Portfolio Loan Playbook: Flexible Financing to Scale Your Real Estate Portfolio

Learn about Portfolio Loan for real estate investing.

Why Portfolio Loans Exist

When I help clients who’ve tapped out conventional financing or need flexibility, portfolio loans are often the next move.

Smaller banks and credit unions keep these loans on their books, so they write their own rules and can move faster.

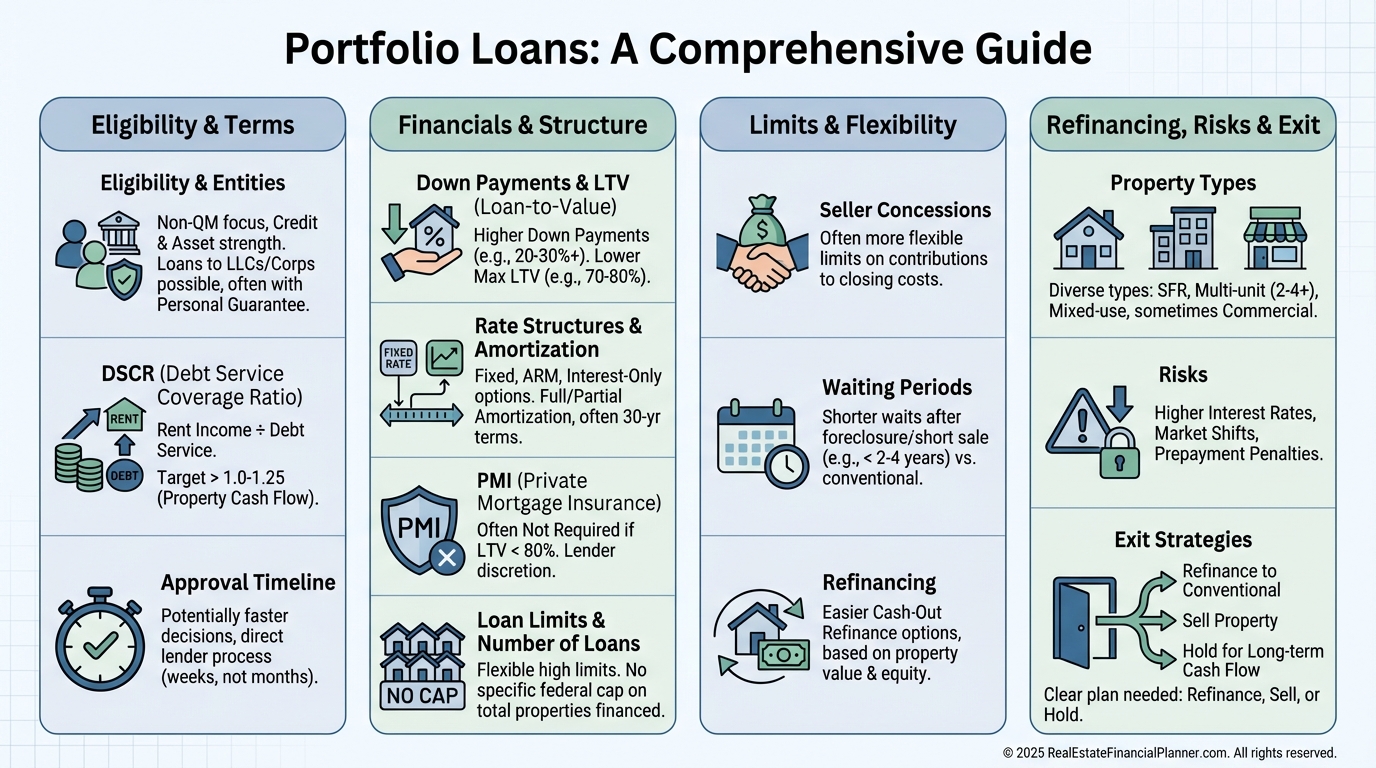

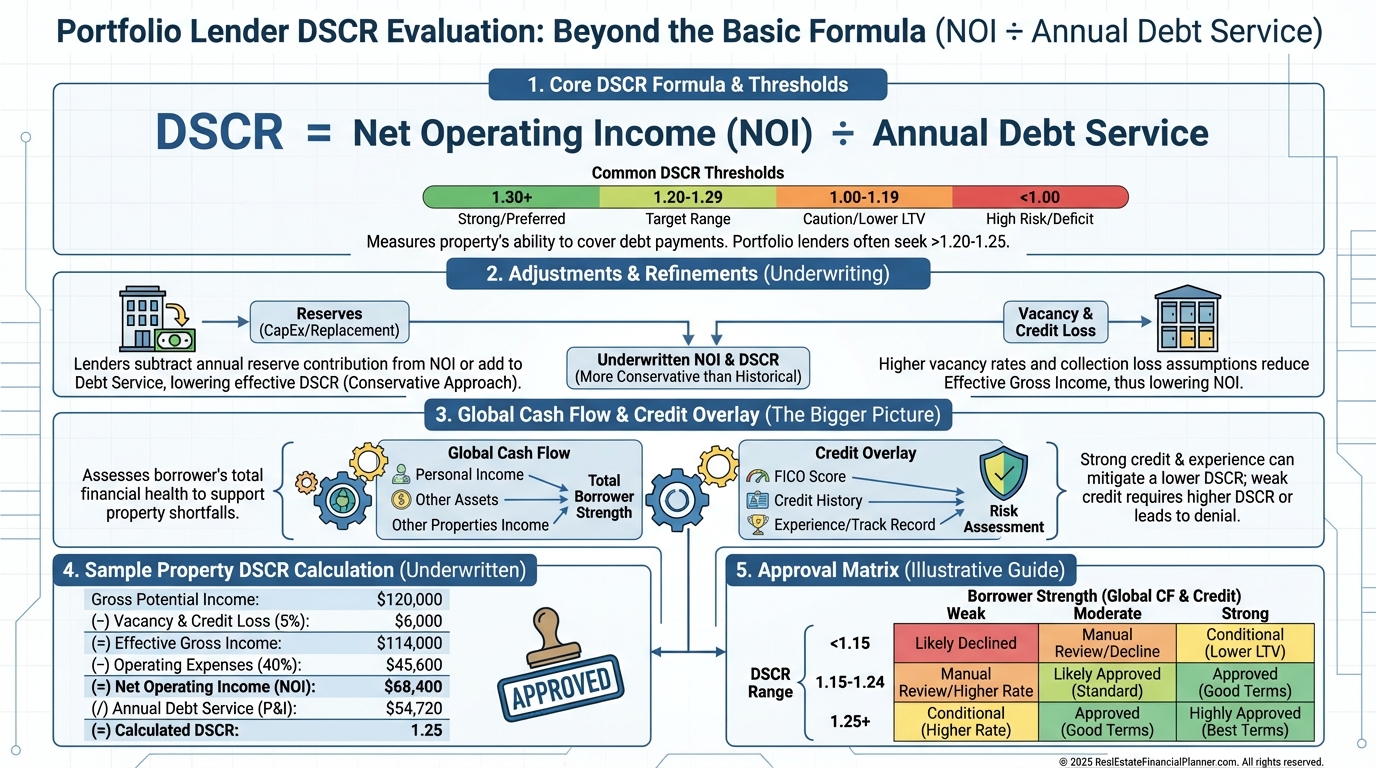

Eligibility and Underwriting: How Lenders Really Decide

Credit score minimums float, but 620 is a common floor.

