Sole Proprietorships in Real Estate: The Simple Way to Start (and Exactly When to Switch)

Learn about Sole Proprietorships for real estate investing.

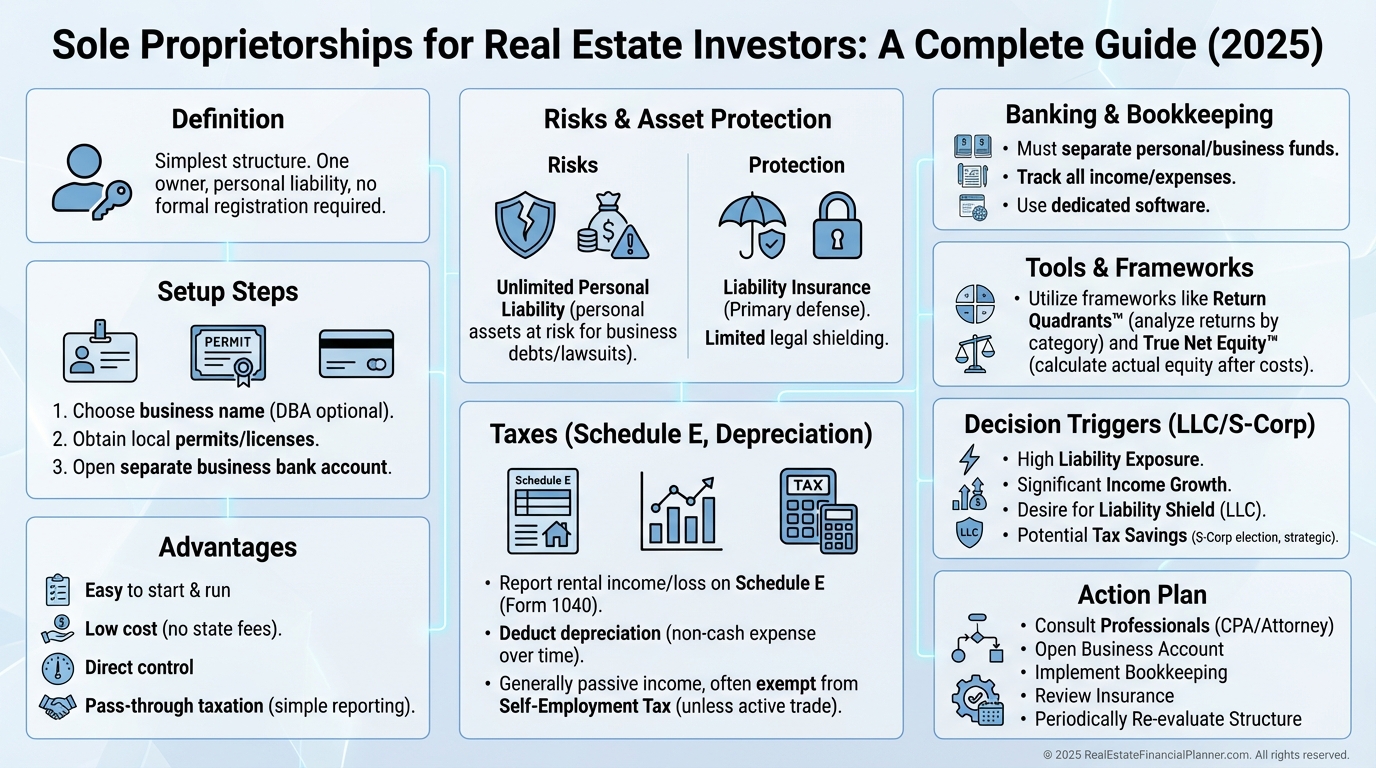

Why Start as a Sole Proprietor

When I help new investors get their first rental, I don’t let entity decisions stall the purchase if a simple, safe path exists.

A sole proprietorship gives you that path: fast setup, low cost, and straightforward taxes so you can focus on buying a great deal.

When I rebuilt after bankruptcy, I used a sole proprietorship for my first two rentals while over-insuring and modeling my downside.

That combination—simplicity plus disciplined risk controls—works for many first-time investors.

