Loan Assumption: How House Hackers and Nomads™ Unlock 3% Rates in a 7% World

Learn about Loan Assumption for real estate investing.

When rates jumped, I watched capable buyers stand on the sidelines while a few quietly took over loans at 3–4%.

Those few were using loan assumptions, and their cash flow told the story.

When I help clients today, I model assumption scenarios first in The World’s Greatest Real Estate Deal Analysis Spreadsheet™.

If the numbers win there, we keep going.

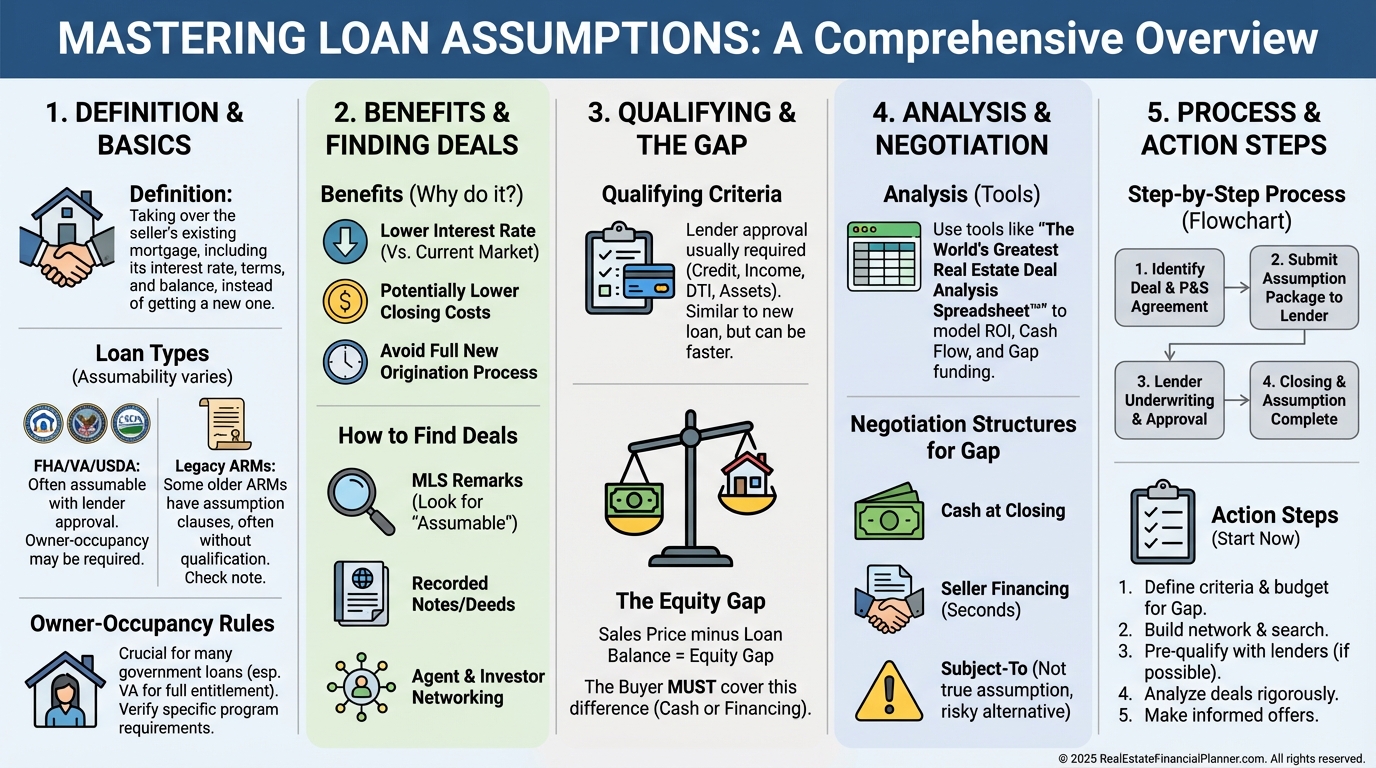

What a Loan Assumption Is and Why It Matters

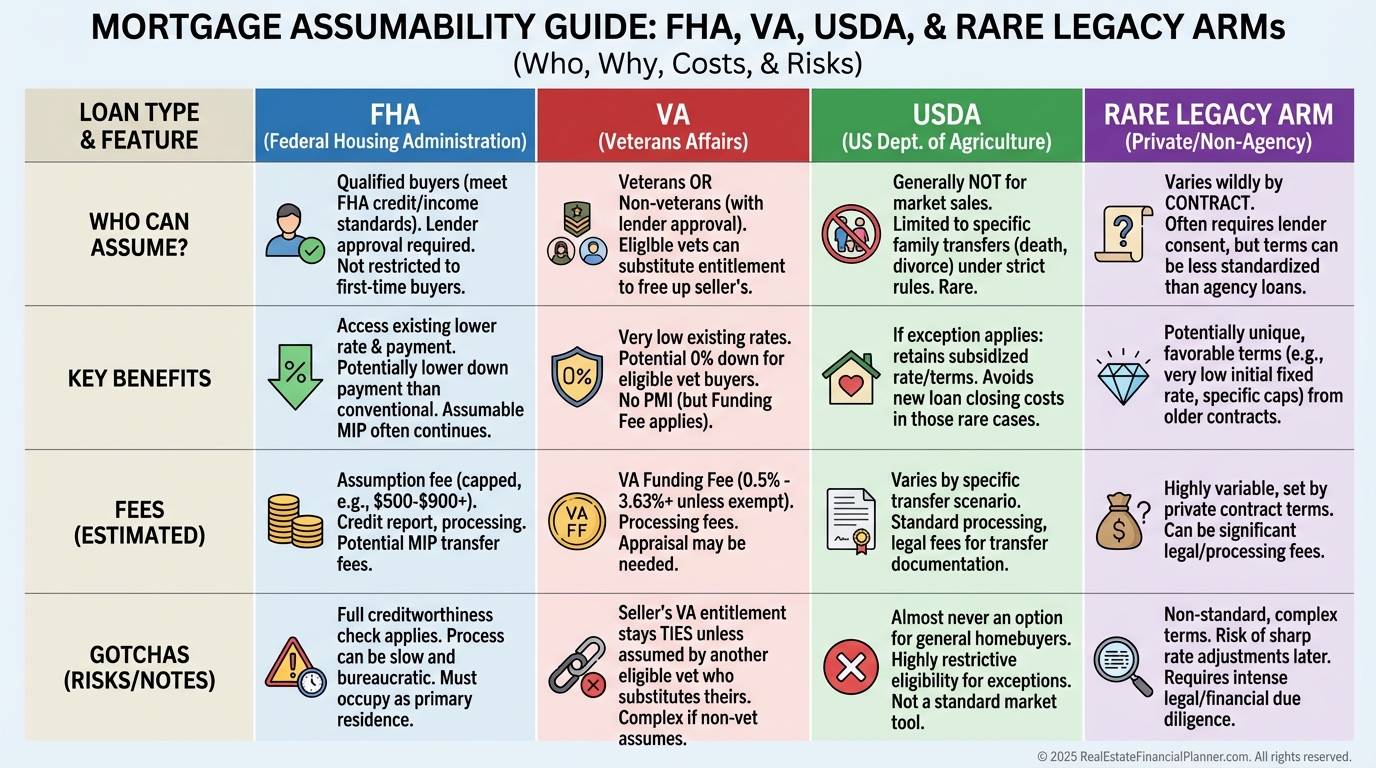

A loan assumption is when you take over the seller’s existing mortgage with its original rate and terms.

In a 7% world, stepping into a 3% loan can turn a “no” into a “go.”

The servicer approves you, the seller is released from liability, and you inherit the amortization schedule where it sits.

That combination is why assumptions often beat new financing even with a large cash requirement.

Non-veterans can assume VA loans, but veterans get extra benefits including entitlement substitution.

Rare legacy conventional ARMs may be assumable if the note allows it, but those are needles in haystacks.

Confirm assumability by reviewing the actual note and calling the servicer’s assumption department.