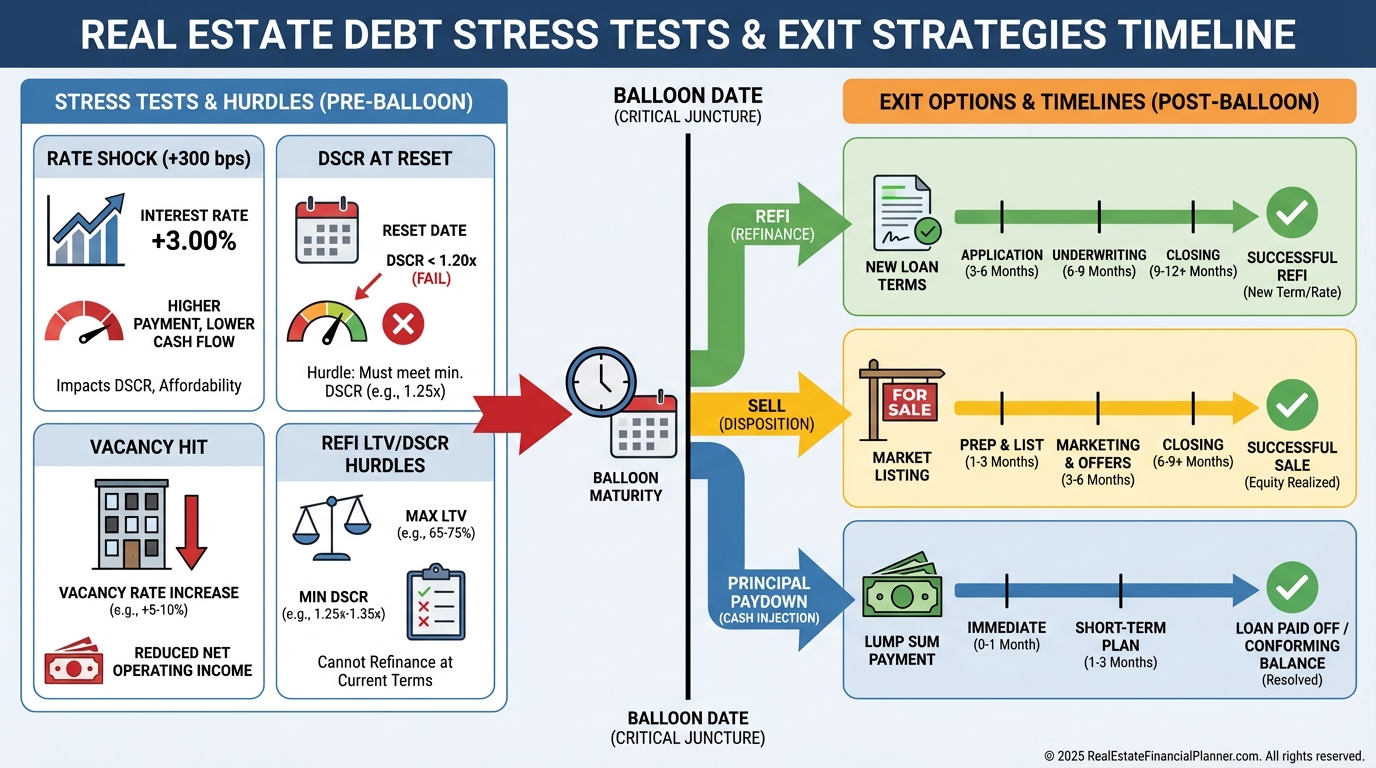

I model DSCR at acquisition and at future refinance using rate-shock scenarios so you don’t get trapped at balloon.

Owner-Occupancy and Investor Use

Portfolio lenders commonly finance non-owner-occupied rentals without requiring you to live there.

That’s why they’re ideal for investors buying directly in an entity.