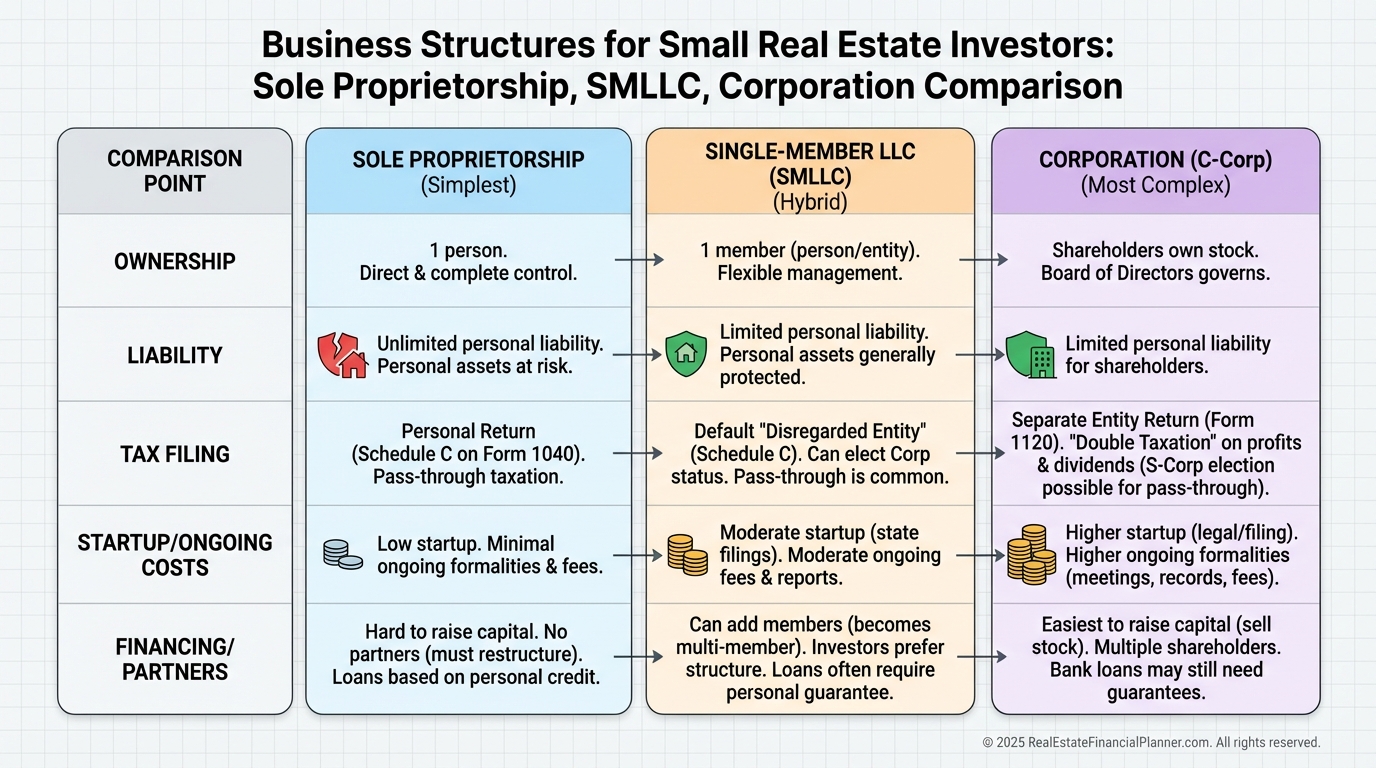

What a Sole Proprietorship Is (and Isn’t)

If you collect rent without forming an entity, you are likely operating as a sole proprietor.

There is no legal separation between you and the business, which is both the feature and the risk.

You get full control, pass-through tax reporting, and no state formation hassle.

You also accept unlimited personal liability for business debts and claims.

Advantages You Can Use Immediately

Sole proprietorships shine for speed, cost, and control.

Here’s what my clients value most on day one:

•

Zero formation delay and minimal cost, so capital stays in the deal.

•

Tax simplicity with Schedule E reporting and no separate business return.

•

•

Easy migration later to an LLC when the math justifies the change.