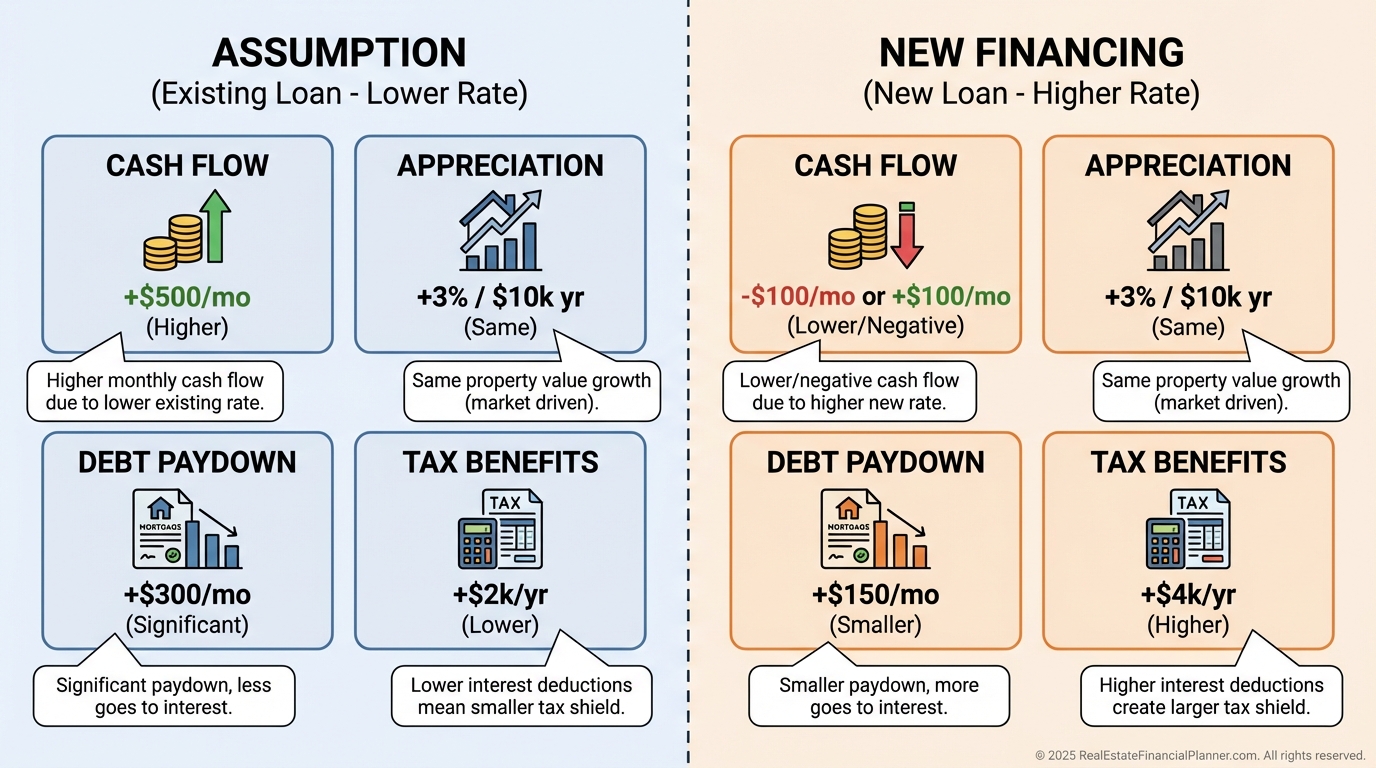

Investor Benefits You Can Quantify

Lower payments are obvious, but the benefits compound across Return Quadrants™.

You gain cash flow today, amortization from day one, better debt paydown efficiency, and often superior risk-adjusted returns.

Closing costs are typically lower, timelines can be faster, and the marketing value of an assumable loan can improve your negotiation leverage.

I verify this by comparing the total cost of debt and lifetime interest saved versus a new loan on the same property.

