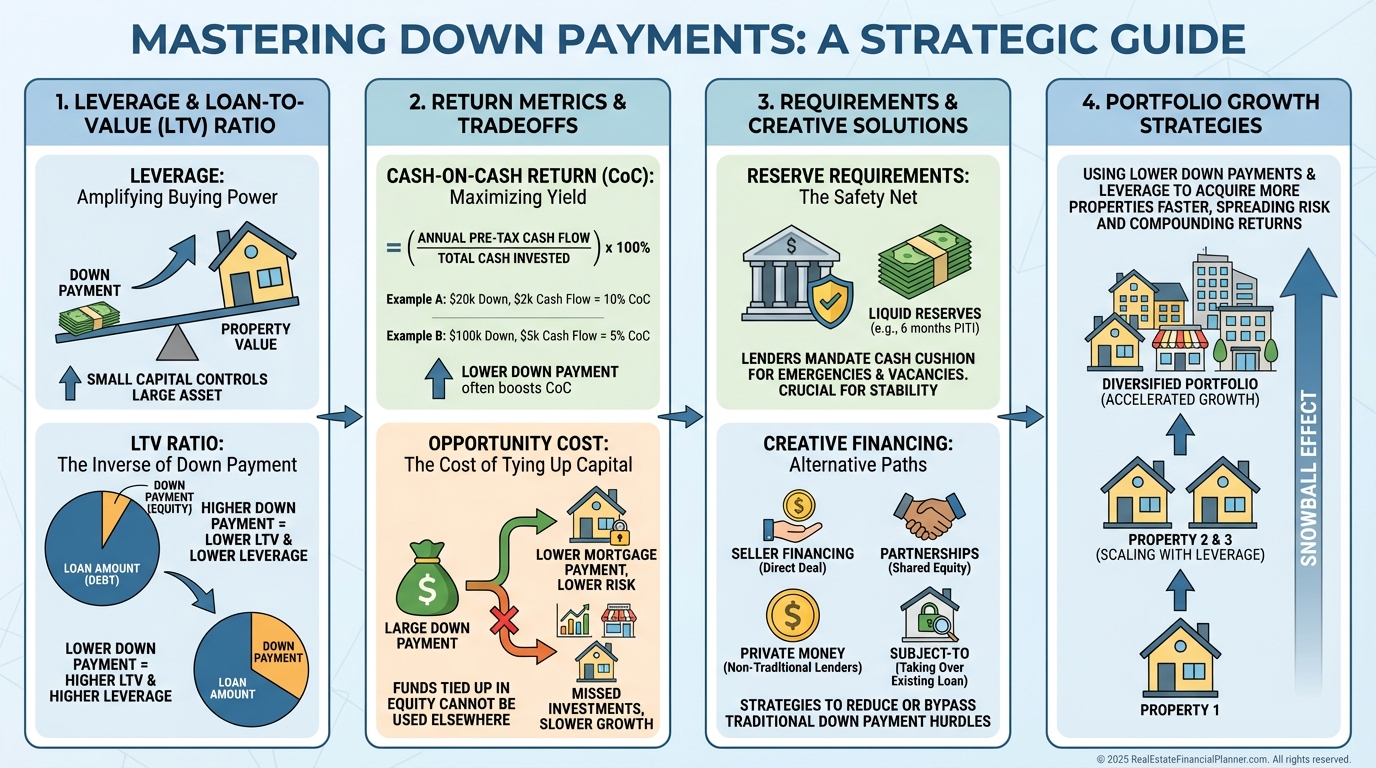

Down payments are not just cash to close.

They are one of the most powerful strategic levers you control as a real estate investor.

What a Down Payment Really Represents

A down payment is your initial equity contribution.

It determines how much leverage you use and how much risk you assume.

For investment properties, lenders usually require twenty to twenty-five percent down.

Owner-occupant loans can be far lower, but that difference reflects risk, not generosity.