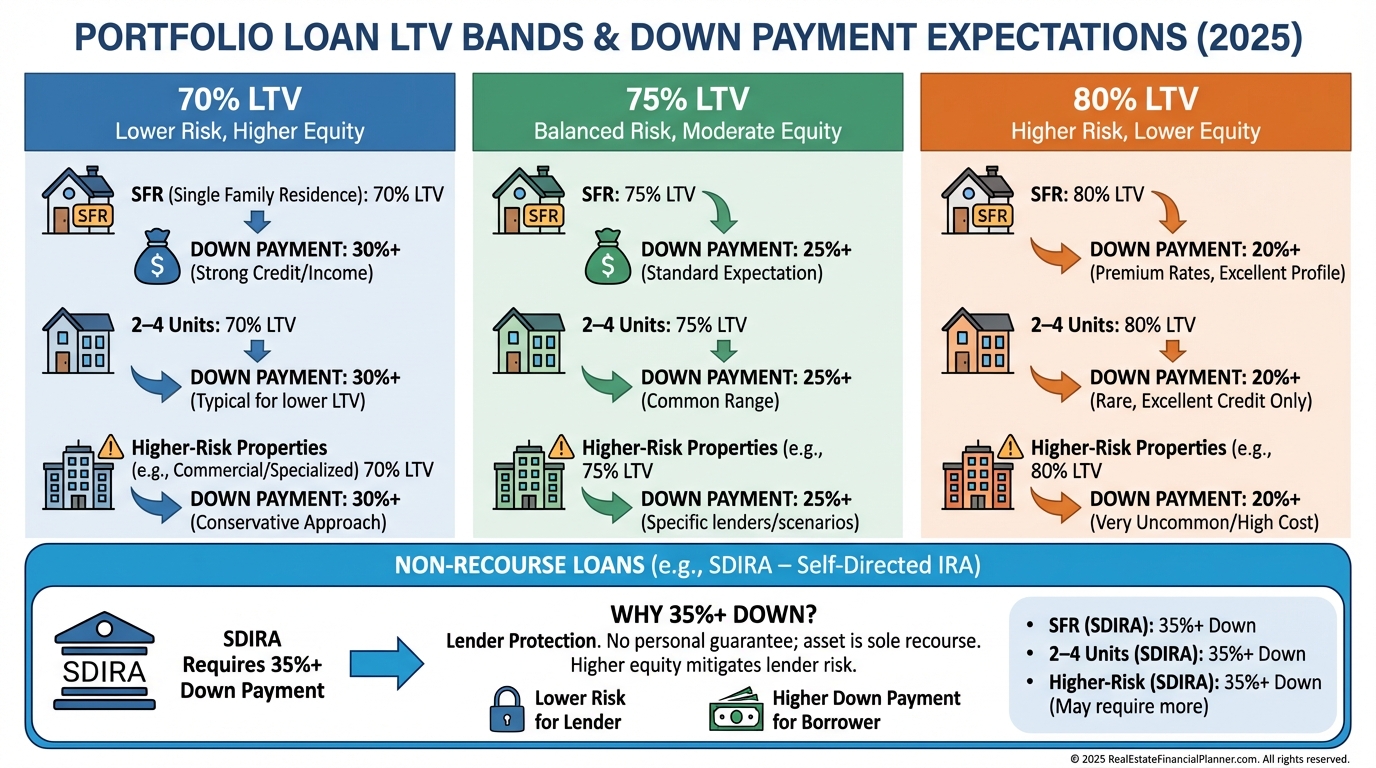

Down Payment, LTV, and Non‑Recourse Nuances

Twenty percent down is typical for 1–4 units if the deal’s strong.

Expect 25% down on 2–4 units if DSCR is tight or the property is quirky.

Standard max LTV is often 80%, but lenders may cap at 70–75% for lower credit, odd property types, or weak DSCR.

For SDIRA non‑recourse loans, plan on 35%+ down and a strict DSCR screen because the bank can only take the property.