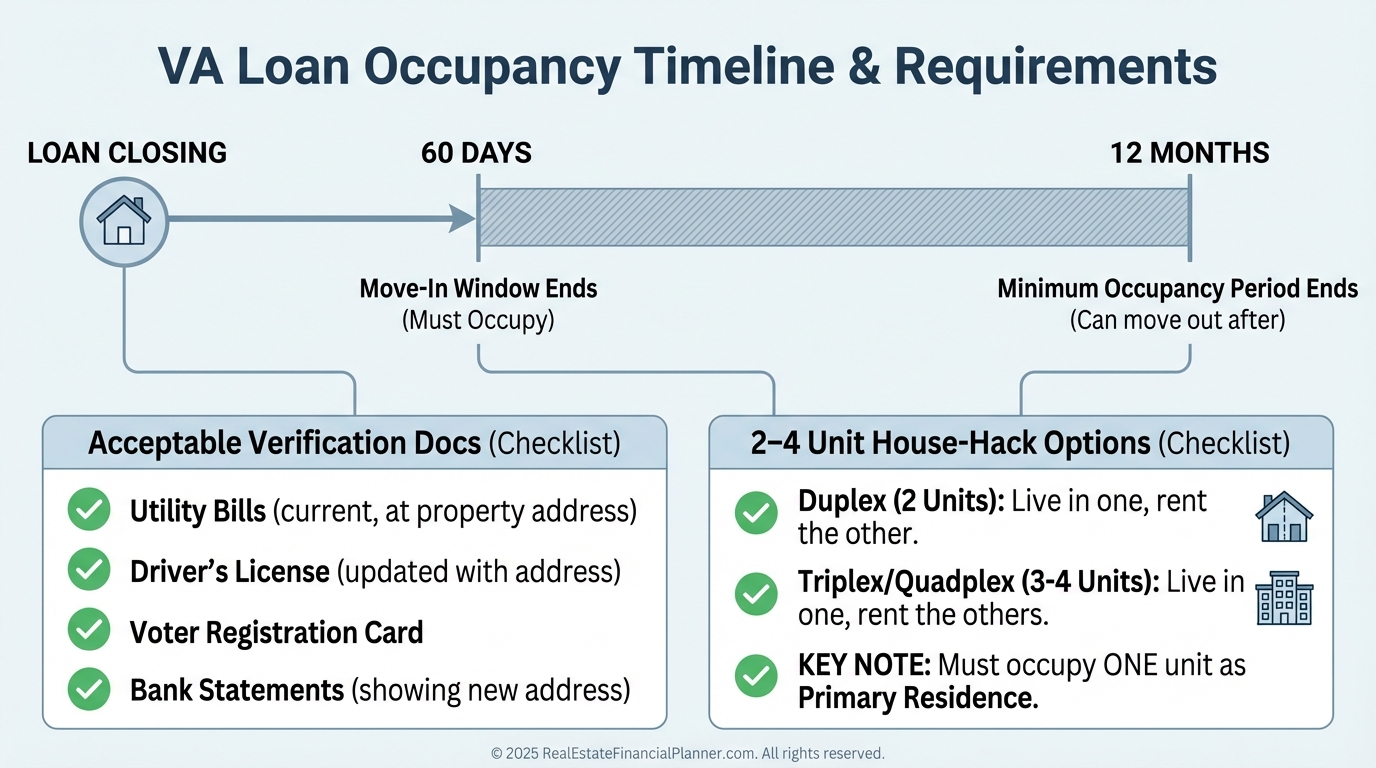

Owner-Occupancy Rules: The Gate That Filters Out Competition

Most FHA and VA assumptions require you to move in within 60 days and live there for at least one year.

This gate keeps pure investors out and makes assumptions ideal for house hackers and Nomads™.

I coach clients to align their move dates with their Nomad™ plan so they can rinse and repeat annually.