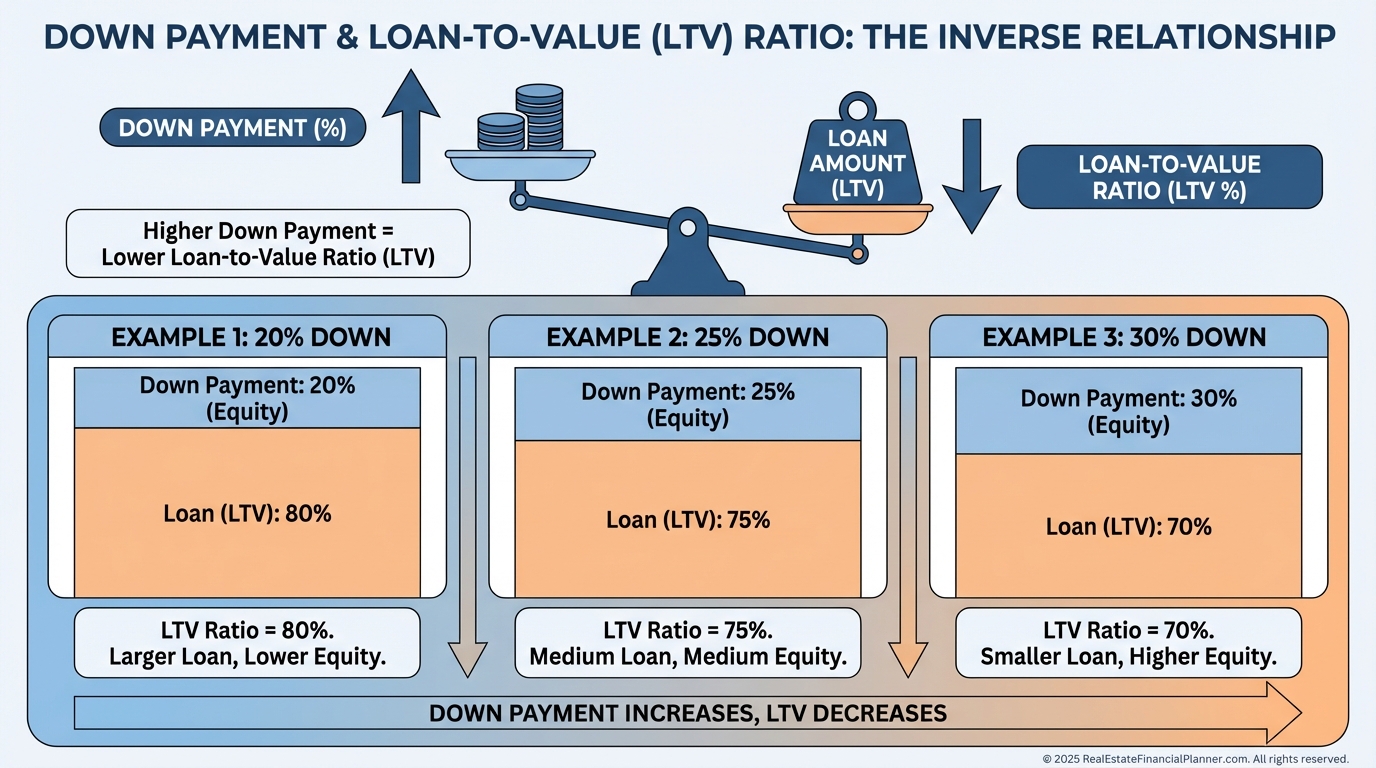

The key metric here is loan-to-value ratio.

A twenty-five percent down payment equals seventy-five percent loan-to-value, and that number quietly drives everything else.

Interest rates, approvals, reserve requirements, and lender comfort all flow from this ratio.

Small changes in down payment can unlock entirely different loan terms.

Why Investors and Homeowners Play by Different Rules

Lenders treat rental properties as businesses.

They expect volatility, vacancies, and management risk.

That is why investors face higher down payment requirements, stricter credit standards, and no private mortgage insurance workaround.

You must bring real equity to the table.

When clients push back on this, I remind them of something simple.

The lender is asking you to share the risk, not punishing you.