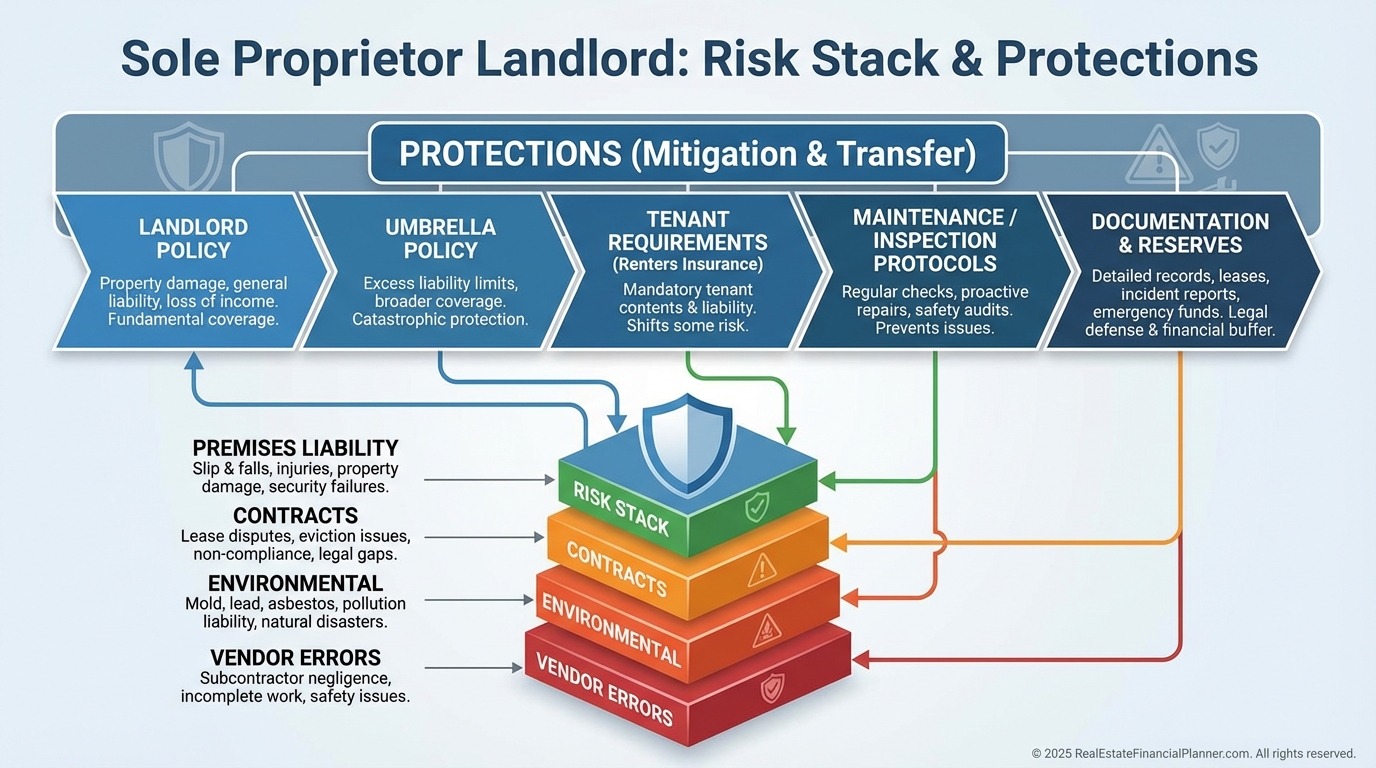

The Risks You Must Neutralize

Unlimited liability is the big one.

If a claim exceeds insurance limits, your personal assets are exposed.

You’ll face partnership constraints, occasional lender skepticism, and no automatic business continuity if you’re incapacitated.

We counter these with insurance layers, operational discipline, and clean documentation.

