Real Estate Appreciation: The Quiet Engine Behind Long-Term Wealth

Amortization quietly shapes your equity growth and long-term returns. Learn how smart investors analyze amortization to make better financing decisions.

Real estate appreciation is the return almost everyone benefits from, but very few truly understand.

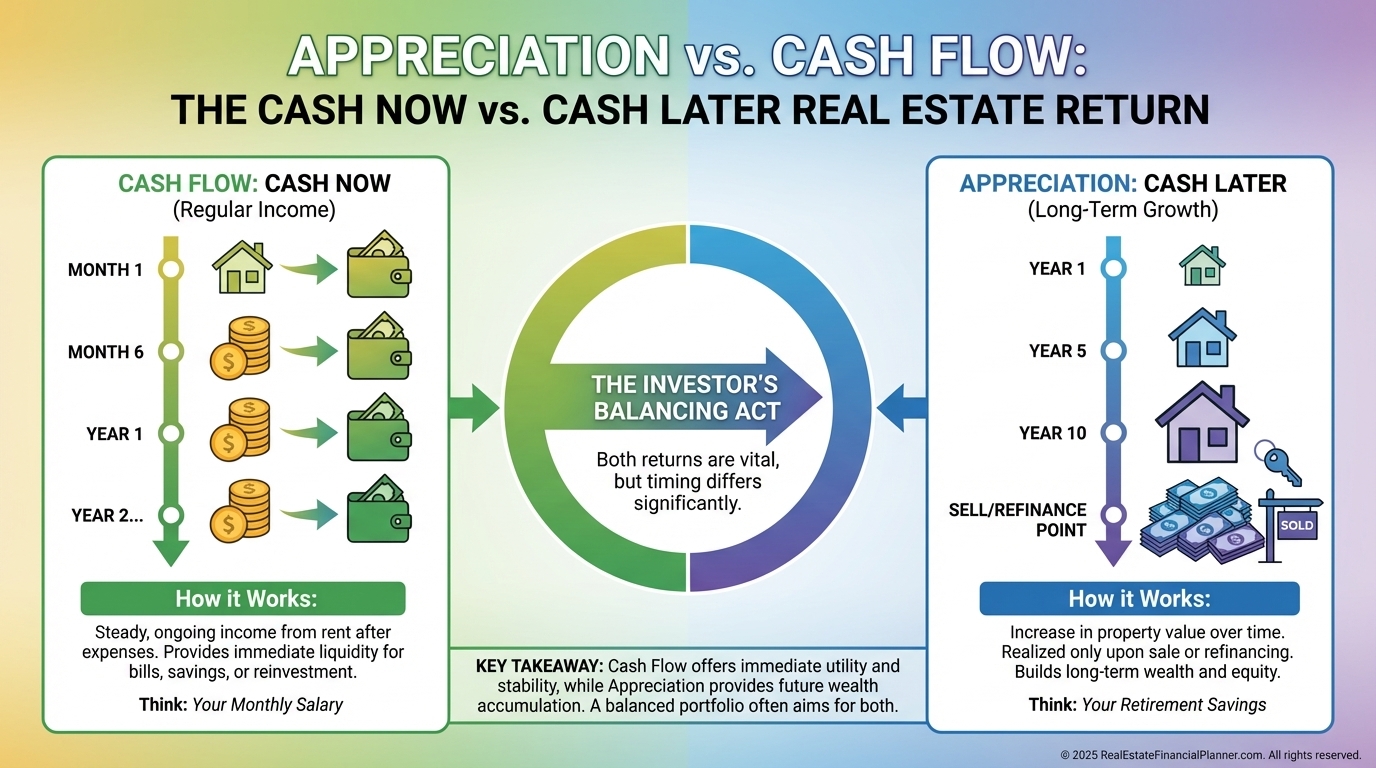

When I help investors analyze deals, appreciation is usually treated like background noise. Cash flow gets all the attention because it shows up in a bank account. Appreciation does not. That makes it easy to ignore and even easier to misuse.

Appreciation is part of what I call the “Cash Later” side of investing. You do not spend it today. You build it quietly over time, and you only access it when you refinance or sell.