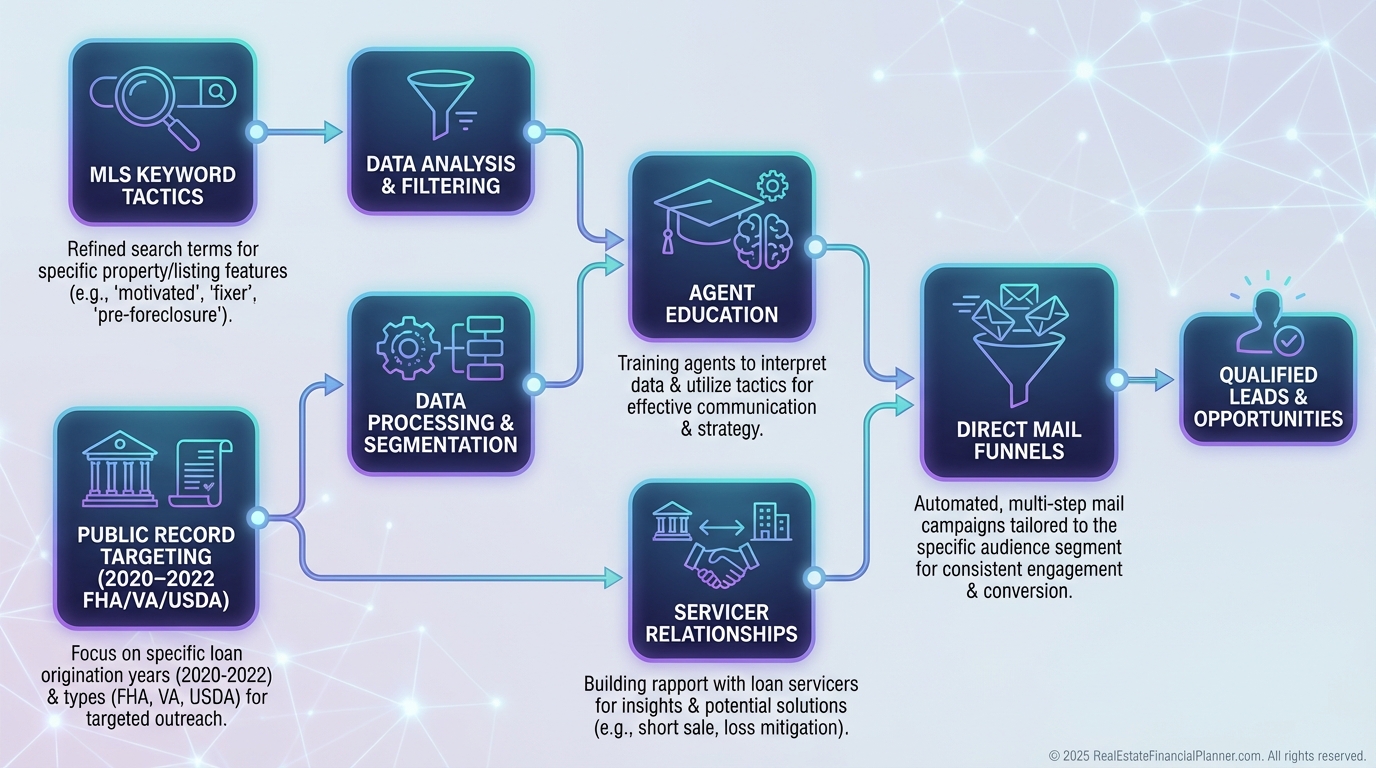

How to Find Properties With Assumable Loans

MLS rarely flags assumptions cleanly, so you search the remarks for “assumable,” “assumption,” “VA assumable,” or “take over payments.”

Filter for properties purchased 2020–2022 and financed FHA/VA/USDA, then contact listing agents about assumability.

I also build a network with servicers, wholesalers, and agents, and I mail owners with FHA/VA loans explaining their hidden asset.

Expired listings with assumable loans are my favorite targets because sellers often didn’t understand their advantage.

Qualifying With the Servicer: What I Coach Clients To Prepare

Assumptions require full qualification with the servicer.

FHA assumptions often approve with mid-500s to 600+ scores if the rest is strong.

VA assumptions may allow even lower with compensating factors and include a 0.5% funding fee for non-veterans.

Bring two years of tax returns, pay stubs, bank statements, and a clean, complete assumption application.

