Preferred Return Explained: The Investor-First Waterfall That Protects Your Capital and Pays GPs

Learn about Preferred Return for real estate investing.

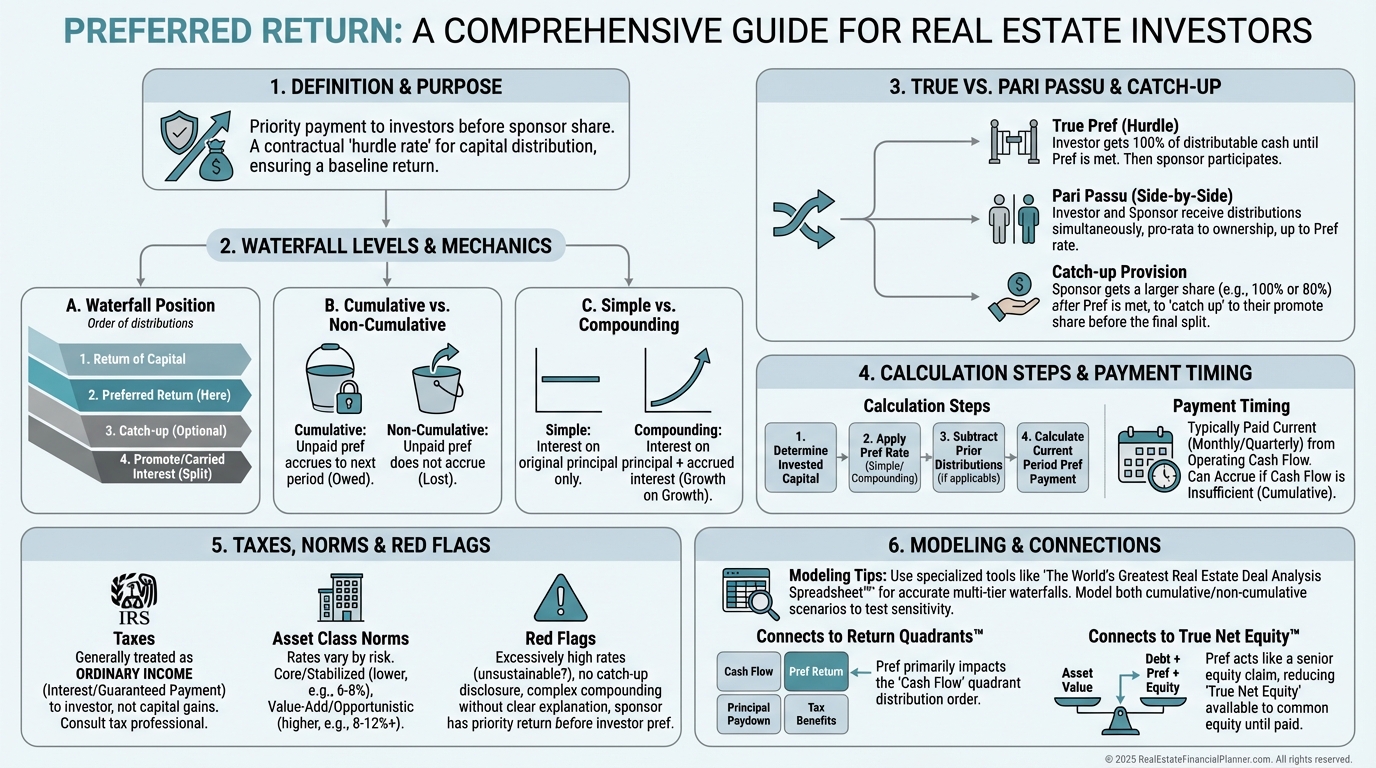

Why Preferred Return Is the First Right to Profits

When I help clients underwrite syndications, the first thing I look for is the preferred return and how it’s structured.

It tells me who gets paid first, how quickly capital returns, and when the GP earns promote.

Preferred return is the investor’s priority claim on profits before the GP participates.