How Down Payments Reshape Your Returns

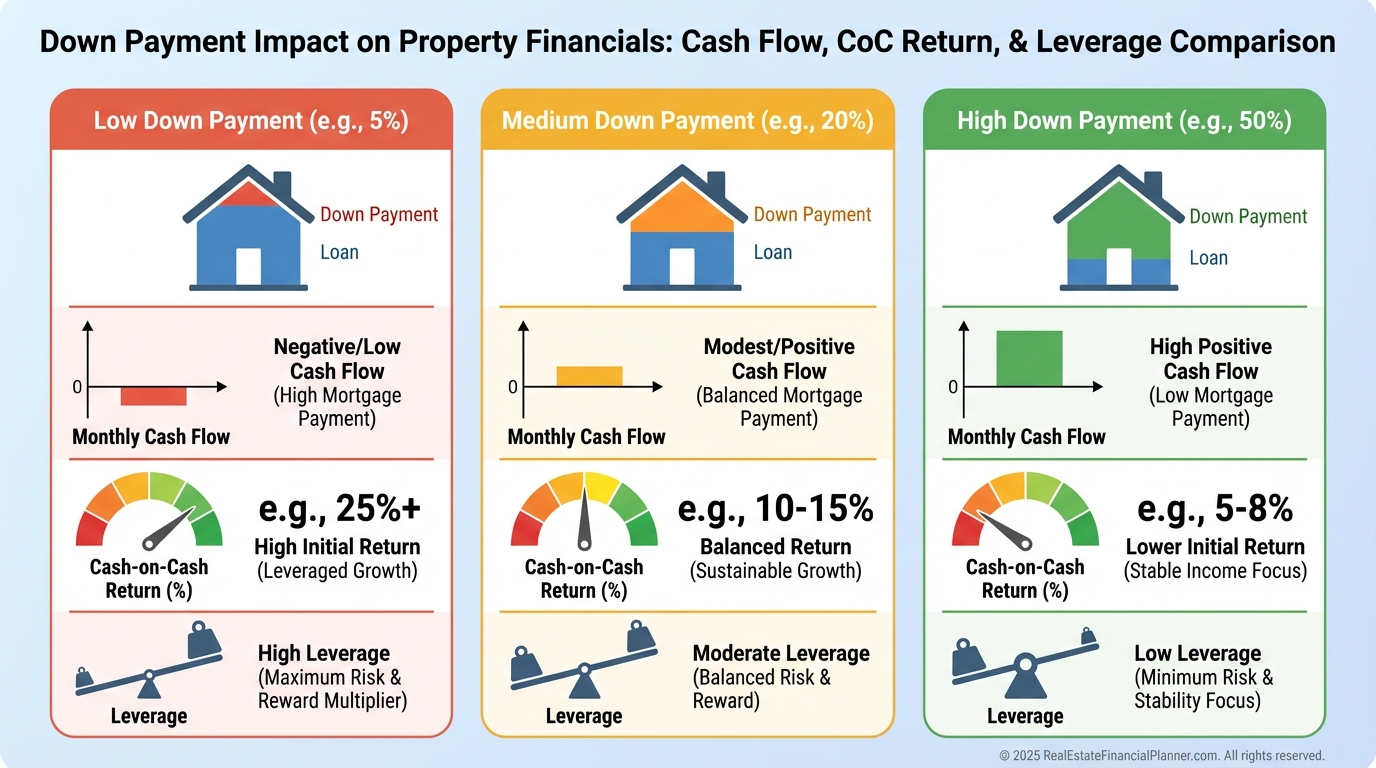

Every return metric responds to your down payment choice.

Cash flow improves as you put more money down, because debt service drops.

But your cash-on-cash return often declines at the same time.

This is where many investors make bad decisions.

They maximize cash flow without measuring opportunity cost.

In Real Estate Financial Planner™ software, I always model multiple down payment scenarios.

Not to find the “best” number, but to expose tradeoffs.

A higher down payment often feels safer.

But safety is not free, and it is not always optimal.