I learned this lesson the hard way rebuilding after bankruptcy. Cash flow kept me solvent. Appreciation rebuilt my net worth.

What Appreciation Really Is (And What It Is Not)

Appreciation is the increase in a property’s market value over time.

It is not guaranteed.

It is not evenly distributed across markets.

It is not something you should rely on alone.

But it is unbounded.

Unlike debt paydown, which caps at your loan balance, or depreciation, which ends after 27.5 years, appreciation has no ceiling. That single fact is why it matters so much over long holding periods.

A property appreciating at five percent annually doubles roughly every fourteen years. That compounding happens whether you are paying attention or not.

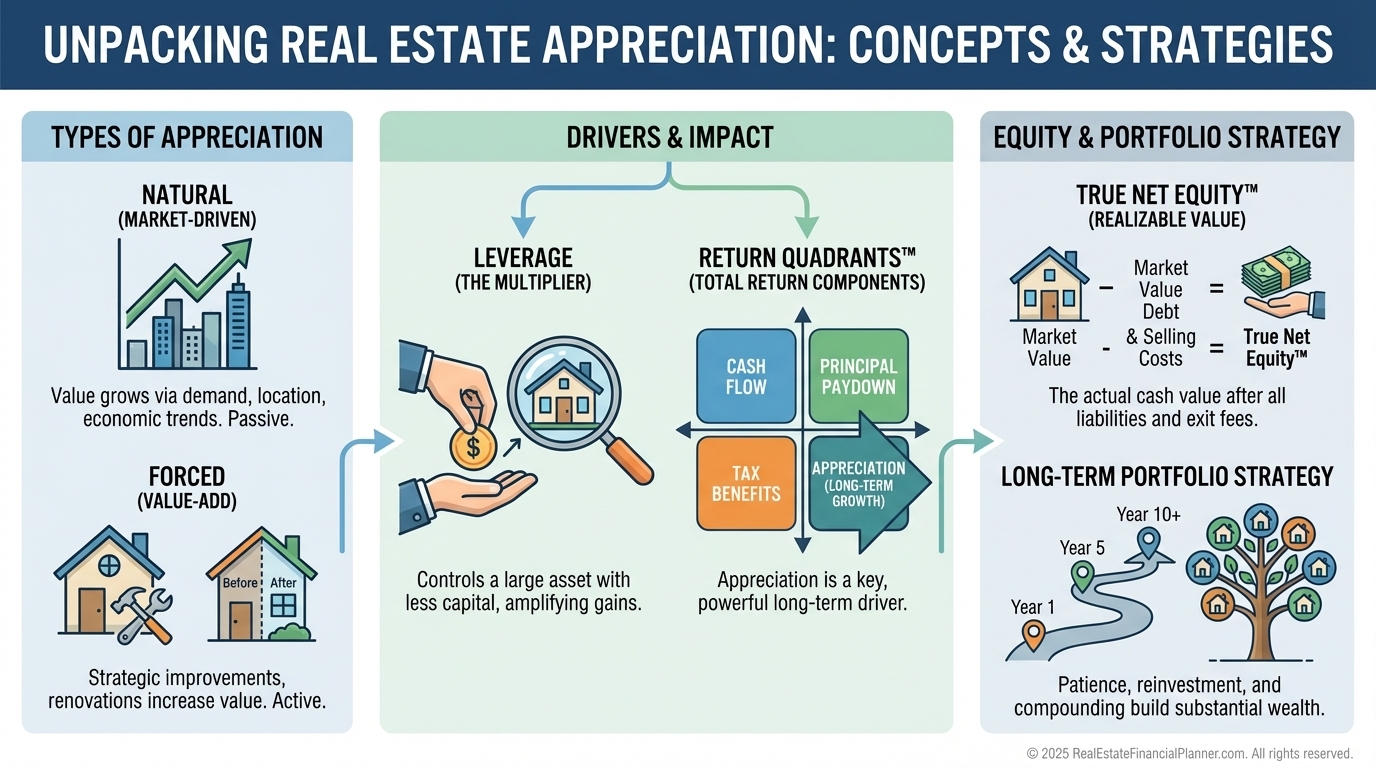

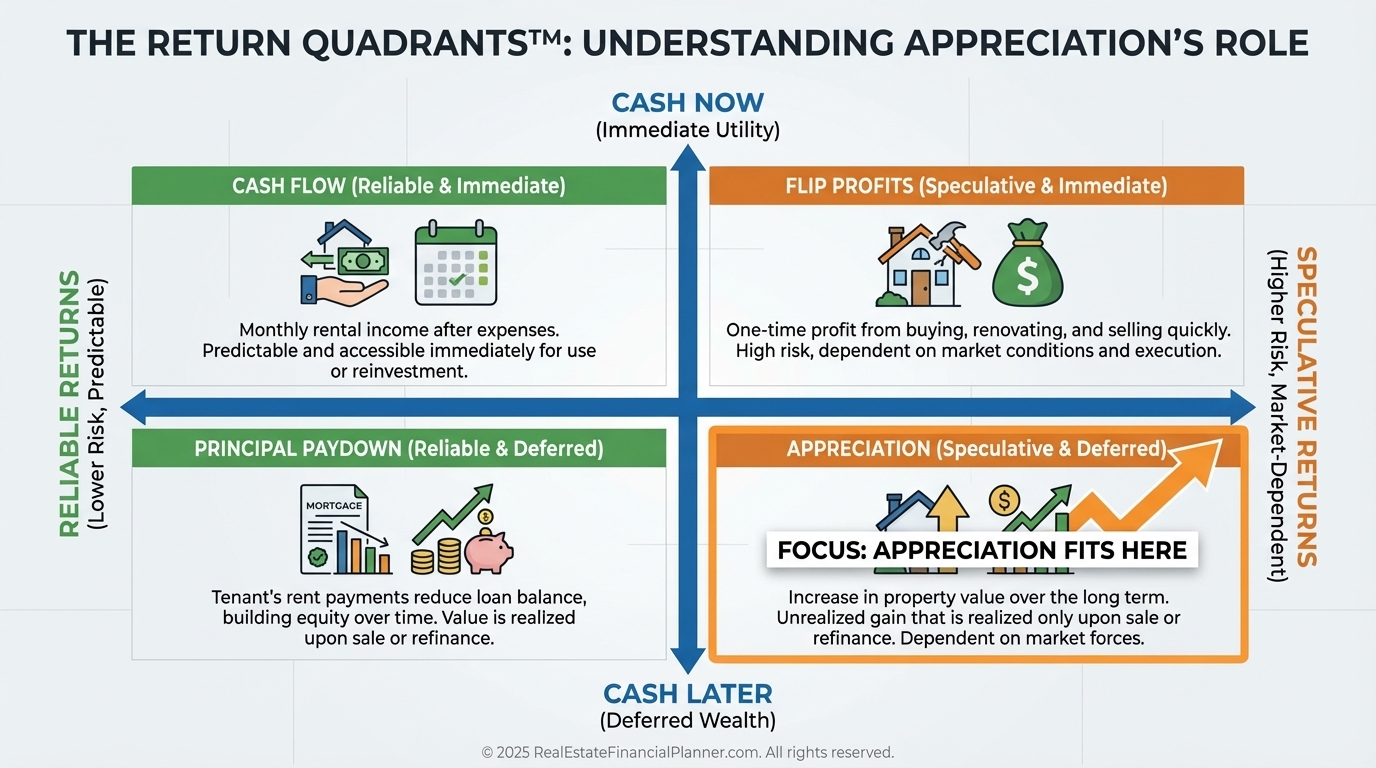

Appreciation Inside the Return Quadrants™

In the Return Quadrants™ framework, appreciation sits in a very specific place.

It lives on the speculative side because markets change.

It lives on the cash-later side because equity is not spendable until accessed.

That positioning is intentional. It reminds you that appreciation is powerful, but it requires patience and discipline.

The framework lets you view appreciation three different ways.

Return in Dollars shows how much wealth was created.

Return on Investment shows how hard your original cash worked.

Return on Equity shows whether your trapped equity is still productive.

When I review portfolios with clients, the biggest mistakes show up in the Return on Equity view. Appreciation builds equity, but as equity grows, returns often fall. That is usually the signal to refinance, redeploy, or rebalance.