It’s equity, not debt, but it behaves like a minimum hurdle the deal must clear annually.

I call it the investor’s “first right to profits,” because that’s exactly what it is.

Typical ranges I see are 6%–10% on stabilized deals, with higher headlines on development or heavier value-add.

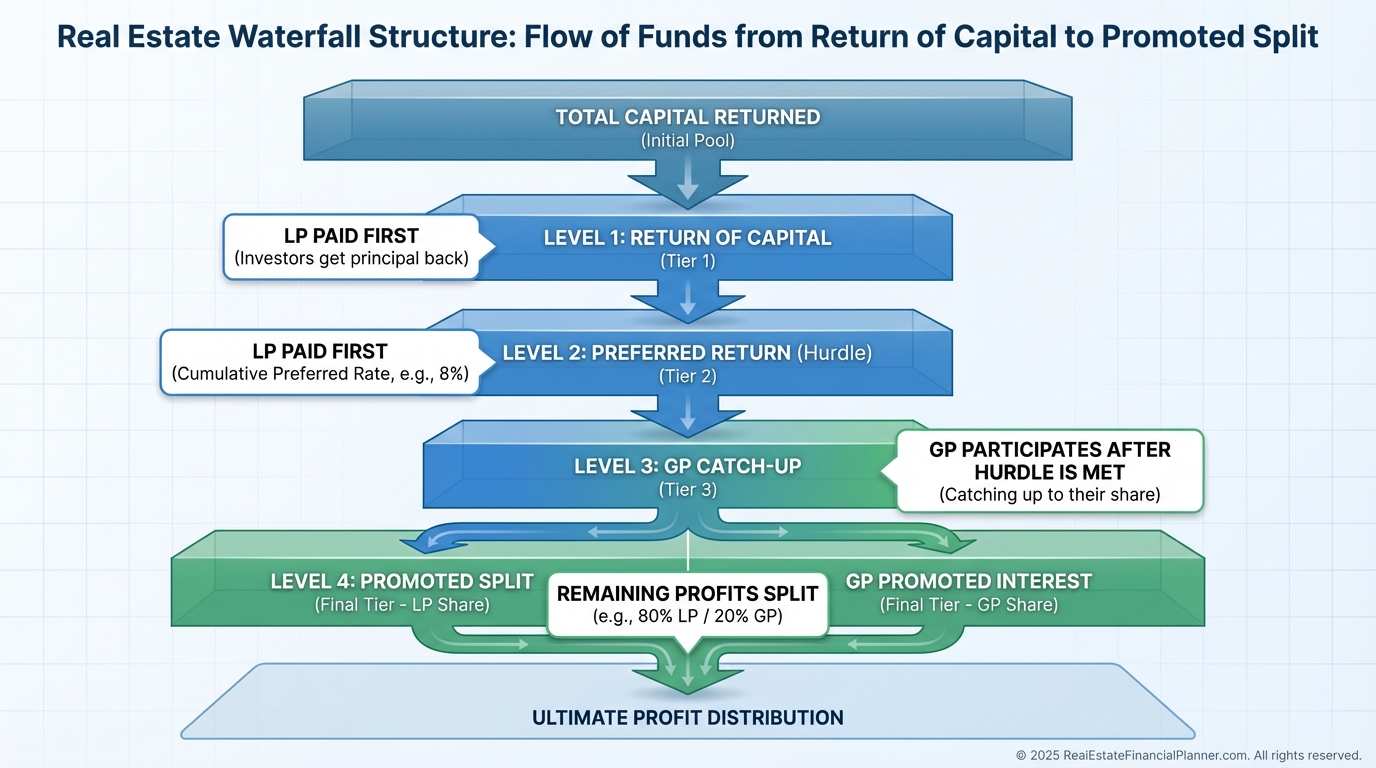

How the Waterfall Pays You (and When the GP Gets Paid)

Every syndication organizes distributions using a waterfall.