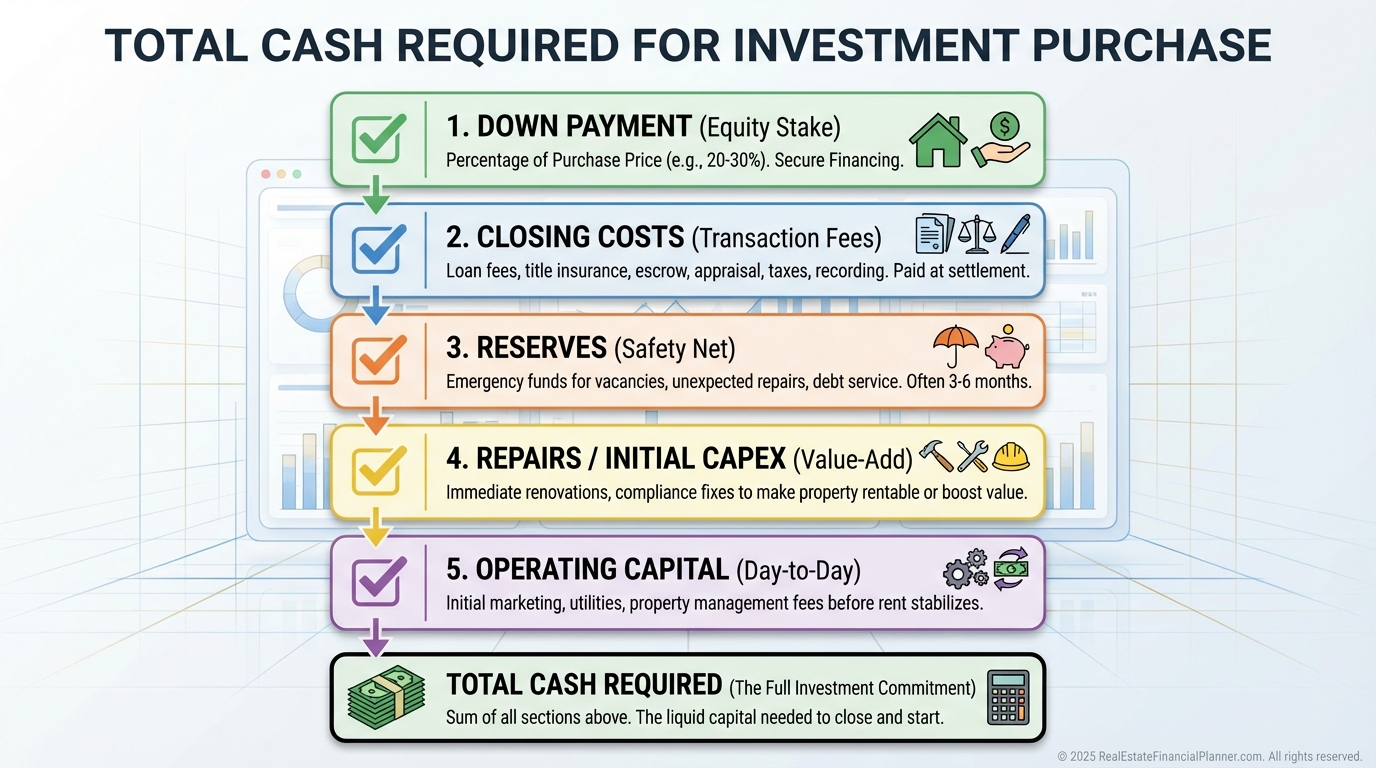

The True Cash Requirement Most Investors Miss

The down payment is only part of the capital story.

Then come closing costs, immediate repairs, and operating cushions.

Miss any of these, and the deal collapses late in the process.

When I review deals with clients, we always calculate total cash exposure first.

Only then do we decide how aggressive or conservative the down payment should be.