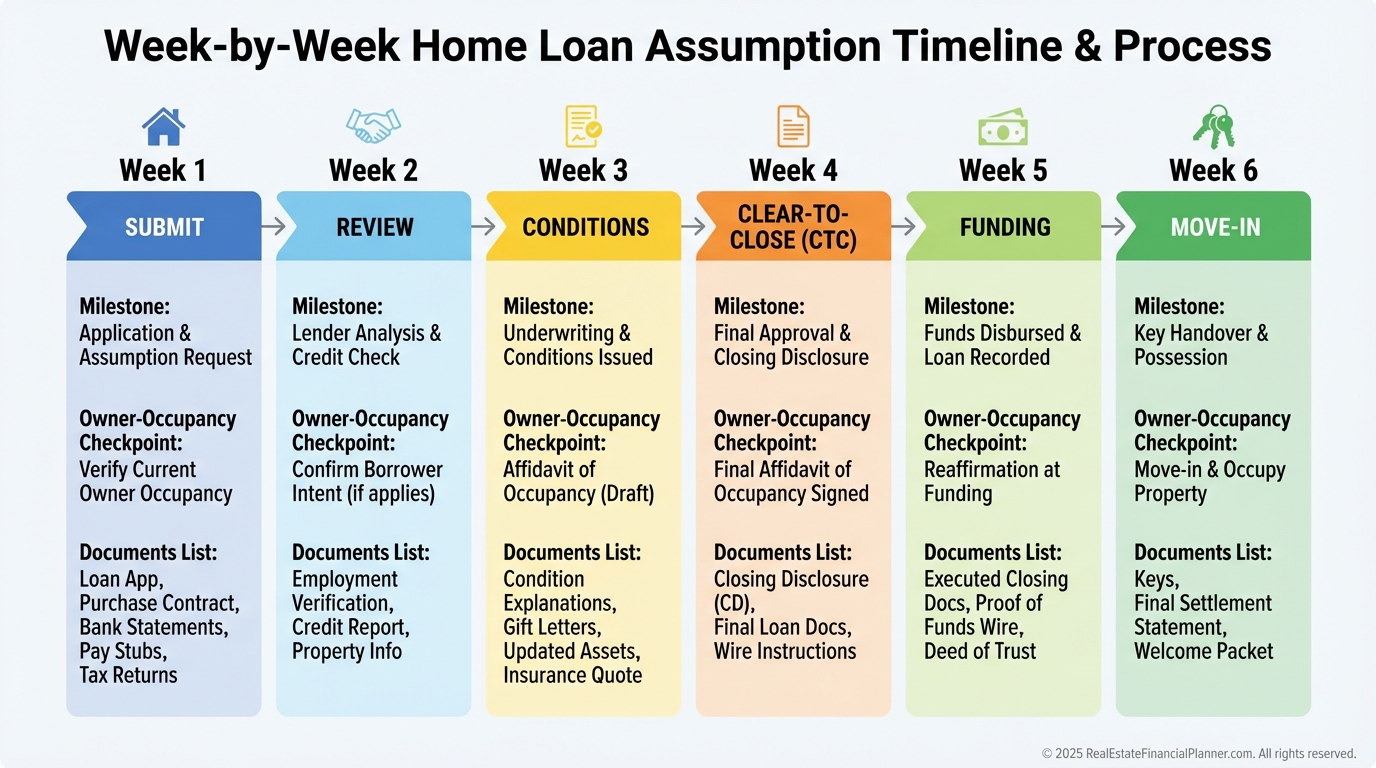

My clients submit within 24–48 hours of contract to start the clock.