It fills investor buckets in strict order before GPs see promote.

•

Return of Capital: Getting your original dollars back.

•

Preferred Return: Your annual priority return, often cumulative.

•

GP Catch-Up: Accelerated split to get GPs to their promote share.

•

Promoted Split: Remaining profits split (e.g., 70/30 or 80/20).

Suppose you invest $100,000 at an 8% preferred return with a 70/30 split after the pref.

If the property produces $10,000 this year, you receive $8,000 first, then $1,400 of the remaining $2,000, and the GP gets $600.

If the property produces $6,000, you get all $6,000 and carry a $2,000 shortfall forward if the pref is cumulative.

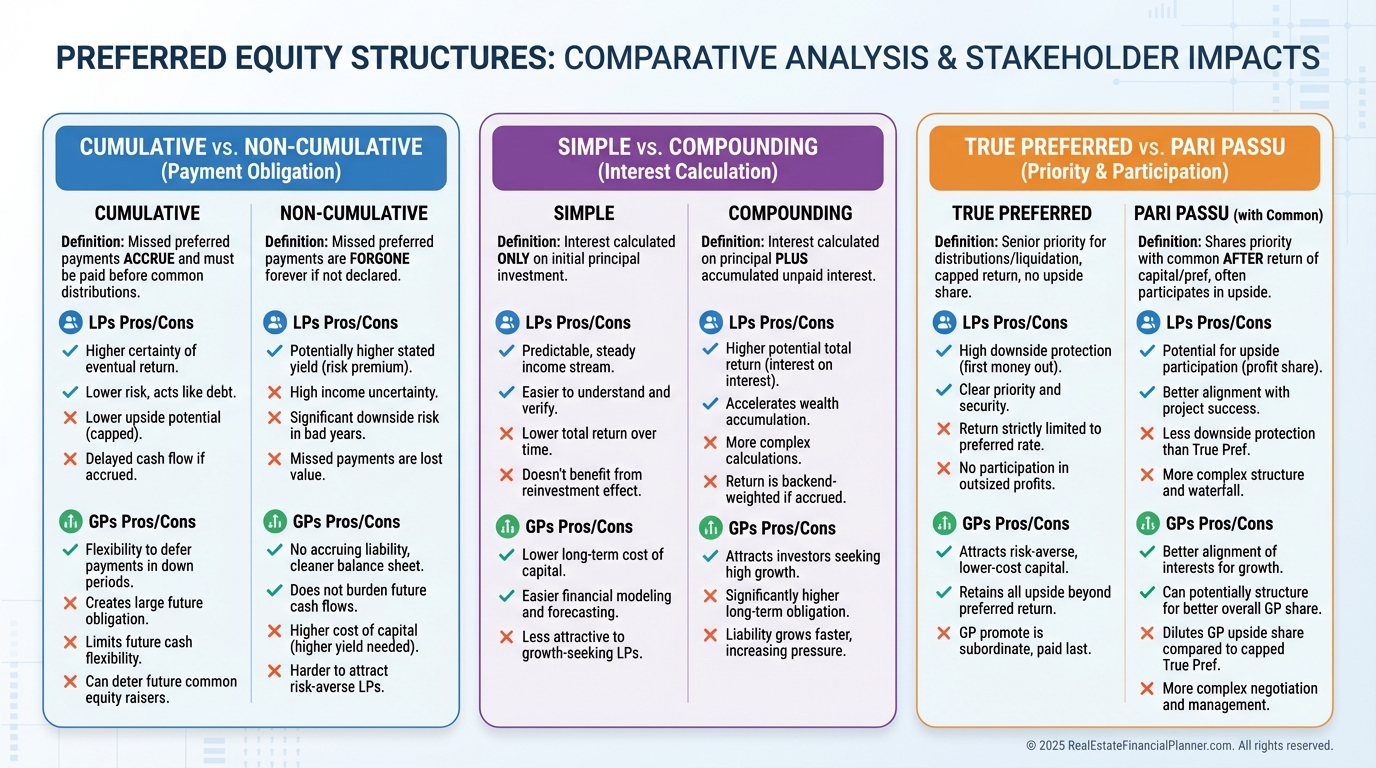

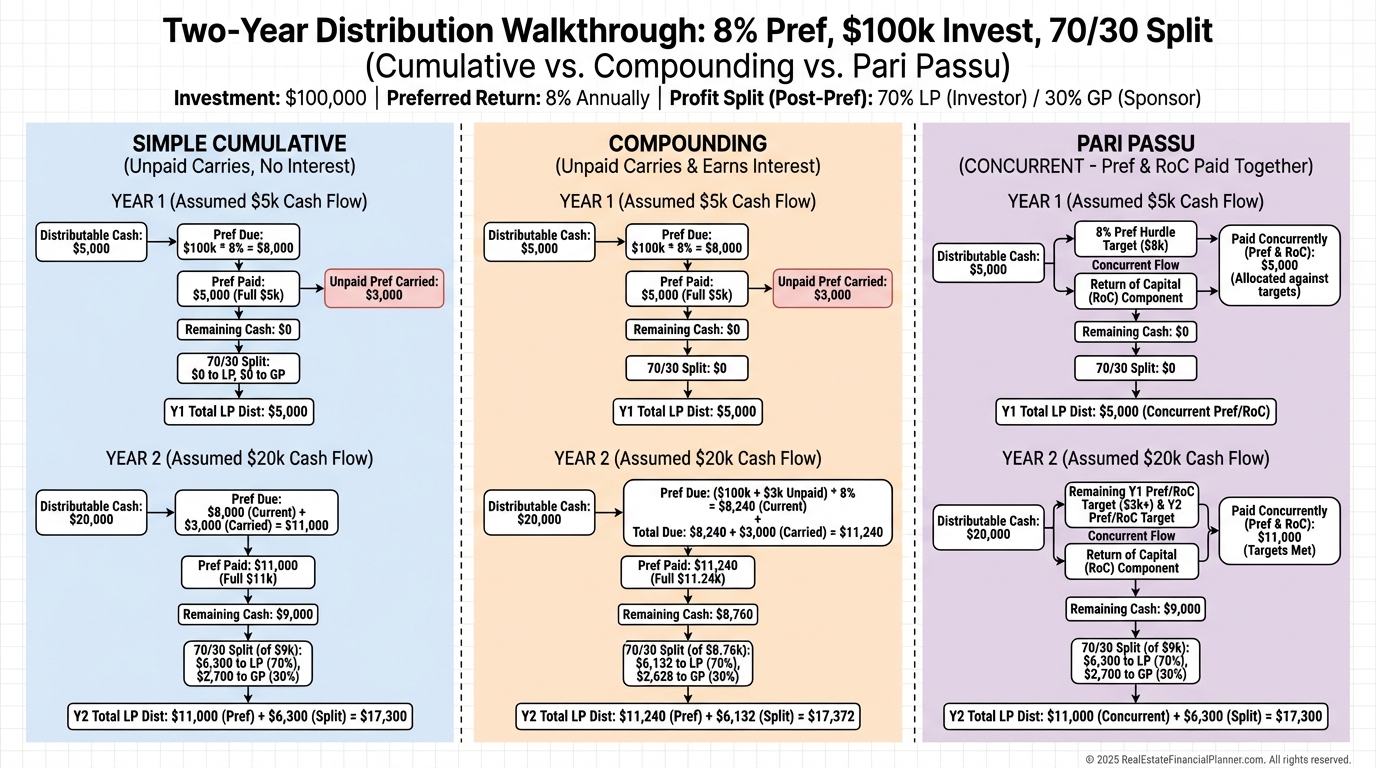

Cumulative, Compounding, and True vs. Pari Passu

This is where most investors get tripped up.

The label “8%” is only the starting point; the structure determines the real outcome.