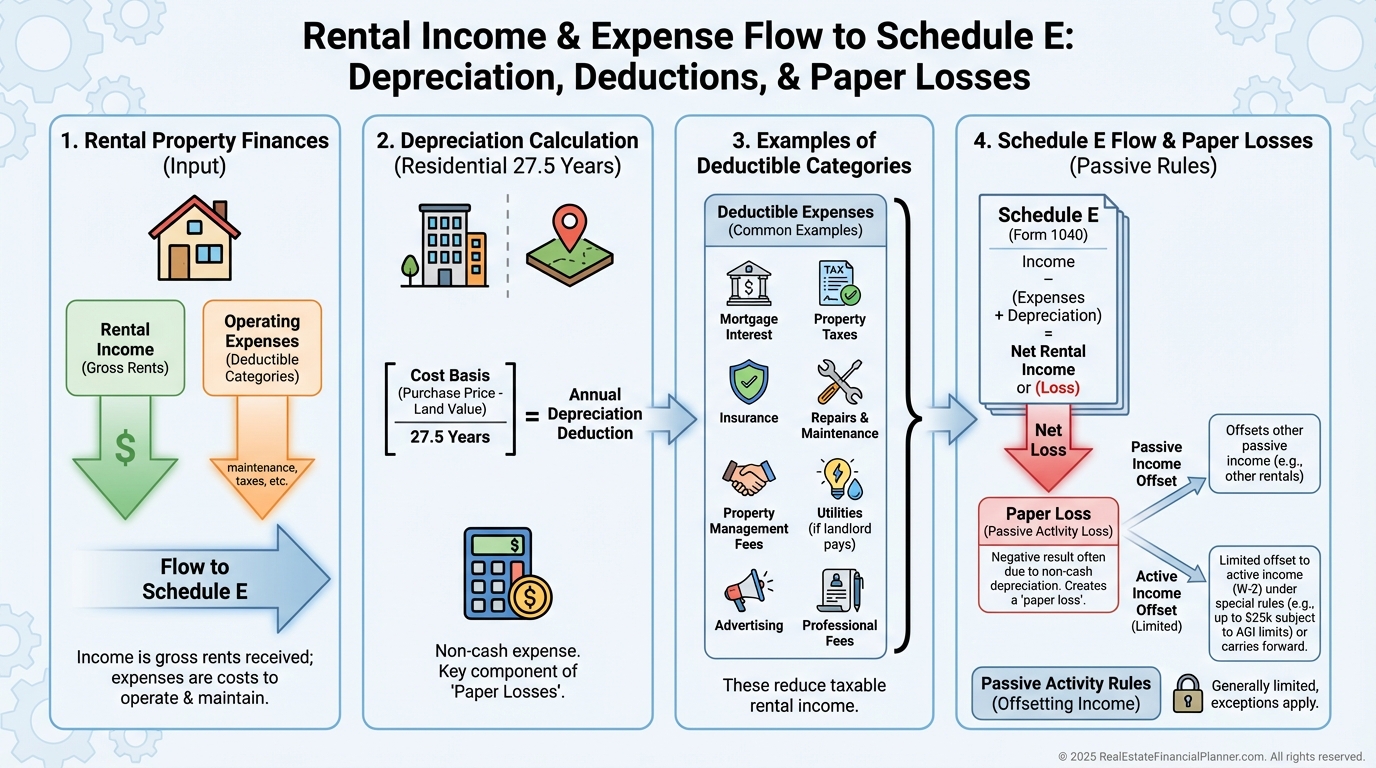

Taxes Made Straightforward

Your rentals typically flow to Schedule E on your personal tax return.

Depreciation on residential rentals over 27.5 years is often the biggest tax benefit.

Track mortgage interest, taxes, insurance, repairs, management, travel, and professional fees.

Be mindful of passive activity rules; most investors must treat rental losses as passive unless they meet specific tests.

I coach clients to set quarterly estimated tax reminders if they expect to owe $1,000 or more.