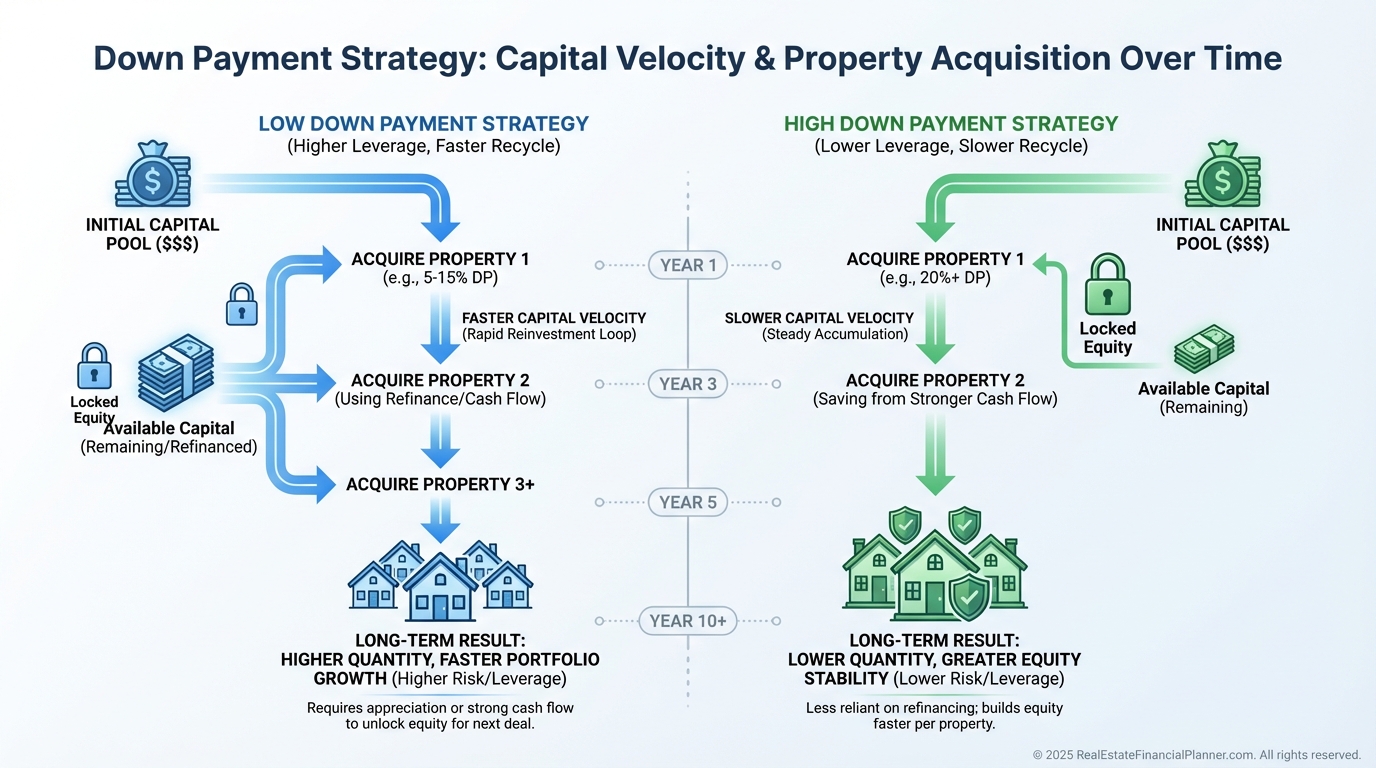

Down Payments and Capital Velocity

Portfolio growth is not just about returns.

It is about how quickly capital can move.

If all your money is locked in one property, growth slows.

If it is spread efficiently, options expand.

This is why I care about capital velocity as much as cap rates.

Down payments directly determine how many doors you can control per dollar.

Sophisticated investors do not ask, “What is the minimum down?”

They ask, “What allocation produces the best long-term outcome?”

Financing Thresholds That Quietly Matter

Most lenders price risk in tiers.

Twenty percent, twenty-five percent, thirty percent, and above.

Crossing one of these thresholds can reduce rates, increase flexibility, or unlock new programs.

Missing them can cost tens of thousands over time.

This is why I never guess on down payments.

I check actual lender rate sheets and model the difference.

The Mistakes I See Most Often

I see investors over-leverage early and panic later.

I see others over-capitalize and stall their portfolios.

I see people forget reserves and lose deals days before closing.

And I see many ignore creative financing because they assume conventional loans are the only path.

The biggest mistake is treating all deals the same.

Stabilized rentals and value-add properties deserve different down payment strategies.