•

Cumulative vs. Non-Cumulative: Does your unpaid pref carry forward to future years?

•

Simple vs. Compounding: Do unpaid amounts earn additional return while outstanding?

•

True Preferred vs. Pari Passu (Modified): Do LPs receive 100% of distributions until the pref is fully paid, or do LPs and GPs both receive something along the way?

When I rebuilt after a personal financial setback, I became uncompromising about clarity here.

A cumulative, simple, true preferred structure is very LP-friendly and easy to track.

Compounding can be fair, but it increases the accrual obligation, which can surprise GPs and stress cash later.

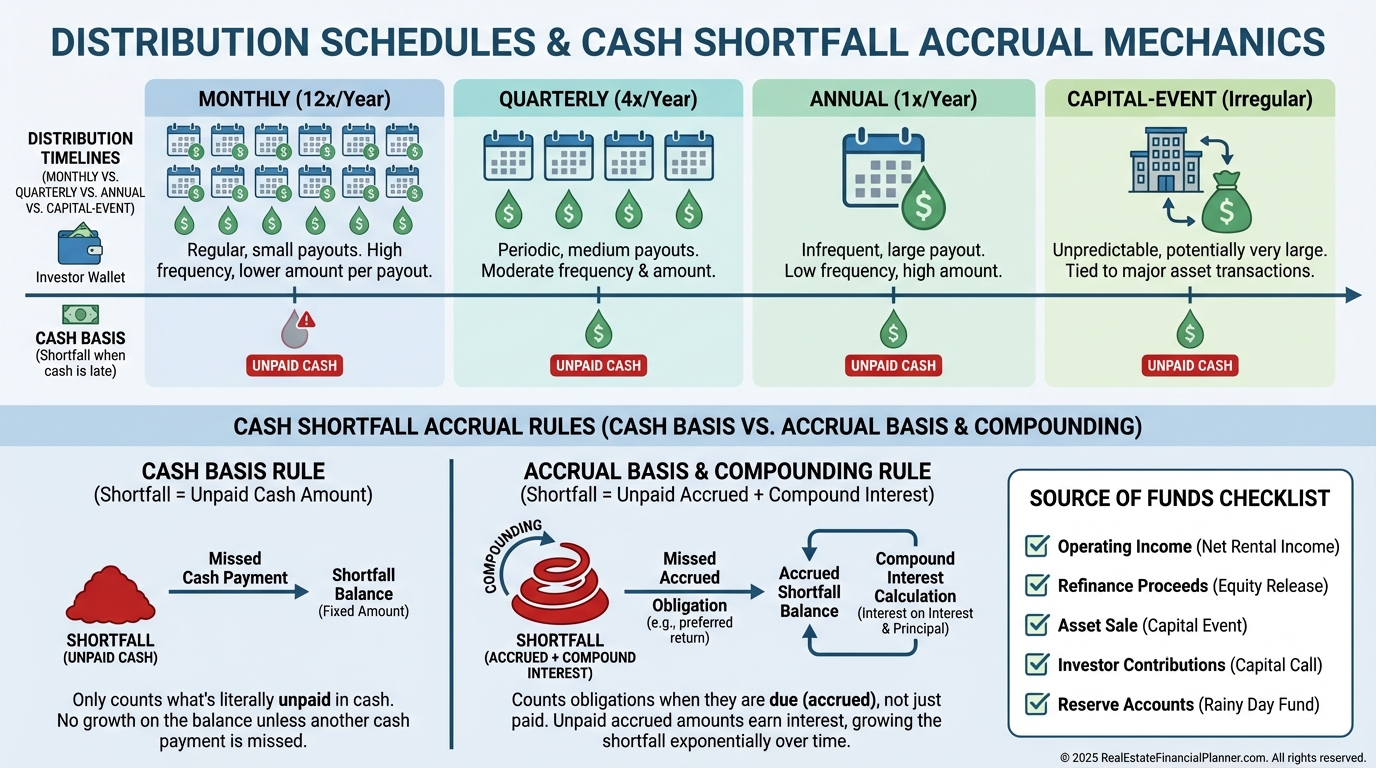

Payment Timing, Cash Shortfalls, and Accrual Logic

Monthly distributions are common in stabilized multifamily.