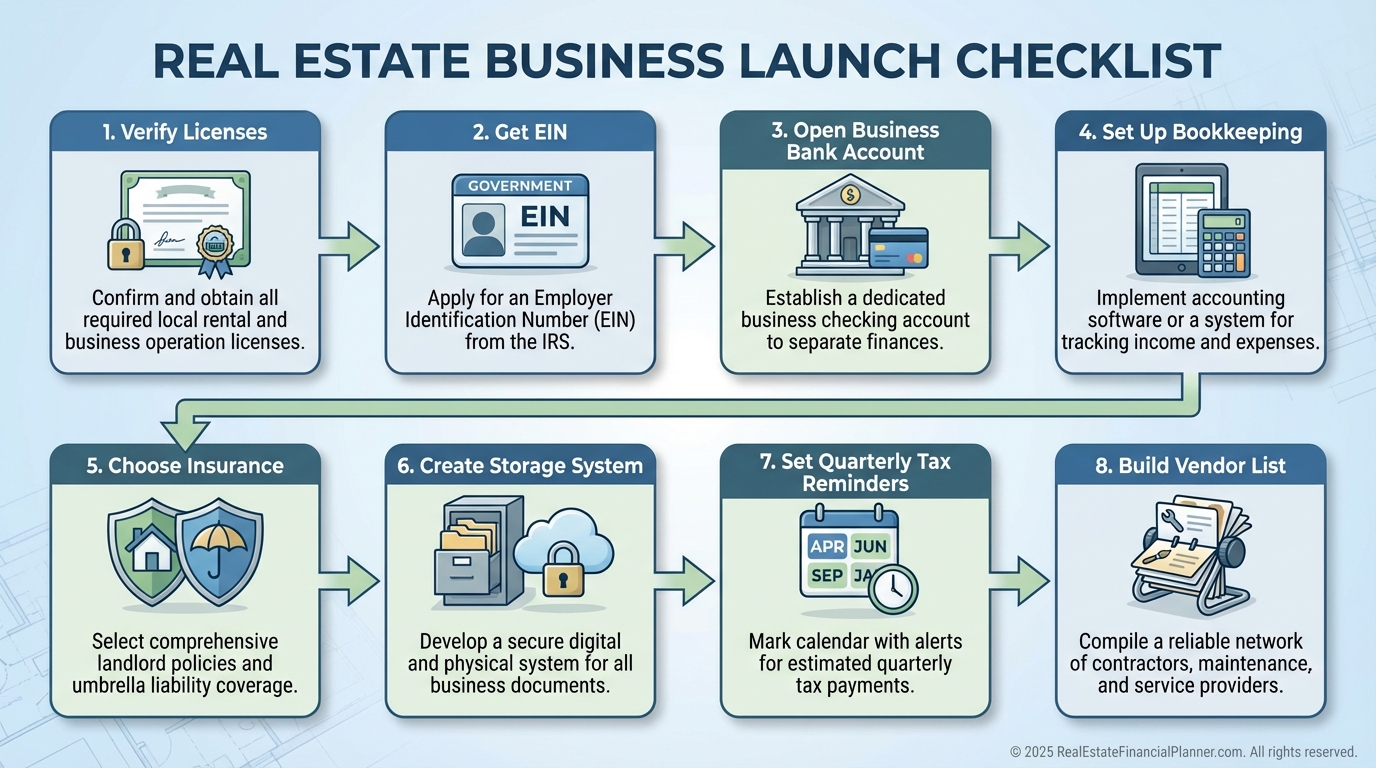

Getting Set Up in 60–90 Minutes

I walk clients through a quick setup that feels professional from day one.

Start with local business licensing, then get an IRS EIN—even if you have no employees—for privacy and vendor forms.

Open a dedicated checking account for rent and expenses.