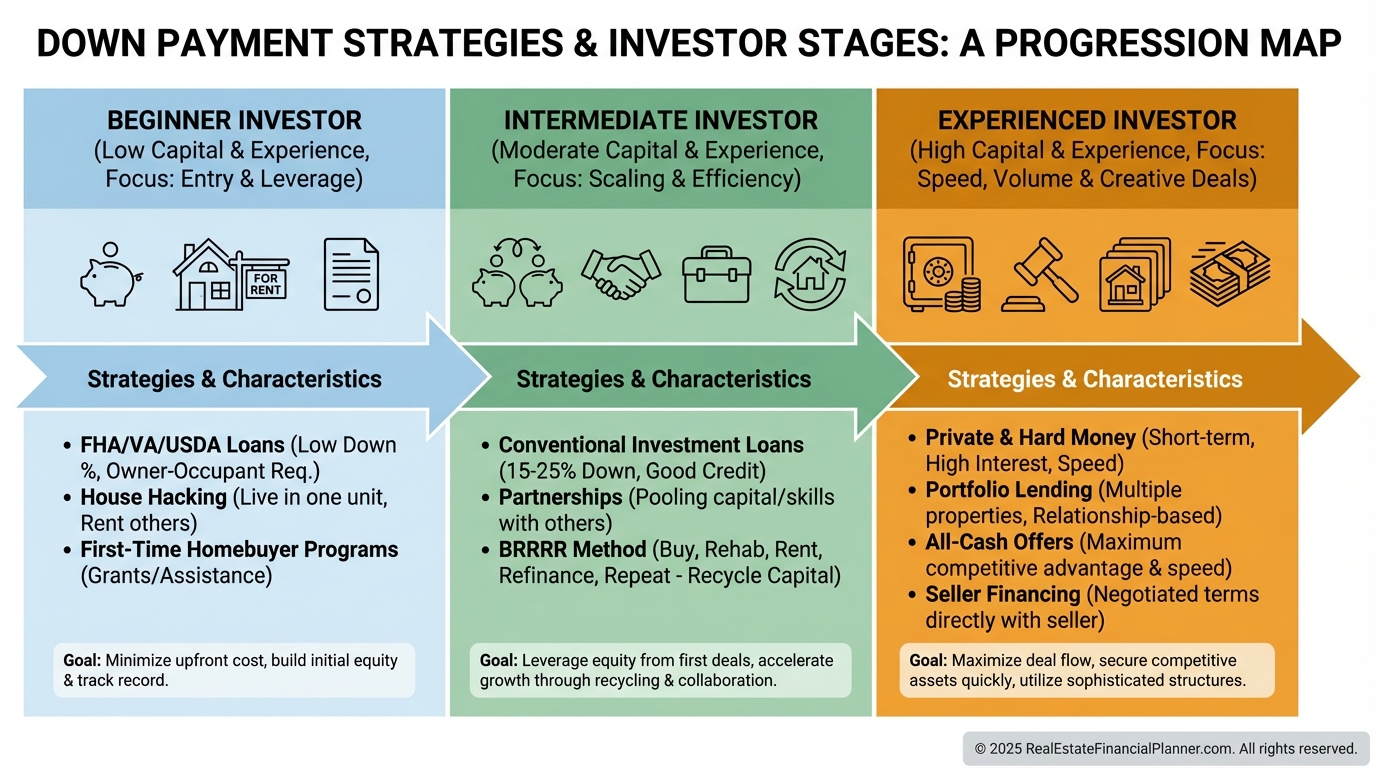

How Strategy Changes as You Grow

Early on, preserving flexibility matters more than optimization.

Later, stability and efficiency take priority.

Nomad™ strategies, partnerships, and creative financing can reduce early down payment pressure.

Portfolio lending and commercial financing expand options later.

No single down payment strategy works forever.

Good investors evolve.