Quarterly is common in assets with quarterly rent cycles.

Development and heavy value-add often defer until refinance or sale.

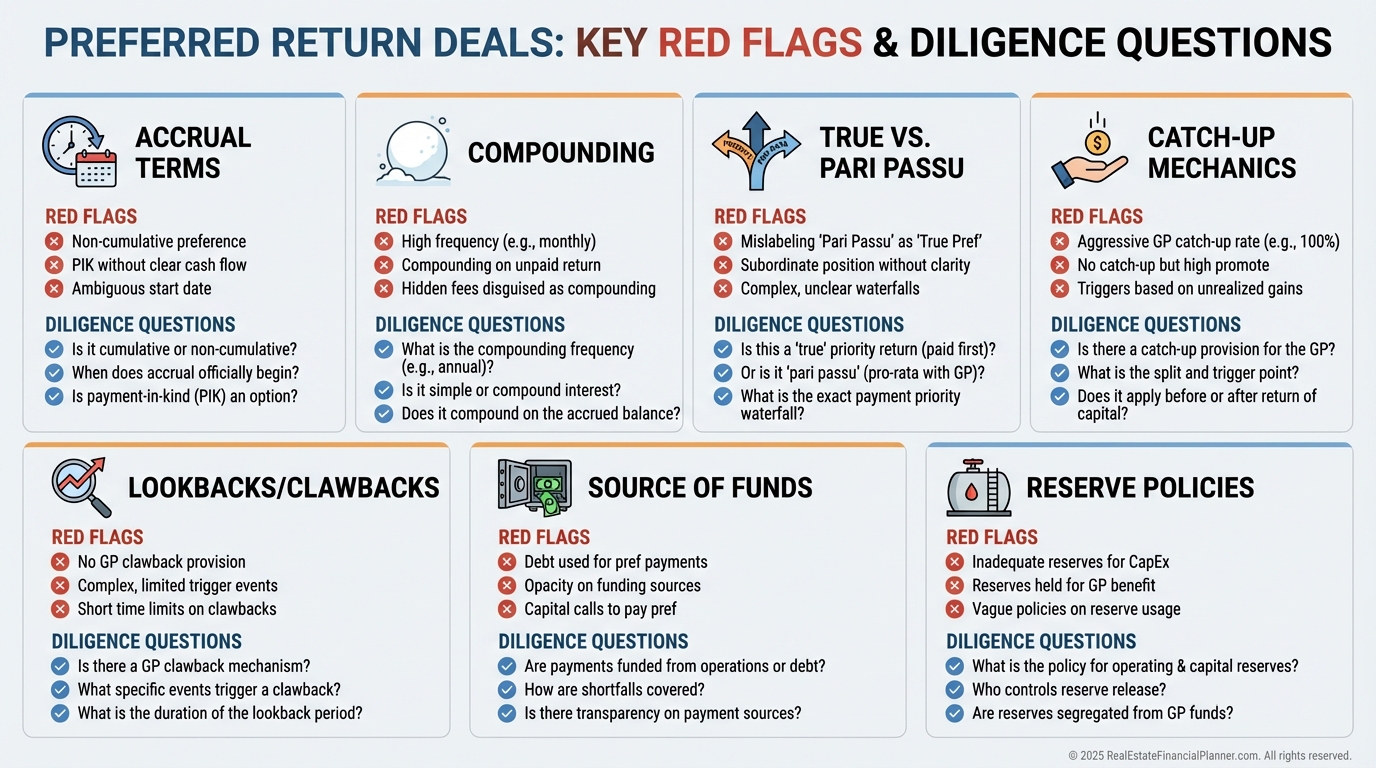

If cash is light, ask whether the pref accrues on an accrual basis or is paid strictly from available cash.

