Why Every Real Estate Investor Eventually Needs a Bookkeeper

Learn about Bookkeeper for real estate investing.

A bookkeeper is one of the least glamorous members of your real estate investing dream team.

They are also one of the most quietly important.

When I help clients analyze deals or review portfolios, messy books are one of the biggest hidden risks I see.

Not bad properties.

Bad records.

A bookkeeper does not replace your CPA.

They make your CPA dramatically more effective.

Their job is simple but critical: keep your financial data accurate, organized, and usable all year long.

What a Bookkeeper Actually Does for Real Estate Investors

A bookkeeper focuses on execution, not strategy.

They make sure every dollar coming in and going out of your rentals is recorded correctly.

That sounds basic.

It is also where most investors make expensive mistakes.

Here is what a competent real estate-focused bookkeeper typically handles.

Setting Up Your Books Correctly from the Start

They create a chart of accounts that matches how real estate actually works.

Rent, repairs, capital improvements, reserves, and loan payments are categorized properly from day one.

If you own property in an LLC, they structure the books so entity income and expenses stay clean and defensible.

Tracking Rental Income and Property Expenses

Every rent payment, repair, management fee, insurance bill, and utility charge gets recorded.

This is what allows you to see true cash flow, not just your bank balance.

When I review deals using the Return Quadrants™, bad bookkeeping often hides negative cash flow until it reminds you the hard way.

Maintaining Consistent Records Over Time

From acquisition through ownership and eventual sale, your bookkeeper maintains continuity.

This matters when you refinance, sell, or compare Return on Equity over time.

Clean records make True Net Equity™ calculations possible.

Messy ones make them guesses.

Preparing Clean Data for Your CPA

Your CPA should not be sorting receipts or fixing miscategorized expenses.

That is wasted money.

A bookkeeper hands your CPA clean, reconciled reports so tax strategy happens faster and more accurately.

When You Should Involve a Bookkeeper

Most investors wait too long.

Then they pay for it retroactively.

You should involve a bookkeeper when one of these happens.

You form an LLC.

You buy your first rental property.

You start mixing personal and business accounts.

You plan to scale beyond one or two properties.