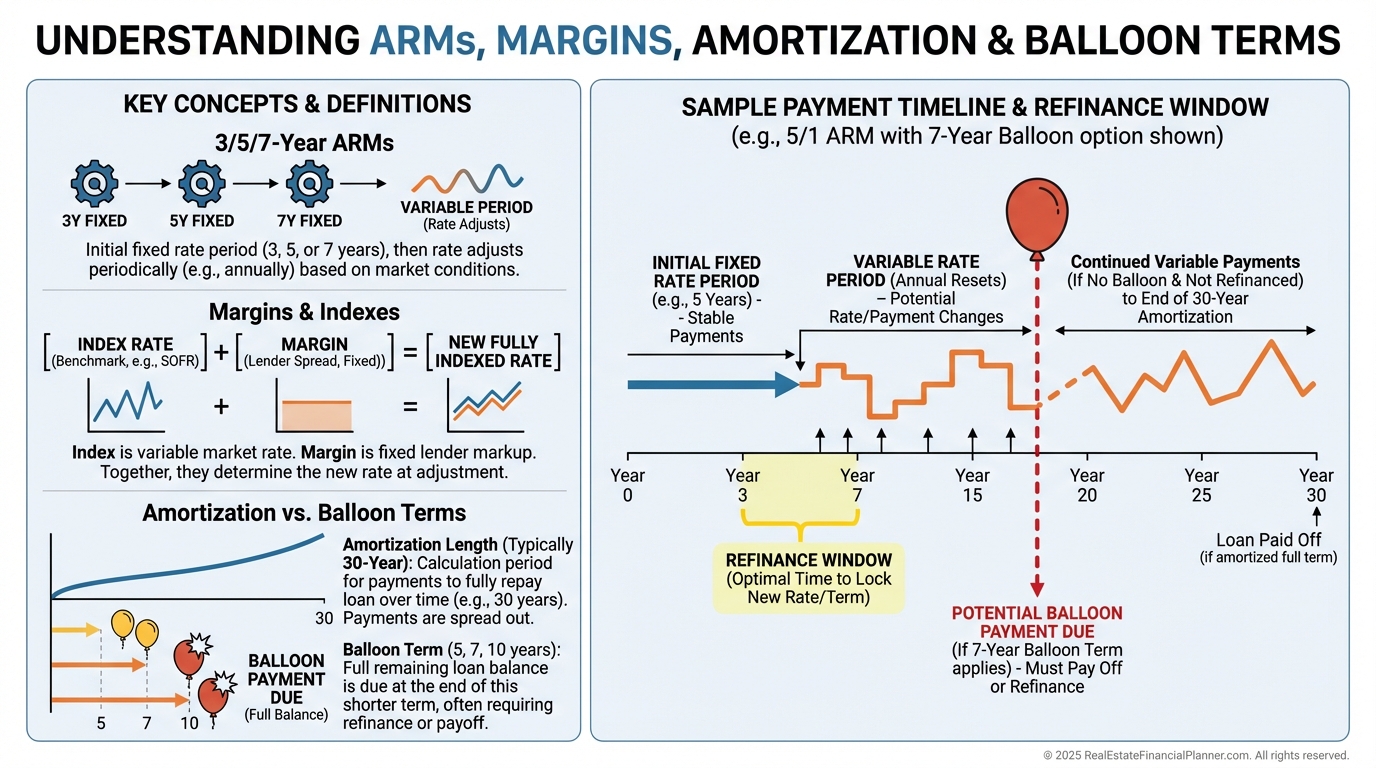

Rate Structures and Amortization

Most portfolio loans are ARMs with a 3/5/7-year fixed period, then annual adjustments tied to an index plus a margin.

Thirty-year fixed is rare; 15–20-year fixed exists but means higher payments.

A 30-year amortization is common even if the note balloons at year 5, 7, or 10.

I calendar balloon dates on day one and start refinance prep 9–12 months early.

PMI and Loan Limits

Because you’re usually at 80% LTV or lower, PMI rarely applies.

There are no hard agency loan limits; the bank sizes your loan to collateral, DSCR, global cash flow, and its legal lending limits.

Scaling Beyond 10 Mortgages

Unlike conventional lending, there’s no strict cap on number of loans.

In practice, banks manage concentration risk, so your relationship, liquidity, and documentation determine how far you go.

Seller Concessions and Closing Costs

You negotiate concessions with the seller, but the lender caps what counts toward closing costs.

Plan on 3–6% allowed, depending on the bank and property type.