If it accrues, confirm whether it compounds and whether the GP can participate before accruals are fully satisfied.

I warn clients to ask, “What’s the source of funds for distributions?” because paying a pref from new investor capital is a red flag.

Examples You Can Model Right Now

Here’s a simple baseline you can replicate in The World’s Greatest Real Estate Deal Analysis Spreadsheet™.

•

Investment: $100,000.

•

Preferred return: 8% simple, cumulative, true preferred.

•

Split after pref: 70/30.

Year 1 produces $5,000.

You receive all $5,000; $3,000 accrues.

Year 2 produces $12,000.

You’re owed $8,000 for Year 2 plus the $3,000 shortfall.

The first $11,000 goes to you, and the remaining $1,000 splits 70/30.

Change one variable and the outcome changes.

If compounding, the $3,000 shortfall grows by 8% for the next period.

If pari passu, the GP may take some cash before the pref is made whole.

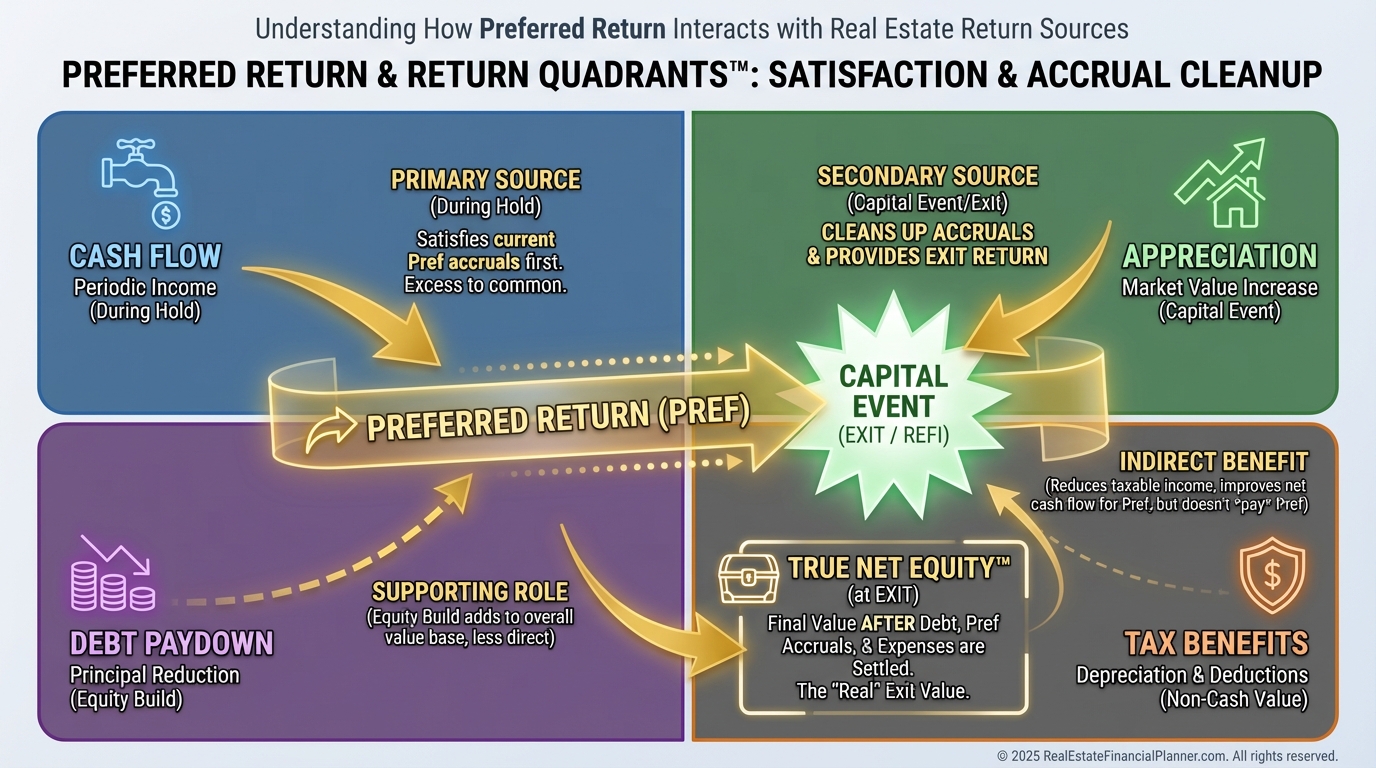

Where Preferred Return Fits in Return Quadrants™ and True Net Equity™

Preferred return prioritizes part of your Cash Flow quadrant and sometimes portions of capital-event proceeds.

It doesn’t change Appreciation, Principal Paydown, or Tax Benefits, but it dictates who gets paid from those buckets first.

When I map deals for clients, I overlay the Return Quadrants™ to visualize what’s backing the pref.

Strong operations and stable cash flow support monthly pref.

Capital events like refi or sale often clean up accruals if early cash is tight.

True Net Equity™ matters at exit.

It’s what you really walk away with after transaction costs, accrued but unpaid pref, GP catch-up, and taxes.

Deal Terms to Watch, Negotiate, or Walk Away From

Here’s what I check, negotiate, or avoid for clients.

•

Definition: Exact preferred rate, cumulative or not, simple or compounding.

•

Priority: True preferred or pari passu before the hurdle.

•

Catch-Up: Whether the GP gets 100% of cash for a period to “catch up” to their promote share.

•

Waterfall Lanes: Return of capital before pref, or pref before capital?

•

Lookbacks: Is performance measured annually or across the life of the deal?

•

Clawbacks: If the GP was overpaid early, do they return funds later?

•

Source of Funds: Distributions must come from operations or legitimate capital events.