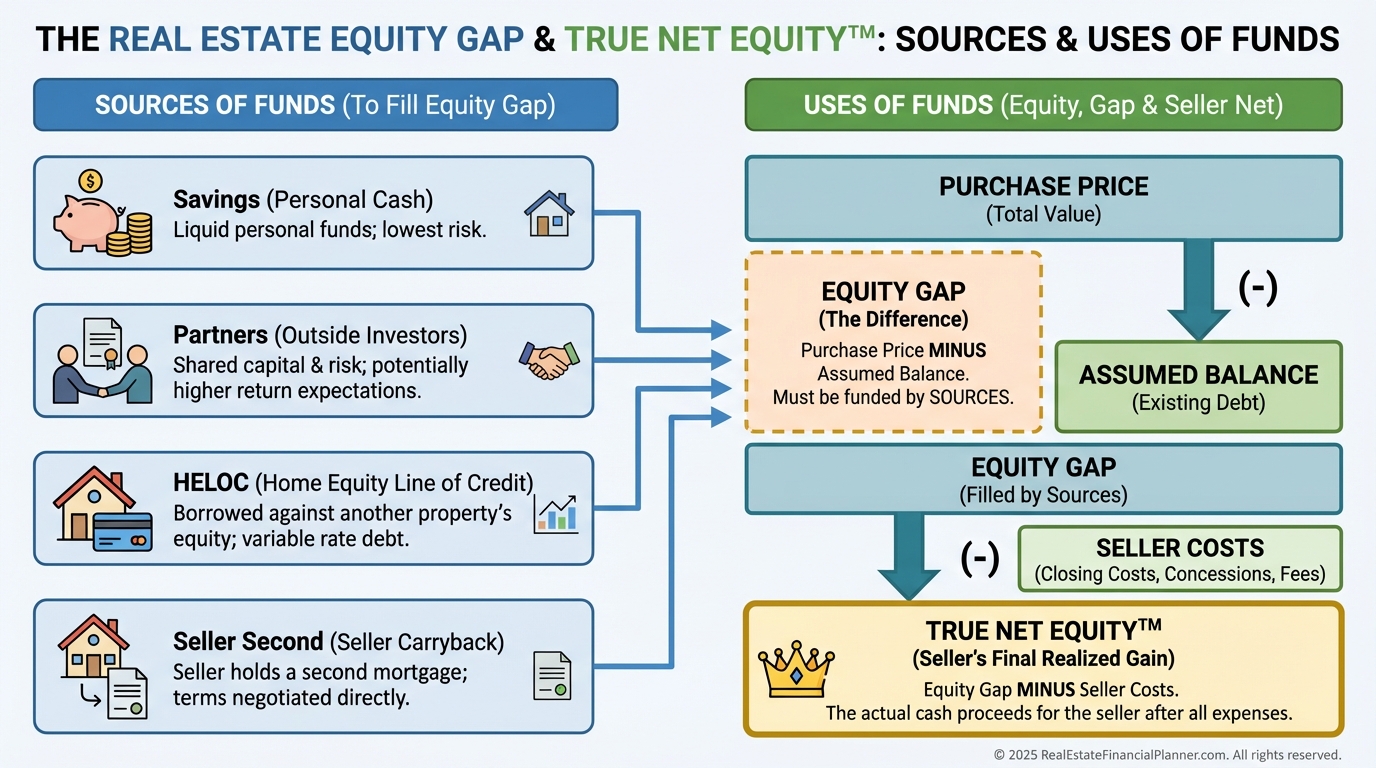

The Equity Gap: Modeling Real Cash Needs With True Net Equity™

Here’s the friction point.

You must pay the seller their full equity because you’re taking over their existing low-rate balance.

As prices rose, that equity often ballooned.

I model this with True Net Equity™ so you see the seller’s walk-away number after costs, credits, seconds, or rate buydowns.

When I rebuilt after bankruptcy, I couldn’t outbid cash buyers, but I could out-structure them with seller seconds, HELOC funds, and performance-based payouts.