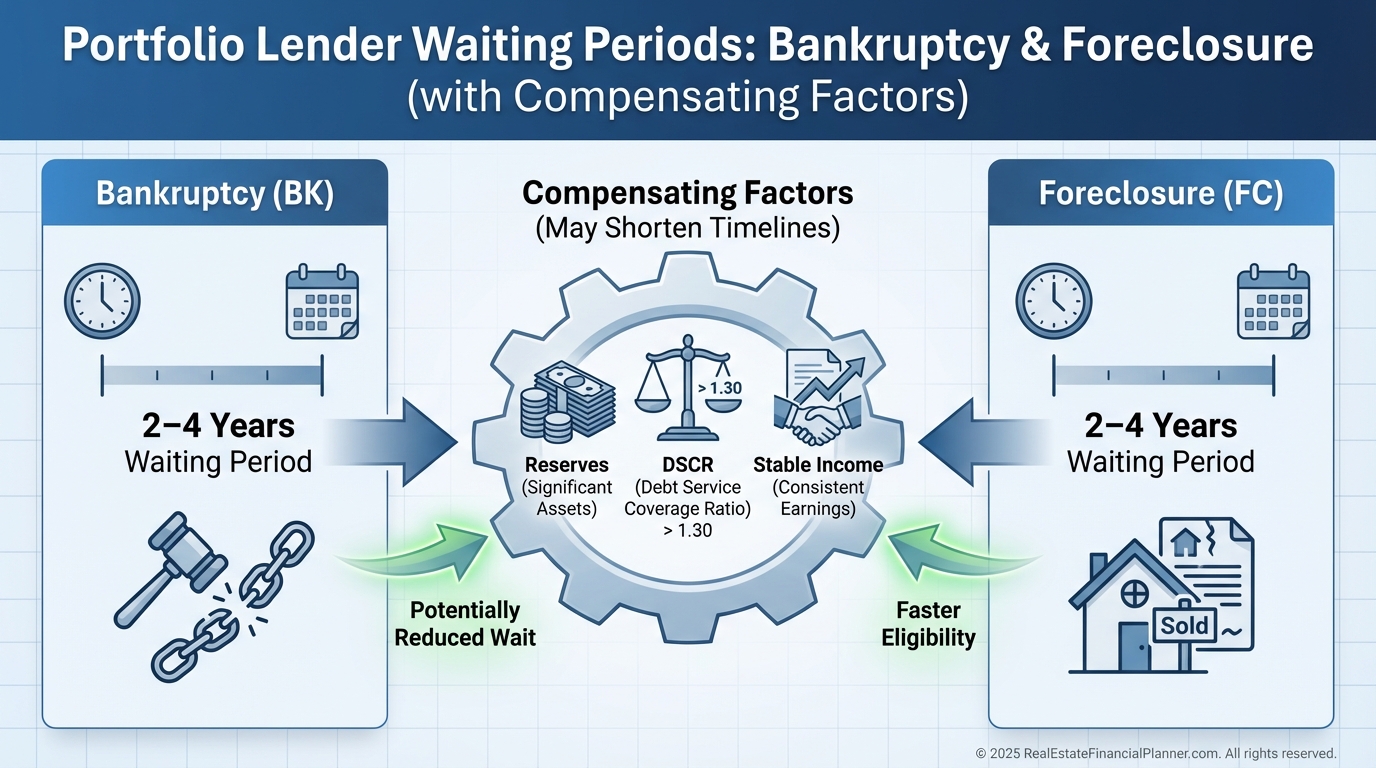

After Bankruptcy or Foreclosure

Many portfolio lenders will look 2–4 years back for BK or foreclosure, and some bend faster with compensating factors and a strong DSCR.

When clients are rebuilding, I show a clean, documented recovery story with reserves and stable income.