Taxes, Asset Class Benchmarks, and Market Context

Preferred return payments can be a mix of return of capital, ordinary income, and capital gains depending on how distributions are generated.

Depreciation often shelters part of the distributions, but expect true-up at sale when depreciation recapture shows up.

On stabilized multifamily, I commonly see 6%–8%.

On development and heavy value-add, 9%–12% is common, sometimes higher with more risk and longer illiquidity.

On credit-tenant triple-net, 5%–7% is typical because risk is lower.

If a sponsor waves a 15% pref on a stabilized apartment, slow down and read the fine print.

How I Underwrite Prefs in The World’s Greatest Spreadsheet

I start by modeling property cash flow conservatively, then layer in the waterfall.

I toggle cumulative, compounding, and true vs. pari passu to see the range of investor outcomes.

I run low, base, and high cash flow scenarios to test whether the pref can be paid organically.

I include a refinance stress test to see if a future cash-in refi would be required to clear accruals.

I add a “source of funds” audit to confirm distributions tie back to operations or real capital events.

If the only way the pref pays is future appreciation at sale, I tell clients they are taking timing risk and should price that risk.

Quick Checklist Before You Wire

•

Do I understand pref rate, accrual, and compounding?

•

Is it true preferred or pari passu before the hurdle?

•

Who gets paid first: return of capital or the pref?

•

Is there a GP catch-up and how is it calculated?

•

Are lookbacks and clawbacks included?

•

What’s the distribution cadence and source of funds?

•

Are reserves adequate for operations and CapEx?

•

Does the pro forma pay the pref from operations, not hope?

•

What are exit assumptions and True Net Equity™ after all splits and taxes?

Final Thoughts

Preferred return is not a yield guarantee; it is a priority.

Structure matters as much as the percentage.

When you understand the waterfall, you negotiate better, select better sponsors, and protect your capital with intention.

If you want to see it all in action, download The World’s Greatest Real Estate Deal Analysis Spreadsheet™ and model the exact terms before you invest.