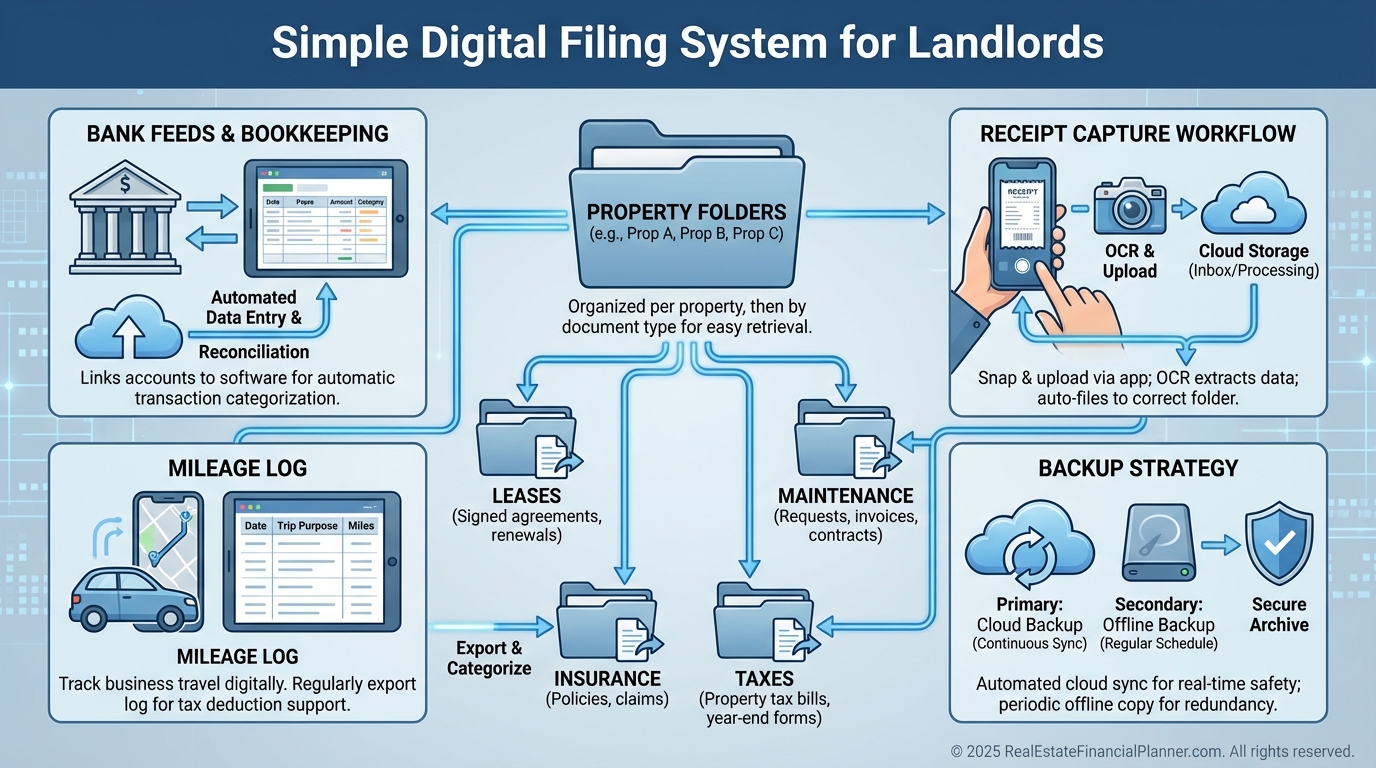

Choose simple bookkeeping now; sophistication can grow with your portfolio.

Secure landlord insurance before a tenant moves in, and price an umbrella policy of $2–5M.

Protecting Personal Assets Without an LLC

Insurance is your first line of defense.

I recommend robust landlord coverage, plus a multi-million-dollar umbrella for serious peace of mind.

Require tenants to carry renters insurance with liability coverage.

Run thorough screening, perform documented inspections, and fix hazards quickly.

Write everything down—leases, notices, work orders, tenant interactions.

Those records win disputes and calm insurers.