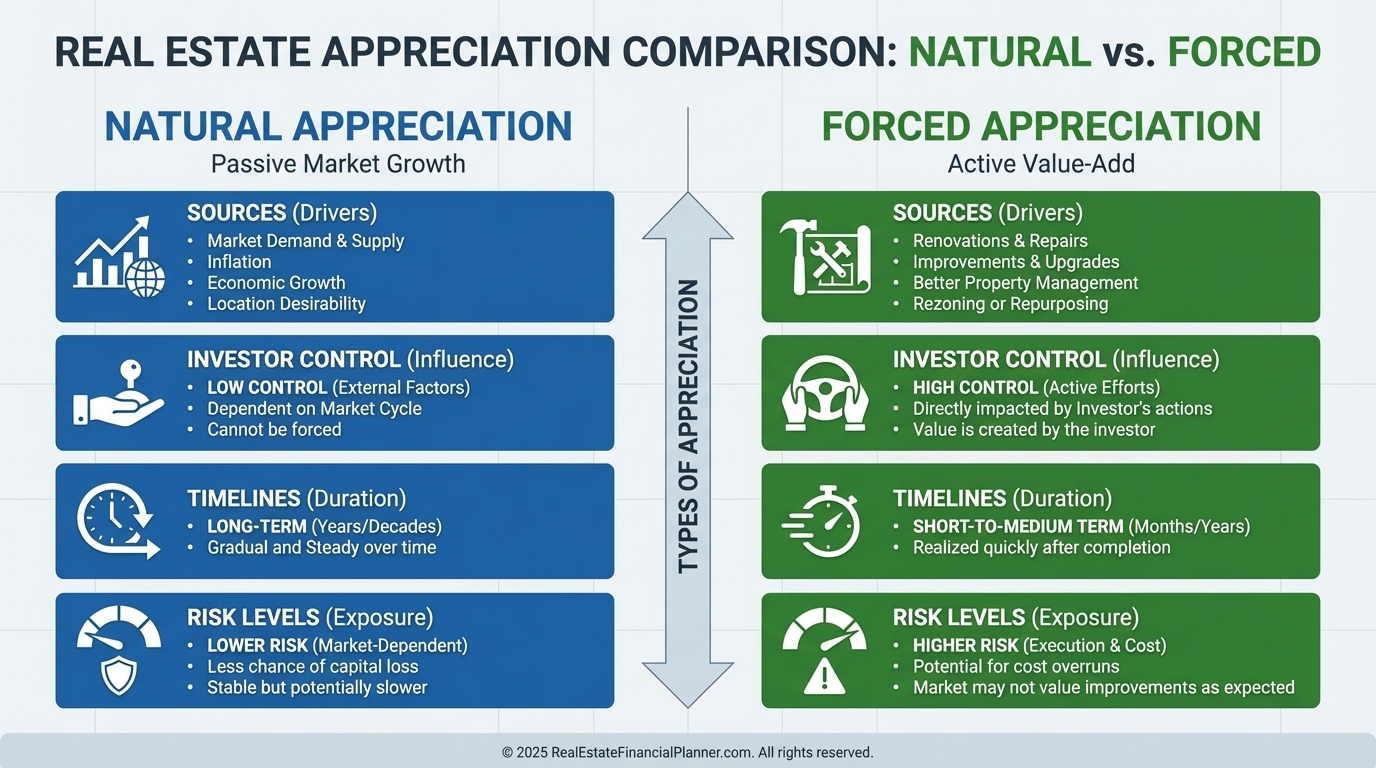

Natural Appreciation Versus Forced Appreciation

There are two very different sources of appreciation, and confusing them causes bad decisions.

Natural appreciation comes from market forces.

Forced appreciation comes from your actions.

Natural appreciation is driven by inflation, job growth, population shifts, supply constraints, and infrastructure. You cannot control these, but you can choose where you invest.

Forced appreciation is created by renovations, better management, curing deferred maintenance, or repositioning a property. This is where skill matters more than luck.

When I coach investors, I always prefer deals that work even if natural appreciation underperforms. Forced appreciation gives you a margin of safety that speculation never will.