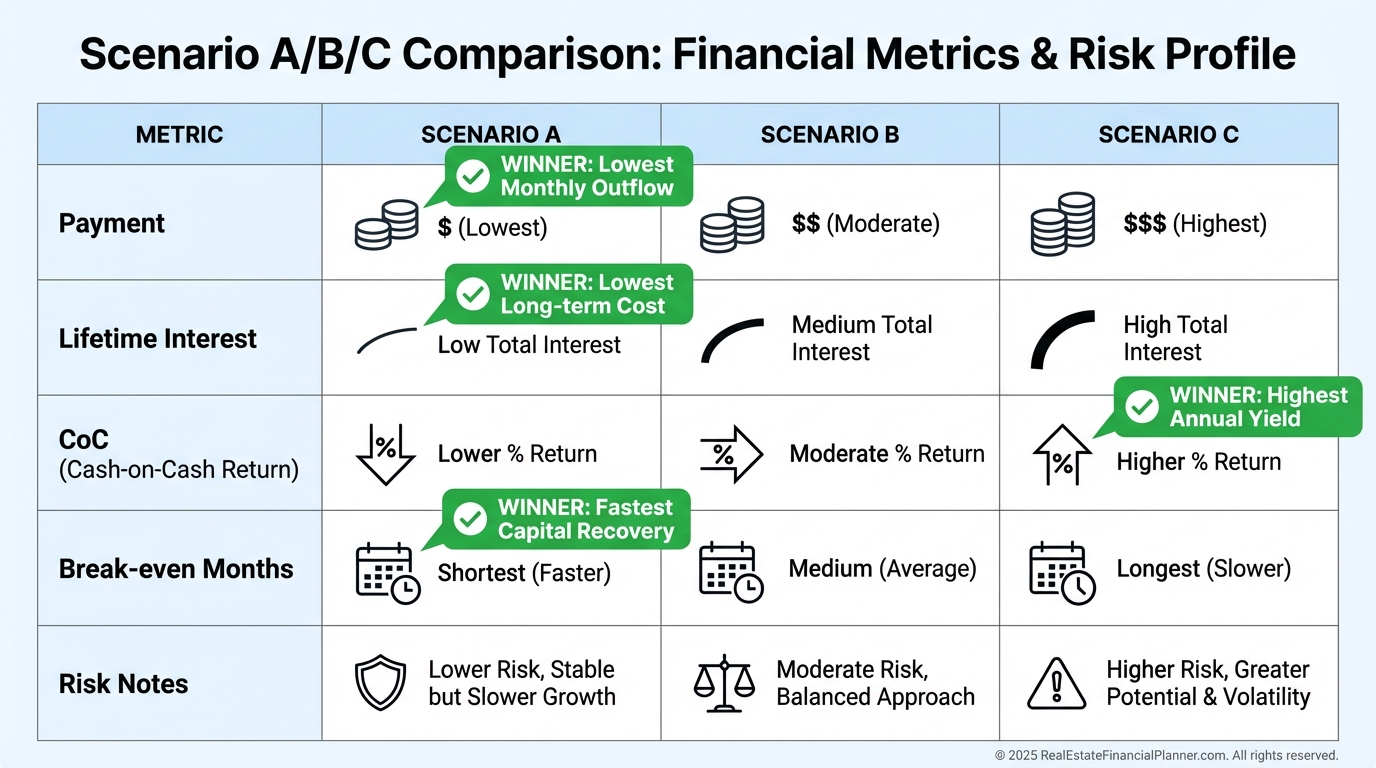

How I Analyze Assumptions Against New Loans

I always run three scenarios in The World’s Greatest Real Estate Deal Analysis Spreadsheet™.

Scenario A: assume the existing loan.

Scenario B: buy the same property with new financing.

Scenario C: buy an alternative property with new financing.

I compare monthly payment differences, lifetime interest saved, cash-on-cash, break-even on the extra down payment, and risk metrics.

The opportunity cost calculator shows whether one excellent assumption beats two average purchases.

Negotiating Structure, Not Just Price

Price matters, but structure wins.

I show sellers a payment comparison so they see why marketing “assumable at 3%” expands their buyer pool.

Then I negotiate the equity gap with a seller second, a phased payout, or performance-based terms tied to rent or refinance.

With VA deals, entitlement substitution can be the key carrot for veteran sellers.

The Assumption Process: Week-by-Week Playbook

Weeks 1–2: Execute the contract, submit a complete assumption package within 24–48 hours, and open title with an assumption-savvy closer.

Weeks 2–3: Respond to all servicer requests within 24 hours and document your owner-occupancy plan.

Weeks 3–4: Clear conditions, confirm the exact rate, P&I, escrow transfers, and insurance.

Weeks 4–6: Finalize funds for the equity gap, coordinate move-in logistics, complete your walk-through, and close.

I call the servicer twice weekly until approval is in writing.

Case Studies From the Field

Jennifer house hacked a triplex with an FHA at 3.25% and a $200,000 equity gap.

We split the gap with $150,000 cash and a $50,000 seller second at 4%.

Her rents from two units covered her payment while she lived free, and the spreadsheet showed $380,000 in lifetime interest savings.

Marcus, a veteran, assumed a 2.75% VA loan on a fourplex with a $230,000 equity gap.

We used $115,000 cash, a $60,000 seller second at 5%, and entitlement substitution to free the seller.

His blended cost of capital stayed near 3.4%, and his unit was free after house-hack income.

Tony tried to wholesale a duplex with a 3.5% FHA and $180,000 equity, but the owner-occupancy rule scared investors.

He pivoted, assumed it as his next Nomad™, negotiated $60,000 as a seller second, and used a $100,000 cash-out refi from his last Nomad™.

He eliminated his housing cost and kept elite financing.

Risks, Pitfalls, and How I Mitigate Them

Do not assume a non-assumable loan.

Read the note, call the servicer, and get written approval.

Avoid occupancy misrepresentation.

You must move in and be able to prove it.

Servicer delays are real.

We maintain twice-weekly contact and build 60-day expectations into the contract.

Confirm taxes, insurance, HOA dues, and escrow transfers so your first payment isn’t a surprise.

Use an attorney to review the assumption agreement, seller second, and release of liability language.

Action Plan: Your Next 7 Moves

1) Download The World’s Greatest Real Estate Deal Analysis Spreadsheet™ and build an assumption vs new-loan template.

2) Set MLS alerts for 2020–2022 FHA/VA/USDA purchases and “assumable” keyword matches.

3) Pull public records to create a direct mail list of FHA/VA owners in your target zip codes.

4) Assemble your assumption team: agent, servicer contact, assumption-savvy title, real estate attorney.

5) Build capital: savings, partners, HELOCs, or a seller second playbook.

6) Analyze three live assumption opportunities this week and calculate break-even months on the extra down payment.

7) Map your Nomad™ calendar around the 60-day move-in and 12-month occupancy so you can repeat annually.

When the numbers work, assumptions give you yesterday’s rates with today’s rents.

That is a structural advantage you can’t match with new debt today.