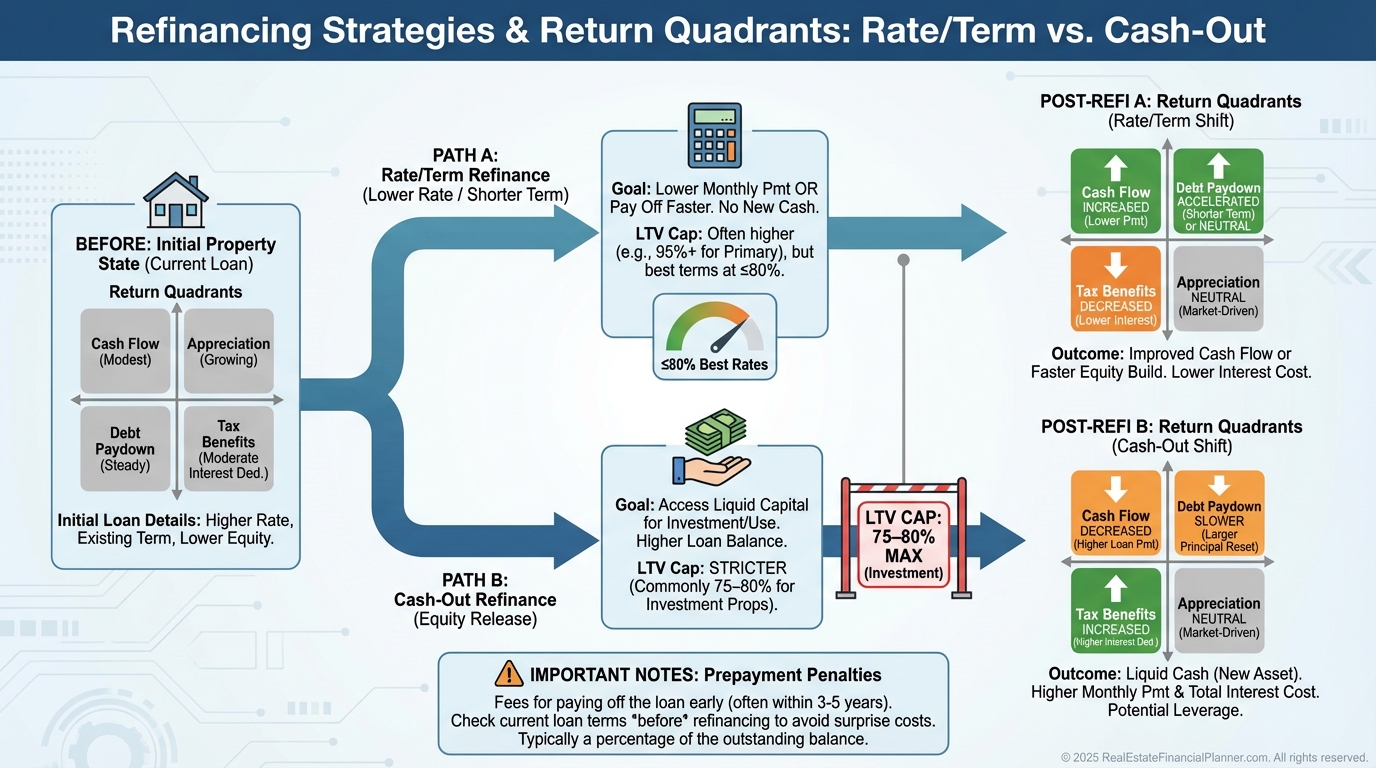

Refinancing, Recasting, and Cash‑Out

Rate/term refinances are common, and many banks allow cash‑out to 75–80% LTV if DSCR holds.

Some will recast after a lump‑sum principal payment; ask early because it’s lender-specific.

I always estimate prepayment penalties and closing costs, then update True Net Equity™ after refinancing to avoid phantom gains.

Cash‑out often lowers cash flow; we offset with rent optimization or reserves.

Property Types Portfolio Lenders Finance

Expect financing for 1–4 unit rentals, small multifamily, mixed-use, and some commercial.

Unique properties work if DSCR and exit make sense.