How Leverage Magnifies Appreciation

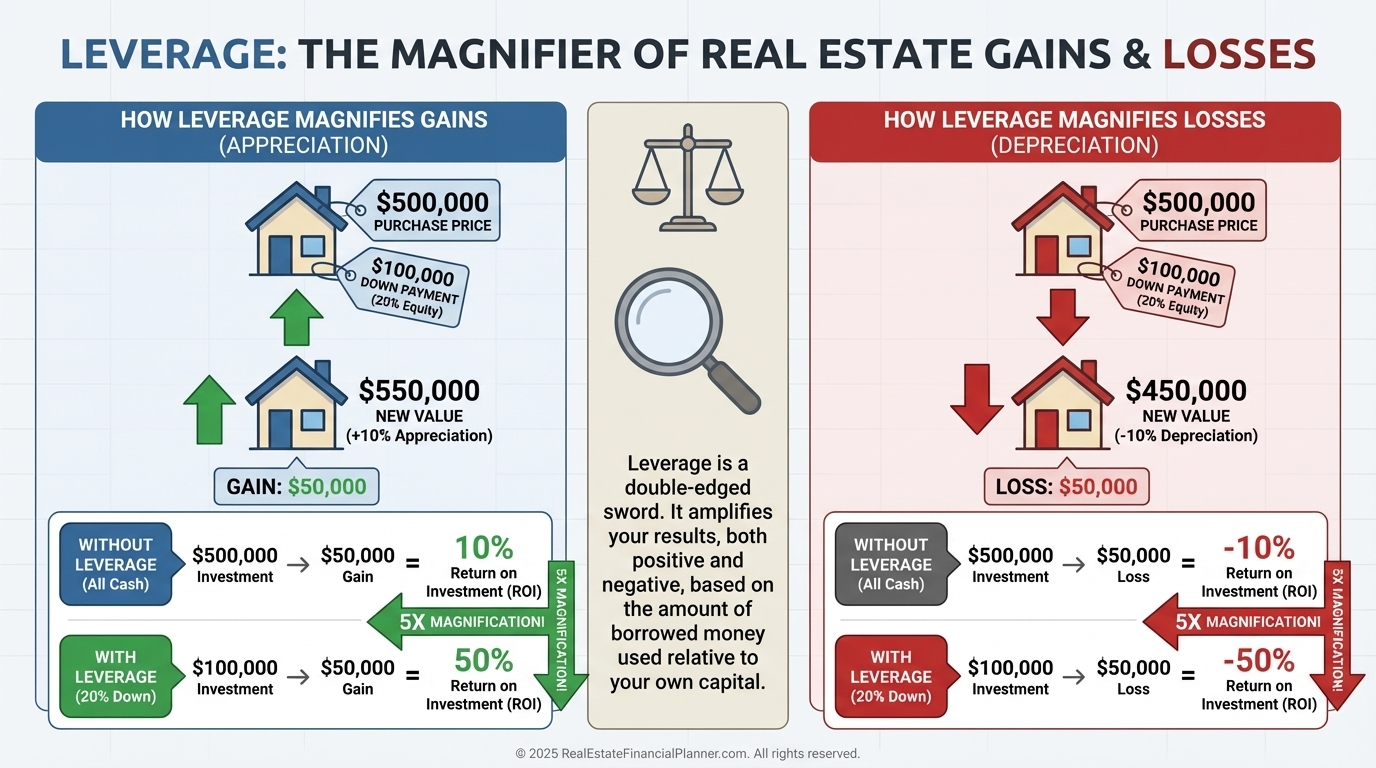

Appreciation becomes truly powerful when combined with leverage.

A five percent increase on the property value applies to the entire asset, not just your down payment. That is why appreciation can produce triple-digit returns on invested cash over time.

This is also why leverage cuts both ways. Declines apply to the full value as well.

I never model appreciation without also modeling downside scenarios. The World’s Greatest Real Estate Deal Analysis Spreadsheet™ makes this obvious by showing appreciation across all Return Quadrants™ simultaneously.

Modeling Appreciation Without Lying to Yourself

Most investors fail at appreciation modeling because they start optimistic and justify backward.