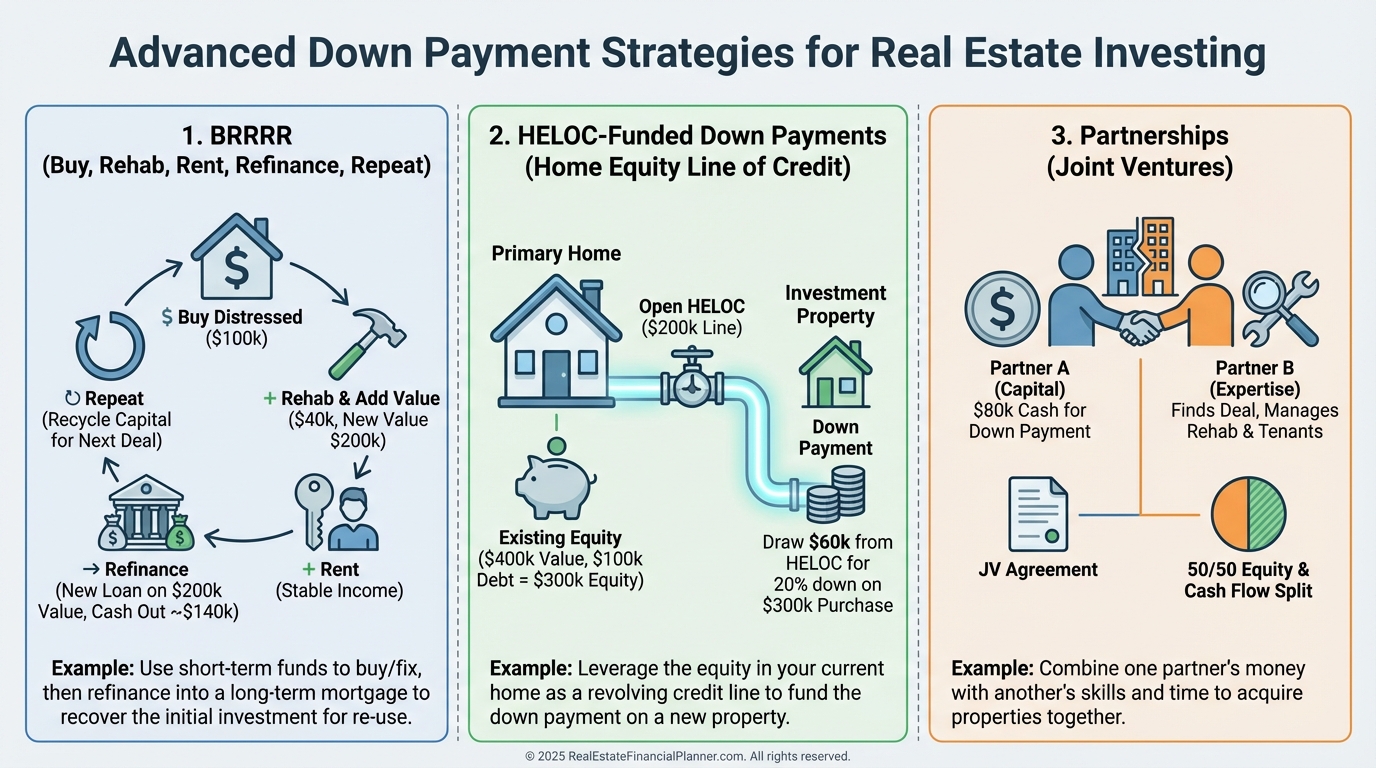

Advanced Uses Most Investors Underestimate

BRRRR turns down payments into temporary tools.

HELOCs turn trapped equity into flexible capital.

Partnerships turn limited cash into scalable control.

Each approach changes how down payments behave inside a portfolio.

These strategies require discipline and modeling.

But used correctly, they radically change what is possible.

Exit Strategy Starts on Day One

Down payments influence future refinances, equity access, and 1031 exchanges.

Minimal equity limits options, while excess equity may sit idle.

When I analyze exits, I look at True Net Equity™.

Not just gross value, but what is actually accessible.

That calculation often changes how much down makes sense at acquisition.

A Practical Action Plan

Stop asking what down payment is required.

Start asking what outcome you want.

Calculate total available capital, not just cash in the bank.

Model multiple scenarios using cash flow, return, and opportunity cost.

Use tools that show you the full picture, not just the payment.

And remember this: down payments are not obstacles.

They are decisions.

And decisions compound.