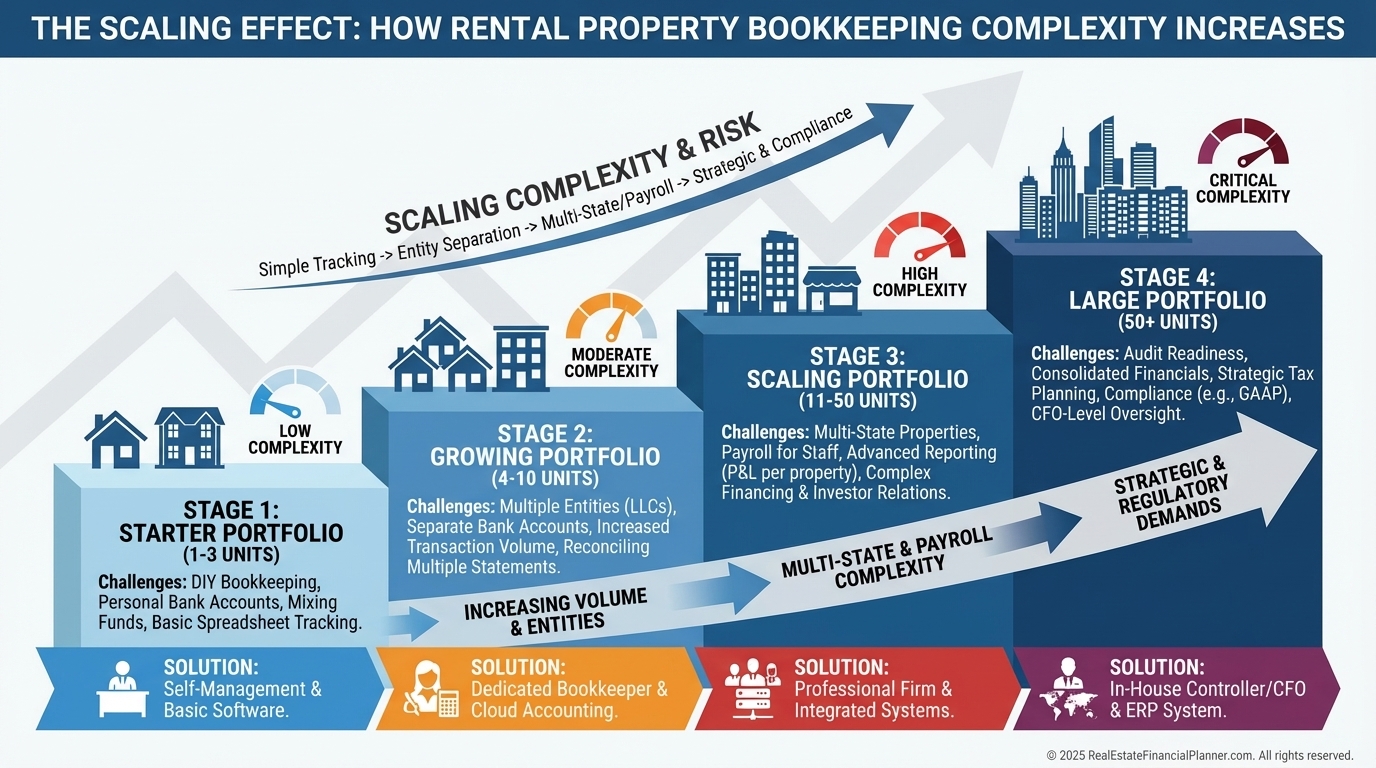

Why a Bookkeeper Becomes More Valuable as You Scale

As your portfolio grows, complexity compounds.

Multiple properties mean multiple income streams, expense categories, loans, and reserves.

Good bookkeeping supports better decisions.

It helps you see which properties are underperforming.

It supports refinancing analysis.

It makes loan applications easier.

It gives partners confidence.

And it protects you when the IRS, a lender, or a potential buyer asks questions.

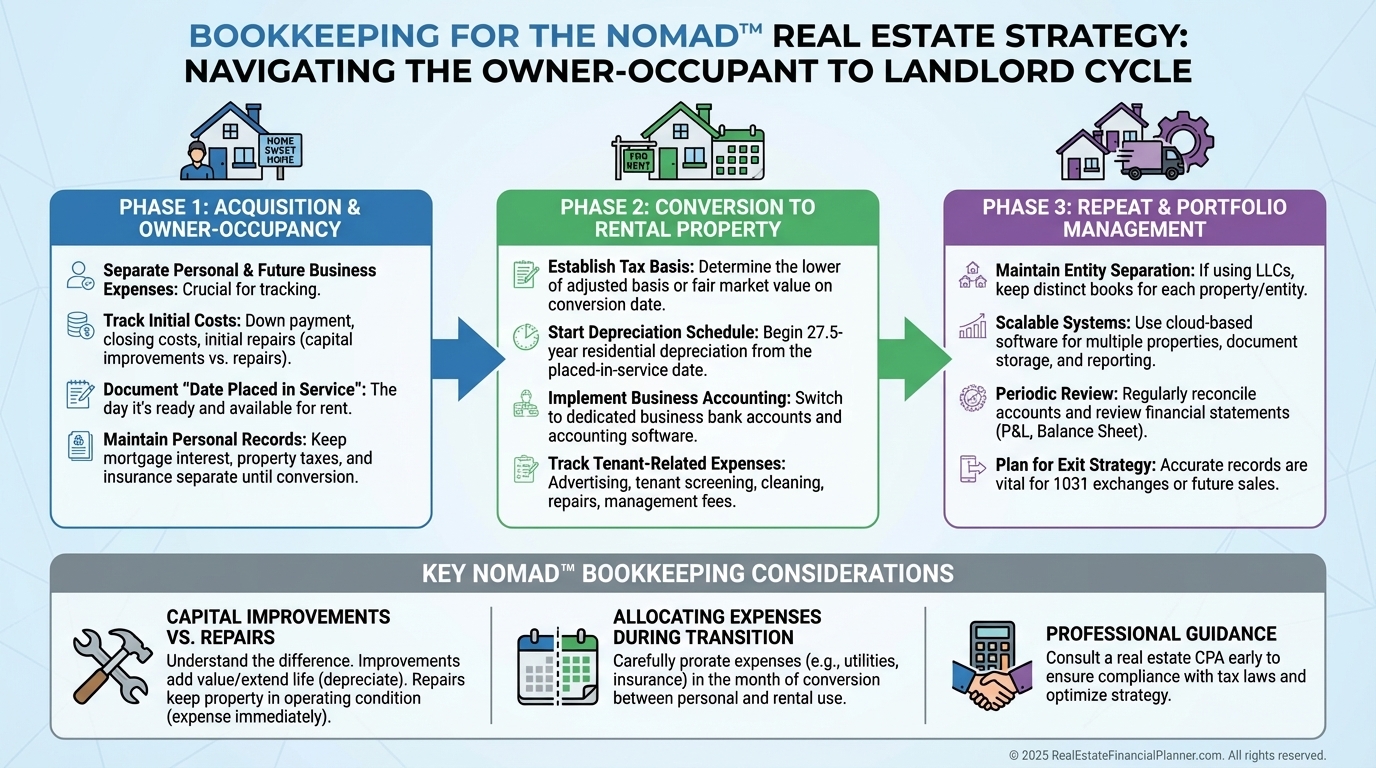

Bookkeepers, Nomad™, and Long-Term Planning

Nomad™ investors feel bookkeeping pain faster than most.