I do the opposite.

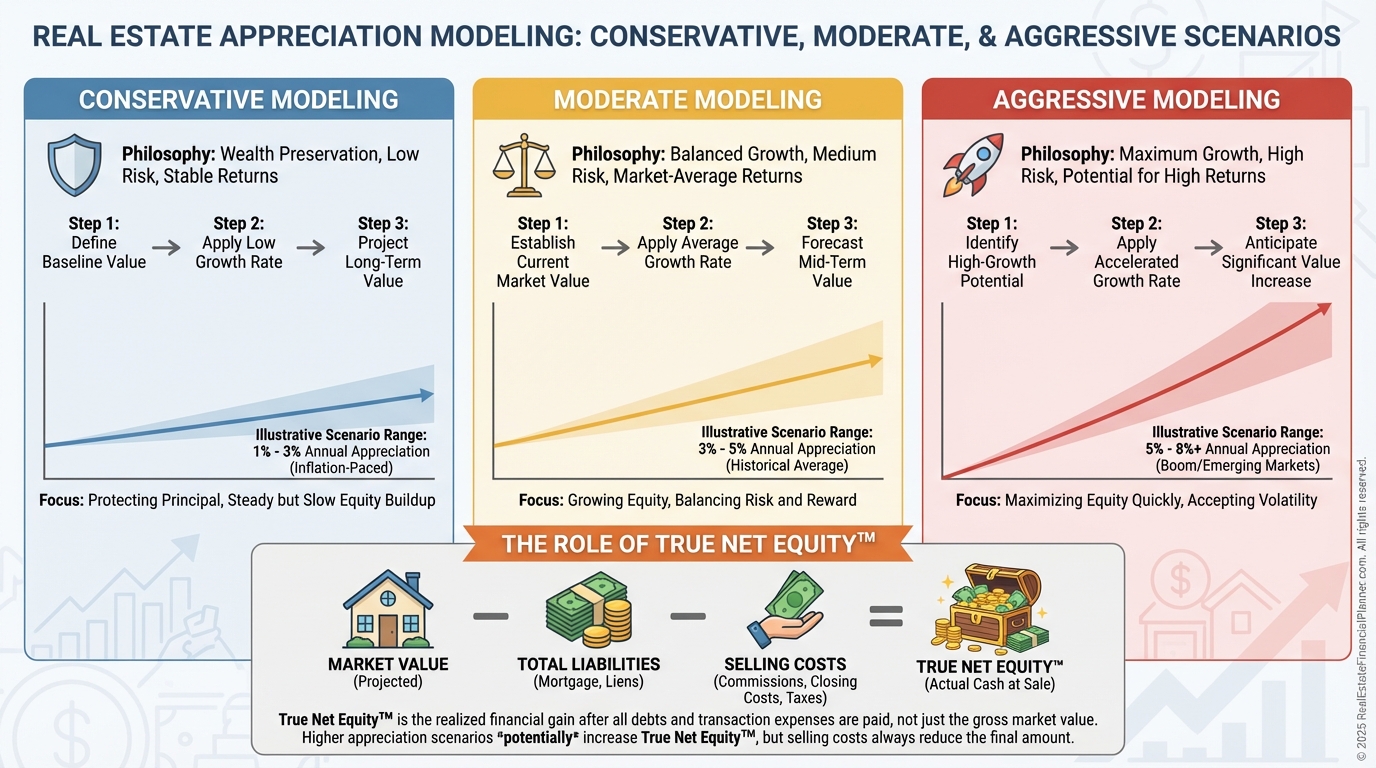

I start with inflation-level appreciation.

I run conservative, moderate, and aggressive scenarios.

I assume cycles will happen.

I never rely on appreciation to save a bad deal.

The spreadsheet calculates appreciation automatically and shows how it flows through Return in Dollars, Return on Investment, and Return on Equity. When reserves are included using the +R versions of the quadrants, risk becomes visible instead of hidden.

This is also where True Net Equity™ matters. Gross equity is a fantasy number. Real decisions require subtracting selling costs, taxes, and friction.