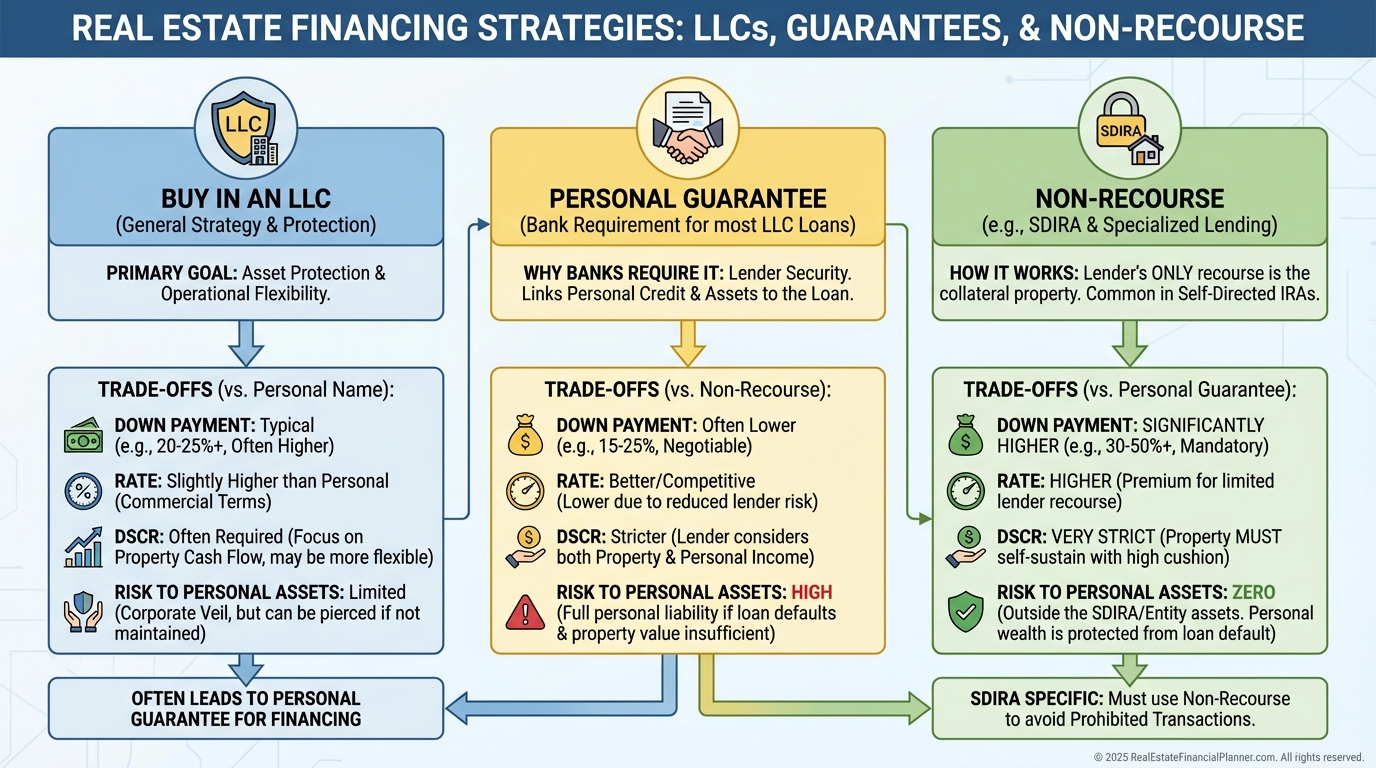

Buying in an LLC, Guarantees, and SDIRA Strategy

Most portfolio loans allow you to buy in an LLC, but expect a personal guarantee.

Non‑recourse is rare outside SDIRA loans and almost always demands lower LTV and higher rates.

If a bank offers cross‑collateralization, I model worst‑case contagion risk across properties and only accept if it unlocks outsized value.

Approval Timeline and What I Prepare

Underwriting can be as fast as 24–48 hours when the file is clean.

I include trailing 12-months income/expenses, leases, tax returns, personal financial statement, global cash flow, rent roll, and reserves.

Risks, Stress Tests, and Exit Plans

ARMs can reset higher and compress cash flow.

Balloons force a refinance decision that may land in a bad rate market.

I run +300 bps rate shocks, 10% rent dips, and 8% vacancy to see if DSCR stays above 1.20.

If not, we map principal paydown or a planned sale six months before balloon.

How I Coach Clients to Use Portfolio Loans in a Plan

I stack the Return Quadrants™ for each property so you see the whole return profile, not just cash flow.

Then I track True Net Equity™ to decide when a refinance or sale actually increases your net position after costs.

That keeps financing flexible while you graduate to bank relationships and larger assets.

Quick Checklist Before You Apply

•

DSCR at purchase and at projected refinance ≥1.25 with rate shock baked in.

•

Down payment and LTV aligned with property risk and loan type (recourse vs non‑recourse).

•

Understand note term, amortization, ARM caps, and balloon date.

•

Confirm prepayment penalties, recast options, and cash‑out LTV caps.

•

Clarify entity structure, personal guarantee, and cross‑collateralization.

•

Verify seller concession limits and required reserves.

•

Prepare full docs: leases, T12, PFS, tax returns, rent roll, bank statements.

•

Update True Net Equity™ and Return Quadrants™ before and after closing so you know your real returns.