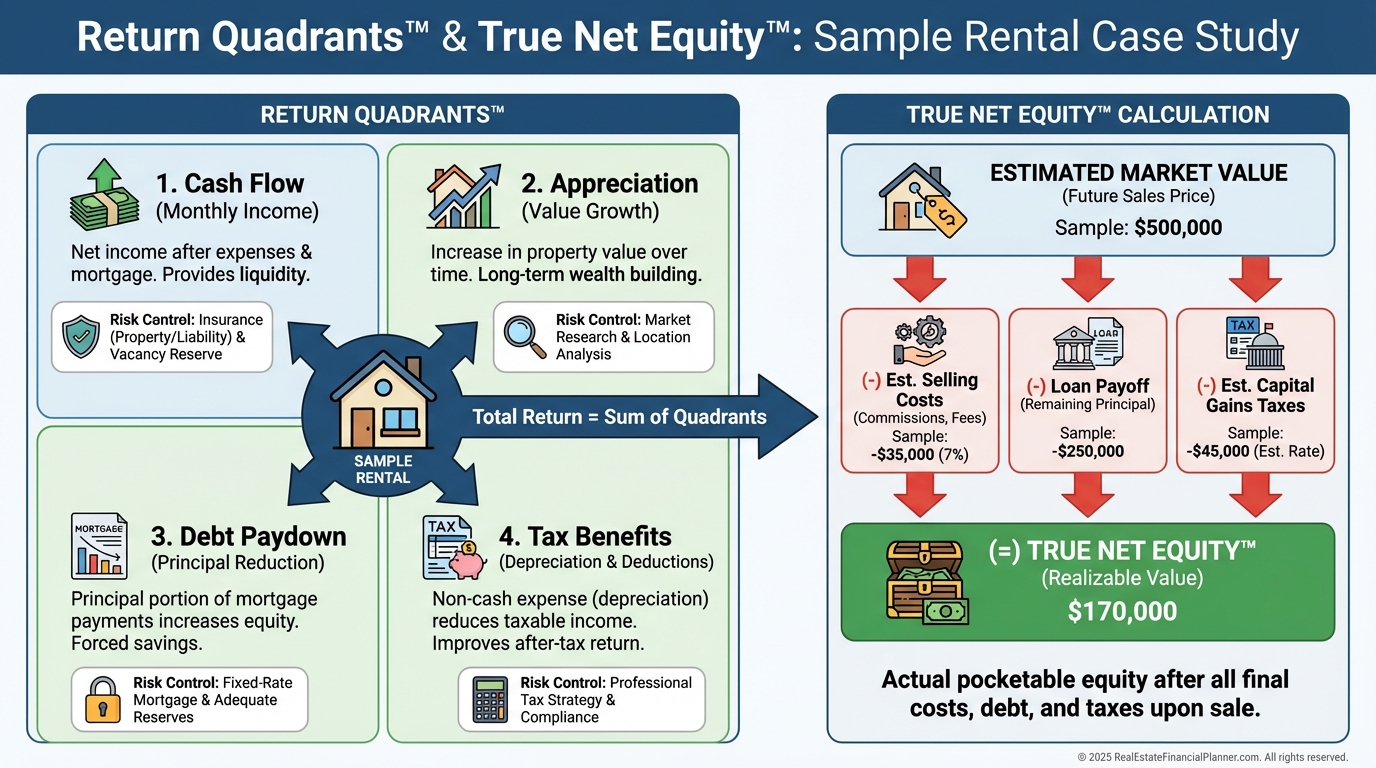

Modeling the Money with Return Quadrants™

Before you decide on structure, model the deal.

I break every acquisition into the Return Quadrants™: cash flow, appreciation, debt paydown, and tax benefits.

Then I measure True Net Equity™—the equity you could actually walk away with net of selling costs and taxes.

If the returns are strong and the risk is insured, a sole proprietorship often makes sense for the first property or two.

When those quadrants grow and your True Net Equity™ crosses your comfort threshold, it’s time to revisit an LLC.

Tools I Trust for Sole Proprietors

Use The World’s Greatest Real Estate Deal Analysis Spreadsheet™ to evaluate acquisitions and see after-tax returns.

Pair it with the RealEstateFinancialPlanner.com software to project Return Quadrants™ and True Net Equity™ over time.

For bookkeeping, pick Stessa or QuickBooks and connect your dedicated bank account.

Property management platforms like Avail or TurboTenant keep leasing, screening, and payments consistent.

Cloud storage such as Google Drive or Dropbox keeps every lease, insurance page, and receipt accessible.