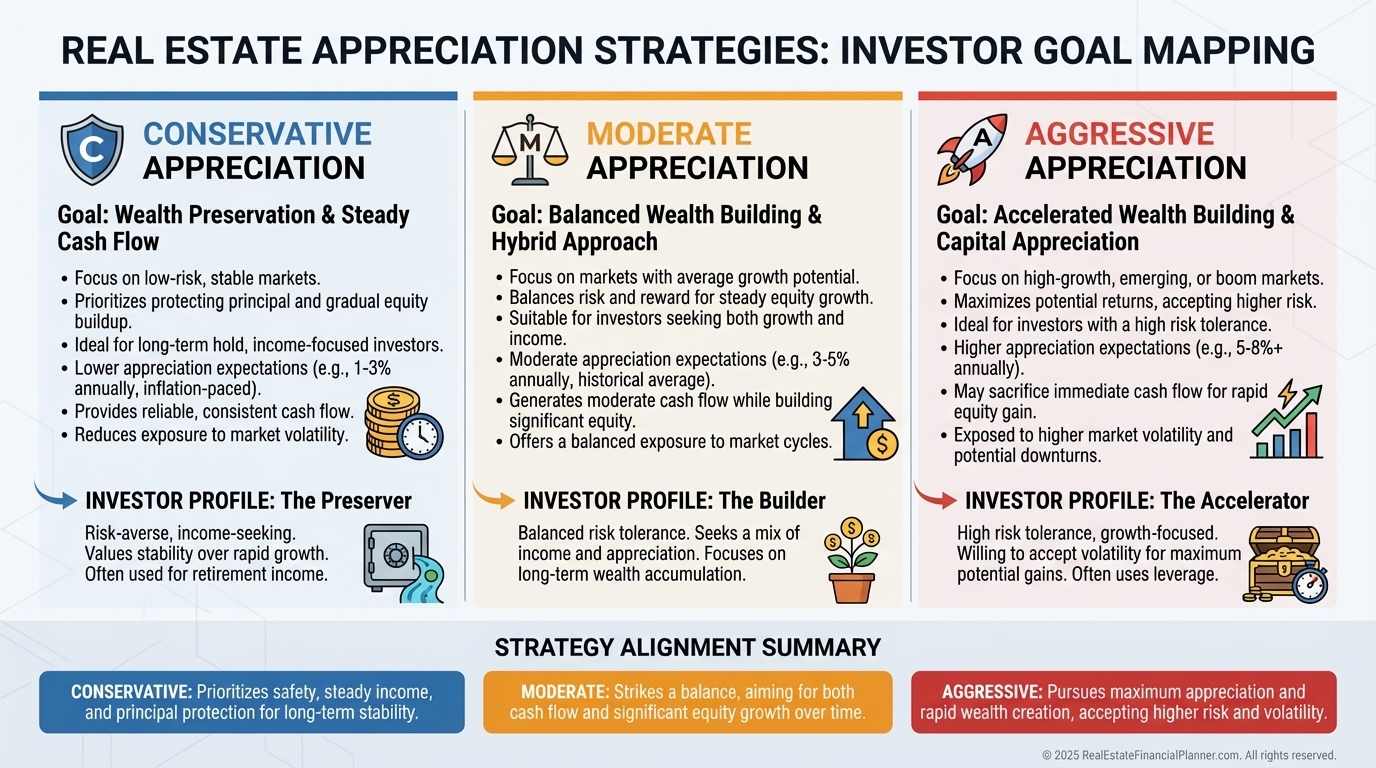

Appreciation and Strategy Alignment

Appreciation should serve your plan, not replace it.

If you are early in your journey, appreciation accelerates net worth growth.

If you need income, appreciation is secondary to cash flow.

If you are optimizing a portfolio, appreciation determines when equity should move.

The Real Role of Appreciation

Appreciation is not the hero of your deal.

It is the accelerator.

Cash flow keeps you alive.

Debt paydown and depreciation add reliability.

Appreciation is what makes the long-term math extraordinary.

When investors get into trouble, it is almost always because they depended on appreciation instead of treating it as upside.

Use appreciation deliberately. Model it honestly. Measure it correctly. Then let time do what time does best.