Owner-occupant moves, conversions to rentals, and changing expense profiles create confusion quickly.

A bookkeeper ensures the transition from personal residence to rental is documented cleanly.

That matters for depreciation, basis, and future tax planning.

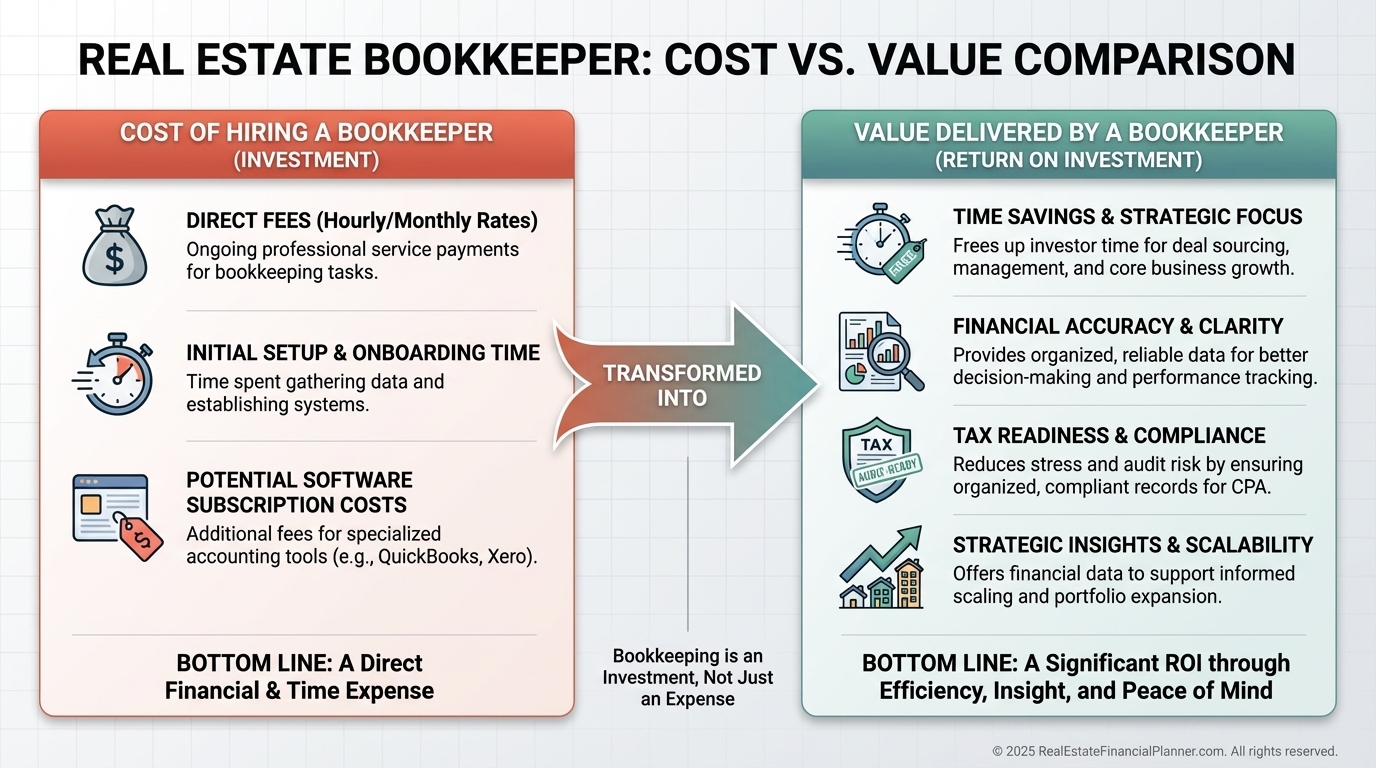

Cost, Value, and the False Economy of DIY Books

Bookkeepers cost less than CPAs.

They save far more than they cost.

I have seen investors lose deductions, delay refinances, and overpay taxes because their books were unusable.

Those are silent losses that never show up on a deal spreadsheet.

A bookkeeper keeps your financial foundation solid.

Everything else builds on that.