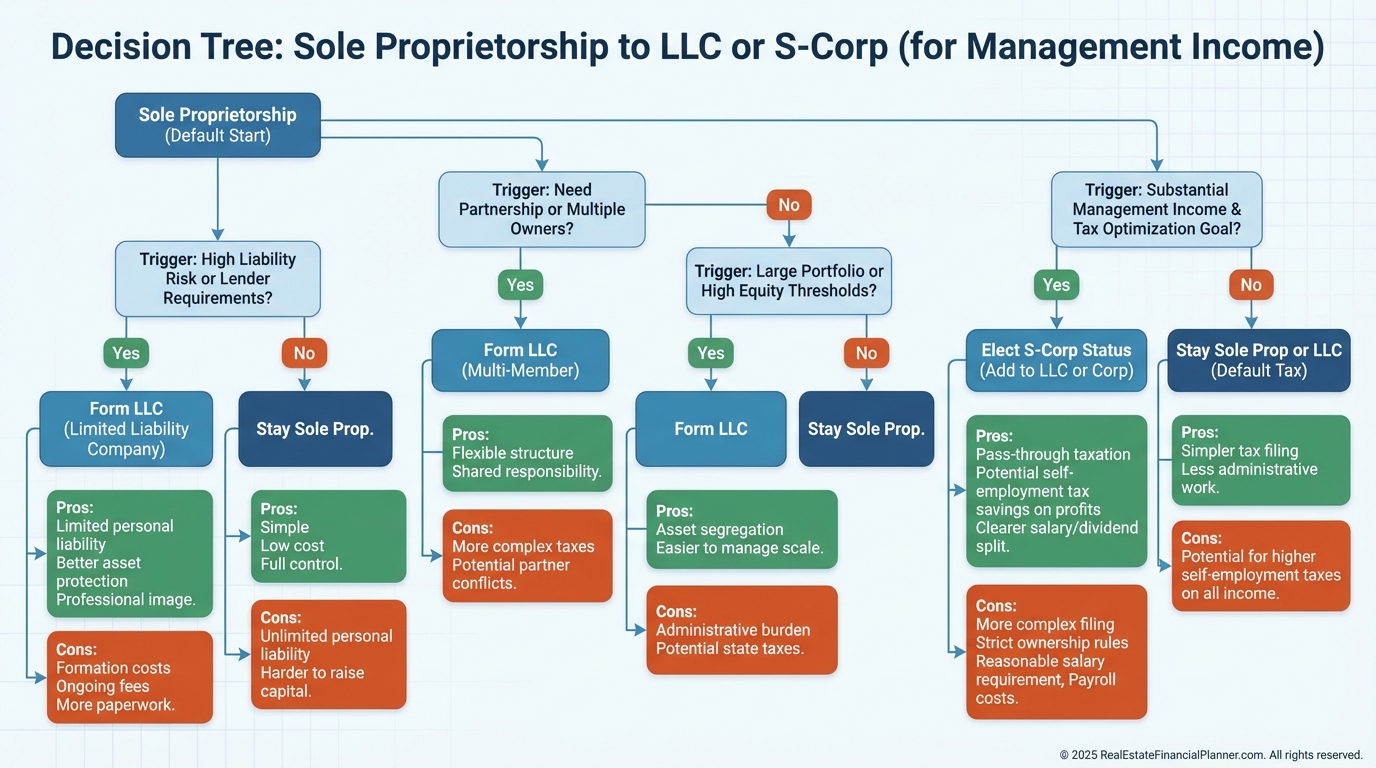

When to Consider Another Structure

I set clear tripwires so the decision isn’t emotional.

Common triggers include owning 3–5 doors, total equity above $500,000, a close call or actual claim, adding partners, or lender requirements.

If you start a separate property management business with meaningful income, an S-corp for the management income may reduce self-employment taxes.

Special Case: House Hacking and Nomad™

If you’re doing Nomad™—buying as an owner-occupant, living in the property, then converting to a rental—keep it simple at purchase.

Your owner-occupant loan terms are favorable, and you can decide on entity structure later when you move out.

I still recommend the same insurance, documentation, and bookkeeping discipline from day one.

Clarity now prevents messy conversions later.

Common Mistakes I See (and How to Avoid Them)

•

Waiting to buy until the “perfect” entity is formed.

•

Commingling funds instead of using a dedicated account.

•

Underinsuring liability or skipping umbrella coverage.

•

Poor documentation of repairs, inspections, and tenant communications.

•

Ignoring passive activity rules and missing quarterly tax payments.

A little structure up front saves money and stress later.

A Simple Action Plan

•

Run your next deal through Return Quadrants™ and estimate True Net Equity™.

•

Get your licenses, EIN, bank account, bookkeeping, and insurance squared away.

•

Use The World’s Greatest Real Estate Deal Analysis Spreadsheet™ before you offer.

•

Set tripwires now for when you’ll revisit an LLC.

Start where you are, protect what you have, and let your systems mature with your portfolio.